FHA vs conventional loans

What’s a better low-down-payment mortgage: The FHA loan or conventional?

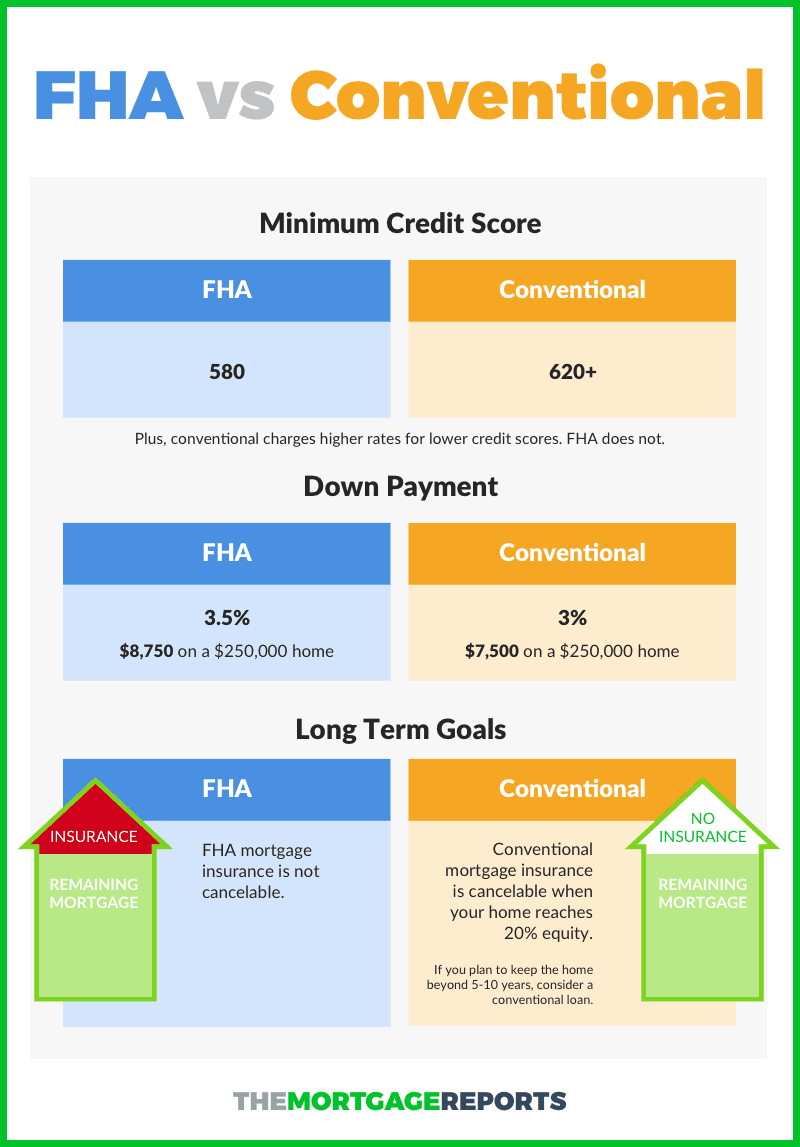

FHA loans are great for low-to-average credit, with scores starting at just 580 and 3.5% down payment. But mortgage insurance is required no matter how much money you put down.

Conventional loans are often better if you have a high credit score, or plan to stay in the house a long time. With credit in the mid- to high-600s, you can get a “conventional 97” loan with just 3% down.

And, conventional mortgage insurance can be canceled once you achieve 20% equity. So your monthly payment could go down if you keep the mortgage long enough.

To decide between FHA vs conventional, you need to compare your options side by side.

Shop FHA and conventional loans today (May 3rd, 2020)

In this article (Skip to…)

Conventional loan vs. FHA

There are a multitude of low-down payment options for today’s home buyers. But many will choose either a conventional loan with 3% down or an FHA loan with 3.5% down.

So, which loan is better? That depends on your circumstances.

Here’s a brief overview of what you need to know about qualifying for a conventional loan vs. FHA loan.

