This post is written by Jet Toyco, a trader and trading coach.

I’m sure you’ve heard this a thousand times already…

“You must find an edge in the market!”

Pretty standard, right?

But then how do you find such an edge in the market?

“You must backtest your trading strategy, if it works in the past, it’ll work in the future!”

Cool.

But wait…

Don’t you need a platform to backtest?

To find your edge in the market?

So you ask yourself:

“Where the heck can I find a good trade simulator?”

“There are so many and most are paid, which one should I use?”

Well, my friend, you’ve come to the right place.

Because in today’s guide you’ll learn:

- What a trade simulator is in simple terms and what are we looking for

- The secret to finding a great trade simulator (most traders miss this)

- The most accessible trade simulator you can use for the Forex market

- A trade simulator for the US Stock Market that will BLOW your mind

- The real reason why trade simulator can be a waste of time (and how you can use it to your advantage)

This training guide’s packed, am I right?

So, if you’re ready for a deep dive into trade simulator then let’s get started.

But first…

What is a trade simulator and how does it work?

As you know…

A trade simulator allows you to look at past prices so that you can “simulate” how your strategy has performed in the past.

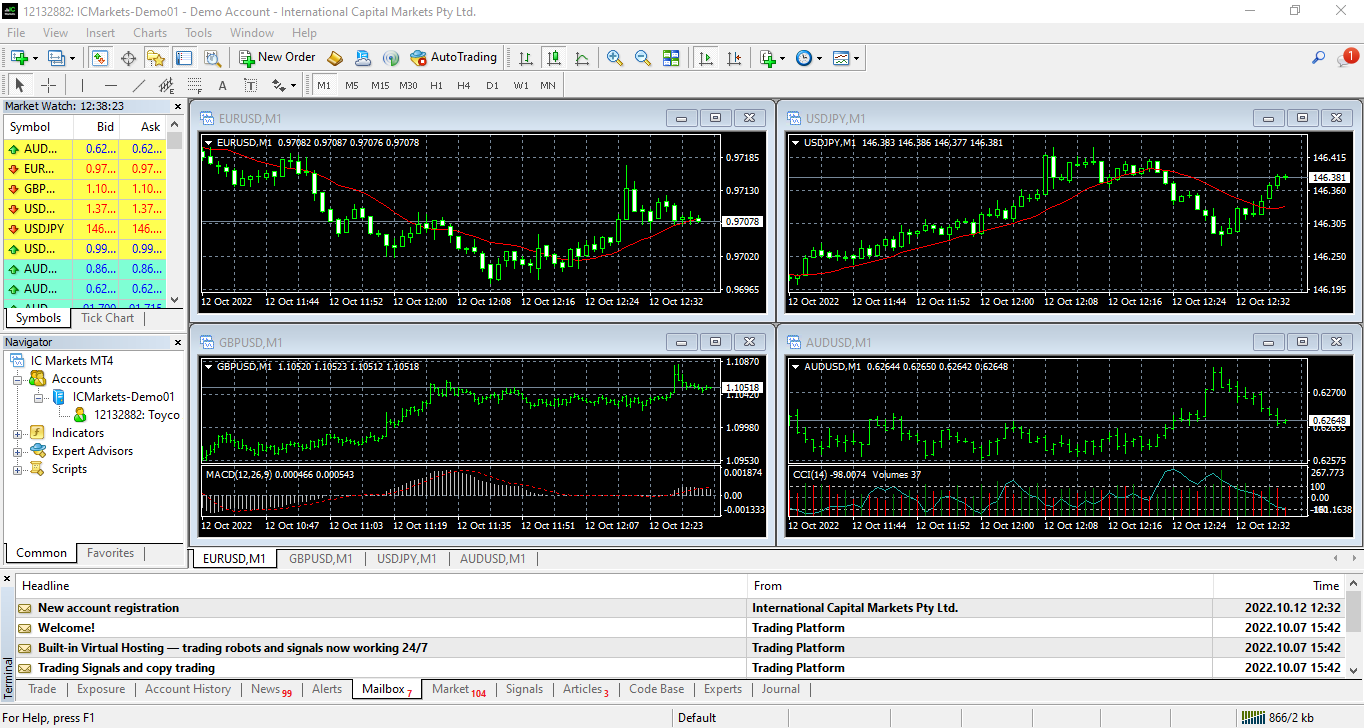

Here’s what it looks like:

So, if ever your strategy lost money in the trade simulator…

Simply make some tweaks and then test it again, and again, and again!

