So, if you have a small account, then you must exploit the ninth wonder of the world.

But first, let’s take a step back. What is the ninth wonder of the world?

Rather,

What is the eighth wonder of the world?

The 9th Wonder of the World

The eighth wonder of the world is what Albert Einstein has said:

“Compound interest is the eighth wonder of the world. He who understands it, earns it, he who doesn’t, pays it.” – Albert Einstein

Taking this a step further, this is what I call the ninth wonder of the world is something that I term on my own.

Let me walk you through an example.

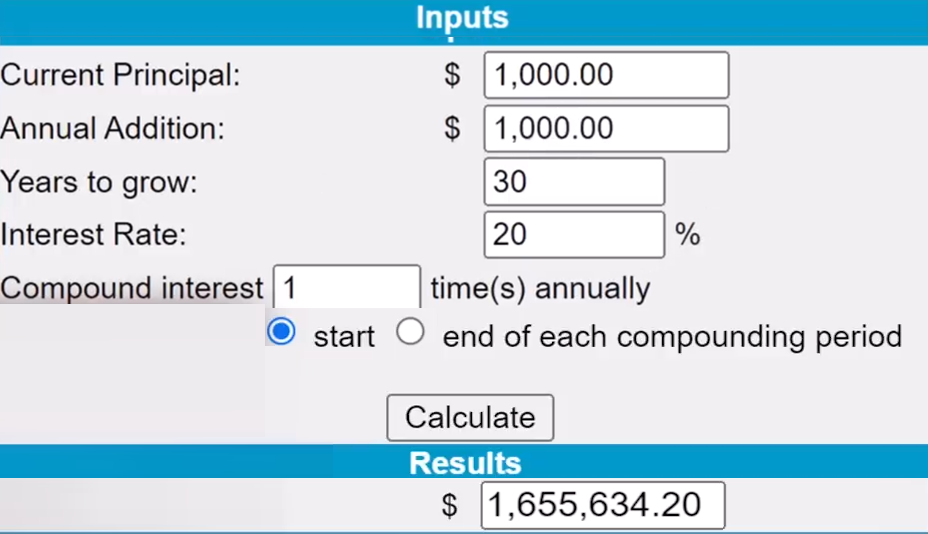

Let’s say you have a trading account, you start off with $1,000, you intend to grow the account for the next 30 years, at an average annual return of about 20% a year.

Your strategy does an average of about 20% a year.

After 30 years, your account will be worth about $237,000.

As you know, inflation is pretty done higher. Taking into account inflation, this isn’t really a lot of money anymore.

What else can you do? You can do a few things.

You increase the duration of your compounding effect, instead of compounding for the next 30 years, you compound for the next 200 years.

Well, that’s all fine, right?

The problem is you have to spend that money in heaven while you sing Hallelujah!!!

So that option is clearly not too feasible.

What about increasing your annual return each year?

Maybe instead of aiming for a 20% annual return, you’re in 400%?

That’s possible.

But the problem is if you were to do that, you would likely have to take on a higher risk to earn that higher return, and you likely risk blowing up your entire trading account.

That’s something we don’t want.

What is left?

The field called “Annual Addition”

What if we added an extra $1,000 to our account each year?

For example:

Each month you save like an extra 80 or $90.

Also, each year you can find an extra $1,000 in your account, How much of an impact would that make on your account?

You can see that we start off with $1,000, and add an extra $1,000 each year to grow for the next three years at this annual return of 20%.

After three years, your account is worth…

$1.6 million.

Can you see how powerful this is?

By the way, you didn’t make many changes you don’t need, you didn’t use a different strategy, you didn’t compound your returns for a longer period of time, and you didn’t increase the risk that you’re taking to trade your account.

The only thing that you did is to add in an extra $1,000/year and you have more than 7x your initial return.

$1,655,634,20

This concept is very powerful, regardless of the size of the account that you’re trading.