FHA vs. conventional 97 comparison chart

| Conventional 97 loan | FHA loan | |

| Minimum down payment | 3% | 3.5% |

| Minimum credit score | 620 | 580 |

| Maximum debt-to-income ratio | 43% | 50% |

| Loan limit for 2020 (in most areas) | $510,400 | $331,760 |

| Income limit | No income limit | No income limit |

| Minimum out-of-pocket contribution |

0% (Down payment and closing costs can be 100% gift funds, grants, or loan) |

0% (Down payment and closing costs can be 100% gift funds, grants, or loan) |

Verify your home buying eligibility (May 3rd, 2020)

Credit scores

In deciding between an FHA loan and the Conventional 97 loan, your individual credit score matters. This is because your credit score determines whether you’re program-eligible; and, it affects your monthly mortgage payment, too.

Minimum credit score requirements for FHA and conventional loans are:

- FHA: 580 credit score with 3.5% down; 500 credit score with 10% down

- Conventional: 620 credit score

Therefore, if your credit score is between 500 and 620, the FHA loan is best for you because it’s your only available option.

But if your credit score is above 620, it’s worth looking into a conventional loan with 3% down. Especially because, as your credit score goes up, your mortgage rate goes down.

Debt-to-income ratio

Another factor you need to consider when choosing between a conventional and FHA loan is your “debt-to-income ratio”: the amount of debt you owe on a monthly basis, compared to your monthly gross income.

Conventional loans usually allow a maximum DTI of 43% — meaning your debts take up no more than 43% of your gross income — while FHA loans allow a more generous 50%.

However, even with FHA loans, you’ll have to shop around if your debt-to-income ratio is above 45%, because it’s harder to find lenders who actually offer so much flexibility.

Debt-to-income ratios tend to make a bigger difference in expensive areas, like big cities, where housing prices are high. If you’re buying somewhere like Los Angeles, New York, or Seattle, your monthly debt (including mortgage costs) will take up much more of your income simply because homes aer so much more expensive.

In that case, an FHA loan with more flexible standards might be a better fit than a conventional loan.

Mortgage insurance

FHA and conventional loans both charge mortgage insurance. But the cost varies depending on which type of loan you have, and how long you keep the mortgage.

| Conventional Loans | FHA Loans | |

| Mortgage Insurance Type | Private Mortgage Insurance (PMI) | Mortgage Insurance Premium (MIP) |

| Upfront Mortgage Insurance Fee | n/a | 1.75% |

| Annual Mortgage Insurance Rate | Up to 2.25%of loan amount | 0.85%of loan amount |

| Duration | Until the loan reaches 80% LTV | 11 years (down payment of 10% or more) OR Life of the loan (down payment of 3.5% to 10%) |

FHA mortgage insurance (called MIP) is the same for everyone: 0.85% of the loan amount per year, with a one-time upfront fee of 1.75%. Conventional mortgage insurance (called PMI) varies depending on your credit score and loan-to-value ratio. So the cheaper one for you depends on your situation.

Conventional 97 mortgage insurance goes away at 80% loan-to-value. This means that, over time, your Conventional 97 can become a better value — especially for borrowers with high credit scores.

Also, consider upfront charges.

The FHA charges a separate mortgage insurance premium at the time of closing known as Upfront MIP. Upfront MIP costs 1.75% of your loan size, is added to your balance, and is non-recoverable except via the FHA Streamline Refinance.

The Conventional 97 charges no equivalent upfront fee for mortgage insurance. It only charges monthly mortgage insurance.

Mortgage rates

Mortgage rates typically look lower for FHA loans than conventional loans on paper. For instance, today’s average FHA rates are as low as 2.75% (3.25% APR), while conventional rates are as low as 3.25% (3.25% APR), according to The Mortgage Reports’ network.

However, those rates can’t be taken at face value. First, because your rate will likely be different from the average rate.

Second, because PMI and credit score can also affect your interest rate and mortgage payment. For conventional loans, a lower credit score means a higher interest rate. So if your score is in the low- to mid- 600s, an FHA loan might be cheaper.

Conventional loans also base mortgage insurance rates on your credit score, which contributes to a higher monthly payment as well.

Get conventional and FHA mortgage rates today (May 3rd, 2020)

Mortgage payments

As your credit score increases, the Conventional 97 loan gets more attractive. That’s because your mortgage rate drops. And as a result, your monthly payments and PMI costs drop, too. This is different from how FHA loans work.

