So, you want to learn about the Three White Soldiers? Well, you’ve come to the right place.

In this definitive article, you will learn everything you need to fully utilize the Three White Soldiers pattern.

The good, the bad, and the spicy!

Here’s what you will learn:

- What the Three White Soldiers pattern is and how it works

- Common mistakes to avoid when trading the Three White Soldiers pattern.

- How to effectively trade the Three White Soldiers pattern like a pro.

- The Truth about the Three White Soldiers pattern that nobody tells you.

And of course, all of these will come with a ton of examples!

Sound good?

Let’s go!

The Three White Soldiers Pattern Explained

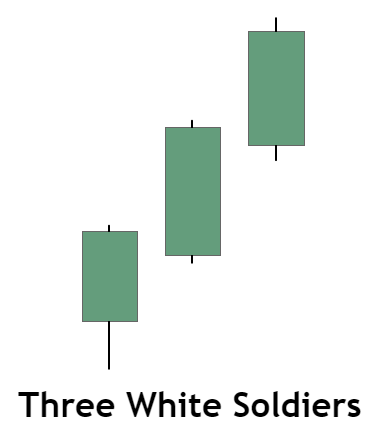

A Three White Soldiers (TWS) pattern is formed when three back-to-back strong bullish candles are printed on the chart after a downtrend.

Here are the characteristics of a strong bullish candle:

- A close near the highs.

- A wide body: That is, the price has moved significantly to close higher than the opening price.

- Little to no upper shadow.

Pro Tip: A long lower shadow is bullish and is a sign of demand. It shows you that strong buying came in during the day to reverse the selling.

Check out the image below to understand what a strong bullish candle can look like:

And when you put three such candles together you get….

Ta-da!

Now, it’s important to look at some mistakes a lot of traders make while trading the Three White Soldiers so that you can reduce your learning curve…

Avoid these Mistakes when Trading the Three White Soldiers Pattern

As you might be aware, there are 3 types of trends:

And it is conventionally said that the Three White Soldiers pattern signals a potential bullish reversal after a downtrend…

But…

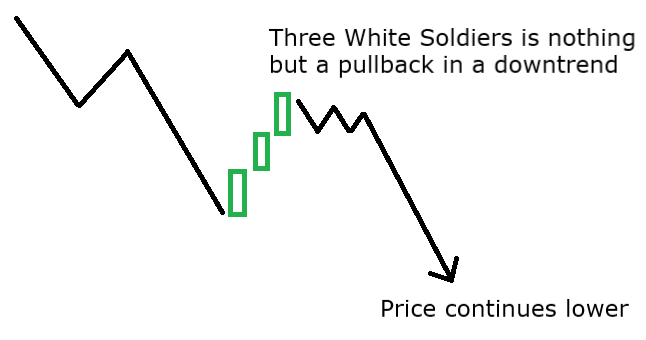

Mistake #1: Don’t use the Three White Soldiers in a Downtrend

Three White Soldiers in a downtrend can simply be a reaction/pullback after a down leg before the price goes even lower.

Here’s what I’m talking about:

And here are some real-life examples:

EURUSD Daily Chart:

