If you’re an active trader, you need the most powerful software available on the market today.

You also need a low commission schedule and sufficient customer service to support you when you need it. Both TradeStation and TD Ameritrade specialize in these areas, but which one should you pick?

Take a look at our research.

TradeStation Overview

TradeStation got its start in the 1980’s when two Cuban-born brothers started writing software code for stock trading. In 2001, Ralph and Bill Cruz added brokerage services and renamed their company TradeStation.

Still headquartered in south Florida, the company continues to grow and add products and services.

TD Ameritrade Overview

TD Ameritrade started a little earlier, in 1975, in Nebraska as First Omaha Securities, Inc. Still headquartered in Omaha (for the time being), the company was recently purchased by Charles Schwab. This acquisition is expected to be completed in 2021.

Opening an Account

TD Ameritrade: There is a convenient online form on TD Ameritrade’s website to apply for an account. Besides Americans, foreign residents in a long list of countries are able to open taxable brokerage accounts.

TradeStation: When we opened our account at TradeStation, we were assigned a representative on our account. This apparently is our go-to person to help us through the account opening process. At TD Ameritrade, you don’t get assigned a rep. That’s one of the first differences between these two firms that we noticed.

Like TD Ameritrade, TradeStation permits residents of many foreign countries to open a brokerage account.

Investment Vehicles and Services

At TradeStation, the following instruments are available for trading:

- Stocks

- Bonds

- Mutual funds, ETFs, closed-end funds

- Options

- Futures

- Cryptocurrencies

- IPOs

TradeStation offers global stocks through a partnership with Interactive Brokers.

TD Ameritrade has the same lineup as TradeStation plus forex and minus cryptocurrencies and global stocks.

Another notable difference between the two brokers lies in dividend reinvesting. TradeStation doesn’t offer a Dividend Reinvestment Plan (DRIP), but TD Ameritrade does.

Fees and Commissions

TD Ameritrade and TradeStation both have reduced their stock and ETF commissions to $0. They do have other trading fees, however.

Here are the details:

TradeStation currently has two commission schedules. Called TS GO and TS SELECT, they offer slightly different pricing. TS GO has the higher commissions on futures and options.

But the plan comes with free access to the company’s advanced desktop platform with a $2,000 deposit.

TS SELECT customers get the lowest commissions and don’t have to deposit any amount. But they also must pay a $10 per-trade surcharge for orders submitted through the desktop platform.

Software

Speaking of desktop platforms, both these firms have fantastic software.

Desktop Platforms

TD Ameritrade: With thinkorswim, traders get a demo mode that has all the features the live version has. These include:

- Charting with 400 technical studies

- Right-click trading

- Free streaming of CNBC and TD Ameritrade Network

- Screeners for equities and options

- Forex and futures trading

- Backtesting tool

- Direct-access routing

- Many advanced order types

- Economic calendar

- And more

Thinkorswim Platform

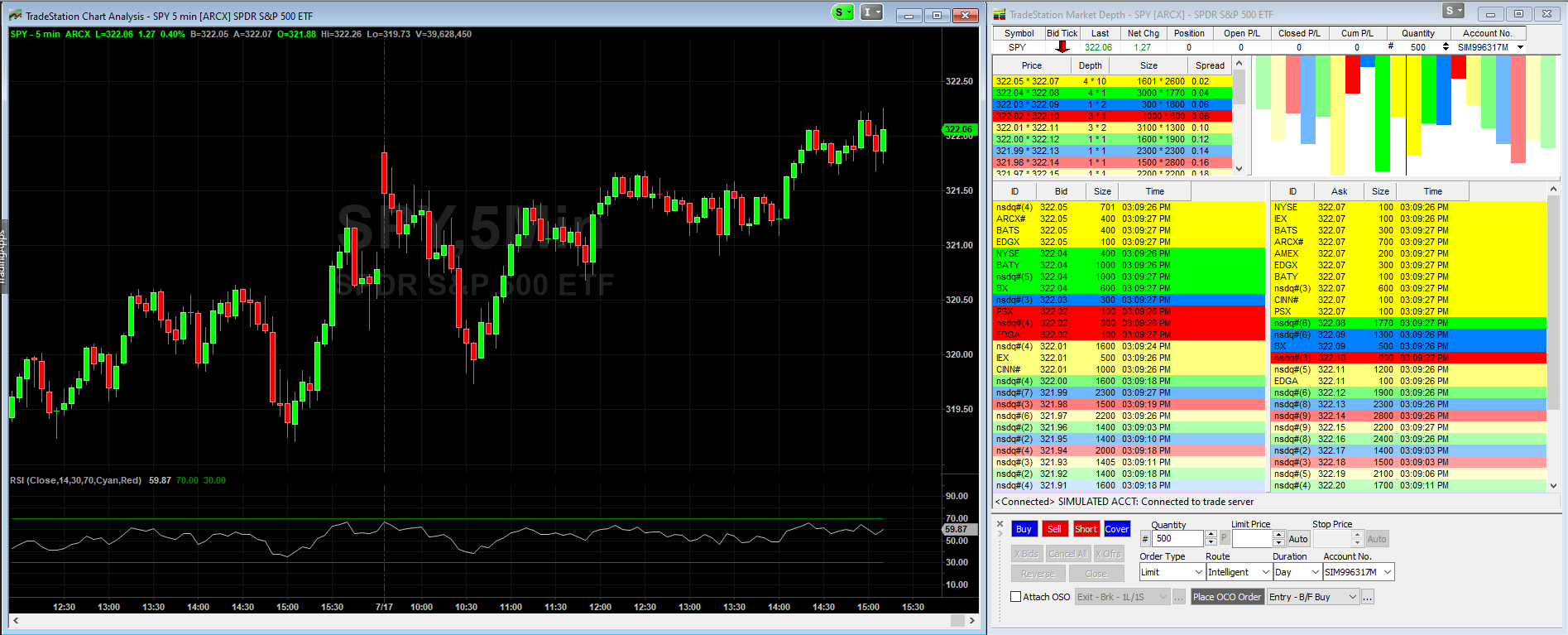

TradeStation: The broker’s latest desktop release is TradeStation 10. This advanced software comes with notable differences compared to its rival.

For example, 10 offers an App store where many software add-ons can be found. (It can be located by clicking on the TS Today tab and then clicking on the TradingApp Store link.)

Highlights on 10 include:

- Direct-access routing (with more destinations than thinkorswim)

- Multiple layouts

- Simulated trading mode

- OptionStation Pro (an advanced platform that delivers a better experience than thinkorswim’s options trading tools)

- Screeners for equities and options

- Advanced orders

- More duration choices than thinkorswim

- Trading matrix

- And more

TradeStation Platform

During our testing on Windows 10, it took 27 seconds for thinkorswim to open, and 40 seconds for TradeStation 10 to open.

Website Trading

Traders who don’t need the complexity of the desktop systems can opt for browser-based trading at either brokerage firm.

TradeStation: A very good browser-based platform is available to both TS GO and TS SELECT clients. Although most of its desktop cousin’s features are missing, it does offer:

- Direct-access routing

- Decent charting

- Trading matrix

- Bracket, OCO, and OSO orders

The TradeStation website is used for account management, and it’s not the easiest to navigate.

TD Ameritrade: Here we get a very good website but no browser platform. The website comes with a trade ticket that offers the following highlights:

- Small graph

- Advanced order types

- Multiple duration choices

- Rapid-fire mode

The rest of the website is user-friendly and provides a lot of great tools, including charting with many tools and account management features.

Mobile Apps

TD Ameritrade: There are 2 mobile apps available to TDA clients. The first is the basic platform, and the second is a thinkorswim platform. Combined, they offer:

- Mobile check deposit

- Streaming video news

- Very advanced charting

- Simulated trading mode

- Level II quotes

- Advanced order types

For some strange reason, Level II quotes appear on the basic app and not on the trading app.

TradeStation: Just one app is available to TradeStation clients. But it offers simulated trading and these features:

- Direct-access routing

- Advanced order ticket

- Multiple pre-installed option spreads

- Horizontal charting with several tools

Missing on TradeStation’s app is mobile check deposit, a convenient feature. We also couldn’t find any video news.

Customer Service

TradeStation: Customer service hours are 8:00 am, EST, until 8:00 pm. And these hours are during the weekday only. There are no weekend hours.

For technical support, the broker is open 24 hours a day, 5 days a week. And the trade desk opens at 7:30 in the morning (but closes at 6:30 pm and at 5:00 on Fridays).

The TradeStation website has a human chat tool that is sometimes up and sometimes not. There are no physical branch locations.

TD Ameritrade: Now we get 24/7 customer support, via both an online robo chat tool and phone service. The broker also provides an online human chat service some hours of the day.

Unlike its competitor, TD Ameritrade has branch locations. We counted over 200 of them. When the brokerage house combines with Schwab, some of these will be eliminated. But some of Schwab’s will be added to the mix. We expect more than 300 at least.

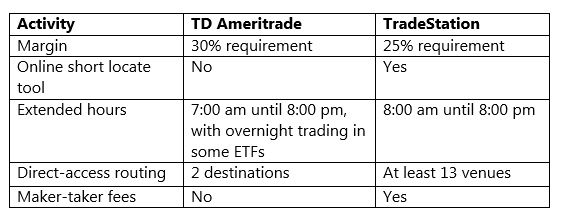

Day Trading

Both broker-dealers in this investigation cater to short-term traders. But that doesn’t mean they’re even.

Because these brokers are headquartered in the United States, day traders will need to maintain $25,000 in account equity and adhere to the PDT Rule. Otherwise, they risk having their accounts frozen.

Security Research

TradeStation: The browser platform, website, and the desktop software offer research and learning materials. The browser system is the least impressive, offering just news articles and trade data.

TradeStation’s website offers many learning materials, including articles and some courses with videos, on a variety of topics. For example, we found these articles:

- Why Day Trading Margin Requirements are Important

- Introduction to Day Trading

- Day Trading Requirements

The broker’s desktop platform offers various widgets that provide:

- Financial metrics

- Screeners for equities, options, and futures

TD Ameritrade: Unlike its rival, TD Ameritrade has lots of security analysis tools right on its website. The first big difference is the availability of free stock reports in pdf format from multiple analysts. For Tesla, we found 8 reports.

Besides equity reports, the TD Ameritrade site delivers lots of security information. These data points include peer comparisons and SEC filings.

TD Ameritrade provides screeners on its website for stocks, options, mutual funds, and ETFs. We found them easier to use than TradeStation’s tools. These web-based tools can supplement the screeners that appear on thinkorswim.

For general investing education, the broker operates its own video network (TD Ameritrade Network). And there are videos and articles that cover a wide variety of trading topics.

Cash Management

Why open a separate bank account for your daily cash needs when you can get the same resources from your broker?

TD Ameritrade: The company offers free check writing and a Visa debit card. There are no minimums of any kind, and TD Ameritrade even reimburses ATM fees. The TDA website also has free bill pay.

TradeStation: The only tool TradeStation offers here is an online ACH tool, which of course TD Ameritrade also has.

Bottom Line

TD Ameritrade and TradeStation both deliver great trading resources for active traders and honestly you can’t go wrong with either one.

It really comes down to personal preference so your best bet is to open a demo account at each one and see which one you like more.