Key themes

- In Q1 2020, the impacts of COVID-19 on issuer earnings were still relatively mild in terms of portfolio growth and losses. However, reserves spiked based on expected future losses, putting significant pressure on earnings.

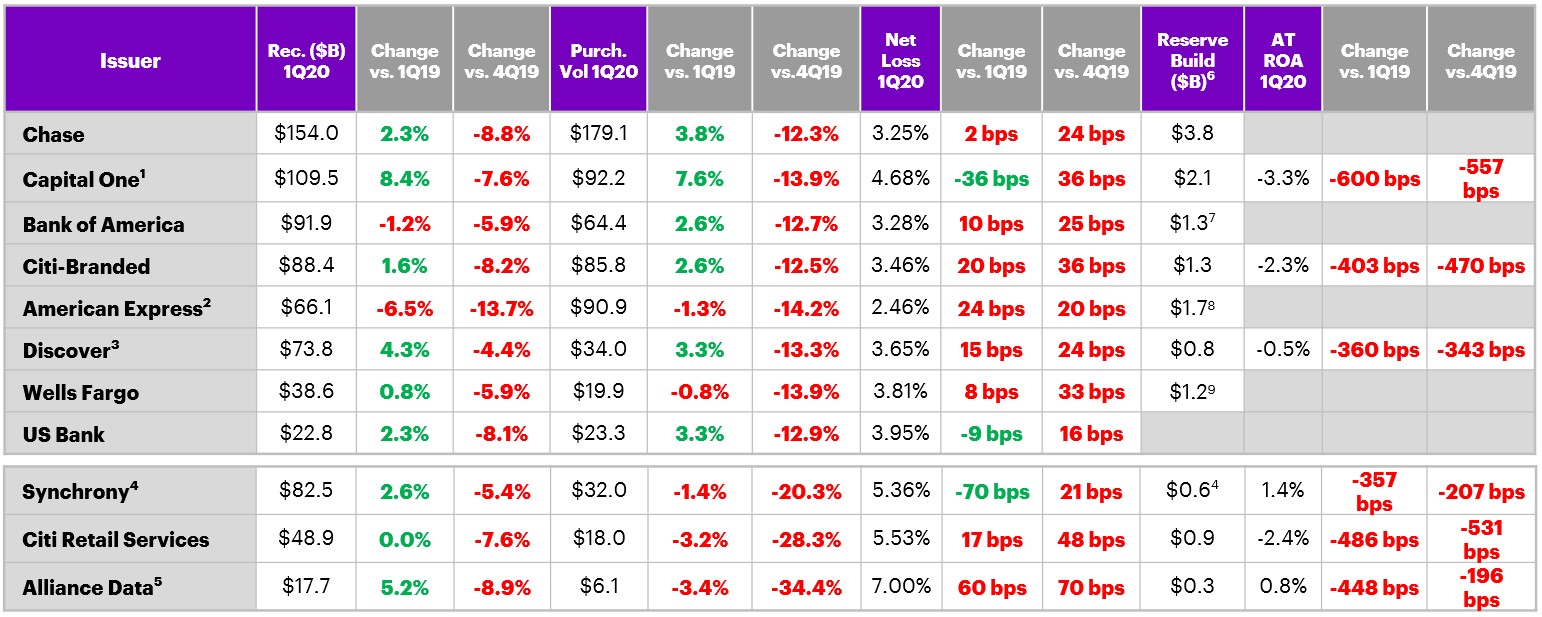

- YoY growth in receivables for Q1 2020 was modest at 1.9%, and below the 4% YoY growth seen in Q4 2019. Similarly, purchase volume growth YoY was 2.6%, but is far below the 7.1% YoY growth in Q4 2019.

- ADS had the most significant decline in spend among all issuers likely due to its high weighting in PLCC cards and mall-based retail; Synchrony and Citi Retail experienced similar results.

- Loss rates increased both YoY and QoQ for most issuers, but only modestly as the impact of COVID-19 on losses will lag until Q2 and/or Q3.

- Issuer profitability declined sharply across the board due to the large reserve builds for future losses expected due to the pandemic, as well as CECL requirements.

For more payments insights, subscribe to our Payments Navigator newsletter

Notable happenings

New partnerships

State Farm announced a partnership with U.S. Bank to outsource its deposit and co-brand credit card accounts; Klarna announced a number of new US retail partners including Good American and Planet Blue; SoFi announced a new partnership with Mastercard to launch a suite of debit and credit card products; Afterpay announced a partnership with Marqeta to issue/market Afterpay product offerings.

Partnership developments

Chase renewed/extended its co-brand credit card relationship with United Airlines until 2029; Alliance Data renewed its long-term co-brand partnership with Caesars Entertainment; Synchrony announced it extended and renewed several key relationships (specific partners were not disclosed).

New products/features

Delta and American Express relaunched the Delta SkyMiles portfolio with enhanced value propositions and benefits; Chase added benefits to its Sapphire Reserve product (namely through new partnerships with Lyft and DoorDash) but at a higher annual fee of $550; Chase and United Airlines announced the launch of a new SMB co-brand card.

Mobile & tech

Revolut launched its Financial Super App and debit card in the US; Capital One launched new features for its chatbot functionality, including fraud and transaction alerts; Ally Financial launched new tools to help customers boost savings.

Industry statistics (based on non-retail card issuers in scorecard section)

1 Total receivables for all issuers below at end of 1Q20. 2 Total purchase volume of all issuers below in 1Q20, not annualized. 3 After-Tax ROA of issuers that publicly report – Citigroup, Capital One, Synchrony, Discover and ADS. 4 YoY = Year-over-year change versus 1Q19. 5 QoQ = Quarter-over-quarter change versus 4Q19.

Issuer scorecard ($billions)—Q1 2020

1 Capital One is US consumer and small business credit cards and installment loans. Purchase volume excludes cash advances. 2 American Express changed its reporting method as of 2Q18; all figures are for US Consumer segment (revolving and charge products) which no longer reports net income. 3 Discover receivables, purchase volume (excludes cash advances), and losses are US domestic card only; ROA includes all of Direct Banking segment (credit card loans represents ~80% of Direct Banking loans). 4 All figures include all of SYF’s business lines (i.e., Retail Card, Payment Solutions, and CareCredit). Retail Card accounts for ~70% of total receivables. 5 Average receivables of $18.3B (does not include loans held for sale). 6Credit card specific unless otherwise noted. 7Consumer Bank. 8Global Consumer Services. 9Community Bank.

This makes descriptive reference to trademarks that may be owned by others. The use of such trademarks herein is not an assertion of ownership of such trademarks by Accenture and is not intended to represent or imply the existence of an association between Accenture and the lawful owners of such trademarks.