Overview

Rocket Mortgage is owned by parent company Quicken Loans.

Together, the two lenders are the nation’s largest mortgage company. They’re also — as Quicken points out on its site — the second-biggest lenders for FHA and VA loans.

Both Rocket Mortgage rates and Quicken rates tend to be a little above the industry average. However, it’s hard to beat the quality and ease of Rocket’s online mortgage process.

Everything is done online, and Rocket claims it can have customers pre-approved for a home loan in just eight minutes.

If that sounds like your cup of tea, check personalized rates from Rocket to see whether the company has competitive rates and fees for you.

Compare Rocket Mortgage rates

Rocket mortgage rates — and Quicken mortgage rates, for that matter — tend to be slightly above market average on any given day.

But remember that advertised rates are only meant as a benchmark, and yours could be lower than most depending on how strong of a borrower you are.

30-year fixed-rate mortgage estimates at major banks

Rocket Mortgage (Quicken Loans) |

Wells Fargo |

Chase |

Bank of America |

|

Average 30-Year Interest Rate, 2019 |

4.16% | 4.22% | 4.22% | 4.05% |

Monthly P&I Payment |

$973 | $980 | $980 | $961 |

Median Loan Costs, 2019 |

$5,075 | $3,484 | $3,440 | $3,918 |

Median Origination Charges, 2019 |

$2,805 | $1,199 | $1,279 | $1,265 |

Average rate and fee data are sourced from public records required by the Home Mortgage Disclosure Act (HMDA).

According to public records, in 2019, Rocket & Quicken customers had median loan costs of $5,075 of which the lender’s own origination fees accounted for $2,805.

*Monthly principal and interest payment based on a $250,000 home price, with 20% down, at each lender’s average 30-year interest rate for 2019. Your own rate and monthly payment will vary.

Verify your new rate (Jul 18th, 2020)

Rocket Mortgage vs. Quicken Loans

Rocket Mortgage and Quicken Loans are owned by the same company. But they serve slightly different purposes.

Rocket Mortgage is Quicken’s main online platform. It handles the application process and takes mortgage payments.

Quicken does more of the behind-the-scenes work. It underwrites and processes the loans that customers apply for.

Whether you apply through Rocket Mortgage or directly through Quicken, you’ll be held to the same standards for qualification and offered the same rate. So don’t expect to be offered a better deal from Rocket than Quicken, or vice-versa.

Get started with Rocket Mortgage today (July 18, 2020)

Rocket Mortgage review for 2020

Rocket Mortgage describes itself this way:

“If you don’t have the patience for banks and want a fast, convenient way to see your mortgage options, you should give Rocket Mortgage a try.”

So, is this all-digital lender really worth it?

One thing to note is that Rocket Mortgage doesn’t excel for its rates, which are average at best.

But one area in which Quicken Loans, including Rocket Mortgage, is industry-beating is in its customer service.

The lender topped J.D. Power’s 2019 U.S. Primary Mortgage Origination Satisfaction Study. And that was the tenth consecutive year in which it had held that spot.

Together, Rocket Mortgage and Quicken have been top-rated for customer satisfaction for the past ten years. Image: Quicken

So if you want to be happy with your mortgage and the service you get along the way, it’s going to be hard to beat Rocket or Quicken.

Of course, that applies only to those who are comfortable using the Rocket Mortgage online application processes.

Naturally, the lender promises “expert advice when you need it.” But the whole idea is that the system itself is so expert it will gently lead you through the entire experience.

And it helps if you’re a “good” borrower: reasonably creditworthy and with debts you can easily afford.

Having said that, the website does say this lender will entertain applications from those with scores as low as 580.

Rocket Mortgage pre-approval

Rocket mortgage offers online pre-approval for home buyers and refinancers.

To get pre-approved by Rocket, start at the company’s online portal. Answer a few questions about your income, assets, and debts. Then Quicken (Rocket’s parent company) will verify your financials by checking your pay stubs and recent bank statements.

Rocket and Quicken say they’ll complete the pre-approval process in just 24 hours. You can start your Rocket Mortgage pre-approval here.