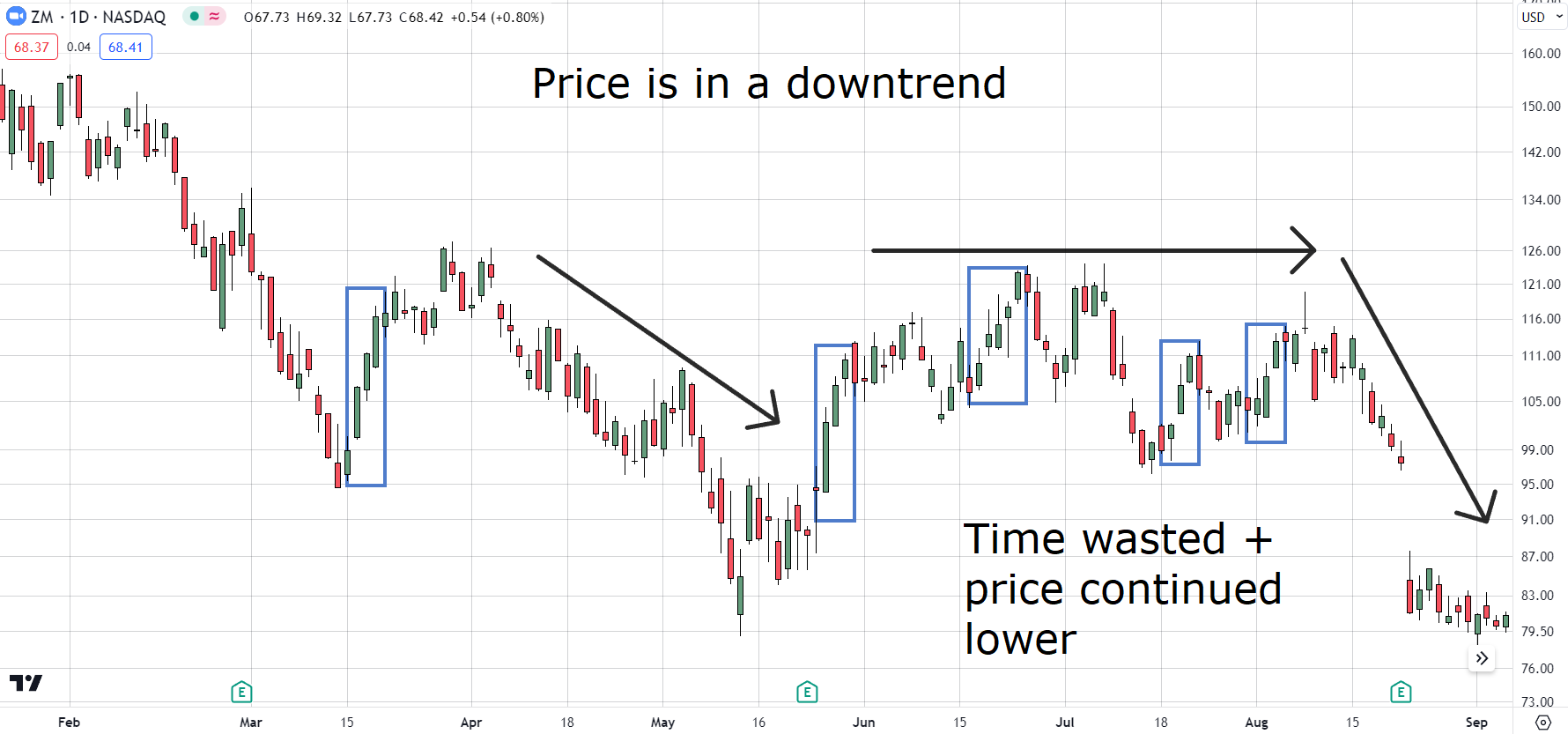

Zoom Daily Chart:

EURUSD Daily Chart:

Google Daily Chart:

To illustrate, here’s what Thomas Bulkowski, author of “Encyclopedia of Chart Patterns”, has to say about the Three White Soldiers pattern:

“Nevertheless, after a downward breakout (of the Three White Soldiers) in a bear market, the price can drop 7.66% on average, over 10 days, but that uses just 56 samples.

I consider a move of 6% to be a gift. The best 10-day performance rank for the three white soldiers candle belongs to downward breakouts in a bull market.

I found 537 examples of those, so the sample count is a bit thin.”

Note: A downward breakout means the price going below the lowest low of the Three White Soldiers pattern.

Interesting, right? Yes, the sample size is low I agree, but that’s because the pattern is rare to find, and even then, the numbers don’t look great.

OK, so that covers the Three White Soldiers in a downtrend, but what about when the price is in a range?

