Video Transcription

Market Structure

Some of you might be thinking…

“But Rayner, this is not as easy as it seems, because there are times when I see the market go up and down and continue higher”

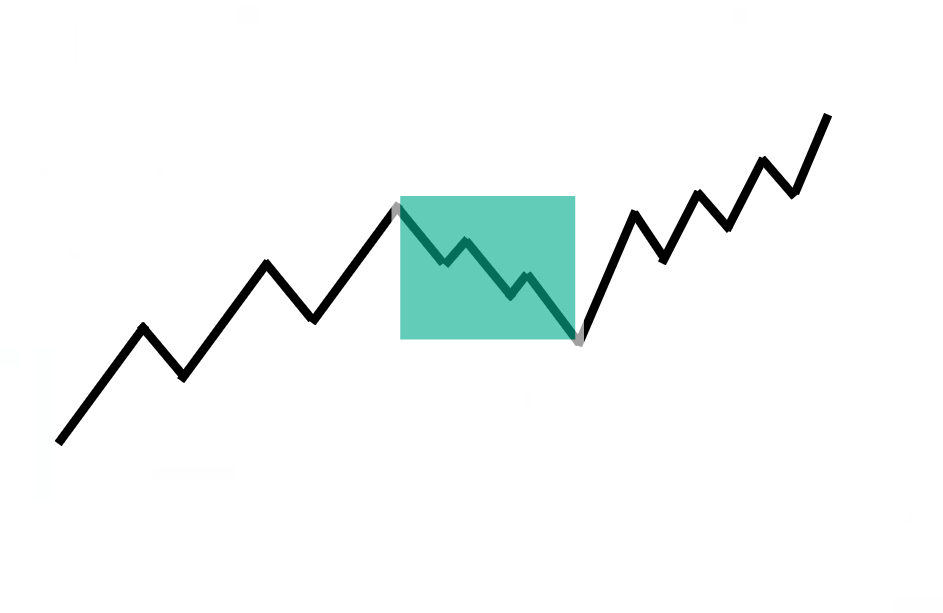

Here is what I mean:

Is this now in a downtrend, because we now have a lower high and lower low?

In a market structure, when the market is in an uptrend, you don’t always get a series of higher highs and higher lows.

There are times when the market can make a pullback and within the pullback, the market gets messy it forms a lower high and lower low, here is an example:

Most times the market can move higher and then go into a range thinking it’s going to be a reversal, and then it pumps and breaks out higher.

How do we know whether an uptrend is intact or not?

How to Identify Trend Reversals Like A Pro

- An Uptrend is invalidated only after the price breaks below the swing low (that precedes the breakout)

What do I mean by this?

Example:

The price goes up and comes down.

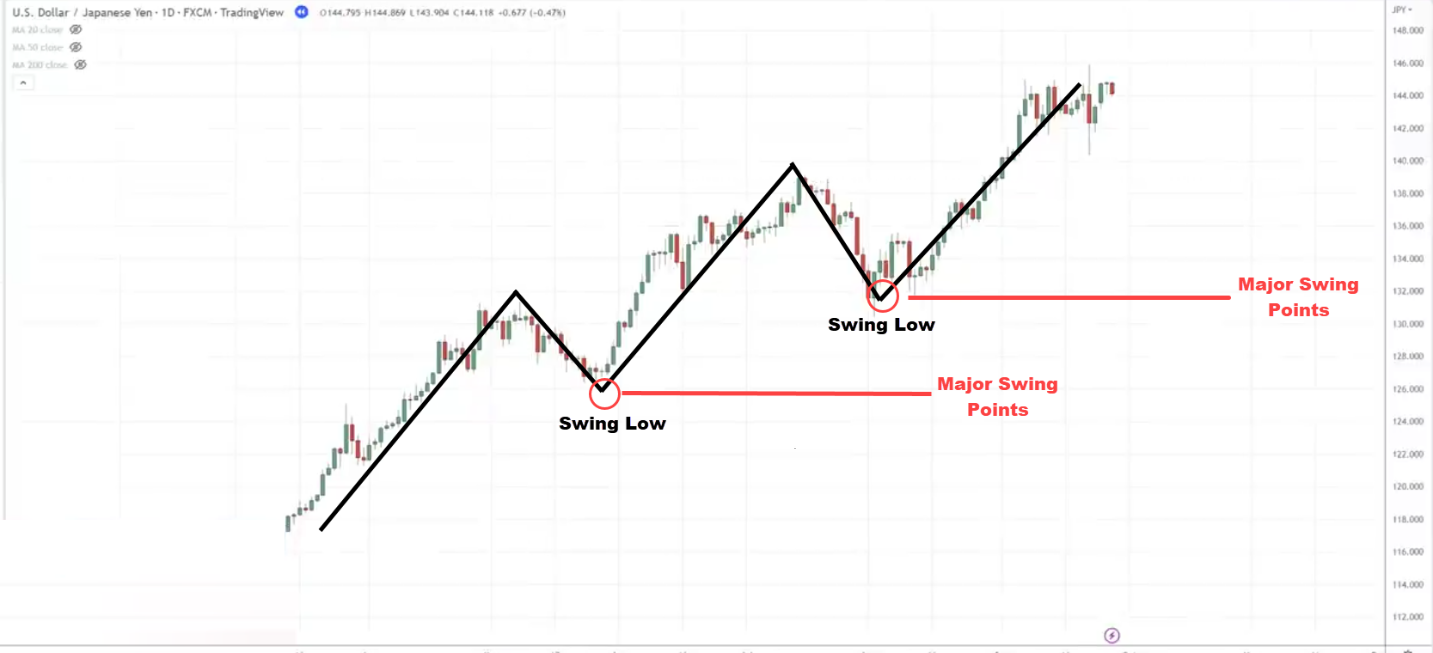

When we talk about the swing low that precedes the breakout.

We are referring basically to a major swing point on the chart.

These major swing points can be hard to decide, for me I know this is a major swing point.

New traders can’t tell, so how do we know that’s a major swing point?

You want to look at where the market broke out this is what I mean:

Where is the swing low that precedes?

The word precedes means “before”

Where is the swing low that happened before the breakout?

You can see the swing low that happened before the breakout.

In other words, this uptrend will be intact unless the market breaks and then closes below this swing low.

Until that has happened, we would say that the uptrend is still valid and we are expecting higher prices to come.

The uptrend is only invalidated if it breaks below the swing low that precedes the breakout.

Example

Look at this chart over here:

The market breaks and closes below the lows.

Is the uptrend still intact or has it been invalidated?

First and foremost, find out where the swing low precedes the breakout, this is what I mean:

This is the breakout point. This is the highest point that we are referring to, at this point, the market has broken out.

Where’s the swing low that happened before the price breaks below this high?

This is the swing low:

You can see that the market did break below this swing low.

At this point, this is when I will say that the trend is no longer intact. It could go into a range or reverse lower.

You’re now able to tell the difference between a pullback and a reversal.

A Powerful Trading Strategy That Works

This is a powerful trading strategy that I use to trade the market. This allows you to profit In a Bull and Bear market.

Example:

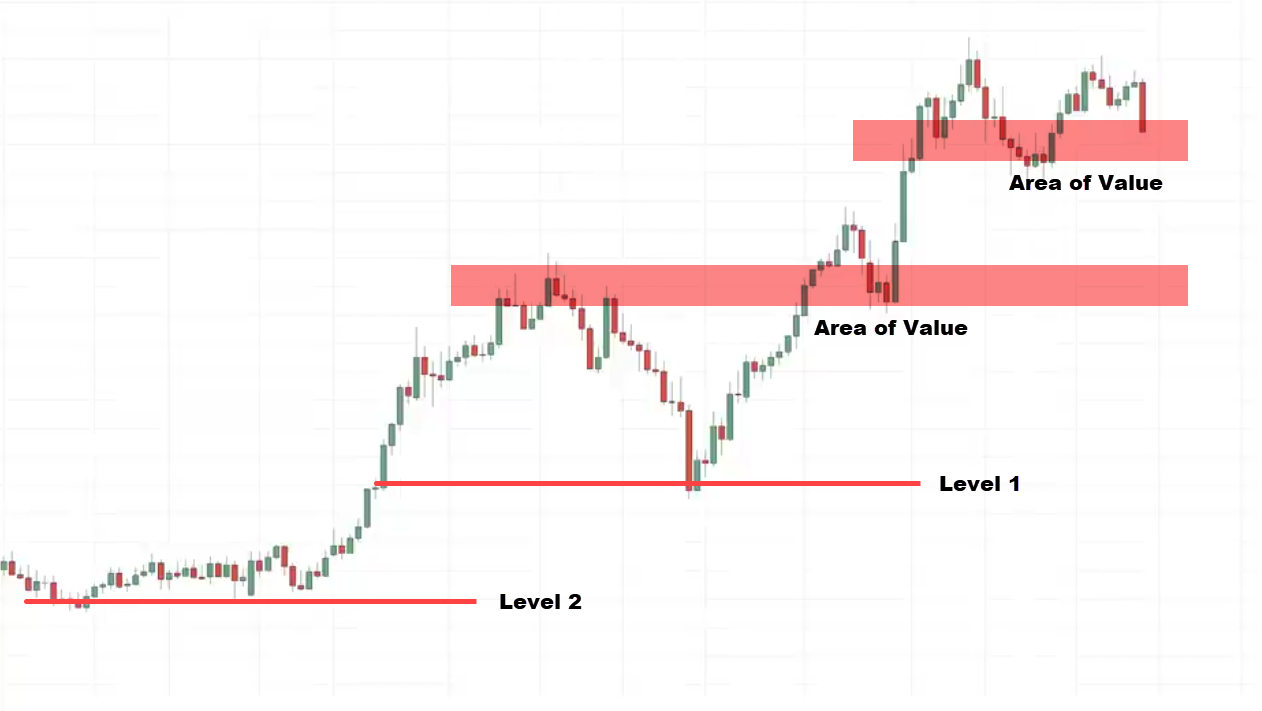

Look at this chart over here:

Market Structure

What is the trend?

You can see that the market is in an uptrend

Area of Value

Where is the area of value?

For me, this is where I will draw it…

These are the two areas of value on my chart.

Why did I plot these two levels?

Because they are the previous resistance.

The price could come back to these areas.

Because at these levels, I don’t want to be buying at the price points. If the market does reach these levels, the market is probably in a downtrend, I don’t want to buy in a downtrend.

How do you want to look for selling opportunities in a downtrend?

There’s no point drawing those levels because if the price gets to it, the trend would have reversed and I’m no longer looking for buying opportunities.

Entry Trigger

The next thing we are looking for is a valid entry trigger to go long.

You have learned things like the hammer and bullish engulfing pattern

In this case, the market came into our area of value

Do we have an entry trigger to go long?

Let’s find out!

Yes!!!

We have a hammer and this tells us that the buyers are temporarily in control.

If you understand the story behind this, you can see that the overall market is in an uptrend. The market then makes a pullback towards the area of value.

An area of value is where buying pressures could step in and push the price higher.

What you can do is to go long the next candle open. Here is what I mean:

This candle would be our entry.

Stops

We like to set it a distance away from the price structure. At a point where it will invalidate our trading setup.

I use the ATR indicator. I use the 20 SMA. What this tells you is that over the last 20 trading days, the market moves an average of 1.221/day.

To know where to set your stop loss, you need to find out the lows of the entry trigger candle and minus 1.221 from it.

The entry trigger candle low is 137.115

You can see that the ATR Value is 1.221

137.115 – 1.221 = 135. 93

This will be my stop-loss level

135.93

That is my stop-loss level…

Target

Where do we want to exit if the market moves in our favor?

I like to set my target just before the resistance.

This is an area where sellers might come to push the price lower.

For those of you who want to know what your R: R ratio on the trade, you can use this tool “Long Position”

Since you are looking at a long trade. It will tell you what your potential R: R ratio is on this particular trade:

This means that you’re risking $1 to potentially make $1.13.

Since this is a cherry-pick chart, you can see that the market reached our target and we exited with a profit.

Conclusion

In this guide…

I’ve shared with you the exact details of when a trend will reverse as well as how to trade it!

Nonetheless, here’s what you’ve learned today…

- Knowing if the uptrend is intact means that the price is constantly making new highs but at the same time has not broken its swing lows

- Timing the exact point of a reversal means that the price has broken below the swing low in an uptrend, and vice-versa for downtrends

- Using the MAEE formula by identifying the market structure, area of value, entries, and exit is a proven formula to spot and trade reversals in the markets

Now, over to you…

What are your experiences when it comes to trend reversals?

Do you often end up on the wrong side of the move?

How do you plan to change things up after this guide?

Share your thoughts in the comments below!