This post is written by Jet Toyco, a trader and trading coach.

Whenever you hear trading interviews, they’ll always say a similar thing at some point:

“Get a trading journal”

“If you want to know if you have an edge, get a forex trading journal”

So…

You spend hours polishing your forex trading journal and start filling in your metrics as you enter trades.

But just after a few weeks…

You stop and eventually forget about it.

You see…

Having a forex trading journal is never about how much statistics you can mash into your spreadsheets.

It’s about how well you use it.

That’s why in today’s guide you’ll learn:

- What exactly a forex trading journal is and why is it important

- Common mistakes traders make before you even make a forex trading journal and how to fix it

- How to create an effective trading journal in less than 5 minutes, because that’s all you need

- The SECRET to using a forex trading journal and not just staring at it

Interested?

Great, then let’s get this show on the road…

What is a forex trading journal and how does it work

In simple terms, a forex trading journal is a tool where you can log your past trades and eventually review them.

And a forex trading journal can look something like this:

Or it can simply look like this:

Believe me, my friend.

There are so many combinations and variations that there’s no fixed rule on what it looks like!

But really…

What exactly is the purpose of a forex trading journal?

Sure, it’s finding your edge in the market.

Sure, it’s knowing whether or not your strategy makes money in the markets.

But what is its true purpose?

Do you want to know?

Let me tell you.

The true purpose of a forex trading journal is to…

Identify bad trading habits and nurture good ones

You see…

A forex trading journal is not just about whether or not your trading strategy makes money.

It’s about you.

Your mental well-being executes your strategy and state of mind; your emotions when trading.

Because what good is a working trading strategy if the trader who’s clicking the buy and sell buttons is inconsistent?

You’ll get inconsistent results of course!

So, before you even start making your forex trading journal.

Know that it’s more about you than your trading strategy.

And this leads me to my next point…

Common mistakes a trader makes when having a forex trading journal (and how to solve them)

Here’s the truth:

A forex trading journal can either be the most powerful or the most useless tool a trader could have…

Here are a couple of reasons why…

Mistake #1: Your forex trading journal is too complex

Less is more when it comes to creating your trading journal.

Yes, it’s true…

Some useful statistics and charts can truly help you out such as the:

- Sharpe Ratio

- Expectancy

- Weekly returns

- Equity Curve

But if this will cost you to fill in extra details on your trading journal manually…

Then filling in your forex trading journal would be too tedious.

This would also discourage you to build an inconsistent routine on trade journaling, which leads me to my next point…

Mistake #2: Your forex trading journal routine does not match your trading style

Let me ask you:

When should you update your forex trading journal?

Every hour?

Every trade?

Once a week?

Well, it depends.

If you’re a day trader, then filling your trading journal every trade would drive you insane!

On the other hand…

If you’re a position trader who barely gets any trades, then filling your forex trading journal will eventually slip out of your mind.

Now that you know these common problems…

What’s the solution?

Solution #1: Establish a consistent forex trading journal routine depending on your trading style

If your actions in trading are inconsistent, then you’d get inconsistent results.

As mentioned a while ago…

Trying to fill your trading journal manually while day trading will ultimately burn you out!

So when should you exactly fill and review your forex trading journal?

Rest assured my friend.

Because I’ve made a cheat sheet for you to refer to depending on your trading style.

Day trading

If you’re a day trader who takes in approximately 10-20 trades a day…

Then only check and review your forex trading journal at the end of your session.

Swing trading

If you’re a swing trader who takes in 5-10 trades a week…

Naturally, you should check your trading journal once a week.

Finally…

Position trading

If you’re a position trader who takes in 5-10 trades a month…

Then only check and review your trading journal once a month.

Simple, right?

However, listen closely…

You must promise me that you should only check your forex trading journal when the markets are closed or when you’re done with your session.

Why?

Because if you look at your trading journal and you see that you’re on your string of losses.

How would you feel?

You’d feel like sh*t.

And what are the chances of you lashing out your emotions and messing up your trading when the markets are open?

Probably high.