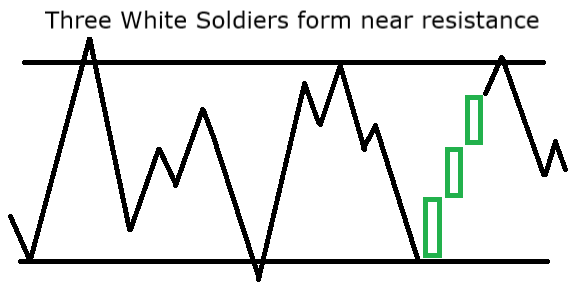

Mistake #2: Don’t trade the Three White Soldiers when the Price is in a Sideways Trend

This is because a Three White Soldiers in a sideways trend will more likely lead to chops.

Think about it…

When the price is going sideways, it is bouncing around between a support zone and a resistance zone.

And by the time the Three White Soldiers pattern is completely formed, the price is likely to be near a resistance zone from where it might turn around.

Here’s what I’m talking about:

See what I mean, right?

Let me show you a few real-life examples, too.

GBPUSD 4-Hour Chart:

NVIDIA Daily Chart:

EURUSD Daily Chart:

Can you see it?

Well, now that you’ve seen some mistakes to avoid…

Do you want to know how the professionals trade the Three White Soldiers pattern?

How to Trade the Three White Soldiers Like a Pro

The pros use the Three White Soldiers pattern as a likely signal that an uptrend is resuming. Here’s what they consider:

1. Accepting The Non-Negotiable

The price must be in an uptrend. You must see higher highs and higher lows being formed on the chart.

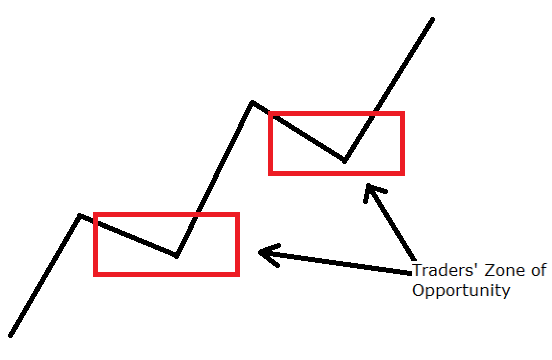

2. Understanding Where the Opportunity Lies

A trader must clearly understand where the zone of opportunity lies for their trading strategy.

For the Three White Soldiers pattern, and other long strategies in general, the zone of opportunity is in the consolidation or pullback that follows after the price has made a higher high.

Price Uptrend & the Traders’ Zone of Opportunity:

3. Visualizing the Psychology

Imagine this

Every day, there is a fierce battle of prices between bulls and bears.

When the price is in an uptrend, it means the bulls are winning the battle.

After making a significant advance… (forming a higher high),

…it is only natural that the bull army takes a pause for a while to rest and set up camp, right? (consolidation/pullback period)

But the bears mistakenly think that this pause means the bull army has become weak.

So, they start advancing their campaign, when suddenly…

Three brave soldiers, with insane firepower and a lot of muscle, come onto the battlefield!

These three soldiers are unlike anything the bears have ever seen before…

They manage to completely overpower the bears and effectively trap them, causing the bears to retreat.

With the help of these three soldiers, the bulls can advance their campaign significantly and tilt the battle in their favor.

Do these 3 brave soldiers sound familiar? I’m sure they do by now!

This is the basic underlying psychology of the Three White Soldiers pattern.

They indicate a sign of strength, namely a sign that the uptrend is resuming and if a sign of strength is all that’s needed, why be so rigid?

This leads to number 4…

4. Being Flexible & Using Common Sense

Is it so wrong to settle with just two really bullish candles? How about four?

What if the candles are not back-to-back but have a small doji or an inside bar in between?

Well, it’s important to understand that the market is ultimately just doing its thing.

Do you think the market is aligning itself to form a precise Three White Soldiers pattern, so that traders can trade it exactly?

Of course not! Sounds ridiculous when I say it out loud, right?

But that’s what many traders can end up trapped into believing.