Working with Rocket Mortgage

We’re looking at one of the mortgage industry’s true innovators here. So you won’t be surprised when you visit Rocket Mortgage’s website and find one of the very best.

Unlike with some of its competitors, the numbers contained in its rate quote should typically be reliable.

Yes, you have to be entirely honest with the information you provide. And yes, you can adjust things later, when you finalize the price of the home you buy or have to change that amount after an appraisal.

You’ll also have a good range of options if you want to purchase discount points. That’s when you pay a bit more upfront on closing to buy a lower mortgage rate.

But, unless you change such things yourself, you can generally rely on the rate quote you receive online to be accurate.

Once Rocket Mortgage approves you, and you accept a quote, you’re ready to move forward.

And the website continues to offer rich functionality.

It provides a secure environment where you can communicate with loan officers, upload documents, monitor your loan information and access your closing documents.

In fact, if you really don’t want to talk to another person, you can opt to communicate via its Talk to Us page. But you always have the option to talk to a real live loan expert over the phone.

Rocket Mortgage customer service reviews

When it comes to information about Rocket Mortgage customer service, it tends to be treated as part of Quicken Loans. That’s fair enough. It is, after all, an “experience” (or brand) offered by Quicken, not a separate company.

Mortgage-related complaints at major lenders

Company |

Mortgage Originations 2019 |

CFPB Complaints |

Complaints per 1,000 Mortgages |

2019 JD Power Rating |

Rocket Mortgage (Quicken Loans) |

774,900 | 187 | 0.24 | 880/1,000 |

Wells Fargo |

1,026,800 | 342 | 0.33 | 837/1,000 |

Chase |

527,600 | 188 | 0.36 | 850/1,000 |

Bank of America |

466,552 | 245 | 0.53 | 843/1,000 |

As mentioned above, Rocket Mortgage and Quicken Loans set a bar for customer service that others simply can’t clear.

Fairway Independent Mortgage got very close in 2019. But it didn’t manage to end the Quicken Loans ten-year run as the league-topping mortgage lender.

And unsurprisingly, Rocket/Quicken’s high satisfaction scores are reflected in low complaints.

Federal regulator the Consumer Financial Protection Bureau maintains a public, online database of consumer complaints against mortgage lenders. And in it, Quicken Loans has one of the lowest (maybe the lowest) number of complaints — at less than half a complaint per thousand mortgages.

Mortgage loan products at Rocket Mortgage

As you’d expect, the Rocket Mortgage product portfolio is the same as the Quicken Loans one. Options include:

- Fixed-rate mortgages (FRMs) — Most people want their fixed-rate loans to last 30 years. But with Rocket, you can choose a term from eight years up to 30

- Adjustable-rate mortgages (ARMs) — These are initially more affordable than fixed-rate mortgages, but come with the risk of higher rates later. You can fix your rate for a period of five, seven or 10 years after which it will move up and down with the market

- FHA loans — Backed by the Federal Housing Administration, these are great for those with imperfect credit and low down payments (min. 3.5 percent of purchase price). But they come with pricey monthly mortgage insurance payments

- VA loans — For eligible service members, veterans and surviving spouses. Zero down payment, even easier credit requirements and no continuing mortgage insurance payments

- Jumbo loans — Borrow up to $3 million, if standard loan caps are cramping your style

The only thing Rocket really doesn’t offer is a proprietary loan product. Some other lenders — mainly big banks — create their own loan types, often with a low down payment and no mortgage insurance.

But Rocket’s mortgage loan portfolio is wide enough that this won’t be an issue for most people.

