This post is written by Jet Toyco, a trader and trading coach

At this point…

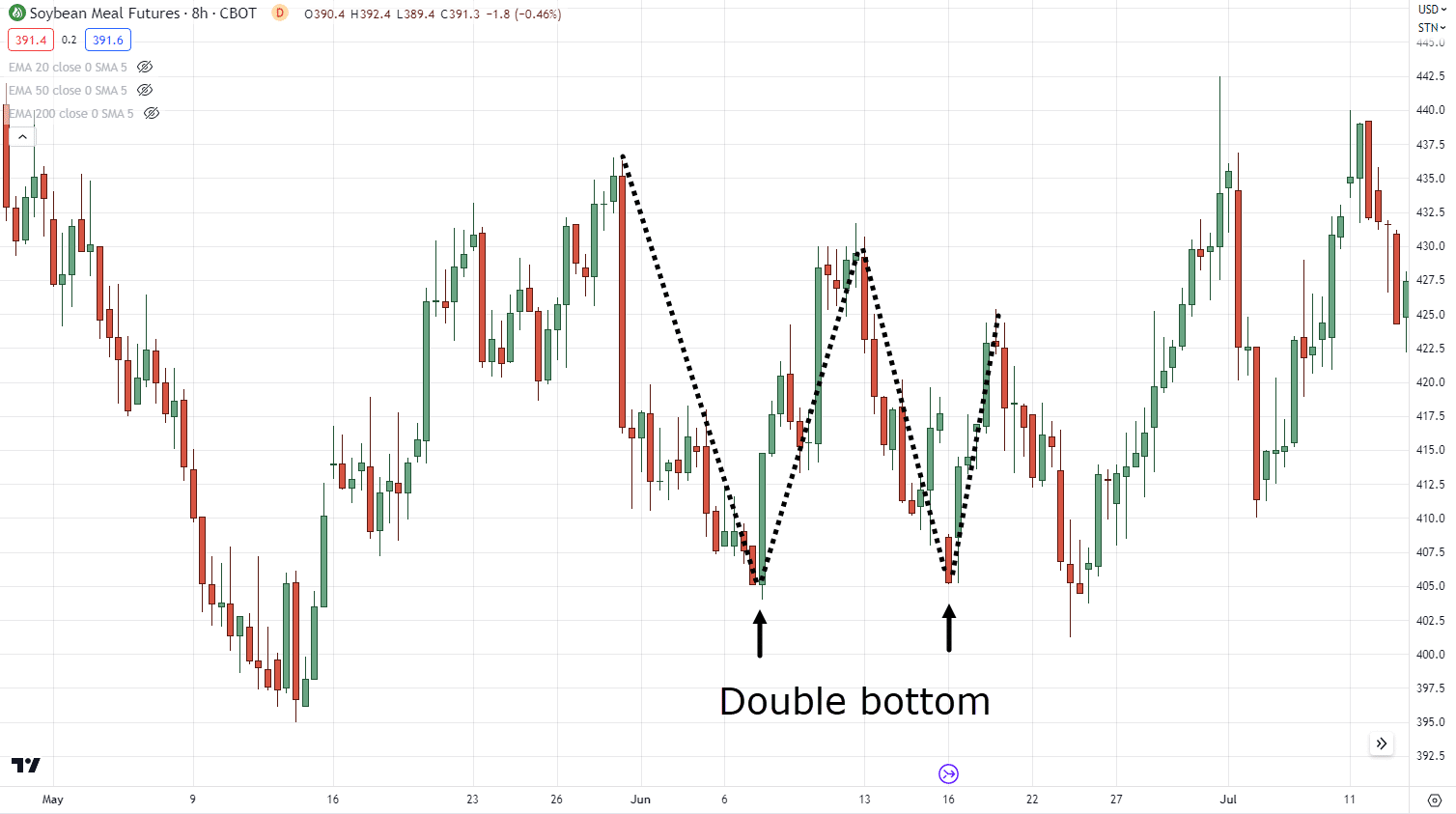

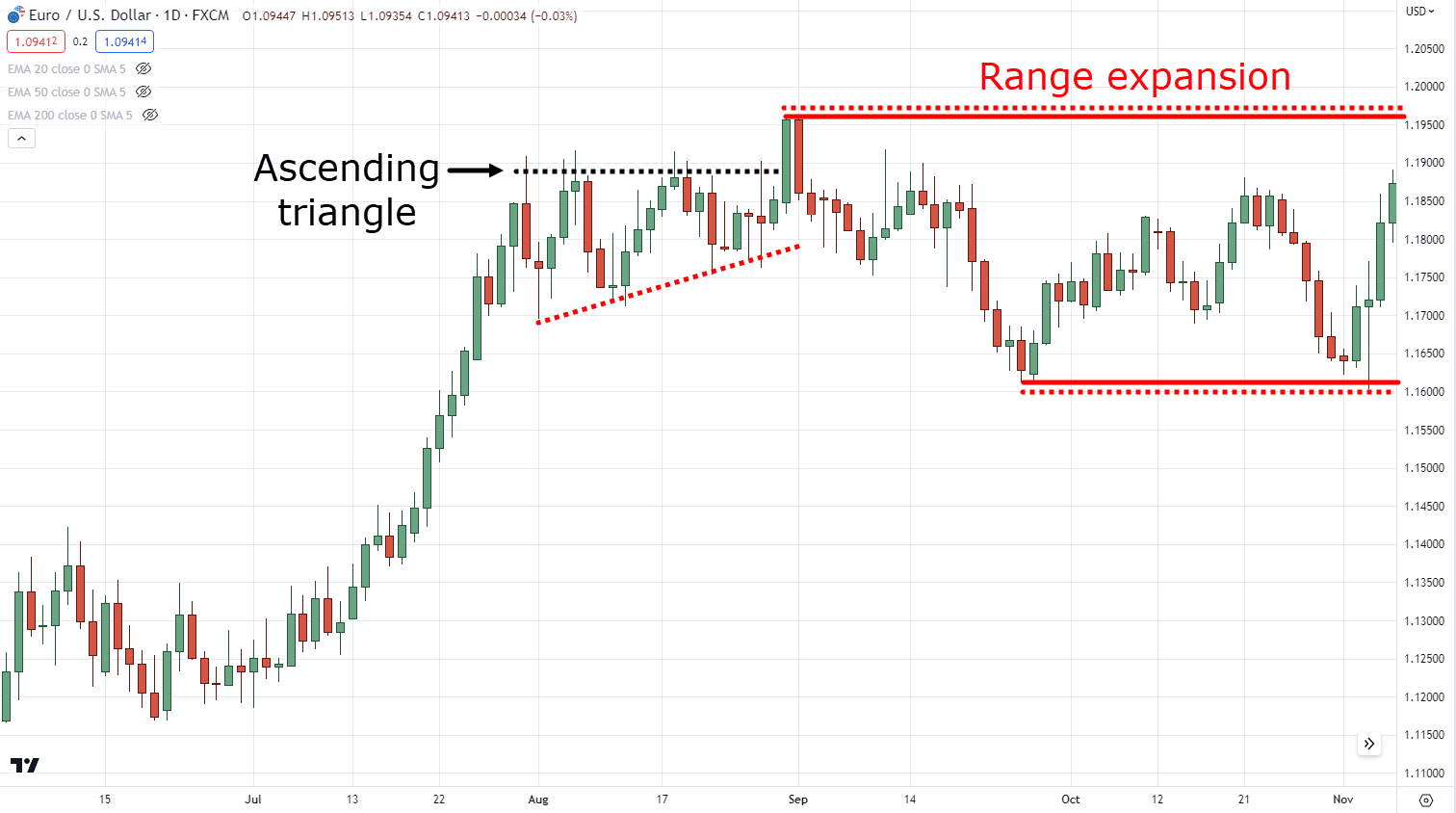

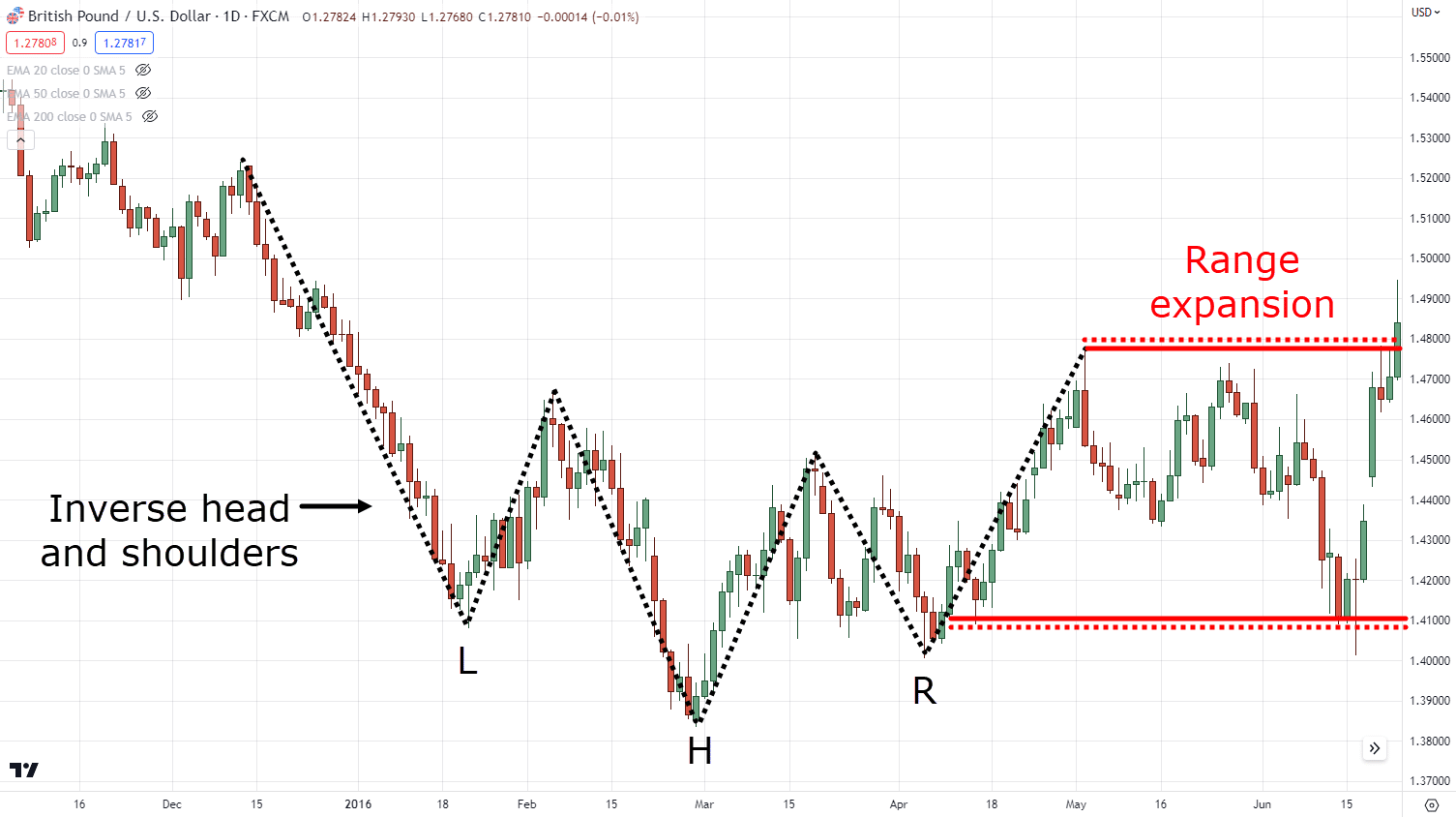

You’ve probably already learned a lot of chart patterns such as the Double Bottom, Ascending Triangle, and the Inverse Head and Shoulders:

But as you know…

Not all chart patterns work all the time.