With an FHA loan, your mortgage rate and MIP cost the same no matter what your FICO score.

That means in the short term, FHA loans often win.

Assuming a loan size of $250,000 and today’s mortgage rates, FHA loans are 10% cheaper for borrowers with “excellent” credit scores. For borrowers with weak credit, they’re 26% cheaper.

But over the long-term, borrowers with above-average credit score will typically find Conventional 97 loans more economical relative to FHA ones.

Remember, mortgage insurance for conventional loans can be cancelled at 20% loan-to-value ratio. But FHA mortgage insurance typically lasts the entire life of the loan.

So if you’ll be staying in the home long enough to reach 20% equity — and especially if you have a good credit score — a conventional loan could be your cheaper option in the long run.

Verify your home buying eligibility (May 3rd, 2020)

FHA vs conventional Q&A

Between FHA and conventional, the better loan for you depends on your financial circumstances. FHA might be better than conventional if you have a credit score below 680, or higher levels of debt (up to 50% DTI). Conventional loans become more attractive the higher your credit score is, because you can get a lower interest rate and monthly payment. Try an FHA loan calculator and conventional loan calculator to compare costs for the two and see which is cheaper for you.

You can switch from an FHA to conventional loan by refinancing your mortgage. This means you get a new, conventional loan to pay off your existing FHA loan. This might make sense to do if you have at least 20% equity in your home and a 620 or higher credit score. Then, you may be able to save by switching from an FHA to conventional loan with no PMI.

If you get a conventional loan with 20% down or more, you won’t have to pay for mortgage insurance. That’s a big benefit over FHA loans, which require mortgage insurance regardless of your down payment size.

The conventional 97 loan also lets you put just 3% down, while FHA requires 3.5% at minimum. And, conventional loans offer lower mortgage rates the higher your credit score is. That’s good news if you have a good credit score of 720 or higher.

FHA loans are great for borrowers who need a home loan with a lower bar of entry. The big benefits are that they allow lower down payments (just 3.5%) and a lower credit score (580) than other loans.

But there are downsides to FHA loans, too. You have to pay for FHA mortgage insurance regardless of down payment size. And you can’t get rid of it unless you refinance. So if you have a great credit score and/or you’re putting 20% or more down, an FHA loan likely isn’t the right choice for you. In that case, look into a conventional loan instead.

Conventional loans require a credit score of at least 620. But some lenders might set their own requirements, starting at 640, 660, or even higher. Plus, your conventional mortgage rate will be better the higher your credit score is. So especially if your credit is on the lower end, be sure to show around with different lenders for the best deal.

FHA loans require a credit score of 580 or higher in most cases. You might be able to get an FHA loan with a credit score of 500-580 if you make a 10% or bigger down payment. But you’ll have to search for the right lender, because not all mortgage companies allow scores in that range for FHA loans.

Conventional loan interest rates are typically a little higher than FHA mortgage rates. That’s because FHA loans are backed by the Federal Housing Administration, which makes them less “risky” for lenders and allows for lower rates. However, if you have a great credit score (above 680, in most cases) you might qualify for a lower conventional rate.

But, you also have to consider the annual mortgage insurance rate with each loan. Depending on your credit score and down payment, conventional mortgage insurance rates could be higher or lower than FHA insurance rates. This will affect which loan is cheaper overall.

You might qualify for a conventional loan if you have a credit score of at least 620; a debt-to-income ratio of 43% or lower; a 3% down payment; and a steady, two-year employment history proven by tax returns and bank statements. To qualify for the low-down-payment conventional 97 loan, you must buy a single-family property (no 2-,3-, or 4-units allowed).

You might qualify for an FHA loan if you have a credit score of 580 or higher; a debt-to-income ratio lower than 50%; and enough money to make at least a 3.5% down payment. You also need a steady job and income, proven by tax returns. You can get an FHA loan with 1-, 2-, 3-, or 4-unit properties.

FHA vs Conventional Infographic

About the FHA 3.5% down payment program

The Federal Housing Administration (FHA) is not a lender. Rather, it’s a loan insurer. The federal agency was established in 1934 and exists to support homeownership within communities.

Promising affordable and stable financing, the FHA established a program by which it would insure U.S. lenders against losses on a loan and provide more favorable loan terms for U.S. borrowers.

