In trading, you get common questions like:

“What’s the best indicator to use?”

“What timeframe should I trade on?”

These are all valid, but countless guides are out there to answer them.

In truth, the answers get more complicated when thinking about how much money you need to start trading.

Why?

Because money is personal.

A comfortable starting point for one trader might be a huge hurdle for another.

Some traders may have $1,000 lying around, ready to use.

While others would struggle to find $500 for trading.

That’s why in this guide…

I’ll explore both the emotional and technical aspects of starting with a small trading account in forex.

Specifically, you’ll learn:

- The most important thing to know before you start live trading

- The primary metric you need to understand when deciding how much to start trading

- How much should you start with, depending on the timeframe you trade

- The secret to managing and growing a small trading account

Excited?

Great, so let’s get started!

Two things you must have before trading a small trading account in forex

Out of all the things I will talk about in this guide, this might be the hardest for you.

To start live trading, you must have two things:

- Correct expectations

- A trading plan

Allow me to explain…

1. Correct expectations

Let me share with you a quick story…

When I first started trading, I was unemployed.

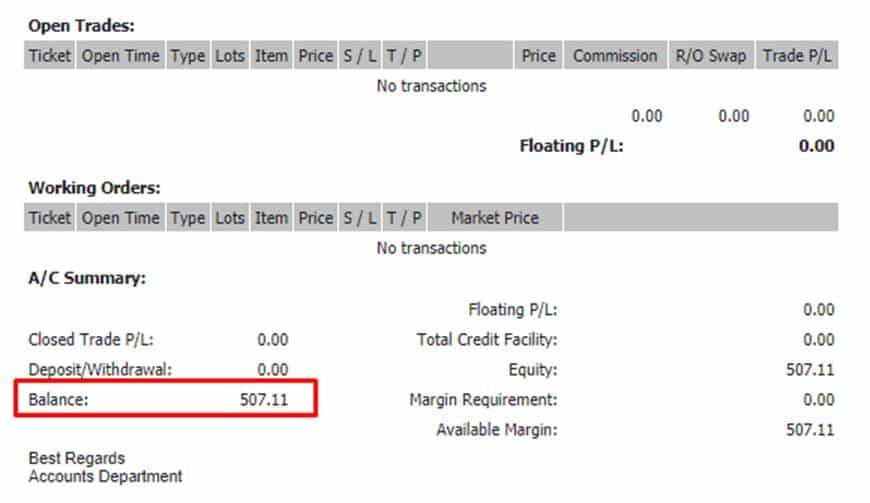

At that time, I was privileged to be supported by my parents, trading a $1,000 account…

But at the time, our family business was failing.

And that $1,000 account contained more than half of our family savings.

Can you see how all this is brewing into a perfect storm?

There are expectations…

There is pressure…

So, can you guess what happens next?

After three months, I lost half of that account…

I had the strategy.

I had the risk management.

But I didn’t have consistency or trading psychology.

The root cause?

Wrong expectations!

Because here’s the thing…

If you see trading:

- As a way to replace your current income

- As a way to quit your job and trade full-time

- As a way to pay off your debt or wants

Then I’m afraid trading is not for you.

However…

If you see trading as a business instead of a job, and as a way to grow your wealth in the long term, then you’re on the right track.

What do I mean by that?

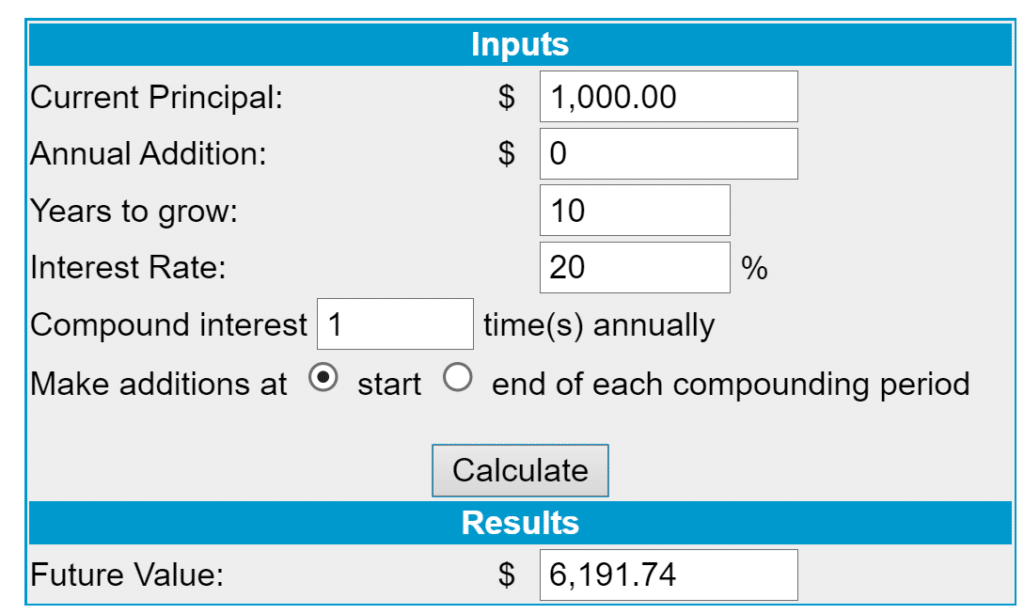

Let’s say that you have a strategy that makes 20% a year on average.

…and, that you start trading with $1,000 the same way as I did…

In 10 years, that would grow to $6,000, as you can see here…

Sure, such a return won’t change anything drastically.