So, what should you do when these chart patterns fail?

What would you do when the range expands?

What should you trade the market by then?

This, my friend, is where the Triple Bottom comes in.

This is one of the least common chart patterns out there, but it’s a crucial tool to keep in your trading arsenal when markets are uncertain.

This is why in this training guide you’ll learn:

- An in-depth guide on how the Triple Bottom works

- How NOT to approach Triple Bottoms (and what you should do instead)

- The RIGHT way to trade and analyze Triple Bottom patterns

- A step-by-step process on how to define and trade the Triple Bottom

Sounds good?

Then let’s get started!

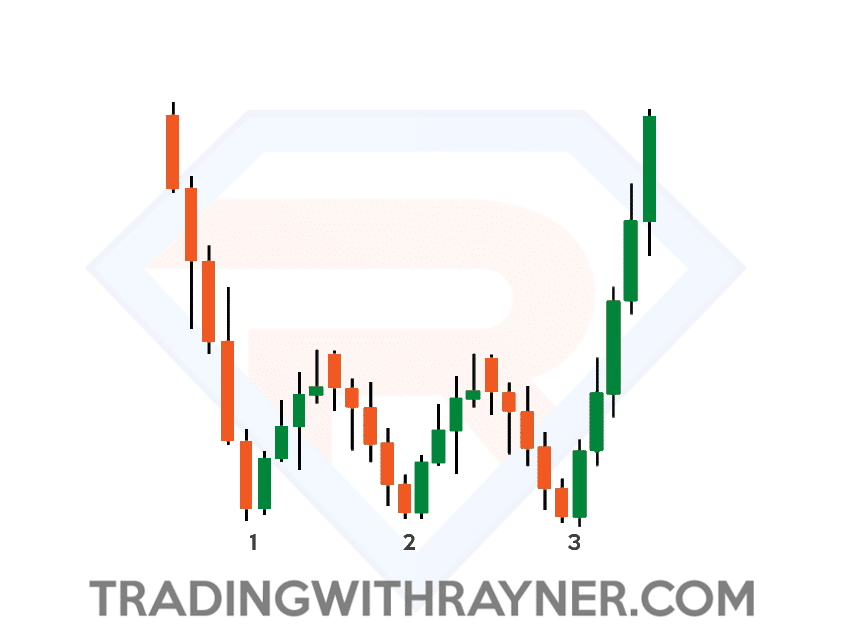

What the triple bottom is and the TRUTH on how it works

Get ready to witness the grand spectacle of the Triple Bottom, my friend!

This pattern is like a superstar performer taking the stage with its unique flair.

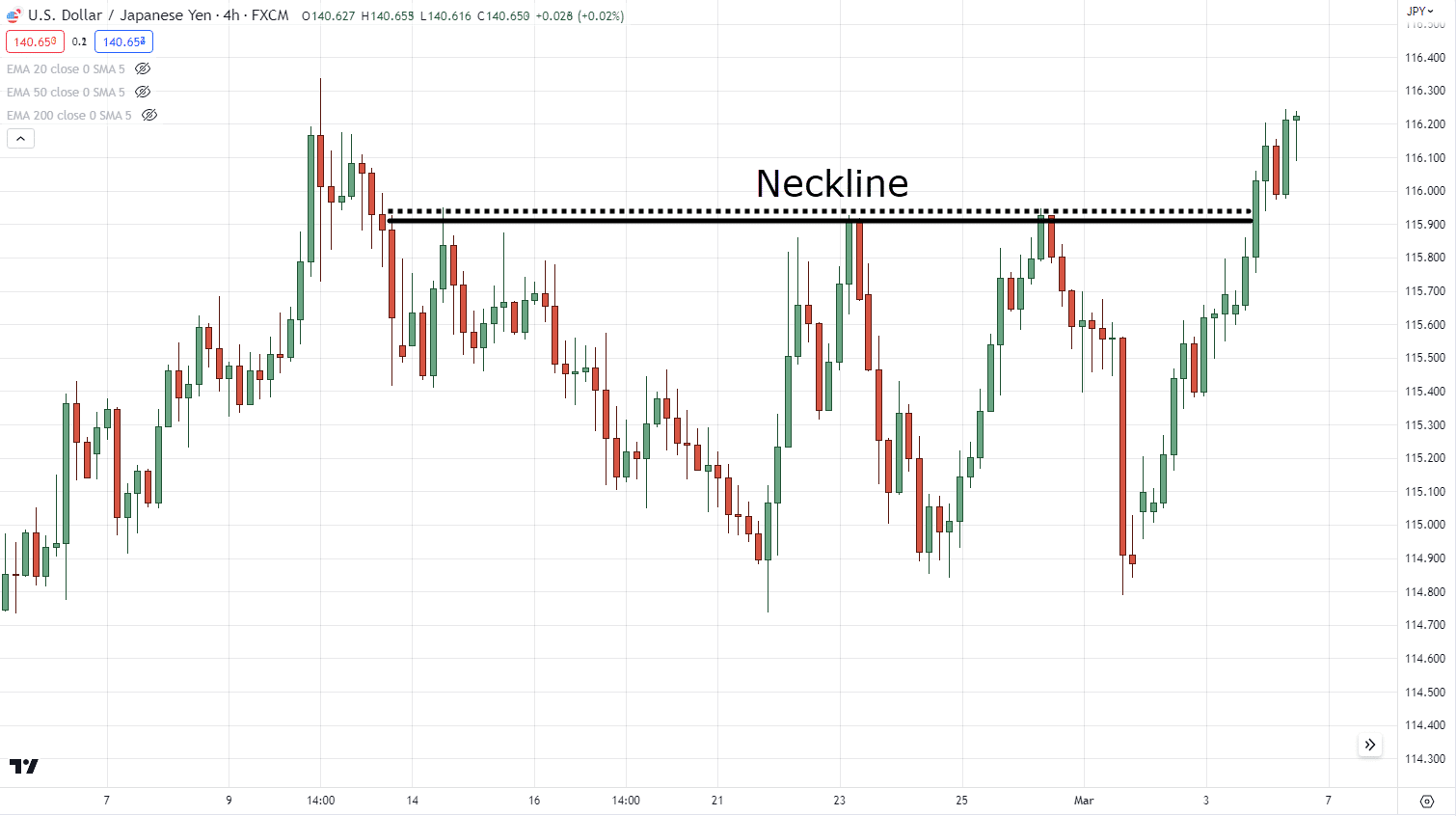

It starts with a neckline – the backbone of the whole shebang.

And then, in a dazzling display of market choreography…

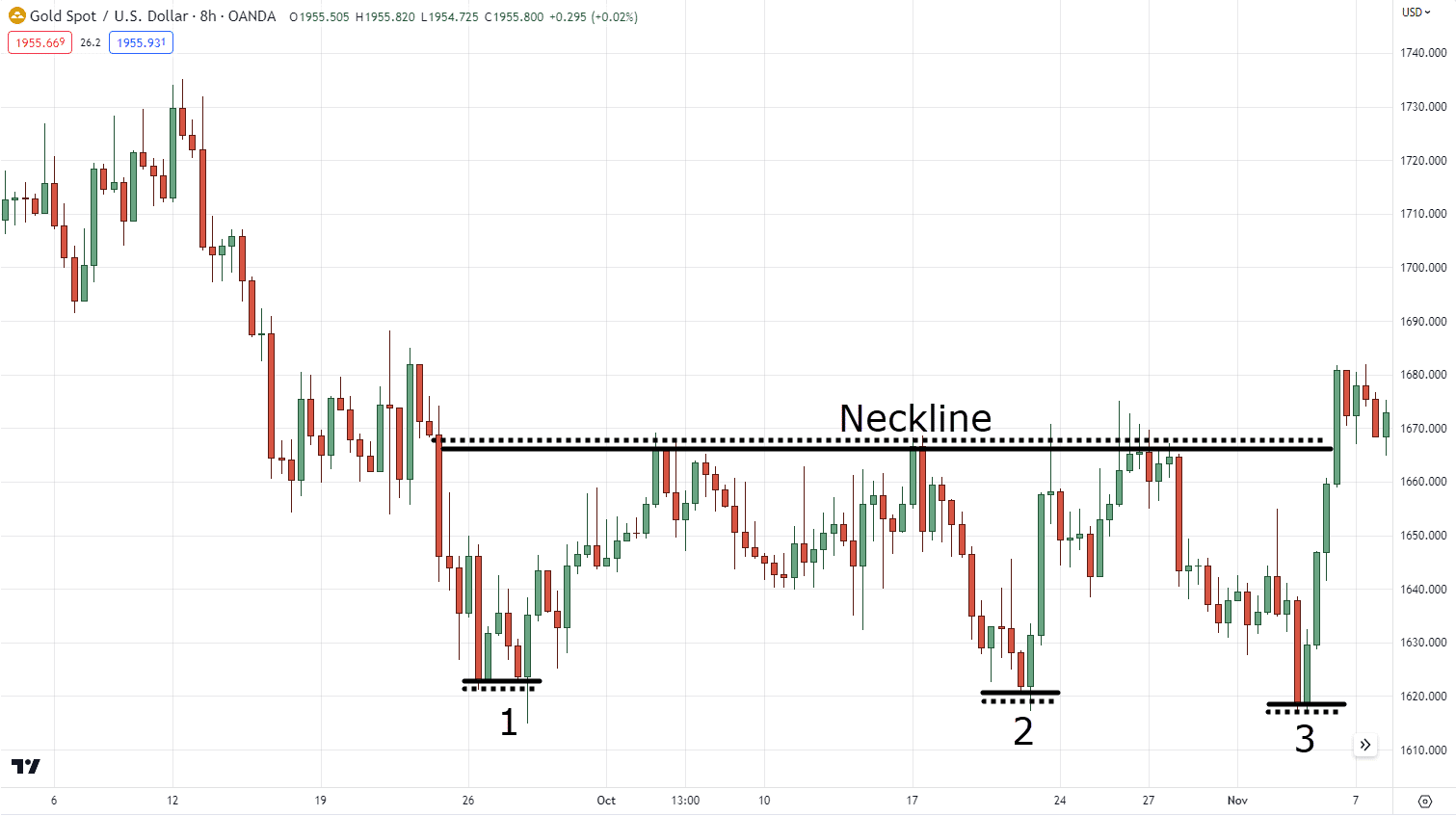

Three bottoms strut their stuff, each playing their part in this captivating formation:

It’s like a synchronized dance routine, in that it commands attention and sets the stage for some potential trading opportunities.

