When consumer sentiment drops as precipitously as it has (see here), then one has to ask if a recession is in the offing in this month. Here’s I’m using the U Michigan consumer sentiment index to determine if we’re in a recession now (i.e., not forecasting).

Here’s Torsten Slok’s graph (among several):

Source: Slok/Apollo.

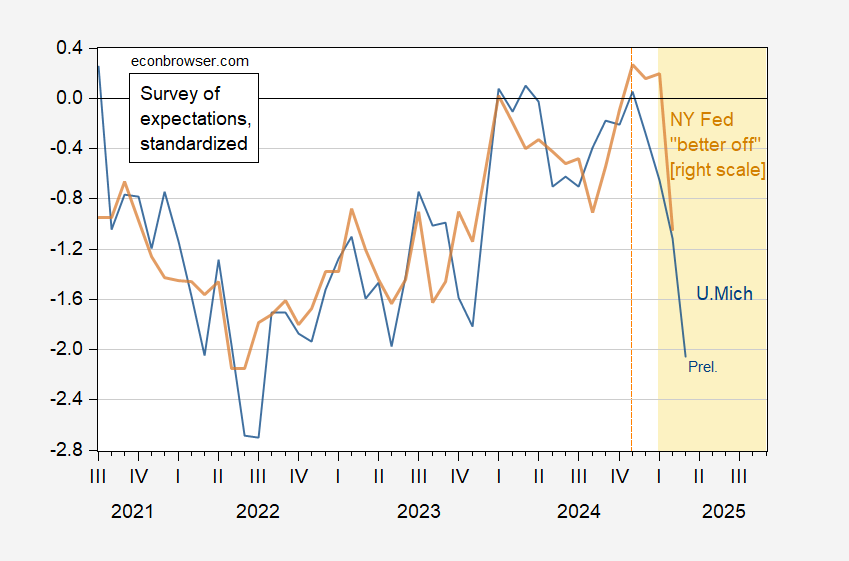

The drop in Michigan sentiment and Conference Board confidence is shown below:

Figure 1: U.Michigan expectations index (blue), and NY “better off” aggregate (tan), both demeaned and standardized (2013M06-2025M02). Source: U.Michigan, NY Fed, and author’s calculations.

Here’s one recent analysis on this subject: [1] Blanchflower and Bryson (2022) argue for predictive power of the Michigan index.

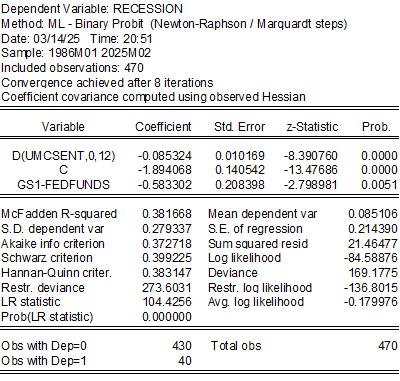

I run a probit regression of a NBER peak-to-trough recession dummy on contemporaneous Michigan sentiment (FRED variable UMCSENT) and the 1yr-Fed funds spread (the last is per Miller (2019) who shows this spread has the highest AUROC of spreads at one month horizon).

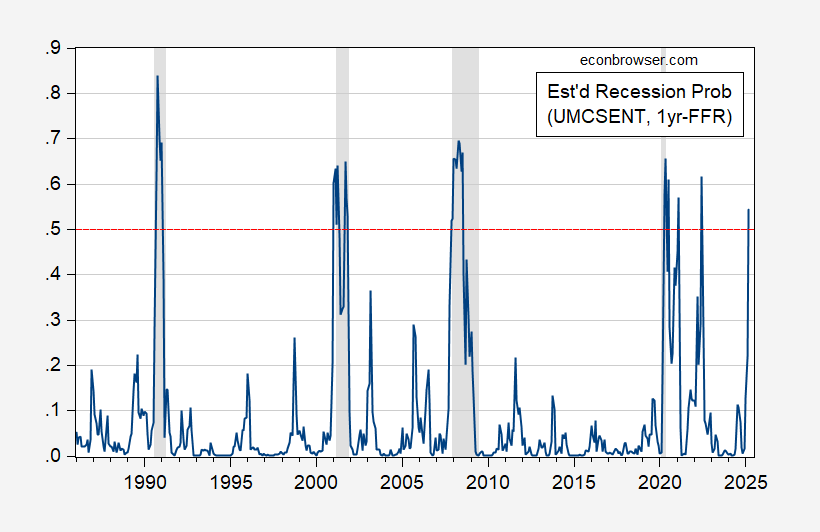

And here’s the estimated recession probability, extended to 2025M03, assuming no recession has occurred as of February 2025.

Figure 2: Estimated recession probability using contemporaneous Michigan consumer sentiment and one year Treasury-Fed Funds spread. March spread based on Michigan preliminary reading and yields/rates through 14 March. NBER defined peak-to-trough recession dates shaded gray. Source: U.Michigan, Treasury, Federal Reserve, NBER and author’s calculations.

While these estimated probabilities match the recessions pretty well, they indicate a mid-2022 recession (one month). The likelihood for this month is 53% (using the preliminary U.Michigan reading and interest rates through the 14th).

Still, we don’t have readings for any variable in March. The unemployment rate would have to jump from 4.1% to 4.9% in February in order for the Sahm rule to be triggered (as of February, it reads 0.27 ppts, far below 0.5 ppts).