Last Updated on

So in my previous post, I revealed the biggest reasons why most retail traders fail and how to avoid it.

If you missed it, then you can check it out here.

At this point:

You’re probably wondering:

“How do I get an objective view of the markets?”

“What are the things that I should focus on?”

“How do I become a better trader?”

Then let me introduce to you, price action trading.

Price action trading

This is a term that might be familiar with you.

But first and foremost, I want to dispel the myth on what price action trading is…

Many traders think that price action trading is about support and resistance, chart patterns, candlestick patterns, etc.

I’m here to tell you that price action trading is not about all that. Instead, price action trading can be summed up in one simple line:

It’s about identifying the current market condition so you can adopt the right trading strategy at the right time.

For example in a house, you have things like the bathroom, the bedroom, the chairs, the TV, the guest room, etc. These are components that make up the house.

Similarly for price action trading, things like candlestick patterns, support, and resistance, trend lines, etc. are components that make up price action trading.

Price action trading is the framework and concept. The tools that you use will be things like support and resistance, candlestick patterns, etc.

Don’t get confused between the two. This is important because we’ll look at this concept later on and this has to be clear in your head.

Why do you want to be a price action trader? Why do you want to focus on price?

I’ll explain…

You trade what you see

You’ve seen earlier that indicators which can be manipulated by changing the settings to give you different biases where bearish can become bullish, or vice versa.

But when it comes to price action trading, the price is the price. The closing price is the closing price, the highest is the highest. You can’t manipulate it.

That gives you an objective view of the markets because it cannot be distorted to fit your bias.

In essence, if you see:

- The market heading higher, you want to look for buying opportunities.

- The market heading lower, you want to look for selling opportunities.

This is the key thing – you trade what you see and not what you think.

You can “predict” what the markets will do

As a price action trader, you can predict what the markets will do.

What do I mean by predicting?

When I talk about predicting, I’m not trying to say I can predict how high the S&P 500 will reach before it reverses, nor the lows of the market.

No, I’m not talking about those kinds of predictions.

The kind of prediction that I am talking about, is knowing what the market will likely do whether will it continue moving higher or lower?

As a price action trader, if you follow the price, more often than not the price will tend to continue in its initial direction. It doesn’t matter whether the news is good or bad.

Here’s an example on EUR/USD:

You can see that on this bar, the European central bank (ECB) had cut interest rates and that is bearish for the Euro. The market continued lower from there.

But if you look at this chart even before the news is released:

You can see that the market is already in a downtrend. It has a series of lower highs and lower lows.

This should give you a big clue that this market is likely to continue lower, even before the news is out.

Here’s the thing:

When the market is in a long-term trend, one macro-economic piece of news isn’t likely to reverse the entire trend. More often than not, the trend will continue.

But sometimes what could also happen is that the news is against the price action.

Here’s what I mean…

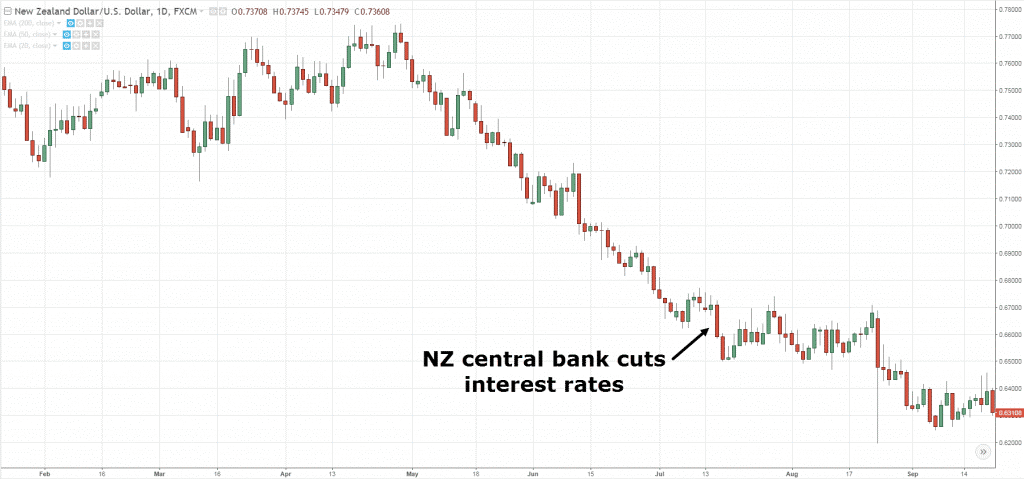

NZD/USD

The Central Bank cuts interest rate on this bar over here.

