This post is written by Jet Toyco, a trader and trading coach

Imagine this…

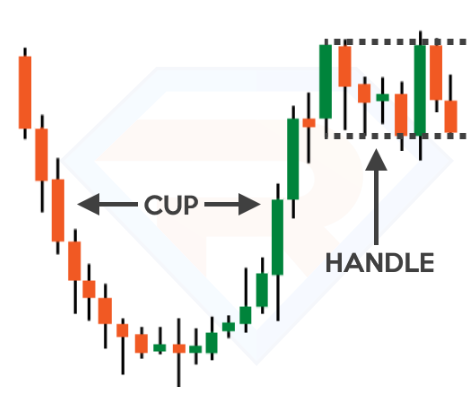

You spot a nice cup and handle pattern:

So, you trade the breakout, thinking that the markets will blow up higher…

But then what happens?

Somehow, the market seems to read your mind and everything goes into reverse!

And here’s the thing…

It doesn’t only happen once or twice…

It happens all the time!

So, what’s going on here?

If you’re experiencing this issue and want to solve it then you’ve come to the right place my friend.

Because in this guide…

I’ll equip you with the knowledge and strategies to tackle those patterns head-on and turn them into your secret trading weapons.

Here’s what I have in store for you:

- What trend reversal patterns are and how they work

- The SECRET to identifying high probability trend reversal patterns

- One SIMPLE trick to trade every trend reversal pattern

- A step-by-step process for trading trend reversal patterns

So, my friend…

Get ready to turn those patterns from daunting to delightful and make trading an adventure to savor!

Demystifying Trend Reversal Patterns: What are they and how do they work?

What’s the deal with these trend reversal patterns, then?

Well, imagine you’re at a party, and suddenly the music shifts from smooth jazz to energetic salsa.

Trend reversal patterns work in a similar way—they’re like the DJs of the market.

Essentially, they signal an imminent change in trend.

So, when you spot these patterns doing their funky dance on the charts:

You know it’s time to bust a move and adapt your trading strategy accordingly!

Make sense?