So review your forex trading journal when the markets are closed.

That way, you can’t do anything stupid.

Solution #2: Automate your trading journal as much as possible

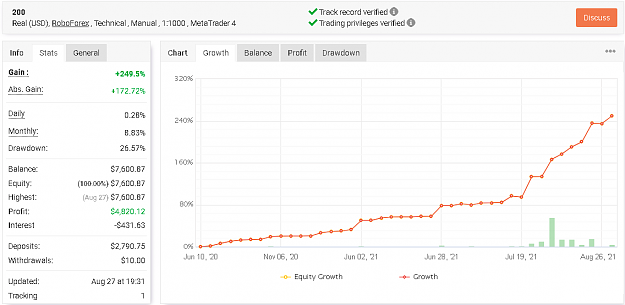

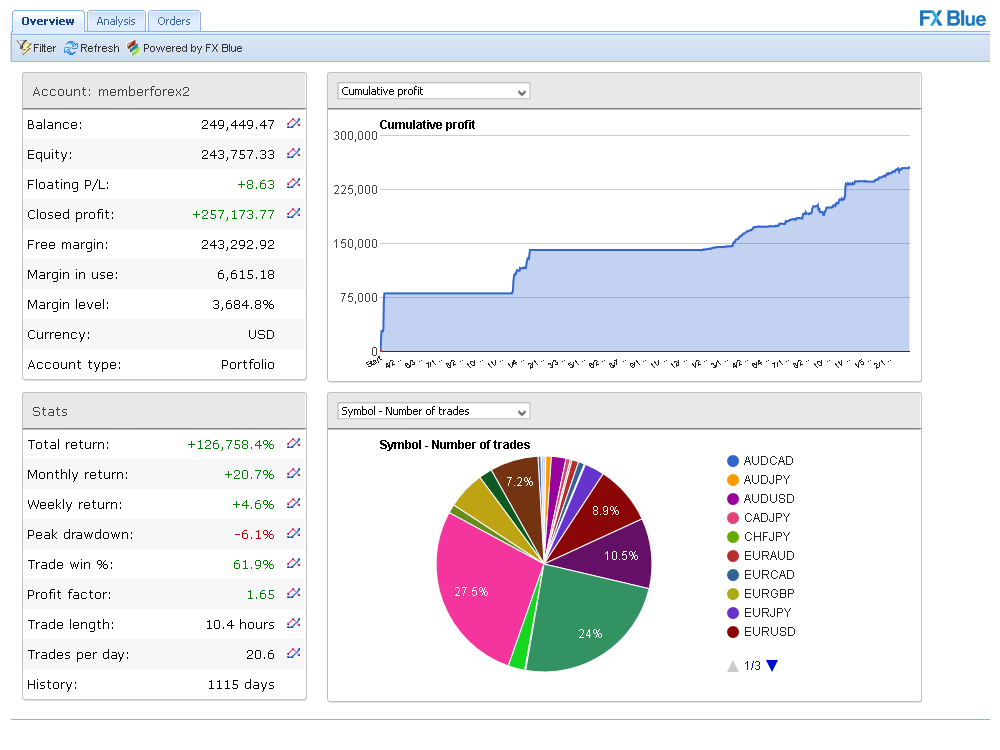

In this day and age, you already have free forex trading journals such as Myfxbook’s trading journal:

Or even Psyquation:

I’m sure they more out there, but here’s the best part…

All of them are free and automated.

That’s right!

Whether you have a demo or a live account, you can use these tools free of charge!

And you don’t even need to input your trades manually as they are all automated once you connect your account!

So…

Why bother spending hours creating your “advanced” trading journal while you can take set it all up in less than an hour?

So if you’re serious about creating your forex trading journal, you must automate things as much as you can.

Got it?

Now at this point, you might be thinking:

“If we can just automate things, then does that mean that manual trade journaling is useless?”

I know I’ve said a lot so far when it comes to automated and manual trade journaling.

But the answer is no.

A manual forex trading journal can still help you out as a trader, even though you already have automated statistics at the back of your trading.

