Conference Board index at 98.3 vs. 102.7 Bloomberg consensus, down from upwardly revised 105.3. Here is a picture of (standardized) U.Michigan Sentiment, Conference Board and Gallup Confidence measures.

Figure 1: U.Michigan Economic Sentiment (blue), Conference Board Confidence Index (blue), Gallup Confidence (green), all demeaned and divided by standard deviation 2021M01-2025m02. Source: UMichigan, Gallup, Conference Board, and author’s calculations.

The three month change in the confidence index is about 1.5 standard deviations from the mean over this period.

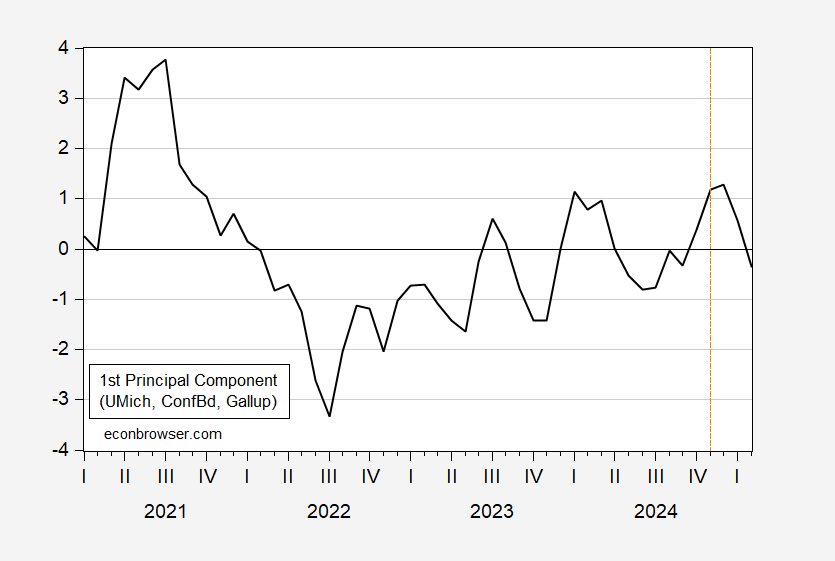

To summarize the movements in all three series, I extract the first principal component of the series:

Figure 2: First principal component of U.Michigan Economic Sentiment, Conference Board Confidence Index, Gallup Confidence (black). Source: UMichigan, Gallup, Conference Board, and author’s calculations.

Any post-election bounce has disappeared.

