Introduction

Are you the type to constantly monitor your trades?

Maybe setting alert upon alert to remind yourself to set that order?

You end up forgetting what trades you need to set your stop losses for or take profits for…

Or perhaps spending countless hours waiting for entries to trigger…

I’ve been there myself!

If only there was a better way to manage trades, right?!

Well, what I am here to tell you is – it doesn’t need to be so complicated!

I present to you the magic of… Bracket Orders!

Once you learn about the genius of Bracket Orders, you will wonder why on earth you were trying to juggle so many trades at one time!

Here’s a breakdown of what I will show you in this article:

- How to Unleash the Power of Bracket Orders!

- How to properly set Bracket Orders to minimize losses and maximise winners!

- How Bracket orders can assist you with your favourite trading Strategies.

- The hidden benefits of Bracket Orders

- The Limitations of Bracket Orders.

Sound good? Then read on!

What are bracket orders?

Well, bracket orders are essentially a much more efficient way of placing orders when trading the markets.

You may even know Bracket orders such as One-Triggers-a-One-Cancels-Other (OTOCO) or One –Cancels –Other (OCO) orders.

Bracket orders are a way to place an entry order, a take profit order and a stop loss order all at once, in an inclusive bracket…

So now you know where the name comes from!

Think of them as being your whole trade planned out, before you even enter.

As you can imagine, they make the time-consuming task of managing a trade or multiple become much more simple.

Here is what they look like…

Entering a bracket order consists of these levels.

Your entry point would be the Buy Limit order and price at which you want to enter the market – in this case “Long”.

The Stop loss level (Sell Stop Order) would be the level at which you want to exit the market at a loss.

This means the point at which you no longer want to be holding the losing trade.

And obviously, the Take Profit level (Sell Limit Order) is the level at which you want to exit your position at a profit!

If the profit order is hit, the stop loss order is canceled, and if the stop loss is hit the Take profit order is canceled.

Get it?

And obviously, all of this is reversed if you were to take a short trade instead of a long trade.

But you might be asking…

“Rayner, why is this even important?”

“I do this anyway with limit orders…”

Well, my question to you is…

Have you ever found yourself thinking you set an order to exit the market, only to realise too late that you hadn’t..?

Instead, finding yourself in a massive losing position..?

It’s actually extremely common!

Especially when dealing with multiple trades at different times…

And it’s precisely why Bracket orders are such a valuable trading tool.

They have every part of your trade built into them with one order – you can just set and forget!

However, It’s important to remember that different brokers have different approaches to bracket orders…

Intra-day Trading with Bracket orders

Now, for some trading platforms that focus more on intraday trading, bracket orders are used a little differently…

Some brokers add more discipline to their bracket orders by making them non-cancellable, for example.

This means that if you were to set an order you would not be able to adjust the stop loss and in some cases the Take Profit order.

Sound unfair?

Well, there’s a philosophy behind it!

At the end of the day, your orders and positions are all closed and the next day starts with a fresh, new slate.

It’s just another layer of discipline that may be more suited to those making quicker decisions on an intra-day setup…

Not your thing?

Luckily, most brokers actually do allow you to modify and cancel bracket orders, but this is definitely something you should research with your broker before using.

But anyway, you must be thinking, what do bracket orders even look like on most trading platforms?

Well, read on and I’ll show you how to set these orders up on some common platforms and what they look like on a chart!