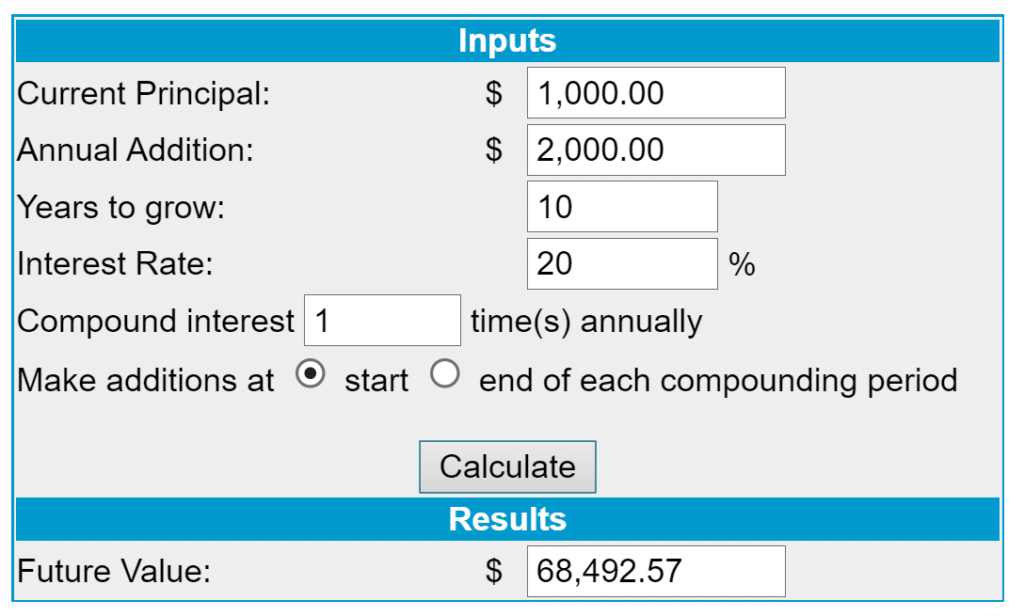

But once you gain consistency and confidence in trading, and you start adding another $2,000 into your account once a year, for example…

…then after 10 years, your account would grow to almost $70,000!…

Now that’s something, right?

So, if you see trading as a business and something you plan to grow and compound in the long run to build serious wealth…

Then, you’re on the right track.

I know that for some, ten years is too long.

But you’d be surprised at how much you can achieve in even 3-5 years.

Remember, this is only the tip of the iceberg when it comes to trading psychology.

But these are the learnings that made the biggest difference on my trading journey after that “incident” happened 7 years ago.

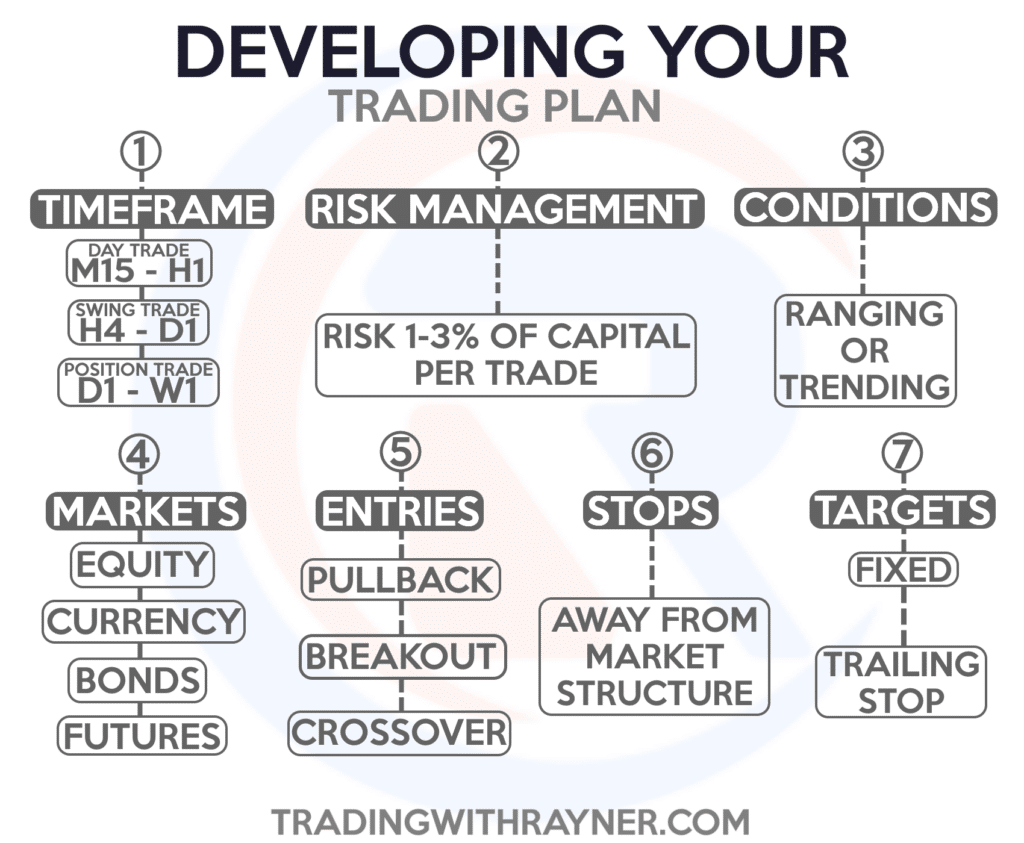

2. Trading plan

Repeat after me:

