The COVID-19 crisis highlighted and amplified the gap between what consumers expect their financial institution to provide and what many traditional financial institutions were able to deliver. Many financial institutions were not prepared to open new accounts without a visit to the branch, and even more organizations could not facilitate small business Paycheck Protection Program (PPP) loans without significant friction. Some institutions even struggled with personalization of messages and adjustments to policies related to direct deposit of benefit checks.

The good news is that many organizations have worked overtime to fix many of the customer facing issues related to digital banking capabilities and have given indications that back-office initiatives have increased in priority since the COVID-19 shutdown.

With organizations in all industries working to provide hyper-personalized digital experiences, there has never been a more dramatic call to action than what has occurred during this pandemic. Coming out of this crisis, there will be much more clarity as to which organizations embraced the digital transformation process and which firms continued to “fake digital” – only making iterative changes to respond to short-term needs.

Read More:

( sponsored content )

Coronavirus Impact Realigns Digital Rivalry

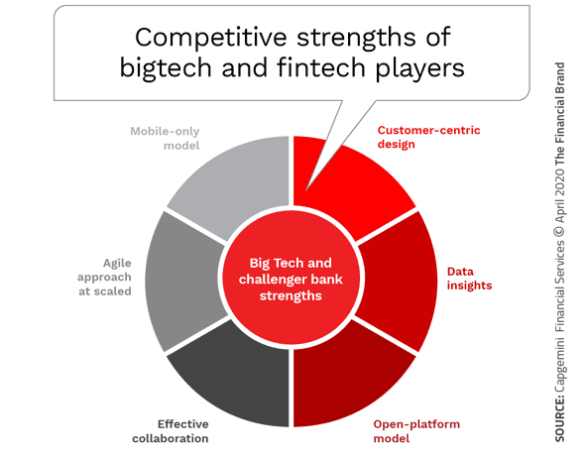

A major change in the competitive structure of banking has also occurred as a result of COVID-19. Several financial institutions have narrowed the gap between the experiences delivered by a select few traditional financial institutions and the experiences of fintech and big tech providers. This journey to “becoming digital” is not complete at any traditional bank or credit union, but the importance of the journey can no longer be disputed.

While the collaboration between traditional financial institutions and fintech firms had not always resulted in the desired results, this dynamic has changed. The prosperity experienced by both traditional banks and fintech firms before COVID-19 caused inaction by both sectors. Traditional banks weren’t feeling any financial pain that required immediate action, and the flow of venture capital to fintech firms was unabated. If urgency leads to action, both traditional banks and fintech firms have a lot more incentive to partner now than just six to eight weeks ago.

The World Fintech Report 2020 found the following pre-COVID pain points:

- Only 21% of banks say their systems are agile enough for collaboration.

- Only 6% of banks had achieved the desired ROI from collaboration.

- 70% of fintech firms don’t culturally or organizationally see eye-to-eye with their bank partner.

- More than 70% of fintech firms say they are frustrated with the incumbent’s process barriers.

- Half of fintech firm executives say they have not found the right collaborative partner.

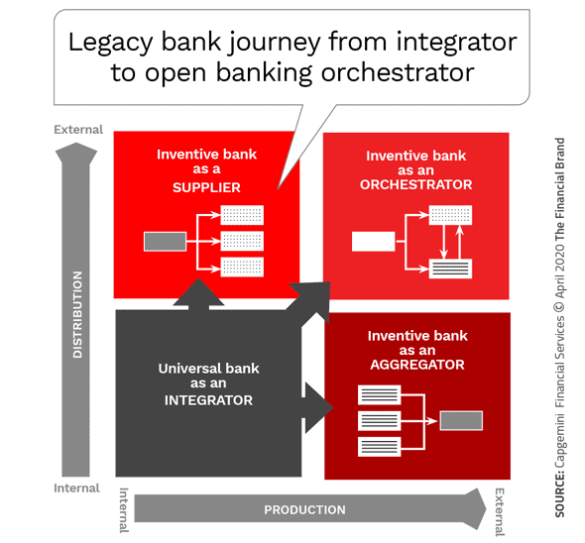

“The world has changed dramatically over the last couple of months. For traditional banks, this will translate into an even greater need for digital experience through further collaboration with fintech firms. It is now essential for incumbent banks to consider them not only as formidable competitors, but as necessary partners of choice to meet changing consumer expectations,” stated Anirban Bose, CEO of Capgemini’s Financial Services SBU. “Inventive banks with the willingness and capabilities to collaborate at scale and industrialize innovation are most likely to prosper within the shared [Open Banking] ecosystem.”

Read More:

REGISTER FOR THIS FREE WEBINAR

Scaling Financial Customer Service and Advice Amid Covid-19 Chaos

How do you retool your contact center and branch offices to deal with this tsunami and scale high-quality service and advice across your customer-facing workforce?

TUESDAY, May 19th at 2pm (ET)

‘Being Digital’ is More Than Skin Deep

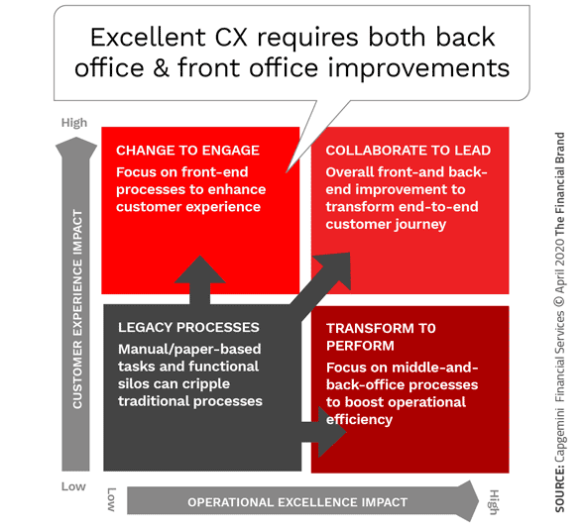

The difference between most big tech and fintech digital financial offerings and those from the majority of legacy financial institutions is that digital-first organizations build digital experiences from the inside out. More than just a pretty mobile app, the design of digital experiences begins with making sure the flow of processes and engagements are seamless. COVID-19 served as an event that highlighted the difference between simply presenting a false digital facade and truly building a digital experience.

According to the World Fintech Report 2020, financial institutions must prioritize middle- and back-office transformation to be successful. Rather than building from within, they recommend building collaborative relationships with those firms that have already built and tested strong digital engagement tools and services. According to Digital Banking Report research on the state of digital transformation, many traditional financial institutions already knew what was needed, and how this could be achieved.

Many organizations simply hesitated to “pull the trigger” due to a business as usual mentality. This created an overall bad experience during the “last mile” of the customer journey. The need to change was highlighted in the Capgemini report that found that consumers didn’t feel like they received a personalized relationship (50%) or couldn’t make direct-debit payment on several merchant sites (60%.). Many younger, tech-savvy consumers were also frustrated with the narrow range of products and services offered by their primary traditional bank.

Read More: