Mortgage rates forecast for September 2020

After hitting new all-time lows eight times this year, mortgage rates are finally hitting resistance.

Not the least to blame is the new 0.50% fee rolled out by Fannie Mae and Freddie Mac.

The unexpected move is causing lenders to increase rates and hand out fewer sub-3% mortgages.

Want to capture a rate that’s still near all-time lows? Better act fast.

Find and lock a low rate today. (Aug 18th, 2020)

In this article:

Just when rates seemed too good to be true — they were

As predicted in last month’s forecast, August 2020 held the lowest rates of all time.

Thirty-year fixed rates dropped below the 3% barrier for the first time ever, according to Freddie Mac.

But just as everything seemed to be going well for mortgage rates, a shocking announcement came from Fannie Mae and Freddie Mac (the GSEs): a 0.50% fee would be imposed on all nearly refinances in the country.

Those who had not locked would likely either pay the fee or take a higher rate to compensate for it.

It proves that unexpected rate increases can come from anywhere: the market, the Fed, and even the two main U.S. mortgage agencies.

Those who didn’t lock in their loans by early August are regretting it. Still, rates are holding historically low, despite the recent “refinance penalty.”

Ready to lock before more unwelcome surprises? Now is the time.

Lock in today’s rates before they rise. (Aug 18th, 2020)

Mortgage rates next 90 days

This chart shows past mortgage rate trends, plus predictions for the next 90 days based on current events and 2020 forecasts from major housing authorities.

Predictions for September 2020

Here are trends we see on the horizon in the upcoming month.

Even a dubious COVID-19 ‘vaccine’ made rates jump

I don’t think we can overestimate how much mortgage rates could rise on positive vaccine news.

Even a rushed-to-market, questionable Russian vaccine hurt rates in mid-August

While it’s tempting to call this the “rushin’ vaccine,” we’ll refrain from dad jokes and say that this vaccine was tested on just 76 people, according to Chemistry World. The site says that vaccines are normally tested on tens of thousands of volunteers before getting a stamp of approval.

Despite what seems to be false hope, rates rose to two-week highs starting August 11, as the “vaccine” was announced.

Why? Because a vaccine could mean the world would go back to normal sooner than expected, goosing economies worldwide.

With hot economies come higher rates, as inflation becomes a concern and people dump money into stocks instead of mortgage-backed securities.

These recent events show how fragile today’s low rates really are. Rates could spike in the event of hopeful news about a vaccine or even a reliable treatment. Smart mortgage shoppers are grabbing today’s near-3% rates while they are still around.

»RELATED: How to Get a Conventional Loan: Down Payment, Rates and Requirements

Fannie Mae/Freddie Mac ‘refinance penalty’ to make sub-3% rates a thing of the past

Fannie Mae and Freddie Mac (the GSEs) just shocked the lending world by imposing a 0.50% fee on all refinances that will be sold to the companies.

The fee will go into effect September 1, but lenders started adding the fee to their rate sheets immediately after the August 12 announcement. That’s because it takes weeks for lenders to close and sell their loans to the GSEs.

For mortgage shoppers, this is a big deal.

It means that if you weren’t locked in by August 11, you will likely get a worse rate or pay more in closing costs.

The 0.50% fee applies to any loan that lenders plan to sell to Fannie or Freddie, which is nearly all refis under $510,000. The GSEs say this is to offset risk during extreme refinance volume and a global pandemic.

The fee is equal to a $1,250 one-time, upfront fee on a $250,000 loan.

However, most consumers will absorb that fee by taking a higher rate. Covering the fee could increase your rate somewhere between 0.125% and 0.375%, say experts who weighed in with mortgage analyst Rob Chrisman.

So remember that 2.875% rate you wanted? Now you’re looking at 3.0-3.25%

That being said, mortgage rates are still historically low. One year ago, the 30-year fixed was 3.6%, says Freddie Mac. So a 3.25% rate is still a fantastic deal.

Lock in today’s rates. Start here. (Aug 18th, 2020)

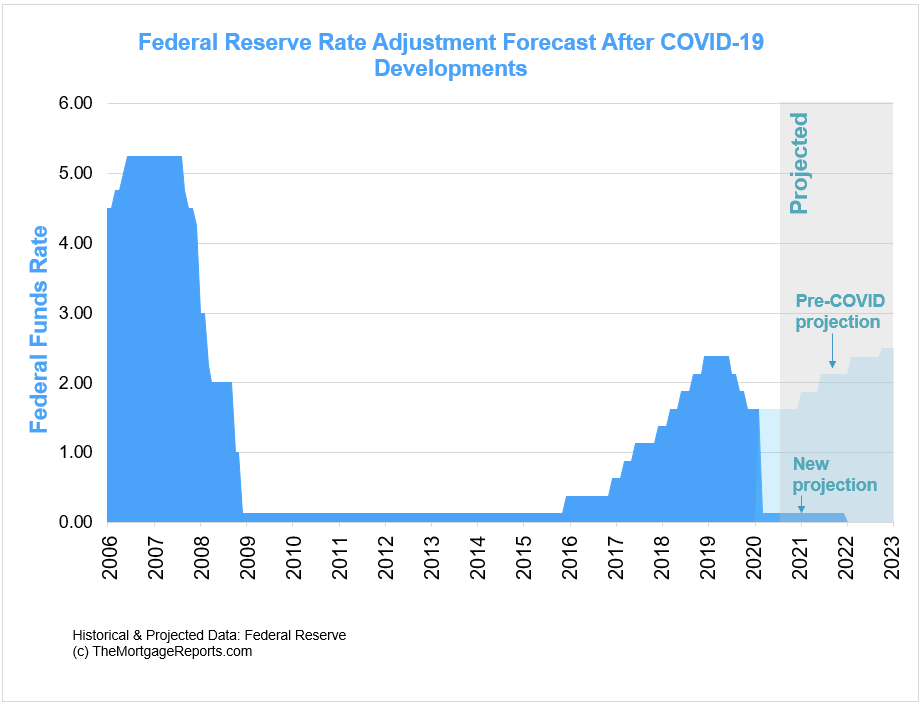

After cutting rates to near-zero, what will the Fed do next?

As recently as early February, everyone expected the Fed to maintain its federal funds rate of about 1.625% into 2021.

As COVID-19 worries gripped markets, the group slashed its rate to near-zero levels. In addition, it committed to buying unlimited amounts of Treasuries and mortgage bonds. It also started doing things it never had before, such as buying corporate debt.

You can see the drastic change in Fed forecasts comparing pre- and post-COVID-19.

In mid-March, we predicted never-before-seen stimulus from the Fed in April. But even we were surprised to see that stimulus checks and 12-month mortgage forbearance were part of the new reality.

The Fed has broad power to keep the economy going, and it’s getting more and more bold about using that power to its full extent.

Know this: the Fed will continue to support a low-rate environment. The exact form that takes could surprise us all.