You must be flexible and look for general characteristics rather than precise patterns.

So, look for signs of strength that show the uptrend is resuming. You can even call them ‘strength candles’ if you like…

Got it?

Awesome!

5. Putting it all together

Before I get to examples, let’s recap the essentials:

Step 1: The price must be in a definite uptrend.

Step 2: Look out for consolidation/pullback in the uptrend.

Step 3: Confirm signs of strength and uptrend resuming: strong bullish candles.

Pro-tip #1: Heavy volume accompanying these strong candles is an added confluence, especially for stocks.

Pro-tip #2: If the price has made a big advance, it is best to wait for the price to consolidate and break out again or simply let the setup go. You can’t catch ’em all! (Again, use your common sense…)

Examples:

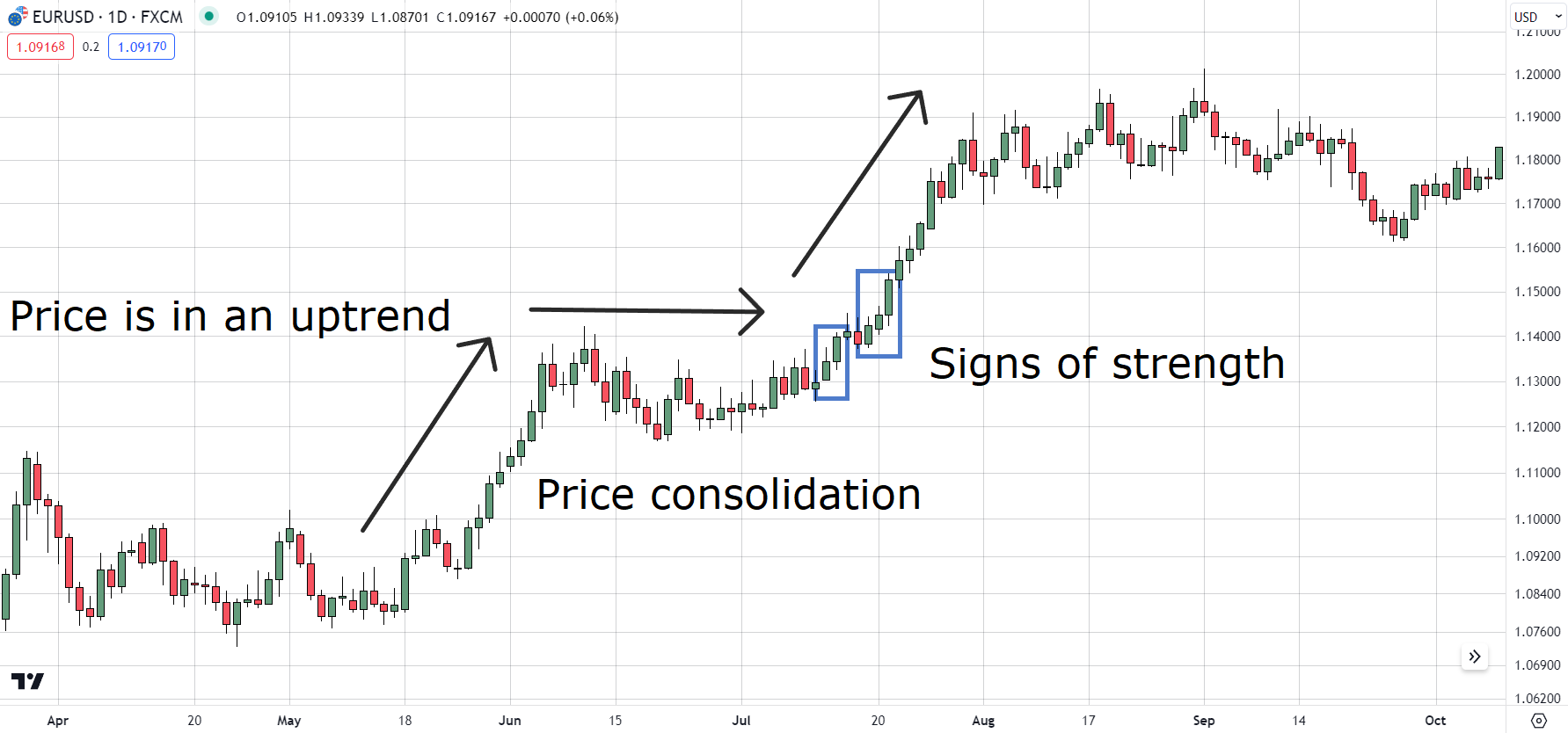

EURUSD Daily Chart:

In this chart, the price had a nice and clean move up before going into a consolidation. As the consolidation progressed, notice how the volatility contracted.

Strong bullish candles emerged from the contraction showcasing signs of strength. This was followed by a smooth move higher.

Spotify Daily Chart:

Here the price had a really nice move up. The price paused for some time and the most interesting thing to note here is that there were virtually no wide-range bearish candles in the consolidation.

Then came the classic Three White Soldiers pattern. This was a clear sign of strength.

Consequently, the uptrend resumed and had a steady move higher.

