Let me walk you through something that confused me for a long, long time…

The Fibonacci.

It comes in so many different forms, right?

You have the Fibonacci fan…

The Fibonacci wedge…

(yeah I’m not sure how to plot that one correctly!)

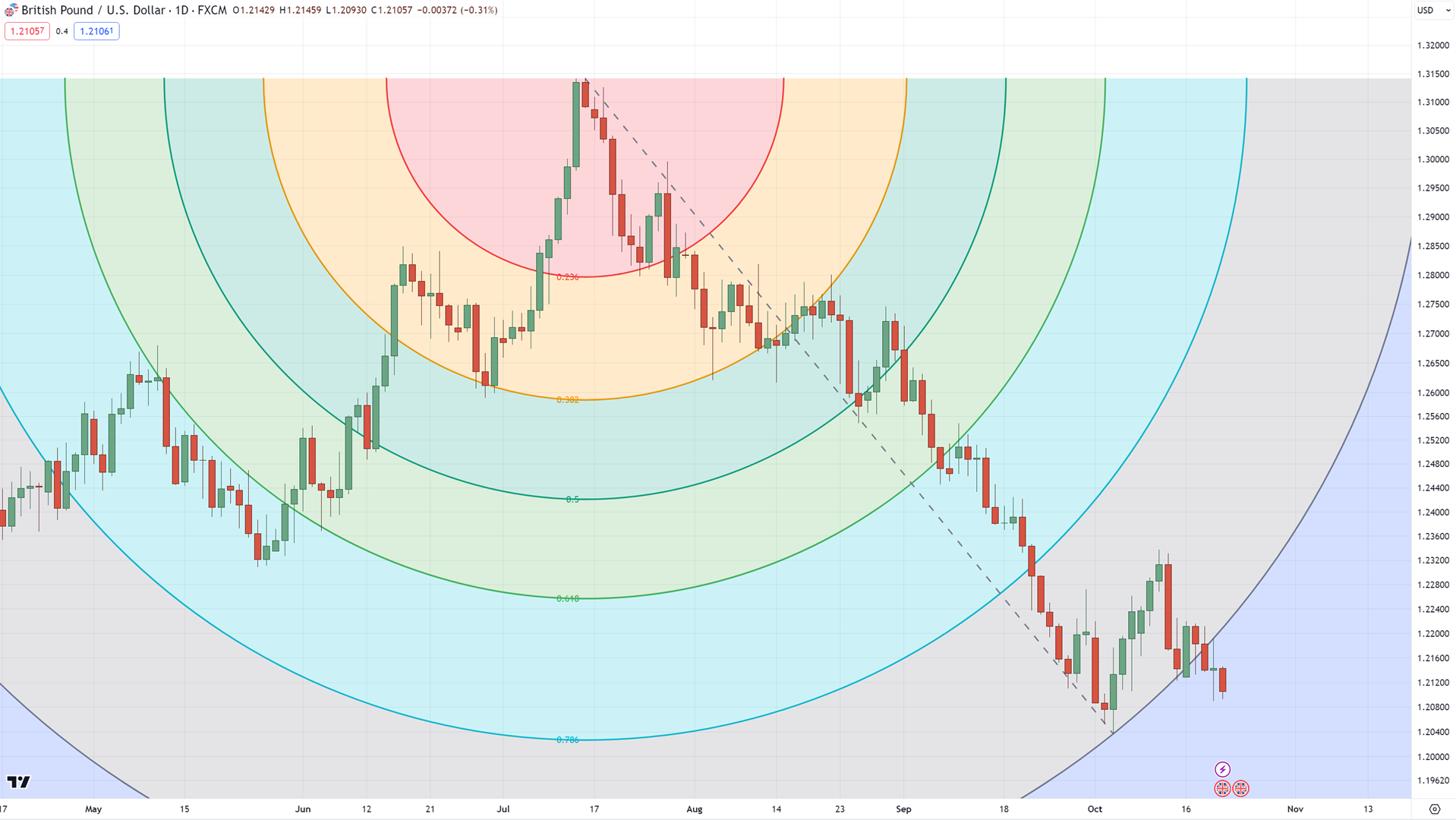

The Fibonacci Speed Resistance Arc…

And probably a helluva lot more Fibonacci special moves and shapes for trading out there which I still don’t know!