Now…

I don’t want to leave you blind when it comes to trade simulator.

So you must know that there are two types of backtesting:

- Automated trade simulator testing

- Manual trade simulator testing

Let me explain…

Automated trade simulator testing

This simply means that you’re getting a set of codes to run the test for you.

Everything’s automated and the testing process is often faster!

So If you want to go down the route of being an algorithmic trader or a systematic trader, then you’d want to focus on this.

But here’s the bad news…

I will not be covering automated testing in today’s guide.

However…

There’s some good news!

It’s that you can learn all about it through a free trading book that we have prepared for you.

So if you think systematic trading is for you, you can check it out here.

Cool?

Next…

Manual trade simulator testing

Unlike automated trade simulator testing, you do everything manually:

- Entries

- Trade management

- Exits

- Risk management

Sure, it is quite a lot!

But if you’re someone who’s been practicing trading methods such as Price Action or Elliot waves then this is the perfect arena for you to apply everything you’ve learned!

Better to practice on a simulator instead of your hard-earned money, right?

So…

If you’re the type of trader who doesn’t want to let a trading robot do the work then this is what we’ll focus on in today’s guide!

But before I share with you these trade simulator, it’s crucial to ask…

What makes a great trade simulator

It wouldn’t make sense if I just place all the trade simulator in a list and let you figure out which ones are good or bad, right?

So that’s why we must have a standard on what makes a great trade simulator.

Because everything that I would recommend below would meet all of the criteria so that you know where I am coming from.

Sounds good?

Now, what are these criteria you may ask?

Three things:

- Must be able to apply risk management

- Must have built-in historical data for you to use

- Must be free

The third one has its exceptions of course!

But let me tell you what I mean…

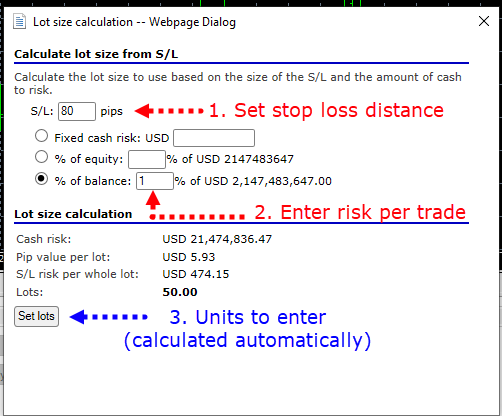

1. Must be able to apply risk management

Remember the trade simulator I showed you a while ago?

As you can see…

There are only two buttons which are buy and sell.

It means that your total percentage gain on a stock will be the deciding factor in whether your strategy makes money or not.

But let me tell you this:

It doesn’t apply to real-world trading.

Why?

Because clicking the buy button is only the beginning!

You would need to determine:

- How many shares should you buy relative to your trading account?

- Where is your stop loss and take profit?

- How much is your potential loss if your stop loss gets hit?

Do you see what I mean?

So the bottom line is this…

A trade simulator must be able to let you apply risk management because anybody can have the same strategy but have two different account sizes.

Makes sense?

Must have built-in historical data for you to use

Let me ask you…

What good is a gun without its bullets?

Pretty useless!

And what good is a gun if it can hold 100 bullets but there are only 20 inside the magazine?

Not very effective, right?

It’s the same for a trade simulator.

What good is a trade simulator without historical data?

Useless!

And what good is a trade simulator if you want to simulate 5 years’ worth of data but your trade simulator only offers 1 year’s worth of data?

Not effective!

See what I mean?

So, if we’re going to look for a trade simulator, it at least must have historical data included already!

(There are some caveats to built-in historical data though)

Must be free

Your eyes are probably sparkling with joy right now when you heard the word “free.”

But it’s true!

Not only do I want you to know about awesome trade simulators out there…

I also want you to immediately try them out after you read this guide.

But here’s the thing:

Eventually, the time will come wherein you must invest in yourself and seek better services.

So I may give paid alternatives whenever possible.

Sounds fair?

The best trade simulator for the Forex market

This might not be surprising to you…

But MetaTrader 4 is one of the most accessible trading platforms if you wish to trade the Forex market.

It’s a powerful trading platform both as a live trading platform and a trade simulator platform.

Here’s the interesting part:

What makes MetaTrader 4 great is not the platform itself, but the add-ons that you can plug into it!