That’s why in the next section…

I’ll teach you how to correctly create your forex trading journal, and teach you how to use it.

Sounds good?

Then keep reading…

How to create your forex trading journal in less than 5 minutes

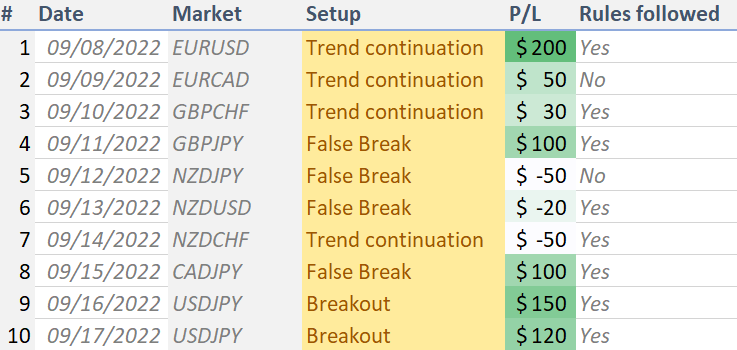

When it comes to creating your own manual forex trading journal you only need these things:

- Trade number (to reference your screenshots)

- Date (to select which month you want to review)

- Market (to know which market the trade was in)

- Trading setup (to determine the type of trade you took)

- Profit or loss (to determine whether or not it was a winning trade

- Rules followed or not (to determine whether or not you messed up big time or not)

Of course, in the next section…

I’ll explain how all these metrics come together.

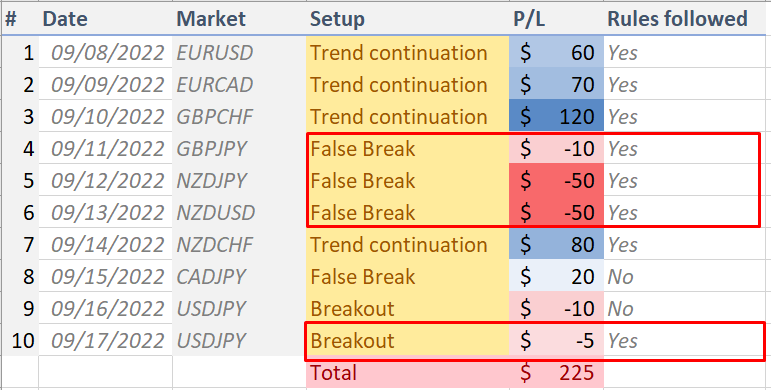

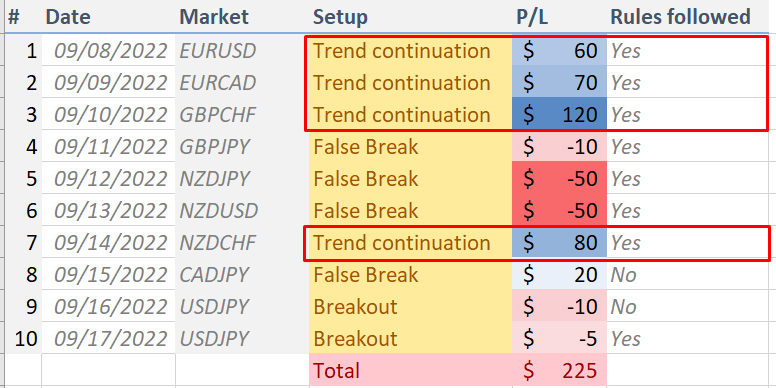

Nonetheless, your trading journal should look like this:

I know that I’ve added a couple of simple designs to dazzle this forex trading journal a bit.

But this takes less than 5 minutes to make (and really, this is all you need).

And the best part?

It takes less than 30 seconds for you to log one trade, so using this forex trading journal would something be easy to be consistent with.

What’s next?