Setting Orders

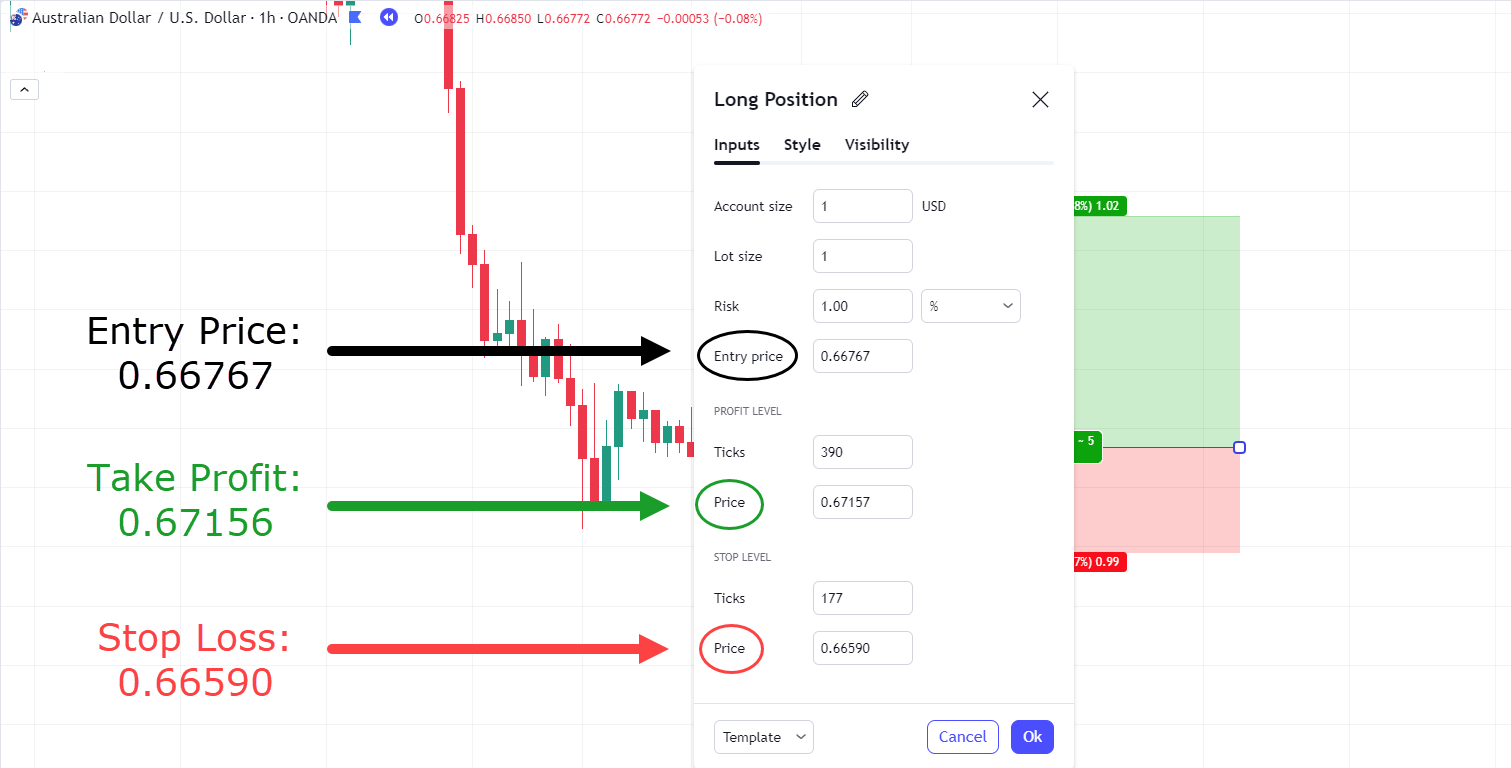

Imagine you were looking at this chart of the Forex Pair AUD/USD…

Example: AUD/USD 1-Hour Chart

Let’s say that you felt that AUDUSD had formed support and wanted to go Long.

In this example, you can see that you could set your Entry (Buy Limit) level as 0.66767, Stop Loss (Sell Stop) as 0.66590 and finally your Take profit order (Limit Sell) as 0.67156

But, how would you enter this trade using the Long Position Tool on TradingView?…