This is why the best trade simulator for the Forex market is not MetaTrader 4 but…

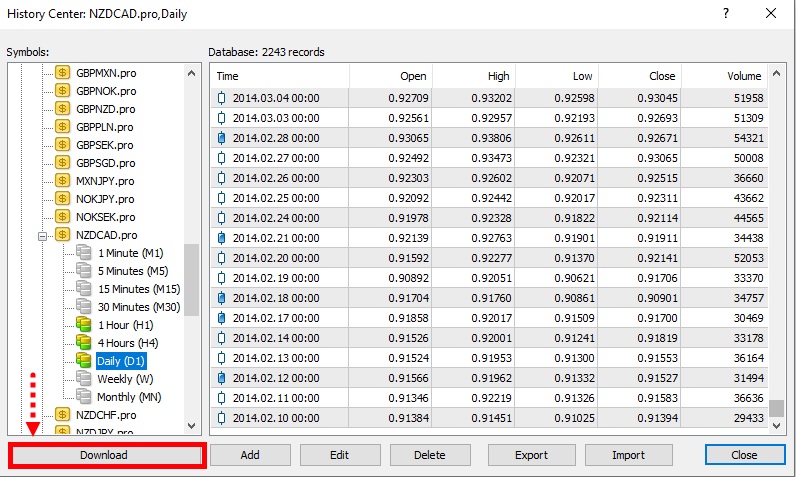

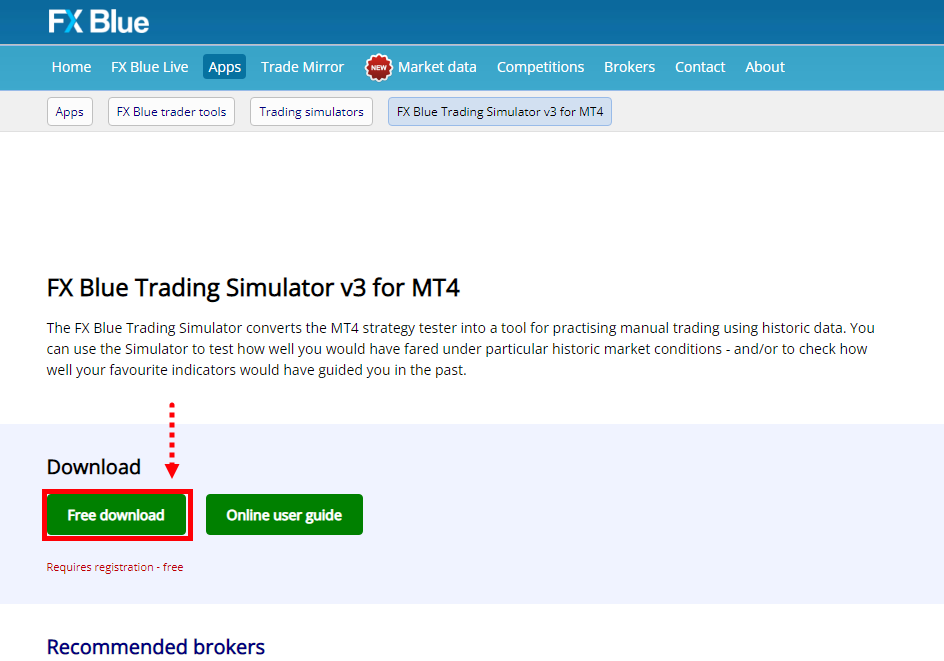

FXBlue (Free)

What’s great about this add-on to the MetaTrader 4 trade simulator is that it ticks all of the boxes we mentioned a while ago!

Is it able to apply risk management?

Check.

Does it come with historical data?

Well, it comes with the MetaTrader 4 platform but, check!

And lastly, is it free?

Damn right it is!

And you can check it out here!

And by the way…

This trade simulator add-on allows you to convert your trend lines and support and resistance levels as your take profit or stop loss orders, how cool is that?

Now Recall:

For a trade simulator I share, I share with you a paid alternative for this section.

Remember?

Good.