But… what if I told you, you only need to focus on the Fibonacci tool that matters?

And what if you dedicated some of your time to mastering it to the highest level?

Pretty exciting results could await, right?

Well, that is what I will teach you today!

A complete masterclass on how to use Fibonacci retracement…

It looks so clean on the chart, don’t you agree?

So, here’s a list of what you’ll learn today…

- How to use the Fibonacci retracement as a superpower to improve your current trading strategy

- How you can use the Fibonacci retracement to spot trading setups systematically and consistently

- The “secret” way to use the Fibonacci retracement to gauge market strength and weakness

- A fool-proof method for choosing which Fibonacci levels to trade for pullback trading

- The secret to timing and managing explosive breakout trades with the Fibonacci retracement

- How to trade Fibonacci retracement on range markets so that you never end up on the wrong side of the chart

A pretty straight-to-the-point guide, then!

And by the way…

I suggest you read these guides first, just to prepare yourself before we get started on this one:

The Essential Guide To Fibonacci Trading

How to Draw Fibonacci Retracement: A Step-by-Step Guide for Traders

Are you ready?

Then let’s get started!

How To Use Fibonacci Retracement To Improve Your Trading Plan Instantly

Here’s how this is going to go…

I want to make sure that when you finish this guide, your trading plan is still intact.

No big upheavals, no huge modifications.

But how do I ensure this?

It’s Simple.

You start by checking whether or not the Fibonacci retracement is for you!

So, this tool is for you if you’re a…

Price action trader

Whether you trade the 1-hour or the daily timeframe, it doesn’t matter.

If you can analyze trends and areas of values free of indicators…

And be able to identify swing highs and lows…

Then, boy, you’re going to love knowing how to use Fibonacci retracement!

If you’re still having a hard time identifying those, you can always check this out later, too.

OK, next, Fibonacci retracement might suit you if you’re the type of trader who…

Only uses minimal indicators

If this is the case, then this masterclass is definitely for you.

Imagine having indicators on your chart…

And then having to add Fibonacci retracements…

Err, it goes without saying – that chart looks ridiculously busy!

You’d be right in thinking there’s too much going on.

So if you want to use the Fibonacci retracement, use minimal indicators and keep your charts simple.

Alright, now that you understand whether this is for you or not… where does the Fibonacci retracement actually come in?

How can it improve your trading plan?

How to use Fibonacci retracement to have killer-accuracy trading setups

Spot a trending market?

Simple, wait for a price rejection at the 38.2% retracement!

How about a ranging market?

Only focus on the 78.6% level buildup and avoid the middle!

(I’ll talk more about this later)

You see, the Fibonacci retracement is a pretty versatile tool in any market condition!

This means that in any market condition, you have a setup.

Makes sense?

Now don’t worry, my friend!

This section is just a taste of what’s to come, as I’ll share with you complete strategies that relate to those setups.

Next up…

Another way to understand how using Fibonacci retracement can improve your trading plan is this:

You’ll be able to accurately determine how you should manage your trade.

OK, I hear your sensible questions…

“What?! Using the Fibonacci retracement to manage your trade?”

“How can that be?”

Don’t worry, my friend.

I’ll spill all my secrets in the next section.

How to use Fibonacci retracement to gauge the strength of any market

Here’s a fact you’re probably familiar with…

Not all trends are equal.

Heck, not even all ranges are equal!

There are clean trends….

And there are choppy ones…

So now the question is…

How do you know how strong or weak the breakout is before the breakout?

Interesting question, right?

