Forex lot sizes can seem like a bit of a mystery from the outside.

Although often overlooked, they play a crucial role in effective forex trading.

Truly understanding them can help you manage risk, leading to gradual, more reliable account growth.

In fact, I often get asked about lot sizes and the best ways to work them out…

…which is exactly why I made this guide!

So in this article, you’ll cover:

- What exactly forex lots are

- A clearer understanding of pips and their role in lot sizing

- Suitable lot types for various account sizes

- Practical examples showing how to calculate lot sizes using charts

- Useful tools for quick lot size calculations

Are you ready?

Then let’s dive in!

What is a forex lot?

A forex lot is the size of a position you take in the forex market, long (buy) or short (sell).

There’s a parallel concept in traditional stock trading.

Just as the number of shares bought determines the position size in stocks…

…lot sizes tell you how many currency units are in a forex trade.

Let’s compare by using a stock market scenario.

Say you invest in a company and purchase 10,000 shares at $1 per share.

The total value of your investment is simply 10,000 shares multiplied by $1, which equals $10,000.

Your quantity is 10,000 shares, and your investment is $10,000.

Now, imagine you’re trading currency pairs instead.

If you buy 1 Standard lot of the EUR/USD currency pair, which is 100,000 units of the base currency (in this case, the euro), your position size equals 100,000 euros.

Alternatively, purchasing 1 Mini lot of that same currency pair, 10,000 units of the base currency, means your position size is 10,000 euros.

As you can see, lot sizes simply determine the volume of currency units involved in the trade.

To truly grasp lot sizing, though, it’s important to understand the concept of pips…

Understanding Pips

Pips, short for “percentage in points” are the universal unit of measurement in forex trading.

They indicate the smallest price change in the exchange rate of a currency pair.

For most currency pairs, one pip means 0.0001 – except for pairs involving the Japanese yen, which I’ll discuss shortly.

Let’s check it out in an example.

Suppose you’re trading the EUR/USD currency pair, and the current exchange rate is 1.2000.

If the exchange rate moves from 1.2000 to 1.2005, it has increased by five pips.

On the other hand, if it moves from 1.2000 to 1.1995, it has decreased by five pips.

Got it?

Trading currency pairs involving the Japanese yen is different, though, due to its relatively low value compared to other major currencies.

In this case, one pip is equivalent to 0.01 rather than 0.0001, so you’ll need to adjust your math.

For example, imagine trading the AUD/JPY currency pair, where the exchange rate is 80.00.

If the exchange rate moves from 80.00 to 80.09, it has increased by nine pips.

Similarly, if it moves from 80.00 to 79.91, it has decreased by nine pips.

Did you notice the difference? (check the decimal places!)

Great – then let’s move on!

Different Types of Lot sizes

Forex brokers offer various lot sizes – for traders with all kinds of risk preferences and account sizes.

Basically, there are four different types of Lot Sizes:

- Standard Lot: 100,000 units of the base currency

- Mini Lot: 10,000 units of the base currency

- Micro Lot: 1,000 units of the base currency

- Nano Lot: 100 units of the base currency

Standard Lot: Preferred by institutional investors and experienced traders due to its substantial size, allowing significant exposure to the market.

Mini Lot: Mini lots are suitable for traders with smaller account sizes or those who wish to trade with less capital at risk.

Micro Lot: Micro lots are popular among novice traders and those with limited trading capital, as they enable precise risk management and smaller position sizes.

Nano Lot: The smallest lot size available, Nano lots are ideal for practicing trading strategies or executing trades with minimal risk.

It’s worth noting that orders can be placed at a fraction of 1 full lot, regardless of its type, allowing for precision in position sizing (e.g., 0.54 Lots).

Take a look at the following table…

Note that Pip Value will always be in the quote pair currency, and most major pairs will be quoted in divisions of $10.

This Pip Value indicates how much your profit or loss will change with one pip movement…

For example, if you’re trading 1 Standard lot and the price moves 5 pips in your favor, you’ll gain close to $50 in profit, minus fees and spreads.

On the other hand, if you were trading a Micro lot, the same 5-pip movement would result in only $0.50 in profit.

So, when using calculators to determine lot size, it’s crucial to consider the pip value for the specific lot size you’re using!