Because for the Forex market, the paid alternative for having the best trade simulator is…

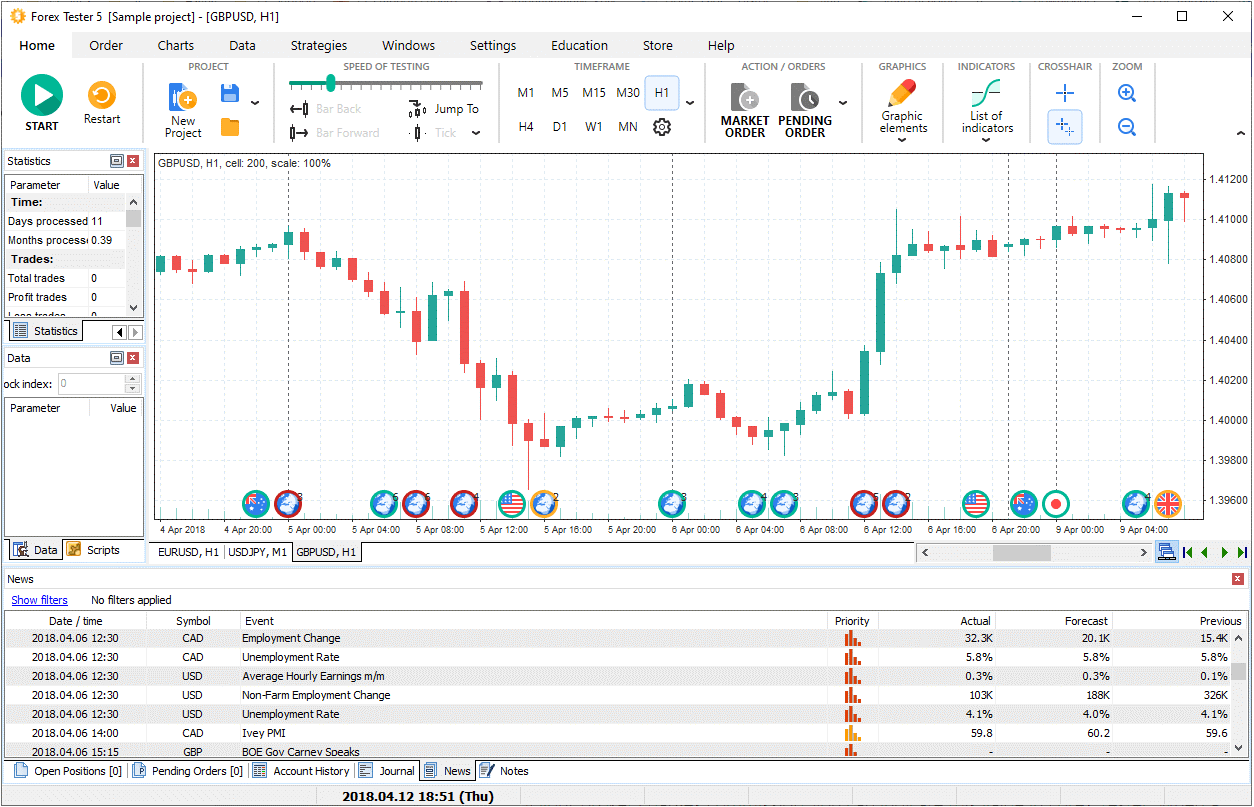

Forex Tester (Paid)

Source: ForexTester

Unlike MetaTrader 4 where you still need to learn how to use the actual software and learn how to place add-ons…

Forex Tester already has everything prepared for you.

Heck, you don’t even need to download anything as it even has a website tester alternative!

And by the way…

Did I mention that you can “try” a glimpse of it out for free?

So, what’s ForexTester have to offer that FXBlue doesn’t have?

There’s so much that this guide won’t do it justice.

But one, you can backtest with fundamental news into play:

Source: ForexTester

Imagine not only having historical data, but also historical fundamental data.

Sweet!

And two, you can simulate spreads and… what?

Simulate depositing and withdrawing money?

How cool is that?

Source: ForexTester

Now, if you think that you’re limited by the features of FxBlue, then ForexTester could be a great investment.

However, if you think the FxBlue does all the job for you and you’ve become proficient in navigating around the MetaTrader 4 platform…

Then there’s no need for you to switch over to the paid alternative.

So, what if you’re trading the Stock market?

What’s a good trade simulator for you to use?

Well…

It’s a bit tricky.

Let me tell you why in the next section…

The best trade simulator for the Stock market

Unlike the Forex and the Crypto market…

There are a lot of stock markets around the world!

There’s the Indian stock market.

The Philippine stock market.

The Singapore stock market.

The Canadian stock market.

So, unfortunately…

I won’t be able to give each trade simulator platform for those stock markets.

So for today’s trade simulator guide…

I will be focusing on platforms that trade the US stock market.

We clear?

I’m sure you’ve already heard about this trade simulator before.

But man it sure is, if not, the best out there!