Example: Long Position Tool Tradingview

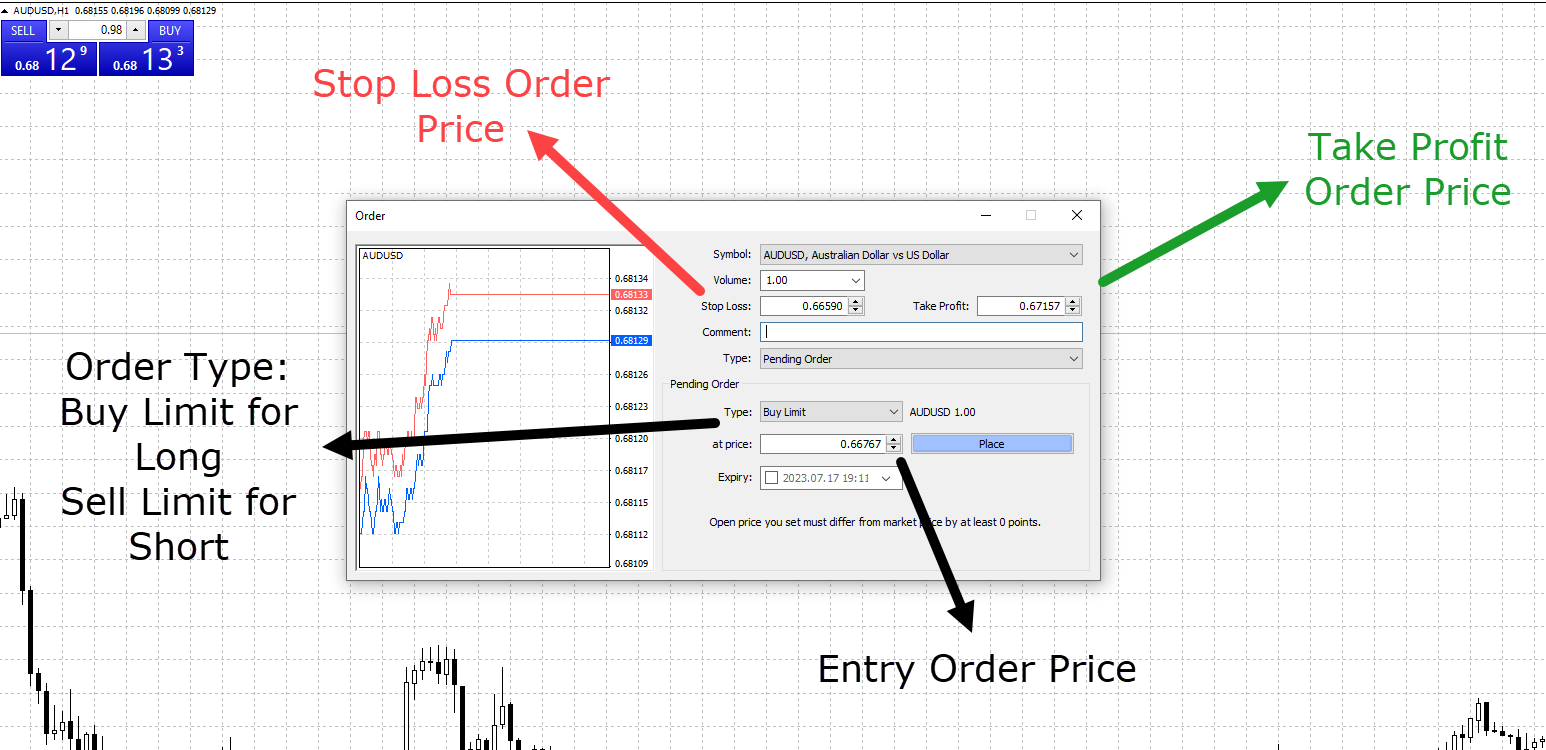

And what if you were entering this same trade on the MetaTrader Platform?…

MetaTrader Platform

Example: MetaTrader 4 Platform Order Form

To be honest, most brokers or trading platforms will have a similar setup to the above examples.

Now let’s continue with this example and see how things turned out…

Example: AUD/USD 1HR Chart

In this scenario, you can see that the price shot up to the profit target!

This would cancel your stop-loss order and close the position at your profit target of 0.67156

Can you see how easy it is when you have the whole trade planned out?

Even before the trade begins?

But truth be told, there’s more to using bracket orders…

How can bracket orders control risk?

Risk Management

As you must be finding out, risk management is by far the biggest part of any trading strategy!

It is always going to be the foundation of any good trading system.

So it makes sense to use every tool you can to make sure the foundations are solid!

But, why do bracket orders have anything to do with this?

Well, they make your trade non-negotiable.

By creating a bracket order, you are actually doing something that you may not even realise.

Namely, you are pre-planning your trade!

You worked out the key levels in which your trade should be entered, should be exited at a loss and should be exited at a profit.

Sounds like a small thing, right?

But trust me, it makes a big difference!

Pre-planning trades is one of the best ways of staying clear-headed and removing emotion from your trading.

