Introduction: Money Management in Forex

In this article, you’re going to learn everything you need to know about money management in forex.

We have discussed all the angles on and the importance of Stop Losses in the articles called “The Ultimate Guide On Stop Losses”. If you have not read that guide, make sure to take a look!

Of course, the stop loss is just a part of the entire equation in our world of Forex trading. Here, we are going to continue with this material, but we are going to look at a broader topic: Money Management (MM). MM is, of course, a vital topic, and is of equal importance as Risk Management, Trading Strategies, Trading Psychology, and Trade Management.

We also have training on Trend Line Drawing with Fractals.

What is Money Management?

Let us start with the question: what is basic Money Management? The core goal of successful money management is maximizing every winning trades and minimizing losses. A master of money management is a master Forex trader. Money management is a method to deal with the issue of how much risk should the decision-maker/trader takes in situations where uncertainty is present.

You might ask yourself, isn’t basic money management the same as risk management?

Risk management, in fact, is your choice of how much risk you want to place on a trade.

You are always in control of how much risk you place on a trade: whether that it is 1% or $100, but I would recommend using a standard % risk (not $) of your designated trading capital. Every trader’s first goal is to preserve the trading capital, which is achieved by being very disciplined in the field of risk management.

In Money Management every trader is actually looking at the reward to risk ratio, or R: R ratio in short. Money management calculates the balance between the risk and the reward of the trade. In Money Management, the following definitions are vital:

- The risk is the stop loss size (discussed in previous articles).

- The reward is the profit potential (take profit minus entry).

How many pips a Forex trader has earned is really not of much value, unless the pips risk is mentioned as well. Anyhow, it would be better to focus on the Rate of Return % and $/money earned. This is what all businesses do and all of us should treat trading as a business.

Reward to Risk Ratio

The ratio between the two is crucial. A trader that targets a quarter of the risk has just won one “battle” but has just lost the “war”. In trading terminology, this means that a trader might have won a trade, but ultimately the win means nothing and that Money Management has set them up for failure. Why?

For a trader to become long-term profitable with a 0.25 reward to risk ratio, the trader would need to win 4 trades to compensate 1 loss. With this equation, the trader has not made any profit. Of course this R: R makes no sense: a trader needs to get above the 80% win % to achieve profit. Not an easy feat.

With a 1:1 Reward to risk the trader only needs to win 51% and more to be profitable. In practice, it would be better to have 60% wins or more. With a 2:1 R:R a trader only needs 35% win rate.

Here are all of the mathematical statistics to make sure you are a profitable Forex trader:

- With a 0.5:1 R:R… You need a minimum of 67%+ wins.

- With 1:1 R:R… You need a minimum of 55%+ wins.

- With 2:1 R:R… You need a minimum of 35%+ wins.

- With 3:1 R:R… You need a minimum of 28%+ wins.

- With 4:1 R:R… You need a minimum of 21%+ wins.

- With 5:1 R:R… You need a minimum of 17%+ wins.

- With 10:1 R:R… You need a minimum of 11%+ wins.

- With 20:1 R:R… You need a minimum of 6%+ wins.

Here is a fast way of calculating if you have correct and rational control over your capital which provides positive mathematical expectancy:

Formula: Win % x Take profit size – Loss % x Stop Loss size

Win % for example 30% * take profit pips 55 – loss % for example 70% * 20p = 2.5 (positive = long-term win).

The smaller the stop loss, the better the R:R ratio when using the same target OR the better the odds of win % when using the same R:R.

Question: What Reward to Risk Ratio Do I Target?

I would like to ask you for some feedback. I think the best way to learn is by sharing the experience with each other. What kind of Reward to Risk ratio do you usually target? Please place a number and we will know it’s the ratio! For example, if you usually target a 3 reward for 1 risk, then please write down a 3. Thanks so much!

By the way, here is a great Forex educational video where you will see how powerful the concept of a 2:1 R:R really is. Make sure to take some time to read this great Forex training on the “risk to reward ratio.”

