The Spinning Top candlestick is a fascinating puzzle for traders seeking crucial market insights!

Its ability to identify market indecision and pauses in price movements makes it a truly invaluable tool in your trading arsenal.

In this ultimate guide, I will delve into the nitty-gritty of the Spinning Top candlestick…

Uncovering all of its secrets…

And you’ll learn everything from how it is formed to how you can actually trade it!

Are you ready?

So here’s what you’ll learn:

- Spinning Top candlestick explained for beginners.

- The hidden meaning of the Spinning Top candlestick that nobody tells you.

- 2 common mistakes you should avoid at all costs.

- Trading strategies to trade the Spinning Top candlestick effectively.

Let’s begin!

What is the Spinning Top candlestick?

Well, the Spinning Top candlestick is basically a small-to-medium range candle marked by a small body and relatively longer wicks…

It can tell you when there is a pause or indecision happening in the market.

Here’s what it looks like…

Since the body is so small, it doesn’t actually matter what the color of the body is.

As I said, the Spinning Top candlestick is an indecision candle…

But have you ever heard of bullish indecision or bearish indecision?

That simply doesn’t make sense, right?

The thing is…

The Spinning Top candlestick is a pattern, that has to be viewed in the context of the overall market conditions.

If you can learn to identify the underlying market context in which the Spinning Top candlestick is appearing, it can work wonders for you!

But don’t worry, we will get to that part soon…

First, I want to share a little bit more about the Spinning Top candlestick, to help further solidify your understanding of this super pattern. Read on!

What does the Spinning Top candlestick signify?

As mentioned, the Spinning Top candlestick tells you that there is a pause or indecision in the market.

Let’s dig a little deeper now!

Look at one of the fundamental structures of any traded market…

You already know that a market will cycle between periods of low volatility and high volatility.

A period of low volatility will be followed by a period of high volatility and vice versa.

A period of high volatility is when the market makes big moves…

Whereas a period of low volatility is when the market just pauses without making any meaningful moves.

Have a look at the chart below to see what I mean…

EUR/USD Daily Chart:

I would like to emphasize a few things in the chart above, too:

- Notice the cyclical nature of volatility: High volatility is followed by low volatility which is again followed by high volatility.

- The high volatility period was marked by long-range candles with wide bodies.

- The low volatility period was characterized by small-range candles with little-to-no bodies, which as we’ve seen are the characteristics of a Spinning Top candlestick.

Now if you connect the dots…

You will realize that the Spinning Top candlestick tells us that the market is in low volatility mode!

This implies that a period of high volatility is likely to follow, and that is exactly what you and I need, as traders, right?

After all, how will you make money if the price just sits there doing nothing?

Ideally, you need a market that will make a big move.

And if you can correctly understand the context within which this low volatility period is appearing, you can put yourself in a position to take advantage of the increased volatility that follows.

This is exactly the premise upon which the strategies that I share in this article are based on!

But before we get to the strategies, let me quickly tell you the 2 mistakes that you should avoid while trading the Spinning Top candlestick…

Avoid these mistakes while trading the Spinning Top candlestick…

Mistake #1: Using it as a trend reversal signal is not a good idea…

Now, conventionally, it is said that the Spinning Top candlestick pattern is a trend reversal pattern…

But I beg to differ!

I argue that it takes more than a single candle to reverse a whole trend.

More often than not, after forming the Spinning Top candlestick, the price will pause for a while or have a small reaction, only to make a trending move again.