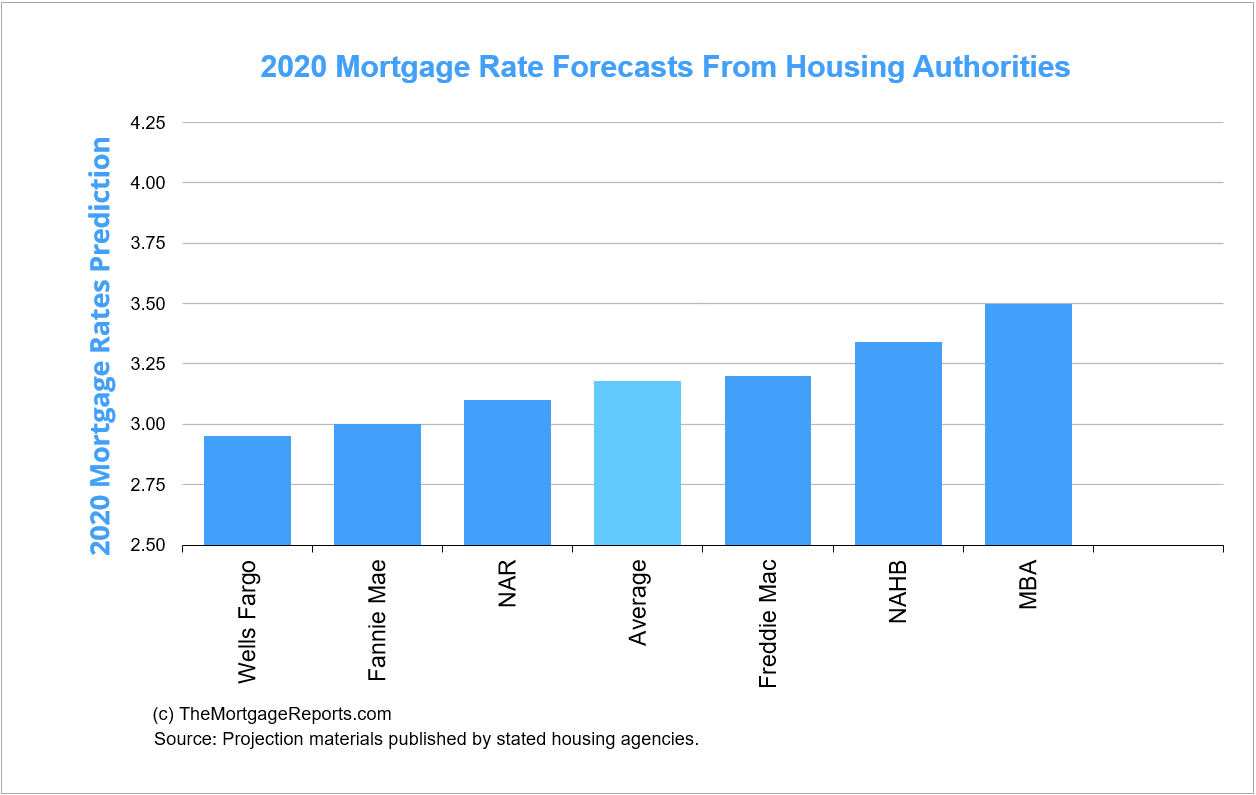

Mortgage rate trends as predicted by housing authorities

Housing agencies nationwide are calling for rates in the low 3s for 2020. One major agency even calls for a sub-3% average rate by year-end.

| Agency | 30-Yr Rate Prediction |

| Wells Fargo | 2.95% |

| Fannie Mae | 3.00% |

| Freddie Mac | 3.20% |

| National Assoc. of Home Builders | 3.34% |

| Mortgage Bankers Assoc. | 3.50% |

| National Assoc. of Realtors | 3.10% |

| Average of all agencies | 3.18% |

To sum it up, rate predictions vary widely. Today’s rate might be as good as we’ll see for years to come, or they might improve.

Mortgage strategies for September 2020

In September, rates will be low despite the new 0.50% “refinance penalty” fee introduced by Fannie Mae and Freddie Mac.

But this fee could be just the beginning of mortgage shoppers’ worries.

We think rates have bottomed out and will start rising in September as we get closer to the U.S. election.

Why? There tends to be a sense of optimism with potential new leadership — no matter the outgoing or incoming party. With optimism comes more risk-taking and less appetite for mortgage bonds. Lower demand for mortgage bonds makes rates rise.

It’s hard to predict how markets will interpret the end of the Trump era, if it occurs. They could view a Democratic president as bad for business, stifling the economy and keeping rates low. We saw the opposite happen after the 2016 election: rates skyrocketed because markets foresaw an era of business-friendly leadership.

Whatever happens with the election, we feel there is significant risk of higher rates toward year-end.

Mortgage shoppers who are able to buy or refinance in September should capitalize on rates that are near-bottom. Delaying and waiting for lower rates could end up backfiring.

