Thanks to the additional $600/week in enhanced unemployment benefits, there are now some people who are making more in unemployment benefits than they did while they were working. Although the enhanced benefits are only temporary, this is still great news!

The never-ending pressure in America to hustle has taken its toll. Our bodies are breaking down, mental illnesses are ubiquitous, and our children are being neglected all by the desire to make money.

As someone who stepped off the treadmill in 2012, although I’m sad millions have lost their jobs, I’m also excited that millions will get to experience what it’s like to finally be able to stand still in adulthood. May we all experience a period of meditative calmness until the worst of the coronavirus is behind us.

With trillions of dollars of government assistance going to individuals and companies, there will inevitably be some who will take advantage of the system. So long as they are doing so legally, like millionaires receiving health care subsidies or millionaires receiving stimulus checks, people don’t seem to mind. There’s so much money to go around.

But when mega-millionaires and fake small businesses owned by very wealthy individuals take advantage of government assistance despite knowing the money was not really meant for them, that’s where I see many seem to draw the line. Let’s have a look at what’s going on.

Big Businesses Taking Advantage

We are seeing maddening headlines such as Ruth’s Chris Steak House getting $20 million (even though the limit is $10 million), Shake Shack getting $10 million (even though the employee limit is 500), and Harvard University, getting $8.9 million in CARES Act grants (even though Harvard has a $40 billion endowment).