But if you look left, prior to it, the market is in a downtrend. Price is heading lower over time.

If the fundamental news is out should it be a surprise to you? No.

Because if you just follow the price, this should be something that you already anticipated. This is why I say you can predict what the markets would do.

If you just follow the price, more often than not, the news would escalate the current price movement. But sometimes the news is against the price.

Look at NZD/USD:

The central bank of New Zealand cut their interest rate yet the candle is bullish and the price goes up.

But what I’ve seen and experienced is that this is usually just a pullback or a retracement.

After the pullback, the market will continue lower.

Here are a few scenarios that can happen after the news is out:

- The price moves further in the direction of the trend

- The price retraces before moving in the direction of the trend

As a price action trader, you will be in the direction of the trend more often if you just follow the price without indicators.

You can better time your entries and exits

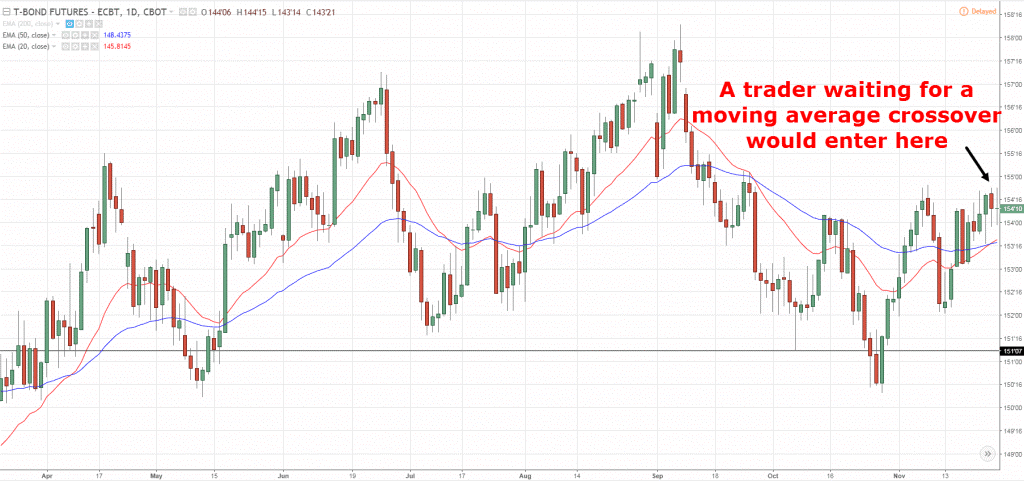

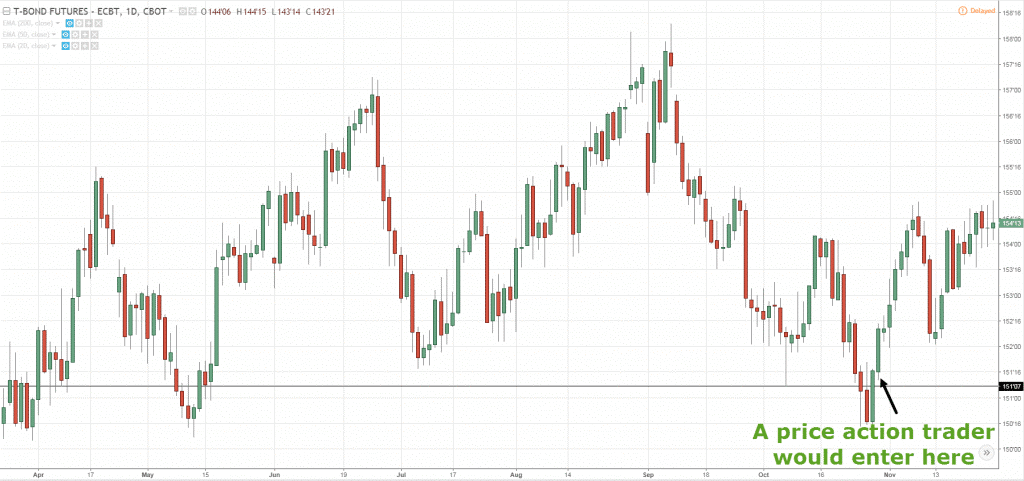

As a price action trader, if you use indicators to time your entry, like a moving average crossover, you will always enter your trades late compared to a trader who can read the price of the market.

Let’s say you use the 20 and 50 moving average crossovers for entry. So when the 20MA crosses over the 50MA you’ll be buying somewhere here:

But a price action trader who can time their entries using price action of the markets, where will they enter the trade?

They’ll enter near the lows.