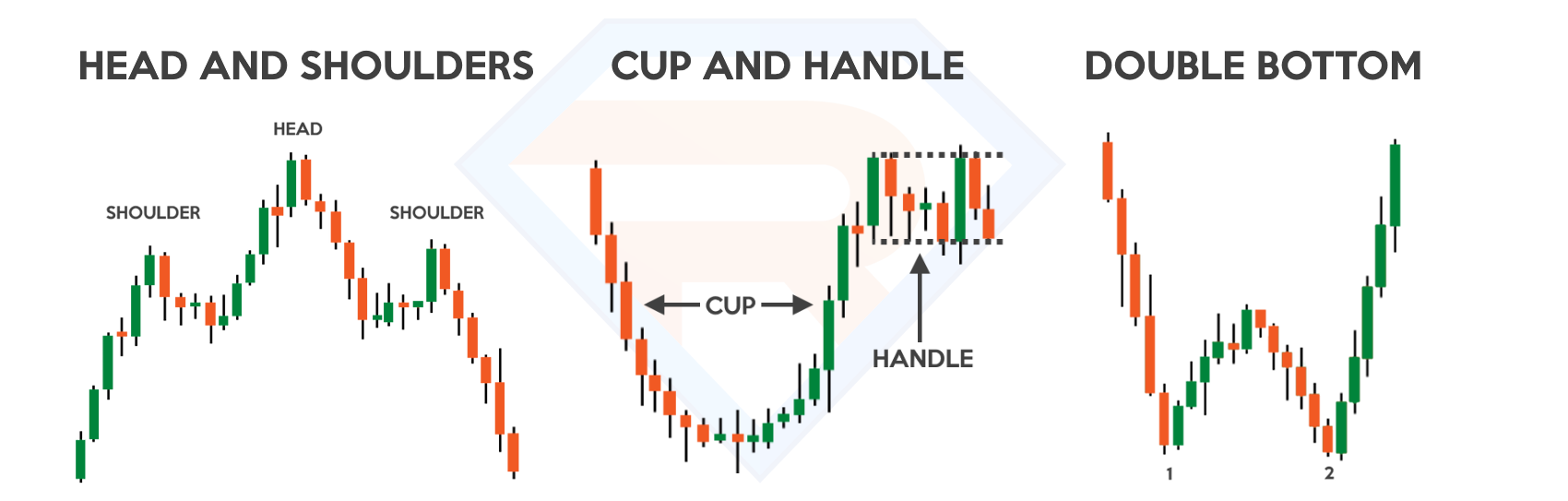

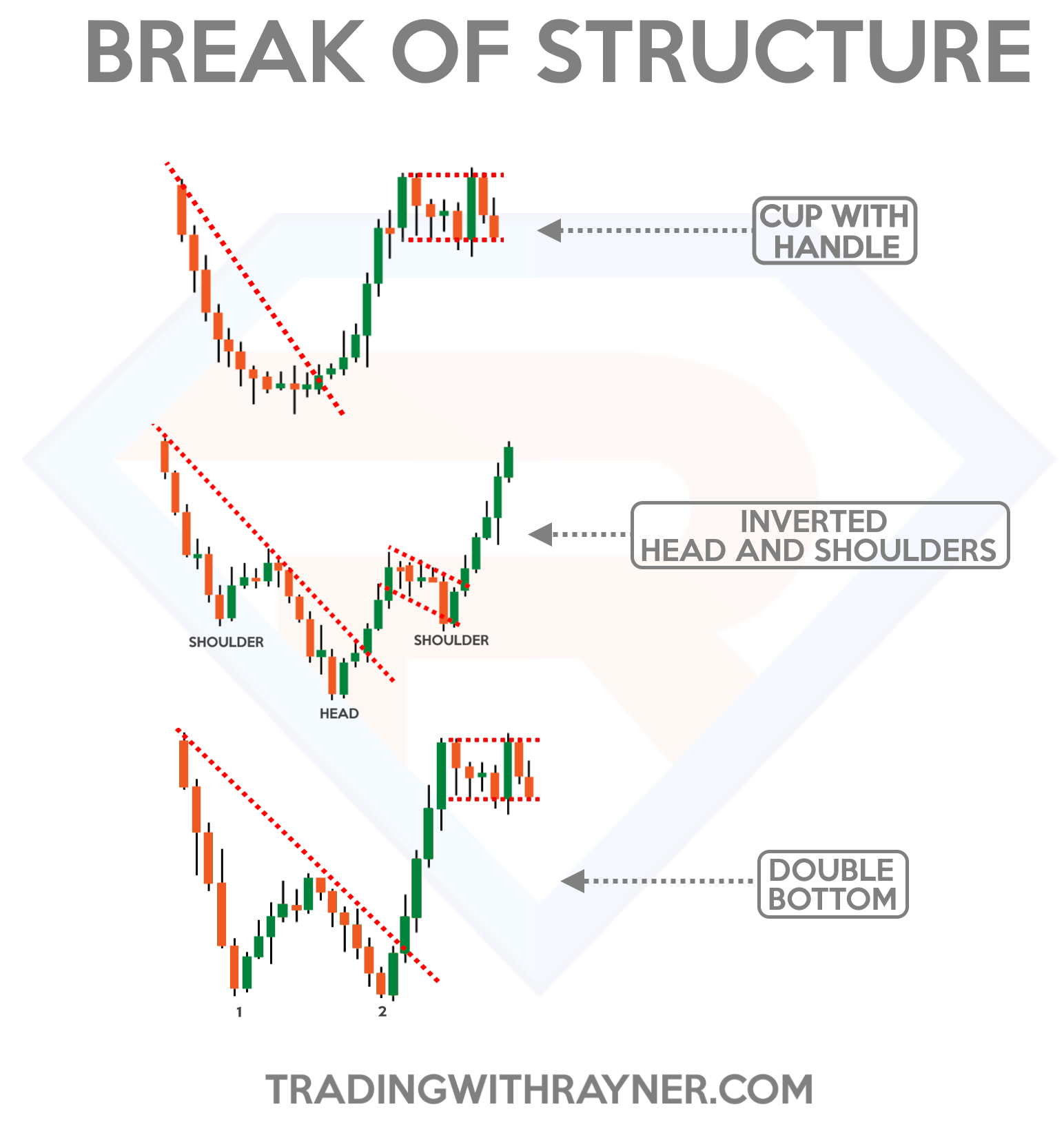

P.S. There are a lot more trend reversal patterns out there, but these are the patterns I’ll be using for today’s guide.

So, despite the trend reversal pattern schematic that I shared with you…

What are the common Trend Reversal Patterns out there?

Now, when I say common…

I mean that no matter which market and timeframe you look at, everything boils down to a variation of these common trend reversal patterns. You’ll spot them everywhere:

- Head and shoulders

- Cup and handle

- Double bottom

Let me show you what they look like on the live markets…

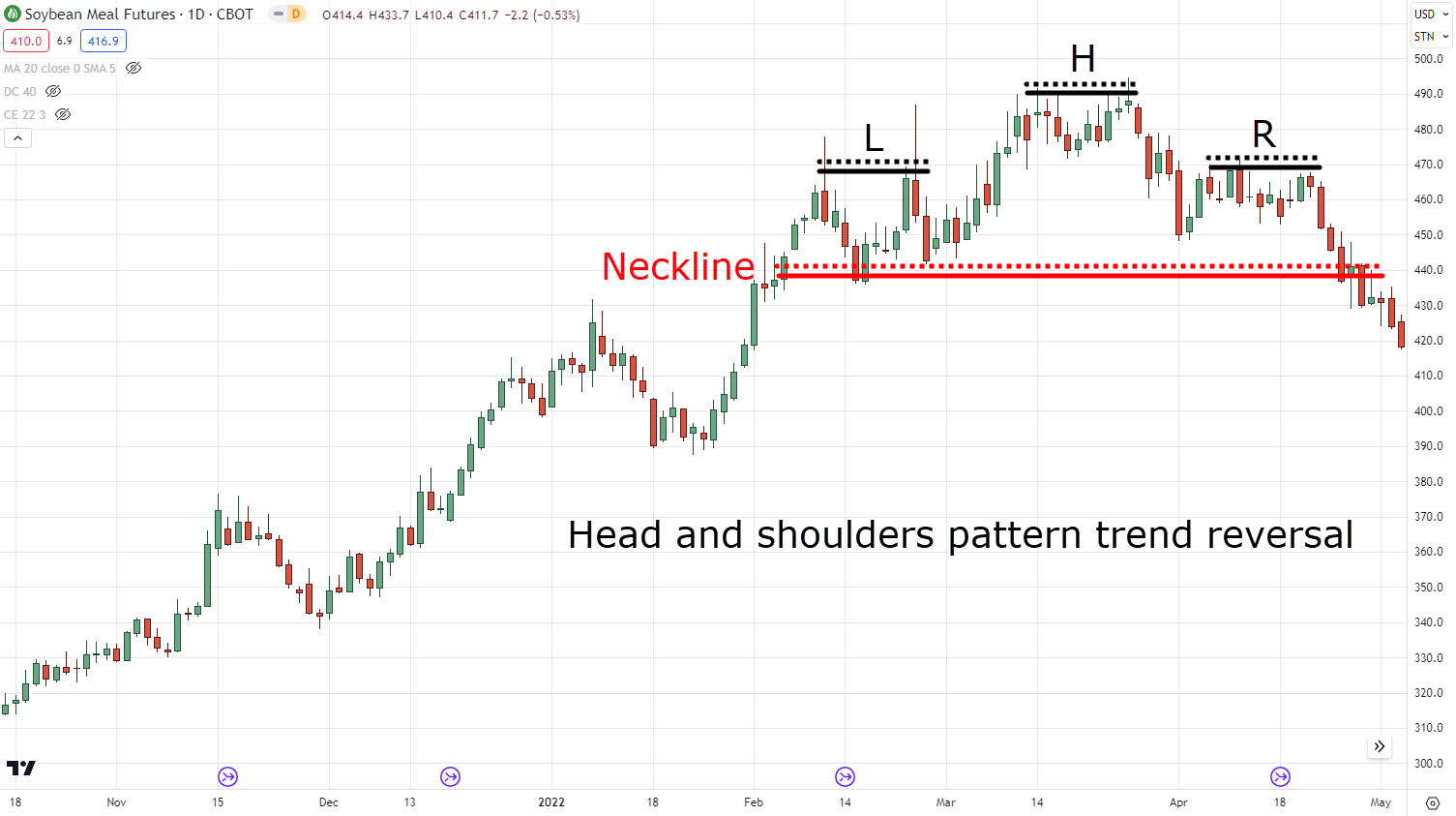

First up, there is the “Head and Shoulders.”

Which, despite its peculiar name…

Has nothing to do with the shampoo:

But it happens when the market breaks energetically into a downside:

And then boom!

A false breakout appears!

If you’re still in the trade you’re probably praying to the market Gods:

“Please, don’t go any further, I need to pay off my Lamborghini!”

But what do the market Gods (ahem institutions) always say?

That’s right…

“Nope, let’s hit all those puny stop losses and reverse the hell out of this trend!”

And that is how a head and shoulders pattern is formed!

Next, we have the “Cup and Handle.”

Which sounds like something you’d find in your grandma’s kitchen, but actually it’s a bullish formation that resembles a teacup with a dainty little handle.

Despite its looks, however, it’s one of the most straightforward patterns to trade.

Why?