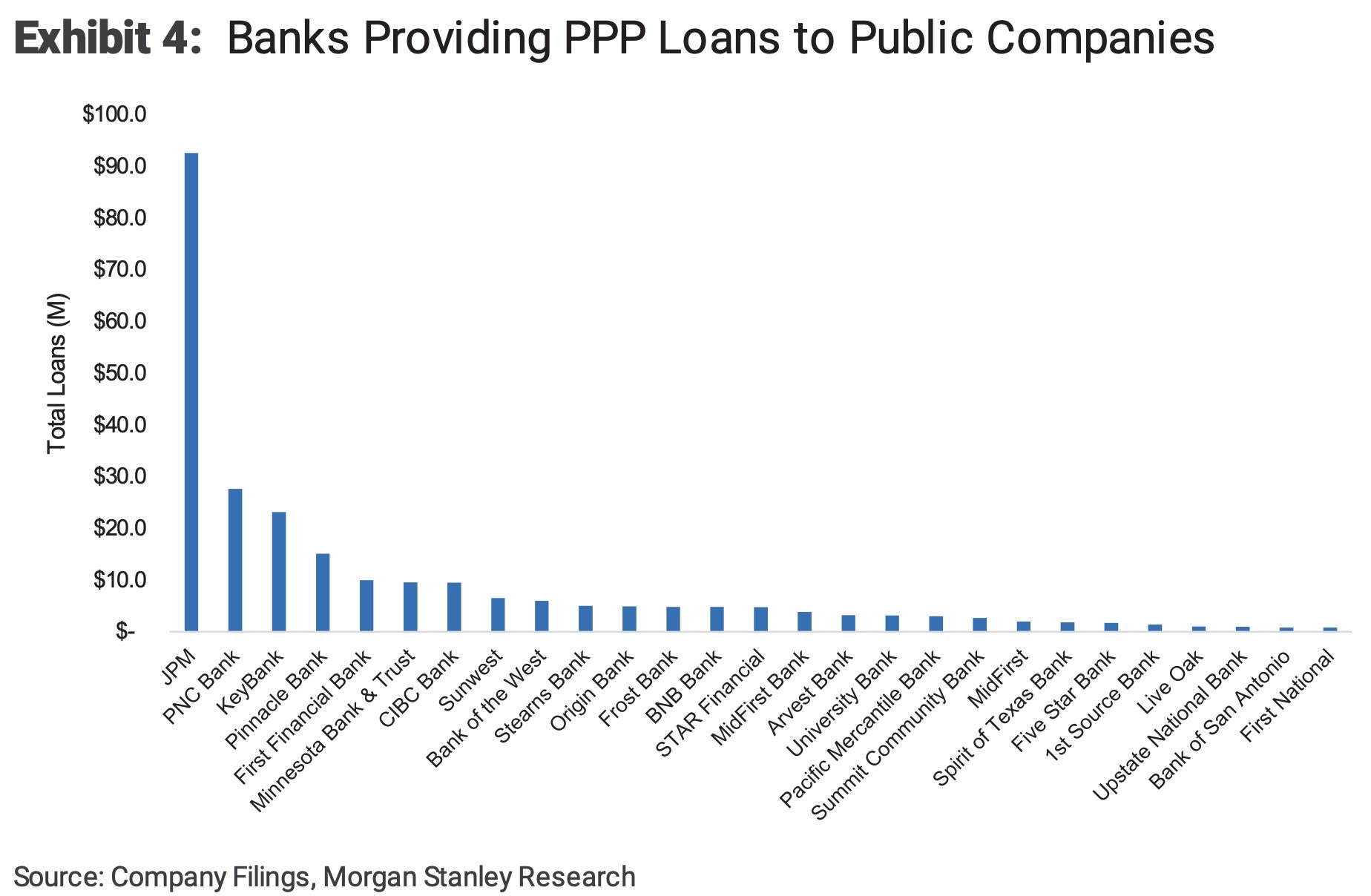

These businesses are violating the spirit of the Paychecks Protection Program and the CARES Act. I also highly doubt that Congress had helping out publicly-traded companies were at the top of Congress’s list for the PPP. It has other stimulus money for them.

But the reality is, these larger and wealthier institutions are likely suffering more than most small businesses in terms of absolute amount of wealth lost.

For example, publicly-traded Shake Shack (SHAK) has lost over $1 billion in market capitalization since the coronavirus pandemic. $10 million is less than 2% of its lost wealth. Meanwhile, Harvard University’s endowment fund has probably lost at least $5 billion in value.

It’s really the negative optics of applying for PPP funding when so many small businesses are suffering that is likely to haunt Ruth’s Chris, Shake Shack, Harvard University, and other large institutions receiving PPP money for the rest of their business days. With so many poorer businesses still not receiving funding, the millions of small business owners and their employees will never forget.

Harvard’s reputation was already getting hit because of how it evaluates different racial groups for admission. Taking $8.9 million from the CARES Act program, when it already has tens of billions is shameful.

Let’s learn how the rich get richer at the expense of others.

Key Lessons From The Rich

First Key Lesson: If the money is legally available, take it. Think about the negative optics later.

During difficult times, access to capital and free money is highly limited. You must rush to get in line first and get yours before the money runs out. If you don’t take the money, chances increase that you will end up losing your business and a lot of your wealth.

Do you think Danny Meyer, the founder of Shake Shack, who is also worth several hundred million dollars, was worried about crowding out PPP funds for small businesses? Of course not. He was focused on getting as much money from the PPP as possible to keep his businesses afloat in order to protect his fortune. During a downturn, it is every man for himself.

Second Key Lesson: Change the narrative in your favor.

Shake Shack made sure it got the maximum amount of PPP loan available. Once it got their relief funds, it was then able to assess the repercussions of its actions.

Once the public found out, the public went berserk that a publicly-listed, billion dollar company got funding. As a result, Shake Shack strategically changed the narrative by painting itself as a noble knight by returning the $10 million to help other small businesses.

As a result, Shake Shack was able to engender a lot of good will amongst the public and receive millions of dollars worth of free publicity. This was a strategically brilliant move by the executives that will likely net them far greater than $10 million in the future.

They created a “heads I win, tails you” lose type of scenario. So sneaky and many unsuspecting patrons will have no idea what happened.

Third Key Lesson: Keep your company private and yourself private for as long as possible.

There’s no point being rich if you are a constant slave to others.

One of the main reasons why Shake Shack got outed for taking $10 million in PPP money is because it is a publicly-listed company. Once you become public, every move you make is scrutinized by thousands of shareholders and the SEC.

If you want to throw big boondoggles, use company funds to buy a private jet, or hire all your friends and relatives, it’s much easier to do so as a private company. Uber and WeWork had a ton of fun as private companies.

No matter how unfair Harvard’s admissions process is, there’s nothing anybody can do about it because Harvard is a private institution. It can admit whomever it wants based on whatever criteria it wants. Harvard doesn’t owe the public anything.

Finally, by being stealth, fewer people will judge you and snoop around your business. Although the threshold for accepting rich people has increased over the years, there is a point where after a certain amount, you are simply too rich. I’m guessing that threshold amount in 2020 is anything more than $10 million per person.

Fourth Key Lesson: Always develop good relationships with financial institutions and people with money.

So long as you have access to capital, you can live to fight another day. Without access to capital, if you find yourself in a temporary bind, you may be forced to shut down at the worst possible time.

Besides having at least six months of liquid cash to pay for all expenses, consider having at least two banking relationships and multiple lines of credit. Worst case, you can always depend on The Bank Of Mom & Dad if you’re completely down on your luck. That said, at least try and develop a good relationship with them long before you need the money.