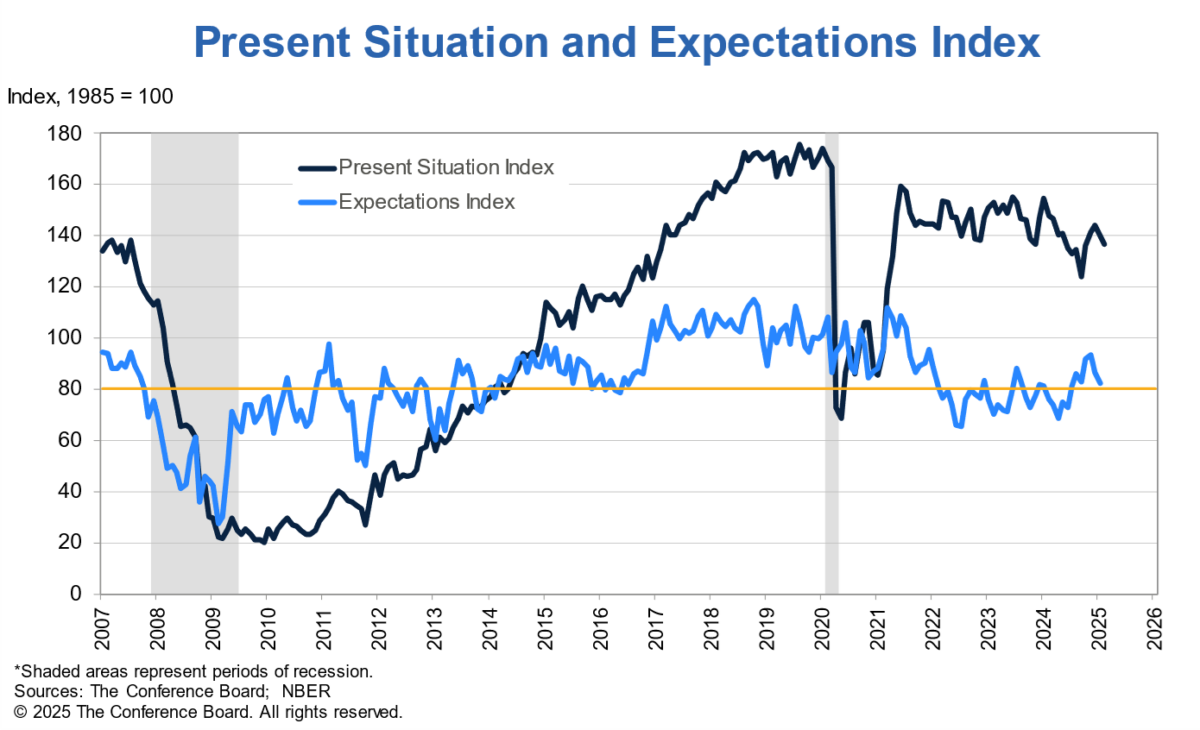

The drop in expectations 6 months ahead in the Confidence Board index is of particular interest. From the Conference Board today:

Pessimism about the future returned

The Conference Board Consumer Confidence Index® declined by 7.0 points in February to 98.3 (1985=100). The Present Situation Index—based on consumers’ assessment of current business and labor market conditions—fell 3.4 points to 136.5. The Expectations Index—based on consumers’ short-term outlook for income, business, and labor market conditions— dropped 9.3 points to 72.9. For the first time since June 2024, the Expectations Index was below the threshold of 80 that usually signals a recession ahead. The cutoff date for preliminary results was February 19, 2025.

Here’s a graph of the current vs expectations components.

Source: Conference Board, accessed 2/25/2025.

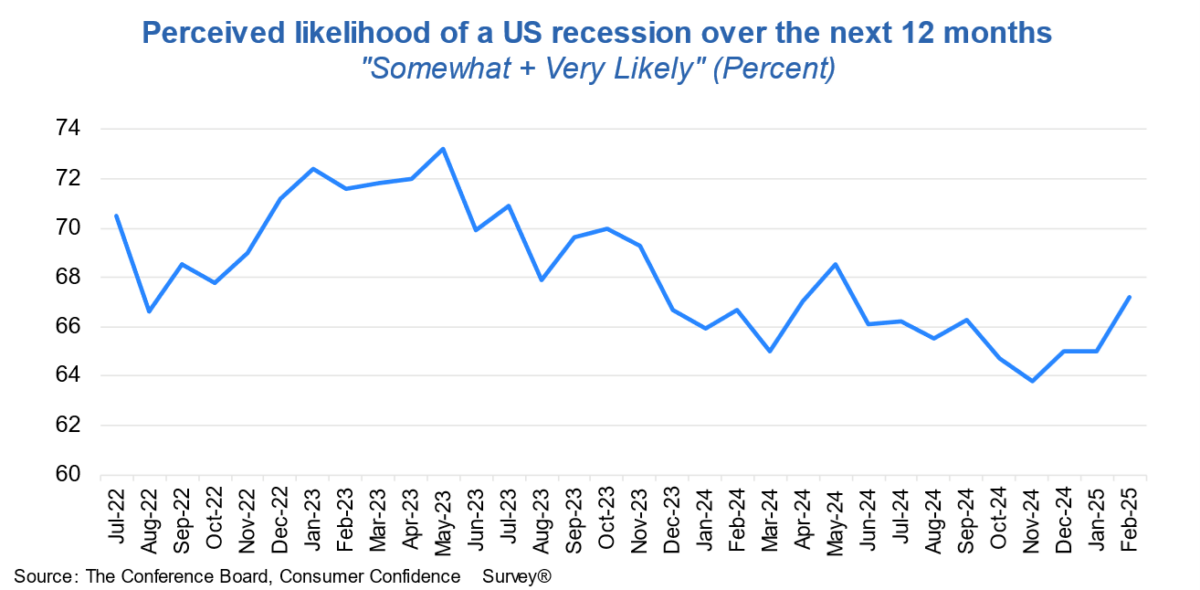

I find remarkable the elevated levels that individuals ascribe to recession probabilities.

Source: Conference Board, accessed 2/25/2025.

That said, I guess it’s best to consider the changes in the likelihood. In this case the likelihood has risen from 64% to over 67%.