To answer this, there are three “secrets” to consider:

- Increasing trend strength

- Decreasing trend strength

- Increasing range breakout

Let me explain…

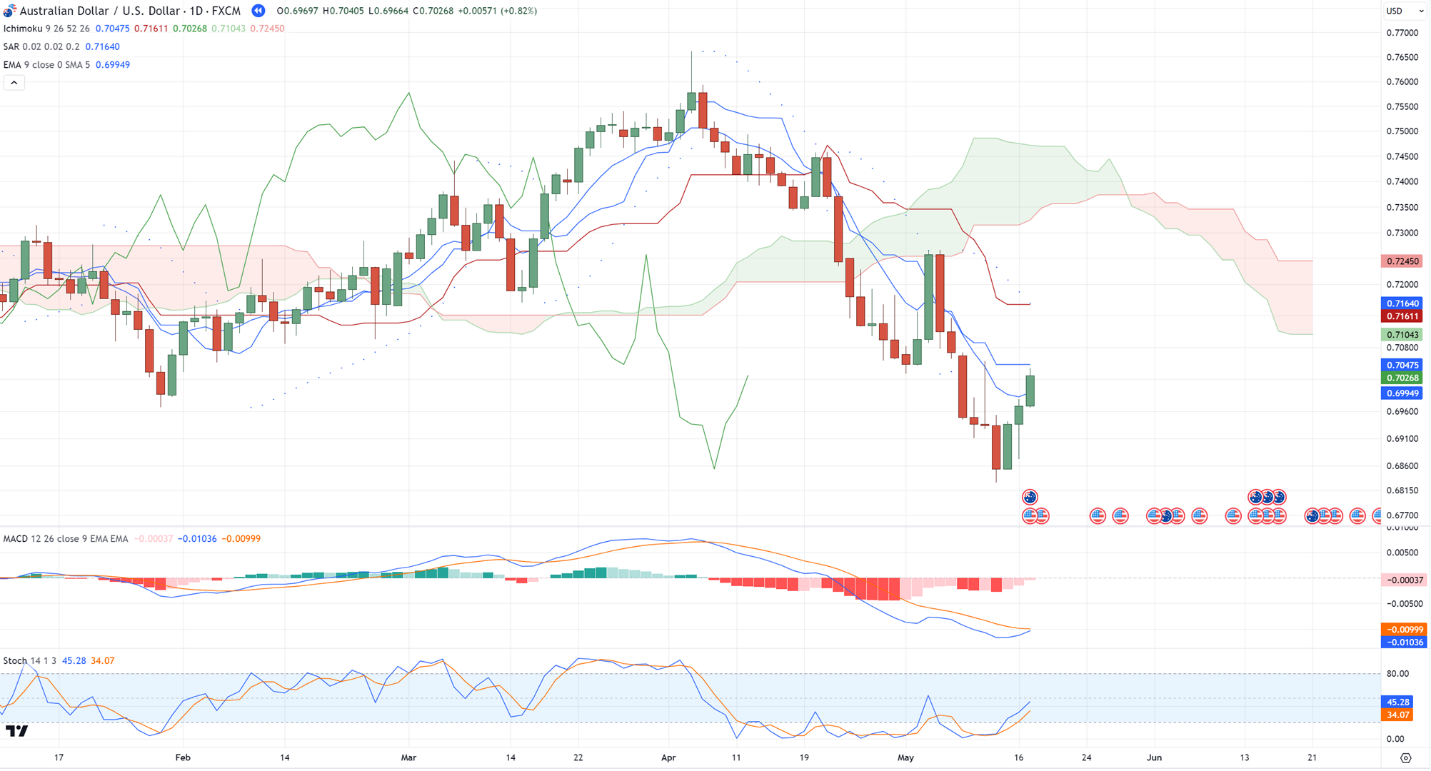

Increasing trend strength

To put it in simple terms, we want to know if the existing trend is getting stronger.

The key here is to look at the pullbacks in an existing trend and try to measure how far they have retraced…

If the last 2-3 pullbacks sustained above the 38.2% level…

…then it basically shows that the trend is healthy or, is about to get even stronger!