Let me tell you…

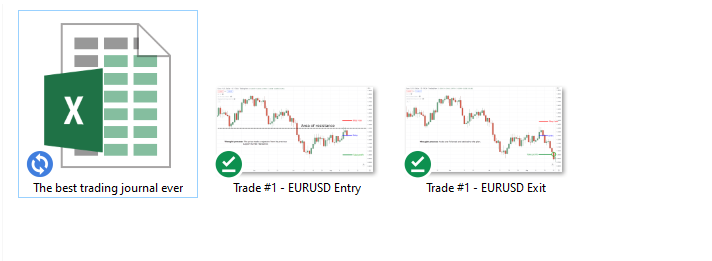

Trade screenshots

That’s right, most automated trading journals cannot perform this.

So, this is something that you must do.

Now, here’s what you should include on your trade screenshot:

- A screenshot of when you took the trade

- A screenshot of when the trade was exited

Simple!

But really, you can put anything you want on your trading screenshots.

But the concept is that you must be able to put your thought process behind the trade.

Here’s an example.

Screenshot #1: Entry

Screenshot #2: Exit

Of course, you should keep in mind what trade number this is, as you’d want to save the screenshots and keep them organized.

Here’s what I mean:

Now at this point…

You’ve made your simple trading journal and you’ve had a couple of screenshots saved.

What’s next?

Aha.

You see, this is where most forex trading journal guides end.

They teach you how to make your journal but not how to use it when you’ve already populated it with trades.

But I need you to stick with me…

Because the next part of this guide is very important as you’ll be able to apply this no matter what kind of forex trading journal you choose.

Ready?

Then let’s go…

How to use your forex trading journal to help you improve in the markets

Now…

When it comes to using your forex trading journal, I want you to keep in mind the I.D.P process which stands for:

- Identify

- Diagnose

- Plan

Let me explain…

1. Identify

Here’s the truth:

When you’re on a losing streak, sometimes it’s not the strategy’s problem.

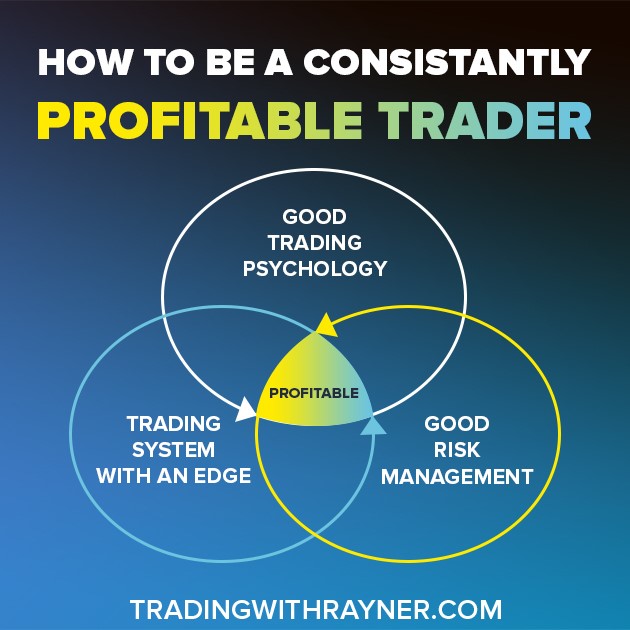

That’s why before you could think about trying to tweak your strategy, you must identify whether or not you’re having struggles with your:

- Trading psychology

- Risk management

- Strategy

That’s right.

Before you even try to tweak your trading strategy, if you’re having a hard time with your trading psychology and managing your risk…

You’ll always blow up your trading portfolio.

If you have the right trading psychology and risk management but you don’t have an edge…

You’ll always end up breakeven.

If you have a working strategy and good risk management but you’re having issues with your trading psychology because you keep on tweaking the rules…

You’ll end up breakeven.

You see my friend.

It’s all about that balance!

Trading psychology + Risk management + Strategy = Consistent profitability

Again, the first thing you need to ask yourself is to determine whether or not you’re having a hard time with your trading psychology.

If you’ve had a margin call or experienced a 50% loss in less than a week, then you need to ask yourself if you’re managing your risk well.

Finally…

When your execution and risk management are on-point, only then you’d have a look at your trading strategy.

Makes sense?

