We (Indians) love the yellow metal (gold). India’s love affair with gold has been since ages. From times immemorial, gold has been seen as a safe investment, especially when there is an economic crisis. Gold has been preferred by governments also, as a collateral against any crisis.

Gold prices in India recently hit a record high. The prices of gold have been rising sharply primarily due to diplomatic tensions between the US & China and the challenging situations faced by many nations due to Covid pandemic.

‘Uncertainty is often seen as good for gold prices.’

After hitting record highs, the gold prices are seeing some correction and some of you who have invested in Gold for investment purpose might be very eager to book profits. If it is so, do you need to pay taxes on the gains (if any) made by you on your gold investment? It is important to know how gold is taxed at the time of selling.

In this post, let us understand – What are the various forms of buying Gold? How are Capital gains arising on selling of Gold treated? What is the Gold Tax Rate in India for FY 2020-21? Gold Investments Tax Treatment in India….

Before jumping on to the Gold Investment Tax Treatment topic, let us understand the various available options for buying Gold.

Gold Buying options

There are different ways of owning gold through Paper / Digital and physical form;

- Physical Gold

- Gold Ornaments / Jewelry

- Coins

- Gold savings schemes offered by Jewelry firms

- Gold Biscuits

- PAPER GOLD

- Gold exchange traded funds (Gold ETF)

- Gold Mutual Funds

- Sovereign Gold Bonds (SGB)

Each form has its own Pros and cons as indicated in the below table;

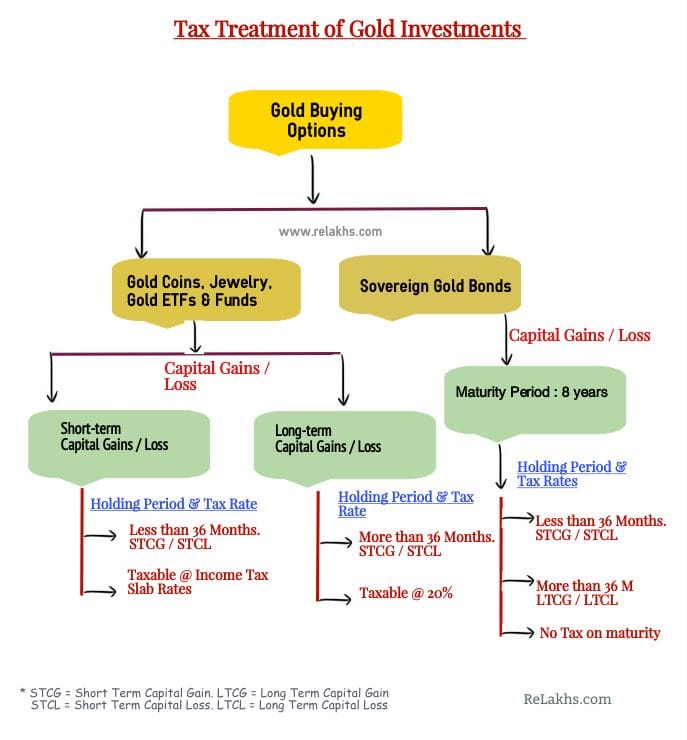

According to income tax laws, capital gains on selling gold is taxed and is dependent on the form it is purchased by you.

Gold Investments Tax Treatment in India | Gold Taxation rules

Income tax on selling of Physical gold

- Capital Gains Holding Period : If the gold is being sold within three years from the date of your purchase then it is considered as short-term, while gold sold after three years is considered as long term.

- Capital Gains & Gold Tax Rates : Short-term capital gains on sale of gold is added to your gross total income and taxed at the income tax rates applicable to your income slab. Whereas, the long-terms gains are taxed 20.8% (including cess) with indexation benefits.

- Do note that the taxation rules on Gold purchased online from e-commerce / Fintech companies like Paytm, ET Money etc., are similar as above (physical gold).

- TDS Rate : TDS rate is not applicable on selling of Gold. However, buying jewellery over Rs 2 lakh in cash will attract 1% TDS.

- GST Rate : On gold jewelry purchase, you are charged Goods and Service Tax (GST) at 3% on the value of gold plus making charges, if any.

Gold ETFs & Gold Funds Taxation Rules

- Gains from sale of gold ETFs or gold mutual funds are taxed similarly as that of the physical gold (or) Debt Mutual Funds only.

- Capital Gains Holding Period : If the gold units are sold within three years from the date of your purchase then it is considered as short-term, while Units sold after three years is considered as long term.

- Capital Gains & Gold Tax Rates : Short-term capital gains on sale of Units is added to your gross total income and taxed at the income tax rates applicable to your income slab. Whereas, the long-terms gains are taxed 20.8% (including cess) with indexation benefits.

Tax treatment on Selling of Gold Bonds

- Capital Gains Holding Period : You need to hold the Gold Bonds for at least three years to be termed as ‘Long Term Capital Asset’. If the gold bonds are sold within three years from the date of your purchase then it is considered as short-term,

- Capital Gains & Gold Tax Rates on Gold Bonds: Short-term capital gains on sale of Units is added to your gross total income and taxed at the income tax rates applicable to your income slab. Whereas, the long-terms gains (if sold before 8 years) are taxed 20.8% (including cess) with indexation benefits.

- Gold bonds will be exempted from capital gains (LTCG) tax at the time of redemption. In case, you hold the bonds till the maturity date (8 years) and if you make any long term capital gains when redeeming your gold bonds, there will not be any capital gain taxes on the profit you make.

- The interest on Gold Bonds shall be taxable. TDS is not applicable on the bond. However, it is the responsibility of the bond holder to comply with the tax laws.

Gold Taxation rules for NRIs

NRI though allowed to invest in all other gold funds and Gold ETFs, cannot subscribe to Sovereign Gold Bonds. The capital gain taxation rules remain same for NRIs as well. The only thing that is different is – NRIs have to pay TDS on redemption of Gold ETF or Gold Fund units.

- Short-term capital gains from gold is slapped at a TDS rate of 30%.

- Long-term gains from gold are subject to 20% TDS.

Related Article : NRI Residential Status & Taxation (new) rules FY 2020-21

How to Set-off capital losses incurred on Sale of Gold investments?

We all want to make profits on our investments. No one wants to absorb the losses. What if you actually have to incur a financial loss on sale of your investments in Gold? There can be times where your investments turn negative value and you have to book losses and move on.

You also have the option to carry forward

- The capital losses can be set-off against capital gains only.

- Long Term Capital Loss can be set off only against Long Term Capital Gains.

- Short Term Capital Losses are allowed to be set off against both Long Term Gains and Short Term Gains.

- If you can not set-off a capital loss under the same head during the same financial year, you can carry forward such losses to the next financial year and can be set-off against Capital Gains (if any) arising in the next year. A capital loss can be carried forward for 8 years from the end of the financial year in which the loss has been incurred.

- A capital loss can be carried forward to the next year only if you had declared such losses in your ITR and the tax return is filed before the due date.

Below table has the details on capital loss set-off rules on sale of Gold ornaments, Gold Bonds or Gold ETFs (Exchange Traded Funds).

I hope you find this post informative. Do share your comments, cheers!

Continue reading :

- How to buy Gold at lesser price than the prevailing Market Price?

- Different Asset classes have different Tax implications – How Returns are taxed?

- Income Tax Deductions List FY 2020-21 | New Vs Old Tax Regime AY 2021-22