This post is written by Jet Toyco, a trader and trading coach.

Let me ask you…

Have you ever got “hyped” into a trading position and then gone all-in?

You get empty promises and hope like…

“This crypto is going to the moon, it will triple in price, guaranteed!”

“I have an insider tip on this stock, this will surely quadruple in a few days!”

And then what happens?

That’s right…

It often always goes the opposite way.

It’s like the market knows when you buy and it always crashes when you do!

Then, you started pointing fingers…

“What in the world is Elon Musk doing?”

“It’s all the President’s fault!”

“I shouldn’t have listened to those stupid traders”

Now…

What if I told you that there’s a method how to see through all of those BS?

What if I told you that there’s a way to profit from sharp market crashes free of other people’s opinions?

That, my friend…

This is what you’re going to learn in today’s trading guide, which is to identify and trade Falling Knives.

Sounds good?

So, here’s what you can expect in today’s training…

- A brief introduction to what a falling knife is

- How to consistently spot and identify a falling knife so that you’ll never second-guess yourself

- A complete falling knife trading strategy (and some extra tips on how to reduce risk and increase reward)

Are you ready to go?

Then let’s get started…

What is a falling knife, and how does it work?

Sure, I gave you some decent examples of falling knives a while ago.

However…

Those charts are cherry-picked (I must admit).

It means that in the real world of trading, falling knives don’t look the same.

That’s why we must go back to the basics my young padawan!

So…

A falling knife is simply when a market experiences a sharp decline.

You might be wondering…

Why is it called a “knife?”

Well…

It’s called a knife because it can slice through your account balance just as easily as a physical knife would!

So, if you spot market declines like these…

These aren’t falling knives!

Those are mini punches, ones that you can handle!

So, let me give you an example of a Falling Knife big enough to pierce your trading account in half…

On last April 2022, Netflix published an earnings report.

However, the report showed that Netflix got fewer subscribers and is expected to decline further.

Can you guess what happened next?

Boom, a 37% decline!

A Falling Knife that pierced through investors’ and traders’ hearts alike!

If you attempted to buy after a sharp decline like that, or, should we say, a Falling Knife…

I wouldn’t be surprised if you second-guessed and asked yourself…

“Oh shoot, Netflix dropped even more, have I made the right choice?”

“Is it not the bottom yet?”

Your confidence would be shaken, and rightly so!

Sure, the price eventually rebounded based on this example…

But remember that this too was a falling knife…

Until of course, it extended and became a Falling Katana (hah).

In this case, what would you do?

Hodl?

Exit?

Pray?

Hope?

Don’t worry…

I’ve prepared a section for you later on that exactly answers these questions.

But do know that all Falling Knife scenarios are not the same as well as how it can affect you psychologically.

And by the way…

Falling Knives can happen with or without any fundamental news (it’s true).

So!

Since I shared with you the “psychological” aspect of trading with Falling Knives and also now that you know what it looks like…

You might be wondering:

“How EXACTLY do I know if it’s a Falling Knife or not?”

“Is there a certain percentage?”

“Which indicator do I need to use to know if it’s a Falling Knife?”

Let me tell you…

Those are some very good questions!

But rest assured that I’ll answer them in the section.

Ready?

Then keep reading…

An in-depth guide on how to identify a Falling Knife

Here’s the truth:

Trading falling knives are risky.

It doesn’t matter how good you are as a trader or how good your gut feel is.

It is risky!

This is why it’s important to know what exactly is and isn’t a Falling Knife!

So, let me tell you this first…

There can never be a single metric or indicator to define a Falling Knife

Take a look at this:

The “sharpness” of this Falling Knife came down to 20% before rebounding!

On the other hand, check this out:

Same market.

Same Falling Knife example.

But different form!

This stock crashed down to [percentage] before rebounding.

The same principle applies in Forex, Commodities, Bonds, and especially…

The crypto markets!

A 43% decline before rebounding!

Well…

I’m sure crypto hodlers are pretty used to it by now, how -50% to -99% declines are pretty normal, but you get my point.

So why am I telling you this?

Here’s why:

Because there is no specific metric or technical indicator that can define a Falling Knife.

Sure, indicators such as the Average True Range (ATR) can help out, but instead…

Here are the two things that you should focus on.

