Despite not wanting to buy stocks after the S&P 500 has rebounded by over 30% since its March 2020 bottom, I still own a significant amount of stocks across a number of investment portfolios: two 529 plans, a SEP IRA, a Rollover IRA, a Solo 401(k) and a couple taxable investment accounts. Then there’s my wife’s SEP IRA, Rollover IRA, and two taxable investment accounts that own mostly stocks as well.

One would think that if I didn’t want to buy stocks after a rebound, I should also be willing to sell stocks that I already own. I do want to sell and I have sold plenty in my accounts in order to de-risk, but I’ve held off on selling stocks in most of my tax-advantageous accounts due to a variety of reasons I’ll talk about in this post.

To be clear, I’m not advocating buying after a huge rebound. I’m going to explain in 12 reasons why I haven’t gone to 100% cash or short-term Treasury bonds across all my portfolios. Everybody is at a different stage in their financial journey. Nobody knows for certain what the stock market will do, so please keep an open mind when reading. This post should help explain why so many people keep buying, despite all the destruction.

Why You May Want To Buy Or Keep Owning Stocks After A Huge Rebound

1) Many are benefitting from the depression. There are winners and losers in any economy. In the global pandemic of 2020, some of the winners include video conference companies, online consumer companies, cleaning product companies, and all the people who continue to work from home and collect a full paycheck.

Just because you are depressed from reading demoralizing headlines in the news every day doesn’t mean that everybody is suffering. The media tends to focus on the negatives to drum up more viewership. During a recession, people would rather read about people suffering more than they are, rather than read about someone doing very well. It’s just human nature.

If you are easily spooked, I suggest not following the news during a crisis. The news will only make you feel like the world is coming to an end.

2) The Federal Reserve is on the investor’s side. Time and time again Fed Chair Powell has indicated he will do whatever it takes to ensure that the financial system continues to operate properly. He has said he will use the Federal Reserve’s balance sheet to buy up different types of assets at whatever price necessary.

With the return of Quantitative Easing 4 (QE4), the Fed’s balance sheet will continue to surge higher until economic prosperity is restored.

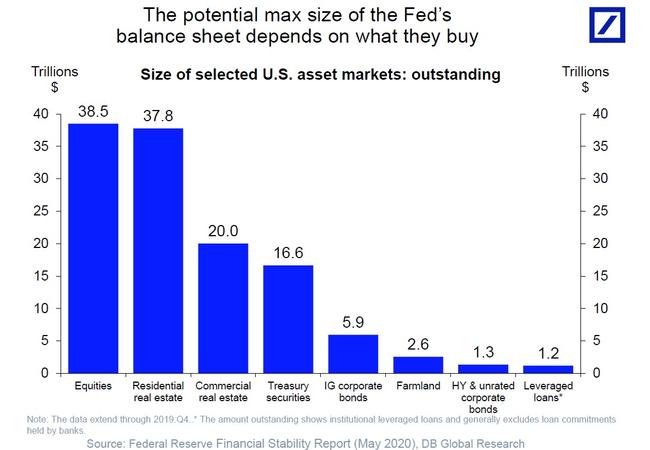

Hypothetically, if the Fed decides to buy everything, based on Deutsche Bank’s estimate below, the Fed’s balance sheet could grow by $130 trillion. One week the Fed might be buying municipal bonds. Another week the Fed could be buying mortgage-backed securities. The S&P 500 will rocket higher if the Fed ever announces it will start buying equities. It’s probably unlikely to happen, but it could.

When you can print endless amounts of money and sell endless amounts of debt, there really is no limit to the size of the Fed’s balance sheet. To the future children of America who have to pay for all our debt, sorry!

3) The Federal Government is on the investor’s side. Whether you believe in the powers to be or not, the Federal Government is on the investors’ side, especially during an election year. The Federal Government can pass stimulus packages that will excite investors. The Federal Government can conduct tremendous infrastructure spending to get millions of people who have permanently lost their jobs working again.

