Central banks can enable and leverage innovation internally and externally to support and promote a vibrant digital economy

In our last post, we looked at how central banks can harness the power of data. We move on now to the second pillar.

Pillar 2: Enable and drive innovation

A key role for central banks is to enable and promote a vibrant financial sector. In the digital age, that means helping to cultivate new fintech entrants, supporting banks and the broader financial services (FS) community to introduce new services and ways of working, and promoting cross-industry and cross-border collaboration. Central banks must also use innovation for their own operations as well as learning and experimenting to ensure they keep up with advancing technology and trends in the market.

There are several ways in which they can drive innovation externally. A regulatory and technical sandbox is a useful tool providing fintechs and banks with a safe space to test potential solutions without being overburdened by regulations at the solutions stage. The worth of sandboxes has been proven across various jurisdictions including Singapore [Monetary Authority of Singapore (MAS)], Hong Kong (Hong Kong Monetary Authority), Saudi Arabia (Saudi Arabian Monetary Authority) and the UK (Financial Conduct Authority).

Another useful tool is a dedicated innovation center, such as those established by the International Monetary Fund and the Bank of International Settlements (BIS). BIS’s Innovation Hub, which is helping to drive innovation among central banks globally, was established to:

- Determine which trends in financial technology would be useful for central banks

- See how the development of public goods can enhance how the global financial system functions

- Provide a focal point for experts on innovation at central banks around the world

Additionally, like other financial institutions, central banks could consider establishing hack-a-thons as a means to demonstrate how new technologies can resolve challenges with regulatory compliance and supervision—such as the one hosted in April 2020 by the Saudi G20 Presidency and BIS. When it comes to driving innovation internally, using these technologies helps central banks operate more efficiently and stand as examples to the industry.

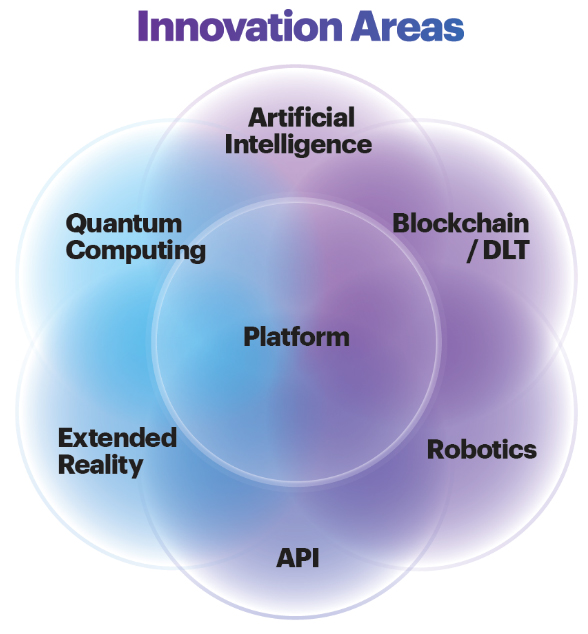

Areas of innovation

Over the past decade, technology has evolved fast from SMAC (Social, Mobile, Analytics and Cloud) technologies to DARQ technologies: distributed ledger technology (DLT), artificial intelligence (AI), extended reality (XR) and quantum computing. Central banks and regulators should embrace and strengthen their own capabilities in DARQ technologies because these will be the next source of differentiation and disruptive technology, will drive innovation areas and will help them supervise the financial sector more effectively.

DLT and blockchain solutions are being used by a number of central banks. The People’s Bank of China, for example, said it will roll out its central bank digital currency in 2022 after piloting it in several areas before that. We are supporting Sweden’s Riksbank in its pilot of the e-krona, just one of a number of projects with which we are involved on the DLT and digital currencies front.¹

AI can address issues related to fraud and anti-money laundering, and to counter the financing of terrorism. In the UK, the Bank of England is working on the concept of an AI-powered bot called BoB that could automate simple tasks such as information-gathering and data analysis, as well as cognitive tasks like financial supervision, monetary-policy analysis and situational assessment. Other solutions—such as Ripjar, Quantexa and FNA—are being used in various central institutions and central banks in areas such as fraud detection, transaction screening, the investigation of financial crimes and liquidity optimization.

Robotic process automation (RPA) can be used in areas like financial institution supervision, data processing for analysis of the macroeconomy, as well as assessing forensic misconduct and allowing central banks to reimagine job roles—all of which boost organizational efficiency and lead to a cleaner and healthier financial sector. RPA ensures repetitive tasks can be completed quicker, while less human input means higher-quality work in enhancing financial prudence and supervision.

APIs allow secure, reliable and fast transfers of data between independent systems—in Open Banking, for instance, allowing the sharing of customer-permissioned data between a bank and an insurance company to devise new products. Regulatory action is key to driving innovation, as the European Union’s Open Banking initiative has shown: Its Revised Payment Services Directive (PSD2) regulates payments services and providers of those services operating in the bloc, with banks required to ensure that their APIs meet the industry standard.

Other technologies may be at earlier stages of implementation but their potential impact warrants development. These include extended reality—which can be used for training as well as banking customer sales and service—and quantum computing, the vast processing power of which “could fundamentally change the face of banking” with the ability to run more sophisticated AI programs, and alter economic modeling and risk-based computation—but which also threatens existing security standards.

Looking ahead

The purpose of delivering such innovations is to drive market efficiency by:

- Providing more efficient and effective regulatory oversight

- Enhancing collaboration between central banks and financial institutions

- Reducing financial risks and security threats

- Driving a cashless and digital economy

- Boosting financial inclusion

- Stimulating growth

By enabling and using innovation internally and externally, central banks can better support and promote a vibrant digital economy. In doing so, they will generate efficiencies—the subject of our next blog—and ensure the FS sector thrives in a secure, resilient and future-ready infrastructure.

For more on how DLT is enabling more functional currencies, read our (R)evolution of money II report.

1For example: European Central Bank’s EUROchain, MAS’s Project Ubin, Bank of Canada’s Project Jasper and the Digital Dollar Project in the US.