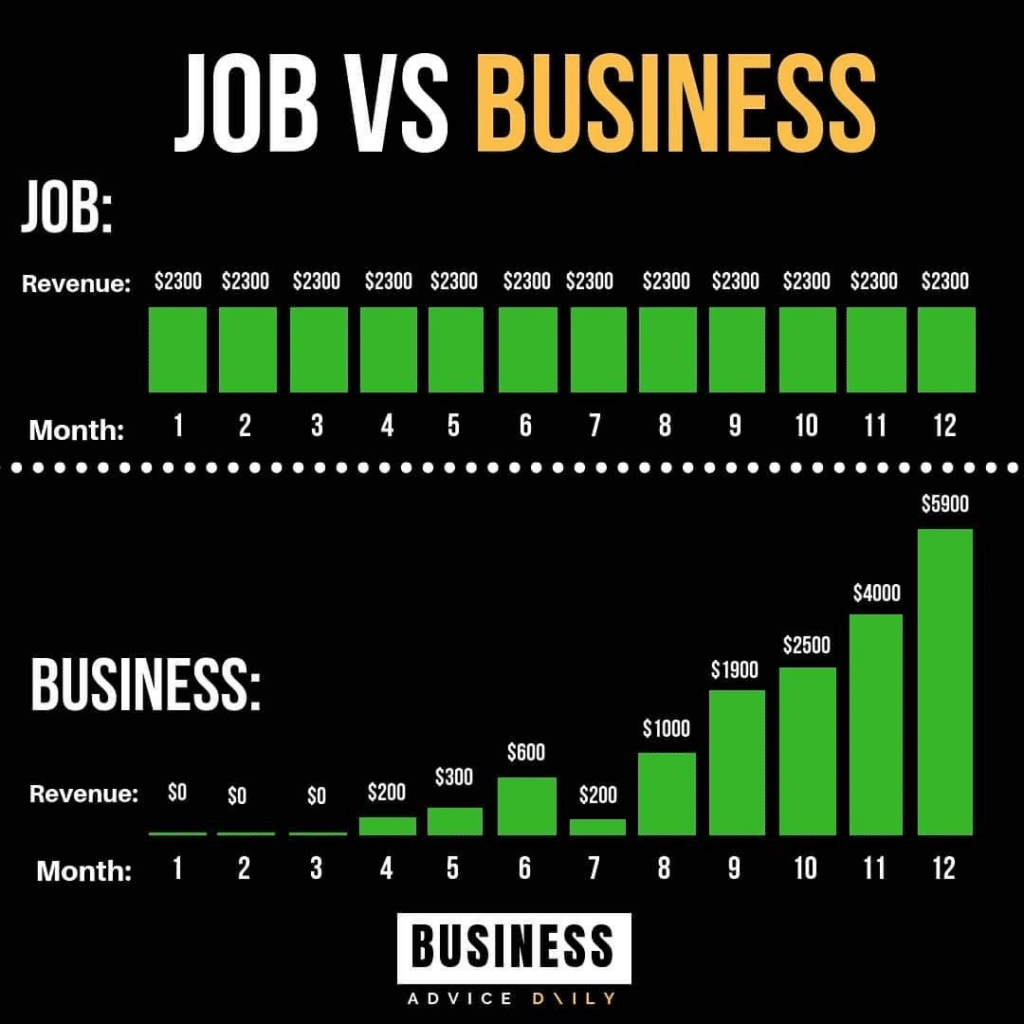

“Trading is a business and not a job”

If you want a better grasp on what I mean, then take a look at this illustration below…

Source: Business Advice Daily

The more you see trading as a business that can grow your wealth in the long term and not in the short term, the better off you’ll be.

However, if you treat trading as a hobby or as gambling, then the faster you will lose money in the short-term.

So, let me ask you, what does every business have?

Correct, a business plan!

And it’s the same as trading, you must have a trading plan.

All this is something you must have before you start trading.

But to give you a guideline, here’s something you can use…

If you want to learn more about it, you can check out this guide here:

How to be a Profitable Trader Within the Next 180 Days

Now…

I know that I’ve shared quite a lot of information with you in this section.

But those concepts became the catalyst that has kept me trading and growing my account for over 7 years now.

And I believe that those concepts will go a long way when you start with a small trading account in Forex.

With that said…

Let’s get to the technical side of things now, shall we?

Small Trading Account: What are lot sizes and why are they important?

When I first started trading, I was introduced to the stock markets.

This means that buying 100 shares or even 1,000 shares on some stocks is normal.

When I was introduced to the forex markets, I created a demo account.

And now comes the twist…

I didn’t know what lot sizes were!

So, my naive ass was thinking back then:

“Eh, why not test the waters and enter 10 shares”

What happened next to my tiny $500 demo account?

It got obliterated!

I instantly got Margin called!

Because I didn’t understand that I was entering with 1,000,000 units (10 lots) and not 10 “shares.”

(Well, thank goodness it was on a demo account!)

So, to make sure you don’t suffer the same fate, keep this “cheat sheet” in mind:

- 1,000 units (0.01 nano lot)

- 10,000 units (0.10 micro lot)

- 100,000 units (1.0 lot)

- 1,000,000 units (10 lots)

Now, you might be wondering,

“Alright, how is this relevant to having a small trading account in forex?”

Two words…

Risk management.

There are two ways to go about this.

First is risk management with the safety mode on, and one more advanced, which will be very helpful once you start to scale up your trading account.

So, let’s get started…

Risk management: Safety mode

The reason why I am calling this the safety mode is for those who want to get started as soon as possible in trading.

Even if you don’t have a trading plan or if you don’t know what the hell you are doing.

So, you can consider this a “fool-proof” method for not blowing your account as a beginner.

Sound good?

This safety mode comes down to how many lot sizes you will enter per trade depending on your account size.

So, if you have an account size of:

- $500 to $1,000 then enter 0.01 lot per trade

- $2,000 to $3,000 then enter 0.03 lot per trade

- $5,000 to $7,000 then enter 0.07 lot per trade

- $8,000 to $10,000 then enter 0.10 lot per trade

This list is relevant if you trade the 4-hour and the daily timeframe.

But basically, this is a generalization of how much lot size you should enter.

In the later sections, I will share the principle behind the list with you and explain how you can be more flexible with it.

P.S. If you trade the lower timeframes then multiply the lot sizes on the list by 1.5

Risk management: Advanced mode

There is no question…

Once you start building your trading plan, you will need to know how and where to place your stop loss.