Between 1933 and 1939, President Roosevelt announced The New Deal, a series of programs, public work projects, financial reforms, and regulations to help the United States recover from the Great Depression. It is highly likely the Federal Government will do something similar again.

4) There could be a vaccine for the coronavirus sooner. Although scientists say that a vaccine is more likely to be developed 12-18 months from now, a vaccine could be developed much sooner. With the potential for billions in profits, you know that scientists and entrepreneurs are working overtime to be the first to find a cure.

On May 18, 2020, we saw the S&P 500 rally by over 3.5% after Moderna announced promising results from its initial trials. Whether its results are legitimate, nobody knows for sure. Given how quickly stocks move, equity investors tend to buy or sell first and ask questions later. Don’t let us down Gilead and Moderna!

5) You want to hedge against a layoff. Ironically, the more terrible the unemployment numbers, the more the stock market rallies. Every weekly unemployment claim in April resulted in a stock market surge. The assumption is that the worse unemployment gets, the more the Federal Reserve and the Federal Government will step in to stimulate the economy.

You see the same phenomena of a company stock rising when a company announces a big layoff. Layoffs show investors that management is being proactive in cutting costs and increasing the company’s chances to return to maximum profitability. For example, after Uber announced another 3,000 job cuts after already laying off 4,000 employees several weeks earlier, its share price jumped by 8%. All the remaining employees are benefitting.

The more a company can do with less, the higher the profits. The higher the operating profits margin. The higher the potential earnings, the higher the potential share price.

6) You want to own companies you can’t join. One of the reasons why I bought stocks such as Facebook, Google, Netflix, Apple, and many other names is because I wasn’t able to land a job at any one of them. Here I was, living in San Francisco since 2001 and missing out on all the tech mania because I worked at an investment bank.

I didn’t join any of the tech companies because I didn’t have any tech skills and it was hard to leave a healthy finance paycheck behind. Instead, I just bought a bunch of tech stocks. I also decided to get as long as possible on San Francisco real estate. Real estate is one of the best ways to invest in the local economy.

If you can’t join a company you like for whatever reason, consider buying its stock so you can still participate in its potential upside.

7) You have specific reasons for investing. The best way to continue investing is if you have reasons to invest. I own stocks in my Rollover IRA, SEP IRA, and Solo 401(k) to help fund my retirement after the age of 60. Because I’ve got 17 more years to go until I reach 60, I’m OK with being overweight stocks in these portfolios.

I am also overweight stocks in two 529 plans because the money won’t be touched for 15 and 18 years, respectively. I’m confident that by the year 2035+, the S&P 500 will be higher. Even though it’s my money, it kind of feels easier taking more risk for my children.

I also own stocks in my taxable investment portfolios because I like some individual companies that have incredible growth potential. I also like receiving passive dividend income. However, I’m underweight stocks in my taxable investment portfolios because I count on these portfolios to provide for our retirement income today, not decades in the future.

To help you stay the course during times of uncertainty, identify specific reasons why you are investing in stocks.