If the setup makes sense when there is no money involved (Before entry), the chances are it makes sense throughout!

And there’s yet more behind bracket orders too…

Discipline

Discipline, you say?

Bracket Orders have discipline built right into them!

But, what do I mean by this?

Well, think about it…

If you have pre-planned the trade and set your stop loss and take profits, it’s much easier to walk away, set and forget and be done with that trade.

Whatever happens, happens… right?

You don’t have to worry about sitting in front of the charts watching the market move closer to your stop loss tick by tick….

You have already done your analysis!

It makes you more likely to accept the result regardless.

Your stop loss is the final defense between you and a blown account, after all!

It’s what allows you to enter the trade and not be constantly asking yourself the question of whether or not the stop is in the right spot.

I mean, you know those times when you think…

“Maybe I will just move the stop down a bit more and give it more room to breathe…”

“I didn’t see that price action so I better move it lower”…

What happens next?

Before you know it, you have moved your stop double what it should have been and now taken a bigger loss!

So what I’m trying to emphasise is that…

Discipline is key – and bracket orders give you a way to maintain it!

Read on to find out how to use these bracket orders in real trading situations.

Logical ways to use bracket order with technical levels

Alright, so here are some practical ways to use Bracket Orders and transform your frantic trading into a peaceful, well-planned masterpiece!

Support and Resistance

First up, bracket orders are essential for successfully navigating support and resistance trade setups.

It is crucial to have your stop loss where your trade idea becomes invalidated and no longer makes sense…

