Get this Strategy in a Free EBOOK!Download this Prop Trading STRATEGY and get it delivered to your email inbox!

- Get a PDF Download

- 6 simple rules of the strategy

- More info on our prop firm!

TDI Indicator: Cheat the FX Market With the Best Traders Dynamic Index Strategy

Cheating the Forex market is possible thanks to our best Traders Dynamic Index Strategy. If you don’t want to be a profitable trader, please don’t read this scalping strategy. This is because it will help you cheat in any market. If you think cheating is morally wrong, you need to understand smart money is constantly cheating to make big profits.

Read this article to the end because by the time you are completed reading, the TDI indicator is explained fully, and you will not have any questions about how to use it. Most importantly, you will be able to apply this to possibly become a profitable trader.

TDI indicator strategy will give you precise entries, so you will never have any doubt about when to enter the market.

“If you ain’t cheating, you ain’t trying.” These are the words one institutional bank trader revealed during the FX rigging scandal. These institutional traders were caught rigging the market. You can cheat the markets without having to suffer any legal penalties by using our trader’s dynamic index strategy PDF.

Our team at Trading Strategy Guides has formulated a way to see the market sentiment. We also know how to read the market sentiment and turn it to your advantage.

You don’t need countless technical indicators on your chart. You may be thinking that when all these indicators line up, it must be good. More often than not, there are indicators going in every direction, leaving you more confused than you were without them.

You need to focus on market sentiment. When price and market sentiment move together, you have a higher probability for a successful trade.

There is one particular indicator that can pull and consolidate the market sentiment for you. It is called the TDI indicator.

What is the TDI indicator?

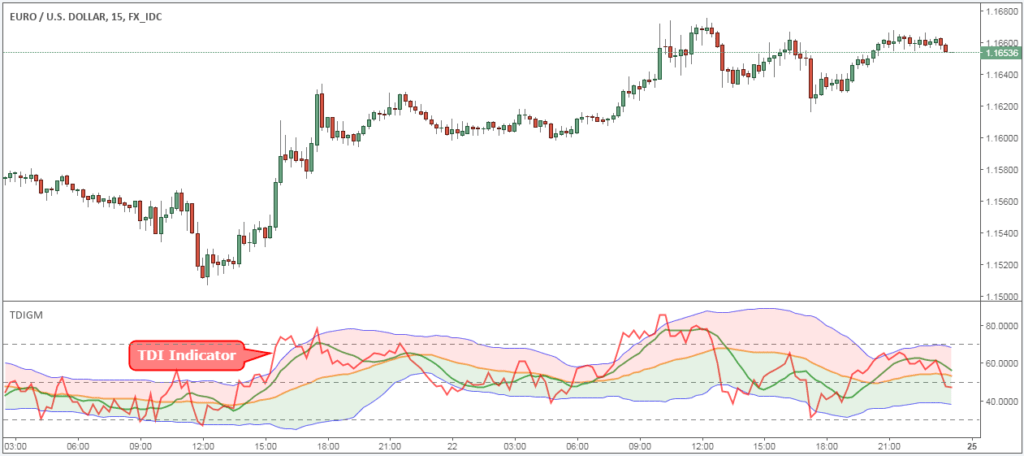

The Trader’s Dynamic Index indicator is the only technical indicator you need to scalp the market successfully. The TDI is the only technical indicator that can read the market sentiment, market volatility, and momentum at the same time.

The concept is very simple, it is 3 rsi indicators on 3 different time frames and then it is combined with Bollinger bands. That is where the 5 lines come from.

The advantage of combining the qualities of several indicators into one indicator is that it can be the “holy grail” you are looking for.

Let’s break down the Traders Dynamic Index indicator and go through it a little bit. As you can see, this scalping indicator has five moving averages.

The green line is called the price line and is similar to the RSI indicator and represents the market sentiment. It shows you how the market is moving related to positive and negative expectation. the settings for the price line is 2.

The red line is called the signal line is simply a crossover of the green line and can be used for entry and exit in the market. The settings for the signal line is 7.

The yellow line is called the base line is what we refer to as the overall market sentiment. It shows the overall direction of the market. The overall market has a tendency to do two things. It can turn slowly, or it can continue to go in the initial direction. This is because it’s too big and it can’t turn too quickly. It’s got to come to a gradual end. The settings for the base line is 34.