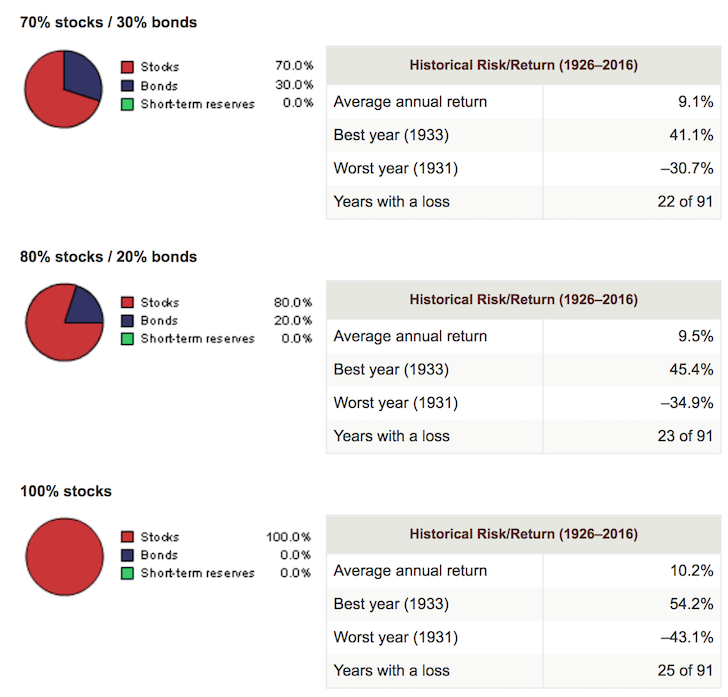

8) Stocks generally do well over the long term. If we look back since 1926, stocks have returned roughly 10% a year, including dividends, on average. A stock investor has almost always made money in stocks over any 10-year period.

One of the keys to good performance is investing in the right time period. For example, if you invested in stocks in 2000, you basically returned nothing for the entire decade.

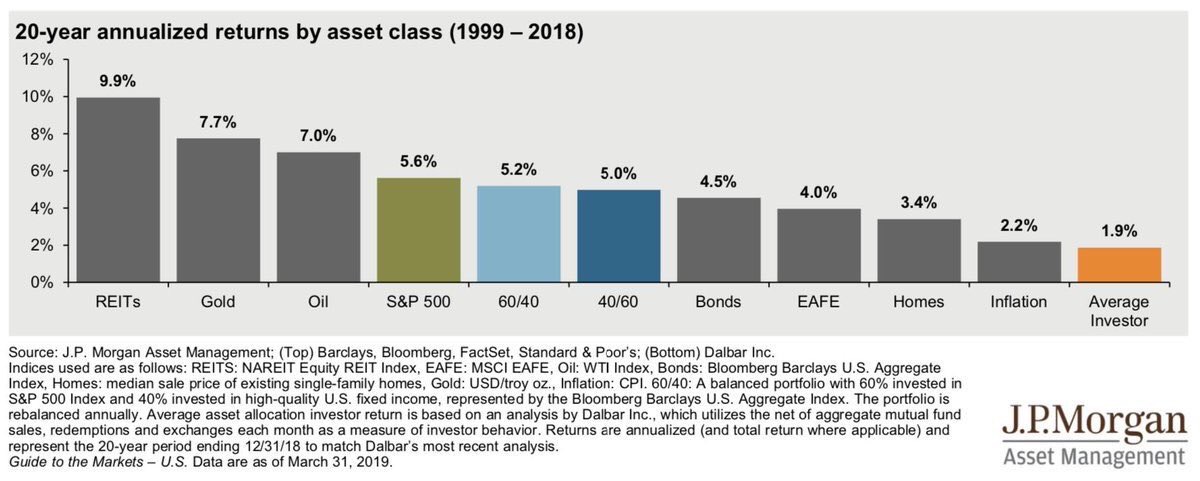

Below are the 20-year annualized returns by asset class between 1999 – 2018. Stocks started doing well between 2009 – 2019. However, it was REITs that performed the best among all the below asset classes.

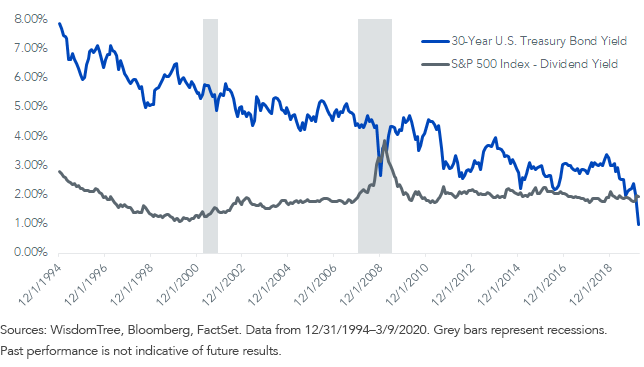

9) Bond yields are too low. Everything is relative in finance. When bond yields are high, bonds look relatively more attractive than stocks. If you can invest in a bond that pays 10% a year with minimal volatility and a guarantee you will get all your principal back, you’d probably invest most of your assets in bonds. I would.