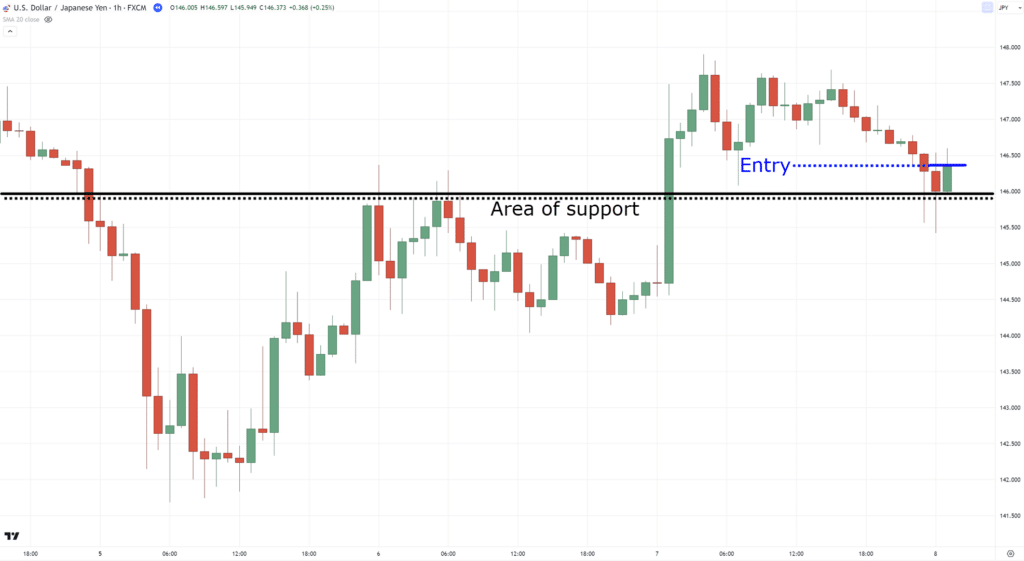

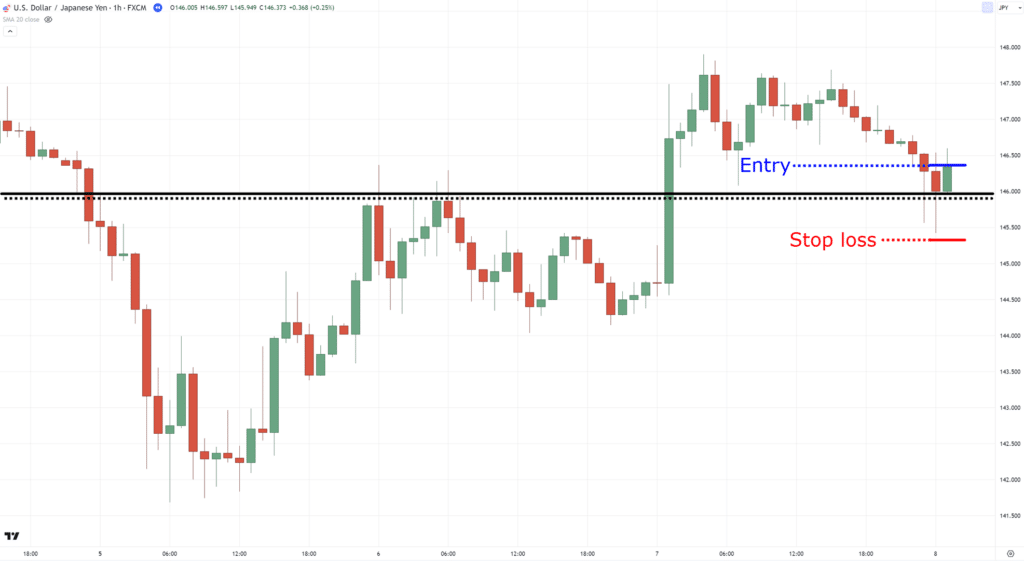

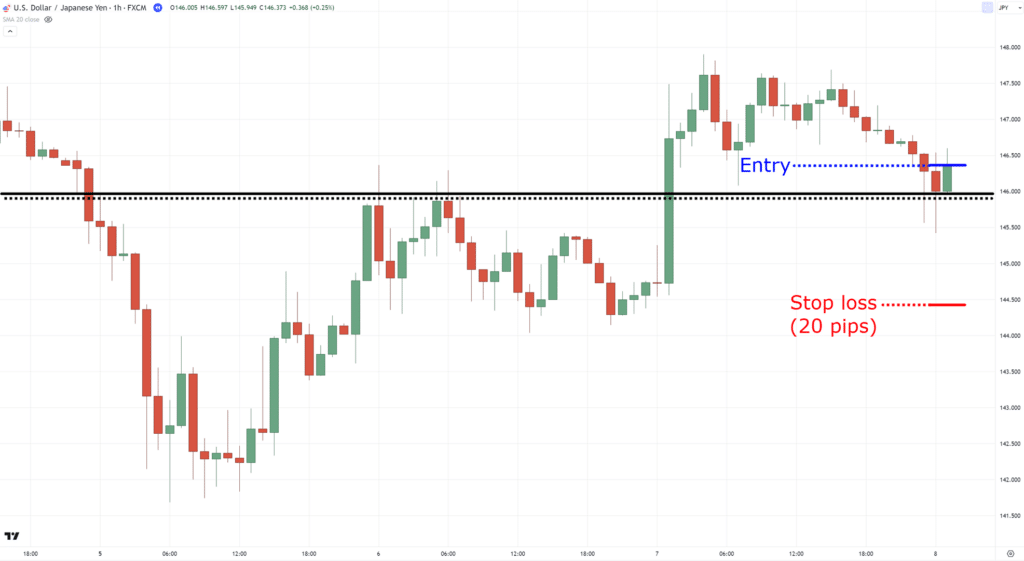

As an example, let’s say that you have a pullback trading setup in the area of support…

And then you decide to place your stop loss below the loss of support…

The next step is to measure the distance between your entry and the stop loss level.

Now, if we were trading the stock markets…

…then we would measure in terms of percentages.

But since we’re learning how to go about managing a small trading account in Forex…

…we measure based on “Pips”…

The main question that we are trying to answer is:

“How can I risk a maximum of one percent of my capital if the price hits my stop loss?”

Thankfully, we already have position-size calculators available for us to make your life easier.