But there’s the other side of the coin, right?…

Decreasing trend strength

If the last 2-3 pullbacks are becoming steeper by constantly touching the 61.8% area…

…then the price tells us that the trend is getting weaker as the pullbacks get steeper.

Make sense?

OK, how about range markets?…

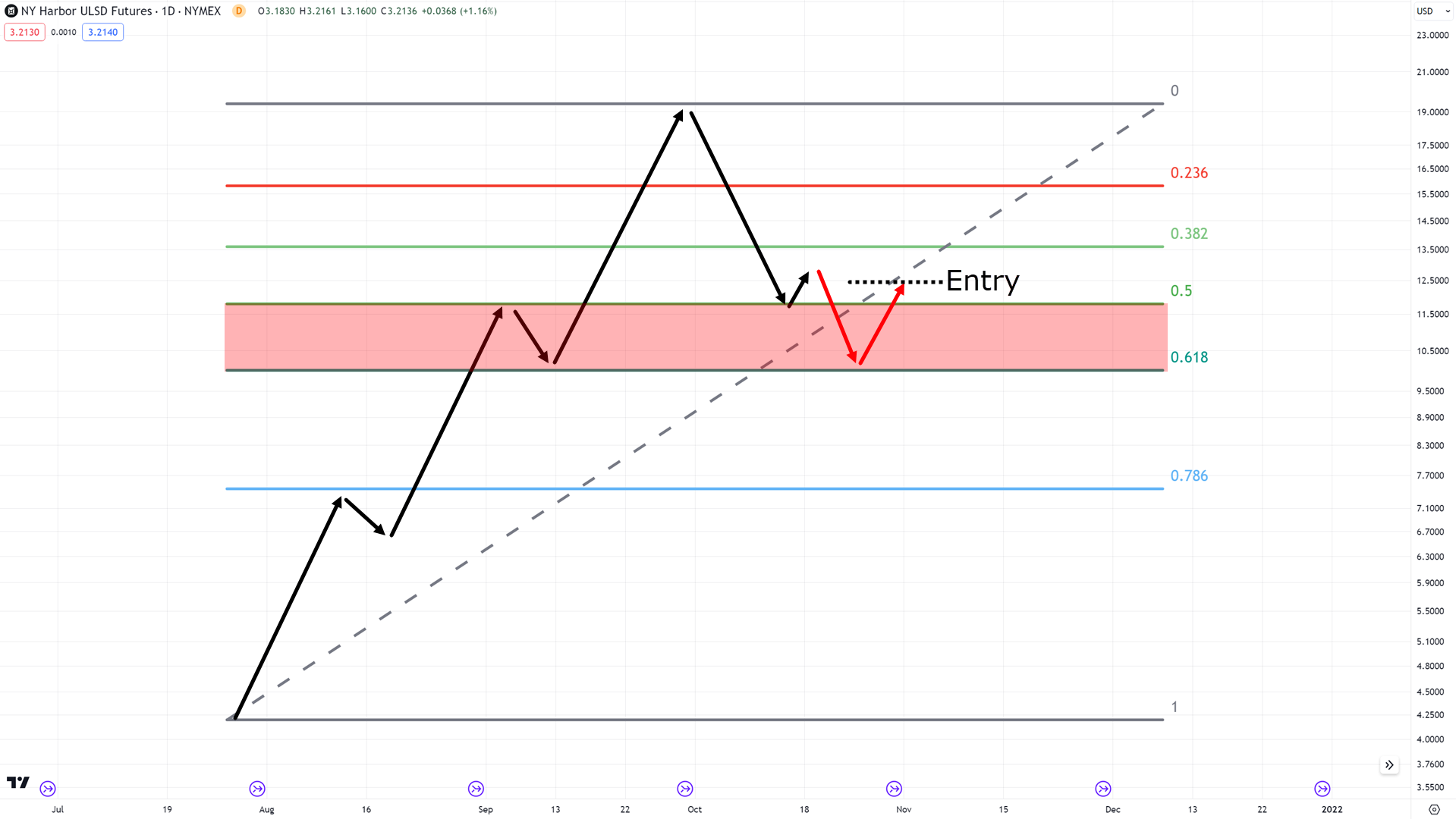

Increasing range breakout

Now, for all you know, a range market can last for months or even years!

