As a direct bank that has never had a branch, Ally Financial was well-positioned as many Americans, isolated by COVID-19, became seriously focused on digital banking for the first time. In March, Ally’s mobile banking app saw record downloads and in the first quarter the bank gained 71,000 new customers.

But the online-only institution’s success isn’t due only to the advantages of being branchless. Always somewhat of a marketing maverick within banking, Ally has taken a careful, but aggressive approach during the pandemic and is ready to move to the next level. Veteran marketer Andrea Brimmer, Chief Marketing and Public Relations Officer at Ally, has led the charge and shares insights here about what they’ve been doing and why.

“I think the flight to digital will become part of the new normal,” says Brimmer, but she also thinks Ally and other financial brands will be back in selling mode before long, in spite of other experts’ viewpoint that trying to sell in the midst of a pandemic isn’t the right move.

Brimmer says she sees a progression in people’s attitudes through the coronavirus pandemic that resembles the classic “stages of grief.” During the first weeks after the U.S. coronavirus outbreak, she says, the common attitude was, “We’re all in this together and everything’s going to be OK.” The next few weeks anxiety and fear began to take over.

Now the U.S., at different points around the country, is reaching the stage of “emergence.” For some states this will be slow progression, for others a quick affair. And some areas won’t change much because they were never as affected as hot zones like downstate New York, urban California and parts of Washington State.

Being ready and able to pivot marketing stance, language and tone will be as critical in the emergence stage as it was going into the pandemic period, Brimmer believes.

“You can’t be tone deaf. You have to be keenly aware of how people are feeling right now. But you also have to be aware of what they want to hear from your brand,” says Brimmer. “Many marketers have not pivoted from those, ‘We’re all in this together’ messages. I think people are fatigued by those.”

That was a good message to send at the onset of things, but it’s time to move back towards some level of normalcy now, she explains.

“People don’t want to hear messages that are depressing and that add to their anxiety,” says Brimmer. “They want to hear optimism and they want to hear about purposeful ideas that make them feel like the world is going to kind of get back to normal.”

( Read More: Will the Pandemic Give Digital-Only Financial Institutions a Big Win? )

( sponsored content )

Brimmer says it’s time for marketers to begin to use smiles and levity in their messages as well.

“People need to laugh,” says Brimmer.

Humor has been a key element in Ally’s advertising for some time, often in the form of poking fun at competitors. “We’ve softened that, but we’re still doing work that provides a smile, without necessarily going after other brands.”

Humor helps salve Americans’ frustration and desire to get back to their lives, while the country awaits the real relief it craves.

“I think we will return to a state of normalcy, particularly when we get a vaccine,” says Brimmer. “Americans don’t like to be constricted and we’re constricted now. People are anxious to get back to their lives and I think as soon as we have some degree of comfort around safety, we’ll go back to a lot of things that we enjoyed before COVID-19.”

Brands of all kinds will play a part in that transition. “I keep using this phrase, ‘Brands are like a warm chocolate chip cookie’,” Brimmer explains. “When people hear from brands they use, it makes them feel like everything is going to be OK and the world is going to be normal again.”

Read More:

A Time for Maximum Flexibility and Ability to Pivot

Bankers and credit union executives frequently speak of the need for the industry to become more agile on the technology front. The COVID-19 period has underscored that financial marketers must grow even more agile than developments like digital advertising and social media force on the business.

Brimmer points to a campaign that had debuted just ahead of the coronavirus outbreak. The purpose was to promote Ally’s savings toolkit. The video spots featured $20, $50 and $100 bills idling around the house — sleeping past the morning alarm, lethargically channel surfing, eating breakfast cereal like a slob, soaking in a bubble bath.

The original theme was “Don’t let your money be lazy.” Once the outbreak hit, the stock market nosedived and unemployment skyrocketed, this theme no longer worked.

“So we changed the voiceover to pivot away from the idea of lazy money because nobody really has money right now that’s being lazy,” says Brimmer. “We pivoted more towards the idea of how to be smart with the money that you have.” The theme of the spots became “Is your money not sure what to do with itself?” — clearly a question occupying many U.S. households.

Shifts in tone, sometimes major, sometimes subtle, will likely be part of the financial marketer’s challenge going forward for some time, especially should COVID-19 appear to go away and then come back later in the year.

“You have to be keenly aware of how people are feeling right now,” Brimmer explains.

