This past week we got new red-hot CPI numbers, further drama in the Elon Musk and Twitter saga, and the start of earnings season.

Let’s look at the technical picture in major indices.

The downtrend pattern in the S&P 500 is under threat right now, as a minor lower high (red arrow) was formed. At the time of writing late Thursday, it’s testing that higher low again. A breakdown through the higher low would make it highly likely that the previous swing low (black arrow) is tested, if not broken through entirely, to continue the strong downtrend.

With the threat of a recession looming, the Fed likely hiking 100bps this month, and a record-high CPI print this week, the news is pretty negative, yet the market is still having trouble forming a new low. It sounds like a lot of supply is being soaked up in the small multi-week range.

Energy is one of the most critical pieces to the economy right now. It’s a significant driver of inflation and significantly disrupts economic growth and consumer disposable income. In the last month, energy commodities like natural gas and crude oil have taken a bloodbath, along with their equity counterparts.

This week was interesting for the fact that natural gas futures rose 10% while crude oil futures declined 8%:

CPI

June’s CPI was 9.1%. Ever since May’s hot inflation print, tons of traders and analysts have been calling for peak inflation and expecting June’s numbers to come in meaningfully lower. There are a few points to note from this.

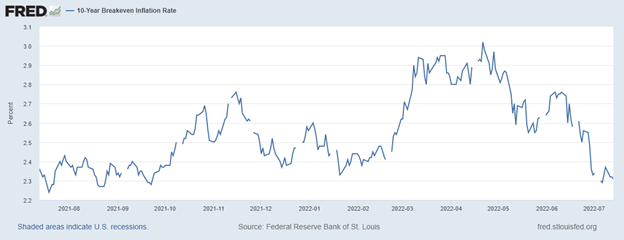

This ‘peak inflation’ narrative has been dominant in the markets for a few months, and to take some indications from market pricing, that makes complete sense.

The 10-year inflation breakeven rate, which is the market’s projection of future inflation, has been on the decline since April:

Furthermore, the raw commodities, which are primary drivers of inflation, have also taken a bloodbath over the last month, as you can see below in the Bloomberg Commodity Index:

With energy commodities being such a pivotal component to inflation, one look at crude oil’s recent price action tells you that the ‘peak inflation’ fellas might have a point:

The market’s reaction to this inflation print was telling too. While S&P futures initially sold off rapidly, there was relatively little follow-through. Instead, the S&P continually tried and failed to rally before testing the lows and bouncing upwards.

Given that the market was expecting a downside surprise, you’d expect a more dramatic reaction. Part of that might be all the prepping that the White House did to get ahead of the report. The market was ready for a hot report and had ample time for it to sink in.

Federal Reserve Watch

Jerome Powell will speak at the next Fed meeting on July 27. The pressure of the hot CPI and unexpectedly strong jobs report last week put pressure on the Fed to hike rates faster.

Earlier in the week, the majority (66%) of traders were expecting the Fed to hike 100 basis points, according to CME FedWatch. However, as a few regional Fed Presidents came out in support of a 75 basis point hike, the market has corrected a bit, with current indications putting the odds at 57% for a 100bp hike and 42% for 75bps.

Last Week’s News

- The Euro and US Dollar reached 1:1 parity for the first time since 2002. Pretty good time for a Europe trip if you’ve been planning it.

- The Elon Musk and Twitter drama continues. Twitter sued Elon Musk in Delaware court, and the complaint is pretty hilarious. Activist short seller Hindenburg took a significantly long position in $TWTR, which juiced the stock higher.

- Cannabis stocks like Tilray (TLRY) are jumping on the news that Senate Democrats are introducing a federal marijuana legalization bill next week. The cannabis sector loves these types of speculative catalysts, so be on the lookout for a rally.

- Activist hedge fund Elliot Management took a >9% stake in Pinterest (PINS), sending the stock up 25%.

- The head of AI and Autopilot at Tesla left the company.

Upcoming Catalysts

- The Senate Democrats are introducing the Federal marijuana legalization bill next week. Stocks in play:

- Earnings season is in full swing

Upcoming Earnings Reports

Earnings season is upon us, and tons of large caps are reporting this week, heavy in financials and telecoms.

Most earnings seasons are marked by easy-to-beat analyst forecasts, meaning companies typically beat expectations so long as operations are going as expected.

But this earnings season is marked by a series of roadblocks, including high inflation, rising interest rates, low consumer confidence, and supply chain constraints. While some of these have been factors in past earnings seasons, this one feels different.

The market is very much at a turning point from a fundamental, sentiment, and technical point of view, and a barrage of bearish reports probably means a significant downside for the S&P 500 from here.

Second quarter forecasts have barely budged to reflect the changing reality of the economy, as earnings are expected to grow at 5.7%. This is a factor that many traders have pointed out lately, as if the internals at these companies are as bad as the stock market and some economic indicators are suggesting, we’re going to have an ugly earnings season.

This week of reports is simply too large to publish every company reporting, we’re just posting the most significant reports.

Monday:

- Bank of America (BAC)

- IBM (IBM)

- Goldman Sachs (GS)

- Charles Schwab (SCHW)

- Synchrony Financial (SYF)

Tuesday:

- Johnson & Johnson (JNJ)

- Lockheed Martin (LMT)

- Netflix (NFLX)

- Novartis (NVS)

- ManpowerGroup (MAN)

- Halliburton (HAL)

- JB Hunt Transport Services (JBHT)

- Ally Financial (ALLY)

- Hasbro (HAS)

- Interactive Brokers (IBKR)

- Silvergate Capital (SI)

Wednesday:

- Tesla (TSLA)

- Abbott (ABT)

- United Airlines (UAL)

- Baker Hughes (BKR)

- ASML (ASML)

- Steel Dynamics (STLD)

- Discover Financial Services (DFS)

Thursday:

- AT&T (T)

- Domino’s Pizza (DPZ)

- Snap (SNAP)

- Philip Morris (PM)

- Dow Chemical (DOW)

- Nucor (NUE)

- Travelers (TRV)

- SAP (SAP)

- Capital One (COF)

- American Airlines (AAL)

- DR Horton (DHI)

- Danaher (DHR)

- AutoNation (AN)

- Freeport-McMoRan (FCX)

- Union Pacific (UNP)

- Blackstone (BX)

Friday:

- Verizon (VZ)

- HCA Healthcare (HCA)

- American Express (AXP)

- Schlumberger (SLB)

- Cleveland Cliffs (CLF)

- Nextera Energy Partners (NEE)

Upcoming Economic Data

Last week we got some significant surprises in the form of a strong jobs report and a red-hot CPI print.

This week’s data releases are all about housing. By the end, we should have a pretty good picture of where the shaky housing market stands.

Home sellers have been rapidly slashing their asking prices, and overall housing volume is down, according to Redfin:

“A record-high share of home sellers are dropping their prices after this month’s historic mortgage-rate hike put a damper on homebuyer activity. But there are early signs that demand is leveling off… Pending sales continued to fall, posting their largest decline since May 2020”

Rising mortgage rates, lower consumer confidence, and low consumer savings remain dampers on demand, but the one potential saving grace for housing is the supply chain crisis. According to several homebuilding executives, homebuilders simply cannot build enough inventory to support the demand.

Monday:

Tuesday:

- Building permits

- Housing starts

Wednesday:

Thursday:

- Initial and continuing jobless claims

Friday:

- S&P manufacturing and services PMI