Free eBook Download!Get A Simple 5-Step Momentum Trading Strategy

In the dynamic world of Forex trading, understanding the nuances of chart analysis is crucial. This article delves into the critical differences between horizontal lines and trend lines, two fundamental tools in technical analysis.

Horizontal lines represent static support and resistance levels, while trend lines dynamically capture market direction and movement.

Before we begin, thanks for visiting Trading Strategy Guides (TSG)! We are so glad you’ve found us. You have discovered the most extensive library of trading content on the internet. Our aim is to provide the best educational content to traders of all stages. In other words, we want to make YOU a consistent and profitable trader.

If you’re a brand new trader, we recommend hopping over to our ultimate beginner’s guide to trading to learn more.

We’ll explore how these tools vary in their application, significance, and impact on trading strategies. This article offers valuable insights for both novice and seasoned traders seeking to enhance their trendline Forex tactics.

Moreover, we aim to clarify these concepts, making them accessible and actionable for effective trading decisions.

What Is a Trendline in Forex?

A trendline in Forex is a crucial tool for traders who like to trade with lines. It represents a line drawn over pivot highs or under pivot lows to show the prevailing direction of the price.

Trendlines are a visual representation of support and resistance in any timeframe. They depict the speed and scope of price movements, aiding traders in identifying the direction of the trend and potential reversal points.

In Forex, a trendline’s break can signal a change in trend, making it an essential element for strategic planning in currency markets.

The Differences Between Horizontal Vs. Trend Lines

Understanding the differences between horizontal and trend lines is vital in the intricate real of trendline trading. This section illuminates these differences, offering insights into how each line works and their impact on trading strategies.

Whether you’re a novice or a seasoned trader, grasping these concepts is crucial for confidently navigating the Forex market.

Angle

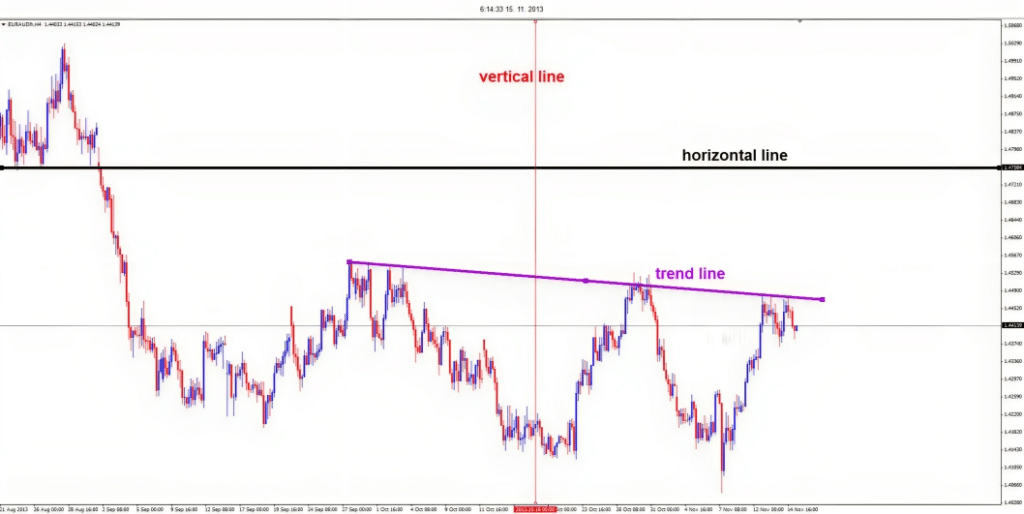

The first but very obvious difference is the angle of the lines. However, it is important to state the obvious and reinforce the concept.

- A horizontal line has no angle.

- A trend line has an angle that is above 0 but below 90.

- A vertical line has a 90-degree angle.

The angle of the trend line can vary from anything just above 0 to 89.99 degrees, which is close to a vertical line. Nevertheless, trend lines never have 89.99 degrees in practical, real-life situations. Anything from 5 to 60 is most common.

Moreover, the vertical line has no particular use in trending unless used on the charts for remembering a specific time or part of price action. We will focus on the trendline and horizontal lines for the remainder of the article. If interested, we also have training on trend line drawing with fractals.

Validity

The validity is another difference between a trend line and a horizontal line. A horizontal line could be placed at any support or resistance level that a Forex trader considers important. On the other hand, a trend line must have multiple touches to be considered valid.

Here is a summary of trend lines and their number of hits:

- At the minimum, there must be two hits/touches. Otherwise, it has no value.

- Three hits or more are the most valuable, as the third hit gives confirmation of the market respecting the trend line.

- A trend line with three hits or more could also be considered the base of a trend channel.

Horizontal lines also have more importance once price action respects that level multiple times, but it is not a prerequisite for validity. A horizontal line that has one price point is a support or resistance.

Moreover, a horizontal line with multiple points is potentially stronger support or resistance. It could be the top or bottom of a range. Also, feel free to read about stop loss order Forex.

Horizontal Vs. Trend Lines Trading

In theory, both horizontal lines and trend lines can be used for trading breakouts. Trading breakouts have significant advantages, primarily because traders avoid lots of moments where price action is indecisive.

Price action tends to consolidate most of the time, and trading breakouts give the advantage of entering when the market has a higher chance of moving in your favor.

One of the most challenging elements of trading is the psychological perspective. Let’s face it: trading is a mental game, and confidently implementing one’s trading plan is crucial.

Avoiding long-drawn-out sideways chops can undoubtedly help that psychological battle. However, it also allows for the optimal allocation of trading capital.

Forex traders who do not have their trading capital “stuck” in chop / sideways movement keep their ability to enter the market with the breakout opportunity of their choice. In contrast, others might have hit their maximum risk levels.