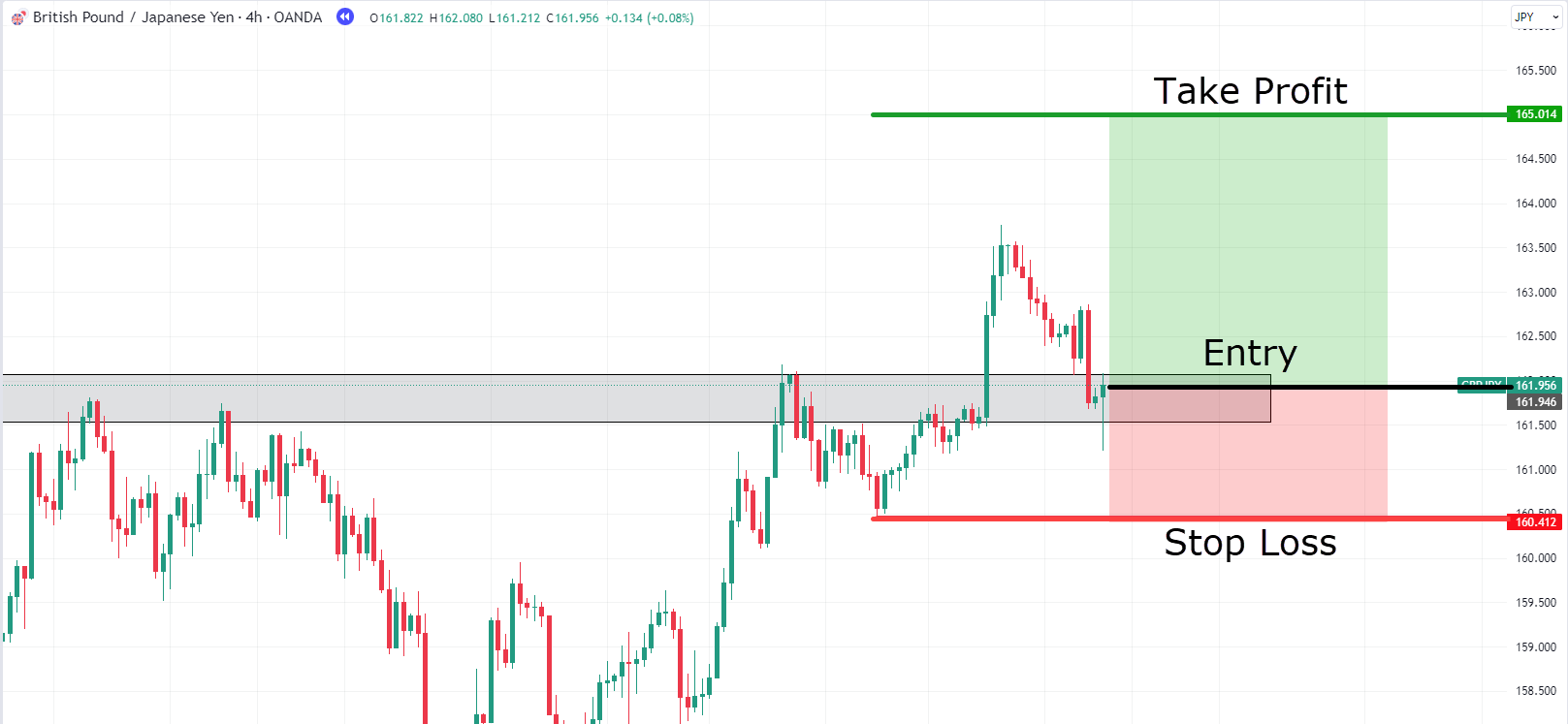

Example GBP/JPY 4-Hour Chart:

In the above example, you can see a price break above the resistance level, right?

The price then comes back to retest it, as support and formed a bullish Hammer.

Let’s say you want to go long and use a bracket order so you can set the trade and walk away…

What would this look like?

So, you could set your Stop Loss level at the previous low and back below support…

But why here?

Because at this point, the price would not be respecting the support and resistance flip, right?

It would be trading back under the zone, and instead of making higher lows, it would now be making lower lows!

Basically, this would make your pre-planned trading idea invalid.

It’s also a signal that at this price, you would be better off exiting your position at a loss and looking for new trading setups.

But how about your Take Profit level?

Say your trading system and rules suggest when the price reaches a 2:1 Risk Reward, you’ll take all your profits.

Let’s see how this trade turned out for you…

Example GBP/JPY 4-Hour Chart:

Congratulations on a cool calm relaxing trade setup that didn’t require you to tinker and monitor 24/7!

Do you feel better?

You should, because it’s the process making it easy!

Now, support and resistance are fairly straightforward but — what about patterns?