Let’s take a closer look…

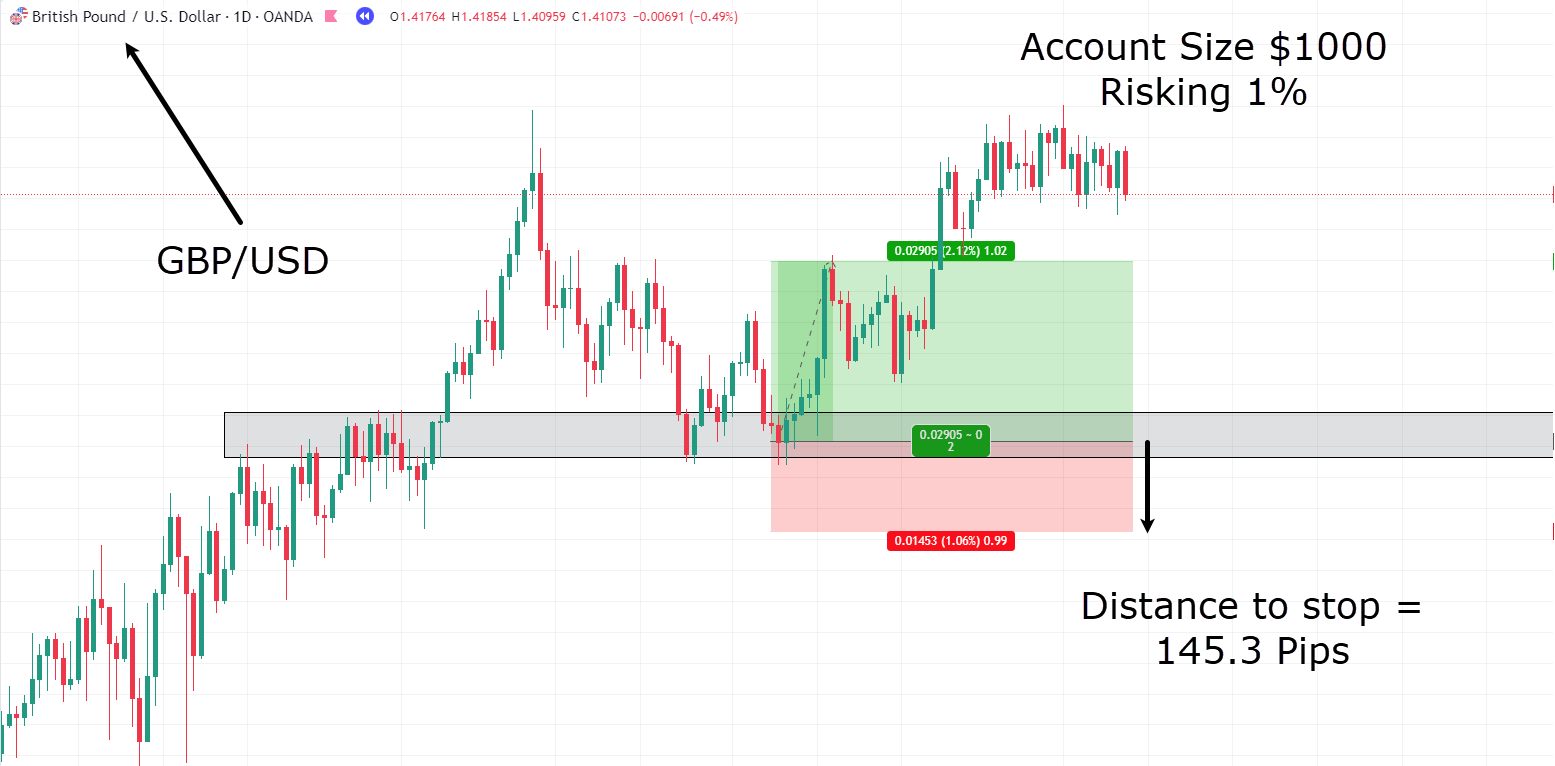

GBP/USD Daily Chart Trade Entry:

Imagine you have a $1000 trading account and want to risk $10 per trade.

The distance to your stop loss is 145.3 pips, which we’ll round to 145 for simplicity.

The calculation for determining the lot size is as follows:

Lot Size = (Account Balance x Risk Percentage) / (Pip Value x Stop Loss in Pips)

Keep in mind that the Pip Value depends on the type of lot you’ll be using, but I’ll use a Standard lot here:

Lot Size = (1000 x 0.01) / (10 x 145)

= 10 / 1450

≈ 0.0069 Standard Lots

This means you’d need to use approximately 0.0069 Standard Lots.

However, entering such a precise lot size may not be feasible, which makes a great use case for Mini or Micro lots instead…

Using Micro lots:

Lot Size = (1000 x 0.01) / (0.1 x 145)

= 10 / 14.5

≈ 0.69 Micro Lots

OK so, I understand what you might be thinking…

“I can’t go through all this maths whenever I want to enter a position!”

…which is exactly why I recommend using a position size calculator to automate the process.

(Still, you must understand how lot sizes are worked out behind the scenes!)

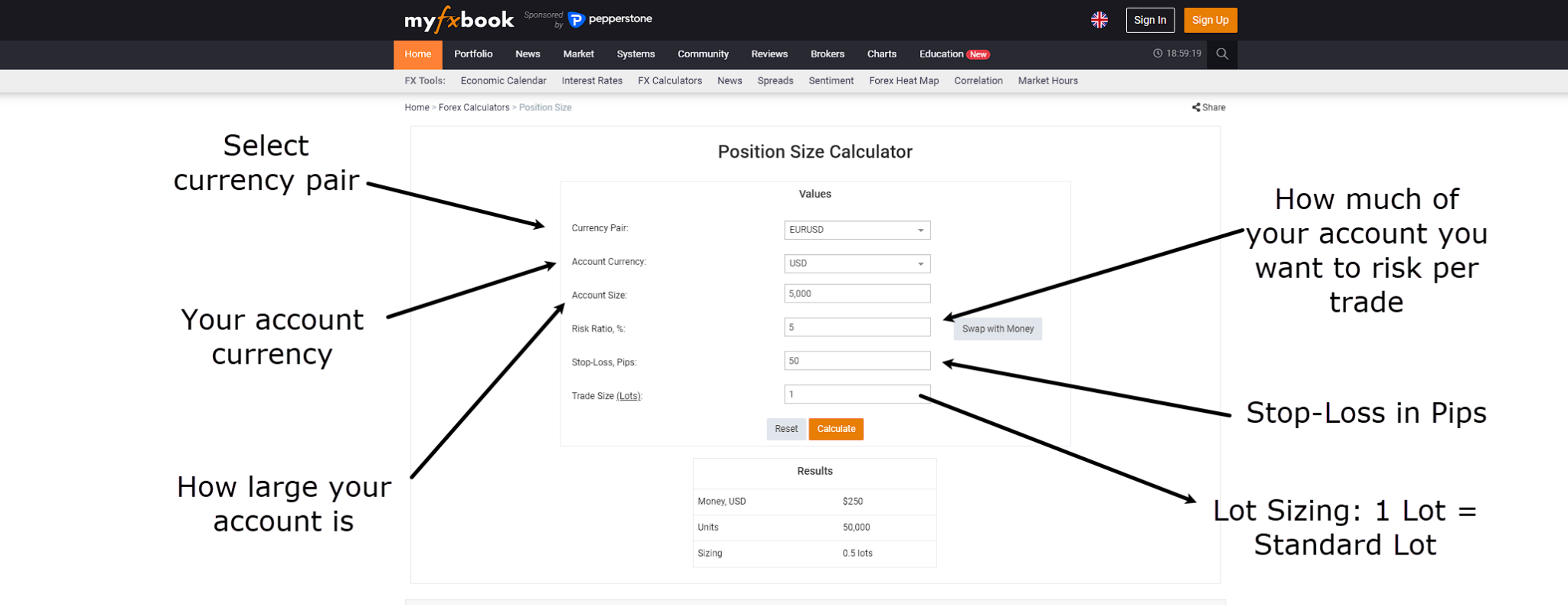

For the next example, let’s use a free web-based position size calculator, Myfxbook…

Myfxbook Position Size Calculator

Suppose you have a $20,000 account and are willing to risk 2 percent on each trade, which amounts to $400 per trade.

Given this risk tolerance, you can afford Standard lot positions, as it works well with the $10 price movement per pip.

Now, let’s examine the chart…

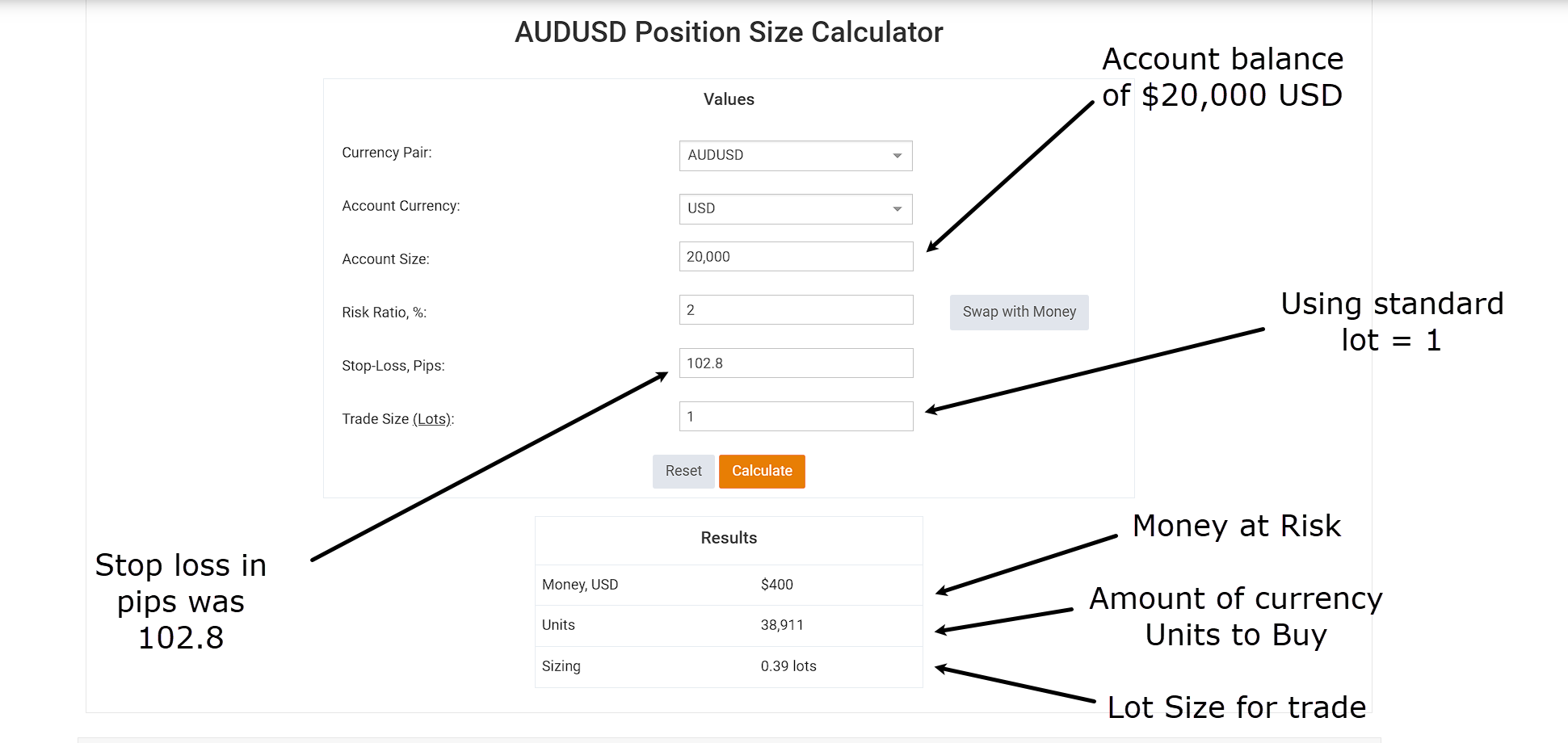

AUD/USD Daily Chart Trade Entry:

In this scenario, we’re looking at a short trade on the AUD/USD pair.

The distance to the stop loss from the entry point is 102.8 pips.

But how would you input this trade into a position size calculator?

Let’s find out…

Position Size Calculator Trade Example AUD/USD:

As you can see, the calculated units required for this trade amount to 38,911.

When calculating lot sizes, though, it’s common to round up or down to the nearest decimal point.

In this case, 38,911 is rounded up to 39,000, meaning a lot size of 0.39 Standard Lots.

If the price hits your stop loss, your stop will trigger a buy order, and you will buy back 0.39 lots at a loss of -$400.

Conversely, if the price reaches the 2RR (Risk-Reward) target, your take-profit order would buy back your 0.39 Lots at a profit of around $800.

Does this make sense?

Great!

Then let’s delve into some extra methods for calculating your lot sizes…

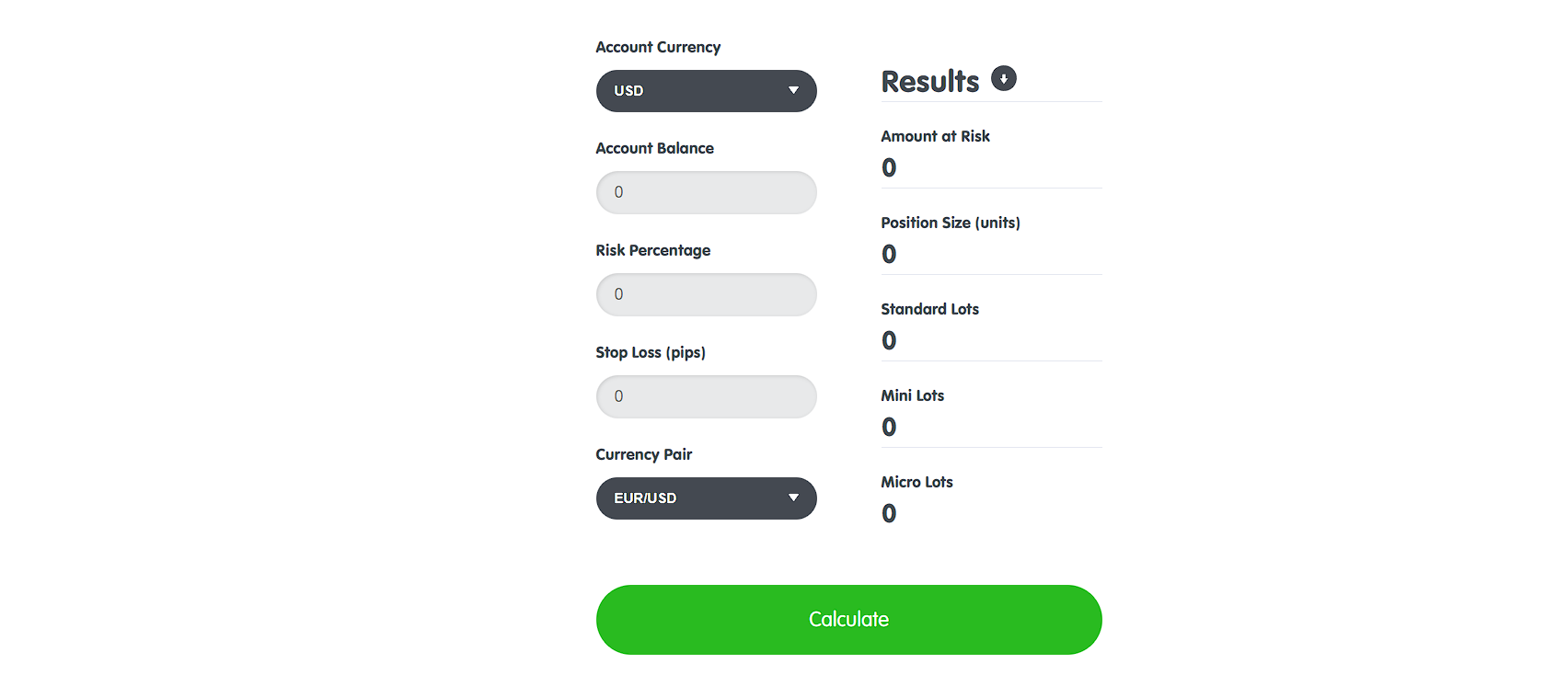

Other Lot Size Calculators

Web Browser Calculators

Just like the Myfxbook calculator, a lot of other forex brokers and websites offer similar tools, through internet browsers on various devices.

You can input your account details, risk parameters, and trade specifics to receive instant lot size recommendations.

For example…

BabyPips Position Size Calculator:

TradingView

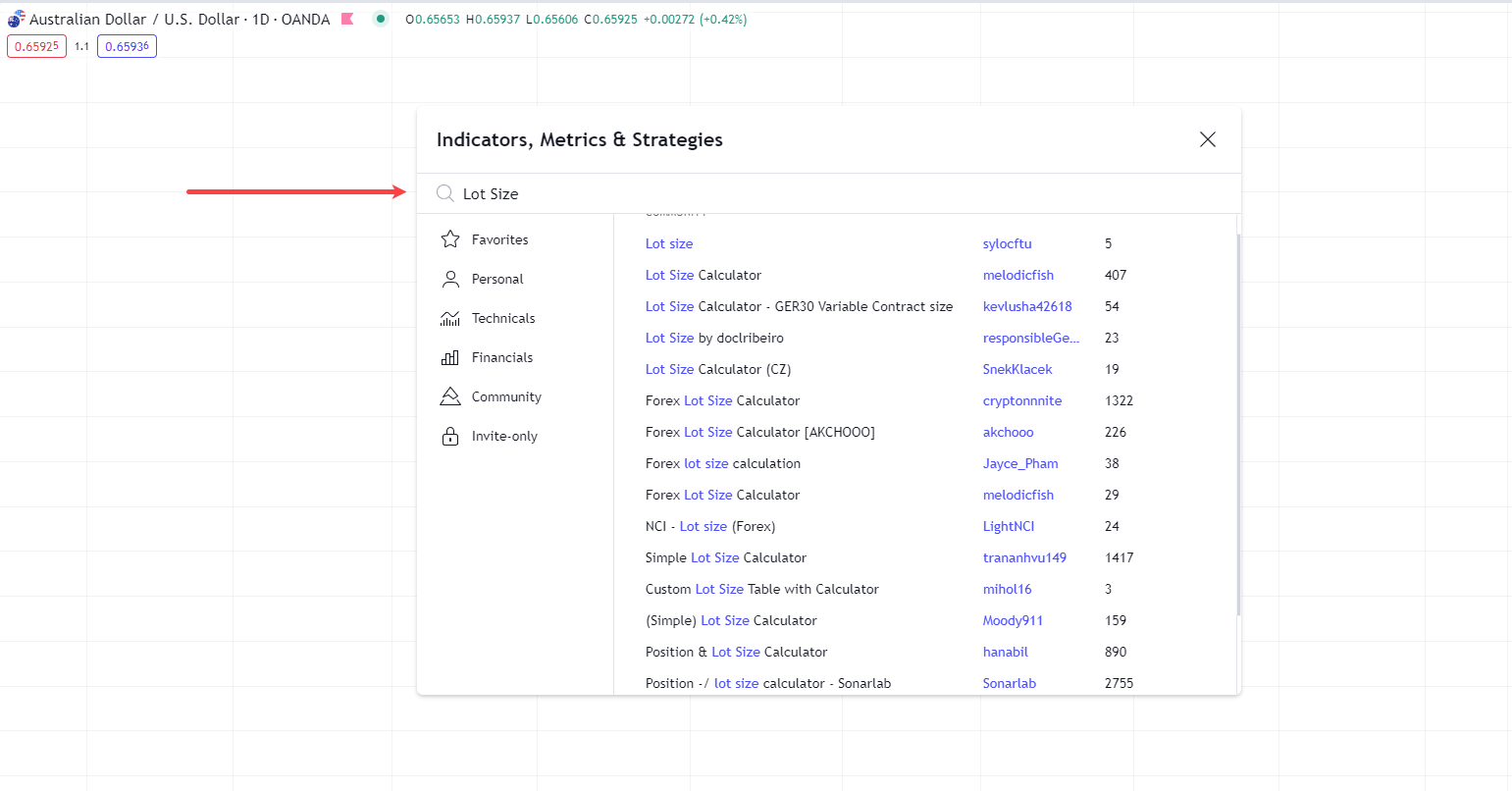

If you prefer using TradingView as your lot size calculator, there are numerous indicators and plugins available for free.

Simply search for “Lot Size” in the indicators window to find a list of them.

Test out a few options and choose the one that best suits your needs, adjusting any settings to match your account details and preferences…

TradingView Lot Size Calculators:

Metatrader

Using Metatrader as your lot size calculator may require a bit more initial setup, but it functions basically the same as other options.

Whether you’re using Metatrader 4 or 5, search for lot size calculators specific to the platform you’re using.

Most of these plugins provide installation instructions, allowing you to add them as layers or indicators to your Metatrader platform…

Earnforex.com Metatrader Plugin:

Conclusion

In conclusion, mastering correct position sizing is essential for success in trading.

Effective forex lot sizing plays a crucial role in managing risk, enabling sustainable growth in your trading account.

Ignoring or neglecting it could easily lead to losses and hinder your progress as a trader – so take note!

To summarize, in this article, you’ve:

- Learned what Forex lot sizes are

- Explored the role pips play in position sizing

- Discovered the different types of lot sizes

- Identified how to calculate you lot sizes manually

- Found new tools to calculate lot sizes efficiently

Congratulations on uncovering another crucial tool for successful trading!

You are well on your way to becoming a profitable trader by calculating the correct position sizing.

Now – I’m eager to hear your thoughts on forex lot sizing…

Do you currently use certain tools or websites to calculate your lot sizes?

Have you considered the relationship between pips and lot sizes in your trading strategy?

Share your thoughts and experiences in the comments below!