Last but not least, we have two blue lines, one above and one below. Those blue lines represent the volatility in the market, similar to the Bollinger Bands. They are increasing and decreasing volatility.

Get ready because we’re going to reveal how to cheat in any market with the Traders Dynamic Index Strategy PDF.

Here are the TDI indicator settings that are standard in the indicator, Price line is 2, signal line is 7 and base line is 34.

Before you get to the strategy portion you can download the TDI indicator mt4 edition by clicking this link.

Traders Dynamic Index Strategy PDF

Have you ever left a trade, but wished you stayed in? This is not just a strategy, but this will be the complete TDI trading system. The difference between a strategy and a system is that a system is a complete trading methodology, whereas a strategy is just a set of rules.

If you ever have this problem when trading, follow this step-by-step trading guide. You’ll learn how to stay in a trade and follow it until it trend reversal happens.

Now, before we go any further, we always recommend taking a piece of paper and a pen to take notes on the rules of this scalping strategy.

In this article, we’re going to look at the ‘buy’ side using a EURUSD chart.

Traders Dynamic Index Strategy

Total Time: 1 hour

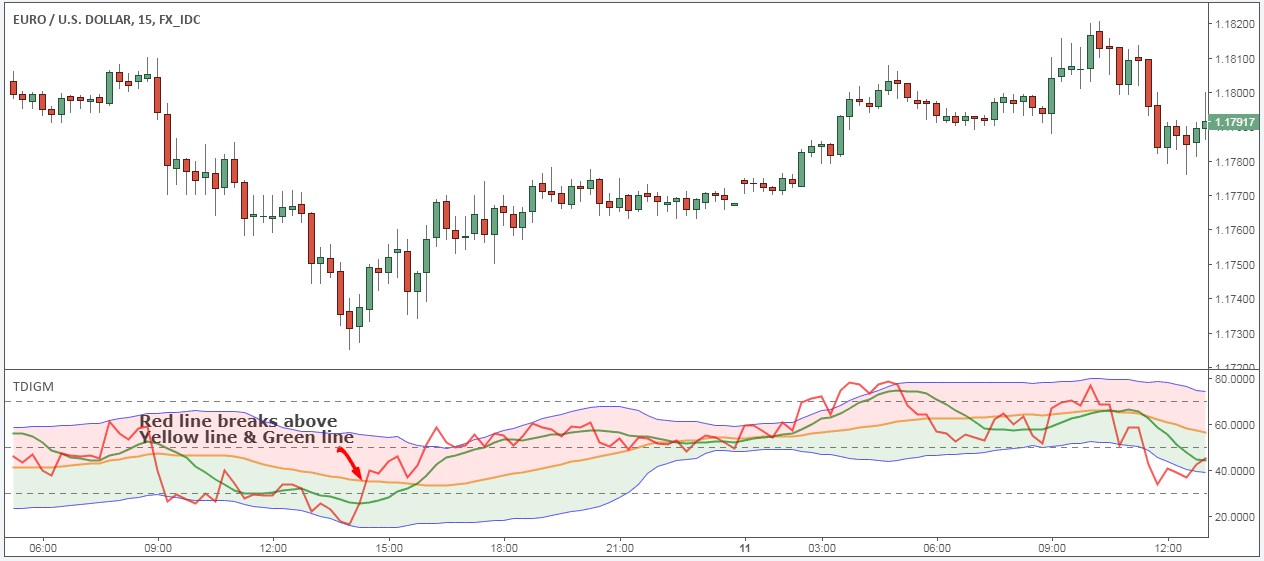

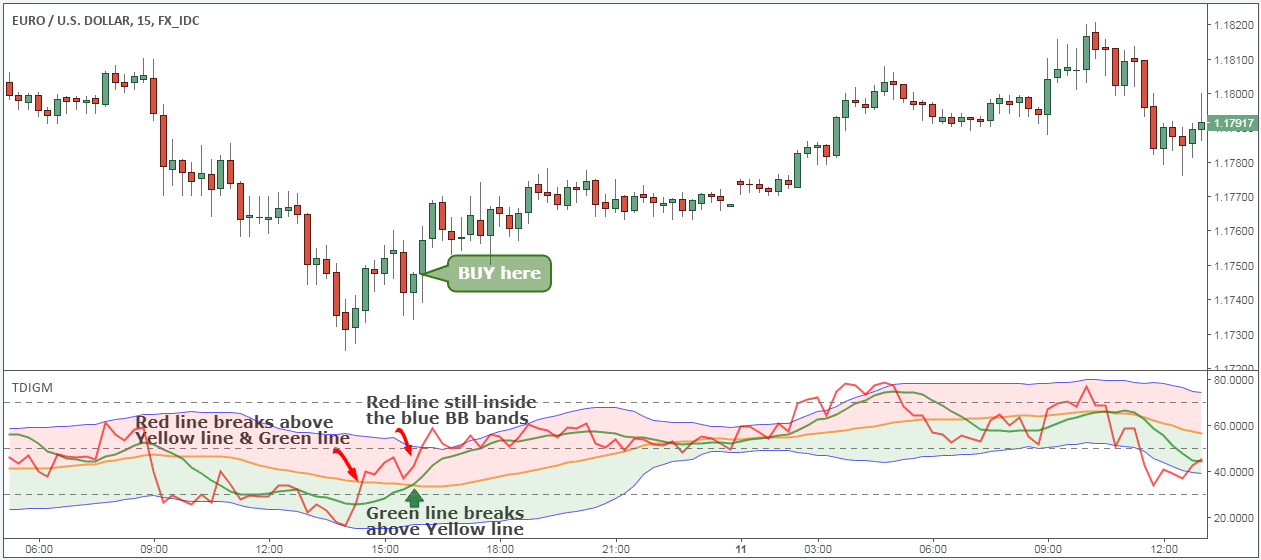

Step #1: Look for the Red Line to break above the Yellow Line

The yellow line is the most important line of the TDI indicator. The line binds all the other parts together and it makes the indicator tradable. Traders also refer to the yellow line as the Market Baseline.

The yellow line can be used to determine the long-term trend. We need to see an alignment between the long-term trend and the short-term trend in order to successfully scalp the market.

When we have positive expectation coming into the market, the red line must be above the green and the yellow line. That’s the first signal that the buyers are stepping into the market.

We need other components of the market sentiment to share the same information before we’re really ready to pull the trigger.

See below:

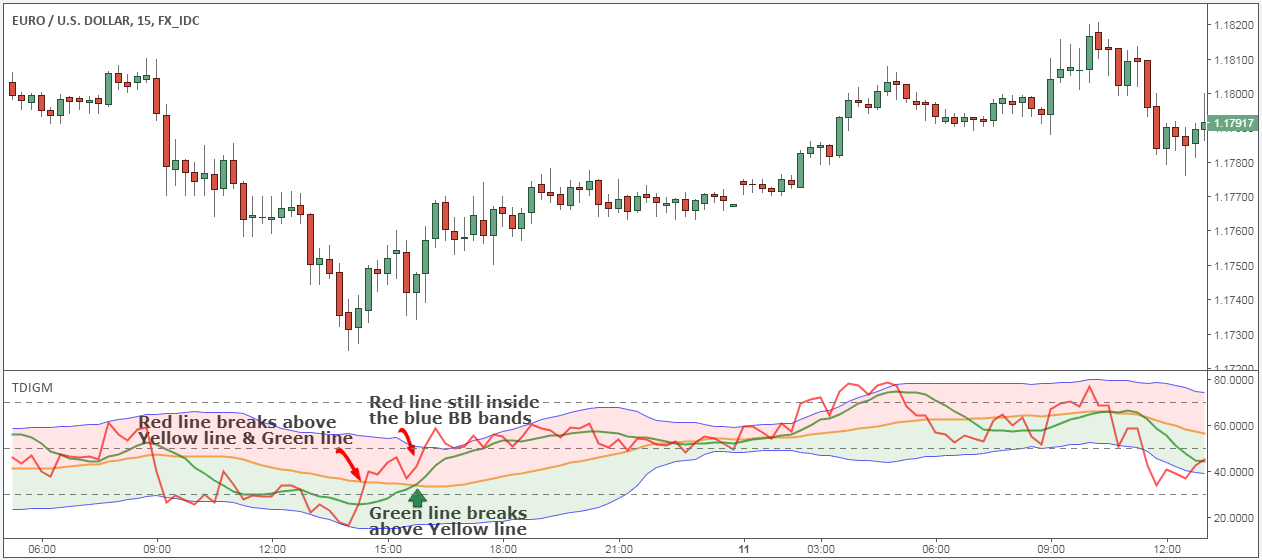

Step #2: Wait for the Green Line to also break above the Yellow Line. The Red Line must not break above the upper blue band.