So, how exactly can we tackle this specifically?

Let me share it with you in the next section.

2. Diagnose

Unfortunately, every trader is unique.

There’s a chance that you might have to diagnose your trading problems differently.

So you must take away the concept or the principle that I’m about to share with you.

Makes sense?

So first…

Trading psychology

Let me give you an example.

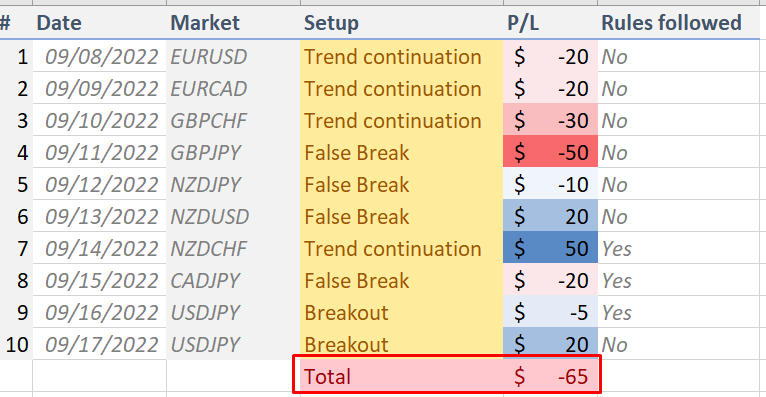

Let’s just say that you’re risking 1% of your $5000 account, so you won’t risk more than $50 per trade.

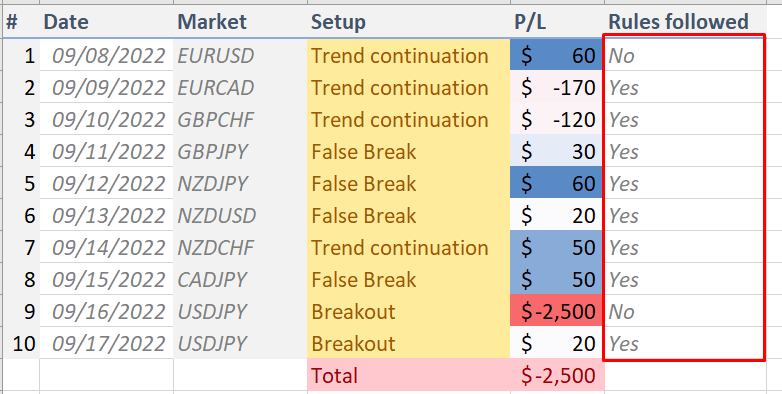

And for September, you’ve had a loss of $65:

At the same time, out of the 10 trades, you’ve taken this month…

You broke your rules 7 out of 10 times:

So, what does this tell you?

Is risk management the issue?

Well, you’ve maintained your risk with a max of $50 loss trade, so it’s not risk management.

Is it your trading strategy?

Hmm, you’ve broken your rules 7 out of 10 times this month, surely they could’ve been a winner if you followed your rules, no?

So, if I ask you what you need to tackle and fix, it should be your trading psychology.

Cool?