And that platform is…

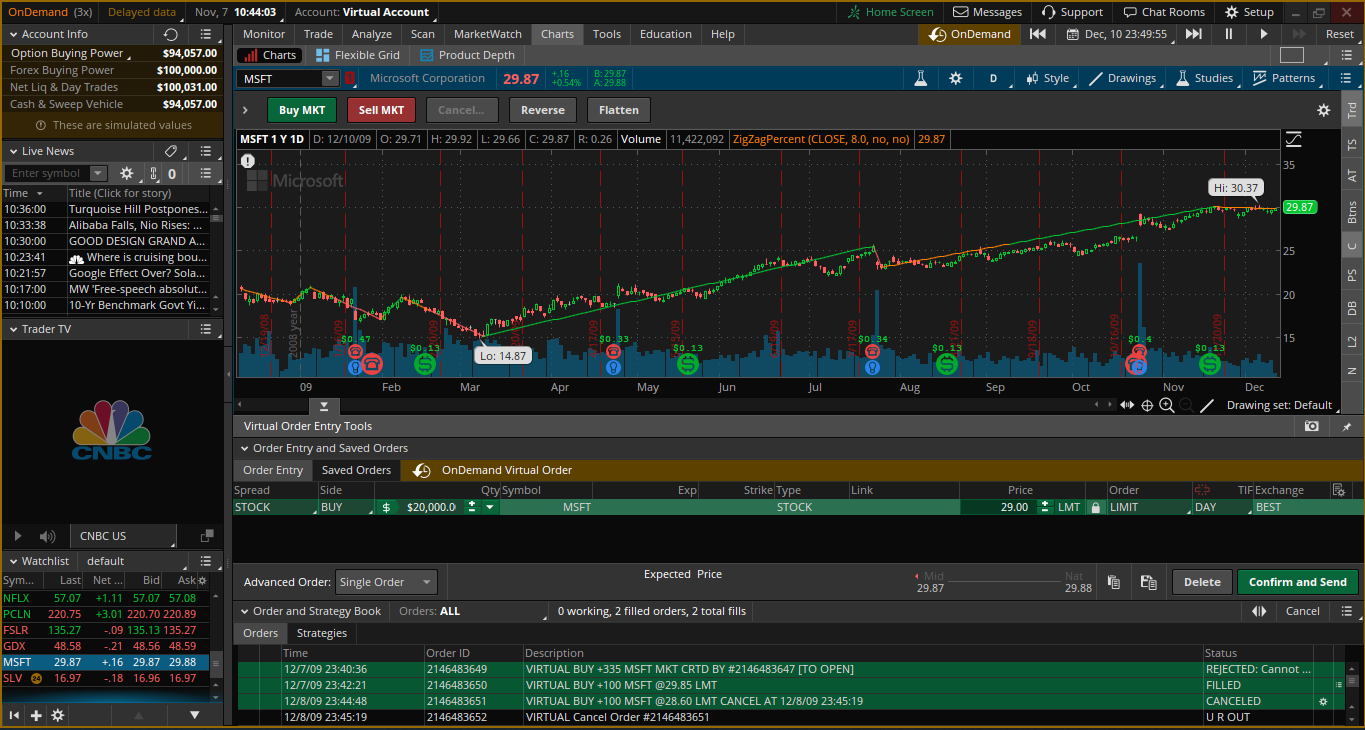

Thinkorswim OnDemand (Free)

Similar to MetaTrader 4, the Thinkorswim platform is mainly a software that allows you to trade live in the markets.

It’s a live trading platform.

However, this platform also comes with its own full-fledged professional trade simulator mode!

The best part?

It’s built-in and free!

Usually, historical data is very hard to come by.

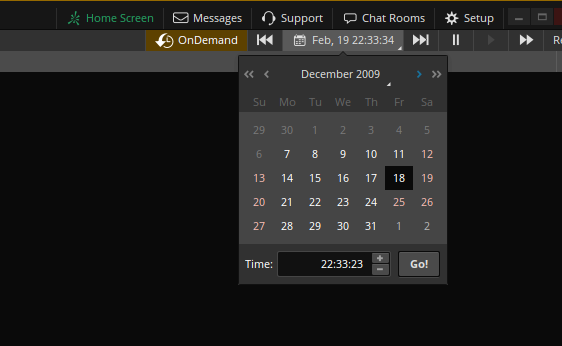

But this trade simulator allows you to test back to December 2009.

And that’s not all…

Thinkorswim OnDemand does not just allow you to go back in time and test one specific stock…

It allows you to trade thousands of stocks as it replays the whole stock market session during that day!

Want to buy shares on Microsoft?

Sure.

