If you wanted to learn to play basketball, how would you go about it?

What if you wanted to learn how to invest in the stock market?

And if you wanted to write a romance novel?

What if I gave you access to learn from Lebron James, Warren Buffet, and Danielle Steel?

Learning from someone who has already mastered the lesson is priceless.

Do any of these descriptions fit you?

- You’re feeling burned out in your current job and you’re looking for something new

- You’re an entrepreneur who wants to start a new business but you don’t know where you start

- You have an existing business and want to add credit repair as an offering

I have spent almost two decades in the credit repair industry. I know about the strategies that each of these 28 credit repair business owners used to build their operation to seven figures!

I’m sharing everything I’ve learned along the way.

My credit repair software has helped millions repair their credit, helped thousands become successful credit repair business owners, and helped 28 people (and counting) become millionaires!

If you want to learn how to make steady, recurring monthly income while helping people in your community – read on. These strategies have been proven and by starting with these 3 steps, you could be on your way to being the 29th credit repair millionaire!

1. Find Your First Client in 24 Hours on Social Media

To become a credit repair millionaire (or to have a successful credit repair business at all), you need clients! But, if you have no experience in credit repair, you may be struggling about where to start.

The answer is: social media.

It’s simple to get your first client right away, even if you don’t have any experience. Just post the following paragraph as a status update on your Facebook page.

“Hey everyone! I’m learning credit repair right now so I can help people raise their credit scores (to help people save $$$ on loans & qualify for their dream car/home). Before I start charging, I need to find a few people willing to let me experiment with what I have learned. I won’t charge anything! Comment or message me if you’d be interested.”

That’s it!

Now serve them as if your life depended on it (more on that in a bit) and get them results.

After these people see your great results, many of them will go on to become paying customers. Others will give you testimonials and referrals to find other paying clients.

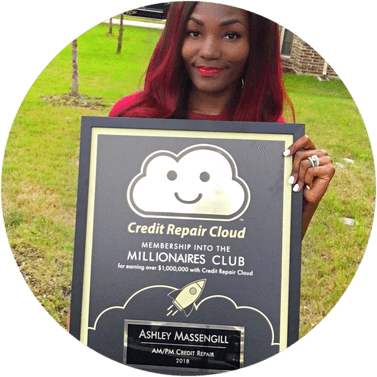

This is exactly how Ashley Massengill started. After helping many of her friends and family repair their credit for free, Ashley realized she could charge for her great results. So she started a credit repair business and in just 18 months, she went from working at the post office to earning over a million dollars in her business.

2. Use Credit Repair Software to Save Time and Scale Faster

On paper, the steps involved with credit repair are straightforward. You send out letters to the credit bureaus and you teach people how to better manage their credit. In exchange, customers pay you a monthly fee.

But, when you have to do everything manually for all your clients, the process takes SO MUCH TIME out of your day. And that takes away from your ability to scale a business and offer exceptional customer service.

Lucky for you, Credit Repair Cloud software helps you automate the most time-consuming tasks involved with credit repair. So you can concentrate on gaining new customers, getting great results for them, and growing your income.

I’ve spent lots of time studying exactly how credit repair businesses work. Then I broke all the processes down into easy steps and then put it all into my credit repair software. I did the work so you don’t have to—using my software saves you tons of time!

For example, the 1-Click Import Audit feature makes it easy for you to serve your clients without spending more than a few minutes on each one, and without being a credit repair expert.

This makes it possible to serve more clients and scale your credit repair business.

Here’s the process:

- Import the client’s credit report in seconds. The software will generate an audit report which you can go over with your client.

- Tag the items on the client’s credit report that you plan to dispute. Credit Repair Cloud highlights any problems in red, making it easy to choose dispute items.

- Send dispute letters for a few items at a time. Credit Repair Cloud helps you create three separate letters for each of the 3 credit bureaus by just clicking your mouse.

Repeat step three over a few months and voila! Your client’s credit will begin to improve.

This simple and automated process reduces your work to less than 5 minutes per month, per client. The software even sends you follow-up reminders and next steps. That means you can spend most of your time actually growing your business.

Don’t get me wrong, being a business owner is hard work. It takes passion, dedication, and time. But my goal in developing this credit repair software is to make the how of running your business easier, so you spend your valuable time focusing on the why.

3. Build Relationships to Build Your Business

I once spent over $200,000 on television ads for my credit repair software. I charged up my credit cards and even re-mortgaged my house and in order to pay for all these ads—and you know what?

I got zero results! It was the biggest—and most expensive—mistake of my life.

What I figured out ($200,000 later) was that if you just work hard, do awesome work and get great results for your clients, they will happily provide you with great referrals. You don’t need ads!

Instead, focus on helping people and building relationships. That’s right – The secret to building a successful business is building relationships.

Here are some of my favorite ways that relationship-building can help you quickly grow your credit repair business.

- Ask your clients for testimonials. You can easily create an automated email that you send to clients to ask for a testimonial on your business’s Facebook page or directly on your website.

- Add affiliates who can refer clients to you. Affiliates are businesses (such as mortgage lenders and auto dealers) who refer people to you that they would otherwise have to turn away for poor credit. It’s a win-win! You get a new credit repair client and they get an improved credit score so they can sell another house or car within a short timeframe.

- Make it easy for customers to find you. Make sure everyone—I mean everyone—knows that you do credit repair. In addition to leveraging your own social media, you can create a free website using the tools available with Credit Repair Cloud software.

The more you get out and meet people, the easier it will be to get more clients, make your credit repair business more profitable, and truly change lives.

Sure, you could try to dunk like Lebron or make readers swoon like Danielle Steel, but doesn’t it sound more rewarding to help members of your own community improve their financial health so they can buy their dream home, pay lower interest on their debt, and ace more job interviews?

Let me help you launch your very own credit repair business. Join our Credit Hero Challenge today!