To sum it up, to exploit the ninth wonder of the world, you want to regularly add funds to your account so you can compound your returns faster.

Now I want to share with you something.

The Chinese Bamboo Tree

What you’re seeing right now is a Chinese bamboo tree.

To grow a Chinese bamboo tree, you must put the seeds in the ground, water them, fertilize them give it sunlight to grow.

Imagine you do this for a full year, guess how much your bamboo tree has grown?

Well, nothing is still flat in the ground, nothing comes up from the ground after one year of you know, religiously, planting the seeds, putting water, sunlight, etc.

You do this again for the second year after all, you know, it’s a good physical workout.

In the third year, again, nothing comes up from the ground.

By then this habit of yours really inculcated into you.

You continue doing this for your tree in the fourth year, and still, nothing comes out of the ground after four grueling years of watering your bamboo seeds in the ground.

At this point, you’re probably thinking…

“Man, did the seeds die?”

You’re probably having a lot of doubts about yourself.

Now, the fifth year comes along…

All of a sudden, within six weeks, the bamboo tree grows up 30 meters, which is about 80 feet in six weeks.

Now the question is this?

Did a bamboo tree grow 80 feet in six weeks?

Or was the little tree actually growing underground to develop a root system to build a strong foundation to support this potential so it can grow outward in the fifth year and beyond?

I think you’ve got the answer.

The reason why I’m sharing this story with you is because it’s the same for trading in your earliest.

It’s meant for you to build your foundation to make all the mistakes that you can make to instill that discipline to find a trading strategy that works for you.

This way, once you have a strong foundation, you can then reap the rewards for the later years to come.

Does this make sense?

Think in terms of percentage

The next tip that I have for you is to think in terms of percentages.

Imagine you have a $1,000 trading account, and you grow it by 20% for the year, which is about $200 a year.

Now, I know many of you will be thinking,

“Man, Rayner so much work for just $200 a year, I can’t even buy milk powder for my kids Rayner. Man!!! Rayner, I work at McDonald’s, and I’ll make even more money”

Guess what? You’re absolutely right.

Working at McDonald’s will probably earn you more than $200 a year.

But here’s the thing…

Working at McDonald’s is not scalable.

What do I mean by that?

In trading, you grow your account size to $10,000 and 20% return on a $10,000 account that will be worth about $2,000 of profits in a given year.

What if you take things even further, let’s say your account size is now $1,000,000.00.

A 20% Return on $1,000,000.00 is worth $200,000 of profits in a year.

Do you know how many happy meals you can buy with $200,000?

Here’s the thing,

I want you to think in terms of percentage.

Not the dollars.

Because it gives you a more objective view of your performance.

Plus, it makes you feel better, especially when you’re dealing with a small trading account.

Sounds good.

Honor your stop loss

Now, the next thing I want you to do is to honor your stop loss.

This is important because, on a small trading account, your losses in terms of dollars can really seem insignificant.

Example:

Let’s say you have a $500 trading account and you risk 2% on each trade. Theoretically, each loss that you incur, will not cost you more than $10.

Imagine as the price reaches your stop loss level, and you’re down $10, you might think to yourself

“Add a small amount of money, I can’t afford to lose it.”

You hold on to your losses, and even worse, you average into your losses.

The $10 loss now becomes a $20 loss.

You continue holding on to your losses.

Now the $20 loss becomes a $50 loss at this point where you average even further into your losses.

The market continues to go against you.

That $50 loss has snowballed into a $300 loss.

Before we know it, you’ve now lost 60% of your account on just one single trade.

This is all because you refuse to honor your stop loss, you refuse to cut your loss when you’re very insignificant at the start.

Here’s the thing, if your losses get too big, you might reach a point of no return.

This is what we call the “Risk of Ruin.”

Let me explain.

The Risk of Ruin

If you look at this table over here:

If you lose 10% of your account, you need a return of about 11.11% to get back to break even.

