With Southwest Airlines offering incredibly flexible change and cancellations policies due to the evolving coronavirus pandemic, it might be the case that you’ve got some travel funds sitting in your account from some previously canceled flights.

Announced earlier this summer, Southwest has rolled out a unique option for those travel funds: It is now possible for you to take your unused travel funds from Southwest Airlines and convert them into Rapids Rewards points, allowing you to use them at any time (and for anyone) for future flights. But one question that lingers is, does this make sense for you to do, and if so, how do you do it?

The fine print

As with all promotions and programs, there are a few bullet points to cover to make sure that you’re eligible to make these conversions:

-

This option is only available through Dec. 15, 2020.

-

Your travel fund expiration date must be Sept. 7, 2022 (typically from a COVID-related cancellation).

-

You have to be a Rapid Rewards member.

-

The name on the Rapids Rewards account must match the name on the travel fund (this will be important later).

When you make the conversion, you’re going to get 1.28 cents per point in value, which is slightly lower than the 1.4 cents per point ratio determined by NerdWallet, but we’ll cover some instances where this makes sense, even with the slightly lower rate.

How to convert Southwest travel funds to Rapid Rewards points

The process is quite simple, so kudos to Southwest for making the entire process easy from start to finish.

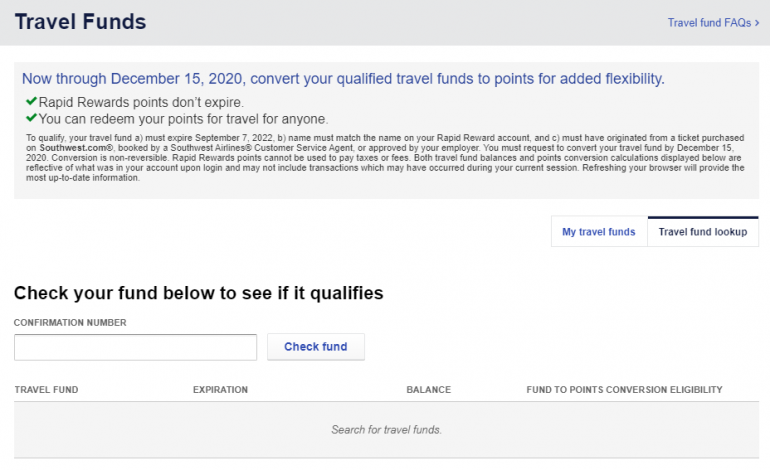

When you log into your account at the Southwest website, find the box that says “View Travel Funds.”

Note: You may be asked to log in again with your Southwest credentials.

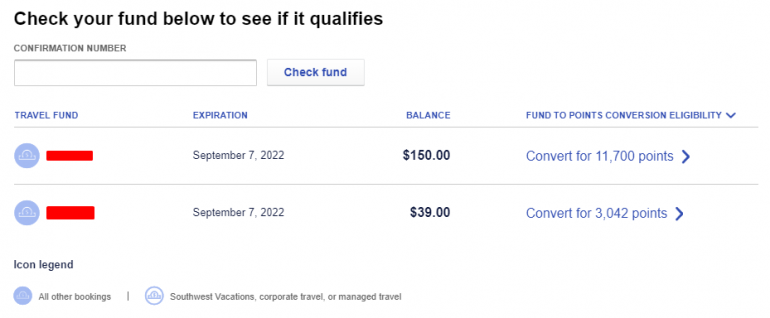

Once the screen loads, you may already be able to see eligible confirmation numbers listed from previously canceled reservations tied to your Southwest Rapid Rewards account. If not, you can use the “Travel fund lookup” tab to search for your reservations.

From your list of travel funds, you can choose to convert any number of them to points, or keep the credit. If you keep the credit, it will be good until Sept. 7, 2022. Remember, however, that the travel funds must be used for the person the original booking was made for.

