The Central Board of Direct Taxes has recently notified the new ITR Forms for AY 20-21 Income Tax Return Filing (for FY 2019-20).

Normally, the last date to file ITR is 31st July. But, due to the outbreak of the novel coronavirus, the due date for AY 2020-21 income tax return filing has been extended to 30th November, 2020.

Below infographic gives you an idea about the various new income tax deadlines applicable to AY 2019-20 & AY 2020-21.

Income Tax Slab Rates for FY 2019-20 / AY 2020-21

Be aware of the applicable income tax slabs and rates before filing your ITR.

Based on the Finance Bill 2019-20, some important proposals (as listed below) have been implemented in FY 2019-20. Let’s revise some of them!

- Surcharge on Individuals with income above Rs 2 cr has been increased.

- New Section 80EEA for Income Tax Deduction on Home Loan Interest Payment was introduced.

- New Section 80EEB for Income Tax Deduction of Rs 1.5 Lakh on Purchase of e-Vehicle was introduced.

- Standard Deduction for FY 2019-20 / AY 2020-21 has been increased to Rs 50,000.

- Income upto Rs 5,00,000 is exempted from income tax (Tax Rebate u/s 87a).

- No tax deducted at source (TDS) for interest income of up to Rs 40,000.

- No notional rent on second Self-Occupied Home.

- Long Term Capital Gains (of up to Rs 2 cr) tax exemption on Sale of Property.

- Mandatory filing of Income Tax Return if you have deposited more than Rs. 1 crore in a current account.

- Gifts to NRIs (non-relatives) are now Taxable.

For more information on the above mentioned points, you may kindly go through this article @ ‘Important & Comprehensive list of Budget 2019-20 Proposals related to Personal Finance | W.e.f AY 2020-21.’

AY 2020-21 Income Tax Return Filing | Important changes in New ITR Forms

Below are some of the important changes that are incorporated in the notified new ITR forms of AY 2020-21;

- Interchangeability of PAN and Aadhaar Number has been introduced in the new ITR Forms. Now, while filing ITR-1, ITR-2, ITR-3 or ITR-4, an Individual assessee having Aadhaar Number but not having a PAN can file his/her ITR by just quoting his/her Aadhaar Number.

- Similarly, in case of let-out property, instead of PAN and TAN details of the Tenant, Aadhaar Number of the Tenant can be provided if the tenant is an Individual.

- In case the Return of Income is being filed by a representative assessee, now there is an option to give either the PAN or the Aadhaar Number of such person.

- Under Nature of Employment section of ITR-1, ITR-2, ITR-3 or ITR-4 forms, Government employees have been bifurcated as Central Govt. and State Govt. employees. The other options like PSU, Pensioners and Others are provided. Also, a new option “NA” has been added to the list. This option can be used by individuals claiming Family Pension, etc.

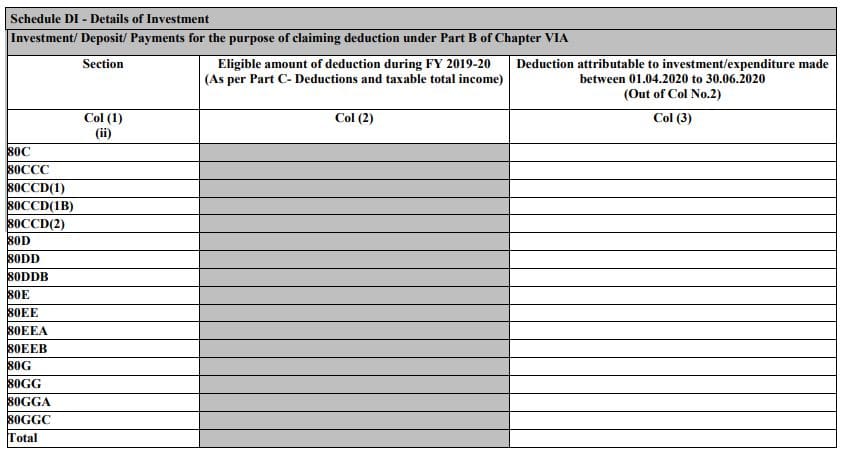

- “Schedule DI- Details of Investment” has been incorporated in all the ITR Forms, for declaring any investments/ deposits/ payments made during the period 01.04.2020 to 30.06.2020 (new revised date is 31-07-2020) for the purpose of claiming any deduction under Chapter VIA. This schedule varies according to requirements of the related ITR.

- Kindly note that, any tax-saving investment between April and July period, is eligible for deduction either in the FY 2019-20 or FY 2020-21.

- You can choose the financial year in which you want to claim the benefits. However, ensure that you don’t claim the deduction for one investment in both the financial years.

- The Finance Bill 2019-20 has made ITR filing compulsory for persons (otherwise not required to file Return of Income); (The same has to be declared in ITRforms.)

- Who have deposited more than Rs. 1 crore in a current account in a year, or

- Who have expended more than Rs. 2 lakh on foreign travel,

- Electricity consumption bill of more than Rs. 1 lakh, or

- Persons claiming the benefits of tax exemption for long term capital gains under various provisions under section 54 of the Income Tax Act.

FY 2019-20 Income Tax Filing | Which ITR form to file?

Who can file New ITR 1 (Sahaj) Form For AY 2020-21 Income Tax Return Filing?

The resident individual whose Total Income includes one or more of the following needs to file ITR-1.

