January Conference Board confidence index comes in at 104.1 vs. 105.7 Bloomberg consensus, down from 109.5 in December. A 5.4 point decline is about 1 standard deviation (2021M07-2024M12). More interestingly, expectations (as opposed to current situation) is also down.

Source: Conference Board.

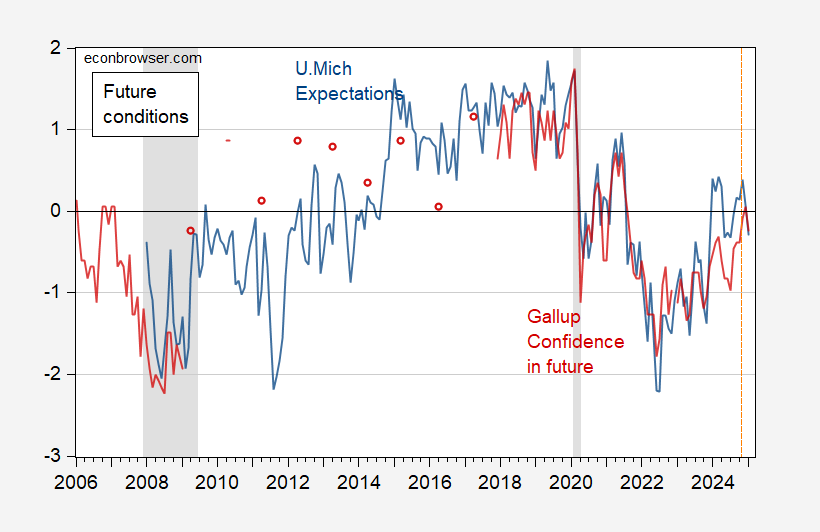

In addition to the decline recorded for the Confidence Board’s measure, expectations have also deteriorated for the University of Michigan Survey of Consumers, as well as the Gallup poll.

Figure 1: Univ. of Michigan expectations (blue), Gallup confidence in future (red), both standardized (demeaned, divided by standard deviation over 1995-2024 period). NBER defined peak-to-trough recession dates shaded gray. Source: U.Michigan via FRED, Gallup, NBER, and author’s calculations.

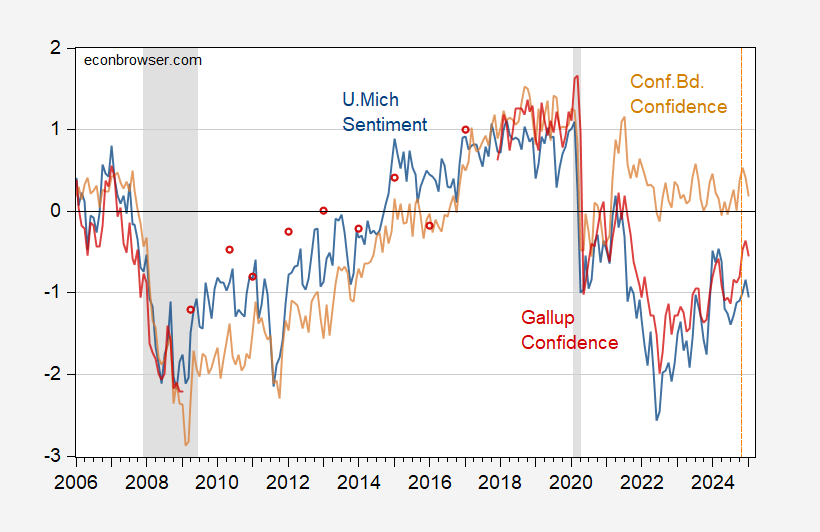

Overall sentiment/confidence indices have declined for U.Michigan, Conference Board, and Gallup series.

Figure 2: Univ. of Michigan expectations (blue), Conference Board confidence, expectations (tan), Gallup confidence in future (red), both standardized (demeaned, divided by standard deviation over 1995-2024 period). NBER defined peak-to-trough recession dates shaded gray. Source: U.Michigan via FRED, Conference Board via Investing.com, Gallup, NBER, and author’s calculations.

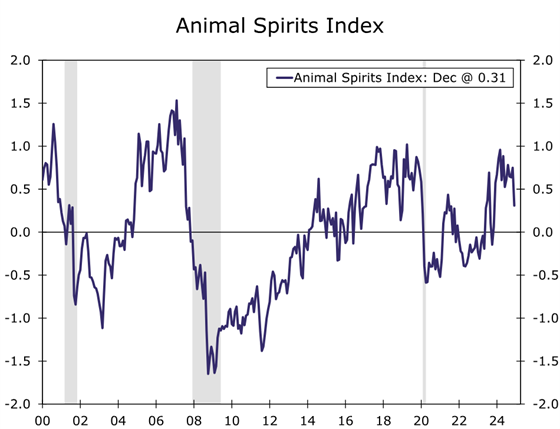

For completeness, I also include Wells Fargo’s “Animal Spirits Index”, which combines the SP500, 10yr-3mo term spread, EPU, VIX, and Conference Board confidence index.

Source: Wells Fargo, 28 Jan 2025.

Wells Fargo comments, regarding the confidence component:

Downside risks to the Consumer Confidence Index (and thus the ASI) in 2025 remain. In December, mentions of tariffs increased in consumer responses, with 46% of consumers expecting tariffs to raise the cost of living in the short term. Higher tariffs, if imposed, would impart a modest stagflationary shock to the economy, resulting in higher prices and slower economic growth. Higher prices would impart a negative shock to real income growth, thereby weighing on growth in real consumer spending, which would soften purchasing power and confidence.

So, even before the imposition of tariffs, their effects are being felt.