Want to buy Apple shares while your Microsoft trade is still ongoing?

Definitely can.

Pretty amazing, right?

This makes this whole trade simulator test very realistic because:

- It allows you to test your trading portfolio as a whole and not just on a single stock

- The historical data allows you to trade across multiple timeframes and charts at the same time

- Allows you to place all types of orders

- Helps you get used to the platform before you put real money on the line

This makes this trade simulator a definite must-have if you want to trade the US Stock market.

But here’s the catch

Have you heard of the saying:

“If it’s too good to be true, it probably is.”

And yes…

Even though ThinkorSwim’s OnDemand trade simulator is every trader’s dream, it has its catches and downsides.

You cannot use the stock screener while using OnDemand

What makes the ThinkorSwim platform so popular is because of its screener capabilities.

But with the Trade Simulator, you won’t be able to use the screeners you’ve made.

Though let’s hope that in the future, they find a way to enable it as this will truly change the playing field.

You need a live account

Unfortunately, you’d need to go through the process of opening an account if you’re to get your hands on Thinkorswim’s OnDemand trade simulator.

The good news?

Is that you’ll be able to start using the simulator even without $0 on your account!

But like I said…

I wouldn’t want to leave you blind so I’m here to share these beforehand.

Fair enough?

Now here’s the thing:

A trade simulator can be the best thing that’s ever happened to your trading journey.

Or it can also be the main reason why you’d lose all your money.

So before I end this training, let me explain why in the next section…

The main issue with a trade simulator and how to fix it

Before I let you go into the wild of exploring the trade simulator I mentioned…

You must know these issues surrounding trade simulator.

Why you may ask?

Because I believe I must make sure you have the right expectations (and yes no need to thank me).

So, a major trap that you must not fall into is…

Treating trade simulator as an end-all-be-all tool to profit in the markets

Have you ever experienced where you’re doing so well in demo trading but when you started trading with real money…

You started losing instead?

If so, then I know how you feel.

So, why does this happen?

Simple!

In a trade simulator, you’re testing your strategy but not your mental capacity.

So if you start trading with a huge account that you cannot afford to lose…

Your emotions will unconsciously get the better of you, to dictate your trading actions by breaking your rules.

What’s the solution then?

Start trading as soon as you can but start small

Remember:

Your purpose of having a manual trade simulator is not only to test whether or not your strategy works.

But to also improve your skill and your process when approaching charts and trades.

So once you think you’ve nailed down both your trading strategy and process.

Start live trading as soon as you can.

But start as small as you can.

That’s right.

Whether it’s a $100, $500, or $1000 it doesn’t matter.

Start as soon as you can!

And once you’ve reached a new “comfort zone” in trading small, you can then add more funds into your account as time goes on.

Sounds cool, right?

Nonetheless…

If you want to learn more about this on a deeper level then I recommend reading: The Complete Guide to Demo Trading

And also: The Definitive Guide to Price Action Backtesting

At this point you might be thinking:

“Omg, what about the crypto markets?”

“What’s the best trade simulator for the commodities market?”

“How about my local stock market what should I do?”

I hear you.

I know how you feel!

But if you recall the criteria I mentioned a while ago which are:

- To be able to apply risk management

- Have historical data

- And must be free

These criteria are often hard to come by.

But seeing how new platforms are popping up these days, there’s a high chance that this trading guide would be updated in the future with fresh new recommendations.

Sounds fair?

Conclusion

Having a trade simulator in this day and age is a miracle in some way.

Since a trade simulator during the 80s or early 2000s was either inaccessible or too expensive.

Nonetheless…

Here’s a recap of what you’ve learned in today’s training

- A trade simulator is a platform that lets you trade past prices so that you can test whether or not your strategy works and also improve your technical analysis skills

- A great trade simulator must be able to let you apply proper risk management, have built-in historical data, and ideally must be free

- FXBlue’s backtester for the MetaTrader 4 platform allows you to have a robust trade simulator to trade the forex market while a paid alternative that you can use is ForexTester

- Thinkorswim’s OnDemand trade simulator allows you to trade multiple stocks at the same time but with a lengthy process of having to create a live account first before having to access it

- A trade simulator is just a step towards successful trading, and you must start live trading as soon as you’ve nailed down your strategy and process in the trade simulator

And there you go!

Now I’m sure I probably missed a couple of trade simulator out there.

That’s why I want to hand it over to you…

What trade simulator do you recommend?

And which market?

Let me know your thoughts in the comments below and who knows!

It may be featured in this article!