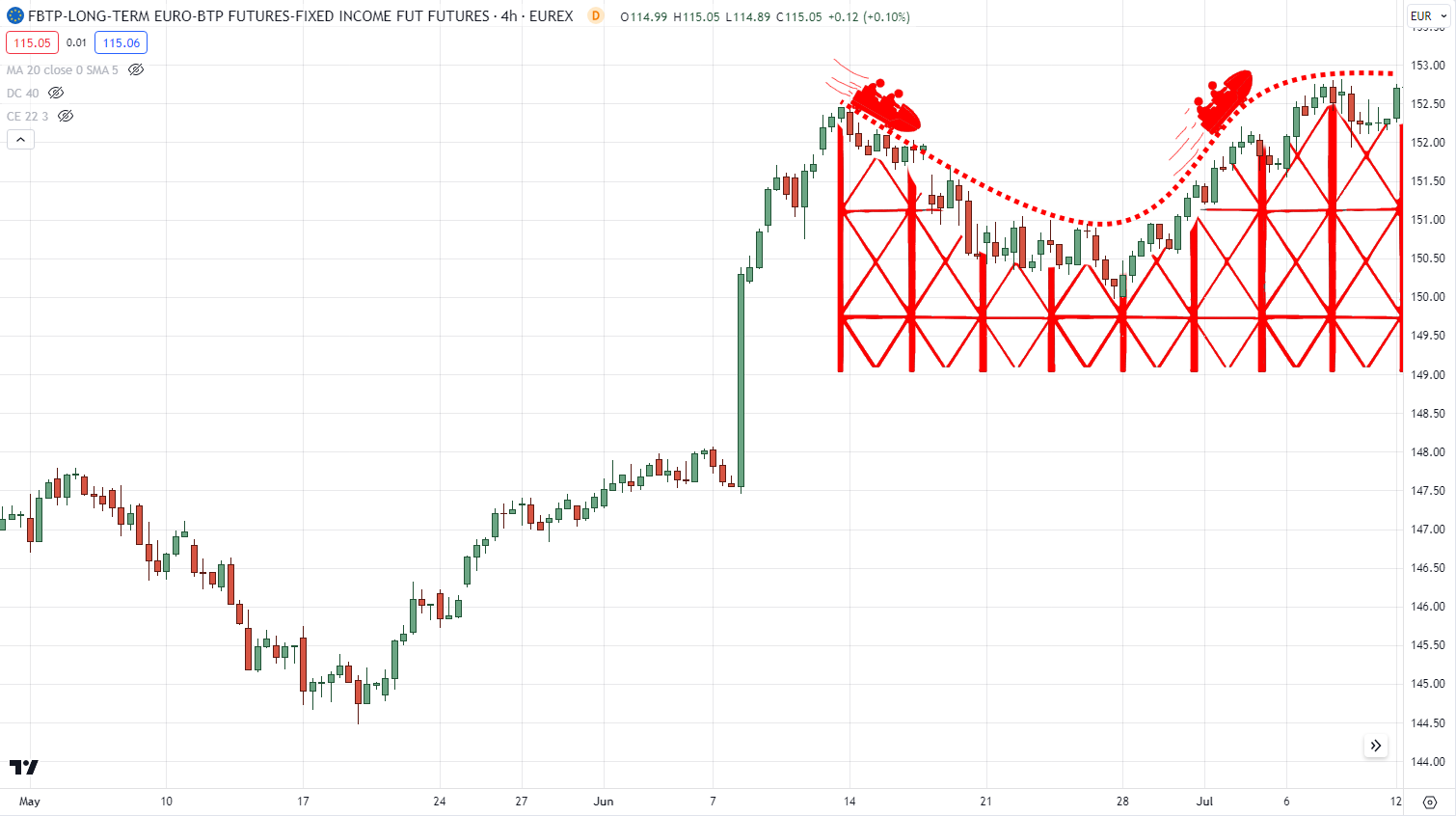

Because it’s like an exciting roller coaster where you have a thrilling drop, rise, and then a plateau before preparing to head upwards!