It can keep chopping up and down, making false breakouts!

So how do you know when it’s about to break out?

Well, the trick here is first to plot your Fibonacci retracement in the range…

Then wait for a flag pattern to form above the 23.6% level or below the 78.6% level (depending on how you plot the Fibonacci retracement).

Here’s what I mean…

What exactly does this imply?

It means that if the price forms a flag pattern and sustains above the 23.6% level, for example, buyers are starting to “build up” right below resistance…

…which is often a sign of strength!…

And the same principle applies to sellers as well…

But overall, the bottom line is this:

You should check how the price reacts to certain levels of the Fibonacci retracement.

Why?

…so that you can determine the next potential move in the markets!

Make sense?

Well, take a few moments to look over the charts and explanations again.

After letting it sink in, you’ll probably be wondering…

“Okay, but how do we actually trade this?”

“What’s the strategy?”

“How do I use Fibonacci retracement using these concepts?”

And they’re great questions!

In the next two sections…

It’s time to get down to the nitty-gritty details.

Keep reading!

How to use Fibonacci retracement to trade and manage pullbacks in the markets

So, the perfect “season” to capture pullback trades is this:

When the price rejects around the 50.0% and 61.8% area…

This kind of action is exactly what you’re looking for.

Recall that if the price is rejected down to that area, the trend is potentially weakening…

But, what should you do?

You take your profits before the area of resistance…

A nice, clean, and simple swing trading setup!

Can you see that it works in principle?

But how does it work with real charts?

Let’s look at how to execute this setup step by step…

Step #1: Identify a long-term uptrend

“Duh, of course, we need an uptrend, any textbook can tell you…”

Yes, it may seem obvious…

But the reason why I’m pointing this out is that you need to know “when” you should use the Fibonacci retracement!

Picking the right moment is crucial for this setup.

To assist, a long-term moving average, such as the 200-MA would help…

198, 211, 230-period…

It doesn’t matter!

What matters is that you’re using a long-term moving average.

So, if the current price is above the long-term moving average, then you can move on to the next step…

Step #2: Wait for the price to retrace below 50.0% Fibonacci retracement

This is what you’ve been waiting for.

You want the market to come to our area and lead it into a trap down below the 50.0% level…

(P.S. If the price closes lower than 61.8%, then there’s a chance that the trend is reversing already.)

Alright so now they’re in play…

Step #3: Wait for a price rejection to enter the trade

Ready to spring the trap?

Great, because what you need to look for next is for the price to close back above 50.0%…

Then, enter at the next candle open!

For stop loss, you can simply subtract 1 ATR below the lows…

All good so far?

Well, now that it’s in place – how do you manage the trade?

Let’s take a look…

Step #4: Exit at the nearest resistance area

I live by the following golden rule:

“Always place your stops and take profits reasonably.”

In short, don’t be too ambitious and greedy with your risk to reward!

It’s precisely why you always want to take profit before the area of resistance…

Just there!

Now, of course, you’ve probably realized… This is a cherry-picked chart.

Like everything else, it isn’t a 100%-win rate, holy-grail strategy and there will be some losses.

But nevertheless, here’s what this setup looks like on the short side…

Alright!

Now, how about breakouts instead of pullbacks?

Because, if you recall, there are only two ways to enter trades (one of which I just shared with you).

It begs the question – how do you use Fibonacci retracement on breakout trades?

Well, buckle up – as that’s exactly what I’m going to show you!

How to use Fibonacci retracement to capture and ride explosive breakouts in the markets

Here’s the good news…

Once you’ve learned how to capture breakouts, you don’t have to pick between this and the pullback setup!

Why?

Well, both setups serve two different scenarios.

It means that you actually get two strategies to add to your arsenal!

So, how can you tell what makes this setup different from the last one?