- The Total Income is not exceeding Rs 50 Lakh.

- If you have Income from only one house property, except when the loss is brought forward from previous year.

- Agriculture income does not exceed Rs 5,000.

- There is no income from capital gain (or) income from business / profession.

- There is Income from other sources excluding Income from Lottery and Horse Races.

In case you are a you are a Director of a company, you own foreign assets or have generated foreign Income (or) you are a Resident not Ordinary Resident (RNOR) and Non-Resident then you can not file ITR-1 form.

Who can file New ITR-2 Form for Assessment year 2020-21?

Individuals / HUFs can file ITR-2 based on the following conditions:

- When your Total Income exceeds Rs 50,00,000 and it includes income from all or any of these three sources; Income from salary, Income from house property, and Income from other sources (including Lottery and winning Horse Race).

- If you have agricultural income more than Rs 5,000.

- If you are a Director of a company.

- Income from Capital Gains.

- If you held investment in unlisted shares at any time during the financial year.

- You own foreign assets or received foreign Income.

- You are either Resident Not Ordinary Resident (RNOR) or Non-Resident.

In case you have Income from business or profession, ITR-2 is not applicable to you.

Who can file New ITR 3 Form for AY 2020-21?

ITR-3 is applicable only to individuals or a Hindu Undivided Family who is carrying on any proprietary business or any profession. The eligible incomes are:

- In case the assessee is an individual Director in a company.

- If you have income as a partner in a firm.

- If you carry on any business or profession.

This ITR covers all kind of businesses and professions irrespective of any income limit. Assessee can also report his income from salary, multiple house properties, lottery winnings, capital gains, speculative income i.e. horse race in ITR3 together with the Business Income.

Who can file New ITR 4 Form for AY 2020-21?

This form is applicable;

- For Individuals, HUFs and Firms (other than LLP) being a resident having total income upto Rs.50 lakh and having income from business and profession

- No Capital Gains

- Agricultural Income which is less than Rs 5k

- No asset in foreign country or no income from a source outside India

- Income from one house property

- Income from other sources.

ITR-4 is also known as Sugam. All those assessees who have opted for presumptive income tax scheme, or they are individual or HUF or Partnership Firm (except LLPs) carrying on any business or profession and have an annual business turnover up to Rs 2 Cr can file ITR-4 (Sugam) form.

Applicability of ITR-5 form

The ITR-5 is applicable for LLPs (Limited Liability Partnership), AOPs (Association of Persons), AJP (Artificial Juridical Person), BOIs (Body of Individuals), business trust and investment fund, for Estate of a deceased and the Estate of insolvent.

Important points to consider before filing your ITR :

- Before you file your Income Tax returns, check if your Form 26 AS has correct TDS entries.

- For example: Your employer might have deducted TDS amount for last quarter and deposited the amount on your behalf. Check for this transaction in Form 26 AS. Also, check whether all the investments with TDS have been duly mentioned in your Tax return form also. Any mismatch will lead to a notice from the department. (Note that new Form 26AS format is applicable from FY 2020-21 / AY 2021-22.)

- Do not file your ITR till you get Form-16 (issued by your employer, if salaried) and Form 16A. While Form 16 is for only salary income, Form 16A is applicable for TDS on Income Other than salary. Form 16A is a statement containing all details of TDS Deducted on all Payments except Salary. For example, Form 16A is issued by banks when they deduct TDS on interest income earned on your Fixed Deposits / Recurring Deposits. (Employers have to issue Forms 16 by 15th August, 2020.)

- Form16, Form 16A and Form 26AS documents will come handy while filing your ITR. As discussed above, you have most of the details in your form 16 with which you can easily file your Tax Returns. Cross check your Form 16/16A TDS amounts with Form 26AS and then key in TDS details in ITR accordingly.

- Based on Form 16, you can fill ‘Income’ and ‘TDS’ details. By looking at your Form 16 A, you can fill ‘income from other sources’ and ‘TDS’ details in ITR sheet.

- Based on Form 26AS, you can cross check the above TDS payments and also fill in details of ‘Advance or self assessment tax’ payments (if any) in your ITR sheet.

- If you had joined a new company during the financial year then do not forget to declare the income from previous employer in the tax return.

- In case, if your declared investment amount (to your employer) is more than your actual investments, you have to pay additional taxes while filing your Income Tax Return

- In case, if your declared amount is less than your actual investments, your company might have deducted higher TDS. So, you can claim this as ‘refund‘ while filing your taxes. (Kindly read : ‘TDS & Misconceptions‘)

- Even if you miss the deadline for submitting the investment proofs, you can still claim all the tax deductions while filing your Income Tax Return.

- In case, you are filing ITR through an auditor/CA, advisable to check the ITR-Draft version thoroughly before submitting the ITR-final to the IT dept.

- It is advisable to keep copies of all your original documents for your future reference.

Tax evasion is illegal. Do note that non-disclosure of income & non-filing of ITR may attract penalties and also has severe consequences. So, file your income tax return on time.

Continue reading :

- Income Tax Deductions List FY 2019-20 | List of important Income Tax Exemptions for AY 2020-21

- Income Tax Exemption Vs Tax Deduction Vs Tax Rebate Vs TDS | Key Differences

- How Income Tax Department tracks the High Value Financial Transactions?

- Income Tax Deductions List FY 2020-21 | New Vs Old Tax Regime AY 2021-22

(Post first published on : 07-August-2020)