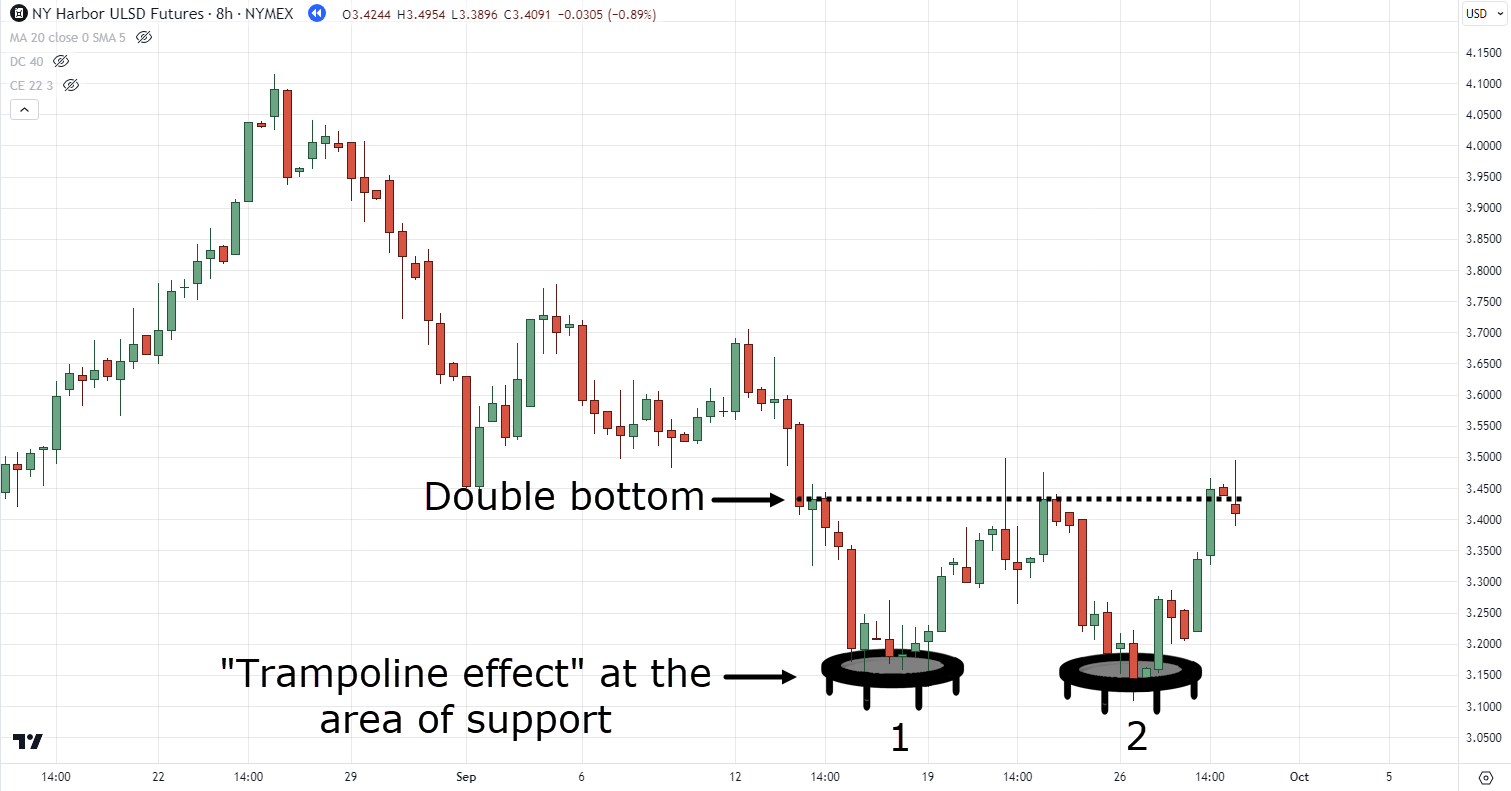

And finally, we have the “double bottom” pattern:

Think of it as the market’s way of saying, “Hey, I hit rock bottom once, but I’m bouncing back for more!”

It’s a like a trampoline where the buyers just won’t break!

Makes sense?

So, these patterns are the chart-topping hits you need to know to stay on top of the trading game.

And now comes an important question…

Why should you bother getting to know these trend reversal patterns?

Well, my friend, they hold the key to unlocking the treasure chest of determining high or low-risk trades.

They’re like the secret map that guides you through the perilous seas of the market, helping you avoid the hidden reefs and find lucrative trading opportunities.

Also, by mastering these patterns…

You become a trading ninja!

…swiftly (and easily) analyzing the market and making smart moves.

Hopefully, you can see…

They’re not just a throwaway tool; they’re a lifeline for your price action trading success.

Now, grab your magnifying glass, put on your detective hat, and get ready to unravel the mysteries of trend reversal patterns!

Cracking the Code: How to spot high probability trend reversal patterns

Let’s dive into the undercover world of high-probability trend reversal patterns.

Picture yourself as a detective, equipped with a magnifying glass and a Sherlock Holmes hat.

Your mission?

Unravel the trend-to-pattern ratio!

It’s the secret clue that holds the key to identifying high-probability trend reversals.

Now make sure to pull out your detective notes as this is the most important part of the guide.

Identify the trend-to-pattern ratio

So, what is it?

Simply, the trend-to-pattern ratio is found by comparing the number of bars in the trending move versus the trend reversal pattern.

Here’s what I mean:

As you can see, it’s like a hidden code and most traders miss it!

But at the same time…

It’s a numbers game that separates the trend continuation heroes from the trend reversal wizards.

Some trending moves are tiny that only last a few bars:

While some trends just keep going!

And it’s the same thing for trend reversal patterns…

Some tiny:

While others are giant, big enough to eat prevailing trends:

Now you might be wondering:

“Can’t we just trade trend reversal patterns and call it a day?”

“What’s the point in learning this?”