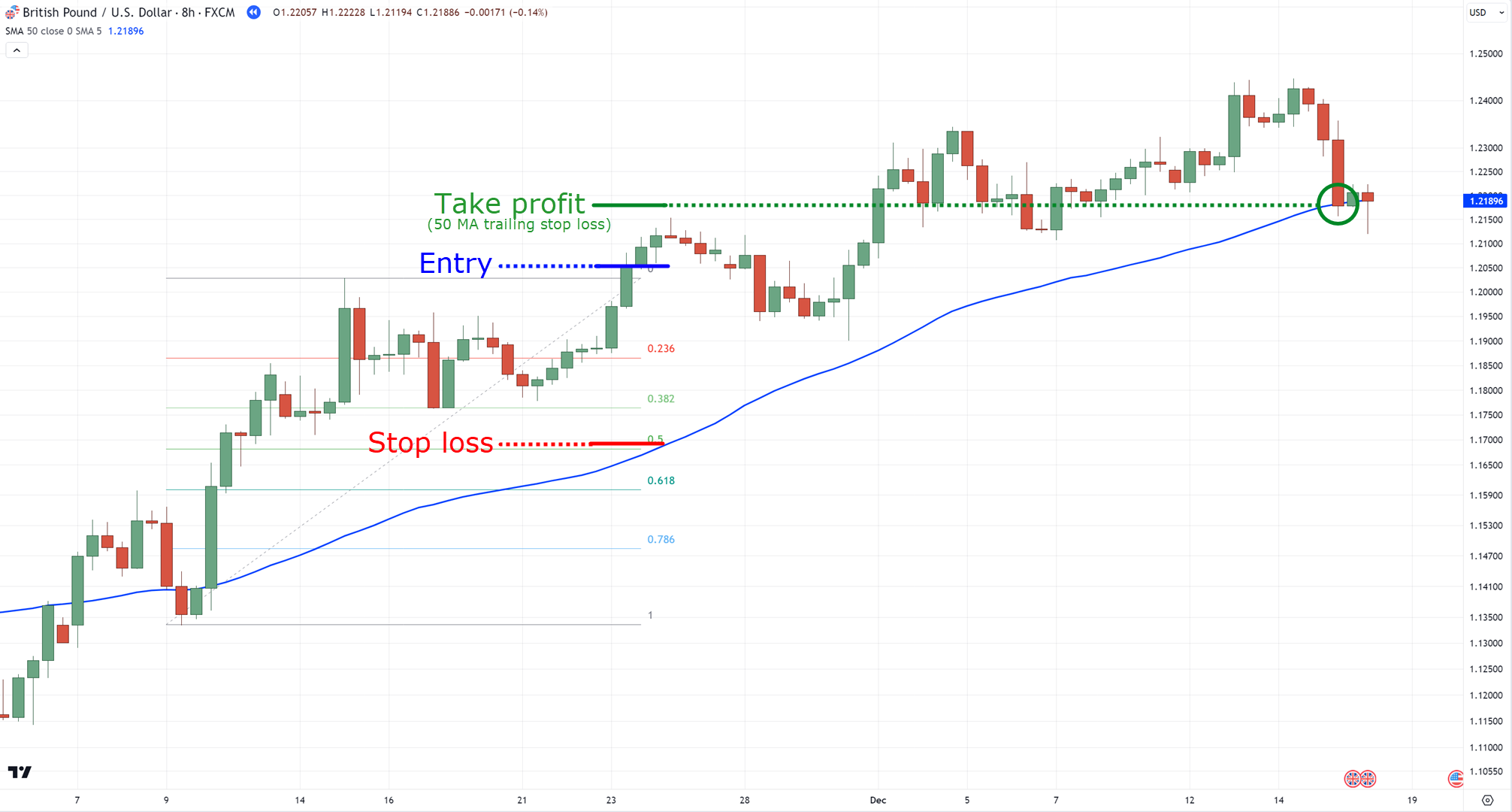

Step #1: Identify the medium-term trend

That’s right, you want to make sure you are looking at medium-term trends!