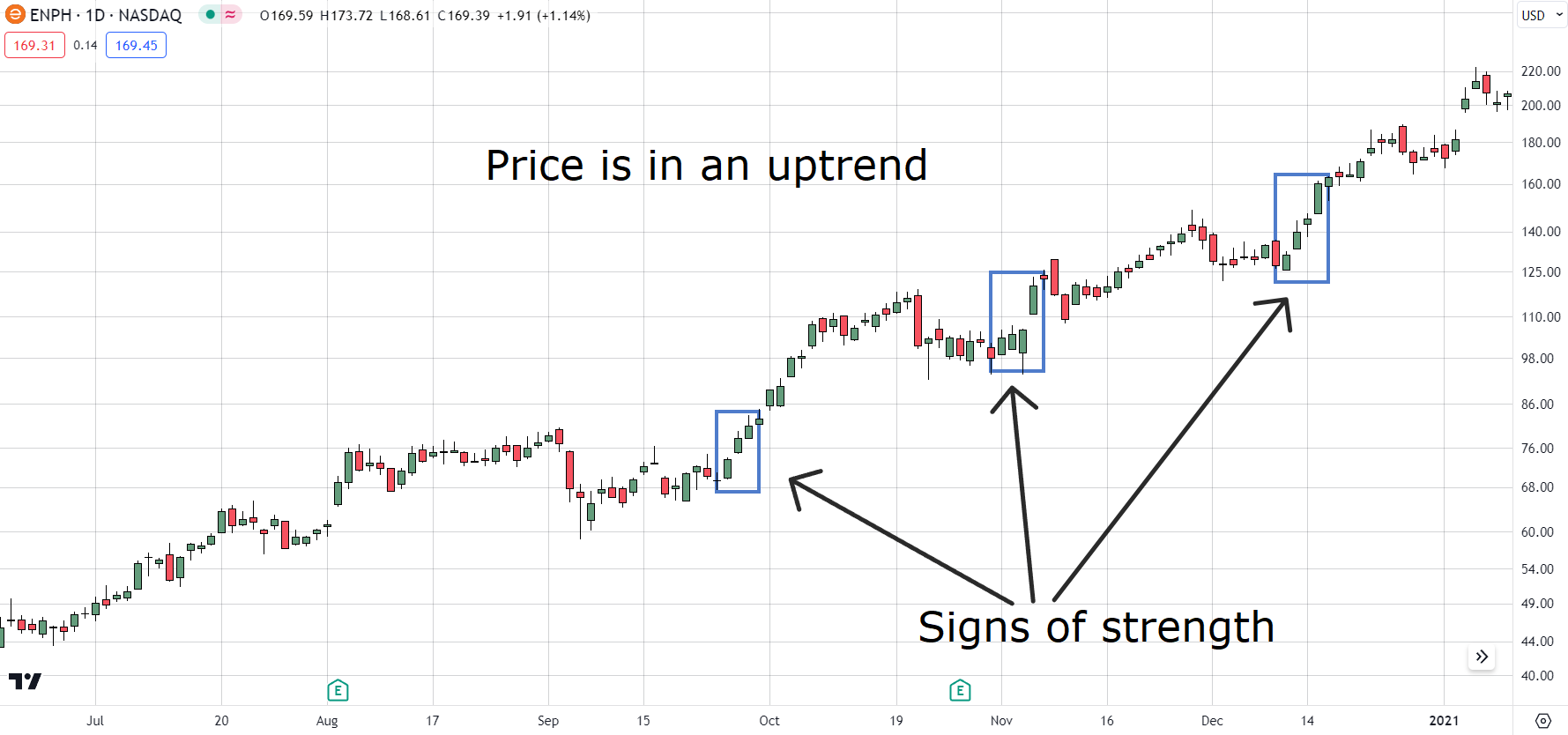

Enphase Energy Daily Chart:

So, this one is a slightly wilder stock in the sense that wide bearish candles were printed on the chart. But notice how none of these scary-looking candles had any meaningful follow-through.

Furthermore, the chart’s higher high and higher low structure was preserved throughout, which is the most important thing.

Then the Three White Soldiers pattern formed and Price displayed signs of strength. The uptrend resumed and the price moved higher.

Now, before you start actually using the Three White Soldiers pattern, I think it best you should hear the whole story.

I’m talking about that side of the story which isn’t talked about very often, simply because it is not as glamorous!

Specifically – we need to consider the limitations of the Three White Soldiers pattern…

No trading tool or indicator is perfect and understanding the pattern’s limitations will help you decide whether it fits your personality or not.

So, are you ready?

The Truth about the Three White Soldiers Pattern that Nobody Tells You

First things first…

As a trader, your job is to identify the prevailing trend and take a position when the price makes a trending move, right?

So, don’t you think it’s best to get in as early as you can?

After all, it is said that a trader should not try to get the top or the bottom, but rather capture the meat of the move…

But if you wait for the Three White Soldiers pattern to form before you go long, you are likely to miss a meaningful portion of the move, especially if you are looking to capture a short-term swing.

Consider the Reward-Risk Relation…

If you enter after a Three White Soldiers pattern forms, you can place your stops in either of these two places:

- Below the lowest low of the Three White Soldiers pattern (low of the first candle).