Let me tell you about…

Trend-to-pattern ratio: Trend continuation (at least 2:1)

If the trend has more bars compared to the trend reversal pattern:

…Do you think that this double-bottom pattern will be enough to break the trend?

Unlikely!

It’s like a small ant trying to stop a moving train…

A 2.85:1 trend-to-pattern ratio!

See what I mean?

So, if the trend-to-pattern ratio is more than 2:1 (meaning, the trend has at least 3 times more the bars of the pattern) …

There’s a high chance that the prevailing trend will stomp over that puny pattern.

Got it?

Trend-to-pattern ratio: Reversal (at least 1:2)

However, if the trend has fewer bars compared to the trend reversal pattern:

A trend-to-pattern ratio of 1:3 for example…

This is when the market taps you on the shoulder and says, “Hold on tight, we’re taking a detour.”

If you see this kind of ratio then there’s a high chance that this pattern will produce a new uptrend – a trend reversal.

Make sense?

Now, why is all this trend-to-pattern ratio stuff important, you ask?

Well, my trading friend.

By understanding this ratio…

You gain a unique superpower—a glimpse into the potential outcomes!

You’re not relying solely on the trend reversal pattern, but instead on the overall price action of the markets!

Now, at this point…

You’ve realized that you shouldn’t be dependent on common trend reversal patterns without analyzing the strength of the trend first.

But what if I told you…

There is one trend reversal pattern to rule them all?

A “universal” pattern that you can use no matter what trend reversal patterns you see?

Interested?

Then read on!

Unveiling the Key: Master Trend Reversal Patterns with this Simple Trick

Get ready to unlock another secret to successful trading as we unveil a simple trick that allows you to master trend reversal patterns like a pro.

It’s like discovering the hidden treasure map that leads you straight to profitable trades.