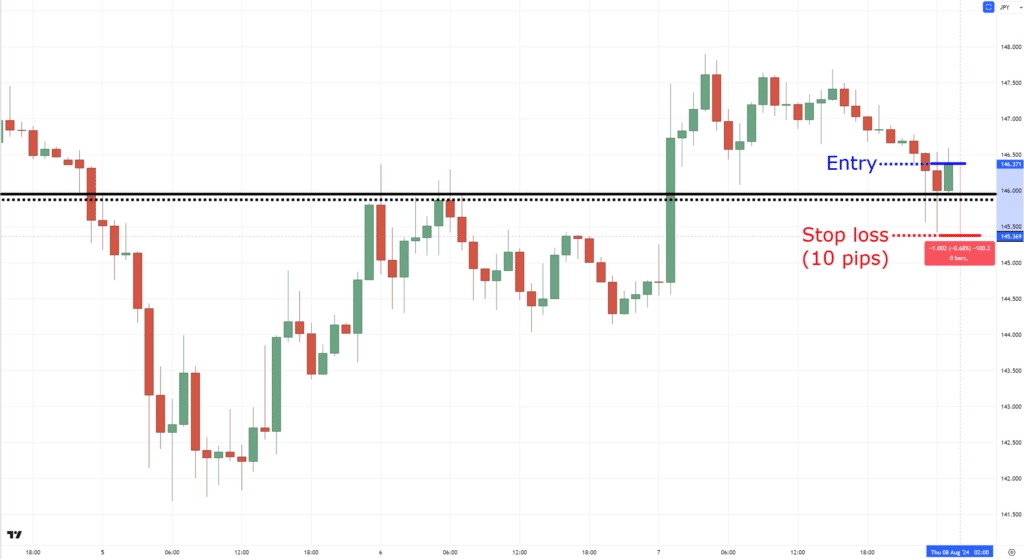

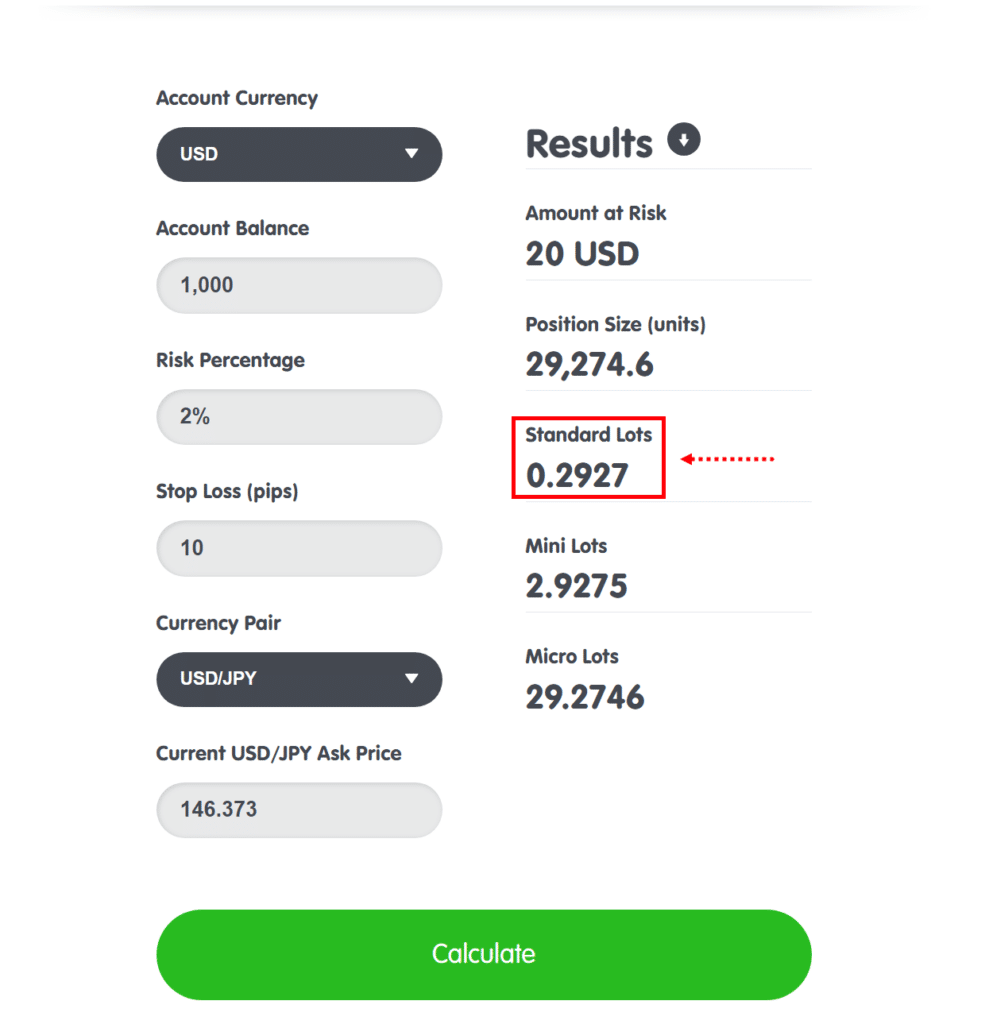

So, If you have a $1,000 capital and you want to risk 2% per trade with a 10 pip stop loss based on your trade…

How many lots should you buy?

Well, if we plug in the numbers on our calculator here…

Then you should enter 0.29 lots on this trade.

This means that if the price hits your stop loss, you will not lose more than $20 on this trade.

Now, what makes this percentage risk management method good is that even if you change your stop loss value, you can still maintain your maximum risk per trade.

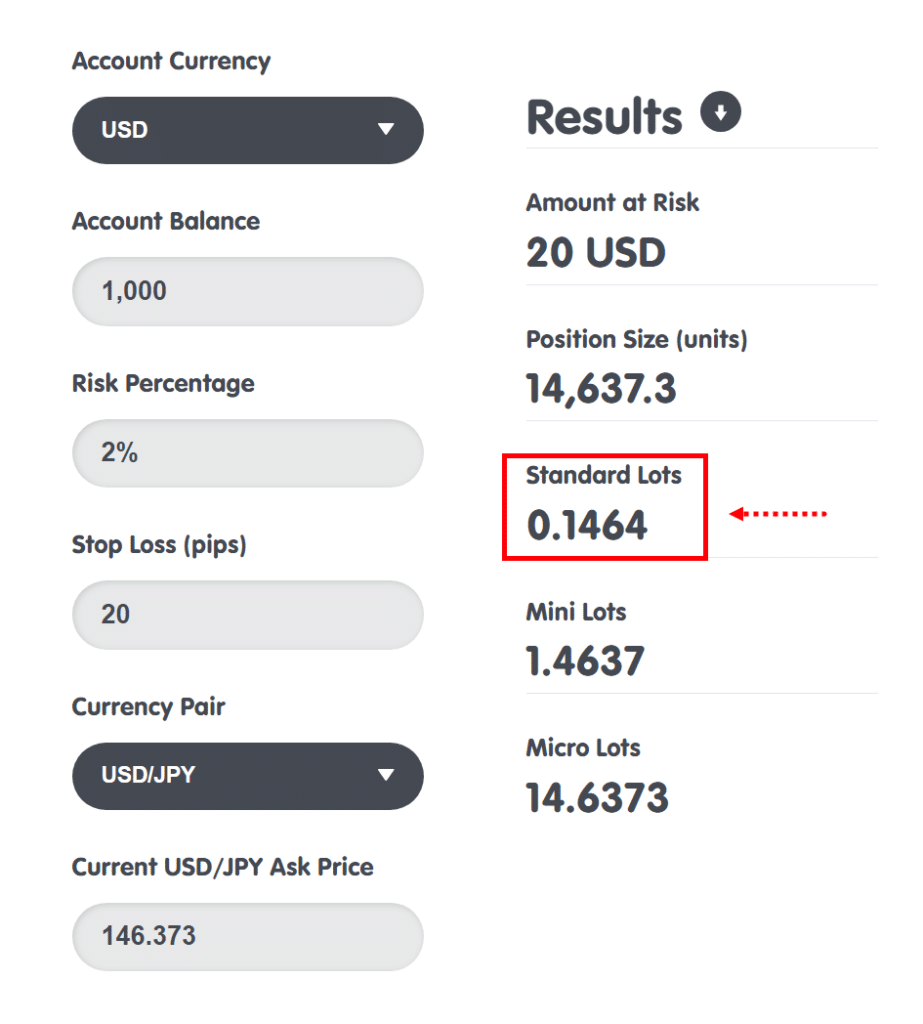

So for example, if we go for a stop loss of 20 pips instead, which widens your stop loss…

And you’re still risking $20 on this trade or 2% of your capital…

…if you plug in the numbers on the calculator, you will get this value…

This means if you enter 0.14 lots on your trade with a stop loss of 20 pips…

You will not lose more than $20 on this trade if the price hits your stop loss.

Your risk is still maintained!

Pretty cool, right?

So, now that you know the most basic and advanced way to manage your risk…

In the next section, I will provide you with full context on how much capital you really need to start trading the forex markets.

And yes, everything that you have learned so far will make a huge difference in what you are about to learn next!