Fifth Key Lesson: Take out just enough debt to help you get richer in good times, but not enough debt to blow yourself up. Even if you have good relationships with the institutions or people who have money, relationships are fickle.

You would think that after going through through a 10+-year bull market, most businesses would be able to last for longer than two months. But reality is, margins may be thing or operators are often pumping money back into their businesses for hopefully more growth.

The Business That Benefits The Most From PPP

Now that we’ve learned some key lessons on getting rich by the rich, let’s do a quick analysis of which type of business benefits the most from the PPP. This type of business will also be “most acceptable” by the public. However, you’ll see from the exercise that even this type of business warrants caution.

The best businesses for the PPP are ones with low operating profit margins, are people-intensive, and regularly pay salaries close to or greater than $100,000. I’m talking nonprofits. Let’s use a nonprofit school as an example.

As the founder of a nonprofit school, your mission is to educate the children of America to one day become outstanding citizens. You strongly believe education is the key to a brighter future. You aren’t running a nonprofit school to get rich. Your rewards come from community admiration, your salary, and your retirement benefits.

Let’s look at how a nonprofit school benefits the most from the PPP. A key assumption is that all revenue is paid out each month towards salary, rent, and benefits.

How A Nonprofit School Benefits

1) In March, the school asks all parents to pay April tuition, despite school being closed. Proceeds: $80,000. But all rent and payroll is paid as well. Net proceeds: $0.

2) In April, the school also asks parents to donate to the school to help pay for rent and other operating expenses given the uncertainty. Proceeds: $40,000

3) In April, the school furloughs all teachers and staff effective May 1, so they can benefit from the extra $600/week in unemployment benefits at least through July 31, 2020. Given there is no tuition for May and no payroll expense either, the net school benefit is $40,000 from donations.

4) On April 3, the school applies for the PPP loan and receives 2.5X monthly payroll expenses on April 30 due to all the backlog. The PPP money enables the school to fully pay for May, June, and half of July payroll. The school must pay for at least eight weeks of payroll for the loan to be forgiven. The school has until June 30 to hire everyone back and start the 8-week clock. PPP proceeds: $200,000. The total benefit is now $240,000 (PPP + donations).

5) School is back in session on June 1. All teachers and staff are hired back. All previously enrolled students return. Full tuition is paid. June expenses are 100% covered by June tuition. The teachers were able to earn $4,200 in unemployment benefits for May, which is good, but $2,450 less than they would have earned if they had worked ($80,000 average salary). Everything goes back to normal.

6) On July 1, 2020, the $200,000 PPP loan is 100% forgiven because all employees were hired back before June 30. The school also gets to keep $40,000 in donations. Thanks to the PPP loan, the nonprofit school gets to boost its balance sheet by $240,000. $24,500 of the funds will be used to pay their 10 furloughed staff for the income they lost in May (regular salary – unemployment benefits). The remaining $215,500 can be used to pay the owners a higher salary, the teachers a higher salary, or keep the money in reserves just in case there is another lockdown in the future.

7) Given the school is still up $215,500 after making all its staff whole, it could also decide whether to refund the $40,000 in donations from the parents. It could also decide to refund the $80,000 in tuition parents paid in April for no school service. Even after refunding $120,000 in donations and tuitions, the school would still be up $95,500 thanks to PPP.

Most people will not understand the math and logic in this example. It is confusing even though I’ve tried my best to make it clear. However, the school needs to read carefully on what it will do after the worst is over. Many people are hurting financially as well.

All Eyes Will Be Watching Small Business Owners

Once the worst of the downturn is over, attention will be focused on how small business owners will act towards the people who supported and sacrificed for their business.

There are situations where businesses will get donations from parents, clients, and good samaritans during the lockdown. There are also plenty of situations where many staff will take significant pay cuts during the lockdown as well.

Honorable small business owners will use any surplus they receive to at least make their staff whole if they were furloughed or laid off. A thoughtful small business owner will then reach out to all its donors and ask whether they would like to have their donations refunded. I’m sure most donors will say no. But it is the right thing to do to ask just like offering to pay for the meal when asked out is a common courtesy.

These two actions will engender tremendous loyalty and respect from the community, thereby likely improving the business’s chances for future survival.

Reputation is important and incredibly difficult to restore once tarnished. Big businesses that took advantage of the PPP designated for small businesses must act publicly and decisively to use their PPP money for good. Otherwise, they will forever be remembered as the vultures who took advantage of poorer people during a global pandemic.

Related: 10 Reasons Why You Should Start An Online Business Today

Readers, what other lessons can we learn from rich people and large business owners who took advantage of the government? Do you see other situations where a small business end up more profitable with a PPP loan than without one?