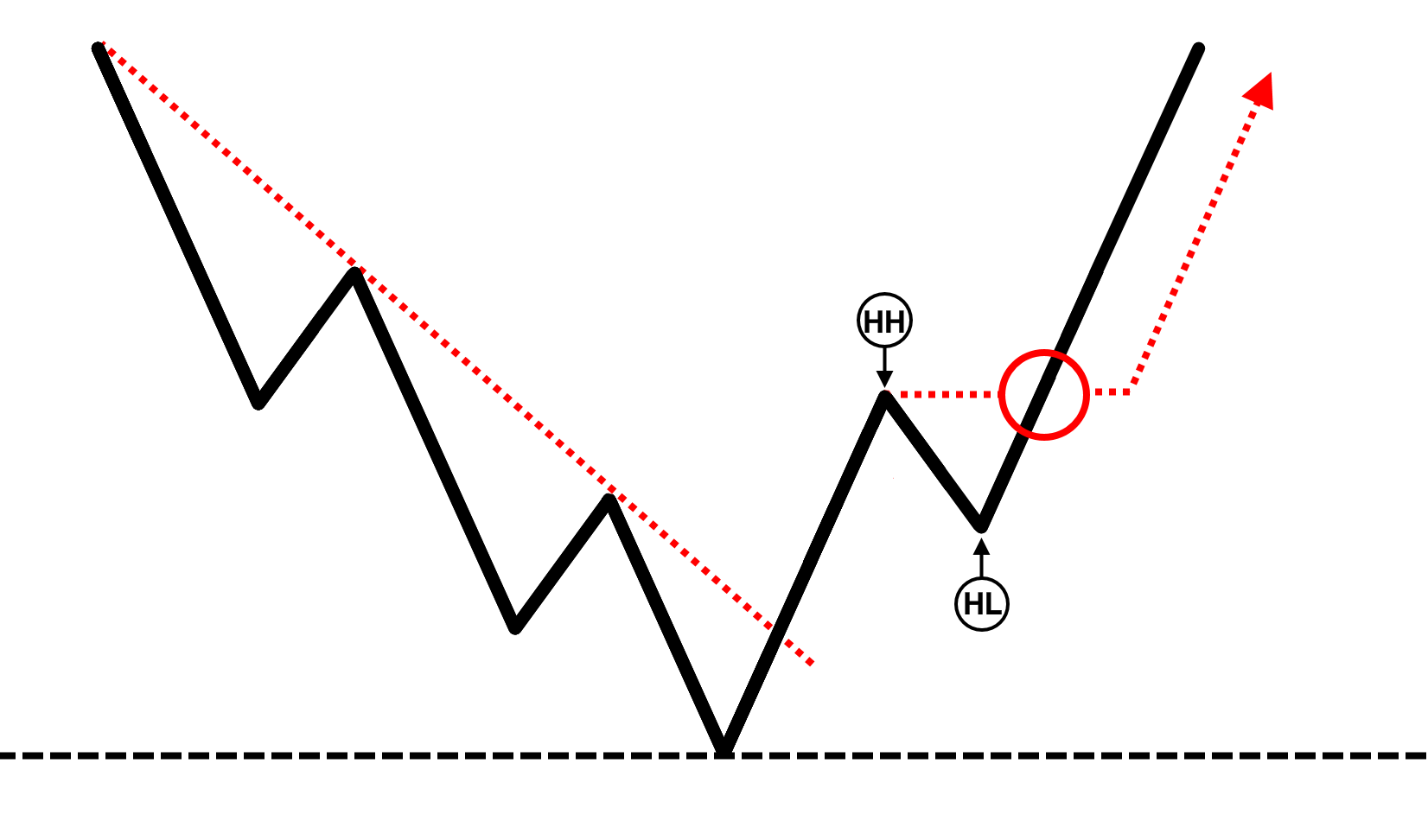

So, prepare to be amazed by the power of the Break of Structure!

As this trick will empower you to navigate the dynamic market with confidence and precision.

Now…

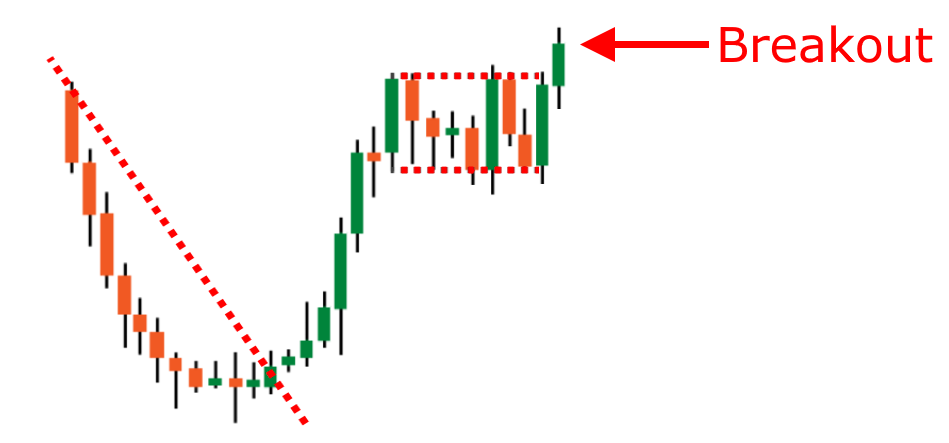

What exactly is the Break of Structure?

Imagine building a house with a sturdy foundation, only to find that the walls suddenly shift and form a new shape.

That’s the break of structure in action!

In trading terms, it occurs when the price breaks the trend line and then forms a flag pattern breakout.

It’s like a bold signal that indicates a significant shift in market direction!

But wait, there’s more.

The break of structure is a key element that exists in all common trend reversal patterns, providing you with a reliable entry point for your trades.

Don’t believe me?

Let me prove it to you:

P.S. For the Double Bottom, it pays to wait for a “buildup” at the nearest high

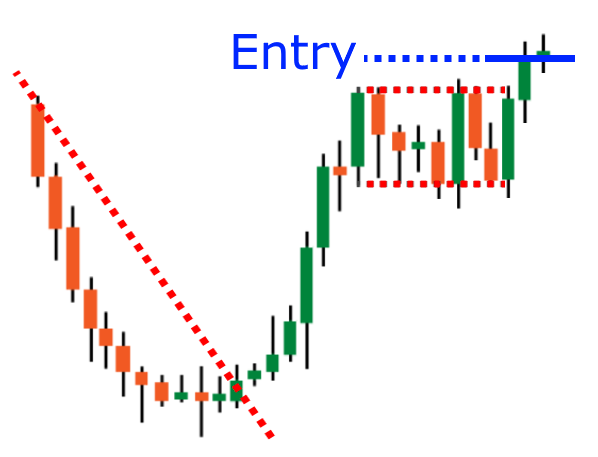

Now, here’s the exciting part – you can leverage the power of the Break of Structure by timing your entry effectively.

It’s like catching a wave just as it starts to swell, ensuring you ride it for maximum gains!

So, when the price breaks out of the flag pattern:

It’s like the starting pistol fires, giving you the green light to act.

This moment of confirmation is your cue to enter the trade confidently:

By mastering this simple trick, you become a skilled trader who can spot trend reversals and seize profitable opportunities.

So, remember…

This simple trick is your secret weapon in conquering trend reversal patterns.

It’s like having a compass to help align you through the twists and turns of the market.

Sounds good?

At this point, you might be wondering…

“What’s the point of learning other trend reversal patterns if the break of structure is enough?”

“How can we use this in the markets?”

“I want my Lambo money right now!”

Chill, my man!

Because the truth is, everything that you’ve learned thus far is to properly equip you with the right knowledge for the next section.

It’s from here that I reveal to you the entries, exits, and trade management on how you can go about trading trend reversal patterns.

