Free eBook Download!Get A Simple 5-Step Momentum Trading Strategy

Today, we’re going to talk about the Average True Range (ATR) and why it might be a good idea to start using it.

Should we use indicators or not? This question refers to the opening phrase “to be, or not to be…” in Shakespeare’s famous play of Hamlet.

Many traders do opt for trading “naked” and solely using price action (momentum) and/or candlesticks for their trading decisions. Other traders wind up using over a dozen indicators or more when making their trading conclusions (causing paralysis of analysis).

First of all, Trading Strategy Guides recommends keeping trading simple. That means that over-combining too many indicators is just not effective and efficient.

Secondly, some indicators have more value for certain types of strategies, and hence, using a few indicators when used properly and within the TOFTEM model actually improves a trader’s decision capabilities.

The decision of which indicators to actually use and which ones to skip is not an easy path. There are tons of indicators available and even more so created each week. How does a trader even start the process of evaluating each and every one?

It is a daunting Hercules task.

However, there is good news too… Trading Strategy Guides is here to help!

We highly recommend using a simple tool called the ATR – Average True Range.

Intro: average true range (ATR)

For a clear explanation of what the ATR is, how it is calculated, and how to use it, it’s recommended to check out “using the average true range profitably.” It explains the basics of its composition, so I will not repeat those lessons here but instead dive into why and how using the ATR is beneficial for your trading.

The Average True Range (ATR) is one of those rare, best forex indicators that you always want to have on the chart because it provides vital information about the probability and likelihood of the market approaching or hitting your exits, which is either stop loss or take profit.

Knowing if your exit is within the market’s range is important information because the exit of a trade will determine whether a trade is a profit or a loss – not the entry. Winners Edge has written several blog posts on the topic before, such as:

- Avoiding early exits is easier than Forex traders think;

- Two methods for improving FX exits;

- This particular post is focusing on the benefit of ATR for the exit decision.

What Is the Average True Range Indicator?

Average True Range indicator is the average of true ranges over a specified period. It’s primarily used to gauge the volatility of an asset’s price. Unlike many indicators, the Average True Range (ATR) doesn’t predict price direction but focuses solely on volatility. This includes accounting for price gaps or limit moves that can affect an asset’s price.

Typically, Average True Range values are calculated over 14 periods. These periods can be of various lengths, such as daily, weekly, monthly, or even intraday. The choice of the period length depends on the specific needs of the trader or analyst. For instance, shorter averages, like 2 to 10 periods, are used to measure recent volatility.

The Average True Range indicator can be a key part of trading strategies, particularly for determining entry and exit points. Since it measures volatility, high Average True Range values suggest possible trend changes or market instability. At the same time, low Average True Range values might indicate weaker trends or consolidation phases.

Moreover, the Average True Range percentage (ATRP) is another way to use ATR. Average True Range percentage represents the ATR as a percentage of the current asset price, providing a relative measure of volatility. This can be particularly useful for comparing volatility across different-priced assets.

Determine Exits with ATR

Traders tend to use a wide variety of tools and indicators for determining exits, but one thing that they often do not use is this:

- An indicator that identifies whether a target is realistically within reach;

- An indicator that identifies whether a stop loss is realistically out of reach;

- An indicator that identifies whether a trail stop loss has a chance of (safely) being moved without putting it needlessly in harm’s way. To know more, read about how to determine stop loss in forex.

The ATR does all of the above. It indicates the average range of recent history and trade and can thereby judge whether the target is within the average of recent history or outside of that zone.

The following conclusions can be made:

- Stop loss is within ATR level – DANGER: stop loss is too close to price action, and trade has too high a chance of hitting the stop loss.

- Stop loss is outside of ATR level – GOOD: stop loss is far away from price action, and trade has a decent chance of not hitting the stop loss.

- Target is within ATR level – GOOD: take profit or soft target is close to price action, and trade has a good chance of hitting that zone.

- Target is outside of ATR level – DANGER: take profit is too far away from price action, and trade does not have a decent chance of not hitting the target zone.

What Is the Average True Range Indicator Formula?

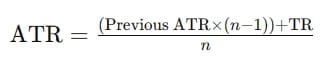

The Average True Range indicator formula is a tool that is used in market analysis to measure volatility. It was developed by J. Welles Wilder and is calculated using the following formula:

In this formula:

- ATR stands for Average True Range.

- n is the number of periods or bars you’re considering. This could be days, weeks, or any other time period.

- TR refers to the True Range for a given period.

The True Range (TR) is a key part of this Average True Range calculation. It’s defined as the greatest of the following three Average True Range values:

- Today’s high minus today’s low.

- The absolute value of today’s high minus yesterday’s close.

- The absolute values of today’s low minus yesterday’s close.

This Average True Range indicator formula is designed to capture the range of price movement in a market, factoring in gaps and limiting moves that might not be captured by simpler range measures.

By averaging these true ranges over a period (such as 14 days, which is commonly used), the ATR provides a smoothed measure of market volatility.

Simple Conclusion – Stay on Target

With the above ideas in mind, the conclusion becomes very simple:

To improve your exits, keep your targets within the average range and keep your stop loss outside of it.

Not many indicators can actually help assist a trader in recognizing that a target or a stop loss is in or out of range. The simplest way of doing so is using the ATR.

What do you think of the forex indicator, Average True Range? Can you imagine how the above ATR tactics could help improve your trading?

Thank you for reading!

Leave a comment below if you have any questions about the Average True Range (ATR) and its necessity.

How Can I Make a Profit and Stop Losses?

Trading Strategy Guides recommends using an ATR with a value of 20. When setting up the average true range stop loss, we recommend using 7 up to 12 values of ATR.

This means that a trader must take the ATR value of the entry candle and multiply it anywhere from 7 to 12. By doing this, a trader knows that they are not placing the protective stop in the middle of price action.

When setting up the take profit, we recommend using 4 up to 8 values of ATR. This means that a trader must take the ATR value of the entry candle and multiply it anywhere from 4 to 8. By doing this, a trader knows that they are placing the target in the middle of price action.

Why the Variance in Levels? (4 to 8 & 7 to 12)

There is perhaps a considerable gap between 7 and 12 for the stop loss and 4 and 8 for the target, and you might wonder why.

The market is not a rigid structure and is very dynamic. In our testing, all of these levels actually work well. Therefore, we would rather decide the multiple levels for each individual trade. How do we do that?

We use the market structure on a higher time frame to choose the best stop loss and take profit levels within the recommended zone. Because the entire zone is good, we can use our discretion within that zone to optimize our results.

What I mean is that a trader can use 4-hour and/or daily tops and bottoms for placing stop losses above resistance or below support, where placing targets below resistance and above support for further refinement of their edge.

Free eBook Download!Get A Simple 5-Step Momentum Trading Strategy