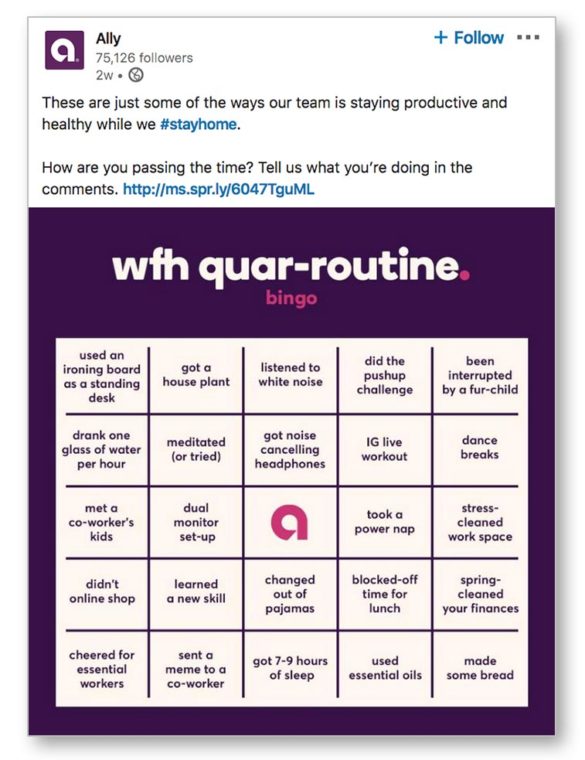

This flexible approach has characterized Ally’s marketing through much of the pandemic period. Among the efforts:

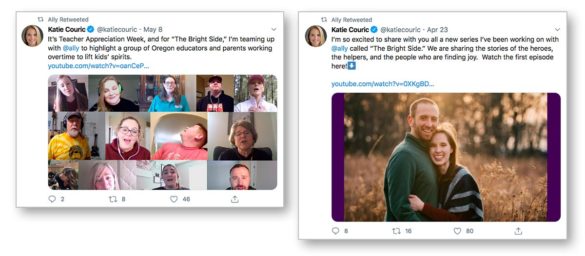

• Ally engaged Katie Couric to present a weekly series of upbeat feature stories under the title “The Bright Side.” Given the need for isolation and social distancing, Couric has anchored the reports from her living room and camera work has been via handheld devices at times. Ally donates to a cause favored by the subject or subjects of each episode or opens an account for them.

• Ally’s NASCAR racing sponsorship might have hit a pothole when in March the organization postponed all races, later shifting to a resumption on May 17 but without live fans. Ally still enjoyed its sponsorship of racer Jimmie Johnson in several ways, however. NASCAR began offering online races conducted from racecar simulators, featuring both past and present drivers. Ally emblems decorated Johnson’s virtual car as well as the virtual track. Johnson also answered fans’ written questions on Twitter with recorded video responses. A variation on the theme was Zoom calls between selected fans and Johnson before virtual races began.

• As America hunkered down at home, Ally began offering rewards for unusual categories of “best” accomplishments. Winners received gift cards if they won a “Stay Insidey” award.

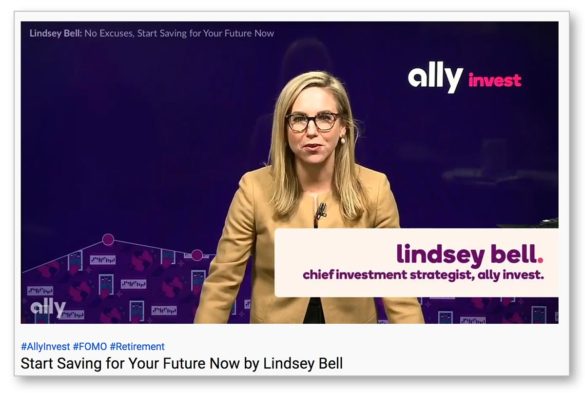

• Financial literacy has become even more important and Ally stepped up its use of YouTube for offering relevant video content. One example is presentations by Lindsey Bell, Ally Invest’s Chief Investment Strategist.

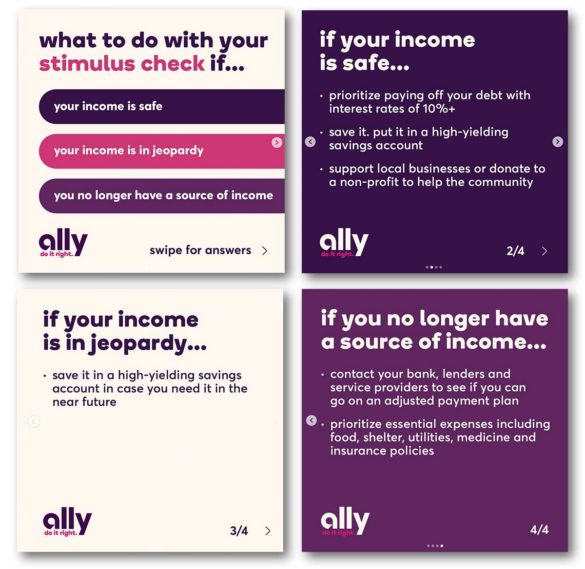

• Ally tapped social media channels to present content or links to website-based content relating to coronavirus issues. For example, Instagram has been used for quick nuggets of “mind candy,” as Brimmer describes it, such as this four-part message of what to do with federal stimulus payments.

Read More:

Four Lessons Marketers Can Learn from the Coronavirus Crisis

Brimmer sees the period the industry is currently embroiled in as having essential things to teach marketers.

1. ‘Brand acts’ are as important as traditional marketing. “Marketing is not just about advertising and content that we put out into the world,” says Brimmer. “It’s about the way that your company behaves at a time like this.”