Excited?

Then keep reading and let’s get right to it!

A foolproof strategy for trading trend reversal patterns

Alright, my friend!

I’ll make this section short and snappy.

So, let’s dive in and discover the secrets to conquering trend reversal patterns!

Step #1: Identify the trend

It all starts with identifying the trend.

Picture yourself as a trend detective, Sherlock Holmes style as before.

You need to analyze the charts and determine if the market is strutting its stuff in an uptrend or doing a downward dance.

But in this example, we’ll use an existing uptrend:

Once you’ve cracked the trend code, you’re ready to move on to the next step and unleash your pattern-spotting skills!

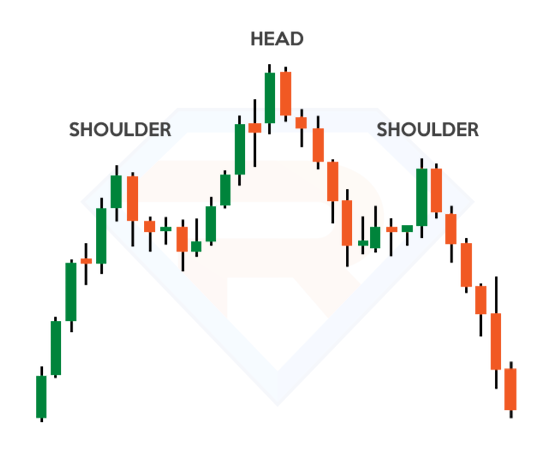

Step #2: Identify a trend reversal pattern

Now it’s time to put on your pattern detective hat and hunt for those trend reversal patterns.

Recall common trend reversal patterns and familiar faces like the inverse head and shoulders, cup and handle, and double bottom.

In this example, we’ll go with the head and shoulders:

Step #3: Identify the trend-to-pattern ratio

The trend-to-pattern ratio is your next clue on this thrilling trading journey.

Calculate the number of bars in the trend versus the trend reversal pattern.

And as you can see:

The trend reversal pattern is 3:1 so…

If the trend outweighs the pattern, it’s like a DJ spinning a hit song for a trend continuation.

If the pattern takes the lead, it’s like the market saying, “Hold up, we’re changing gears!”

Now, I know what you’re thinking:

“But wait, the head and shoulders is a bearish trend reversal”

“The trend should reverse!”

This is why I taught you the trend-to-pattern ratio.

Because that puny “trend reversal” pattern is about to get crushed!

So, what do you do?

That’s right, you stay bullish.

Step #4: Identify your setup (flag pattern breakout)

Now, it’s time to identify your setup—cue the break of structure!

This means that you’d have to wait and look for the price to break out of the trend line and then form a flag pattern.

That’s right, we’re ignoring the head and shoulders here.

What’s next?

Wait for a valid candle breakout of the flag pattern, and now your setup is complete!

But wait there’s more…

What should you do now that you’re in the trade?

There’s no use knowing when to enter the trade without knowing when to exit it, right?

So, last but not least…

Step #5: Manage your trade

Just like a skilled captain navigating stormy seas…

You need to set your stop-loss and take-profit levels.

For your initial stop loss, you can place it at a distance right below the buildup.

Here’s what I mean:

As for taking profits, you should adopt a medium-term trailing stop loss such as the 50-period moving average…

As you can see…

These are like the safety nets for your golden plunder, protecting your capital and securing your gains.

But of course, I don’t want to limit you from these options as there are many ways how you can manage your trade!

In fact, you can learn more about them by checking out these guides…

How to Use Trailing Stop Loss (5 Powerful Techniques That Work)

How To Set Take Profit Orders (The Essential Guide)

With that said…

Let’s do a quick recap on what you’ve learned today and wrap this guide up.

Conclusion

Trend reversal patterns offer great opportunities to correctly time market reversals.

An important point you’ve learned today is that trend reversal patterns should not be used in isolation.

On top of that, you saw that:

- Trend reversal patterns (inverse head and shoulders, cup and handle, double bottom) offer insights into potential trend changes.

- The trend-to-pattern ratio helps assess trend continuation or reversal probabilities.

- The break of structure (breakout of the trend line with a flag pattern) provides a powerful entry point for trading trend reversals.

- The step-by-step process involves identifying the trend, pattern, ratio, and set up, and effectively managing the trade.

These points pretty much sum up everything shown in this article.

They also highlight the importance of trend reversal patterns, the trend-to-pattern ratio, the break of structure, and the step-by-step process in successfully trading trend reversals.

With that said here’s what I want to know from you now:

What is your experience trading with trend reversal patterns?

Do they often “hunt” your stop loss?

Or are they an effective pattern to keep in your trading arsenal?

Let me know in the comments below!