More than 80 years later, the FHA continues to fulfill its role.

Today’s FHA homeowners get access to loans of up to 30 years; minimum down payment requirements are as low as 3.5%; and, FHA mortgage rates routinely beat the market average — often by a quarter-percentage point or more.

In order to get the FHA’s backing, banks must only verify that loans meet minimum FHA lending standards, a collection of rules which are more commonly known as the “FHA mortgage guidelines”.

FHA mortgage guidelines state that eligible home buyers must have documented, verifiable income, for example; and require home buyers to live in the home being purchased.

The FHA also requires home buyers to pay mortgage insurance premiums (MIP) as part of their monthly payments.

FHA MIP varies by loan type and downpayment, with the most common scenario being a home buyer using a 30-year fixed rate FHA loan with the minimum allowable 3.5% downpayment; and paying 0.85 percent against the borrowed amount in mortgage insurance premiums annually, or $71 per month per $100,000 borrowed.

The FHA cancels FHA MIP after 11 years for loans which started with a 10% down payment or higher. For everyone else, FHA MIP must be paid until the loan is paid-in-full or refinanced into a non-FHA loan.

The FHA is the largest insurer of mortgages in the world. It currently insures close to 1-in-4 new U.S. mortgages.

Verify your FHA home buying eligibility (May 3rd, 2020)

About the Conventional 97 3% down payment Program

The Conventional 97 loan is another low down payment option available to today’s mortgage borrowers.

Available via Fannie Mae and Freddie Mac, the program was recently retooled to be cheaper and easier to use.

For example, as compared to the original Conventional 97, the newest version is available to first-time buyers and repeat buyers alike, where “first-time buyer” is defined as a person who has not owned a home in the last three years.

This definition of first-time buyer means that consumers who lost a home to foreclosure last decade can be Conventional 97-eligible under the program’s new rules.

Furthermore, because Conventional 97 allows for cash gifts for down payments, home buyers are not required to make a down payment from their own funds. Monies may be 100% gifted from parents and relatives. The only requirement is that the gift is actually a gift — down payment “loans” are disallowed.

For eligible borrowers, the rules of the Conventional 97 program are straightforward.

The Conventional 97 program requires a minimum downpayment of 3%, only 30-year fixed rate mortgages are allowed, and the loan must be used for a primary residence.

Beyond that, there is very little to distinguish a Conventional 97 loan from any other conventional mortgage type. Borrowers are required to verify income and employment; the program can be used to refinance a home; and, home buyer counseling is not required.

And, like other conventional loans, because Conventional 97 loans feature less than twenty percent home equity, they require borrowers to pay private mortgage insurance (PMI).

With all Conventional 97 loans, though, PMI cancels when the loan reaches 80% LTV. That is, when the homeowner has 20% equity in its home.

Verify your conventional loan eligibility (May 3rd, 2020)

Additional low-down-payment mortgages

Today’s mortgage rates are low and rents are rising nationwide. In many U.S. markets, the answer to “Should I rent or should I buy?” has shifted toward “buy”.

Even better — first-time home buyers have ready access to low-down payment loans.

Recently, mortgage lenders reduced minimum credit score requirements for the FHA’s popular 3.5% downpayment loan; and, two 3% down payment programs have been retooled — the Conventional 97 and the Fannie Mae HomeReady™ mortgage.

Add to these two programs the 100% VA loan backed by the Department of Veterans Affairs and the no-money-down, “rural housing” loan from the U.S. Department of Agriculture (USDA), and you’ll find today’s home buyers with no shortage of low- and no-downpayment home loan options.

For many buyers, though, the choice among low-downpayment loans will be between the FHA loan and the Conventional 97. This is because VA loans are available to military borrowers only; USDA loans are restricted to suburban and rural areas, with maximum income limits; and HomeReady™ has similar income restrictions.

Today’s FHA and conventional mortgage rates

For today’s low down payment home buyers, there are scenarios in which the FHA loan is what’s best for financing; and there are scenarios in which the Conventional 97 is the clear winner. Rates for both products should be reviewed and evaluated.

Take a look at today’s real mortgage rates now. Your social security number is not required to get started, and all quotes come with instant access to your live credit scores.

Verify your new rate (May 3rd, 2020)