But if you’re not ready yet, rates will still be historically low for some time. We feel that worse-case rates would hit the mid-3s in late 2020. This is still fantastically low. Just not as low if you’re comparing them to the sub-3% rates available this summer.

Get started on your loan application here. (Aug 18th, 2020)

Loan product rate updates

Many mortgage shoppers don’t realize there are many different types of rates. But this knowledge can help home buyers and refinancing households find the best value for their situation.

Following are updates for specific loan types and their corresponding rates.

Conventional loan rates

Conventional refinance rates and those for home purchases have trended lower in 2020.

According to loan software company Ellie Mae, the 30-year mortgage rate averaged 3.42% in June (the most recent data available), down from 3.44% in May.

This is higher than Freddie Mac’s 3.03% average because it factors in low credit and low-down-payment conventional loan closings, which tend to come with higher rates. Plus, it’s a more delayed report, and rates have been dropping.

Lower credit score borrowers can use conventional loans, but these loans are more suited for those with decent credit and at least 3% down. Five percent down is preferable due to higher rates that come with lower down payments.

Twenty percent of equity is preferred when refinancing.

With adequate equity in the home, a conventional refinance can pay off any loan type. Got an Alt-A, subprime, or high-PMI loan? A conventional refi can take care of it.

For instance, say you purchased a home three years ago with an FHA loan at 3.5% down. Since then, home values have skyrocketed.

You now have 20% equity, so you can refinance into a conventional loan and eliminate FHA mortgage insurance.

This could be a savings of hundreds of dollars per month, even if your interest rate goes up.

Getting rid of mortgage insurance is a big deal. This mortgage calculator with PMI estimates your current mortgage insurance cost. Enter a 20% down payment to see your new payment without PMI.

Find a low conventional loan rate. Start here. (Aug 18th, 2020)

FHA mortgage rates

FHA is currently the go-to program for home buyers who may not qualify for conventional loans.

The good news is that you will get a similar rate — or even lower — with an FHA loan than you will with conventional.

Related: Read more about FHA costs and requirements on our FHA loan calculator page.

According to loan software company Ellie Mae, which processes more than 3 million loans per year, FHA loan rates averaged 3.41% in June, a bit lower than the average conventional rate.

Another interesting stat from Ellie Mae: About 20% of all FHA loans are issued to applicants with scores below 650.

FHA loans come with mortgage insurance. But the overall cost is not much more than for conventional loans.

A little-known program, called the FHA streamline refinance, lets you convert your current FHA loan into a new one at a lower rate if rates are now lower.

An FHA streamline requires no W2s, pay stubs, or tax returns. And you don’t need an appraisal, so home value doesn’t matter.

Learn more about the FHA streamline refinance here.

Find low FHA rates. Start here. (Aug 18th, 2020)

VA mortgage rates

Homeowners with a VA loan currently are eligible for the ever-popular VA streamline refinance.

No income, asset, or appraisal documentation is required.

If you’ve experienced a loss of income or diminished savings, a VA streamline can get you into a lower rate and better financial situation. This is true even when you wouldn’t qualify for a standard refinance.

But don’t overlook the VA loan for home buying. It requires zero down payment. That means if you have the cash for closing costs, or can get them paid for by the seller, you can buy a home without raising any additional funds.

Don’t overlook the VA loan for home buying. It requires zero down payment.

VA mortgages are offered by local and national lenders, not by the government directly.

This public-private partnership offers consumers the best of both worlds: strong government backing and the convenience and speed of a private company.

Most lenders will accept scores down to 620, or even lower. Plus, you don’t pay high interest rates for low scores.

Quite the contrary, VA loans come with the lowest rates of all loan types according to Ellie Mae. In June, (the most recent data available), 30-year VA mortgage rates averaged just 3.20% while conventional loans averaged 3.42%, representing a big discount if you’re a veteran.

Check your monthly payment with this VA loan calculator.

There’s incredible value in VA loans.