- Below the most recent swing low.

Both of these locations give a wide stop from entry, and the price will have to make a significant move, to give even a 1:1 reward: risk.

So keep in mind that a Three White Soldiers-based entry is already an extended one.

Remember The Trade Might Take Some Time to Work…

After the Three White Soldiers pattern has formed, the price might consolidate for a while before moving again.

Bear it in mind, and assess the opportunity cost of having capital locked up in a trade.

Lastly, the Pattern is Rare to Find…

I used Tradingview’s automatic pattern finder and here were the results:

On the weekly chart of Apple, not even a single occurrence of the pattern was found.

Compare this with the Bullish Engulfing finder on the same chart:

See the difference!

Now you may argue that an automated finder will have very rigid rules and it is better to search manually but, it’s by defining some basic criteria that you gain an objective approach.

Doing so will also help you to prevent FOMO and hindsight bias from playing a detrimental role in your trading.

So in summary, these are the points you should definitely remember before you decide to start using the Three White Soldiers pattern.

Congratulations – you’ve covered a lot about the Three White Soldiers pattern.

Let’s do a quick recap!

Conclusion

Here’s everything that you learned:

- You learned what the Three White Soldiers pattern is.

- I showed you the mistakes to avoid while trading this pattern.

- You saw how pros use this pattern in their trading.

- You discovered the truth about the Three White Soldiers pattern that nobody tells you.

Finally…

A quick question for you!

How do you plan to use the Three White Soldiers to level up your trading?

I look forward to knowing your ideas and thoughts.