How your small trading account in forex depends on your trading style

This part is the most “tricky” when it comes to knowing how small your trading account should be.

But the principle is this:

The higher the timeframe you trade, the wider your stop loss will be, therefore, the bigger your capital should be.

I’ll show you an example.

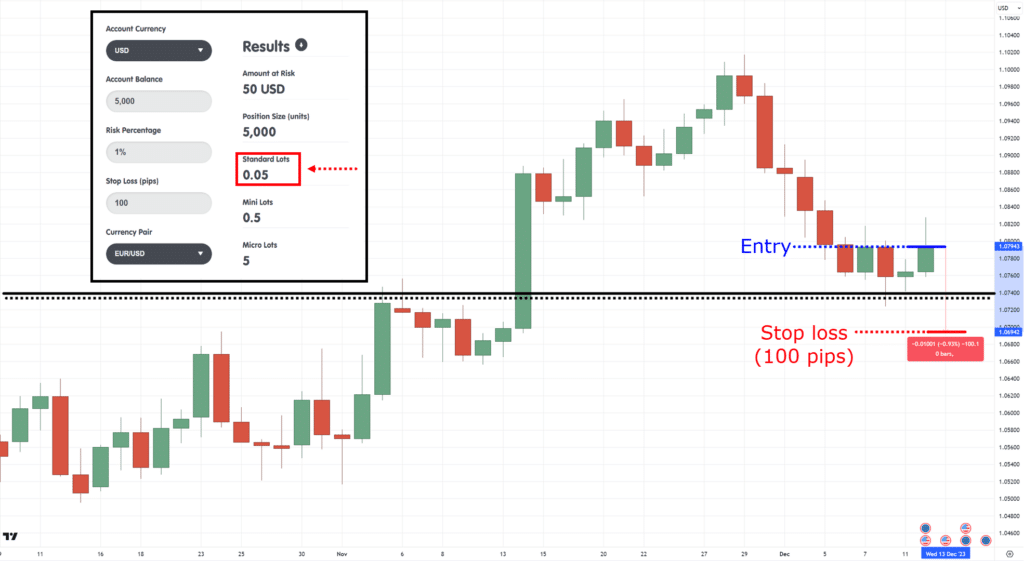

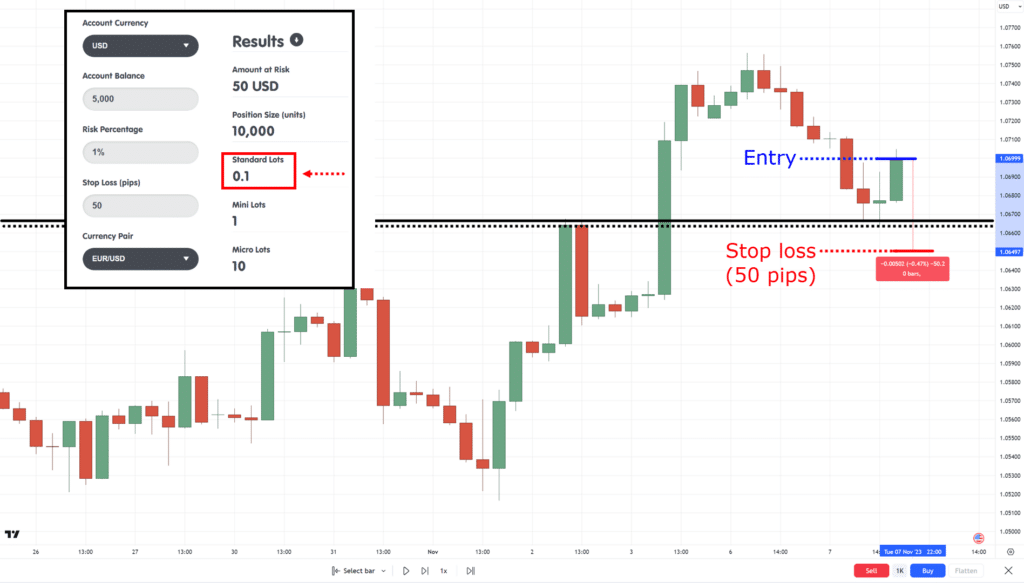

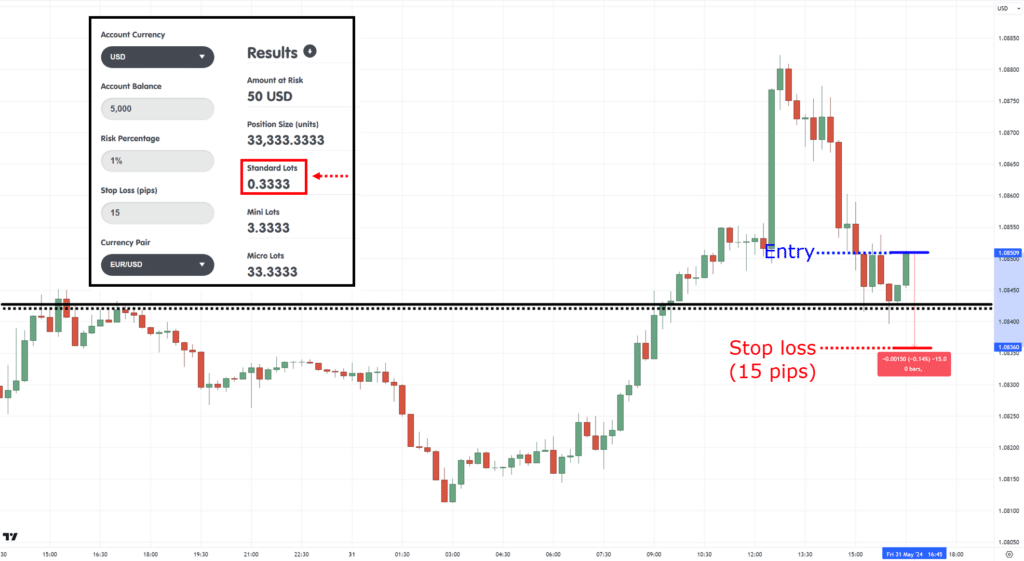

Let’s say you have a $5,000 account and the risk per trade is $50 which is 1% of that account.

So now, let me share with you the same trading setup on three different timeframes where previous resistance turns to support…

USDCAD Daily Timeframe (100 pips):

USDCAD 4-hour timeframe (50 pips):

USDCAD 15-minute timeframe (15 pips):

The reason why I chose those timeframes is because they are likely the timeframes you would choose if you decide to be a:

Now, if you look back at the examples what do you notice?

That’s right!

The “tighter” your stop loss is, the more concentrated your trading position is.

And the “wider” your stop loss is, the less concentrated your trading position is.

What this means is that the tighter your stop loss is…

…the more it can accommodate you trading on a smaller account.

But the wider your stop loss is, the bigger the account should be.

Make sense?

So, to sum things up, you can refer to the following:

- Position trading with stop loss greater than 100-200 pips = $3,000 to $5,000 account

- Swing trading with stop loss ranging from 50-100 pips = $1,500 to $3,000 account

- Intraday trading with stop loss ranging from 10-30 pips = $500 to $1,000 account

Note: These numbers are based on my experience trading the Forex markets and by using the risk management method I shared with you

What the list means is that there’s no specific number on how much you should start with.

Because trading with a “small trading account” really depends on your trading style.

This means that if you are a swing trader, then trading with a $1,500 is what you can consider a “small” account.

But for intraday traders, that $1,500 is more than enough to start trading while apply proper risk management!

Now…

Here’s another question I usually get:

“What if I only have $100 to trade the markets?”

I know this is something you might not want to hear.

But the best way to go about it is to use that $100 to invest in your education in trading.

Again…

Spend that money on education!

(or save up)

At any rate, the specific amount you need to start with a small trading account in Forex depends on your trading style.

But as you know, the trading journey does not end there.

Because once you start live trading…

What’s next?

How can you manage a small trading account and grow it?

After all, trading is a long game, right?

Let me answer those questions for you in the next section.

A strategy on how to trade a small account

Here’s the truth:

Starting with a small trading account is the best way to start trading!

This means that it doesn’t matter if you already have $5,000 or $10,000 in your bank account.

What matters is that you start small.