Let me give you another example…

Risk management

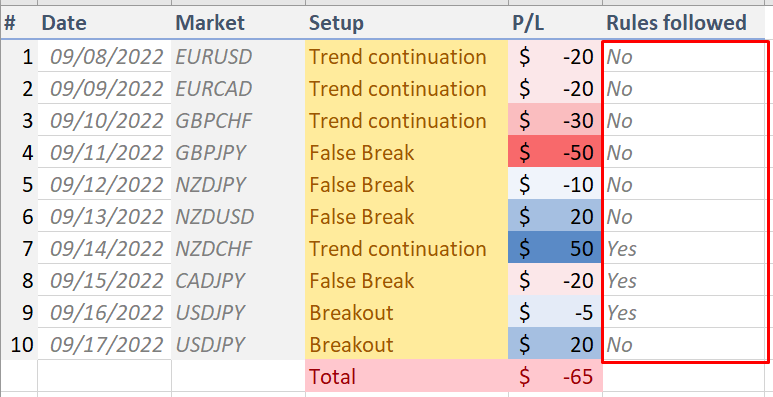

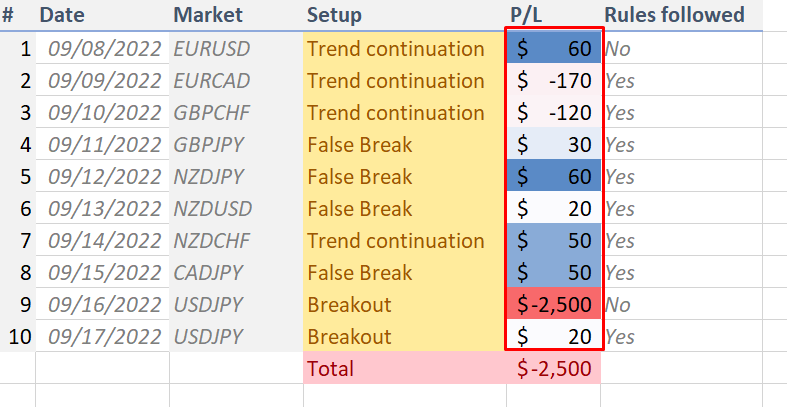

The same thing, you have a $5,000 portfolio and you don’t want to risk more than 1% per trade.

But this time, you’ve noticed that you’ve had a 50% loss in just one month.

Holy moly, that my friend is not normal…

Well, I’m sure it’s obvious that your risk management is the problem here.

But let’s go this step by step, shall we?

So, as you can see:

You’ve followed your rules 8 out of 10 times, so when it comes to your trading psychology…

There’s not much of an issue.

How about your system?

As you can see, you’ve won 7 out of 10 trades (70% win rate).

So, it’s not your strategy either.

And how about risk management?

Recall, that you’d want to risk 1% of your account per trade.

However, all of your losing trades were above that.

So as you can see, risk management is something that you’d want to tackle, and not your trading psychology or your trading strategy.

And finally, we have the most interesting part…

Trading strategy

You know the drill.

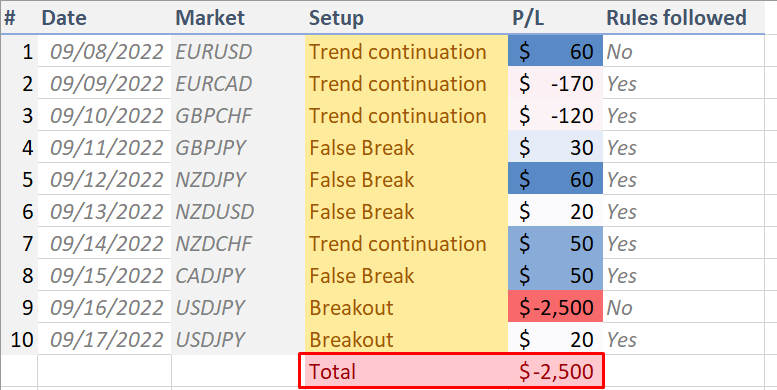

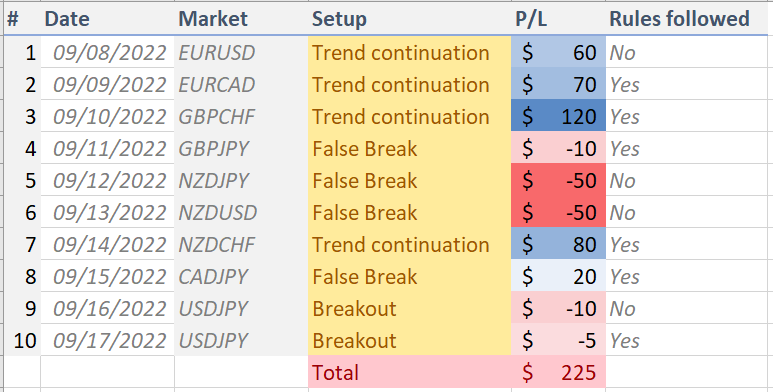

Same account size as the first example, and then we go into the step-by-step process of figuring out what’s the wrong column by column.