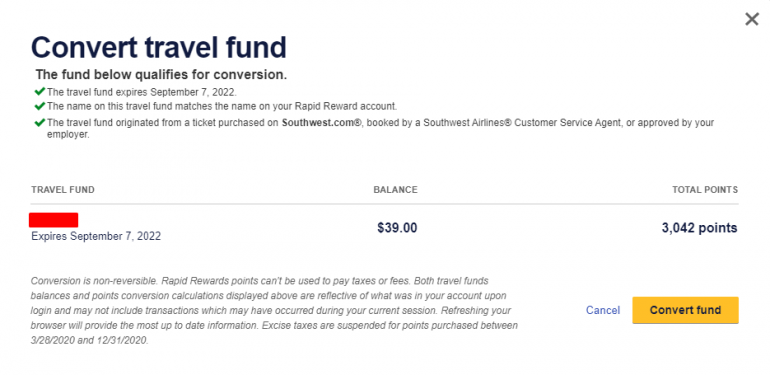

In the example above, we decided to convert the $39 travel fund to 3,042 Southwest points, so the next screen gives us one more chance to back out before pulling the trigger.

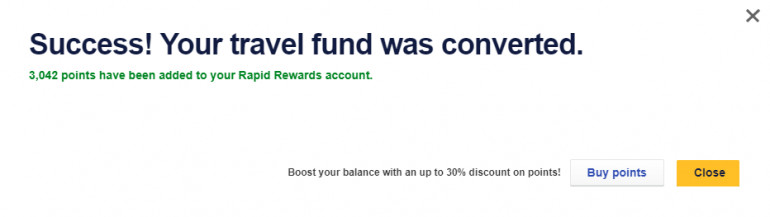

Hit “Convert fund” and just like that, voila! The points will appear in your account instantaneously after the conversion.

Should you convert Southwest travel funds to Rapid Rewards points?

A few considerations come to mind right away when it comes to this promotion. This is not a one-size-fits-all situation, so you’ll want to think through each eligible travel fund you have.

Expiration dates: When will you travel next?

The first question, of course, is do you plan to fly on Southwest again before Sept. 7, 2022? Additionally, how much money do you have tied up in travel funds related to those plans? The thought of not traveling for another two years gives us that sinking stomach feeling, but everyone will have their own risk tolerance and plans in regards to future travel. Travel funds will expire, while Rapid Rewards points will not.

Travel funds earn points, Rapid Rewards do not

If you do decide to hold on to the travel funds, you’ll be able to use them in the future, and because travel funds are used on cash bookings, you will earn Rapid Rewards points for that future reservation. On the flip side, if you convert travel funds to Rapid Rewards, redeeming those points for a reservation does not earn any additional points.

If you noticed in the above example, we had both a $150 credit and also a $39 credit. We decided that we’re going to hold on to that $150 credit, for a trip in the future. By doing so, we’ll be able to earn Rapid Rewards points for that reservation.

Travel funds have limits

Another important note is that you are allowed to use a maximum of only two travel funds per new reservation. So, for example, if you have a few smaller credits (like the $39 credit above or some $5.60 credits for taxes and fees), you might be better off converting those smaller credits into points to make them more useful. It will be difficult to use a high number of small credits with the two per reservation limit.

Points can be used for anyone

The true power in holding your currency in points versus travel funds is the flexibility in redeeming your points. If you recall earlier, the travel fund must match the name on the Rapid Rewards account. If you make the swap for points instead of a travel fund, those points can be redeemed for anyone to fly on Southwest. This gives you far more flexibility in the future.

The bottom line

You will have to weigh the pros and cons of each option to decide which travel funds to convert, or not. Generally speaking, if you anticipate traveling on Southwest prior to September 2022, keeping your larger travel funds intact will benefit you more in the long run as you earn points on those bookings. Conversely, if you don’t plan to travel, or your travel funds are in smaller denominations, converting them to points can be a smart play in extending their value and flexibility.

Remember, you don’t have to make the decision today. You’ve got a lot of time since the promotion ends Dec. 15, 2020. A lot can happen in four months, so don’t feel the need to jump in right away, but do set yourself a calendar reminder if you decide to wait.

How to Maximize Your Rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2020, including those best for: