Paul Tudor Jones is known in the mainstream investing world for his cowboy-style futures trading and for correctly calling the Black Monday market crash in the 1980s. As a result of successfully managing his fund over the last few decades, Jones has a net worth of roughly $5 billion.

Now he’s making a big bet on Bitcoin, comparing it to gold’s status as an inflationary hedge in the 1970s. He laid out his thoughts on the coming years of financial market activity in his May 2020 macro fund investor letter.

Jones said of the central bank response to coronavirus: “even a market veteran like myself was left speechless.”

The Great Monetary Inflation

Here’s the situation, according to Jones: central banks just printed 6.6% of global GDP in the last few months, a circumstance Jones is referring to as the Great Monetary Inflation (GMI).

The initiation of the GMI comes at a time of sky-high global indebtedness. Jones cites congress projections that the US government debt will reach new highs in 2021. Corporate and consumer debt also reached historic highs leading into the pandemic.

Source: Tudor BVI investor letter

With the Federal Reserve’s balance sheet growing 60% in less than three months, the supply of money is sky-high, historically. “Money Printing is a Hard Habit to Quit.”

Speaking of money supply, Jones refers to M2, a measure of the amount of cash in the system. M2 includes cash, checking deposits, money market funds, mutual funds, and similar deposits. Jones sourced his M2 analysis from “Wall Street dinosaurs” because hardly anyone uses the metric anymore.

Federal Reserve Balance Sheet

In Jones’ eyes, this all but promises that elevated inflation is coming and will be here to stay.

Interest Rates and Inflation Explained

With central banks globally printing trillions of dollars, the overall supply of money has gone up. It’s common sense to expect that inflation will follow. While there are many forces at play, this is basically the crux of Jones’ argument, with some pretty charts and economic theory to support it.

With the current economy so saddled up with debt, it will be difficult for central banks to increase interest rates for the coming years without causing a recession.

As Milton Friedman has said countless times, inflation is caused by governments and central banks printing money. The correlation between inflation and the supply of money over time is always about 1.

Inflation? Enter Bitcoin

Skeptical investors have long loved gold. You can’t print gold, and therefore its supply is, by definition, finite. Jones realizes this and calls gold a “2,500-year store of value.”

Bitcoin is similar in this respect. Bitcoin’s protocol dictates that only 21 million total bitcoins can be mined. As of writing this in May 2020, 18.5 million of those have already been mined.

This basic trait makes inflation of Bitcoin impossible, making them preferable as a store of value to fiat currencies for many investors.

Grading Bitcoin As a Store of Value

Jones tests Bitcoin as a store of value using these criteria, taken from his investor letter:

- Purchasing Power – How does this asset retain its value over time?

- Trustworthiness – How is it perceived through time and universally as a store of value?

- Liquidity – How quickly can the asset be monetized into a transactional currency?

- Portability – Can you geographically move this asset if you had to for an unforeseen reason?

Jones grades Bitcoin against the following inflation hedges (taken from his letter):

- Gold

- US Treasuries Yield Curve

- NASDAQ 100

- US equity cyclicals/defensive

- AUDJPY

- JPM Emerging Market Currency Index

- TIPS Breakevens

- GSCI (Goldman Sachs Commodity Index)

Purchasing Power

Jones calls back to the 1970s, a time of double-digit inflation. Back then, most financial assets (like stocks and bonds) couldn’t outpace inflation, and currency carry trades became the predominant method of escaping inflation.

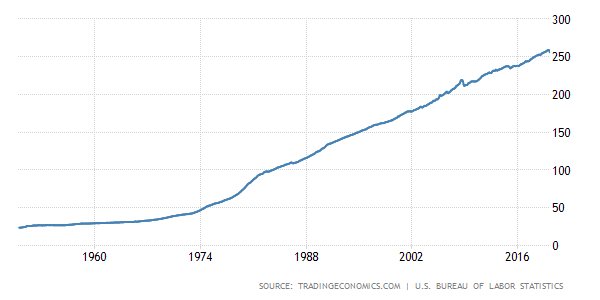

For reference, below is a historical chart of the US Consumer Index (the index used to measure inflation). As you can see, inflation really picked up in the ’70s.

As mentioned, Bitcoin is definitionally finite at 21 million coins. Once all are mined, there’s never any more left. The kicker here is that, even though the vast majority (roughly 18.5 million) of bitcoins are already in circulation, stored away, or lost forever, the last of the approximately 3 million unmined coins won’t be mined until about 2140.

Trustworthiness

It goes without saying that Bitcoin’s trust is low. The IRS and SEC seem to do what they can to make it difficult for cryptocurrency traders to transact easily. The token has a reputation as a safe harbor for money launderers, drug dealers, and other criminals.

In recent years, public trust in the token has risen with the CME’s creation of Bitcoin Futures and notable investors like Jones investing.

The token still has ways to go before it can reach any network effect for use in commerce or enough trust for institutional asset allocators to include Bitcoin in portfolios.

Jones performed a ‘subjective study’ with his research group to ascribe assets score for their ability to store value. Bitcoin’s score was near-zero in the trustworthiness category.

Liquidity

Bitcoin shares some similarities with gold in that it’s “near money.” It’s not quite cash (aka, you can’t buy Starbucks with it), but it can be readily converted to cash quickly.

The problem arises with transaction fees. For smaller transactions, Bitcoin’s transaction fees are higher than most assets and unreliable. Transaction fees have ballooned over 2,000 in 2020 alone.

A critical factor in grading an asset’s liquidity is the ability to turn it into cash with minimal transaction fees and slippage. Bitcoin is pretty lacking in this department, especially when compared to US equities and gold. It does, however, defeat real estate by a mile.

Bitcoin Futures, an institutional investor’s preferred method of trading/investing in Bitcoin, has weak volumes. It’s unclear why the most hyped release of a futures contract in several years failed to garner significant volume.

The 1-minute Bitcoin Futures chart looks more like that of an obscure penny stock chart:

Portability

Portability is the one category Bitcoin wins by a longshot. In the event of a global disaster, like a hostile takeover of the government, your interests in financial assets may lose their abilities to cross borders.

Gold is difficult to transport in large quantities. You can store all of your bitcoin on a USB thumb drive or smartphone.

Final Thoughts

Paul Tudor Jones has a decorated investing career. He’s best known for forecasting and profiting from the Black Monday crash, but his career following is more impressive. Since the start of his career in the 1980s, the Tudor Group of hedge funds has returned an average annual return of 19.5%.

While Jones isn’t the first notable investor to buy Bitcoin in a significant quantity (lower single digits of his fund), he’s the largest and most prominent.

With skepticism of the Federal Reserve and central banks going mainstream (see the ‘money printer go brrr’ meme), perhaps Bitcoin will finally have its day among institutional investors.