She adds: “Marketers need to have a loud voice in that behavior, because it’s the behavior, and not the marketing, that consumers are going to remember.” Brimmer says that Ally offers one of the most comprehensive relief packages in the industry. “That was a big brand act. I was integrally involved in the conversations around what was the right thing to do for consumers,” she explains.

REGISTER FOR THIS FREE WEBINAR

Scaling Financial Customer Service and Advice Amid Covid-19 Chaos

How do you retool your contact center and branch offices to deal with this tsunami and scale high-quality service and advice across your customer-facing workforce?

TUESDAY, May 19th at 2pm (ET)

2. Be closer to your customers than ever. During the pandemic Brimmer has been involved in some fashion in every message that reaches the public, a level of involvement that in more typical times is executed through subordinates. “I am in the nitty gritty of everything right now,” she explains. Nothing leaves Marketing without her eye running over it, sometimes in consultation with other members of management, and she is continually personally monitoring digital traffic, online consumer comments and more.

Brimmer is meeting multiple times each week with Ally’s outside agencies and she takes part in regular meetings with firms that conduct consumer sentiment tracking for the company.

“And we’re having different conversations than we normally do, because we need to begin to understand how the world is going to feel in the next six months, especially as we put together our re-emergence strategy,” says Brimmer.

To young financial marketers, Brimmer says, “You’ve got to roll up your sleeves and get your hands dirty. Be in every bit of every fight and get closer to the customer than ever.”

3. Hold your nerve. This is no time for marketers to retreat. Brands shouldn’t go dark nor just continue with the same old same old. Even this far into the crisis, says Brimmer, she is seeing brands running pre-COVID ads that are irrelevant. They feature images that are out of synch with current restrictions, even pushing people to physical locations that may not even be open right now.

“You’ve got to be auditing everything you have out in the marketplace,” says Brimmer.

4. Be human. Brimmer points out that every consumer is stressed, anxious, fatigued and more by the collection of implications of the pandemic and the economic impact of the shutdowns and lockdowns.

“It’s super important to think like a human and not just like a marketer right now,” Brimmer says.

A Fifth Factor that Ranks Highly in COVID-19 Marketing

To this list Brimmer adds something that she has been stressing to Ally’s marketing staff throughout the crisis: Do no harm.

“We have had multiple conversations with our leadership team and with our agency teams regarding what our guideposts should be right now,” says Brimmer. “You have to keep your eyes on what is acceptable right now and what’s not.” She says “gut checks” of marketing efforts are more frequent.

“There are definitely more voices involved in the process right now that I’m happy to have invited in because we have to be ultra cautious about the way we’re thinking about every aspect of the marketing mix,” she explains.

And she is also cognizant of an audience some marketers may not automatically think of because they are not explicitly “customers.” This is the investor community.

“I have been having more conversations with my CFO these days around what’s the right message, the right time for it, and more, from the perspective of investor and the market, as we re-emerge,” says Brimmer.

Read More:

Don’t Bother with Homogenous Messages Today — Target!

In the financial sphere, Americans are now divided into two major groups right now, according to Brimmer. The first group are nervous people who are seeking safe places to put funds, like CDs. The second group are people who are in better cash positions who see the current state of the markets and rates as an opportunity. They are ready to take greater risks to capitalize on potential gains.

Increasingly, financial brands need to craft messages to both groups and they have to find the best channels to reach them with what will likely be different messages. People in the first group want answers to questions about FDIC insurance, savings plans and other conservative matters. By contrast, people in the second group don’t need such content, but they want to hear what experts think the market will do.

“We are utilizing more targeting and social media listening in order to deliver more personalized messages,” says Brimmer.

( Read More: Why Financial Institutions Should Continue Advertising, But Differently )

Where Will Marketing Budgets Go in the Months Ahead?

Brimmer thinks financial marketing spending plans will vary all over the lot in the months ahead. She suspects that disruptor brands that can afford it will step up their budgets to seize the opportunity to promote digital channels. Likewise she thinks direct banks — such as Ally — “will more heavily lean into the opportunity to go after this new behavior.”

Many money-center banks will likely cut budgets, she expects, in order to shrink expenses. Overall, she thinks more institutions will be cutting marketing funding than increasing it.

One reason for this is a divergence from past patterns. In a twist, spending may fall because in certain content categories there is simply less supply to be had.

“The networks aren’t producing shows, sports are cancelled,” says Brimmer. “Even if you had all the money in the world available to you right now, there’s not a lot to spend it on.”

And there’s a second twist as well: Production values that have represented such a high proportion of marketing costs may not be as critical as had been thought.

Brimmer points to the growing number of commercials shot on iPhones and the growing proportion of consumer-generated content put together for video marketing.

“It’s less glossy, but its also more real and more authentic,” she explains. With news programs, network talk shows and more coming live to you from the living room of the host or anchor, will America go back to old looks and ways?

“People are really liking this voyeuristic look into celebrities’ lives and homes,” says Brimmer. “There could be some very interesting changes coming out of this period.”