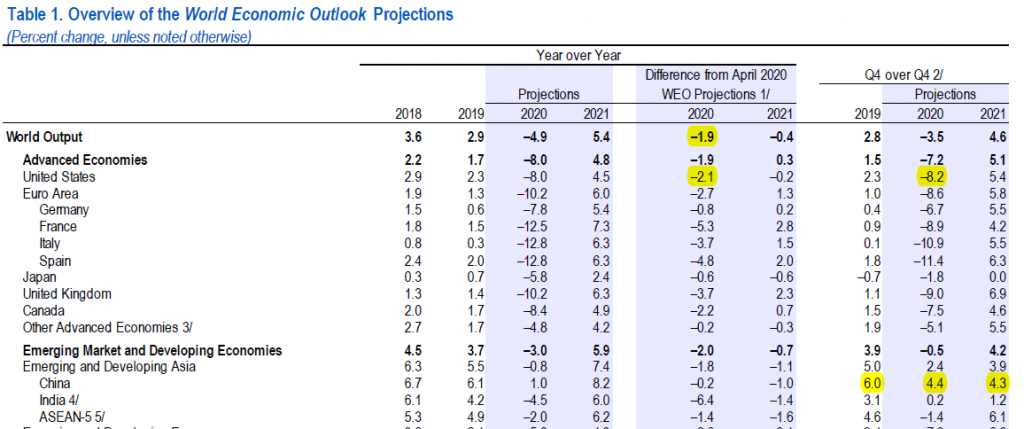

Today, the IMF released an extensive update to its April forecast, incorporating substantial downward revisions to forecasted growth.

Inspection of the table presenting forecasts and revisions is enlightening.

Notice the US forecast for 2020 has been revised down by 2.1 percentage points on a year-on-year basis, reflecting a variety of things, of which I imagine the incredibly botched response to the pandemic is a major part. It is interesting that Q4/Q4 growth for 2020 is projected to be -8.2%, lower than -6.2% implied by the WSJ June survey mean responses.

Regarding China, the 4.4% 2020 Q4/Q4 growth doesn’t seem that much lower than the 6% recorded in 2019. However, one must recall this rate is being sustained by massive fiscal, quasi-fiscal, and monetary policies. Both public and private debt levels are rising rapidly.

From the WEO:

Uncertainty. Similarly to the April 2020 WEO projections, there is pervasive uncertainty around this forecast. The forecast depends on the depth of the contraction in the second quarter of 2020 (for which complete data are not yet available) as well as the magnitude and persistence of the adverse shock. These elements, in turn, depend on several uncertain factors, including

• The length of the pandemic and required lockdowns

• Voluntary social distancing, which will affect spending

• Displaced workers’ ability to secure employment, possibly in different sectors

• Scarring from firm closures and unemployed workers exiting the workforce, which may make it more difficult for activity to bounce back once the pandemic fades

• The impact of changes to strengthen workplace safety—such as staggered work shifts, enhanced hygiene and cleaning between shifts, new workplace practices relating to proximity of personnel on production lines—which incur business costs

• Global supply chain reconfigurations that affect productivity as companies try to enhance their resilience to supply disruptions• The extent of cross-border spillovers from weaker external demand as well as funding shortfalls

• Eventual resolution of the current disconnect between asset valuations and prospects for economic activity (as highlighted in the June 2020 GFSR Update)

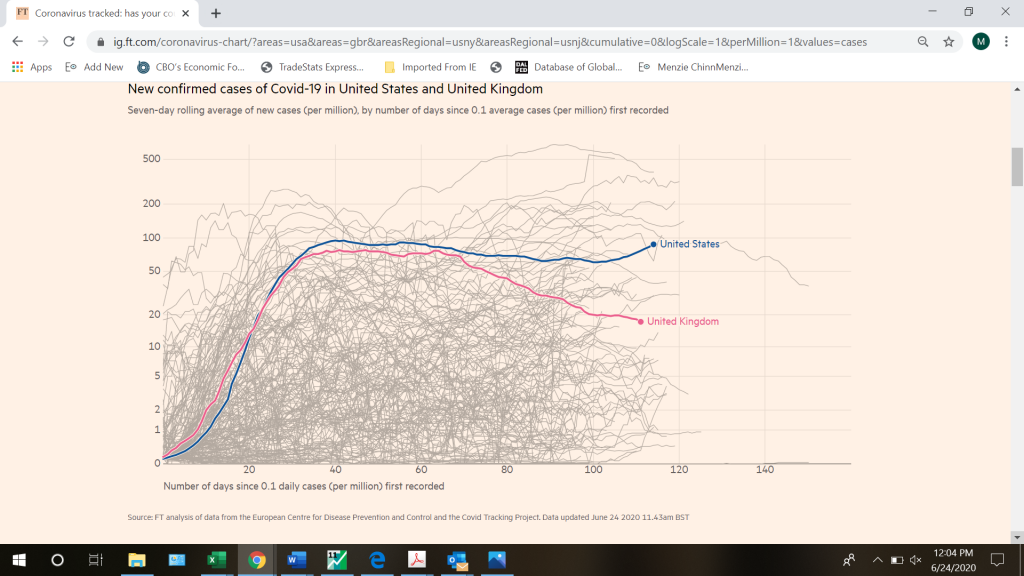

Regarding the length of the pandemic, it’s clear that the Trump attempt to just plow through in reopening is likely to increase uncertainty and end in sadness.