First…

A large-bodied candlestick

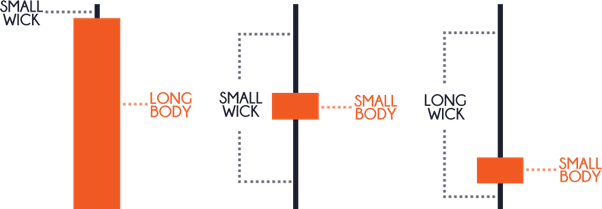

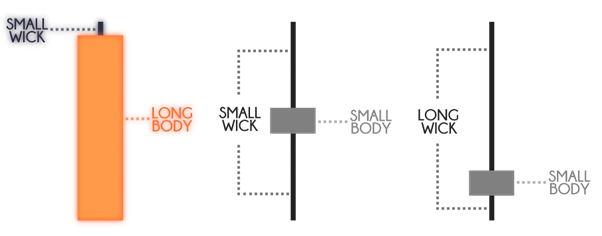

There are only three kinds of candlesticks out there.

Small wick with a long body.

Small wick with a small body.

Long wick with a small body.

So, which candlestick should you spot when looking for Falling Knives?

…

…

…

That’s right, a LARGE-bodied candlestick!

This is exactly what defines a Falling Knife!

But we’re not done yet.

Because the second thing that you should look for in defining a Falling Knife is…

A large-bodied candlestick relative to other candlesticks

Let me explain.

Do you see these candles here?

It pretty much looks like a normal day, candlesticks living in peace.

And then this happens…

Boom shakalaka!

It’s like the last candlestick just slaughtered every previous candlestick!

So, without second-guessing or squinting your eyes, I’m sure you can agree with me that this is a Falling Knife, right?

Good.

So just a quick recap, it’s a Falling Knife when these two things happen…

When the market makes multiple big-ass bearish candlesticks.

And when it’s clear as day that it’s bigger and meaner than the rest.

Simple, right?

Alright!

Now that you know what it is and how to identify it Falling Knives…

You’re now ready to dive in to know how to trade the Falling Knife.

Make sure to take notes as we won’t just focus on entries and exits…

But also risk management techniques on how to reduce your risk and increase your rewards when trading Falling Knives.

Excited?

You damn should be!

So, keep reading, and let’s go!

A step-by-step guide on how to trade a Falling Knife successfully

You’re probably going to get angry at me for saying this but here’s the thing:

We don’t exactly “catch” and enter as the knife is falling.

If you can’t do that in real life, what more in trading?

Instead, what do we do?

We enter after confirmation.

That’s right, we want to know “how long” the knife is.

Because then we’ll know the lowest it can stab the markets!

Don’t worry my friend, I’ll explain.

Step 1: Confirmation

Of course, spotting a falling knife based on what I’ve shared with you before is the first thing.

So, when you see this, do you buy it?

When this market is already on the news, do you buy?

When your friends and family are hyping up this market promising you x10000 returns, do you buy?

No, my friend…

You wait for confirmation.

You cut yourself out of the “noise” and follow your plan.

So, what happens now when you see this?

Finally!

You’ve waited for so long, a green candle!

But do you buy it?

Not yet!

Because to confirm this Falling Knife setup, we must dig deeper down into the lower timeframe…

Step 2: Transition trade setup

That’s right, once you see the first green candle after a sharp decline, you go down to the lower timeframe.

In this case, I showed you an example of ETHUSD on the 8-hour timeframe, so we’re digging down into the 1-hour timeframe.

So, now that you’re in the lower timeframe, what are you looking for?

A break out of a bullish flag pattern.

In case you’re wondering, here’s what it looks like:

And where it is on the chart:

Alright now, this is important…

Once there is:

- A valid Falling Knife on the higher timeframe (In this example, I used the daily timeframe)

- A first green candle from that Falling Knife

- A bullish flag pattern on the lower timeframe (In this example, I use the 4-hour timeframe)

You have one last confirmation before you hit the buy button.

Can you guess what it is?

It’s simple, a candle close!

A candle close is a single event that confirms everything we saw.

Not an assumption, a confirmation!

Once that happens you want to enter at the next candle open, with stop loss below the flag pattern:

Makes sense?

Now, what’s next?

Well…

This one’s a bit tricky.

However, this technique can potentially reduce your risk while increasing your rewards.

Step 3: Risk Management

No matter how good you are as a trader or how good your gut feel is, trading Falling Knives is risky.

