The Indian Finance Minister has tabled today, the Union General Budget 2025-26 in the Parliament. From the Assessment Year 2021-22, a tax assessee has been provided with an option to select either new tax rates or old rates.

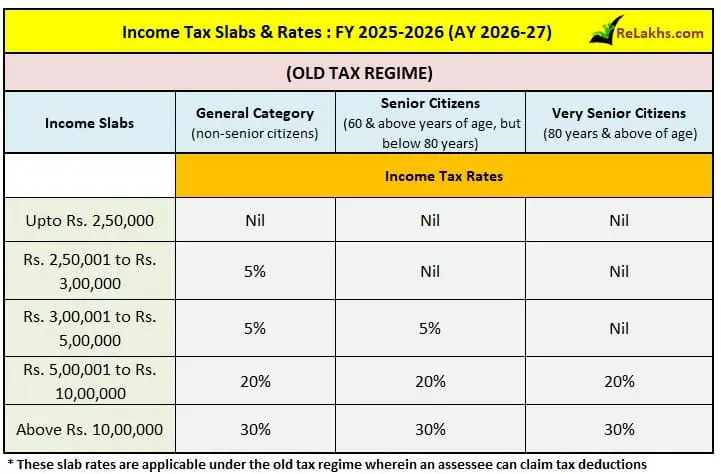

As per the Budget 2025, there has been no changes made to personal Income tax structure under old tax regime. However, a significant revision to the income tax slab structure has been proposed under the new tax regime, with effective from the Financial Year 2025-26 (AY 2026-27).

Latest Income Tax Slab Rates for FY 2025-26 / AY 2026-27

Effective from FY 2020-21, the individual tax assessee has an option to go for new Tax Slab Rates by forgoing the most of the Income Tax Deductions and Exemptions, like HRA, Section 80C, Home loan tax benefits etc.,

As per the Budget 2025, no income tax will be payable on income up to Rs 12 lakh has been proposed. Below is the new tax slab structure under the new tax regime

What is Tax Rebate? Tax rebate is a refund on taxes when the liability on tax is less than the tax paid or liable to pay, by the individual is referred to as Income Tax Rebate.

Section 87A allows individuals to claim the rebate on income tax liability that arises for each income slab. This rebate is now available for all the tax assessees with income up to Rs 12 lakh.

The salaried individuals eligible for the standard deduction benefit of Rs 75,000 will not be required to pay any taxes if their gross taxable income does not exceed Rs 12.75 lakh.

“Resident individuals with a net taxable income up to Rs 12 lakh will now pay no income tax. For salaried individuals who avail of the standard deduction benefit of Rs 75,000 under the new tax regime, the tax-free threshold increases to Rs 12.75 lakh. This is a significant increase from the previous Rs 7 lakh income limit under the new tax regime.”

I believe that income from Capital Gains is not part of this Rs 12 lakh bracket. The tax rebate does not apply to special income like capital gains, which is taxed at separate rates.

In case, you wish to claim your IT deductions and exemptions then your income will be subject to tax as per the below income tax slabs and rates;

Continue reading :

Kindly note that this article will be updated/edited as and when more information is available.

(Post first published on : 01-February-2025)