With the 10-year bond yield under 0.8%, it’s hard to invest in bonds for capital appreciation. Instead, investors are mainly investing in bonds for safety. If the S&P 500 is reasonably valued and provides for a higher dividend yield, investors may be more inclined to invest in stocks.

Below is a historical chart of the 30-year U.S. Treasury bond yield versus the S&P 500 index dividend yield. Based on the last global financial crisis, buying equities was a good idea once the S&P 500 index dividend yield surpassed the 30-year U.S. Treasury bond yield in 2009.

10) You believe earnings estimates are too low. If earnings estimates are too low, this means that current equity valuations are too high. When equity valuations are too high, investors tend to stay away. However, if you believe a company’s true earnings are higher than currently expected, then you may want to buy the company’s stock in anticipation of analysts catching up to your higher earnings estimates.

In other words, buying when valuations are high is the perfect time for investors who believe earnings have upside surprise. Below is chart that shows the S&P 500’s historical P/E and where it should be based on a 20X P/E, 15X P/E, and a 10X P/E.

Let’s go through a stock example to highlight why buying when valuations are high may be a good idea. Let’s say a pharmaceutical stock trades at $10 a share and the consensus earnings estimate for the year has fallen from $2 to $1 a share. As a result, the P/E is an expensive 10X versus a historical P/E multiple of 8X.

A typical investor might think the stock is too expensive and stay away. However, based on your knowledge about its vaccine trials for COVID-19, you believe the true earnings estimate for the year is between $5 – $10 a share, giving the company a current true valuation of only 1X – 2X P/E.

If the company’s vaccine gets approved and the company’s earnings go to $5, then based on a historical earnings multiple of 8X P/E, the company’s share price could rise to $40 (8 X $5) from $10. If the company’s earnings go to $10, then its shares could surge to $80.

At the end of the day, a stock’s share price is based on its earnings potential and a valuation multiple. Generally, the higher the earnings potential, the higher the share price.

In today’s environment, if you believe in a V-shaped recovery, 90% – 100% of laid-off employees getting their jobs back at full pay, no second wave of COVID-19, and a vaccine by the end of the year, you should be buying stocks since the S&P 500 is still more than 10% below its all-time high.

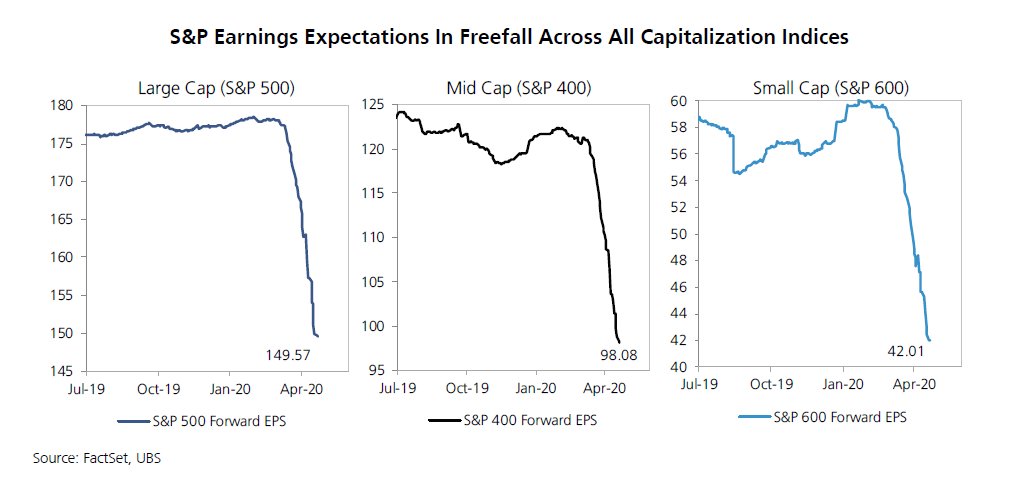

Below is a chart that shows how forward earnings estimates have been cut by about 15% across all capitalization indices. A stock market bull will believe a 15% earnings cut is too much. A stock market bear will believe that only cutting earnings expectations by 15% is way little.