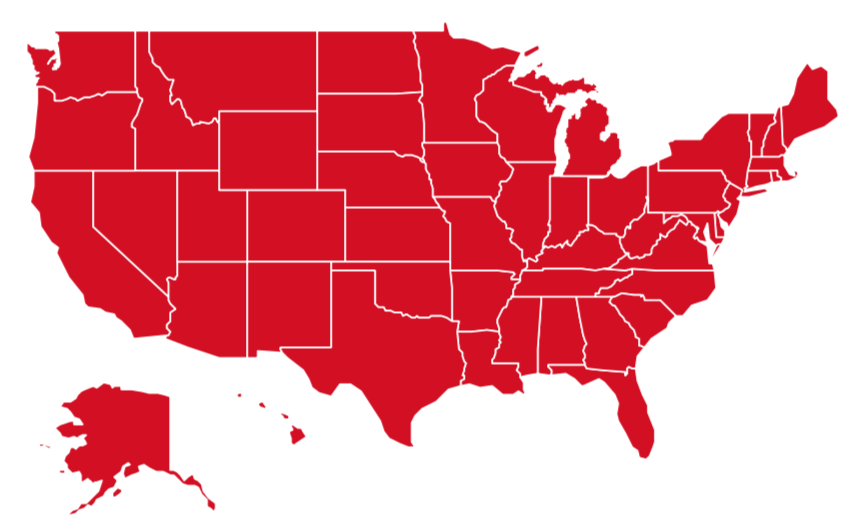

Where can you get a mortgage with Rocket Mortgage?

NMLS ID: 3030 (Quicken Loans Inc.)

This is where we normally tell you about a lender’s branch network. But Rocket Mortgage has none.

Rocket Mortgage, a subsidiary of Quicken Loans, is licensed to lend in all 50 states. However, Rocket does not operate physical branches in any state.

Of course, you can talk to loan officers over the phone. And one may call or email you — most probably right at the end, when finalizing your loan.

But it’s perfectly possible for the first human interaction you have to be at closing, when your new home becomes yours.

If you find that prospect unappealing, then Rocket Mortgage likely isn’t the lender for you.

However, increasing numbers of borrowers like and want a wholly online experience. And for those people, Rocket Mortgage is leading the charge to a better home loan experience.

Rocket Mortgage FAQ

Rocket Mortgage is an online mortgage platform offered by Quicken Loans. The two companies have the same loan types and pricing, but a slightly different experience. Rocket lets you take the mortgage or refinance process 100% online — including e-signing your closing papers from home. It’s meant to be the easiest and fastest way to get a mortgage from Quicken.

Rocket Mortgage allows credit scores starting at 580 for FHA loans. Other loan types have higher credit score requirements. Rocket’s minimum credit score is 620 for conventional and VA loans.

Yes — Rocket Mortgage offers VA loans for qualified service members and veterans. VA mortgages, backed by the Department of Veterans Affairs, allow zero down payment and typically have lower mortgage rates than other loans. To get a VA loan from Rocket or parent company Quicken, you’ll need a credit score of at least 620.

Rocket Mortgage does not offer home equity loans. Neither does its parent company, Quicken. However, Rocket Mortgage and Quicken both offer cash-out refinancing, which is another way to tap into your home equity.

Rocket Mortgage says it can pre-approve customers for a mortgage in 24 hours.

Note: Pre-approval is different from pre-qualification. Pre-approval verifies your income, assets, and credit, so the amount you’re approved to borrow is actually verified. With Rocket Mortgage, this is called “Verified Approval.”

Pre-qualification is faster, but it’s simply an estimate of what you can afford based on your answer to a few questions. You can’t make an offer on a house based on a pre-qualification. With Rocket Mortgage, this is called “Prequalified Approval.” (You can see how the terminology might get confusing.)

Expect closing costs with Rocket Mortgage to be between 3% and 6% of your loan amount. For a $250,000 loan, that means closing costs could be anywhere from $7,500 to $15,000.

But note, the percentage usually drops as the loan size gets larger. For instance, you’d be unlikely to pay Rocket $15,000 in closing costs for that $250,000 loan — they’d likely be closer to the 3% end.

Is Rocket Mortgage the best mortgage lender for you?

Rocket Mortgage and its parent company Quicken are the most popular mortgage companies in the U.S. That’s probably because they have stellar customer service and a whole host of great online tools.

In other words, if you want to get a mortgage quickly and easily, Rocket is worth a look.

Just keep in mind that rates from any single company aren’t competitive for everyone.

You can compare a loan estimate from Rocket Mortgage with a few other companies to be sure you’re getting the best possible deal.

Verify your new rate (Jul 18th, 2020)