Check today’s VA loan rates. Start here. (Aug 18th, 2020)

USDA mortgage rates

Like FHA and VA, current USDA loan holders can refinance via a “streamlined” process.

With the USDA streamline refinance, you don’t need a new appraisal. You don’t even have to qualify using your current income. The lender will only make sure that you are still within USDA income limits.

More about the USDA streamline refinance.

Home buyers are also learning the benefits of the USDA loan program for home buying.

No down payment is required, and rates are ultra-low.

Home payments can be even lower than rent payments, as this USDA loan calculator shows.

Qualification is easier because the government wants to spur homeownership in rural areas. Home buyers might qualify even if they’ve been turned down for another loan type in the past.

Find a lock low USDA rates. (Aug 18th, 2020)

Mortgage rates today

While a monthly mortgage rate forecast is helpful, it’s important to know that rates change daily.

You might get 3.25% today, and 3.5% tomorrow. Many factors alter the direction of current mortgage rates.

To get a synopsis of what’s happening today, visit our daily rate update. You will find live rates and lock recommendations.

September economic calendar

The next thirty days hold no shortage of market-moving news. In general, news that points to a strengthening economy could mean higher rates, while bad news can make rates drop.

- Tuesday, September 1: ISM Manufacturing

- Friday, September 4: Nonfarm Payrolls, wages, unemployment rate

- Friday, September 11: Inflation Rate

- Wednesday, September 16: Federal Reserve meeting adjourns

- Wednesday, September 16: Retail Sales

- Wednesday, September 16: NAHB Housing Market Index

- Thursday, September 17: Housing Starts, Building Permits

- Tuesday, September 22: Existing Home Sales

- Wednesday, September 30: Pending Home Sales

Now could be the time to lock in a rate in case these events push up rates this month.

Mortgage rates Q&A

In this FAQ:

Below are some of the most common questions about mortgage rates.

Mortgage rates fluctuate based on market conditions and your specific situation. For instance, someone with a high credit score will get a lower rate than someone with a low score. To see average rates, go to themortgagereports.com/today or contact a lender over the phone or online here.

According to our survey of major housing authorities such as Fannie Mae, Freddie Mac, and the Mortgage Bankers Association, the 30-year fixed rate mortgage will average around 3.18% through 2020. Rates are hovering below this level as of August 2020. See the full forecast from housing authorities here.

Yes. Lenders have the flexibility to drop their rates and fees. Often, you must approach a lender with a better offer in writing before they will lower their rate.

Historically, it’s a fantastic mortgage rate. The average rate since 1971 is more than 8% for a 30-year fixed mortgage. To see if 3.875% is a good rate right now and for you, get 3-4 mortgage quotes and see what other lenders offer. Rates vary greatly based on the market and your profile (credit score, down payment, and more).

Most companies have similar rates. However, some offer ultra-low rates to gain market share. Others have lower rates for FHA than conventional, or vice versa. The only way to know if your company is offering the lowest rate is to get quotes from various lenders. Read our report of data collected from 5.9 million loans where we rank the top 24 US lenders by rate and fees.

A point is a fee equal to 1% of your loan amount, or $1,000 for every $100,000 borrowed. Your rate could drop 0.25%-0.50% or more for each point paid, however, that can vary greatly depending on the lender, loan characteristics, and borrower profile.

You can 1) request a lender credit; 2) request a seller credit (if buying a home); 3) increase your mortgage rate to avoid points; 4) get a down payment gift (which can be used for closing costs); 5) get down payment assistance. Find more strategies here.

What are today’s mortgage rates?

Low mortgage rates are still available. You can get a rate quote within minutes with just a few simple steps to start.

Show Me Today’s Rates (Aug 18th, 2020)

Selected sources:

- https://www.elliemae.com/mortgage-data/origination-insight-reports

- https://tradingeconomics.com/united-states/calendar

- https://www.federalreserve.gov/monetarypolicy/fomccalendars.htm

- https://www.chemistryworld.com/news/russian-vaccine-launch-shocks-scientists/4012279.article