Now, if you’ve spent virtually any time searching for the word ‘Forex’…

…you’ve undoubtedly come across MT4, aka MetaTrader 4!

The MT4 platform is probably one of the very first platforms you’re introduced to in Forex trading.

I mean, it’s written up at almost every Forex broker!

But if you’re anything like me, there’s always been a huge downside to it…

…everything looks so complicated!…

And to be honest, there’s a truth to that.

You actually do need those extra tools. (eventually)

Luckily, in the previous guide…

I taught you how to set up your MT4 platform from absolute scratch in only 10 minutes…

…and it even shows you how to manage your risk on the platform, too!

So, with that in place, I’ll share with you the exact workflow I’ve been using for years in today’s guide.

I’ve become ultra-efficient with it now, enabling me to analyze tens of charts and manage all of my trades in less than 5 minutes a day.

You’re about to learn it too!

Specifically, you’ll cover…

- What your MT4 platform should look like, and how it’s meant to be used

- The one element that you should always have on your trading plan to ensure that you never run out of trading opportunities

- My “secret” technique on how to find trades across tens of charts in less than 3 minutes

- The “best” tools you can ever acquire and use for MT4

Ready?

Then let’s get started…

MT4 Tips and Tricks: Simplifying your platform

In this guide…

I’ll teach you a repeatable process that you can follow to fully utilize MT4 – no matter what trading strategy you have.

And to achieve that, “simplifying” your platform comes in three steps.

1. Declutter your platform

Your first step is to declutter everything on your chart…

Next, choose only the tools you need on the tabs (as you don’t need most of them)…

And yes, see those extra tabs?

Close them as well!…

Finally, press “F8” and customize the colors on your chart…

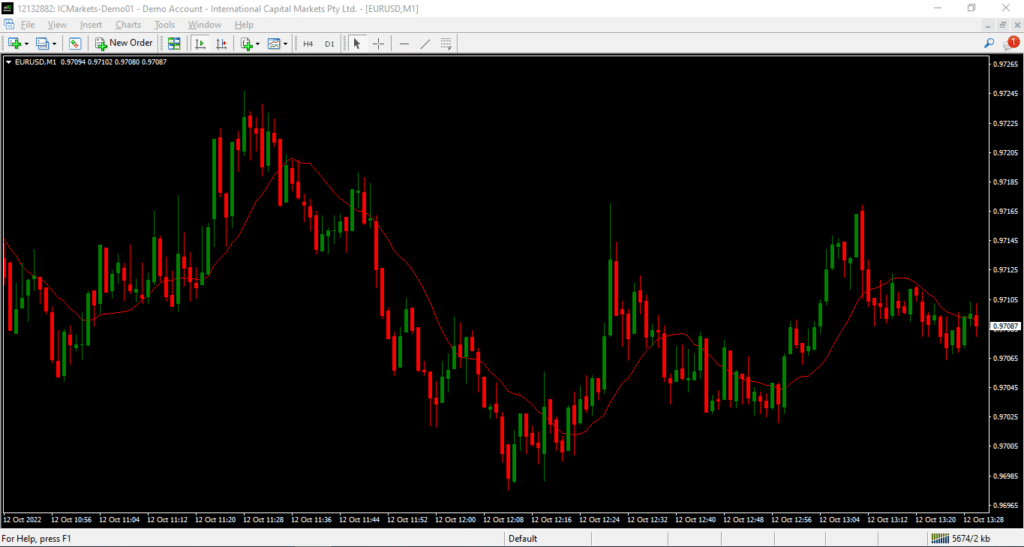

After that, you’ll have a platform that looks something like this…

Instead of this mess!…

2.Develop a template

The reason why this is important is that you can instantly apply your “chosen” indicators to any chart you see…

To do this, simply place the indicators you normally use and save them as a template…

Now…

Everything you’ve learned so far is in preparation for what you’ll see later.

A successful setup lays out the foundation to execute your trading strategy!

But first, I’ll share with you the most crucial aspect to consider when building a trading plan…

MT4 Tips and Tricks: Define your market selection method

If you look at every successful trader out there with a trading plan, there’s always one thing they have in common…

A market selection rule

Every consistent trader has a method on how to search for markets to trade.

For some, they have a set of markets completely fixed on their watchlists!

To be fair, this is a topic that deserves a new guide on its own… (so watch this space!)

But as an example, I have a fixed set of markets to trade, which you can check out below…

Major pairs:

- EURUSD

- GBPUSD

- USDCHF

- USDJPY

- AUDUSD

- NZDUSD

- USDCAD

Cross-currency pairs:

- EURCHF

- EURGBP

- EURAUD

- EURJPY

- EURCAD

- GBPCHF

- GBPAUD

- GBPJPY

- GBPCAD

- AUDCHF

- AUDJPY

- AUDNZD

- AUDCAD

- CADJPY

- CADCHF

- NZDJPY

- NZDCHF

- NZDCAD

- CHFJPY

In short, I don’t need to change my watchlist as the Forex market is often liquid enough to trade almost all the time.

But again, this is just an example!

Stock traders use a stock filter, while some forex traders use a currency strength meter, which you can also check out here.

The core principle remains:

You must have a market selection rule that you can execute consistently without relying on other trader’s opinions.

Next…

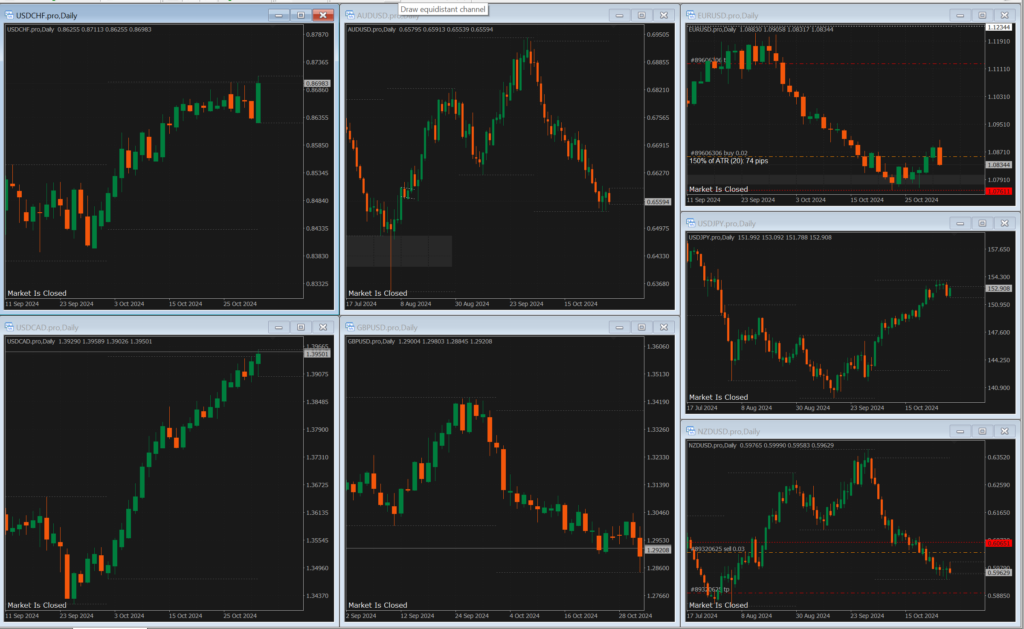

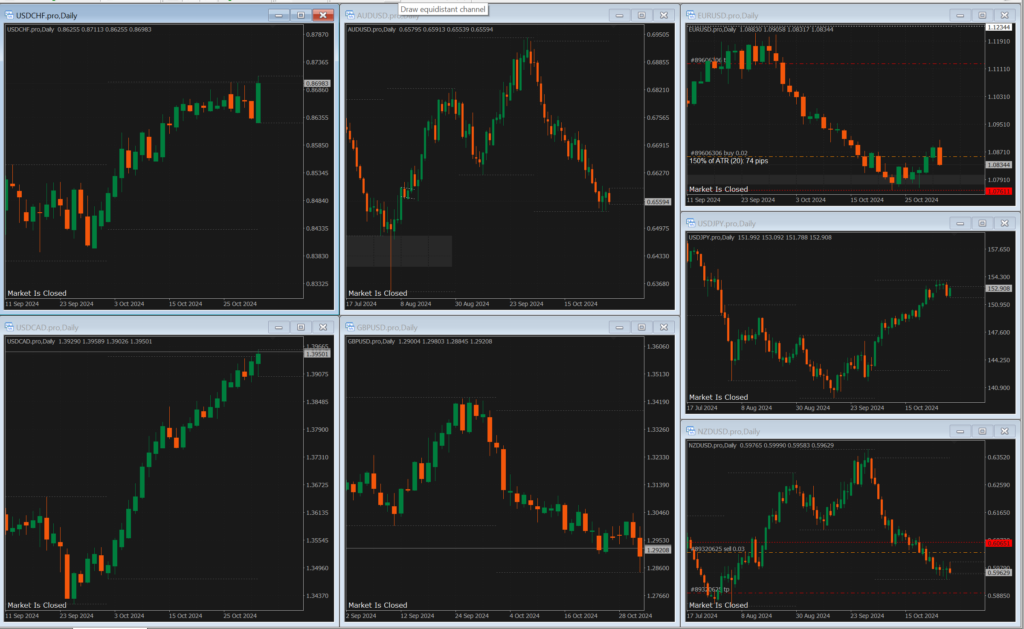

Once you have established your watchlist, you should take advantage of MT4’s mult-chart tool…

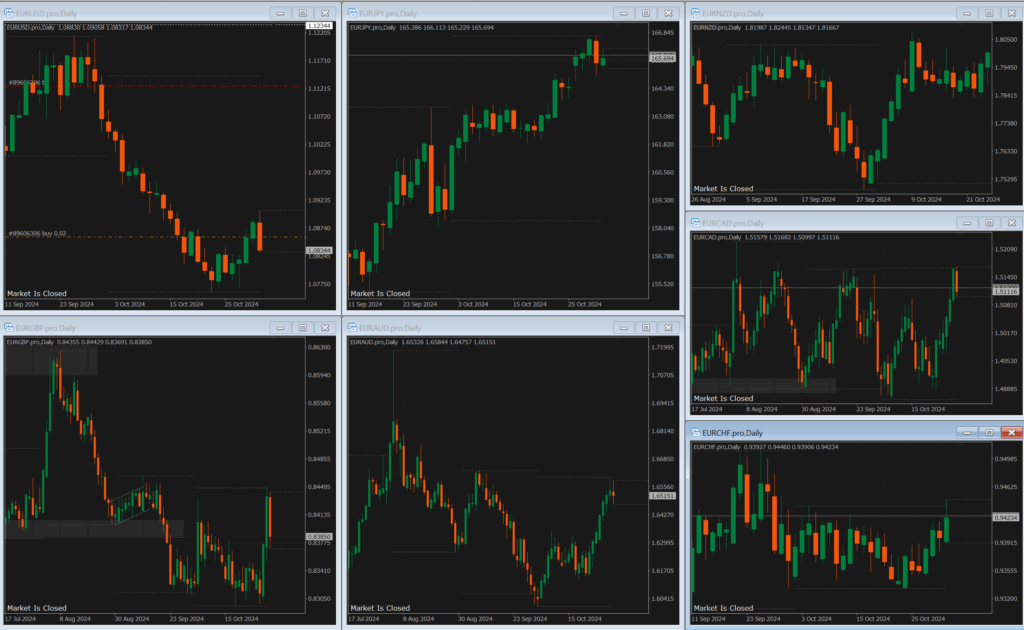

Basically, enter the markets on your watchlist (you can split your watchlist if it’s too many) by opening multiple charts and pressing ALT + R…

And then click the “Default” text at the bottom and save your template…

You can repeat this process again, depending on how many watchlists you have!

Once you’ve established your watchlist, you can simply select the template, and your watchlist will be shown accordingly…

Now, what’s next?

How do we deal with all of these charts?

Do I tediously analyze them one by one?

Well, you could do that – but that would take a lot longer than 20 minutes!

So, how can we streamline this process?

Let me show you in the next section…

MT4 Tips and Tricks: Bottom-up approach

The first thing you want to do when presented with an ocean of charts is take a deep breath…

…and focus on your setups.

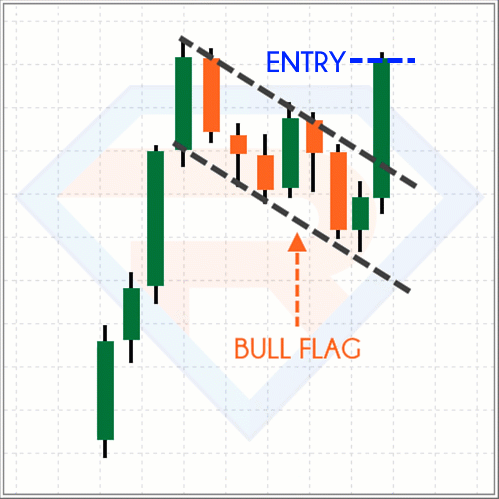

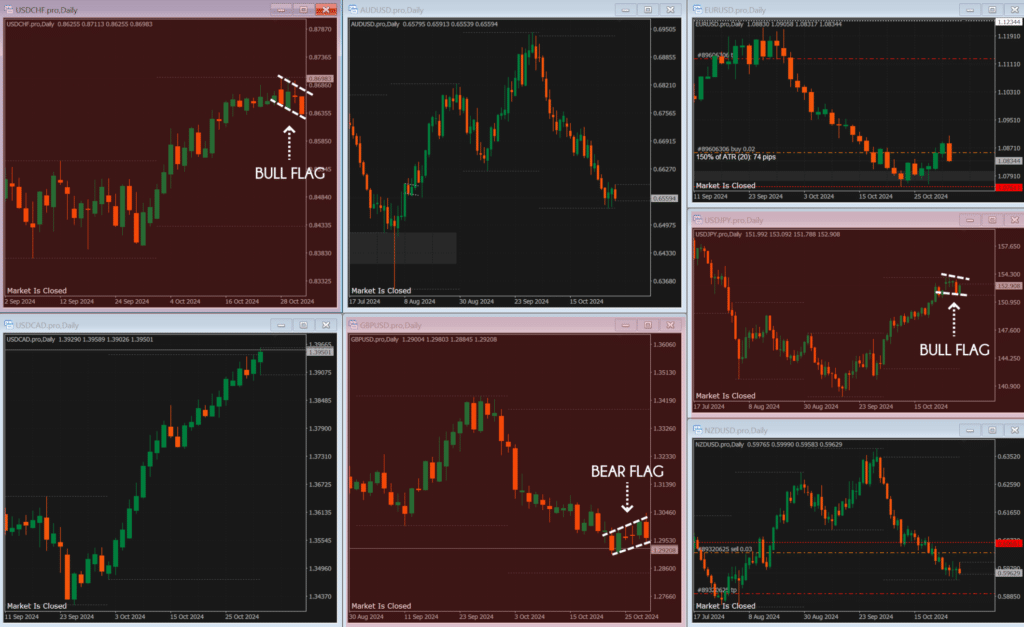

Your trading setup could be a specific chart pattern, such as the bull flag…

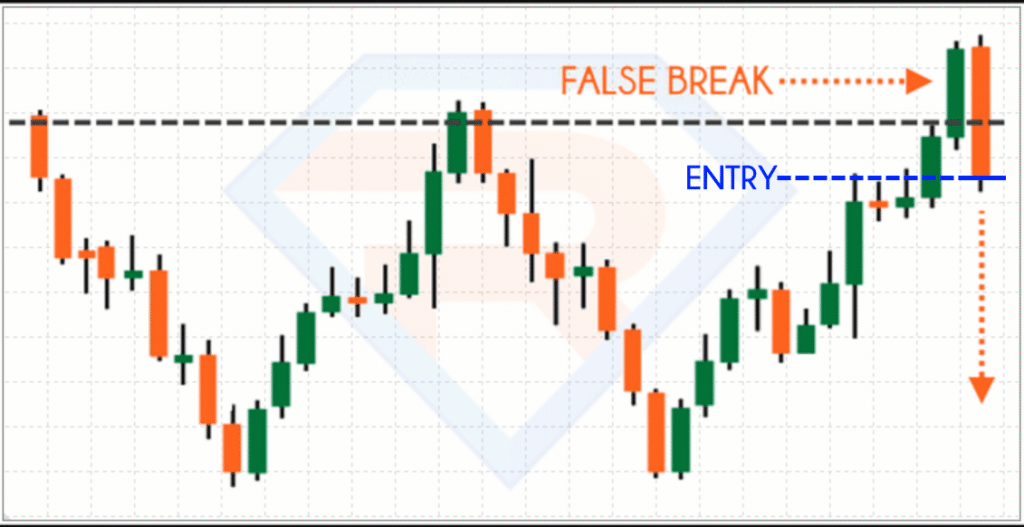

Or perhaps a false breakout setup…

What matters is that you’re limiting what you search for on a particular chart.

It will make it easier to hit the buy button and know how you plan to enter the trade itself.

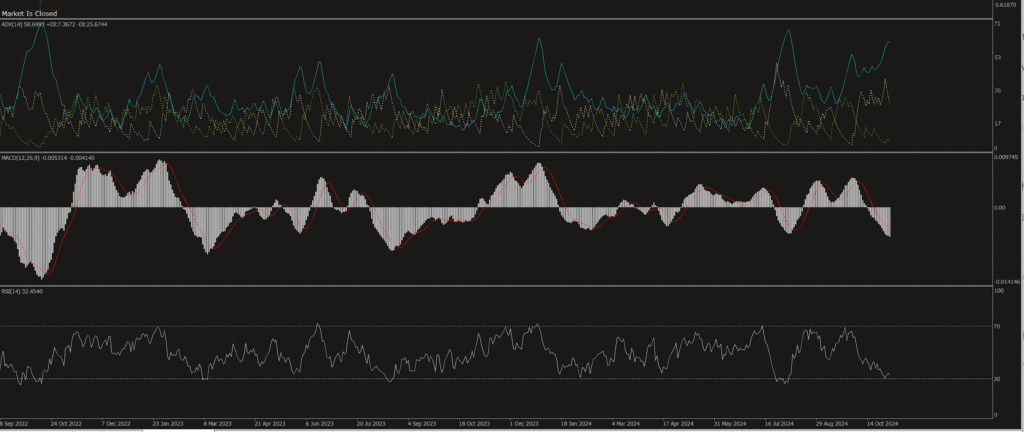

I showed you price action setups, but there are indicator setups as well, which you can learn more about here.

Remember the watchlist templates I shared with you a while ago?

Good.

Because all that’s left for you to do is to go through all of those watchlist templates with multi-chart enabled…

Remember – the only thing that you need to look for is your setups.

Nothing else!

You don’t analyze the trend…

…you don’t identify support and resistance… (not yet.)

…you only need to identify your trading setup!

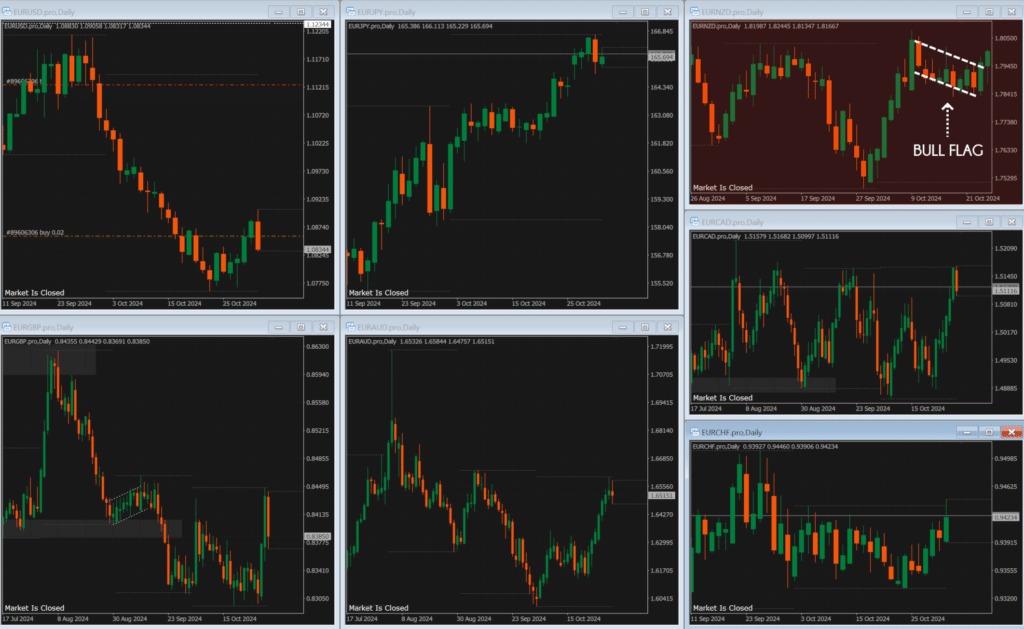

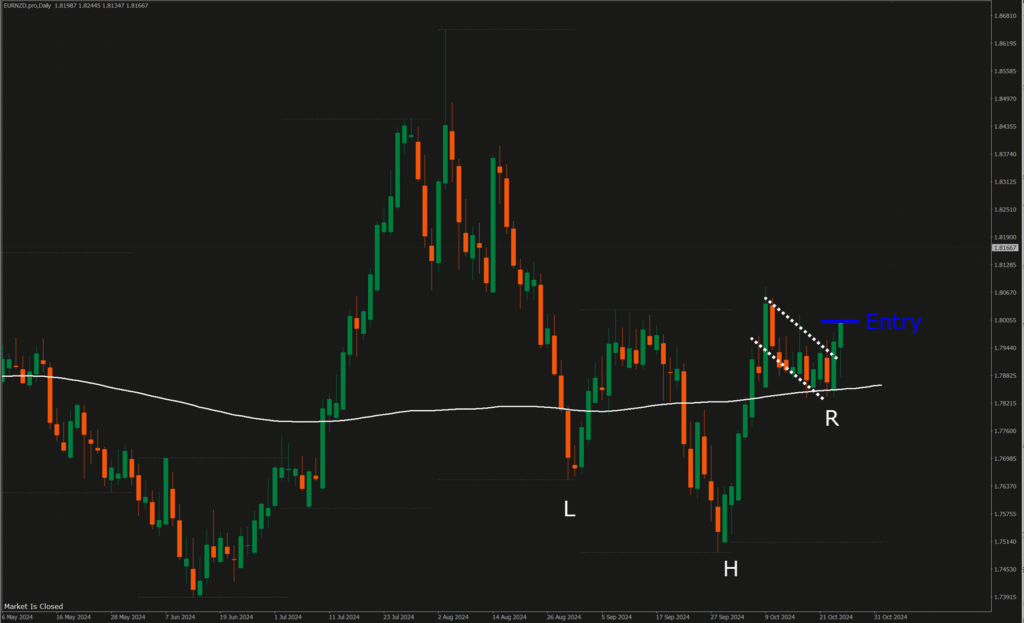

So, in this example, let’s use price action setups.

Specifically, only flag patterns.

Ready?

So, let’s have a look.

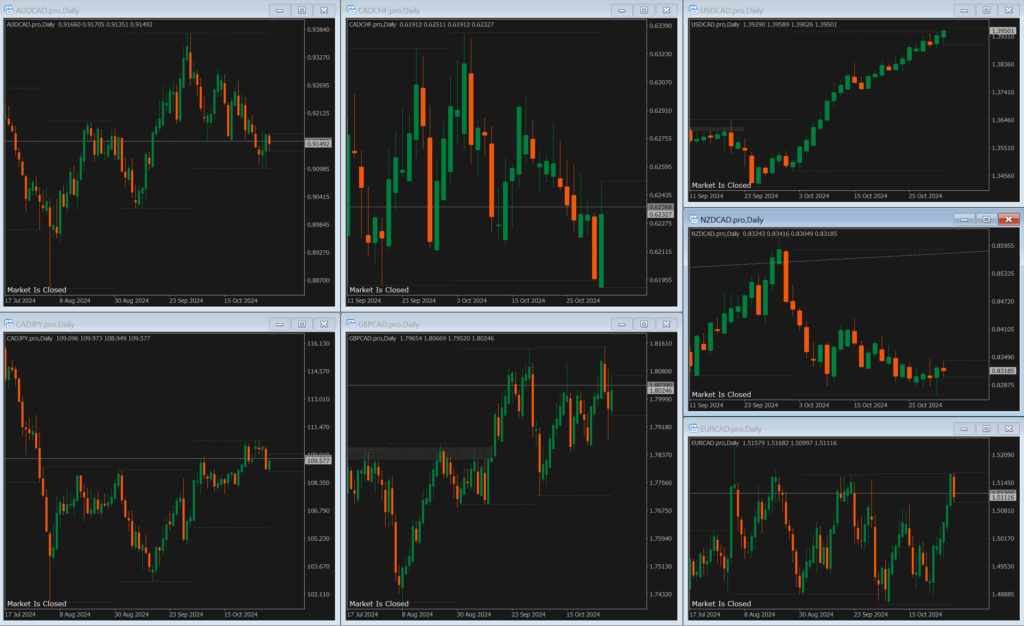

On the 1st template (which are the major pairs), do you see any valid flag pattern entries?…

Sure, we have these…

But they haven’t broken out yet, so this means that our setup is not yet valid. Moving on.

Next template…

None?

Yep, nothing here.

Next…

Also none!

Next…

OK, looks like we got one!

This time, it has indeed broken above the flag pattern and has formed a valid entry trigger.

So, take note of that currency pair and move on to the next.

Finally, the last template for this example…

…and, none there.

Done!

Pretty easy, right?

In less than 3 minutes, you’ve looked at tens of charts but extracted only the markets that matter.

This saves a tonne of time and makes the trading process much more efficient!

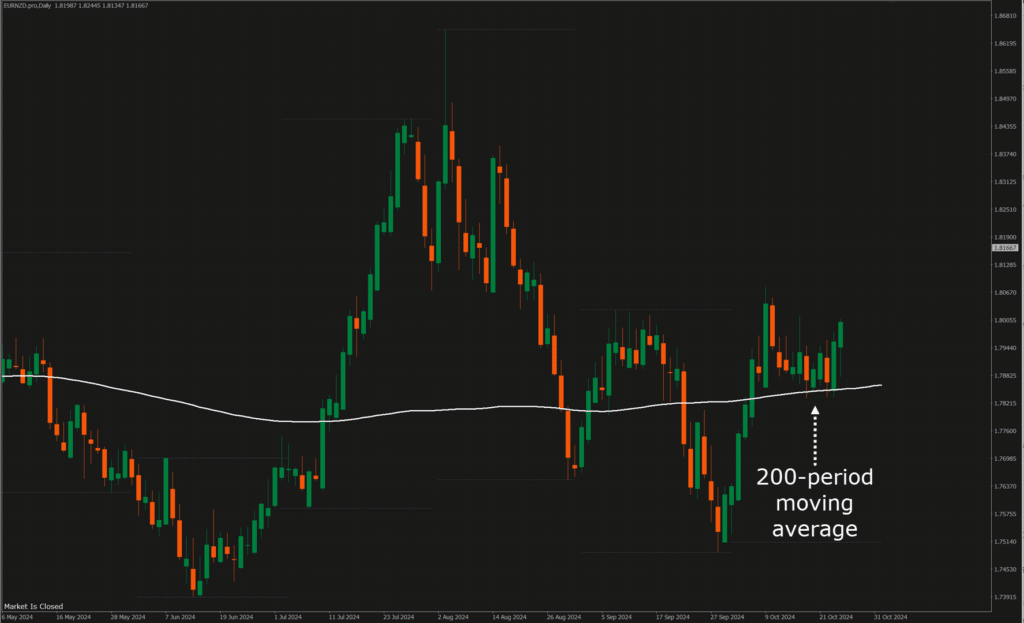

So, what do you do with the Forex pair that has a valid entry trigger?

Well, that’s the one to analyze!

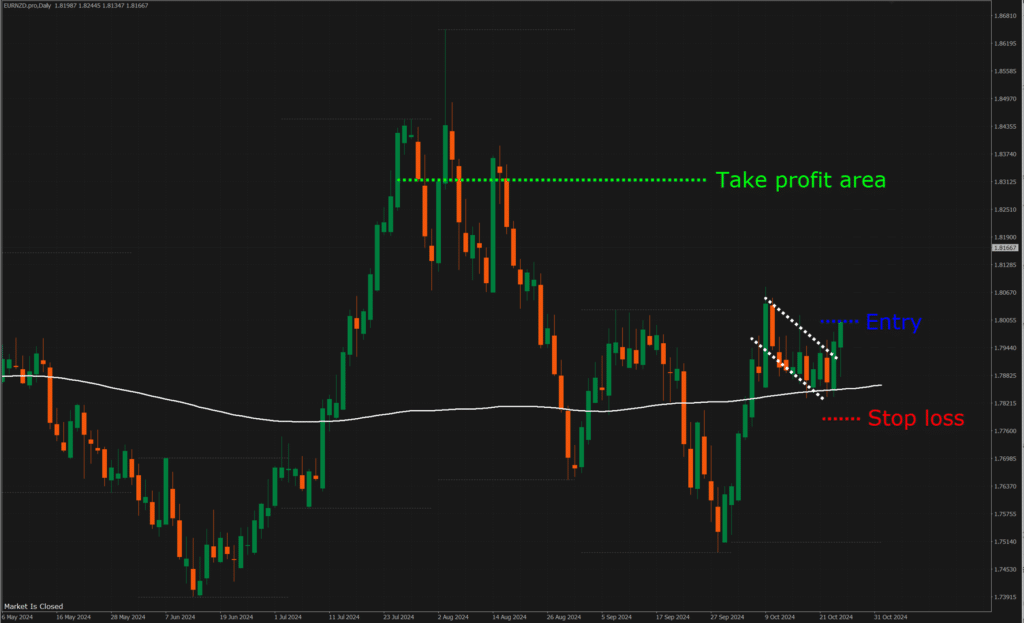

Now, as it turns out, the price is above the 200-period moving average…

At the same time, the price made an inverse head and shoulders pattern, and the flag pattern was just a confirmation…

This shows that the price is showing signs of bullishness.

As for take profits, you can consider selling before the nearest high, and stops below the lows of the flag pattern…

Now, stop a moment.

Imagine if you had to do this same process with 20+ charts… every time…

…you’d probably go nuts, right!?

Instead, you only pick the market with a valid “entry trigger” from your setup and analyze it from there.

As time goes by, you’ll be able to complete this process in less than 5 minutes, I promise!

(I trade off the daily timeframe, and I check the charts once a day, if you trade the lower timeframes, then you’d have to check more frequently)

With that said…

Let’s top things off with some tools you can consider adding to your MT4 platform.

MT4 Tips and Tricks: Extra tools indicators and tools to improve your trading

So maybe whenever you hear the word “indicator”, you always imagine something like this…

But in this section, I’ll share with you something way more sensible than that.

Ready for a game-changer?

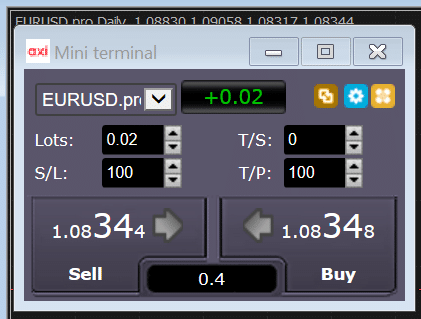

Well, it’s FXBlue’s integrated trade management tool…

Yes, that’s right…

FXBlue’s trade terminal can be integrated directly inside your MT4 platform!

This benefits you more if you’re a day trader, as it has multiple options for managing different kinds of positions.

Think of this as your trading portfolio’s ”air traffic controller.”

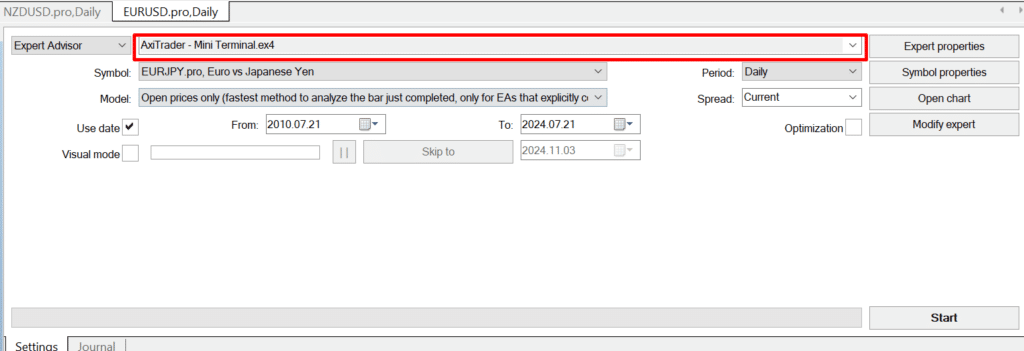

Another thing to consider using is FXBlue’s mini terminal…

A great aspect of this plugin is its multiple features.

It really simplifies risk management, and you can even use a trend line as a stop loss!

But the thing that makes this tool the best is that you can literally use it as a simulator.

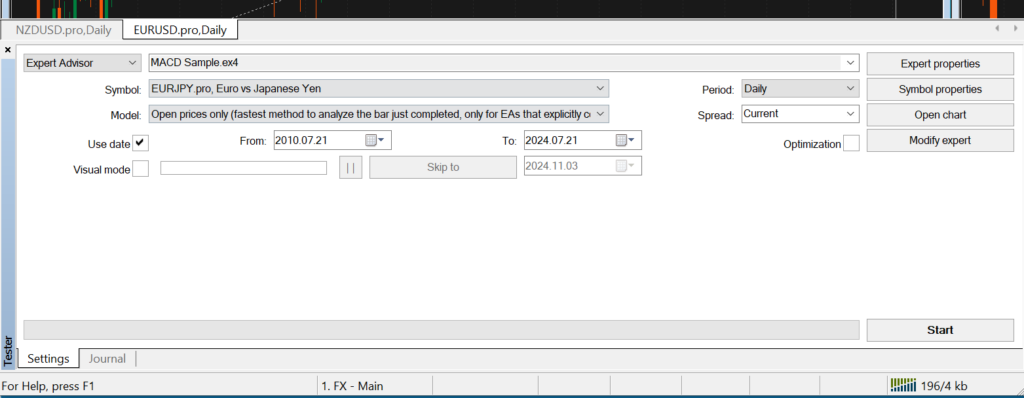

Just press CTRL + R…

Select the mini terminal…

You can then practice your trading using historical data!

It’s so useful I’ve also got a guide on how you can go about back-testing price action like this here.

At any rate, these trading tools will help take your trading execution and management to a much higher level.

With that said, let’s do a quick recap of what you’ve learned today!

Conclusion

Despite its age, MT4 remains one of the best trading platforms for Forex trading out there.

It has readily available custom indicators and expert advisors (not necessarily trading robots) for you to take advantage of.

By taking some time to integrate these MT4 tips and tricks, I’m certain you can improve your trading efficiency in no time!

Here’s what you’ve learned today…

- How to simplify your MT4 platform, declutter tabs, and develop a “master template” that includes all your indicators

- Understanding that market selection rule is crucial, taking advantage of the multi-chart feature to take it all in at a glance

- Using the bottom-to-top approach with watchlists, only analyzing valid setups

- Exploring FXBlue’s free tools to help you get the best out of the whole platform

And there you go!

A complete guide that further shows tips and tricks on the platform!

Note that I’ve been using this same process for around 3 years now, and I’m completely confident that this same process will help you out immensely.

Now I really want to know…

What is your experience with MT4? (I’m sure you have some!)

Do you have certain setups you prefer?

How does it compare to different trading platforms?

Let me know in the comments below!