There is a difference between trading trend lines and horizontal lines. The angle is the primary focal point because there is also a difference between trading shallow, regular, and steep trend lines.

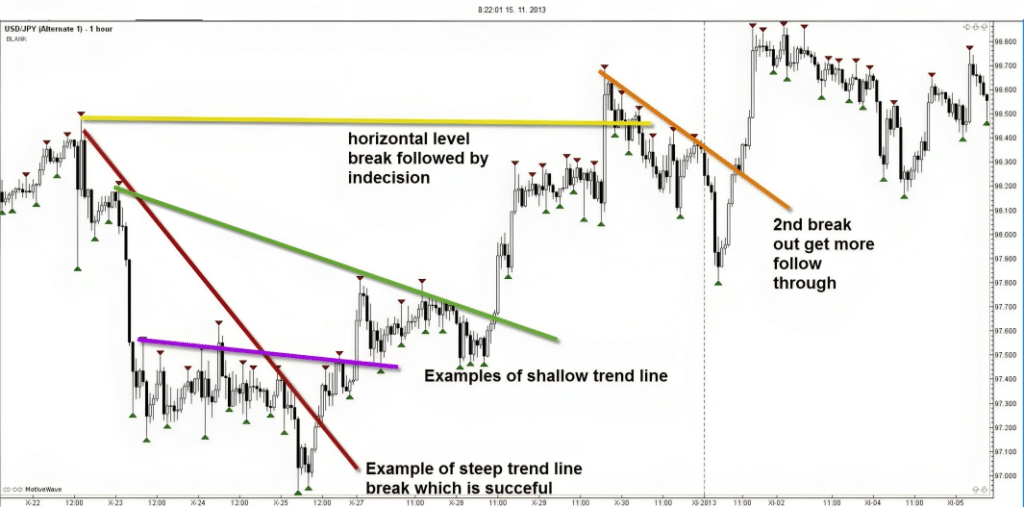

Steep Trend Lines (More than 40 Degrees)

Price action is moving with a lot of momentum. Otherwise, the trend line could never be that steep. A break of this line indicates that this considerable momentum is stopping, but usually, it’s only temporary.

Usually, price corrects the angle of the trend before it continues with the trend. In general, these trend lines are great as a trailing stop and are an excellent method of making a profit upon a break.

Some steeper trend line breaks see a reversal, and trading those to the opposite side is profitable. This primarily happens when a 4-hour chart shows a trend and the smaller time frames are moving in a steep correction. A break of that steeper counter-trend line has a higher chance of succeeding.

Regular Trend Lines (10-40 Degrees)

Price action is moving at a well-balanced angle but mostly weaker as well. The market is showing exhaustion to one side, and the price is moving correctively in these cases (as the angle suggests). A break of the trend line indicates the end of that corrective movement.

However, These trend lines still have plenty of space towards the next bottom or top (support or resistance), which is the primary reason why the breakout is often less volatile than trend lines with a shallow angle or horizontal trend lines.

All breakouts tend to have their ups and downs before a one-directional price action occurs, but regular trend lines are the most “stable” in their breakouts.

The “stable” breakout will lead a good run in one direction before the currency bottoms or tops out on the lower time frames. Therefore, using a tighter stop loss has a higher chance of succeeding here than in other examples.

At that moment, there is a good chance of a hookback or pullback to the price level of the broken trend line, but only after a good-sized price moment has been made. Both the breakout (strike) and pullback (boomerang) are trade setups that the Winners Edge Trading room uses.

Shallow Trend Lines (0-10 Degrees)

Price action is moving at a weak angle. The market can hardly move away from the top or bottom, and the correction is very timid.

A trend line break also indicates the end of that corrective movement. Still, there is one crucial difference: tops and bottoms (support and resistance) are close by, and this could make the breakout short-lived before price action respects those levels.

In our trading room, we have a simple solution to ensuring that we have an appropriate reward to risk when tackling these trades. This helps take away the subjectivity from the decisions. Remember, always keep your approach to trading as simple as can be.

Due to this lack of space for the next support or resistance, price action often moves choppier than usual. Forex traders are not willing to make a trade right in front of these levels, so many ups and downs are usually accompanied by this environment. Our trading room also has guidelines on how the breakout should proceed.

Horizontal Lines (0 Degrees)

Price action has broken the top or bottom, which means that one support or resistance is out of the way. However, there are cases when, even though one support and resistance has been broken, there is another one right above/below it. That could cause an unexpected and sudden (opposite) turnaround.

Often enough, the break of the horizontal level is accompanied by lots of volatility and sudden moves up and down. The breakout will see some follow-through, but often enough, this potential is limited as price action wants to hook back to the broken horizontal level.

Very frequently, the currency makes a retracement after this breakout. This retracement could even turn into a full-fledged reversal. With horizontal levels, it is safer to trade the second breakout or continuation trade setup, which occurs when a breakout and pullback have already occurred.

Before you go, feel free to read our article about how to find opportunities in Forex.

Final Thoughts

Mastering the use of horizontal and trend lines is a pivotal skill in Forex line trading. While both tools are vital components in trading strategies, their unique characteristics and applications offer distinct advantages.

Understanding the intricate differences between these lines empowers traders to make more informed decisions, harnessing their strengths in market analysis and execution. This knowledge forms the foundation for developing robust trading strategies tailored to the ever-changing dynamics of the Forex Market.

Do you recognize the aspects of the horizontal line and trend line yourself during forex trading? What do you think of trend lines and their angle? Let us know down below!

Have a great weekend, and thanks for sharing the article!!

Thank you for reading!

Please leave a comment below if you have any questions about horizontal vs. trend lines!

Free eBook Download!Get A Simple 5-Step Momentum Trading Strategy