If you lose 50% of your account, you need a return of 100% to get back to breakeven.

And of course, when you reached a drawdown of 70% – 80% or 90%. This is where the returns get really ridiculous just to get back to breakeven.

This is what we call “The Risk of Ruin”

The point of no return.

If you want to avoid the risk of ruin, you must honor your stop loss.

Yes, I know that this loss can seem small and insignificant, but you still must honor it.

Your good habits start now when your account is small, right?

Not later on when you’re trading a six-figure to seven-figure account where you make mistakes like this is going to cost you a lot more.

Consistent action = consistent results

I know this sounds a little bit you know, vague.

Let me give you an example so you understand how this works.

Imagine your trades.

The outcome of the next few trades is something like this:

LOSE-LOSE-LOSE-WIN-WIN-WIN-WIN

Let’s say you’re trading a proven trading system and you are following your rules and as you can see.

Your first three trades are losers.

You are feeling really bad

“Three trading losses, Argh these suck”

When the fourth trade comes you decide to skip it because of the recent losses that you had.

You think

“Oh, man, you know, this is likely to be a losing trade as well, let me skip the trade”

Well, guess what?

It turns out to be a winner over here.

Then your fifth trade comes along, again, you decide to skip the trip because of the recent losses that you have encountered.

The pain is still very raw.

“So let me skip the trade again”

Turns out to be a winner.

“What? What? What the F**K!!!”

So then comes the next trading opportunity, now you’re stuck.

You’re thinking…

“Man, should I follow my trading rules or skip the trade?”

But because the recent losses are still too much to bear, you decide to let your emotions take over and skip the trade.

Then guess what?

Another winning trade that you missed?

“No, God, please. No…No….”

At this point, you can’t take it anymore…

“Arrrrrrrrrrrrrrrrrrrrrrrrrrrrrrrrrrrrrrrgh”

You decided to follow your trading strategy because if not, you might miss out on further gains.

You decide to take the next trade that comes along.

Finally, you caught this winner over here.

LOSE-LOSE-LOSE-WIN-WIN-WIN-WIN

However, if you look back, your winner is not enough to cover your losses, the three losses that you had earlier.

If you look at this, from a big-picture standpoint, if you had followed your rules, you would have not come up profitable, because you had four winners over here, compared to your earlier losses that you had earlier.

Four winners against three losers, you would have made money over this series of trades.

But because you didn’t follow your rules, because of emotions, because your actions were not consistent.

That’s why you didn’t get consistent results.

You can see that if you want to be a consistently profitable trader, you must have “A Consistent Set of Actions”

Whenever the setup presents itself, you have to take it.

You can’t second guess yourself, or maybe that is going to be a loser.

Because guess what, if you end up skipping trades, your results will not be consistent because your actions are not consistent.

By now you can see how important it is to be consistent with your action.

But let’s start off because you must also have a trading strategy that works.

If not right, imagine this…

You are consistent with your actions, but you are using a trading strategy that doesn’t work.

Guess what happens?

Well, your results will still be consistent.

But you will be constantly losing here.

It’s important to have a trading strategy that works.

Conclusion

Here’s the truth:

Growing a small trading account is hard.

Why?

Because it’s easy to treat it as “gambling” or “play” money.

However, by embodying the concepts I’ve shared with you today…

You’ll be able to adopt the same traits as a professional trader who manages billions of dollars of funds.

Nonetheless, here’s what you’ve learned for today’s guide:

- By using the “9th wonder of the world” you quadruple your returns without changing your strategy by consistently adding funds to your account

- Thinking in terms of percentage helps you detach yourself from the outcome and attaches you to the process

- It always pays to keep the risk of ruin in mind, so always honor your stop loss, as it’s the crucial factor in how to grow a small trading account

So…

What do you think?

Will you start trading as soon as possible with a small account?

Or do you wish to wait a bit longer until you have more funds to start trading?

Let me know your thoughts in the comments below!