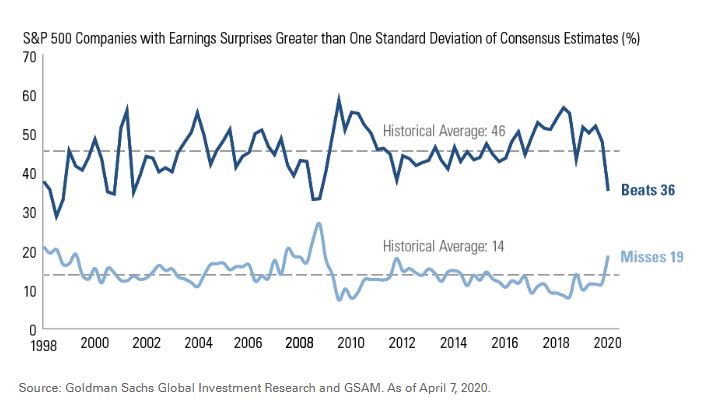

Below is another interesting chart that highlights the number of S&P 500 companies that beat or missed consensus estimates by greater than one standard deviation. So far, the data is not looking good for bulls because analysts have not cut their estimates fast or large enough.

11) You have a high risk tolerance. Dollar-cost investing in stocks doesn’t take a lot of guts because the average amount you are investing isn’t very large relative to your income or net worth. You just have to keep on investing in good times and bad times. On the other hand, investing a much higher-than-average amount of capital after a 30% rebound during a global pandemic with record-high unemployment is another thing.

Since 1999, I’ve had no problem investing a maximum amount each year in my 401(k). While I was working, the maximum contribution amount was between $10,500 – $18,000, or less than 20% of my gross income each year. But I could never get the guts to invest more than $200,000 at a time into the stock market during times of uncertainty. Instead, I bought property because I knew property wouldn’t just disappear overnight.

If you have a high-risk tolerance because you’re young, have a stable job, don’t have dependents, don’t freak out about volatility, make a lot of money, or have endless energy to make up for any potential losses, then investing in stocks can be a good choice.

