Like me, I’m sure you found yourself wondering… “What does volume mean for my trades, and how do I understand it?”

Analysts and traders often talk about volume, but it can be hard to figure out how to use it when making trading decisions.

The truth is that volume holds secrets….

…that can provide valuable insight into market movement…

So, to unlock the mysteries of market momentum, I present you with…

…the On-Balance Volume (OBV) indicator!

In this mastery article, you’ll:

- Discover how On-Balance Volume provides precise information and early warning signs in diverse market conditions.

- See how OBV confirms trends and offers insight into potential momentum shifts.

- Use practical examples to make use of differences with OBV

- Learn the limitations of the OBV indicator and how to manage expectations to trade effectively.

Are you ready to begin your journey – unlocking the potential of the On-Balance Volume indicator?

Let’s dive in!

What is OBV?

The on-balance volume (OBV) is a significant indicator which measures the flow of volume in and out of a stock or other asset.

It can be even be used to forecast changes in asset prices by analyzing volume flow…

To start understanding OBV, let’s look at how it is calculated for a daily timeframe:

If the closing price is higher than the previous day:

OBV = Previous OBV + Current day’s volume

If the closing price is the same as the previous day:

OBV = Previous OBV + 0

If the closing price is lower than the previous day:

OBV = Previous OBV – Current day’s volume

This calculation involves adding volume to the running OBV total on days when the asset’s price increases and subtracting the day’s volume when the price decreases.

So… while OBV generally mirrors the price trend, its advantages shine when it deviates from the price chart.

Let’s break down the OBV using Visa’s daily chart…

Visa Daily Chart OBV Example:

Here, the OBV currently sits at 2.469 billion (B).

In OBV analysis, if the price moves up, the volume of the following day is added; if the price moves down, it’s subtracted.

With cumulative OBV at 2.469B, it suggests an uptrend.

Let’s take a look at the next day…

Visa Daily Chart OBV Day 2:

In this case, the next day sees a volume of 4.148 million (M) with a red candle, indicating a down day.

This requires subtracting the day’s volume from the previous day’s OBV:

Yesterday’s OBV: 2.469B

OBV = 2.469B – 4.148M = 2.464B

Now take a look at the next day to reinforce the concept…

Visa Daily Chart OBV Day 3:

On the third day, a bullish candle emerges, prompting the addition of the day’s volume to yesterday’s OBV:

OBV = 2.464B + 3.843M = 2.468B

In this theory, volume is significant as a primary market mover.

Major shifts often correlate with volume changes, a bit like a spring propelling prices in a certain direction…

OBV offers insight into crowd sentiment, helping predict bullish or bearish outcomes at critical chart points.

What Type of Indicator is the OBV?

The On-Balance Volume (OBV) indicator falls into the category of a momentum indicator, specifically designed to track the momentum of volume on a price chart…

On-Balance Volume Indicator Layout:

Positioned as an oscillating indicator at the bottom of the trading panel, OBV stands out from fixed-value indicators like the Relative Strength Index (RSI)…

This is where the cumulative value comes from, as every candle closure volume is added or subtracted from the previous value.

Type of Assets: Suitable for All Markets

While OBV was originally created with stock trading in mind, it has proven to be a versatile and valuable tool for trading in all markets.

In the context of the forex market, though, where trading happens in a decentralized way, the accuracy of volume data often faces challenges.

Unlike stocks, the forex market lacks a primary exchange to consolidate all transaction data into a single ledger…

As a result, the precision of data for currency trades during a specific period is less than that of stocks.

Due to the decentralized nature of the forex market, there is a possibility of encountering false signals when using OBV.

However, despite this drawback, OBV generally provides an accurate indication of volume trends, offering valuable insights for traders!

Trend Confirmation

Another application in which On-Balance Volume (OBV) serves as a valuable tool is trend confirmation.

Despite its simplicity, it can provide crucial insights into the alignment of price trends with volume dynamics.

Let’s explore an example showing how OBV can confirm a trend.

Here’s an example of a strong trend vs. the OBV indicator…

In the chart above, look at how both the OBV and the price action show strikingly similar behavior!

This alignment is a strong indication that the volume behind the trend corresponds to that of the price action…

And actually, this correlation provides a reassuring sense of confidence!

Whether you are looking for a buy entry on a lower timeframe or are already in a buy trade, knowing that the trend and momentum are in sync can greatly boost your trading decisions.

After all, it’s confirmation that the strength of the trend supports your trading idea!

Exploring Trend Breaks with On-Balance Volume (OBV)

Another valuable application of On-Balance Volume (OBV) is observing trend breaks.

This approach is similar to trend confirmation but focuses on detecting shifts in volume momentum when a trend break occurs.

It can be a useful tool for traders looking for support when starting new trades.

Now, this strategy is most effective on higher timeframes, where trend breaks hold greater significance.

Let’s explore this idea using a real-world example, considering the scenario of trading stocks.

This time, let’s examine the 4-hour timeframe chart of Amazon…

Amazon 4-Hour Timeframe Price Chart Downtrend Break:

In the chart above, the downtrend in Amazon is highlighted by the broken trendline, right?

This signal alone might suggest a shift in price action and the start of a new trend.

But how could you enhance confirmation…?

Thats right!

You could turn to the OBV!…

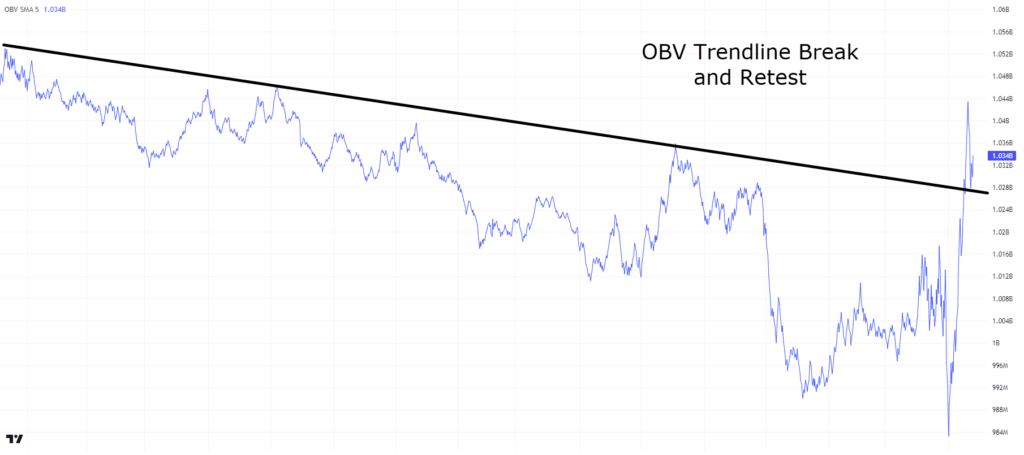

Amazon 4-Hour Timeframe OBV Chart Downtrend Break & Retest:

In the OBV chart, you can see the OBV responding to the recent downtrend break.

It’s worth noting that the volume surges as the trendline is broken, indicating increased activity during this pivotal moment.

In addition, the volume retests the trendline before experiencing a bounce.

Comparing these two charts side by side strengthens the argument for considering a technical buy on Amazon stock.

So how about it?

What do you think occurred after the trend break?…

Amazon 4-Hour Timeframe Price Chart New Uptrend:

Well, look at that!

Following the trend break, Amazon begins a new uptrend on the price chart!

Those who entered the market based on the confirmation provided by the trend break, coupled with other relevant entry triggers, would have successfully captured Amazon’s most recent uptrend.

However, it’s crucial to highlight that while a trend break offers valuable confirmation, it might not always be enough to act as a standalone trigger for executing a trade…

There needs to be integration with other technical and fundamental analysis tools that can enhance the robustness of your trading decisions.

As with any indicator, their real strength lies in combined use – within a comprehensive trading strategy.

Divergence Trading

So, divergence is one of the main ways I like to use OBV.

Divergence trading is a strategy that leverages the On-Balance Volume (OBV) indicator.

In this section, you can take a look at some actionable examples and see a step-by-step process for how to carry them out.

Now, what exactly is divergence trading?

Divergence occurs when the price movement diverges from the OBV, signalling a potential shift in the market dynamics…

Being able to recognize divergence is crucial, as it helps predict potential reversal points in the market.

I’ll show you this concept with a detailed example of the AUD/CAD pair, highlighting a divergence between the indicator and price…

AUD/CAD 1-Hour Timeframe Chart Downtrend:

Take a closer look at the chart…

You can agree that the price exhibits a robust downtrend in this scenario!

In this kind of downtrend, traders can use the OBV to identify a bullish divergence—a signal that the price might be ready to transition from a downtrend to an uptrend.

So, how would this bullish divergence show itself with OBV?

Well, first, the price needs to be making lower lows…

AUD/CAD 1-Hour Timeframe Chart Lower Lows:

Now that you have the price forming lower lows, let’s take a look at the OBV and see if it’s doing the same – or – creating a divergence…

AUD/CAD 1-Hour Timeframe Chart OBV Divergence:

Examining the OBV chart for the AUD/CAD pair in the 1-hour timeframe, you can spot a crucial divergence!

While the price forms lower lows, indicating the ongoing downtrend, the OBV chart tells a different story… as it forms higher lows!

This difference suggests a potential shift in volume momentum – favoring the bulls, and hinting at fatigue in the prevailing downtrend.

Let’s take a look at what occurs from this point…

AUD/CAD 1-Hour Timeframe Chart Uptrend:

As expected, the following price action validates the OBV divergence signal!

You can see the downtrend loses momentum, and a new uptrend emerges on the 1-hour timeframe.

At any rate, this example shows how OBV, when used together with the overall market context, can serve as an early warning tool – identifying trend reversals and getting ahead of a developing trend.

In fact, this technique isn’t just useful for entering trades; it’s also great at managing your existing trades effectively, too!

Let’s use this same AUD/CAD example but in a different context…

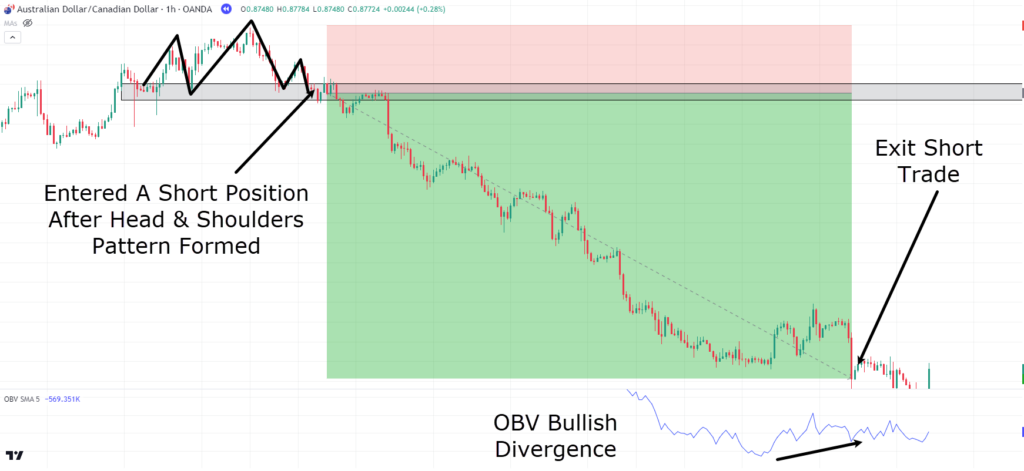

Consider a scenario where you’ve initiated a short trade on the AUD/CAD pair, guided by a head and shoulders pattern and a convincing break and retest of a key support level…

AUD/CAD 1-Hour Timeframe Chart Short Trade:

As the price follows a downtrend, a noteworthy development unfolds on the OBV chart—it begins an upward shift.

This happens even as the price continues to form lower lows.

It’s this shift in OBV, acting as an early warning signal, that could prompt a decision to take profits from the short trade or tighten your trailing stop-loss.

It’s all about safeguarding capital while expecting a possible price reversal.

Understanding when to exit a trade before momentum makes a decisive shift is a vital aspect of trade management.

By combining divergence analysis for both entry and exit strategies, you not only improve the accuracy of your entries – but also get valuable insights into the best time to secure profits.

This complete trade management approach equips you with the tools needed to confirm exits precisely, maximizing your profit potential and raising your overall trading strategy.

Let’s delve into another example to get a better grip on this powerful technique.

Take a look at this AUD/USD daily chart…

AUD/USD Daily Chart Support Level:

Examining the daily chart of AUD/USD, a support level becomes apparent.

This level, where the price experienced a notable bounce, could hold significance for future price action.

Let’s continue on…

AUD/USD Daily Chart Support Level Retest:

As expected, the price revisits the support level and shows signs of rejection, which matches up with the idea of buying at a support level.

The conventional approach for many traders would mean looking at this as a prime buying opportunity, right?

It does make sense on the surface. However, a nuanced viewpoint emerges when we integrate On-Balance Volume (OBV) and our divergence strategy…

In particular, the price on the chart hasn’t formed a lower low at this point.

For the sake of exploration, let’s assume you’re looking for additional confirmation that OBV provides before committing to the buy…

AUD/USD Daily Chart Support Level Broken:

And so – the story gets even more interesting!

The price has broken the support zone, potentially leading to stop-outs for those who entered long positions with tight stops beneath the support level.

Luckily, you weren’t one of them!

The divergence strategy with OBV comes into play…

The lower low on the price chart aligns with a higher low on OBV, presenting a classic divergence setup.

This scenario presents a pretty powerful opportunity to consider a long position.

However, before impulsively initiating a buy, another critical question arises…

How can you be certain that this level will act as support again?

As stated earlier – you can’t just blindly enter trades every time there is an OBV divergence, right?

What if, instead, you choose to wait for price confirmation — a reclaiming of the support level following the identified divergence?

Let’s delve into the subsequent price action to unravel the outcome…

AUD/USD Daily Chart Support Level Reclaim:

Looks like it was a fake out!

So what arguments do you have now to enter a trade?

The divergence between the lower low on the price chart and the higher low on OBV has been proven correct…

On top of that, OBV has sustained its momentum after printing the higher low…

Crucially, the price has not only rebounded but has also reclaimed the daily support level.

This serves as a compelling argument for a potential entry into a long position!

To test it out, let’s place the stop loss beneath the previous fakeout.

If the price were to form a lower low, it would invalidate the analysis, and the significance of the support level would diminish….

Let’s see how your trade turned out…

AUD/USD Daily Chart Take Profit:

Congratulations! The trade was executed successfully, with profits taken at the previous highs!

The use of OBV divergence, coupled with other technical analyses, greatly strengthened your decision-making process.

You can see how, when combining OBV divergence with other simple technical analyses, it’s possible to create better arguments for when you should enter a trade.

This example provided you with insight into how to time the entry using divergence and other signals to get the confirmation needed to achieve the best possible success!

However, it’s also important to point out that buying at support before the lower Low was a viable option!

Using the OBV you could still see that the volume momentum was shifting, and although the price went a touch lower, it still could have been used to make a successful trade.

So, in this final example, you will see a realistic scenario that highlights the importance of managing expectations and risk in trading….

GBP/JPY 1-Hour Timeframe Chart Divergence:

The GBP/JPY 1-Hour Timeframe chart presents a seemingly favorable set-up—a bullish divergence.

Price is forming a lower low while the OBV is forming higher lows, too!…

GBP/JPY 1-Hour Timeframe Chart Support Level:

On top of all of that, the price is also rejecting a well-established support level.

Every time the price has come into this zone – it has bounced.

Entering the trade at this juncture seems logical, considering the combination of multiple positive factors, right?

Let’s take the trade…

GBP/JPY 1-Hour Timeframe Chart Support Level:

Oh no!

Err, how could this happen??

You followed all the right steps…

You executed the trade after the lower low formed, and the price established a higher low on OBV…

Considering that the price was adhering to a support level, what caused this trade to hit the stop loss?

Well, the straightforward and honest answer is the same as it always is…

…not all strategies are going to yield success every time!

It’s crucial to emphasize though, that by placing a stop loss, you successfully limited the trade’s risk, preventing it from incurring more losses than necessary.

Now, let’s delve into what unfolds after the stop-out!…

GBP/JPY 1-Hour Timeframe Chart Summary:

So, the price faked out and retraced to test the support before continuing its upward movement, aligning with our original trade plan!

While this might feel a bit disheartening, it’s vital to remember that these things are just part and parcel of trading.

Also, consider the timeframe you’re looking at here.

The 1-hour timeframe tends to exhibit fewer reliable divergences compared to the 4-hour and higher timeframes….

And, in this situation, you had options…

You could have re-entered the trade when the price consolidated above the support zone, with its multiple bullish divergences…

Alternatively, you could have opted to step back and scout for another promising setup…

It would help if you always remembered, that there are countless setups across various timeframes.

So, take a moment to relax…

Acknowledge that setups won’t always unfold perfectly!

The real key lies in adapting and fine-tuning your strategy to harmonize with the market, rather than resisting it.

Taking this approach will undoubtedly lead to greater success!

Limitations

Importance of Volume:

OBV’s effectiveness is closely tied to the volume of an asset.

In situations where assets experience low trading volume, OBV indicators may struggle to generate meaningful signals.

Consideration for Asset Choice:

Assets with limited volume flow might not be the optimal choice when employing OBV strategies.

While OBV can still function with lower-volume assets, higher-volume assets provide a more robust overview of overall market dynamics without sudden changes in momentum.

Divergence Signals Rarity:

OBV typically aligns closely with the market flow, tracking price action.

As a result, occurrences of divergence, which signify a shift in market momentum, can be infrequent.

To increase the likelihood of identifying divergence signals, traders might think about applying OBV across multiple assets and markets, casting a wider net.

No Guarantees of Success

Like any indicator, relying solely on OBV may not always yield consistent results!

Incorporating OBV into a broader strategy that includes elements such as support and resistance, moving averages, or a trader’s developed strategy increases the likelihood of successful trades.

In summary, while OBV is a valuable tool for analyzing market dynamics, traders should be mindful of its limitations.

Asset dependency, the rarity of divergence signals, and the need for complementary strategies really highlight the importance of a wider and more diversified approach to trading.

Unreliable On Low Timeframes

Another vital consideration to bear in mind is that the reliability of OBV diminishes as you move to lower timeframes…

This isn’t to say that it’s ineffective for shorter durations, but, as shown in the example, there’s a greater chance of finding multiple divergences before the direction you want finally materializes.

While this still provides traders with early insights into upcoming shifts in momentum, pinpointing an entry based on lower timeframes does become more challenging.

This is particularly so when a divergence observed on the daily timeframe carries significantly more weight than one on the 30-minute or 1-hour chart.

Conclusion

In conclusion, the On-Balance Volume (OBV) indicator emerges as a remarkably valuable tool, offering traders a deeper understanding of how volume influences the market.

This indicator can serve as a guide to detect shifts in market momentum, meaning easier identification of trends as they start to get weaker.

The combined use of OBV alongside other technical analysis tools further increases the chance of success by aligning multiple favorable signals in support of a trade idea!

So, throughout this article, you have gained valuable insights into the direct relationship between volume and price action – giving you a competitive edge in the market.

To summarize your journey:

- Gaining a better understanding of what OBV is and how volume influences market momentum.

- Exploring the application of trendlines on both OBV and Price, offering extra confirmation of momentum shifts and enabling you to trade with increased confidence.

- Learning about OBV divergence and its hidden potential assists – in managing existing trades while identifying new entries at crucial market points.

- Understanding the limitations of OBV, giving you the knowledge to manage active trade situations that may not go as planned, and fostering realistic expectations.

All in all – Congratulations!

You have added another invaluable tool to your trading arsenal!

Armed with this newfound knowledge, I encourage you to test out these strategies on your charts and discover what brings you the most success.

Now, I’m curious to hear your thoughts on the On-Balance Volume Indicator…

Do you believe OBV divergence can help pinpoint your entries?

Have you previously incorporated OBV into your trading strategy?

Feel free to share your insights in the comments below!