Tesla is the seminal stock story of today’s bull market cycle.

Despite possessing a small portion of the automobile market share, Tesla dominates the headlines and financial discussion.

Regardless of their thoughts on Elon Musk’s business acumen, bulls and bears both agree on Musk’s marketing ability. Many call him the P.T. Barnum of the 21st century, for his ability to draw attention to Tesla continuously.

Automotive analysts credit the company with disrupting the industry and altering consumer preferences for the ICE to electric drivetrains.

On the other end, short-sellers have been predicting the company’s imminent demise since 2013, when the stock started moving up.

In terms of both stock price performance and financials, 2020 is Tesla’s best year yet. The stock is up over 500% over the trailing twelve months, and the company reported its fourth straight quarter of GAAP profits in Q2 2020.

Tesla bulls are betting on the Tesla of tomorrow. Among other things, bulls are buying because of the prospect of a future robot taxi network controlled by Tesla, a shift in the preference from ICEs to EVs, growth from the Chinese market, and the simple fact that they think Tesla produces a terrific car.

Among many other things, short-sellers take issue with Elon Musk’s conduct, the market’s misattribution of Tesla as a technology company, its cash burn, and mounting EV competition from legacy automakers.

Throughout this article, I’ll highlight some of the main points from both prominent Tesla bulls and bears.

It’s impossible to capture each argument’s nuances without going directly to the source, so don’t treat this as an exhaustive guide to the respective theses of Tesla investors.

The Bear Case

A good portion of Tesla bears think the equity is worth zero and that bankruptcy is imminent.

However, the majority of Tesla bear cases simply come down to valuation: they believe that Tesla’s stock is massively overvalued.

Automaker Comparables

When using a comparables-based valuation model, it’s easy to understand where the bears are coming from.

A frequent complaint of Tesla bears is that the market mistakes Tesla for a software company, and values it as such.

In the mind of a Tesla bear, the market should value Tesla as an auto OEM: meaning that the valuation should be roughly in line with that of GM or Ford, with a premium multiple for the growth and brand value.

While technological innovation and software are undeniably a part of Tesla’s business, they’re still a company that produces cars. And that typically means lots of debt, economic cyclicality, and low margins.

When looking at the market caps of the largest automakers, Tesla is in a league of its own. It’s worth over $250B, more than Honda, Ford, GM, and Daimler combined, while only capturing a fraction of the revenue.

Auto Industry Revenues

Auto Industry Market Cap

Levying Competition

With the demand for fully-electric vehicles (EVs) growing and eating into ICE market share, the largest automakers are responding by producing their own electric cars.

Although Tesla is continually pushing the price of their Model 3 down to entice the mid-market of car buyers, a base model still costs around $38,000 without incentives factored into the cost, meaning their current target consumer is the luxury car buyer. In this segment, the competition is rapidly growing.

A slew of luxury EVs is currently on the market, with several more in the pipeline, like Audi’s E-Tron, BMW’s iX3, Porsche’s Taycan, Jaguar’s I-Pace, and the like.

Tesla short-sellers and skeptics claim that while Tesla has benefited greatly from being a first-mover in mass-market EVs, their competitive advantage will erode as consumers are given more choices of EVs, making Tesla more of a niche player for affluent brand enthusiasts.

Growth is Stagnating

Anytime a company’s valuation is unusually high for its industry, that can usually be explained by the current growth trajectory being projected into the future. This couldn’t have been more true for Tesla prior to 2019, whose revenue grew at a dizzying pace each quarter.

In the trailing 18 months, however, Tesla’s revenue growth is close to flat, which raises questions about the company’s high multiples.

Mark Minervini, once a winner of the US Investing Championship, and author of multiple books about growth stocks, posits that growing earnings without growing sales is a red flag for a growth stock. Without accompanying sales growth, it usually signals increased operational efficiency (finite), rather than acquiring more customers and market share.

Below is Tesla’s revenue over the last five years. As you can see, growth slowed considerably in 2019.

The Bull Case

Like most growth stocks, Tesla bulls base their valuation on the Tesla of tomorrow.

Among the factors driving their thesis are a potential Tesla robot taxi network, a radical change in consumer preferences for EVs over ICEs, and Tesla leading the self-driving vehicle industry.

The fact that Tesla is even a functioning automaker right now is a feat in its own right.

Every American automaker in history has gone bankrupt, except for Ford and Tesla. Becoming an auto OEM has to be up there with airlines in the most challenging industries to enter. It’s a viciously cyclical, low-margin industry with massively high barriers to entry.

Top-Selling Midsize Luxury Car in 2019

Tesla has been producing niche vehicles for only a handful of years and dominated the midsize luxury car market in 2019. According to data compiled by GoodCarBadCar, Tesla sold 161,100 Model 3s in 2019, with the Lexus ES being the next runner-up, selling just 51,336 units.

The fact that Tesla is scorching the veterans of their industry shouldn’t be taken lightly. One of the central tenets of the bear case for this company is the levying competition from Tesla’s legacy rivals. This competition is a real threat that would eat into Tesla’s market share.

When confronted with the mounting competition, Tesla bulls typically compare Tesla’s reputational and consumer preference power to that of the iPhone.

Sure, Samsung, OnePlus, Google, and dozens of others manufacture phones, but most iPhone buyers don’t weigh these competitors against each other.

A similar argument could be made about Tesla, but the car buying cycle is slower, Tesla owners haven’t by and large proven themselves to be repeat purchasers yet.

A leader in Autonomous Driving Miles

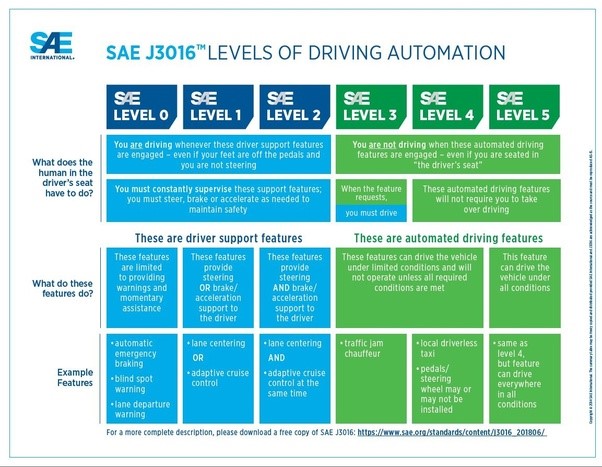

The one standard for measuring self-driving technologies is SAE International’s J3016. This is the standard referred to when you read that a company has “level 3” self-driving technology.

By most accounts, Tesla is somewhere between levels 2 and 3, which is basically where the rest of the industry is as well.

There’s much analysis out there about which company has the best technology, but Tesla is the only one actually to use the technology on any reasonable scale.

By way of comparison, Tesla has about 3 billion cumulative autonomous miles, compared to Waymo’s 20 million, and GM’s 1.4 million.

Self-driving technology is mainly based on machine learning, so the more data you feed the algorithm, the better it gets at driving.

Being so early in such a new industry, it’s difficult to quantify the value of Tesla’s mileage advantage, but it’s one of the few hard numbers we can put on the self-driving industry right now.

Dominant In The Electric Vehicle Market

Tesla currently has roughly 60% US EV market share, a market they’re helping expand by altering consumer preferences. While China, a growth market Tesla is aiming for with the production of a new Chinese factory, has several competitors in the EV space, analysts seem confident that Tesla can quickly outshine them.

According to Acumen Research projections, the EV market is projected to grow at a 25% compounded annual growth rate until 2026.

At this point, they expect the industry to be worth roughly $567 billion. If Tesla were to continue to own 60% of the market, its share would be $300 billion a year.

Bottom Line

Every market cycle has its stocks with cult followings.

However, Tesla might be the first stock in modern history to have such strong cult-like followings from both the bulls and bears.

The bulls call Musk this generation’s Edison, while the bears call him an overrated Silicon Valley executive in over his head in a tough-as-nails industry.

Only history can tell.

Some main points:

- Tesla bulls and bears both acknowledge competition from legacy automakers. Bears view it as the company’s demise, and bulls view it as confirmation of Tesla’s value; that the legacies are rushing to copy Tesla.

- Tesla bulls buy based on tomorrow. Tesla bears sell based on today.

- Highly successful investors with great Wall Street reputations are found on both sides of the trade.