Using Bracket Orders with Patterns

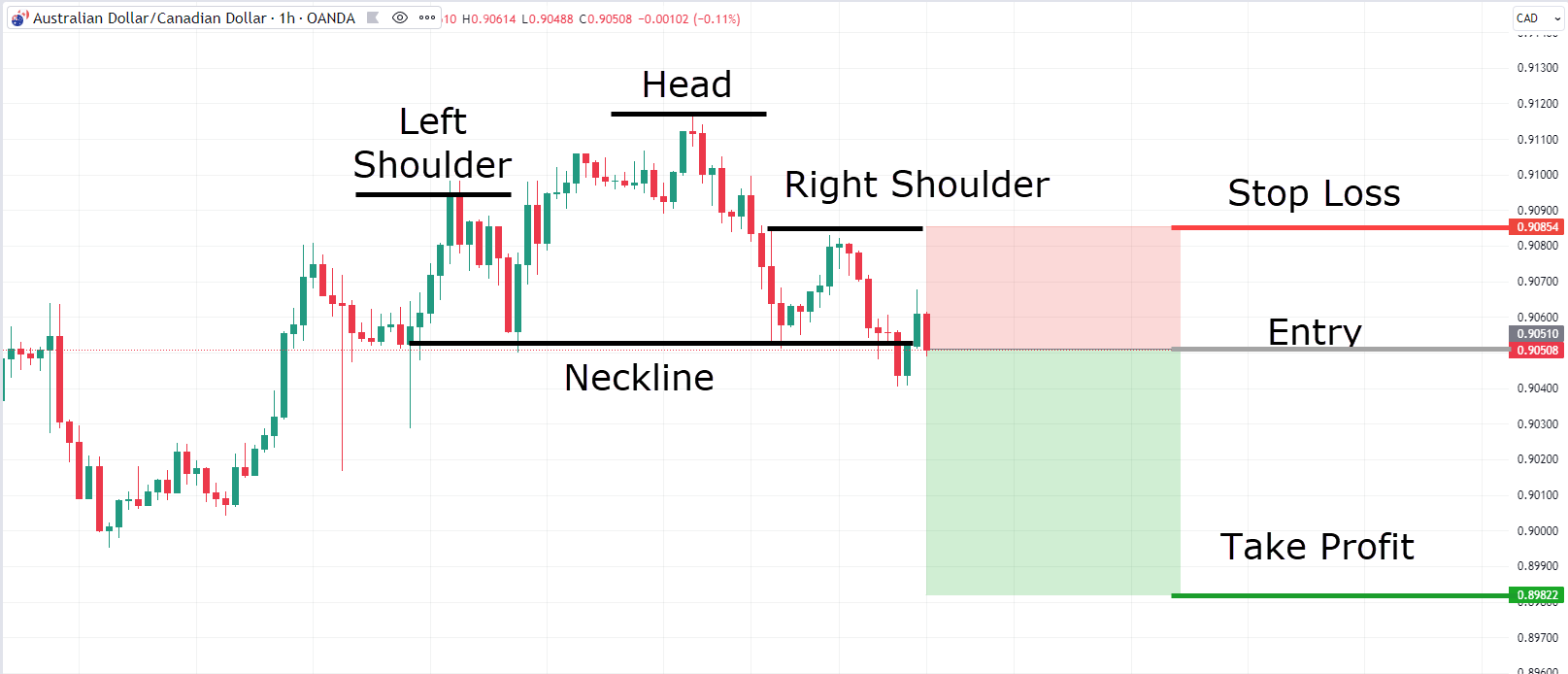

Let’s focus on the Head and Shoulders pattern…

Where would a logical place to place your stop loss be when setting your bracket order?

You guessed it!

Right above the previous high, aka the “Right Shoulder”.

This is because, if the price moves above that high, the chances are the neckline has been rejected and the so-called head and shoulders pattern no longer makes sense!

But, what about the take profit?

Well, a common way to set the take profit for the head and shoulders pattern is by measuring the distance from the neckline to the head, and then targeting that level below the neckline.

Below is what your bracket order would look like…

Head and Shoulders Pattern AUD/CAD 1-Hour Chart:

So how about this trade?

Are you cool calm and relaxed?

You should be!

Because you don’t have to do anything other than wait for the results…

Let’s take a look…

Head and Shoulders Pattern AUD/CAD 1-Hour Chart:

See what I mean?

When the trade is planned out and entered using a bracket order, It makes the whole process a lot easier!

No micromanaging…

No second guessing…

Just pure profits!

Make sense?

Let’s move on!

The advantages of bracket orders

Risk Management

As mentioned before, a major advantage of bracket orders is the risk management that is built into them.

Simplicity

Bracket orders allow simplicity when trading.

With your whole trade planned, you no longer have to overcomplicate your order book.

Trade Management

Bracket orders allow you to set your trade up in a well-planned calm environment.

No more alerts and individual orders for one trading idea, just set the trade and forget about it!

Discipline

Finally, bracket orders keep you as a trader honest and disciplined.

It’s much harder to go against your trading idea when the levels for stop losses and take profits were predefined and already sitting there as an order.

Simply let the trade do its thing and stay disciplined!

As a trader, though, you need to understand some of the downsides of bracket orders, too…