The second required condition for a valid trade signal is to wait for the green line to break above the yellow line. Once this happens, we have an alignment between the short-term trend and the long-term trend.

When an alignment in the trend direction occurs, we have explosive scalping opportunities.

The catch is that we need the red line to be contained inside the blue Bollinger Bands. When the red line breaks the upper blue band, we know the market is stepping on the gas. This means we have an acceleration in volatility which tells us that buyers are exhausted.

We don’t want this to happen!

A picture is worth a thousand words! The chart below highlights a bad trading scenario where the red line crosses above the upper blue band which we want to avoid.

Let’s determine the appropriate place to go long EUR/USD.

See below:

Step #3: Buy at the closing candle after the Green Line breaks above the Yellow Line

When the green line crosses above the yellow line, it tells us that the buyers are buying and the fact that we have a positive sentiment.

We’re looking to buy in a market with increasing volatility and in a market where both the short-term and the long-term trend align in the same upward direction.

When the price and the market sentiment align, and they are sharing the same sort of expectation, then that’s the best time to enter the market. We buy at the closing candle after the green line crosses above the yellow line.

See below:

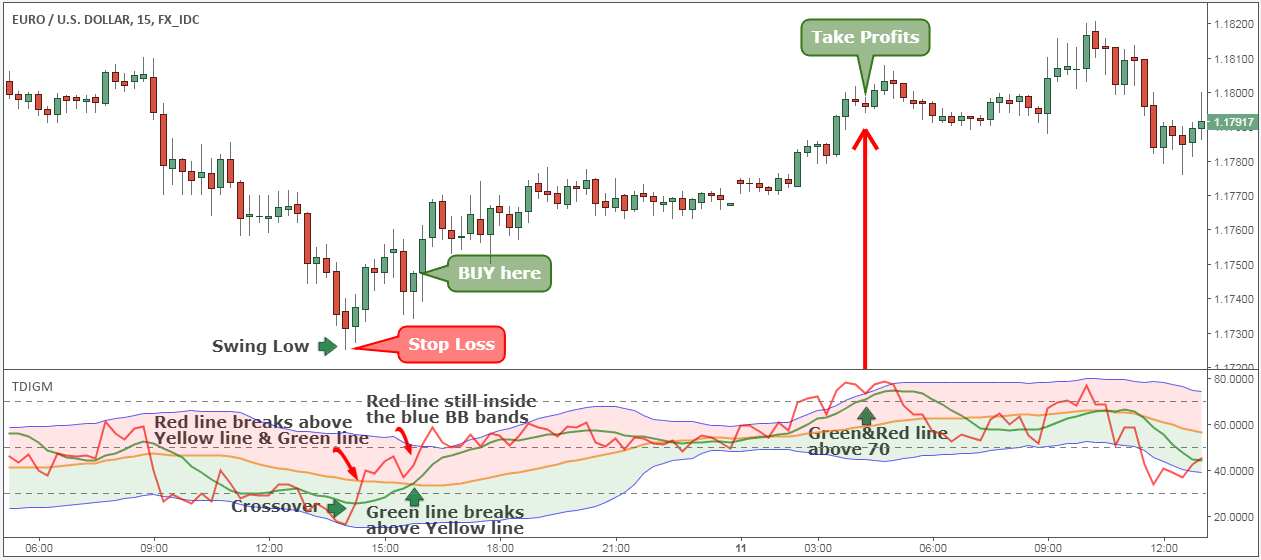

Step #4: Hide your protective Stop Loss below the respective swing low that developed as a result of the red line crossing above the green line.

On the chart, find the last time the red line crossed above the green line and on the price chart, locate the respective swing low developed as a result of this crossover.

