I run a probit regression of a NBER peak-to-trough recession dummy on contemporaneous Michigan sentiment (FRED variable UMCSENT, and final reading for March) and the 1yr-Fed funds spread (the last is per Miller (2019) who shows this spread has he highest AUROC of spreads at one month horizon).

The pseudo-R2 is pretty high, but to be expected for doing a near-contemporaneous prediction of recession.

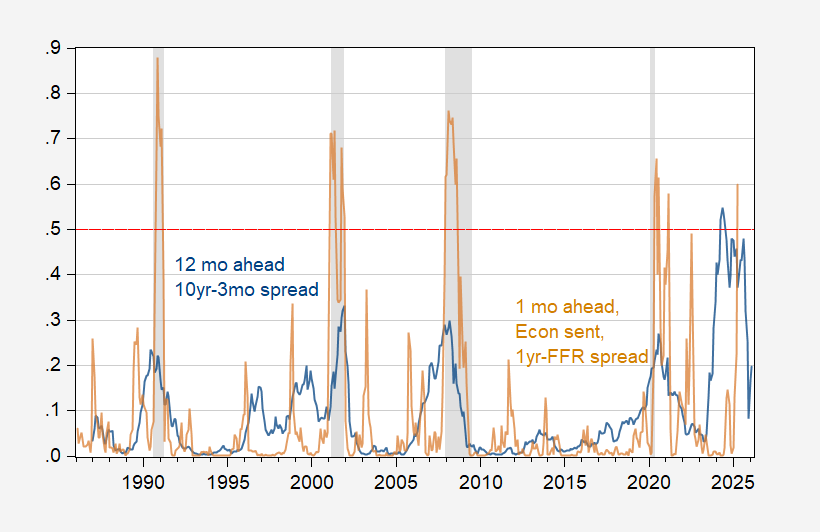

And here’s the estimated recession probability, extended to 2025M03, assuming no recession has occurred as of February 2025.

Figure 2: One month ahead estimated recession probability using y/y change in Michigan consumer sentiment and one year Treasury-Fed Funds spread. March spread based on Michigan final reading and yields/rates through 28 March. NBER defined peak-to-trough recession dates shaded gray. Horizontal red dashed line at 50% threshold. Source: U.Michigan, Treasury, Federal Reserve, NBER and author’s calculations.

The likelihood for April is 60% (using the final U.Michigan reading and interest rates through the 28th). Note that using a 50% threshold, there are no false positives (using a 45%, one would find a false positive in 2022.

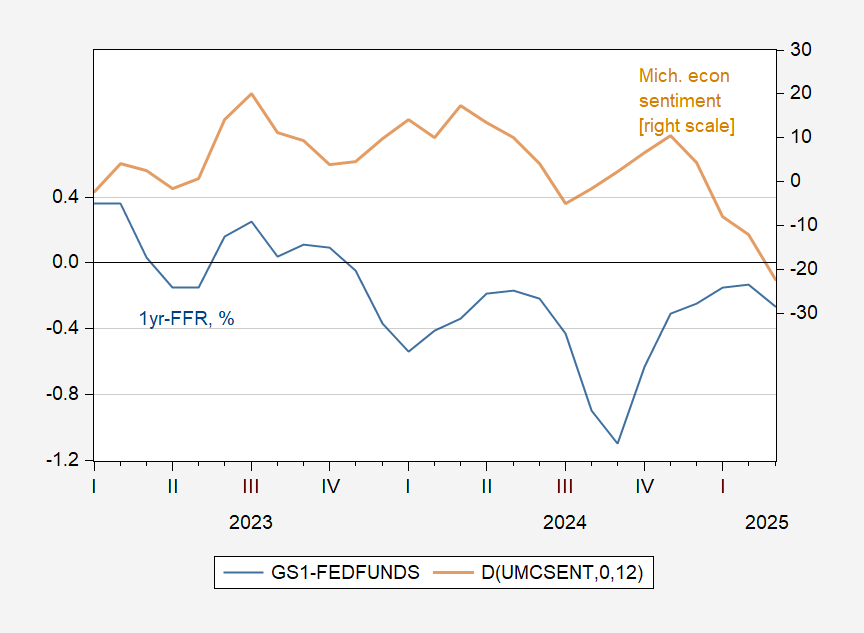

Looking at the determinants makes one understand why the estimated recession likelihood is high.

Figure 2: One year Treasury – Fed funds spread, % (blue, left scale), and Year-on-Year change in U.MIchigan economic sentiment (brown, right scale). Source: FRED, U.Michigan, and author’s calculations.

The 1yr-FFR spread has deepened its inversion, and the Michigan sentiment index has experienced a large and quick decline.

That being said, aside from consumption, there’s been little sign of a recession in contemporaneous, hard-data indicators.