The disadvantages of bracket orders

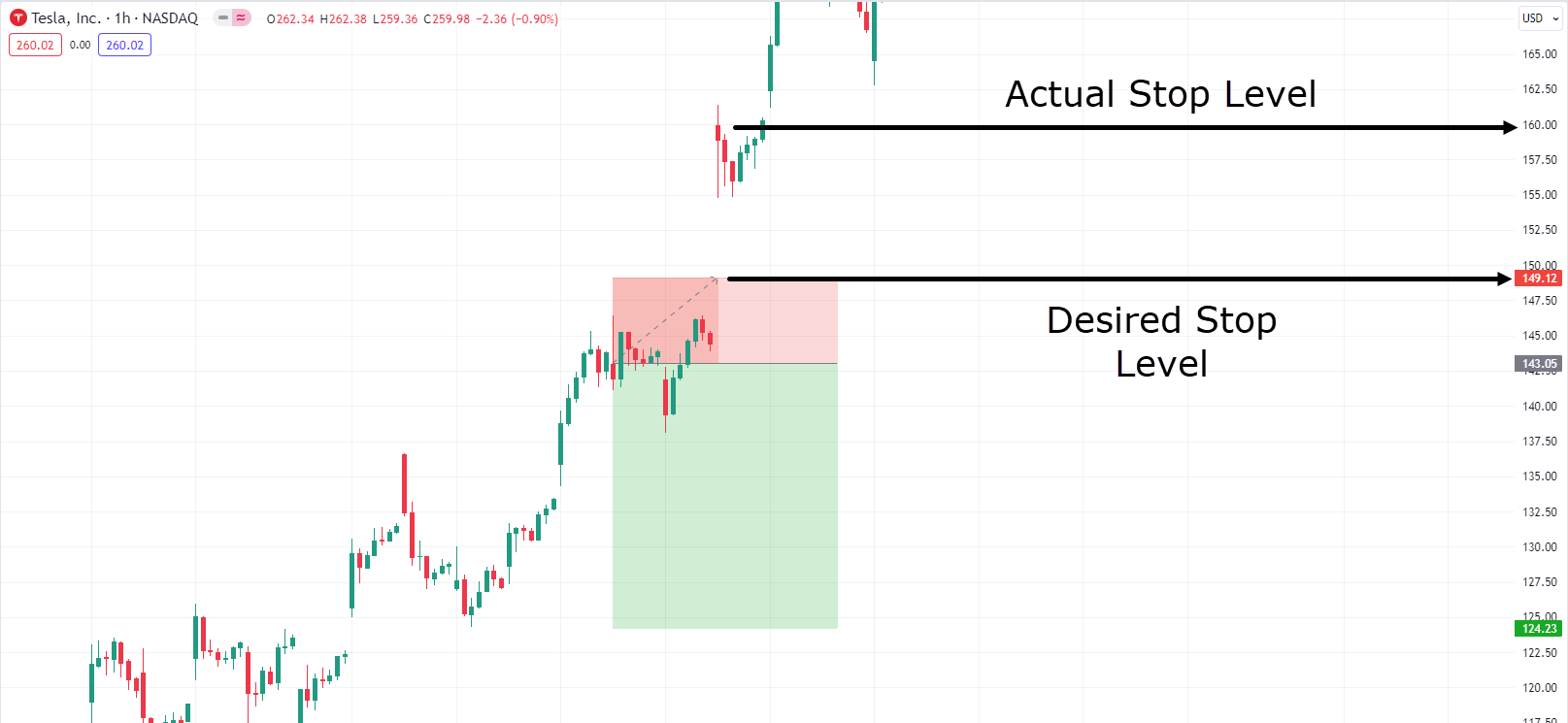

Gaps in the Market

One major disadvantage is what I call gaps in the market.

This occurs when, for example, a stock might close one day at a certain price but the next day open at a different price than the close, causing a price gap.

If your stop loss is positioned inside that gap you might not be stopped out at the price you had planned for…

Due to your stop loss being a Buy Stop order, not a limit buy, you will be exited at the next available price!

The size of the gap could heavily impact this…

Let’s take a look at an example…

As you can see, this trade would have resulted in a substantially bigger loss than originally planned!

This isn’t an isolated issue with Bracket Orders though…

It’s just something to be aware of whenever setting a trade and walking away.

However, this is more common on the daily open and closes.

If you use bracket orders in between these periods and close out the trade before the end of the day, this issue would be greatly minimised.

Different brokers have different rules

Some brokers will set up their bracket orders differently, so it’s vital to fully understand how the bracket orders work with your broker!

Although it’s safe to say the majority of platforms and brokers allow for the cancellation of orders throughout the trade, you must be aware that some intraday platforms will not allow you to cancel the stop loss order or adjust it until the session is complete…

Always check with your broker!

OK, so there was a lot of information there – let me sum it up for you!

Conclusion

Bracket orders will change the way you manage and open new positions from now on!

They have built-in risk management which allows you the freedom of being a professional trader without the countless hours of having to monitor every position.

And their simplicity allows any trader to become familiar with the process, making it much easier to be disciplined throughout the trade!

Bracket Orders force you as the trader to pre-plan your trade, removing emotion, and allowing for well-structured planned-out masterpieces…

So are you excited to try Bracket Orders from now on?

Maybe you have used some already, right?

Well, comment below and let me know!