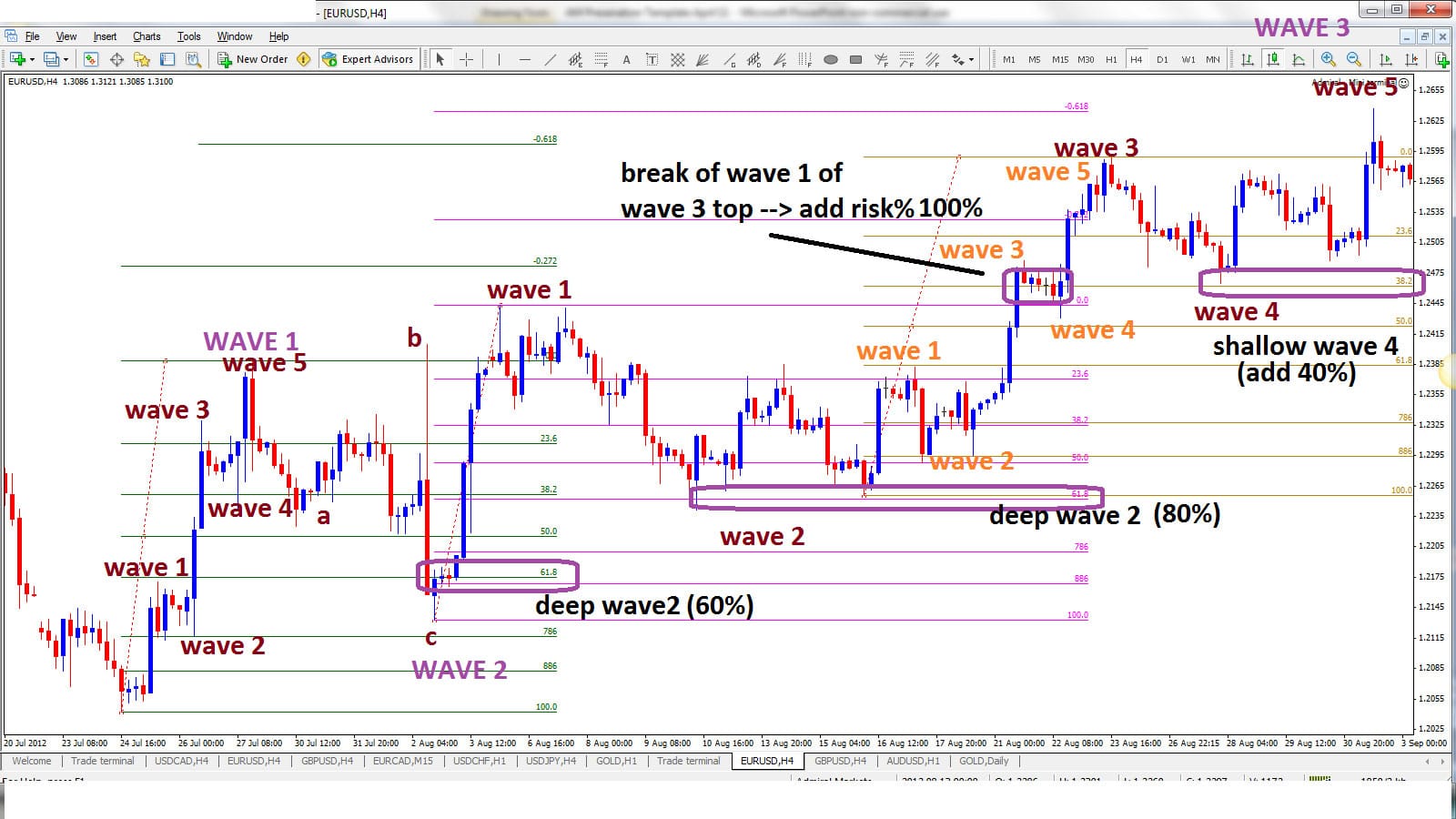

R:R using Fibs and Elliott Wave

Minimize the risk of Fib trading and decrease the potential stop loss size by splitting your trading into multiple parts. If a Forex trader decides to put their entire risk of the trade (for example 1%) on the 382 Fib, then they have no opportunity to add a trade even if the currency would retrace deeper to the 618 or even the 786 Fib.

- Splitting the trade into 2 or 3 parts allows for flexibility and psychological ease as well: a trader does not have the feeling that they will miss a trade with tying themselves down to a single entry point.

- Splitting the risk into 3 positions would mean that the trader choices to split the chosen risk of 1% into 3 parts. The risk can be evenly divided among all 3 parts (3×33%) or more weighted to one Fib level (for example 20%-30%-50%).

With a 1% risk total, this means either 3 trades with 0.33% or 3 trades with 0.2%, 0.3%, and 0.5%. This is called cost averaging. Businesses used it often: it makes their inventory cheaper. For us Forex traders, it makes the average stop-loss smaller and that is great for our R:R.

Forex traders can do the same for Fib targets. By splitting the trader with different take profit targets, they can optimize the profit average of all positions and the entire trade.