And the right tool to use here?

A 50-period moving average…

Again, whether it’s 55 or 63-period, it doesn’t matter!

All that’s important is that it’s a medium-term period.

Step #2: Wait for the price to hover around the 38.2% levels

If you recall…

When the price hovers around 38.2%, it means the market is showing signs of strength…

And it’s here, my friend, that you can see what makes this setup different!

As with pullbacks, I’m taking advantage of the trend’s weakness…

But with breakouts, I take advantage of the trend’s strength and momentum!

Step #3: Wait for the price to breakout above the Fibonacci retracement

In a nutshell…

You’re pretty much looking for a flag pattern breakout.

So, once it makes a strong candle breakout close…

You can then enter at the next candle open with stop loss 1 ATR subtracted from the nearest low’s price…

Can you see what I mean?

Well, I’ve made that as specific as possible.

So, feel free to refer back to this guide again when you want to implement this setup!

Step #3: Use a medium-term trailing stop loss to ride the trend

Remember the 50-period moving average?

Good.

Because instead of adding one more indicator to clutter our charts…

We can use the same indicator to trail our stop loss!

It means that you won’t exit the trade until the price closes below the 50-period moving average…

Make sense?

And once again, here’s what the setup looks like on the short side…

Alright then!

Now that I have shared with you how to trade trends, how about range markets?

How to use Fibonacci retracement in ranging markets to time breakouts with accuracy

I left this one for last.

Why?

Well, range markets can be challenging to trade, not least because they can expand and contract!…

Now the main question is:

How do you make sure that you always end up trading on the right side of the range?

Let’s find out…

Wait for the price to hover below the 38.2% level

Basically, wait for a bear flag pattern to form below the 38.2% level (in this case, we’ll use a short example)…

Pretty familiar, right?

It’s almost the same as the last setup, but we’re simply plotting the Fibonacci retracement in the highs and lows of the range.

To put it even more simply…

We’re trying to time the breakout of the range with a flag pattern.

That’s right – we’re not here to fight against the range!

Once it makes a breakout and you enter the trade…

…what’s next?

Use a 50-period moving average to trail your stop loss

OK, I can hear more great questions coming…

“50-period moving average again?”

“Why not the 20-period?”

“How about the 10-period moving average?”

Well, you see…

Whenever a price breaks out of a range, you’ll never know how strong or weak will the next move be…

Anything can happen!…

So, to give the market some room to find itself.

We’ll be using the 50-period moving average to trail your stop loss until the price closes below it…

Damn, what a big trade!

And there you go!

A complete trading strategy on how to use Fibonacci retracement both for trending and ranging markets.

And not only that…

I’ve also shared with you the principles behind them.

Not just the “how” but also the “why,” which is crucial to know!

So, with that said…

Here’s a summary of what you’ve learned:

Conclusion

When used correctly and in a simple way…

Knowing how to use Fibonacci retracement can be your all-in-one tool to trade trending and ranging markets.

And it’s exactly what I’ve shared with you today!

No complicated Fibonacci confluence, Elliot waves, or harmonic patterns.

Just plain price action with the Fibonacci retracement.

So, here’s what you’ve learned today:

- The Fibonacci retracement will fit your trading plan like a glove if you’re a price action trader and would like to keep your charts clean

- The tool allows you to have more efficient and clean trading setups across trending and ranging markets

- You can gauge whether the trend is slowing or strengthening by how deep the price retraces from the highs

- You can trade pullbacks by waiting for the price to reject beyond the 50.0% Fibonacci retracement level

- You can trade breakouts by waiting for the price to hover above the 38.2% retracement (or below 78.6%) and then breaking out of its flag pattern

- You can trade range markets by waiting for the price to hover above 38.2% (or below 78.6%)

Wow…

That’s a serious amount of knowledge, right?

So, with all that said and done…

Do you think you’ll make some tweaks on how to use Fibonacci retracement?

If not, how so?

Share your thoughts in the comments below!