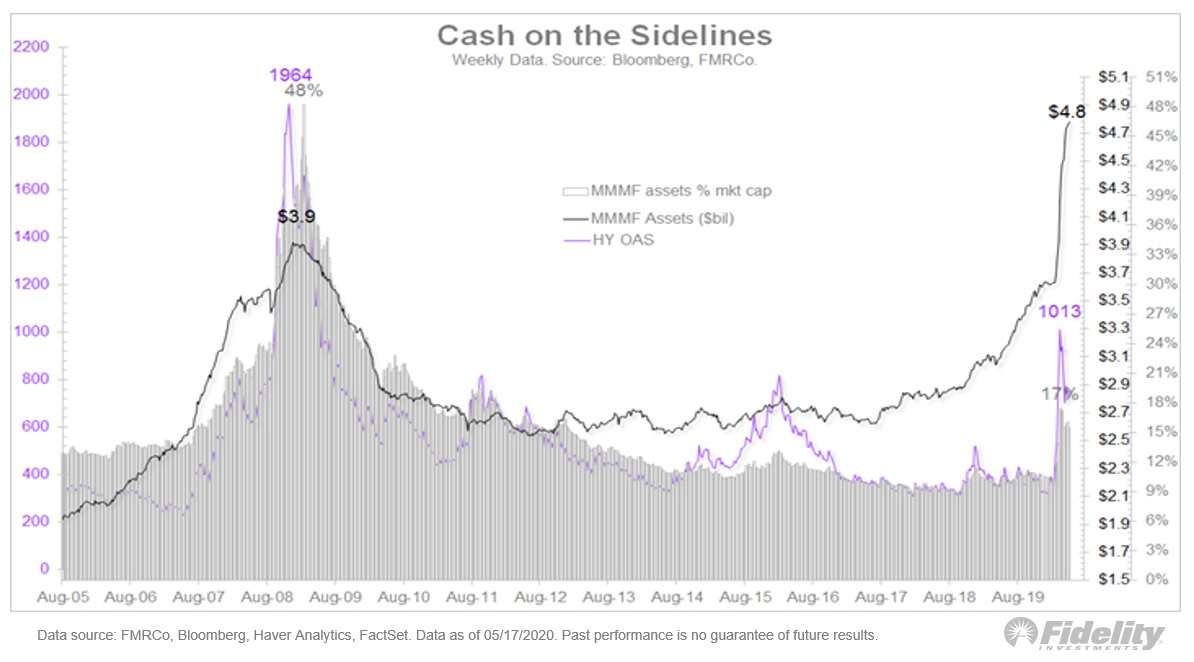

12) There is a massive amount of cash on the sidelines. Despite the big rebound in the stock market so far, cash on the sidelines continues to move higher as skepticism about the recovery increases. As a result of a large amount of cash, there is the potential for the stock market to go even higher if more good news starts getting reported about the virus and the economy.

When cash levels were high back in August 2009, the stock market was near its low and proceeded to march higher as cash was put to work. The problem with today is that we’ve already rebounded a lot from March lows.

When Investing, Think In Probabilities

Conventional wisdom says to buy and hold stocks for the long term. Based on the S&P 500’s historical track record, it’s hard to go against conventional wisdom. However, I’m also a strong believer in regularly spending your profits to pay for a better life.

There’s no point investing if you never end up using your investment money. If you hoard all your investments until your remaining few years of life, you will have wasted all that time working and saving.

When investing, always think in probabilities. Ask yourself what is the probability the stock market will go higher or the probability the stock market will go lower within a certain time frame. Time is an important factor because we can’t live forever and there is an opportunity cost for investing your money.

For example, if you believe there is a 30% chance stocks move higher within a year after a big rebound, you logically believe there is a 70% chance stocks move lower in the same time frame. You don’t know for sure, but you can invest according to your beliefs and invest more conservatively.

In this situation, if you have $1 million in investable assets, perhaps you will only allocate $300,000 (30%) in stocks and allocate the remaining $700,000 (70%) in bonds or leave it in cash.

Given the opportunity cost to investing is not spending money today, you can also spend some or all of the remaining $700,000. For example, I know with 100% certainty that spending $15,000 for a hot tub will bring me tremendous joy. Therefore, if I needed another one, I would absolutely spend $15,000 instead of invest the money.

Despite all the economic destruction that has happened since lockdowns were implemented, I do believe there is still a 30% chance the S&P 500 will reach a new all-time high in 2020 and a 40% chance a new all-time high will be reached in 2021. I also think there’s a 60% chance the S&P 500 stays rangebound between 2,600 – 3,000 for the year. Given these percentages, I will keep my tax-advantageous money mostly in stocks with the expectation that I will be wrong.

However, with my taxable investment portfolios, which are larger, I don’t want to risk being too wrong because I need the money to spit out a steady stream of retirement income. If I end up losing a lot in my equity portfolio, I increase the risk of having to go back to work. Therefore, I have logically lowered my equity exposure the higher equities go.

Finally, given I believe there will be real estate buying opportunities in the near future, I’m looking to amass more cash instead of always investing new cash flow into the stock market.

Real estate is likely always going to be my favorite asset class to build wealth given it provides shelter for my family and has the potential to go up. Living in a larger home with a backyard for my son has really been a godsend during the lockdown period. Real estate may not provide as much appreciation as stocks, but it won’t fall as drastically as stocks either.

If you still want to buy stocks after a massive rebound and after carefully reading this post, go ahead. Just be aware of the risks. I’ve maxed out my tax-advantageous retirement accounts for the year and won’t be investing any more money in my taxable portfolio in stocks until valuations look more reasonable.

In the meantime, let’s go bull market!

Related: How To Predict A Stock Market Bottom Like Nostradamus

Readers, I’m curious to know what are your reasons for buying and holding stocks after a huge rebound?