The Elliott Wave can be used to decide which Fibs and with which division % the trade is taken. For example, for a wave 2 the trader can choose to put the risk on the 500, 618 and 786 Fib with the following division of the risk: 25% on 500 fib, 35% on 618 fib, and 40% on 786 Fib. For a wave 4 the division would be skewed higher: maybe 50% on the 382 Fib, 25% on the 500 fib and 25% on the breakout.

The EW can also be used for Fib targets. A trader should aim for higher targets if a wave 3 is expected and for closer targets if a wave 5 is expected.

For more on Fibonacci trading, read our Fibonacci Trading Strategy.

How To Calculate Position Sizes:

Position sizing is important because it allows the trader to adjust the size of the trade according to the market conditions. If a trader takes a fixed position size of 1 mini for example, the loss can vary widely depending on the size of the stop loss. With position sizing, that can never happen and a trader is always in control of their risk!

To summarize:

With position sizing, the stop loss size is not important for risk management. No matter what the stop loss size is, Forex traders always choose the risk percentage level. That said, the stop loss size is important for money management. The stop loss size is an integral part of the Reward to Risk ratio.

- Here is how any trader can calculate position sizing’:

Determine the desired risk level (risk management) à a trader determines the risk level of that particular trading strategy, trading week, trading day, market structure, and that particular trade; - The trader needs to determine the best stop loss placement: not too close to market action, but not needlessly distant as well. Please read this article about stop losses to learn about the best placements.

- The trader needs to choose an achievable and realistic take profit target. Because we already did an article on stop losses, I was thinking of doing one on take profits next week. It depends if there is any interest. Would you like an article on taking profits?

- The R:R expectancy ratio should provide a positive mathematical expectation.

For example:

- Deposit = 5000 EUR

- Risk = 1% from Deposit = 50 EUR

- Currency pair = EUR/USD

- SL = 30p = 300 USD on a standard lot basis

- Size to open in order not to risk more than 1% = Risk/SL = 50/300 = 0.16 lots

How Much Leverage Do I Use?:

Be careful with the leverage you use. A good rule of thumb is to use for example 5:1 leverage. That way a Forex trader is not over-trading. For example, if your account balance is 5,000 USD, then your total is the capital of $5000 multiplied by your leverage of 5, which equals $25,000. A mini lot is $10,000, so that would be 2.5 minis. Use this formula to calculate how much risk you are taking: (SL times/multiplied by Leverage)/100 %. For example if the stop is 30 pips: (30 x 5) / 100 = 1,5 % of risk.

Here you can learn how to profit from trading.

Reinvesting Trading Capital:

Regarding trading capital, a trader has several options.

- Reinvest the profits back into the trading capital. This way the trading capital gets larger and a percentage risk of the capital is realizing a higher return in USD (same percentage risk though);

- Withdraw all profits. This way the trading capital remains the same;

- Semi-flexible approach with some withdrawals and some reinvestment.

I think that option 3 is the best money management approach. Growing your account is a great thing, but you want to withdraw some money once in a while so that you still realize that the numbers are your account are still real and not fake! Then again, withdrawing everything will take away the advantage of compounding your profit. So option 3 is the best value. You can also read about money management strategy.

Pro Tip – Use a Stepped Approach:

What I approach for point 3 is a step approach. This is how it goes:

- Use the same current trading capital for your risk management until you have a drawdown of x % or a profit of x% (the numbers are your choice).

- Once you hit your drawdown maximum, you will use the new trading account balance as your trading capital.

- Once you hit your profit target, you will use the new trading account balance as your trading capital.

- If you hit your profit target, you can decide the division of withdrawal and add-on % of the profit. So you could choose to withdraw 50% of your profits and add 50% of profits to your trading capital. The new trading capital balance would be your old trading capital + 50% of the profits. Also, be sure to read banker’s way of trading in the Forex market.

Hedge With Multiple Trading Accounts:

Another part of your money management strategy is that you want to make sure that you are diversified. This is also known as a hedging strategy.

- Preferably you are only investing a part of your savings into the Forex trading capital and you have a decent percentage of your savings invested in other vehicles – if possible.

- You have multiple accounts with different goals. This is to spread the risk of having your trading capital on one account. The different accounts can also be used for different strategies and purposes: one could be for long-term trading, the other for intermediate.

- Keep part of your trading capital on your account. Even though you want to trade with a certain amount of money, there is nothing wrong with keeping a part of it in the bank account. I do not think that a trader needs to put all 100% on the trading account, but make sure a margin call is not needed if you opened a trade with 1 mini. Want to learn more about mini trading? Read the ultimate guide to trading Emini futures here.

Thank you for reading!

Please leave a comment below if you have any questions about Money Management in Forex!