So as a price action trader:

- You can get in the trade much earlier compared to someone who relies on indicators to time their entry

- You can exit your trades at the swing high as the market moves in your favour

Compare to the moving average trader who just entered the trade, you’ve already exited the trade to book your profits.

That’s the difference between a price action trader and a trader who relies on indicators to time your entries and exits.

You are in control

Let me explain why this is important as a price action trader.

1. You know what to do at any point in time

You trade what you see and not what you think. You know whether to be a buyer or a seller, whether to stay out of the market because you can read the price action of the markets.

You know what to do at any point in time across any timeframes and any markets.

2. You know when to enter and exit your trades

You can identify potential buying and selling pressure to enter and exit your trades.

3. You know how to manage risk

You know how many units or shares or currencies to buy so you don’t blow up your trading account.

You don’t have to rely on fundamentals to manage your risk.

As you’ve seen, by the time fundamental news is out you can lose a huge chunk of capital.

As a price action trader, you are focusing on technical analysis and that helps you to manage your risks

4. You never have to rely on signal services, expert advisors or copy trading

You never have to rely on someone or somebody or any entity because you are in control – it’s all on you.

You can ignore the news

We have spoken about it earlier, but I just want you to share a few more examples to nail the point.

Often traders are wondering, “What’s the latest piece of news I need to be aware of?”

But as a price action trader, I’m going to show you why you can ignore the news.

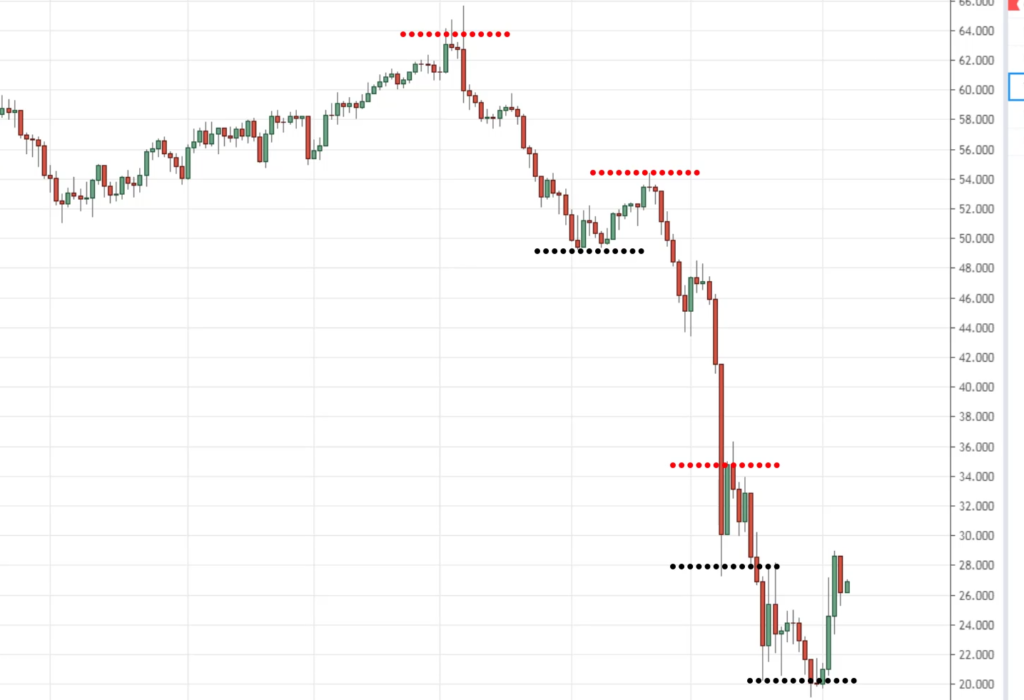

An example on Crude Oil:

In the daily timeframe, I have no idea what the news is for this market right now, but as a price action trader, I know one thing.

I want to be selling in this market condition. Why? Because the overall trend is towards the downside.

If you recall, we said earlier that price action trading is about identifying the current market condition so you can use the right trading strategy at the right time for that given market condition.

So firstly, what’s the current market condition?

This market is in a downtrend, otherwise known as a declining stage. It has a series of lower highs and lower lows.

In this market condition, I want to be selling because that’s the path of least resistance.

At this point…

You’ve learned what is price action trading and the difference it can make to your trading.

Now you’re probably wondering:

“How do I apply price action to my trading?”

“Where can I learn more about price action trading?

“Do you have any price action techniques I can use?”

Don’t worry.

I’ve got another lesson coming where you’ll discover a simple price action trading strategy that works.

Then I’ll open up my premium training program, The Ultimate Price Action Trader (UPAT) if you want to take things a step further.

So stay tuned!