So, here’s what we have:

This time, I’ll hand it over to you.

Can you determine what can you improve in this trading journal?

Sure, it’s the strategy since I’ve covered the others.

But why I wonder?

You’re up for this month!

But that doesn’t mean you should be complacent.

So let’s break it down:

As you can see in your forex trading journal…

You’ve followed your rules 80% of the time, and you’ve maintained your risk on your losing trades.

But if you look at your trading setups…

You can see that for this month, you’ve lost all of your False Break and Breakout trading setups.

(and yes, I highly suggest that you exclude trades where rules aren’t followed)

But at the same time, do you know which trading setup works?

That’s right…

Your trend continuation trades!

It means that there’s a chance that it’s the right setup for the right market condition.

Now, it doesn’t mean your other trading setups do not work and that you should discard them.

It only means that since market conditions change all the time, no trading strategy works all the time.

Makes sense?

3. Plan

Here comes the tricky part.

Because as I said, planning on how to tackle these problems in your trading journal (after diagnosing) can depend on the trader.

So, things may not be as specific as the last part, alright?

Now, if you’re having a hard time with your…

Trading psychology

It could be these three things…

- Personal relationships

- Trading capital

- Expectations in trading

Now, do you know why I ask you to check on your trading psychology first before the rest?

That’s right, because we’re all humans after all, and there’s more to life than trading.

So, if you’re having a hard time with your relationships, and you think it’s directly affecting your trading performance…

Then, don’t hesitate to pause.

If you think that you’re creating a lot of trading errors (such as overtrading) because your trading capital is too huge…

Then, don’t hesitate to withdraw and reduce your trading capital.

Because there’s a high chance that you’re trading without confidence and that you need to build it up slowly without pressure.

Finally, I’m going hard on this one.

If you think that trading is a get-rich-quick scheme and you’re expecting a steady source of income every month to replace your full-time job?

Then, I don’t think trading is for you, my friend.

Nonetheless, I highly suggest you check these articles out when it comes to trading psychology:

Trading Psychology: 6 Practical Tips to Master Your Mind and Money

Trading Psychology: 3 Profitable Tips To Trading Success

I Lost 50% Of My Capital Before Turning Profitable. Here’s How…

Next…

Risk management

When it comes to risk management, you must get to answer these two questions:

- Do you exactly know how much you are going to lose before you enter a trade?

- How many units do you need to buy so that if your trade hits your stop loss, you won’t lose more than 1% or 2% per trade?

Once you’re able to identify those answers before every single trade you take…

Then you’ve got a sustainable trading business, my friend.

Nonetheless, I highly suggest you check this out:

Forex Risk Management and Position Sizing (The Complete Guide)

Stock Risk Management: How To Calculate Your Position Size

Trading Strategy

Similar to trading psychology, it’s not as easy as giving you a working strategy.

Because as you know…

Not all strategies work all the time, and not all trader’s risk appetites are the same.

Nonetheless, one thing that has helped me is to know where you stand first as a trader.

Where you are a:

- Discretionary trader

- Systematic trader

Knowing where you stand between the two would cut your learning curve by half.

Because you’d know what to look for!

So, if you want to go down the route of being a discretionary trader, I suggest you check this out:

The Price Action Trading Strategy Guide

And if you want to be a systematic trader, then these articles will help to give you an idea:

Turtle Trading Rules: Does It Still Work Today?

There you go!

A complete and comprehensive guide to creating and using your trading journal!

Have you learned something new today?

Conclusion

If you’ve reached the end of this trading guide…

I’m sure that you should realize by now that having a forex trading journal is not about your strategy.

But it’s all about you.

Knowing what you want as a trader, what works for you, and what could be the best for you.

That’s why I hope that after you read this trading guide…

You wouldn’t treat a forex trading journal the same way again.

But over to you…

Have you used a forex trading journal before?

How did it help you?

Are there any tips you could share with me?

Let me know in the comments below!