To show you what I mean, let me give you a few examples…

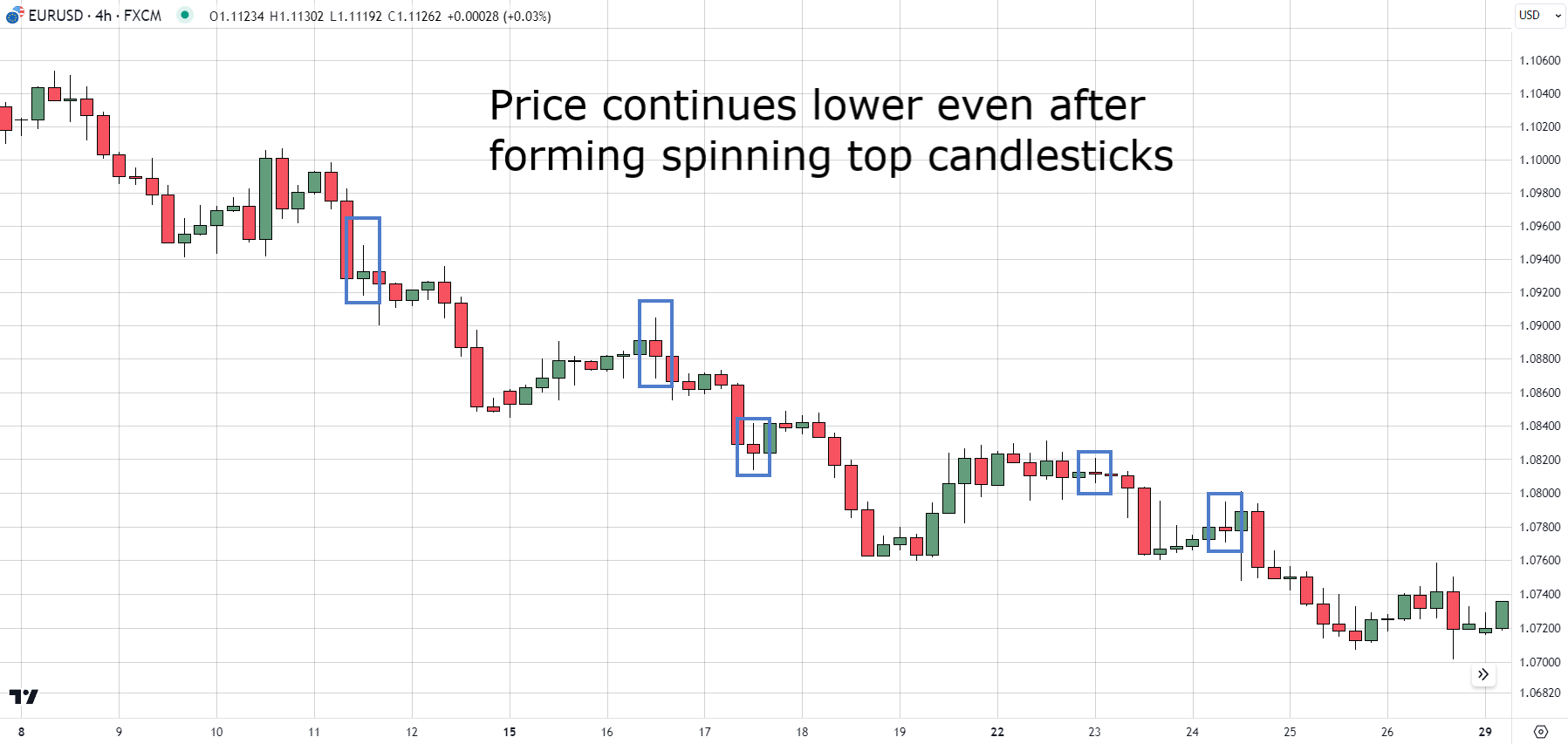

EUR/USD 4-Hour Chart:

Here, in a prevailing downtrend, the price formed several Spinning Top candlesticks but failed to reverse.

Instead, it continued lower.

Also, note that there are several more Spinning Tops in this chart, but I’ve marked only the perfect ones to further emphasize my point.

Take a look at another…

NVIDIA Daily Chart:

In this chart, after the Spinning Top candlesticks were formed, the price paused for a bit before continuing higher.

Can you see why it is not a good idea to bet against the trend just based on a single candle?

This leads me to the second mistake to avoid…

Mistake #2: Don’t use the Spinning top candlestick as a standalone pattern…

The Spinning Top pattern is not a strategy in itself!

Let me explain…

If you check any chart, you will see that the Spinning Top candlestick is very common.

It appears so frequently that if you want to actually use it, you must be able to understand the context within which it is appearing.

Have a look at the chart below…

Walmart Daily Chart:

Do you see how some Spinning top candlesticks led to a price rise, while some led to falls and in some cases, the price just went sideways?

So, how many are you going to trade?

Also, it is safe to assume that most traders are tracking more than one stock/pair.

Can you imagine the number of Spinning Top candlesticks that will show up every day?

Clearly, it’s going to be a lot!

This is why it is not a good idea to use the Spinning Top candlestick as a trading signal on its own.

Now…

Let us look at how you should be trading this awesome pattern…

How to correctly trade the Spinning Top candlestick pattern

Strategy #1: The flag strategy

In this strategy, we will incorporate the Spinning Top candlestick, into the classical flag pattern.

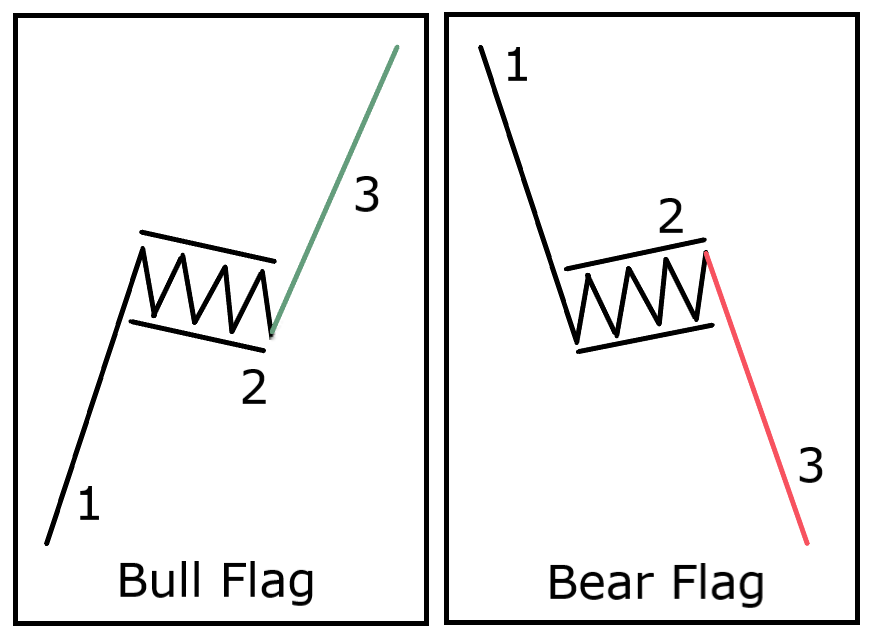

If you don’t know, here’s what a flag pattern looks like…

Let’s break this pattern down:

- A trending move, also known as the pole of the flag.

- A pause, which looks like a flag, hence the name. Here, the volatility contracts.

- This is the continuation period. Volatility increases again and price makes a trending move.

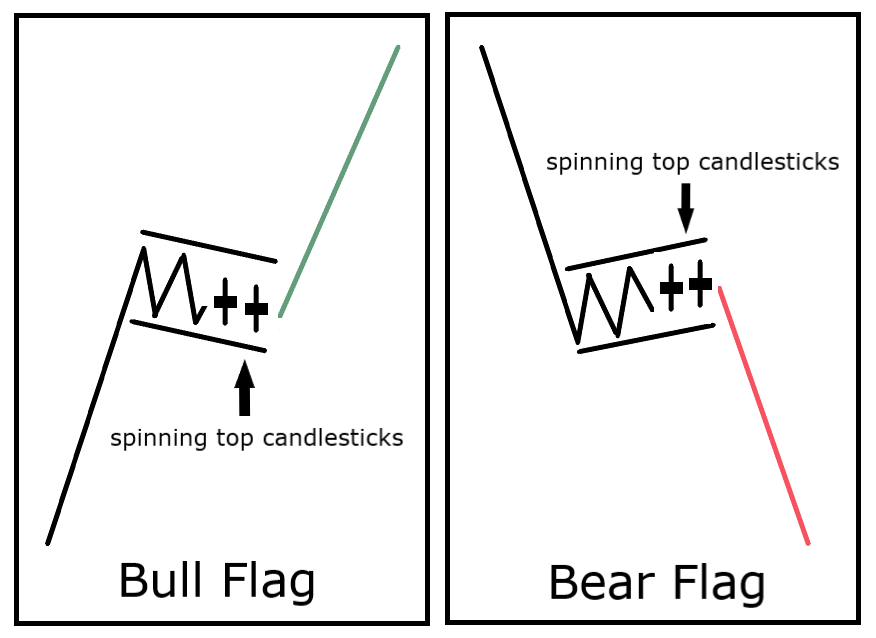

But, where does the Spinning Top fit into this?

As I said earlier, a Spinning Top candlestick tells us that the volatility is low…

So, where in the flag does the price have low volatility?

That’s right! In the flag region where price pauses!

Low volatility is important, as the price must digest its previous trending move before it can trend again without becoming exhausted.

Essentially, what we are looking for is for the price to make a trending move…

…take a pause…

…before forming one or more Spinning Top candlesticks!

This tells us that the volatility is low, and volatility is likely to expand from here.

And since the price is trending, a continuation in the direction of the trend becomes more likely.

Now, have a look at this general diagram I’ve made to illustrate what we’re looking for on the charts…

Before I show you some examples, though, take a look at the rules of this strategy:

The context:

Look for a trending move that is followed by a pause. The appearance of Spinning Top candlesticks tells us that volatility is low and the price is digesting its previous trending move.

Entry criteria:

For bull flags: Enter when there is a strong breakout candle that closes above the bull flag.

For bear flags: Enter when there is a strong breakdown candle that closes below the bear flag.

Stoploss:

For bull flags: Below the flag low.

For bear flags: Above the flag high.

Taking Profits:

You can either book profits at a fixed reward: risk ratio like a 1:1, 1.5:1, or 2:1.

Alternatively, if you want to ride the trend, you can use the 20 SMA to ride the trend.

An exit signal would be generated when you get a close below (for bull flags) or above (for bear flags) the 20 SMA.

So, basically, a combination of the above two techniques where partial profits are booked at a certain RR ratio and a certain portion is kept to ride the trend is a good idea!

Also, keep in mind that profit-taking is a dynamic exercise and also depends on whether there is another trade in which your funds can be better utilized.

OK, let’s look a bit closer at some examples now…

Goldman Sachs Group Daily Chart:

In this example, the price first had a superb move higher, forming the pole of the flag.

This was followed by a pause where the formation of Spinning Top candlesticks indicated low volatility.

So, we would start watching the stock at this point!

Entry was triggered when the price broke out of the flag and more importantly, closed above it.

The entry could have been taken just before the close, or at the next day’s opening.

Stop loss would be below the low of the flag as marked.

Price had a nice move higher. Profits could’ve been booked as per the techniques discussed above.

Now let’s look at a bear flag example next…

Sea Daily Chart:

In this chart, the price had a move down forming the pole of the flag.

It went into a consolidation forming several Spinning Top candlesticks within the flag.

Entry was triggered when the price had a breakdown and closed below the flag.

Stoploss would be above the high of the flag as marked and this was followed by a good move lower.

So, that was the flag strategy!

I hope the examples helped you understand the strategy better.

If you have any questions, please don’t hesitate to ask them in the comments!

Now, there is another interesting way in which we can use the Spinning Top candlesticks.

Presenting to you the next strategy…

Strategy #2: The false break strategy

A false break simply means a failed breakout or breakdown.

In this strategy as well, we’re looking at things within the context of the prevailing trend and will take trades only in the direction of the trend.

But you may be wondering…

What the Spinning Top candlestick has to do with this, right?

Well, when a Spinning Top candlestick forms when the price is trying to breakout/breakdown, it tells us that there is still indecision and the break in price lacks conviction.

For long trades…

We will look to buy a failed breakdown at an important swing low or support zone, within the context of an overall uptrend.

When a breakdown fails, all those who shorted at the breakdown will see their stops getting hit and start covering their shorts, which further adds to the upward momentum.

Entry trigger: A bullish candle, which tells us that the breakdown has likely failed.

Stoploss: Below the low of the failed breakdown.

Taking profits: The techniques are the same as those discussed in strategy #1.

Here’s an example…

Apple Daily Chart:

In this chart, we see a prevailing uptrend.

The price attempts to breakdown below the swing low, but forms a Spinning Top candlestick instead.

This tells us that the break in price lacks conviction.

A bullish bar adds confluence to this false break and serves as our entry trigger.

Our stop loss would be below the low as marked.

We see a nice move higher!

Now let us look at the short side of things, shall we?

For short trades,

We will look to short a failed breakout at an important swing high or resistance level, within the context of an overall downtrend.

When the breakout fails, the stops of all those who went long will be hit, and it will further add to the selling pressure.

Entry trigger: A bearish candle, which tells us that the breakout has likely failed.

Stoploss: Above the high of the failed breakout.

Taking profits: The techniques are the same as those discussed in strategy #1.

Have a look at this example…

GBP/USD Daily Chart:

Here, the price attempted to breakout above the previous swing high, but failed and reversed intraday, which served as an entry trigger.

The presence of a Spinning Top candlestick just before this failed breakout told you that there was indecision going into the breakout.

This was followed by a nice move lower.

So…

That was all about the Spinning Top candlestick.

By now, I hope you realize how powerful the Spinning Top candlestick can be if it is used in the right context.

Let’s do a quick recap of all that we’ve learned!

Conclusion

In this article, you learned:

- How to identify the Spinning Top candlestick.

- Its significance and underlying structure.

- The importance of using the Spinning Top candlestick in the right context.

- The mistakes that you must avoid while using the Spinning Top candlestick.

- 2 strategies to effectively trade the Spinning Top candlestick.

Hope you enjoyed and gained a lot of value from this post!

Now, a quick question for you,

What was your most important takeaway from this post?

I’m eager to know!

Cheers!

Disclaimer: The contents of this article are for educational purposes only. They are not to be constituted as financial advice.