The Forex Edge Finder Strategy is the best way to become a successful trader. This article will show you how to find your edge and identify a forex trend. While this is not a forex trading strategy, understanding forex trends will give you a solid foundation.

Having a solid base to work from will make your transition to profitable trading much faster. Trend trading education may appear, on the surface, to be a beginner’s article because it is foundational. However, if you are not yet profitable, this will contain important elements that could transform your trading to great success.

Let’s begin learning about the Forex Edge Finder Strategy!

Swing High / Swing Low: Forex Edge Finder Basics

The first thing you must know to find your Forex Edge is to find Swing High and Swing Low on a chart. Price does not move in a straight line it moves in a zigzag pattern. For Traders to grasp forex trend trading, they must understand how price moves. Trends can be identified and traded within any time frame. Also, read about Scaling in and Scaling out in Forex.

How to Identify a Forex Edge Finder Trend:

Step 1 Identify higher highs and higher lows for an uptrend or lower lows and lower highs for a downtrend. The way to determine a higher high is by watching the price. If the price moves above the previous high then that is a higher high, look at the image below to see how it works.

Step 2 Mark them on your chart, and that’s it, finding a forex trend is quite simple.

There are always higher highs and high lows in an uptrend and lower highs and lower lows in a downtrend.

Finding the higher highs and lower lows is the foundation of trend trading, and it is important to understand this so you can find valid entries with a positive risk-to-reward ratio. Traders continually make trend trading more complicated than it needs to be. There is no requirement for fancy Forex Trend indicators, that will confuse you.

All a trader needs is to see the patterns in the image shown above and learn to identify them on a chart. This article will show you how to find these patterns and entries on a consistent basis.

Forex Downtrend Example

Notice the Swing High and Swing Low in this downtrend as indicated by the pink horizontal line.

Forex Trend Analysis Simple Trend:

The image shows an example of an uptrend as identified as the green lines showing resistance areas that initially get broken to the upside continuing the trend in the current direction.

The concept of trading with the trend on the surface seems very simple, but the price does not always respond the way you would think that it would I will explain this in detail in a moment.

Complex Forex Trend Example:

The market is powered by traders buying and selling, and that is what causes the different responses that you see in trends. Traders will make irrational emotional decisions creating the simple trends you expect to act out of the ordinary.

This failure to take out the high caused more selling and move the price to retest the previous swing low. This type of trend can cause traders to believe that it was a reversal coming. Rather than a continuation of the current trend. The second green line is a failure to take out the previous highs which can get many traders falsely believing that the uptrend is over. This false belief will trap many inexperienced traders in a losing trade.

The two pink lines that have lines pointing to them indicate current support and again since the previous high failed.

This type of price action causes head fakes and causes new traders to enter in on the wrong side of the trade. Then they get trapped in a losing position, and that fuels the buying by the experienced traders. That is why we get a significant move to the upside when the second swing low is tested a second time.

How to Recognize a Change in Trend Direction

The trend has a way to fake inexperienced traders out of their winning positions and into losing positions. It is important for trend traders to know how to identify a change in trend direction to avoid fakeouts and be able to trade with the right side of the trend.

Simple steps to find a change in trend direction

Identify the current trend by marking swing high and swing low on your charts.

After the most recent swing low of an uptrend or a swing high of a downtrend is broken, then the forex trend direction has changed.

Identifying the change in trend is simple also, but it is surprising how many traders get trapped on the wrong side because they do not understand the concept of trend change direction. The best trend indicator forex is by examing prices and looking for a market structure change as seen in the image below.

Forex Trend Direction Change:

Once the trend breaks a lower high, that is the easiest way to find a new trend. Remember this can be done on any time frame depending on your trading preference. Notice the pick Lower Highs on the image above ramping up into the trend direction change.

Another Trend Direction Fake Example

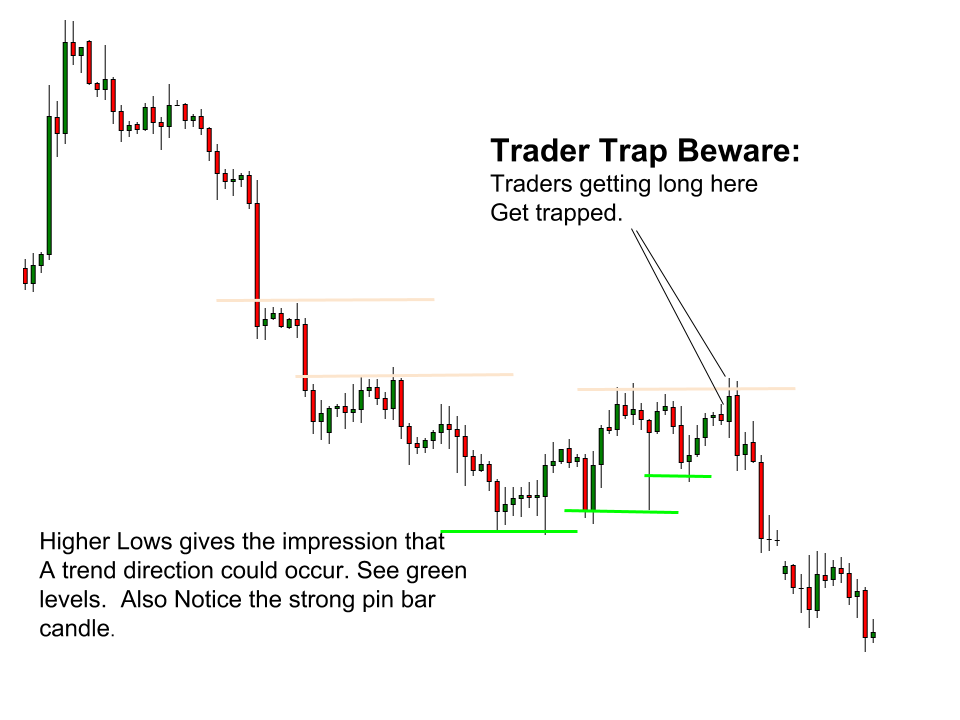

When you see higher lows or lower highs moving into a counter-trend move such as what is shown in the image above. Be wary of automatically assuming that the trend is going to change. Predetermine is one of the market’s classic moves to get traders to jump in on the wrong side of a trade.

Markets are moved, and trends are built by traders making decisions, and a strong trend won’t die easily. Do not be one of the traders that get caught in a trend reversal fake.

Understanding Trend Direction Market Structure:

Once you fully understand the trend direction market structure, your next goal is to use this knowledge to find excellent trading entries. An accurate analysis of forex trend direction will give you an edge in your trading. It will also help you to avoid the traps that plague so many traders.

In some cases, combining multiple trend indicators into a single trading strategy can be especially effective.

Failed Breakout With Rapid Trend Drop

If you look at the image here, there is a failed break of the uptrend. That failed break caused traders to go long, and those traders get trapped.

Forex Trend Trading Entry Strategy

The entry will be one of the most important components of any complex trading position. Now the part that everyone has a firm understanding of forex trend structure now, it is time to start planning a trade. The important part of any forex trend trading system is understanding the setup.

Here are the 5 steps.

- Identify Trend Direction

- Identify Key Support and Resistance Areas

- Identify Potential Entry areas either with the trend along the support or resistance areas or along key support resistance areas once the trend changes direction.

- Determine all possible outcomes of the trade, know when a trade is lost and know when you are right.

- After you determine the full plan for that trade execute the trade if the market confirms your trade idea.

Proper Trend Trade Execution Plans

In the next example, I am going to illustrate a complete forex trend trade plan. The following graphic will contain all five elements of planning a trend trade.

Step 1 Identify that the trend is moving down because of lower highs and higher lows.

Step 2 We also mark out the key support and resistance areas as shown by the green and pink lines.

Step 3 has been completed as we have identified potential trade areas next we need to determine what the actual entry will be and what price has to do to confirm our trade. We also have to determine what price will do if it proves our trade to be wrong. The faster we can prove our trade idea to be wrong the better. Because we will put less money at risk if we can figure out if we were wrong quicker.

Step 4 Predetermine price below is an example of how we will predetermine before we take the trade, ensuring that you have a proper risk to reward ratio set and that we know exactly when to take our loss. When you are wrong, you are wrong; move on to the next trade. The image below is the same trade zoomed up to give you a better view.

Step 5 is to execute the trade according to your plan.

Conclusion: Forex Edge Finder

Now that you have a firm foundation on how to use the Forex Edger Finder Strategy to identify and trade Forex trends, you can begin to develop your strategies and tactics. Start creating your plan and do testing to determine if trading Forex trend analysis is the right method for you.

Thank you for reading!

Please leave a comment below if you have any questions about Forex Edge Finder Trends Analysis!