The RBI has been reducing its benchmark repo rate for the last few quarters. The repo rate was cut by 115 basis points between March and May 2020, to support the economy in light of the coronavirus induced slowdown.

As a result, banks also have had to reduce their lending and deposit rates to adjust to the new interest rate scenario. (One basis point is 0.01 percentage point.)

What rate of interest are you receiving now on your Bank Deposits? It should be around a meager 4% to 6%, am I right?

Is this 6% interest rate, the nominal return or the real rate of return? What is the difference between the two? Can interest rates turn negative? What is negative real interest rate? – Let’s understand….

What is Negative Real Interest Rate?

Before understanding – what is negative real rate of interest, let’s first understand, what is nominal rate of return?

The nominal rate of return is the annual percentage return realized by an investor on an investment (or) borrower has to pay.

The interest rate that you earn on your bank deposit (say 5%) is nominal interest rate.

Then what is Real interest rate or real rate of return?

When the Nominal Interest Rate is adjusted for inflation, it is called Real Interest Rate.

- If the inflation is 4% per annum, it means that now we have to pay Rs. 104 for goods and services for which we earlier paid Rs. 100.

- And if your nominal rate of return is say 6% on an investment of Rs 100 then you have actually earned Rs 2 only.

- Your nominal rate of return here is 6% and real rate of return (adjusted to inflation) is 2% (6%-4%), which is a positive return.

The nominal rate of return gives you an idea of how your money / investment is growing, while the Real Rate of Return tells you how much your purchasing power is growing.

Can Interest Rates Be Negative?

What if the inflation rate is more than your nominal rate of return? Will this lead to negative real interest rate?

As per the latest press release by the GoI, the consumer price index (inflation) in the month of June 2020 was around 6%. (I always believe that the actual inflation rate can be even higher.)

If the inflation is 6% per annum, and the bank provides an interest of 4%, then it is a negative real interest rate scenario.

Why is RBI opting for low interest rates?

The Central bank (RBI) vary the policy rate in response to changes in the economic cycle and to steer the country’s economy by influencing many different (mainly short-term) interest rates.

Higher policy rates provide incentives for saving, while lower rates motivate consumption and reduce the cost of business investment. So, considering the current challenging times (covid pandemic), high inflation rate, the central bank has been opting for lower policy rates.

Negative real returns? | Should you be worried as an Investor?

Generally, the negative interest rates can give consumers and businesses an incentive to spend or invest money rather than leave it in their bank accounts. But, a negative rates over a longer period can have their own risks and side-affects for everyone (investors, bankers, economy etc.,).

Let’s note that the interest rates or inflation rates are very dynamic and they do not remain constant.

The one-year SBI deposit used to earn 6.50% as recently as September 2019 when inflation was at just 3.92%, thus giving a real return of as high as around 2.5%.

The below table has the average inflation rate data from 2001 to 2020.

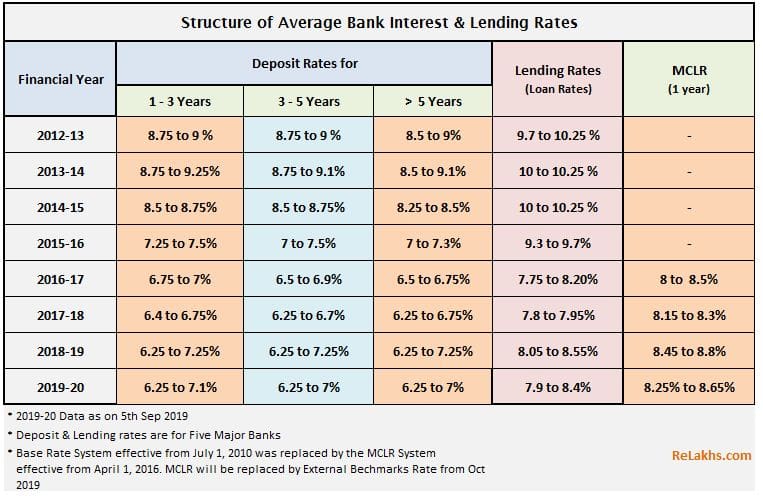

Below table gives us some idea about the trend of bank deposit and lending rates since 2012.

I believe that the RBI may keep policy rate at the lower end and the savers / investors will see negative real rates for most part of this remaining calendar year (2020).

Once things settle down, we may see inflation rates easing and we should expect real rates for savers to adjust accordingly (positive rates).

As investors, we should always look at our own investment objective, risk profile, time-horizon and save / invest accordingly.

If you are saving for say – ‘building your emergency fund‘, safety and liquidity is more important than rate of return. So, there is no need to worry too much about negative real rate.

The lower or negative returns from your savings should not influence you to shift your emergency fund to a risky investment avenue like direct equity (Stocks), for want of higher returns.

However, if you are investing for a long term goal, you need to maintain a property asset allocation (Equity : Debt), so that you achieve a positive portfolio real rate of return.

Besides the inflation rate the other factor that you need to consider while calculating the real rate of return is ‘Taxes’ (if any). The actual formulae to calculate the real rate of return are;

Post-tax returns = Pre-Tax returns * {(100-Tax Rate)/ 100 }

Inflation adjusted & Post Tax returns = { [( 1+ post tax return ) / ( 1+inflation rate )] – 1 } * 100

Continue reading :

- 15 Q&As on Fixed Deposit Interest Income Taxation Rules (FY 2019-20)

- What is Time Value of Money (TVM)?

- The importance of numeracy in becoming Financially Literate!

- Cost Inflation Index FY 2020-21 / AY 2021-22

- RBI’s statistical data on Indian Household Investments & Savings (2018-19) | How & Where do we save & invest?

(Post first published on : 24-July-2020)