Pretty easy to identify, right?

So, now that you know what the pattern looks like…

Why does the Triple Bottom pattern form anyway?

If you’re wondering the same thing then you’re on the right track my friend.

Because knowing the ‘why’ is more important than the ‘what’!

So the first reason this pattern forms is because of…

1. The indecisiveness of the market

Picture the market as a fickle character, unable to make up its mind.

It’s like that friend who can never decide where to eat or what movie to watch.

Enter the Triple Bottom pattern!

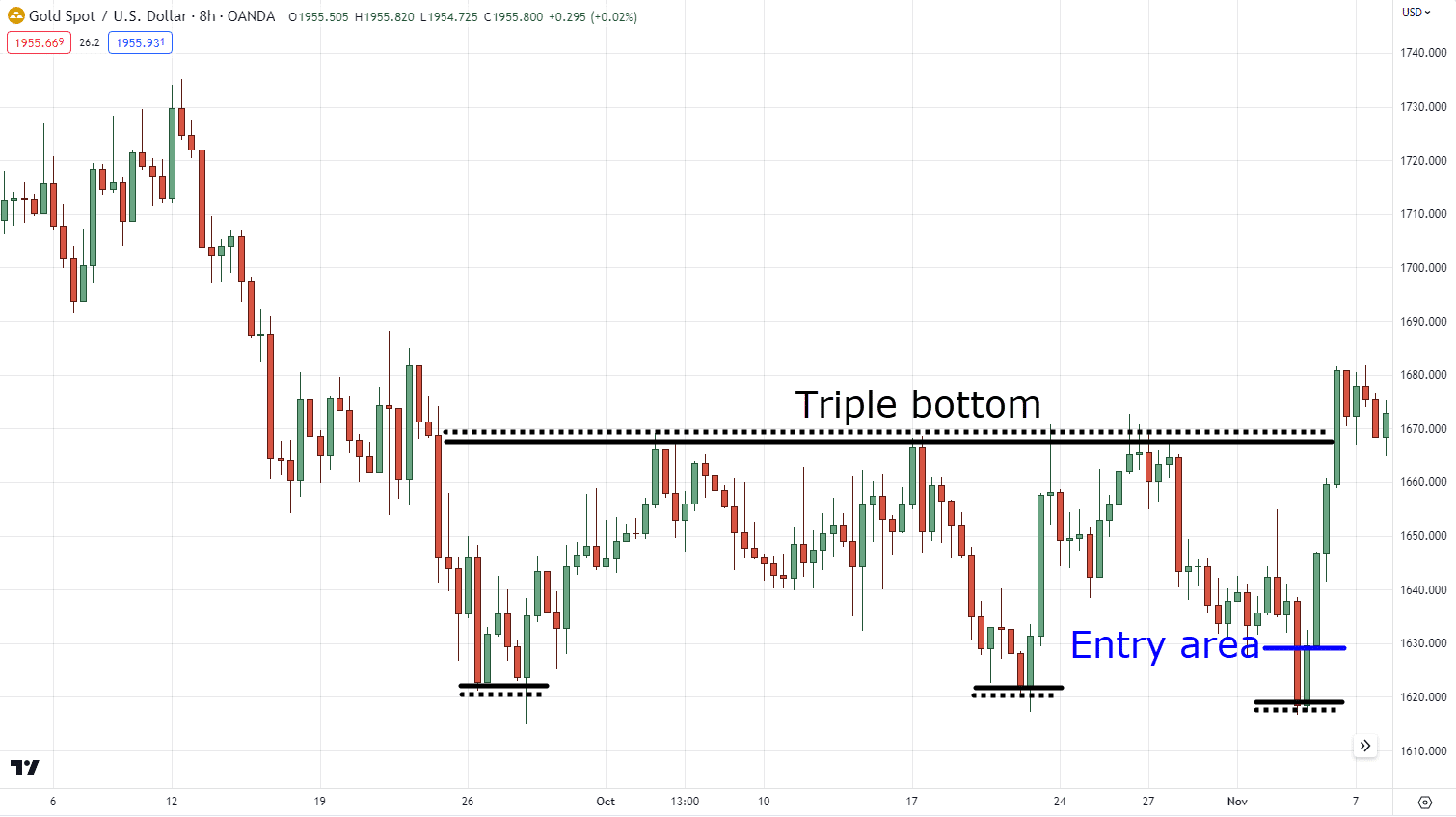

This pattern emerges from the chaos of market indecisiveness:

It’s as if the market itself is saying, “I have no clue which way to go!”

Can you see how the range kept on expanding on the example above?

It’s like a moment of confusion frozen in time, giving traders a chance to capitalize on the upcoming resolution.

It’s as if the market itself is saying, “I have no clue which way to go!”

Can you see how the range kept on expanding on the example above?

It’s like a moment of confusion frozen in time, but it gives traders like us a chance to capitalize on the upcoming resolution.

So basically what we’re saying here is…

A Triple Bottom pattern is the result of the market’s indecisiveness.

But here’s an additional fact about this pattern…

2. It takes a while to develop

This pattern likes to take its own sweet time to develop.

But that just makes it a slow-cooked gourmet meal that’s well worth the wait!

Like watching a suspenseful movie, knowledgeable viewers can anticipate the climax.

The market tests your patience, teasing you with its subtle movements.

But fear not, my trading friend!

For those who are willing to wait and observe…

The Triple Bottom offers a potential feast of profits.

So, sit back, relax, and let this pattern unfold its delicious trading opportunities in good time.

And in fact, to add onto this principle, you can take advantage of the Triple Bottom pattern if…

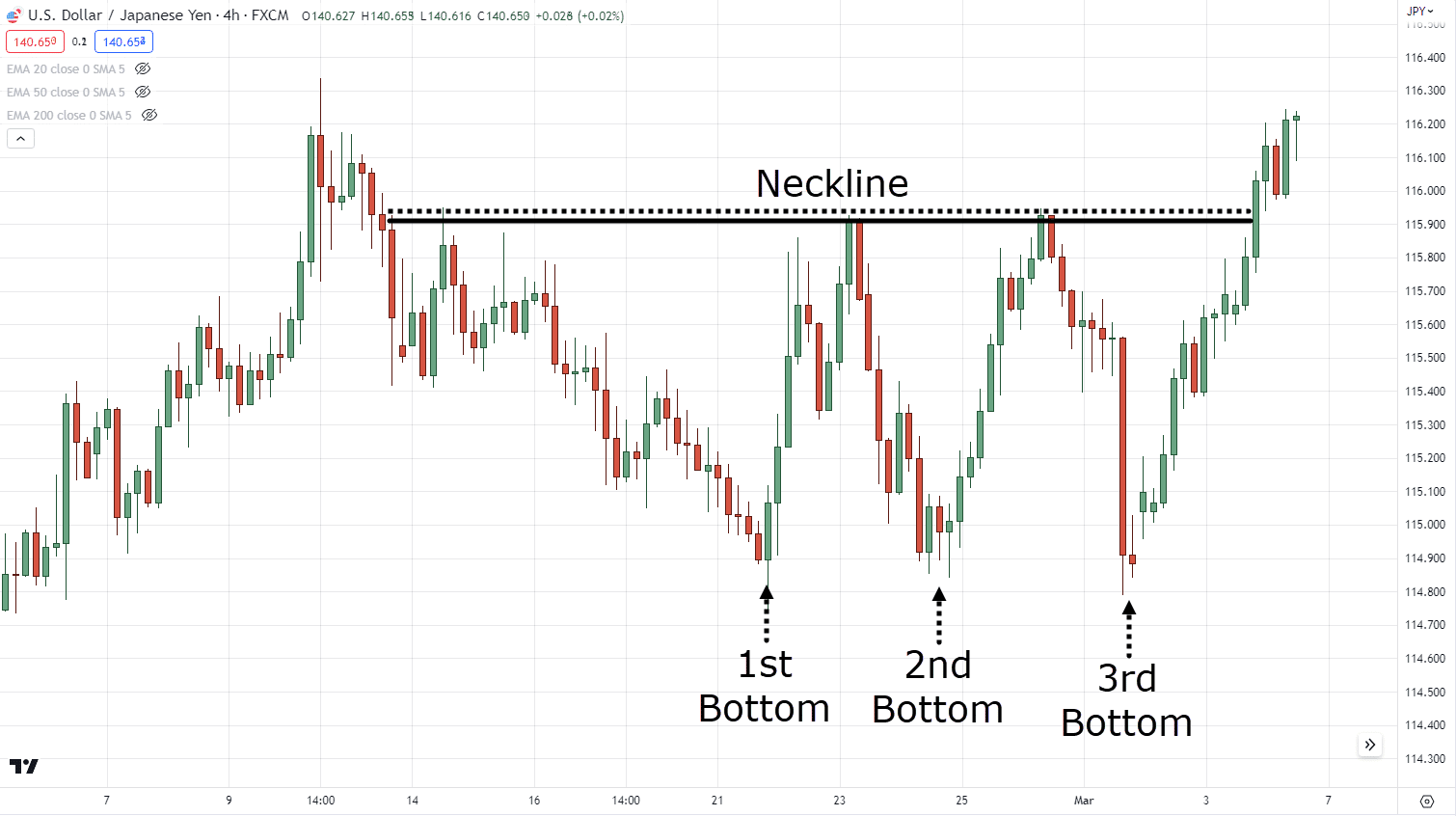

3. You missed the double-bottom pattern

If you missed out on the Double Bottom pattern.

Then there’s still no need to wallow in regret, my fellow trader!

Because the Triple Bottom pattern is here to save the day, providing you with a second chance to join the party.

It’s like finding a secret treasure chest when you thought all hope was lost.

And in this way, the pattern presents an alternative entry point.

Almost as if the market is saying, “Hey, I’ve got your back, buddy!”

Now…

I know that it makes more sense to trade the Double Bottom pattern… but that all depends on if you catch it, right?

If you’re a conservative trader who needs more confirmation, it’s well worth keeping an eye out for the Triple Bottom.

It’s a pattern that offers redemption, excitement and a shot at rocking those profit charts.

Sounds good?

So, now that you know what the Triple Bottom looks like and how it works…

Now’s the time to let me tell you how you should not trade it!

Because remember…

All trading patterns out there have their strengths and weaknesses.

Don’t you agree?

Then keep reading…

The Biggest Mistake When Trading a Triple Bottom: Avoid These Pitfalls!

Now…

Let’s talk about the biggest blunders you should steer clear of when tackling the Triple Bottom pattern.

Now…

Let’s talk about the biggest blunders you should steer clear of when tackling the Triple Bottom pattern.