Remember that line from a while ago?

Good, because that remains true.

Since we can’t change the fact that trading Falling Knives is risky, what can we change?

Our risk management.

What do I mean?

Before you enter Falling Knife setups we discussed such as these:

You want to make sure you risk half than usual.

So if you enter trades with a 1% risk per trade, it’s crucial that you first enter with a 0.5% risk per trade.

Meaning, when the price hits your stop loss, you won’t lose more than 0.5% of your account.

Yes, the rewards are almost non-existent but you first want the market to confirm your trade before you fully commit!

And what if it does?

You scale into the trade, and then move your stops to breakeven!

Clever, am I right?

And mind you, this concept doesn’t just apply to Etherum, it applies to other markets out there!

So, remember…

Risk small, and then commit to the trade by scaling in as it makes another bull flag breakout.

And finally…

Step 4: Trade Management

This step is the most important step of all.

Why?

Well, how else are you going to make a profit?

So, just like the rest.

There must be a rule in place on how you should manage and exit your trades.

And the easiest way to do it?

Is to set your take profit area before the Falling Knife happened.

At the “handle” of the knife.

Since a Falling Knife crashes, there’s barely any room for potential sellers to get in as the “roof” is too high!

Now, notice that we’re defining your take profit at the higher timeframe which the the 8-hour timeframe in this example.

That’s right!

As you time your entries on the lower timeframe, in this case, we manage our trade on the higher timeframe.

This is called transition trading, and it’s the same method is that gives us such a MONSTER risk-to-reward ratio!

So now you might be wondering:

“Hmm sounds cool, but what if the price just smells the take profit area and then reverses?”

“What do I do if the price never reaches the take profit area and then goes back again to my stop loss?”

If that’s you then boy you sure are pretty rare!

Most traders don’t even question when they should exit their trades.

Saying…

“Ah I’ll just hold this for 10 years and leave it be”

“I’ll know, I’ll let my gut feel decide when to exit”

But of course, that’s not you!

So, what do you do in case the price doesn’t reach your take profit area?

We use a short-term trailing stop loss.

That’s right, two things!

A short-term…

Trailing stop loss…

There is a couple of popular trailing stop loss out there such as:

- Moving Average

- Average True Range

- Donchian Channel

And probably more.

So, what you do is pick one that makes sense to you the most, and choose a “tight” period to trail your stop loss in the higher timeframe!

As an example, we’ll use a moving average to trail our stop loss.

This means that we won’t exit our trade unless it hits our take profit, or hits and closes below the moving average!

Again!

Short-term…

Trailing stop loss…

So, in this case, we will use a tight moving average period of 8.

Sure, you can use 10 MA, 6 MA, and 7 MA, it doesn’t matter.

What matters is that you are using a short-term trailing stop loss!

So in this example, we can see how the price didn’t reach the take profit level and hit our trailing stop loss.

Sure, it didn’t hit the “jackpot” take profit area you plotted, but still, you can secure some profits.

Sounds good!

Now, if you want to learn more about trailing stop loss (which again, you can apply using the concept I taught you), you can check this out:

How to Use Trailing Stop Loss (5 Powerful Techniques That Work)

So before I end, let me give a brief disclaimer for you.

This is important.

Disclaimer

I know I sound like a broken record.

But trading a Falling Knife is risky.

So, as much as possible…

I want you to test this on your end and see with your own eyes how the edge of this setup unfolds.

Finally, Falling Knives do happen in every market and timeframe, but It’s crucial that you:

- Choose a timeframe that you can consistently commit to (don’t jump around timeframes)

- Know that Falling Knives don’t look all the same, and can look different from the example I showed you just now

With that said…

Let’s do a quick recap of what you’ve learned today!

Bottom Line

- A Falling Knife happens when the price makes a sharp decline in a short amount of time

- Falling Knives don’t look the same, but one objective way to define it consistently is to make sure that the large-bodied candles are bigger than the rest

- When trading Falling Knives, you must wait for a green candle to form, and look for a bullish flag pattern on the lower timeframe which then you can use a fixed or trailing stop loss to capture a profit.

There you go!

I hope you found this article informative and enjoyed reading it.

So now over to you…

Would you trade the Falling Knife strategy?

Also, do you know someone who lost a lot of money from Falling Knives?

Let me know in the comments below!