Now, use this swing low to hide your protective stop loss.

See below:

Step #5: Take profit when both the red line and the green line crosses above the 70 level

The real reversal signal is given when the green line also joins the red line and touches the 70 level which signals buyer exhaustion again. When this happens, we want to take profits.

The expectation is that when we get up to these levels to start looking for market reversal because the market can’t go any higher. This is the perfect place to get out of our scalping trade and take profits.

The evidence of this price behavior can be seen in the EUR/USD chart below:

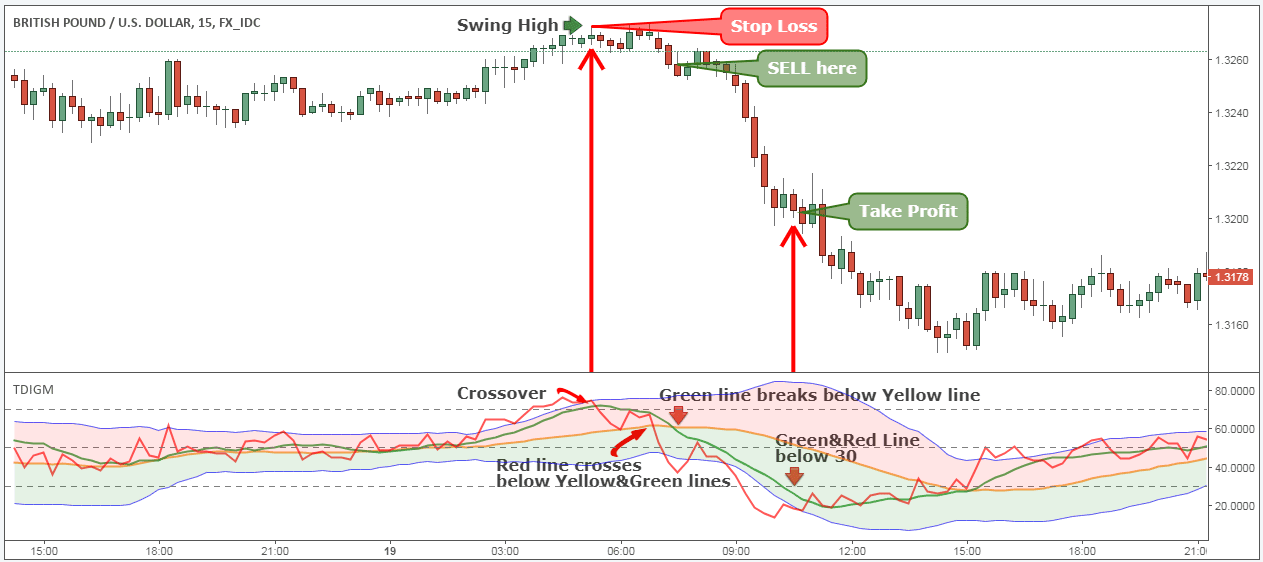

**Note: The chart above is an example of a BUY trade using the best traders dynamic index strategy. Use the same rules for a SELL trade – but in reverse. In the figure below, you can see an actual SELL trade example.

Estimated Cost: 1 USD

Supply:

Tools:

Materials: TDI Indicator

TDI Trading Strategy Video

Conclusion – The Best Trader’s Dynamic Index Strategy

The best trader’s dynamic index strategy can literally make a complete change in your trading because it gives you the ability to identify scalping opportunities in real time. The TDI is a 3-in-1 indicator (trend direction, momentum, and market volatility) is a relatively new technical indicator that was introduced in 2005.

This makes the TDI indicator more sensitive to the current market environment.

If you struggle with the analysis paralysis syndrome, it’s important for you to have simplicity in your trading. Our scalping strategy can give you a distinct trading advantage and can erase all the confusion from utilizing too many trading indicators.

Thank you for reading!

Please leave a comment below if you have any questions about traders dynamic index strategy PDF!

Best TDI Strategy PDF Download

Please Share this Trading Strategy Below and keep it for your own personal use! Thanks Traders!

Get this Strategy in a Free EBOOK!Download this Prop Trading STRATEGY and get it delivered to your email inbox!

- Get a PDF Download

- 6 simple rules of the strategy

- More info on our prop firm!