Mistake #1: Trading in the middle of the triple bottom pattern

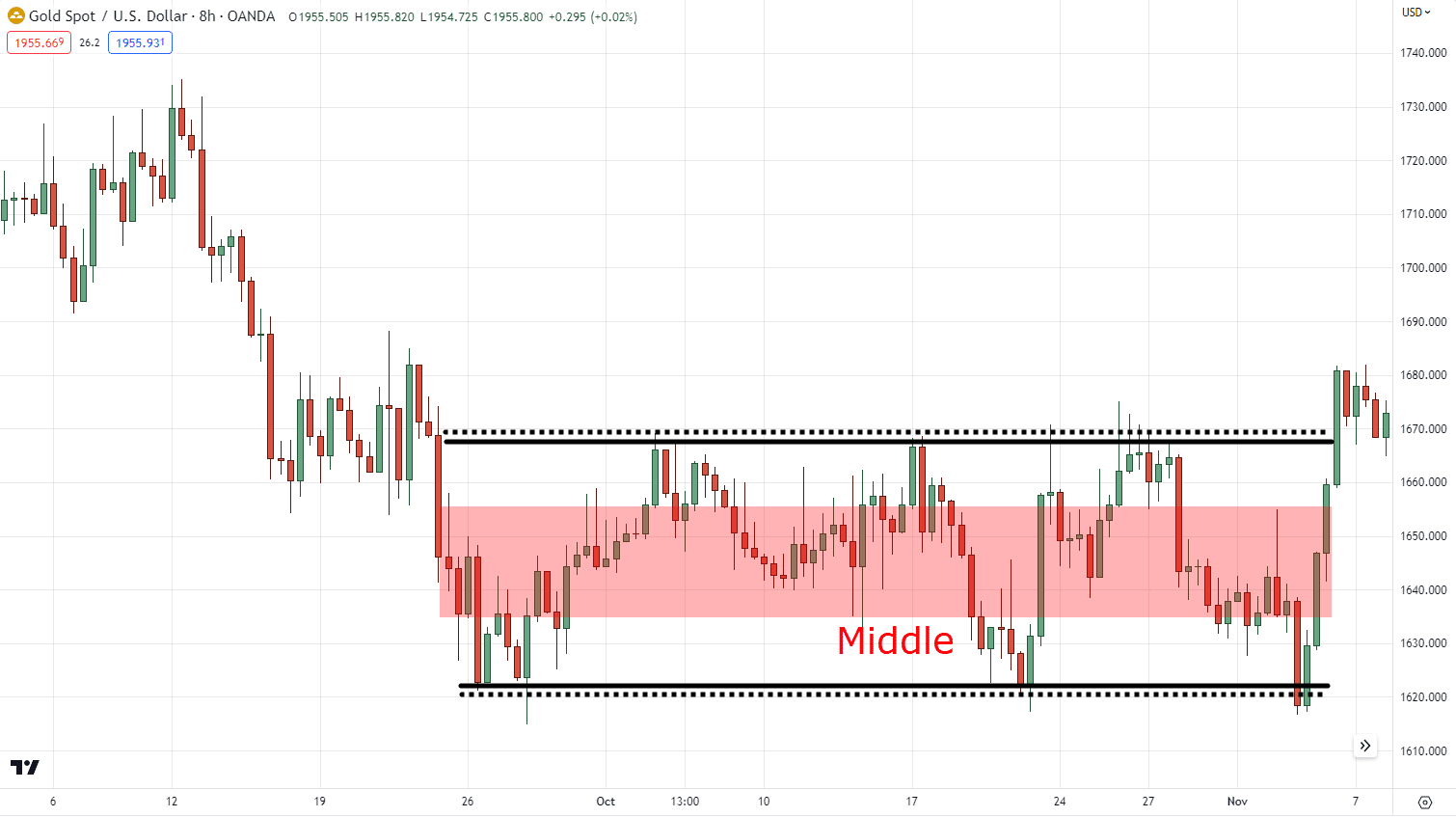

First up, trading inside the range is like trying to squeeze into an overly tight pair of jeans.

Remember, a Triple Bottom occurs when the market is in a state of indecisiveness.

It’s behaving like a kid in a candy store struggling to choose between all the delicious options.

So, resist the temptation to hop in and out of trades within the pattern’s range.

Instead…

Wait for the market to make its mind up!

So basically…

Avoid the middle.

Focus on the area of value (a.k.a. support and resistance).

Simple, right?

But be ready – because here comes a paradox.

Another mistake when trading the Triple Bottom pattern is…

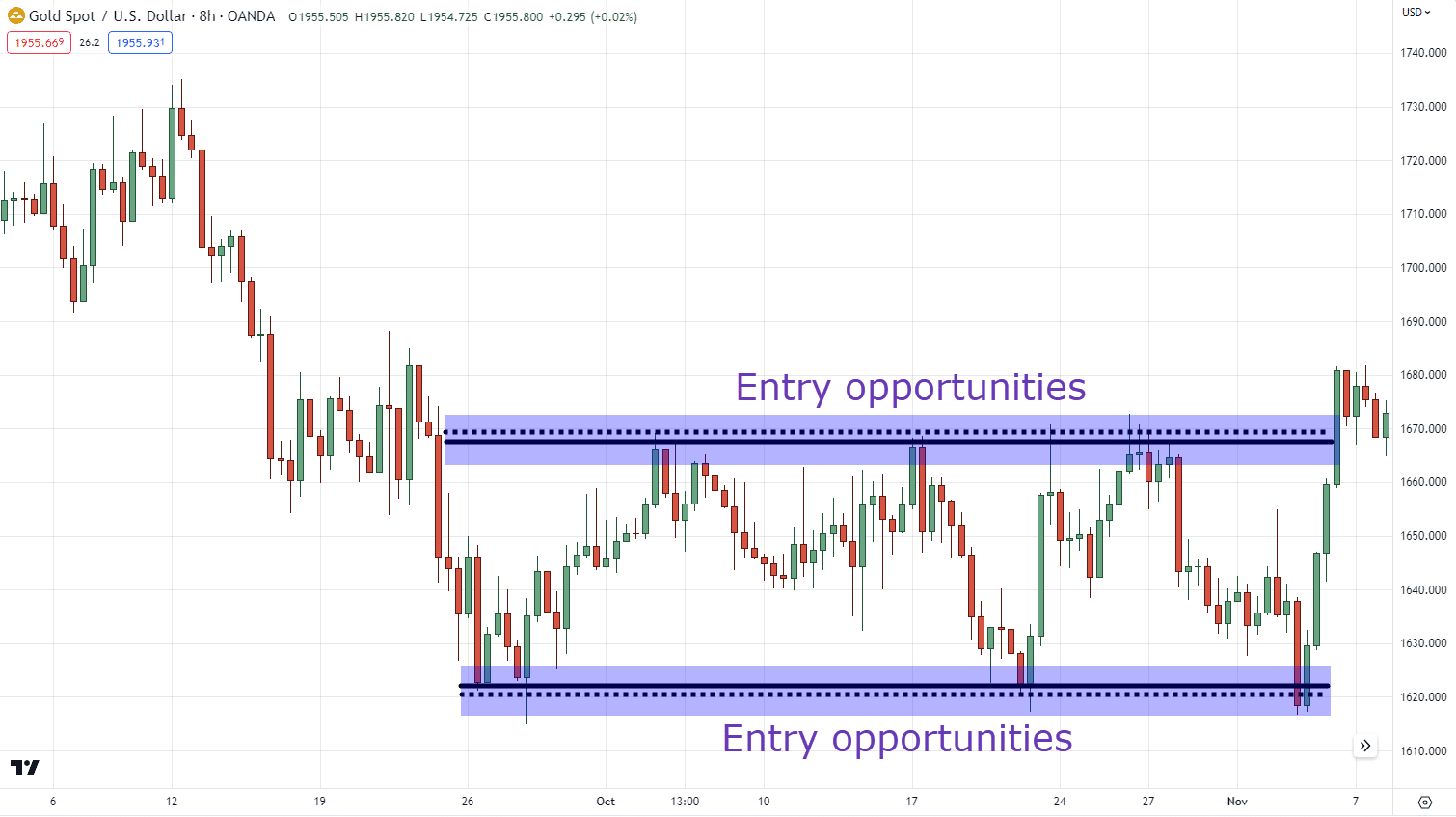

Mistake #2: Blindly trading the highs and lows

“Wait, what?”

“If we can’t trade the middle of the Triple Bottom pattern, trading the highs and lows is a mistake too?”

Let me explain…

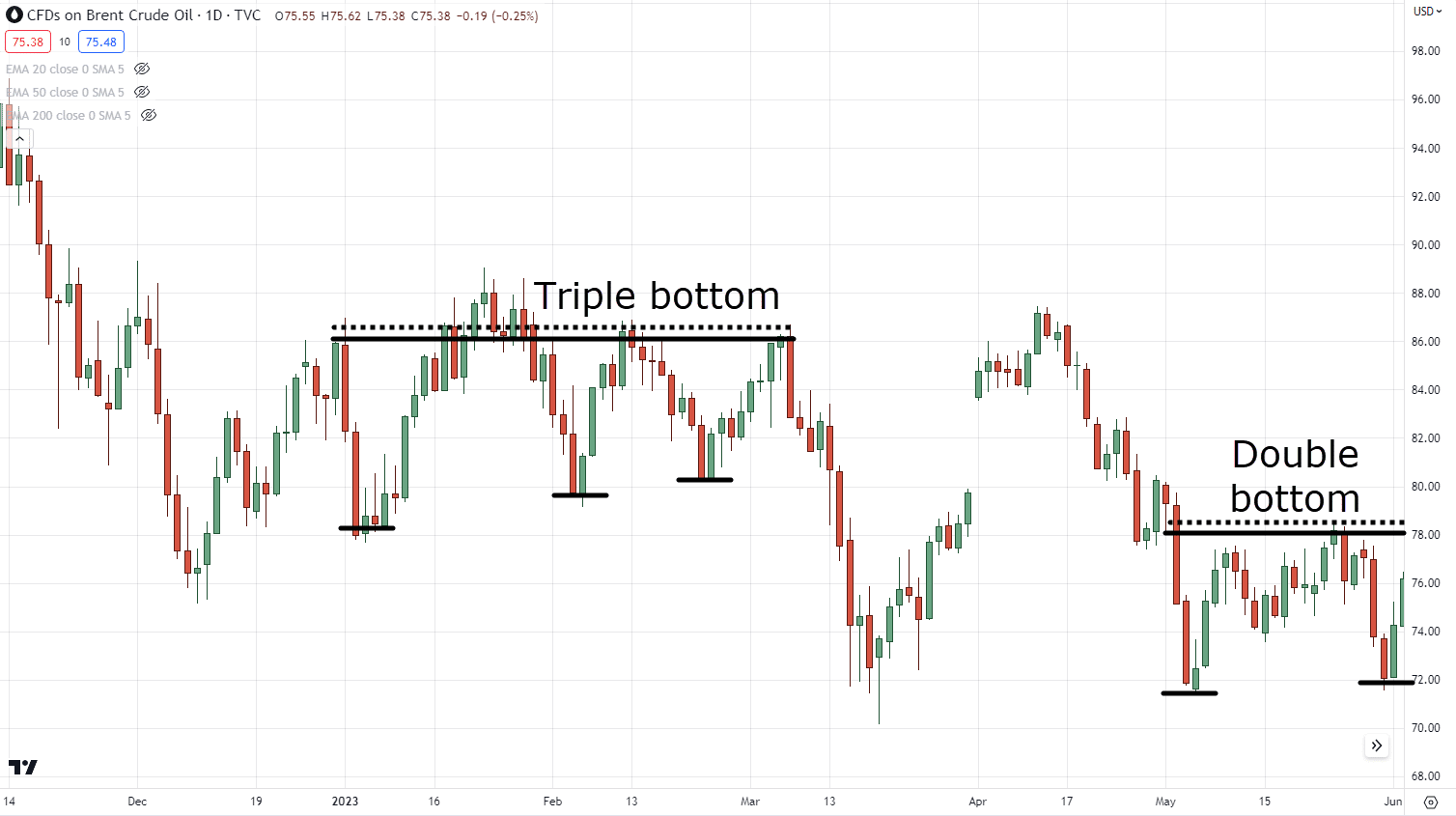

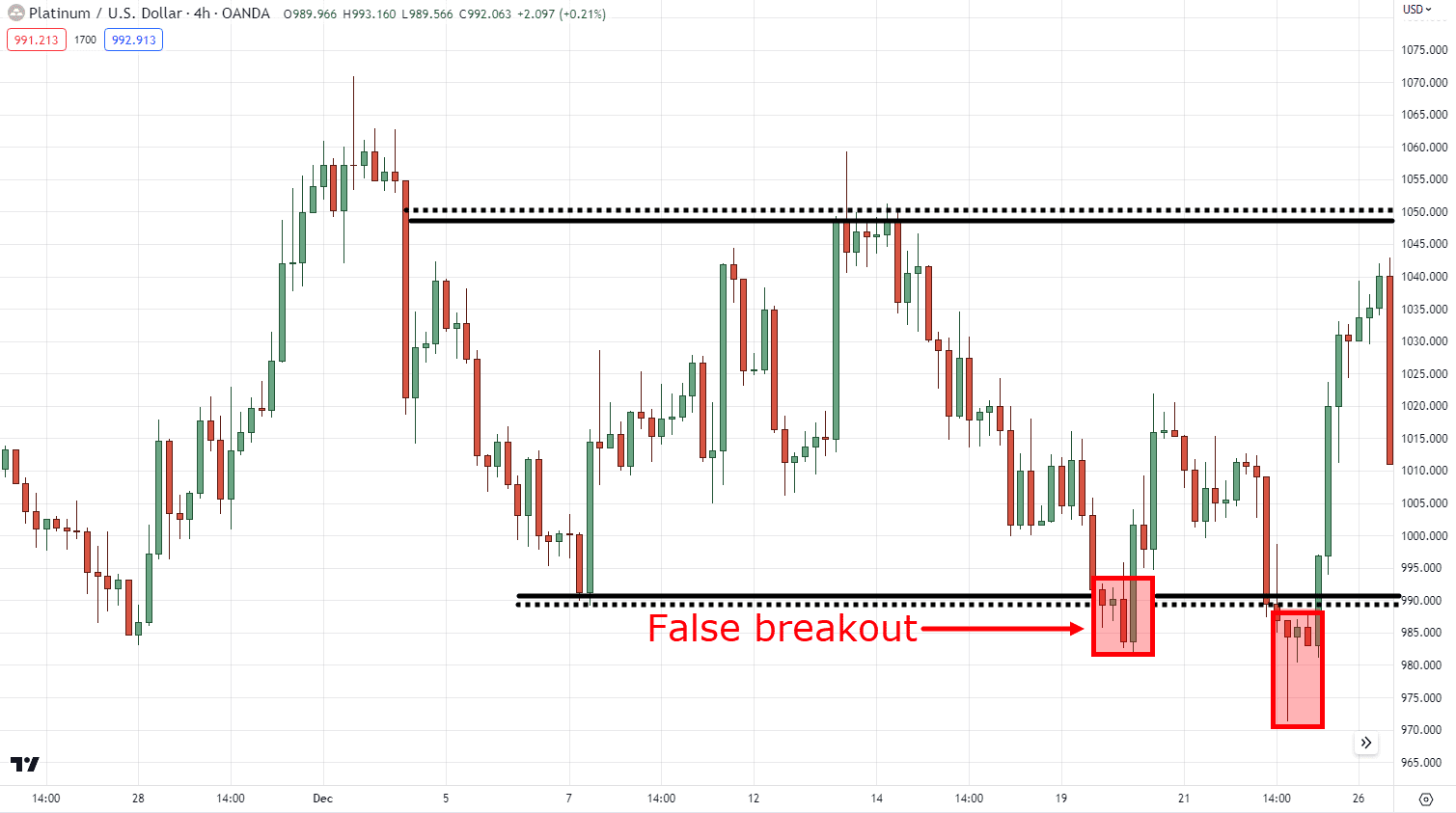

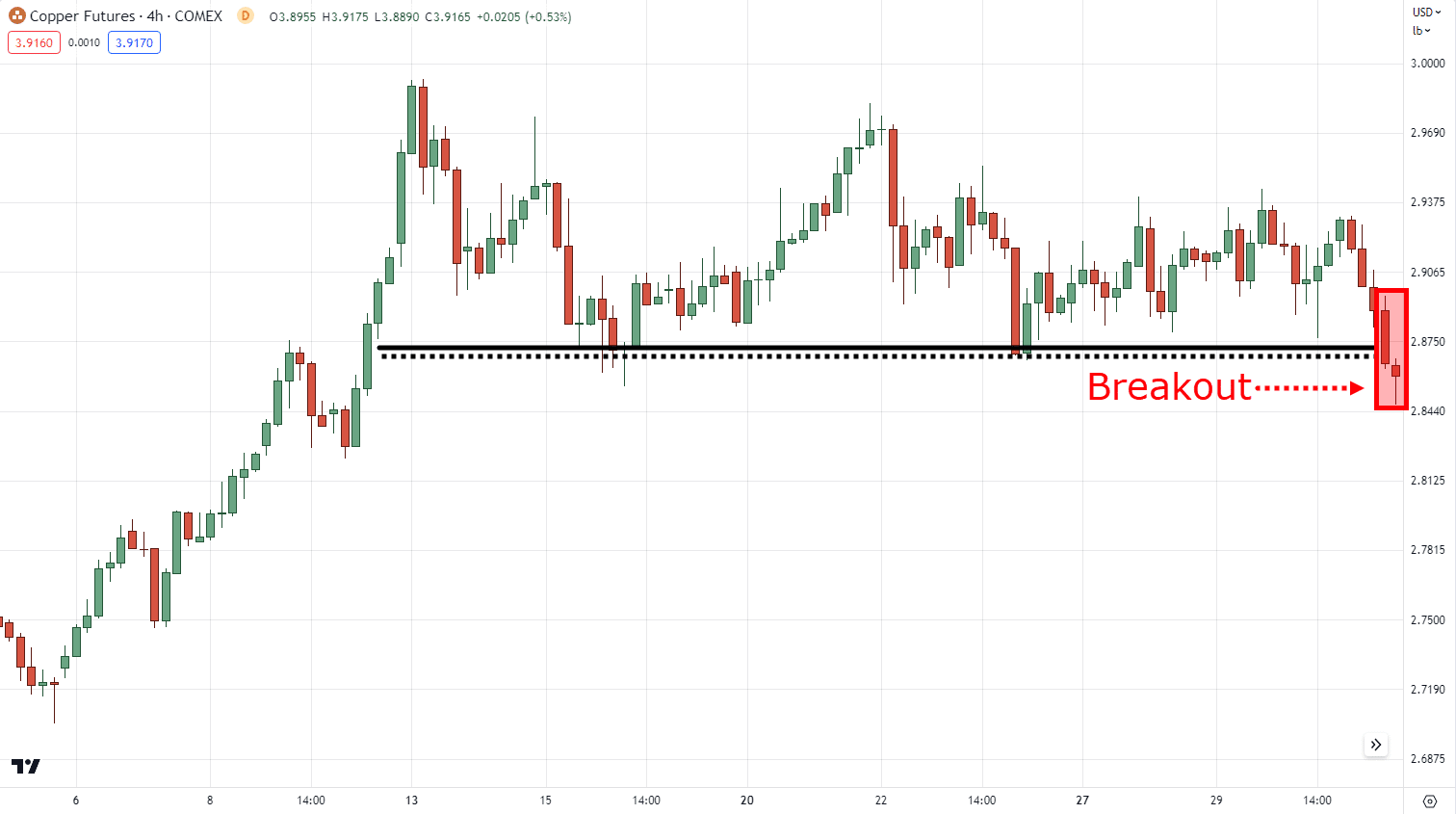

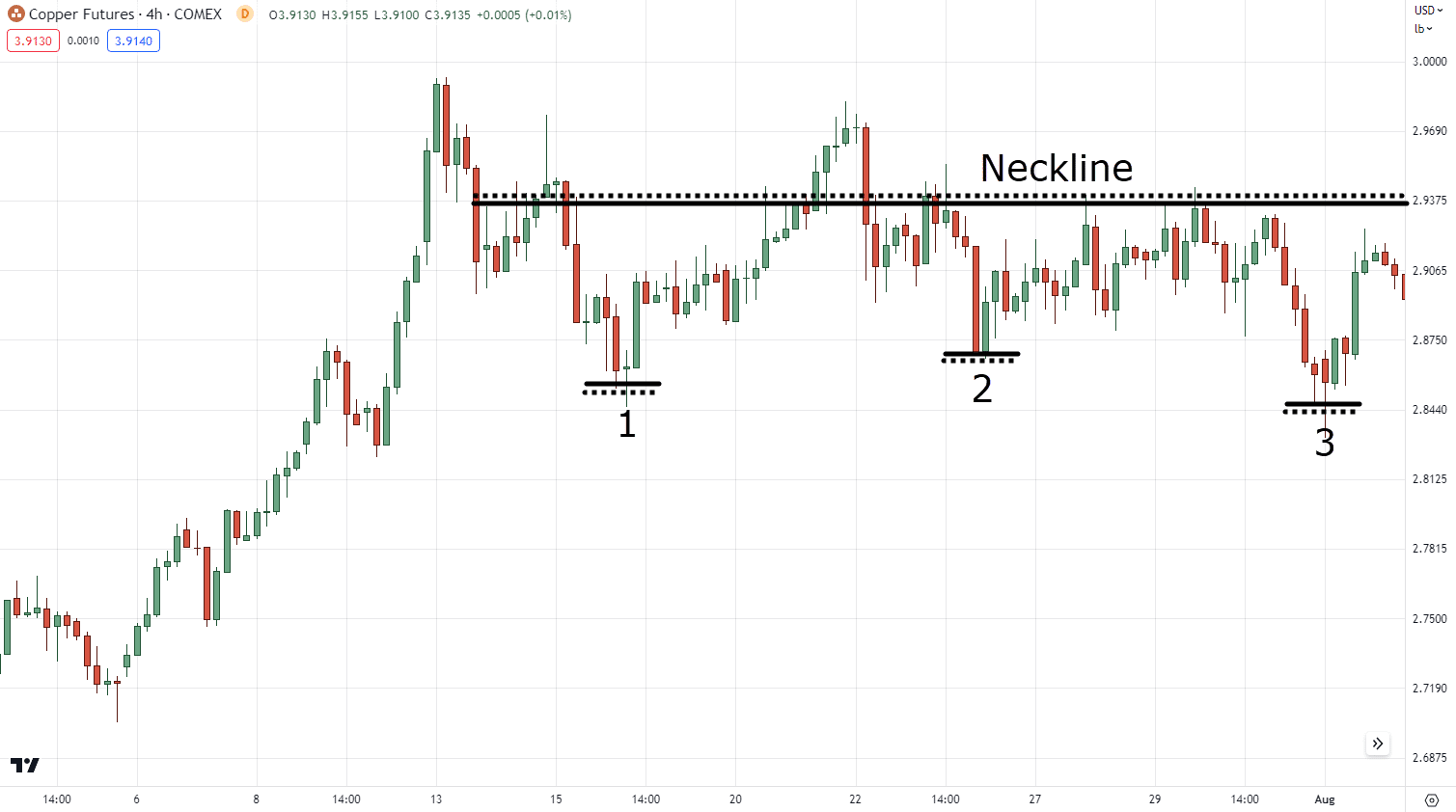

You see, Triple Bottoms are notorious for their mischievous false breakouts:

Because that’s what ranging markets do!

They expand, they contract, and a Triple Bottom can turn into a quadruple bottom!

It’s like a prankster hiding in the shadows, ready to jump out and startle you!

So, don’t blindly chase those highs and lows like a squirrel after nuts.

Instead, what should you do?

Simple, wait for confirmation before diving headfirst into a trade.

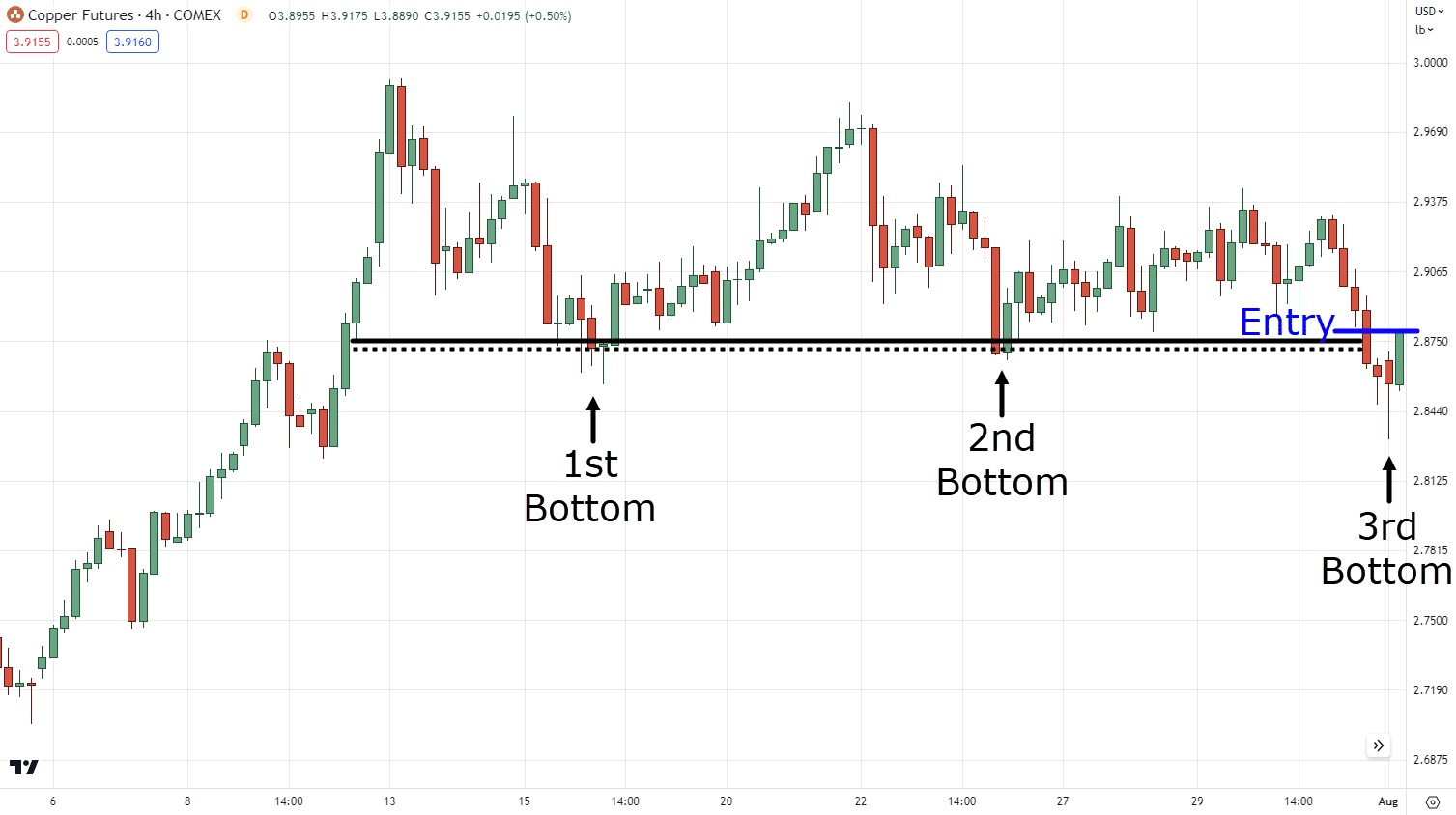

This means waiting for the actual breakout to happen on the 3rd bottom:

And entering when the price closes back into the range, therefore confirming the 3rd bottom:

So, just because the price is at the highs and lows, it doesn’t mean that you should trade them immediately.

Instead, stay vigilant and wait for extra confirmation!

Next, a major mistake traders make when trading the Triple Bottom pattern is…

Mistake #3: Using the double bottom pattern to call market direction

Now, let’s clear the air and debunk a common misconception.

The Triple Bottom pattern may turn out to be the life of the party…

But it’s not a psychic fortune-teller when it comes to market direction.

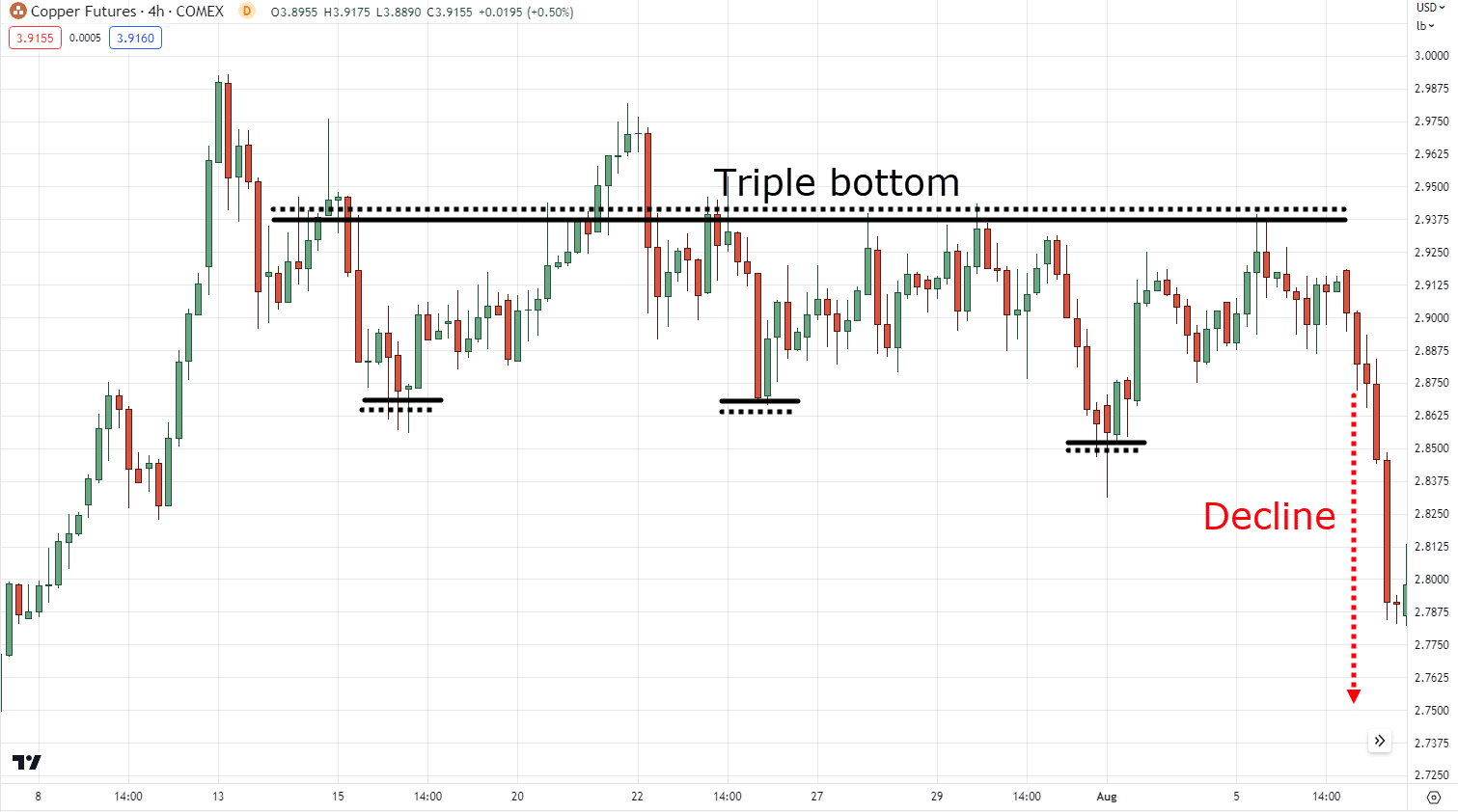

This means that just because you spot a Triple Bottom doesn’t mean that the market is obligated to break out higher.

This can happen as well:

It’s like expecting a crystal ball to predict tomorrow’s lottery numbers—highly unlikely!

So, don’t rely solely on the Triple Bottom to determine the market’s next move!

Analyze other factors and use the Triple Bottom pattern as a complementary tool rather than your sole indicator.

Finally, one mistake that a lot of traders (even me) have missed out on is…

Mistake #4: Relying too much on “textbook” triple bottoms

Let me explain…

When it comes to triple bottoms, don’t get too hung up on textbook definitions.

This pattern is like a chameleon, donning different variations and surprising you at every turn.

It means that there are a variety of valid Triple Bottom patterns, like the one you saw earlier:

As well as this:

So, toss aside your rigid expectations and embrace the beauty of its diverse forms.

Because what matters is the “sharp bottoms” you see on your chart!

Got it?

Now, you might be wondering…

“Alright man, I know how to spot the damn pattern and what not to do when trading it”

“So, how do I trade it?”

And if that’s you talking, then now’s the time to shine.

As I’ll share with you three simple market moves to look for when trading the Triple Bottom pattern.

Excited?

Then keep on reading!

Rock the Trading Dance Floor: The Best Moves for Triple Bottom Success

Ready to shake up your trading game with the Triple Bottom pattern?

Here’s a move that will make you the star of the dance floor:

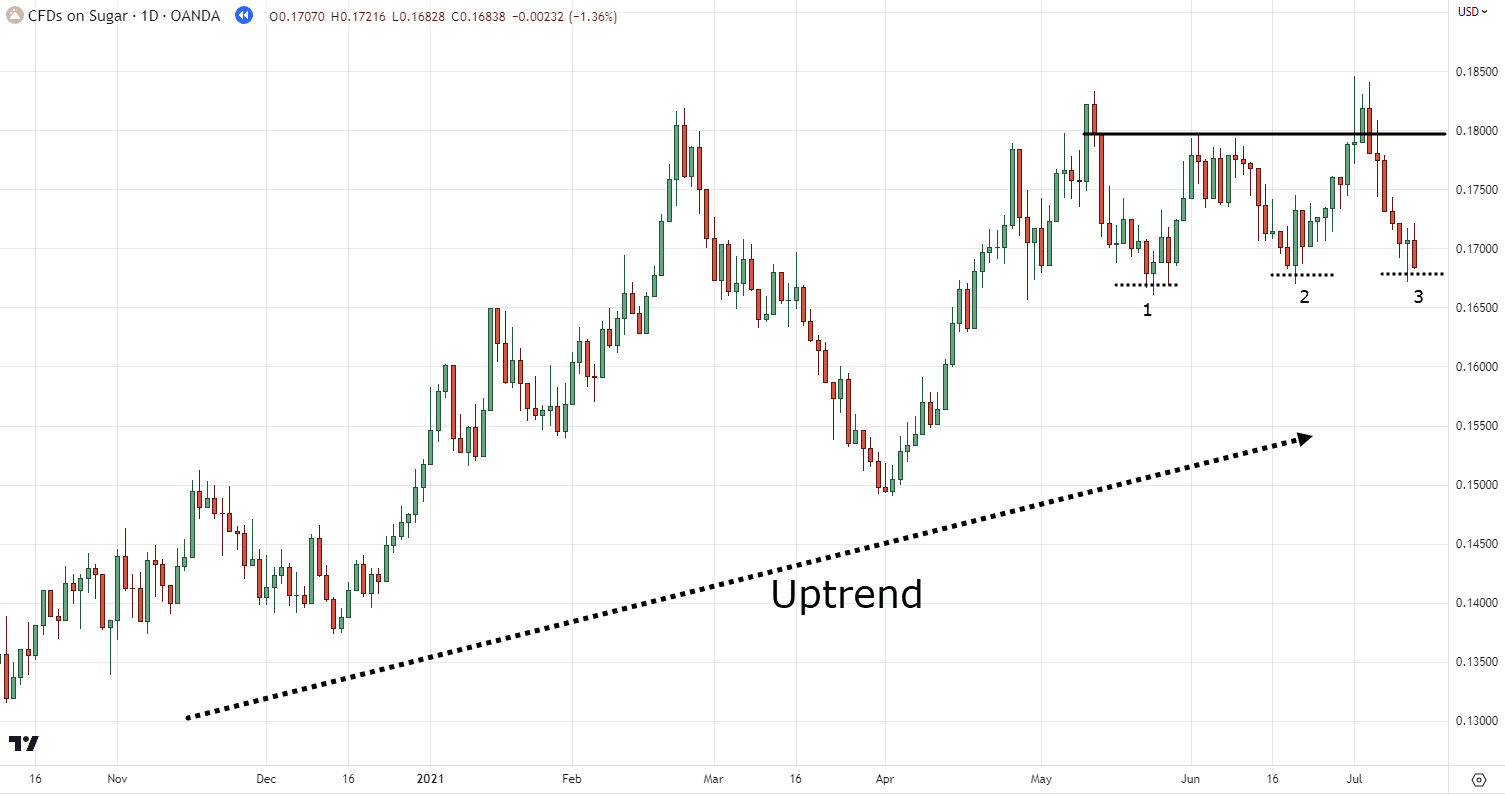

Ensure that the triple bottom is in an existing uptrend

It’s like joining a dance party where everyone’s already in a jubilant mood, ready to boogie down.

By aligning your trades with the prevailing uptrend…

You’re increasing your chances of success and moving to the rhythm of the market.

Keep an eye out for that uptrend like a seasoned dancer spotting the perfect partner, and get ready to twirl and dip with the Triple Bottom pattern!

So now, let’s talk about the fancy footwork within the Triple Bottom pattern on what you should look for next…

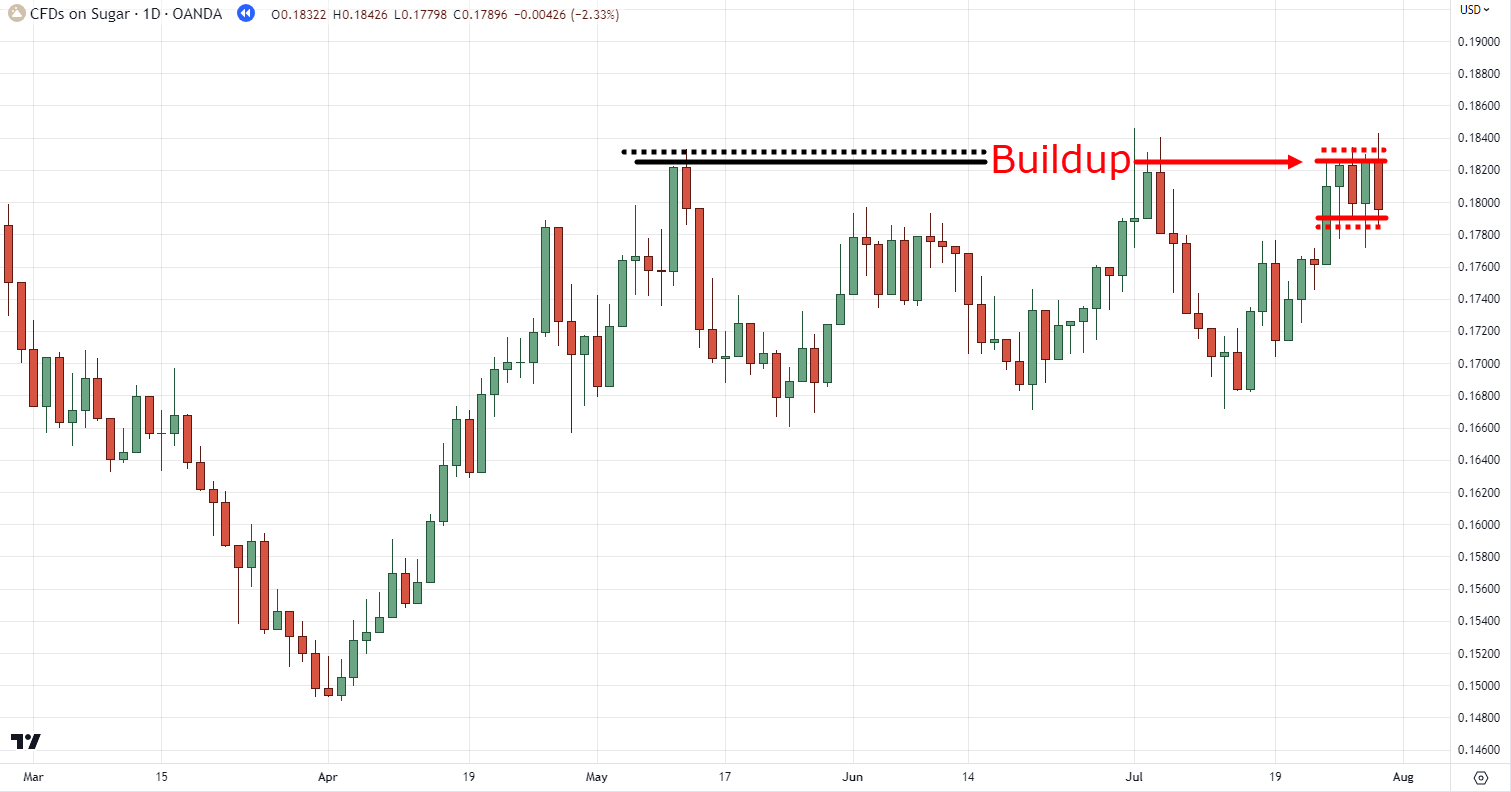

Look for a false breakout or a buildup

Just like a skilled dancer throwing in unexpected tricks and moves, the Triple Bottom pattern can sometimes surprise us.

When you spot a false break at the third bottom:

It’s like catching your dance partner teasing a dip but quickly rising back up with flair.

This means that it’s a signal that the pattern is ready to steal the spotlight.

On the other hand…

If you’ve:

- missed entering the Double Bottom

- missed trading the false breakout at the Triple Bottom

Then fret not, as you still have a chance!

Because if you notice a buildup at the highs:

It’s like witnessing the moment before an electrifying lift.

As it’s a sign that the Triple Bottom is gearing up for an explosive breakout.

So, keep your eyes peeled for these snazzy moves, and get ready to unleash your trading prowess on the market dancefloor!

Now at this point…

You already have all of the infinity stones to successfully trade the triple top bottom.

But as you know…

Your infinity gauntlet’s effectiveness depends on whether you can wield it!

So, if you’ve been trading similar patterns like the Double Bottom for quite some time.

You’re all set!

But if you want a simple and clear process on how you can spot, trade, and manage the trade with the Triple Bottom…

Then keep reading for the grand finale.

Mastering the Triple Bottom: A Trading Strategy That Will Make You Dance in Profits!

Ready to put your trading skills to the test with a simple yet effective triple-bottom strategy?

Let’s break it down step by step.

Just like learning a new dance routine.

Step #1: Start by identifying an uptrend on the daily timeframe

Picture it as finding the perfect rhythm that sets the mood for a captivating performance.

Look for those higher highs and higher lows that are signifying a strong upward movement.

Once you’ve locked onto that uptrend…

It’s time to move on to the next step and groove to the beat of the market!

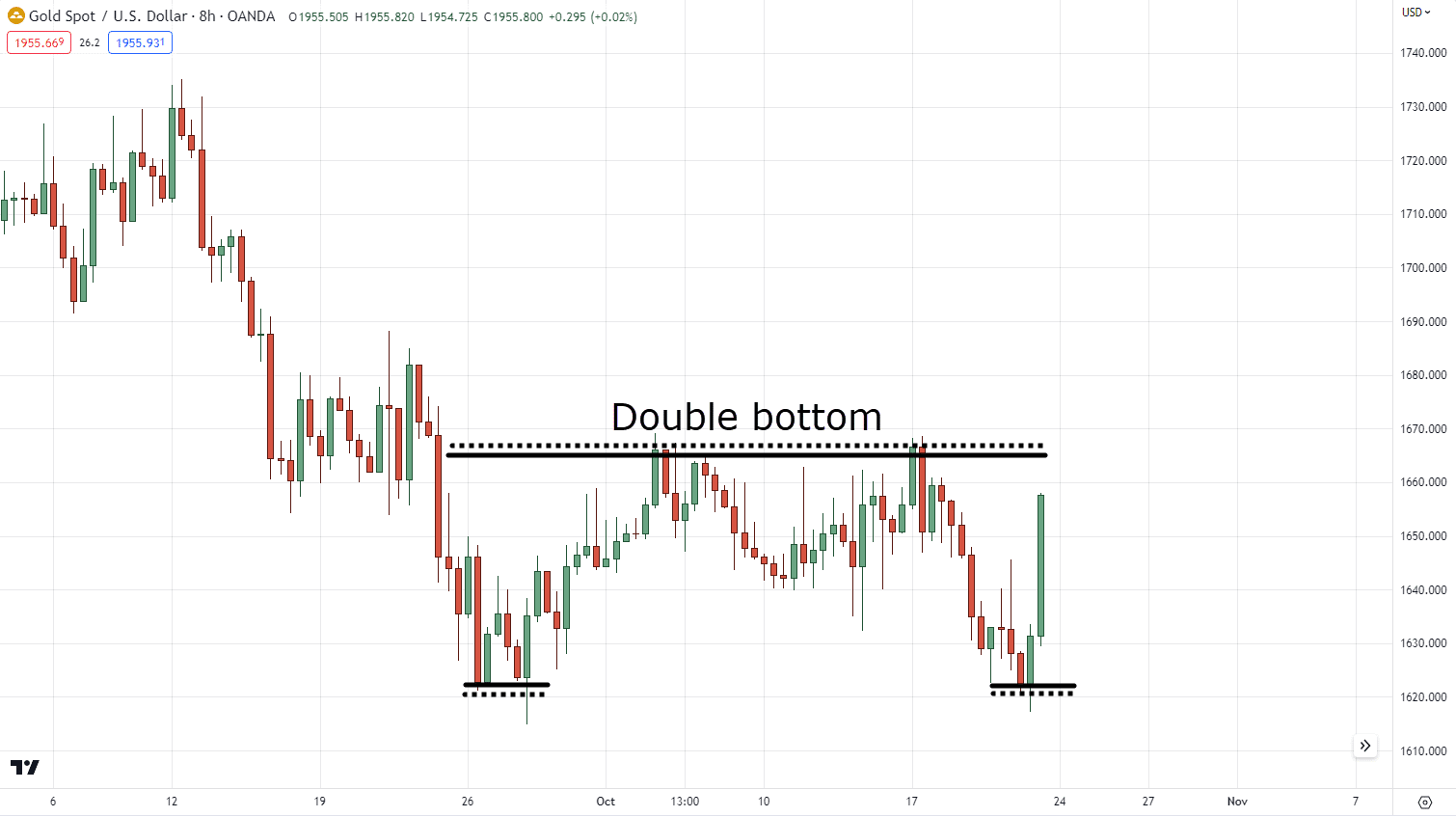

Step #2: Identify a potential triple bottom at the 4-hour timeframe

Now…

Shift your focus to the 4-hour timeframe where the potential Triple Bottom pattern comes to life.

Imagine it as the choreography of the dance, where each move has a purpose.

Identify the Triple Bottom formation, consisting of the three distinct bottoms connected by a neckline:

It’s like spotting the synchronized footwork of a group of dancers, creating an eye-catching pattern on the dancefloor.

Once you’ve spotted this Triple Bottom masterpiece in play, it’s time to prepare for the perfect trading entry!

Step #3: Trade the false break at the 3rd bottom

This is like executing a stunning spin or a quick change in direction that leaves everyone in awe.

When the market momentarily breaks below the third bottom but quickly bounces back up…

It’s a signal that the pattern is ready to take center stage.

So jump in with your trade, riding the upward momentum like a seasoned dancer stealing the limelight.

Remember, timing is key.

Wait for that false break and strike when the iron is hot!

Step #4: Scale in at the breakout of the buildup on the neckline

It’s time to amplify your trading performance.

‘How?’ you may ask.

Simple, by scaling in at the breakout of the buildup on the neckline.

Picture it as a grand lift in the dance routine, where the energy soars to new heights.

When the price breaks out above the neckline with conviction, it’s a sign that the Triple Bottom is about to unleash its full potential.

And when this happens, what should you do?

Well, add to your position, building upon your initial trade and maximizing your profit potential.

It’s like a crescendo in the music.

And importantly, this breakout offers an opportunity to ride the wave of success!

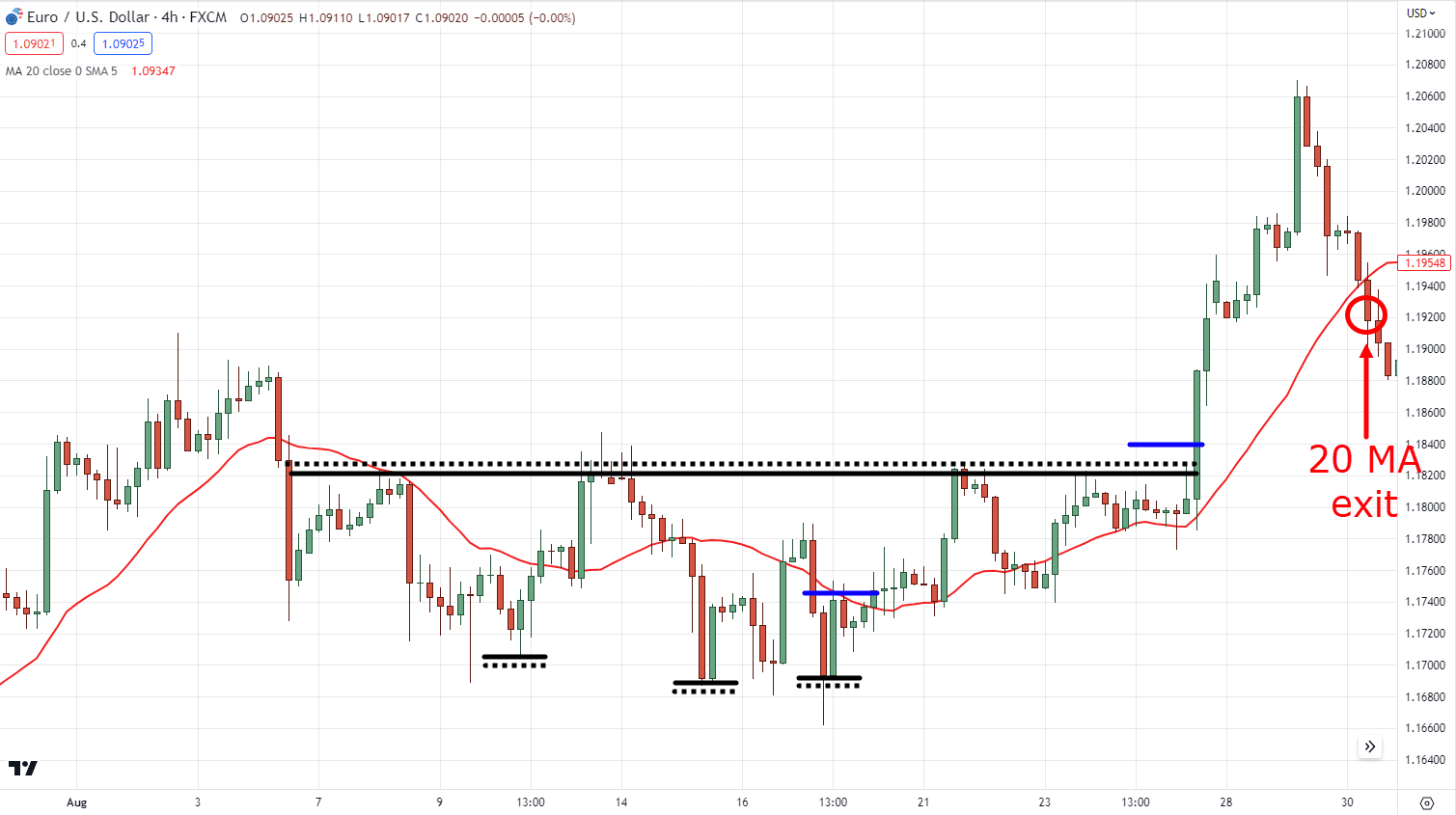

Step 5: Trail your stop loss using a 20-period moving average

Now that you’re in the trade…

How should you manage it?

In this case, I suggest trailing your stop loss using a 20-period moving average.

This indicator is like having a reliable dance partner who ensures your safety on the dance floor.

As the price moves in your favor, trail your stop loss using this dynamic indicator to protect your gains.

It’s a way to lock in profits while still allowing room for the market to groove its way up to higher levels.

Stay nimble and flexible, adjusting your stop loss as the rhythm of the market evolves!

And here’s something else you should know…

You always have the freedom to choose between Step 3 or Step 4.

If you’re a risky trader?

You can try both steps 3 and 4.

If you’re a conservative trader?

You can enter when the price breaks out the neckline (step 4).

If you’re in between?

You can consider step 3 and instead of scaling in, you can scale out on step 4.

Sounds good?

So, put on your trading shoes, practice those steps, and let this simple Triple Bottom strategy be your ticket to trading success!

Conclusion

In conclusion…

The Triple Bottom pattern is a powerful tool in the trader’s arsenal by offering a second (or even a third) chance for those who may have missed the Double Bottom opportunity.

Furthermore, this can also be a great pattern to master when trading and analyzing ranging markets.

At any rate, here’s what you’ve learned in today’s guide…

- The Triple Bottom pattern offers a second chance for traders who missed the Double Bottom opportunity.

- It consists of a neckline and three distinct bottoms, forming during market indecision and taking time to develop.

- Avoid common mistakes like trading inside the range and relying too much on textbook patterns.

- The best way to trade Triple Bottoms is to align with an existing uptrend and watch for false breaks at the lows, or buildups at the highs.

- A simple trading strategy includes identifying the uptrend, spotting the Triple Bottom formation, trading the false break, scaling in at the breakout, and trailing stop loss using a 50-period moving average.

That was pretty packed, right?

So, here’s what I want to know…

Have you traded double or Triple Bottoms before?

Also, what are your favorite chart patterns aside from the Triple Bottom?

Let me know in the comments below!