Check out my reasoning…

Why you should start trading with a small account

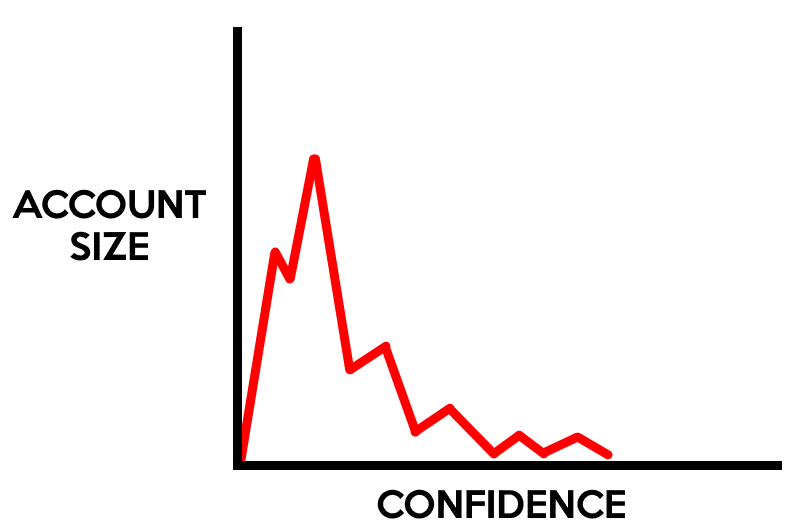

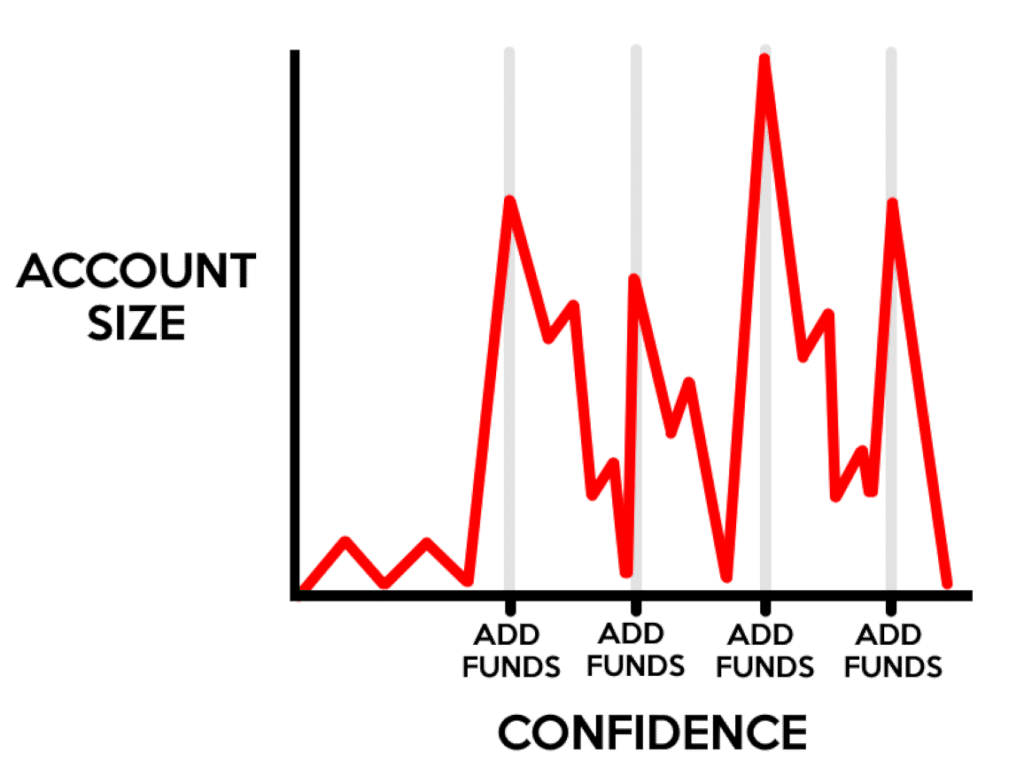

You see, some traders will try to start with a big account…

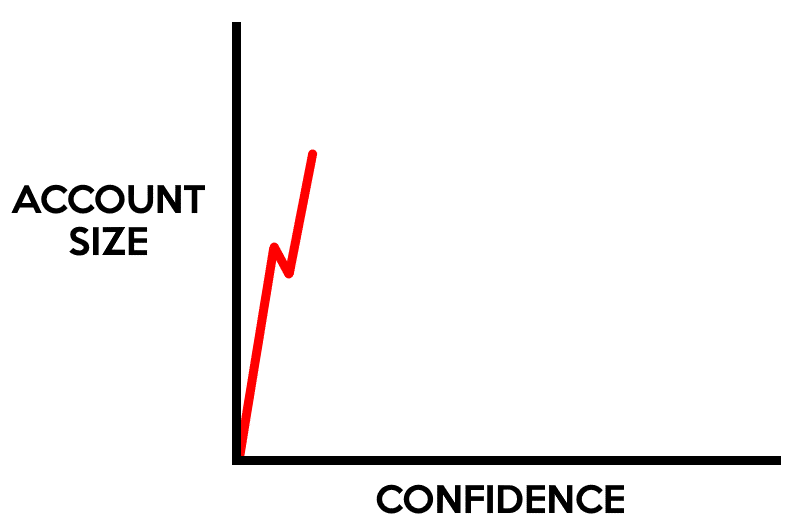

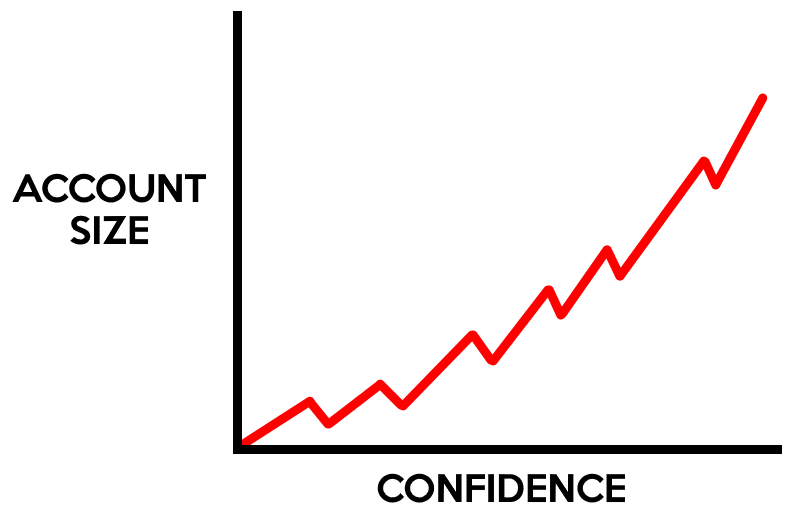

But the thing is, every trader starts with almost zero trading confidence.

And what happens if you have a big account size with little to no confidence?

That’s right, your account dwindles as time goes on…

So instead, what should you do?

Start with a small account while your confidence is small!…

So, as you start putting in good trades one at a time consistently…

…not only does your confidence grow, but also your trading account…

In short, you want to match your account size to your confidence!

Now…

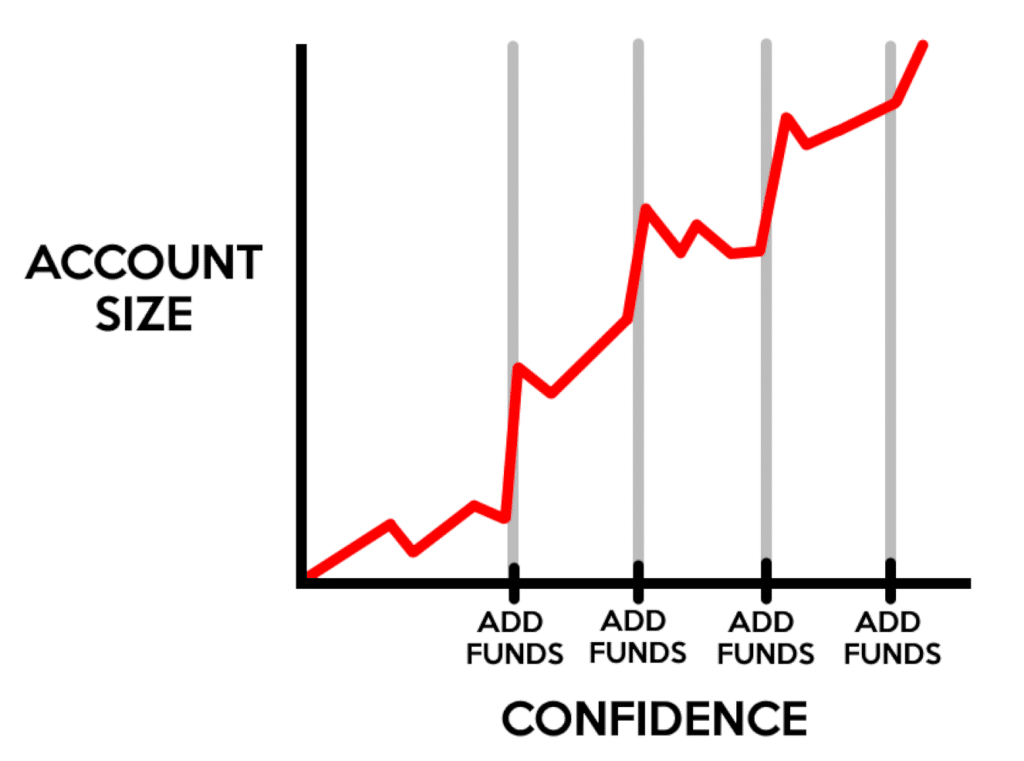

What if you have a $5,000 account, and you actually do have extra funds to put into your trading account?

The key now is to know when to add them.

“Accelerate” your trading account by adding more funds

The best time to add funds to your account is when you are most confident and starting to see the gains.

Do you agree?

This means that if your small trading account doesn’t work out…

…then simply don’t add more funds!

Because it’s better to go bust on a small account than a big one, right?

However, once you gain consistency in trading, then it pays for you to add more funds by betting more into your trading confidence and results…

That way, you not only grow your account from starting small, but you accelerate it!

Because again…

You don’t want to be adding more funds if you only keep sabotaging yourself (therefore affecting your confidence in trading)…

It’s like you’re just adding more fuel to the fire!

To sum it up…

If your small trading account is not doing well, then don’t add funds and review your trading journal to see what went wrong.

If your small trading account is starting to do anywhere above breakeven and your trading actions have been consistent…

…then consider adding funds.

You only want to bet on something that works!

Or rather, bet on yourself at your best in trading!

Got it?

Conclusion

In today’s guide…

I made sure to equip you with knowledge on how to start a small trading account in forex but also the mindset to manage it.

Overall, here’s what you’ve learned for today:

- Trading is not a job but a business; having the right expectations in trading is the key to lasting long in this game

- Understanding lot sizes is the key to managing risk on a small trading account in forex

- A small trading account amount depends on what kind of trading style you wish to adopt in your trading

- Starting with a small account is the way to go when starting in trading, and eventually adding more funds as you become more consistent

To be honest, this is a trading guide I made that I wish I had read 7 years ago…

…so, I hope that you enjoyed reading through it!

But actually, I want to hear your story…

Where are you right now in your trading journey?

Do you plan on starting a small trading account in forex soon?

If so, how do you plan to go about it?

Let me know in the comments below!