There are many types of markets around the world that you can trade right now.

The Crypto market, the Agriculture market, the Bond market, and the list goes on!

However…

Two markets that can tend to be compared throughout the years are the Forex market and the Stock market.

And whether you’re a newbie trade or a seasoned trader…

This “battle” of comparison just never ends!

That’s why in today’s guide…

We’ll be settling on which market is the “best.”

Sounds good?

So, here’s what’s in store for you:

- What are the Forex and the Stock market (and some interesting facts about them)

- How to choose which timeframes to trade for both the Forex and the Stock market

- The secret to choosing which Stock and Forex pairs to trade

- The most important skill in trading both the Stock and the Forex market

- How to determine the best market to trade (and how to trade them both)

Ready yourself…

As this is going to be quite a journey.

So, let’s get started!

Forex market vs stock market: What are they?

At this point…

I’m sure you’re already a pro on what these markets mean.

Because a quick google will simply tell you that:

The Forex market is a decentralized market that allows the trading of other currencies.

While the Stock market is an equity market that allows you to acquire and trade shares of companies.

Cool.

But setting aside the classic dictionary terms…

How do these markets work?

How do these markets apply to us?

So, in this section, let me give you a quick (and interesting) refresher on what these markets are.

Shall we?

First…

The Forex Market

The Foreign Exchange market is a decentralized global market that allows you to trade or exchange currencies around the world.

For example:

You live in India and you’re planning to travel to the United States.

Therefore, you need to convert your Indian Rupees to US Dollars, right?

So, what do you do?

You go to the money changer!

Now, how does the money changer determine the exchange rate of your local currency to the US dollar?

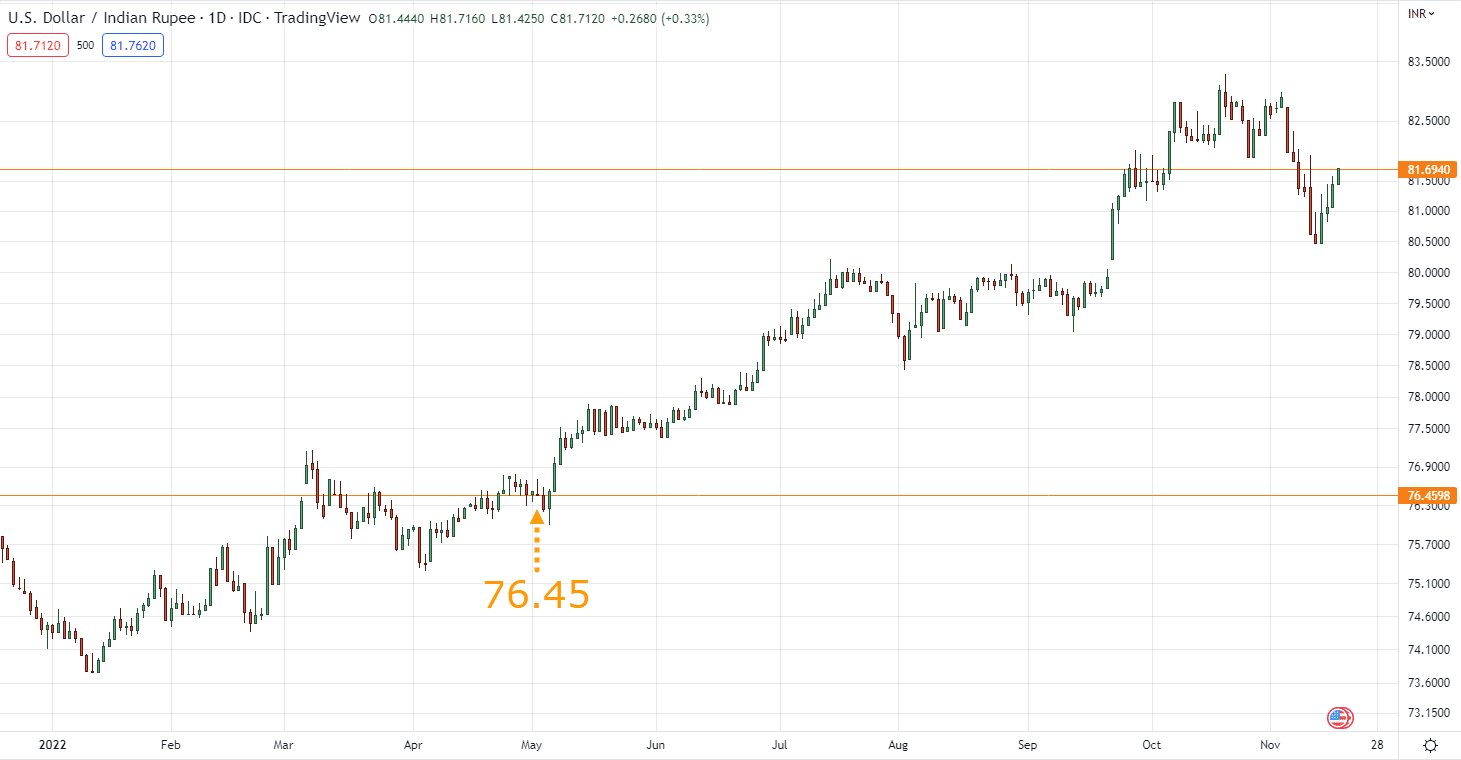

By looking at the Forex market on USDINR of course:

So, if you have 20,000 Indian Rupees in your pocket, you’d expect to have around 245 US Dollars.

But here’s the thing…

The Forex market is never static.

Meaning, if you bought US Dollars with your 20,000 Indian Rupees…

You’d probably have 262 US Dollars!

And this is just one of the examples of how the Forex market is present in our daily lives.

Meaning, the Forex market isn’t just about planning your travels to go to other countries.

It can also be about increasing the prices of your imported products such as:

- Gadgets

- Apparels

- Luxury Items

But on the other hand…

Do you remember when I said “decentralized?”

You’ve probably heard it already for the crypto markets.

What does decentralized mean for Forex?

Simple.

It only means that multiple banks around the world are keeping the Forex market up and running.

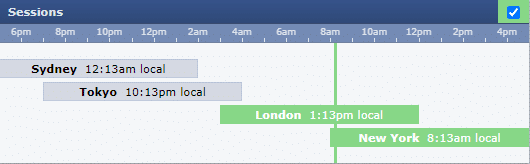

It means the Forex market is open 24 hours a day, and 5 times a week!

Source: Forex Factory

So as you can see, once the New York session ends…

The Forex market session would then be handed to the banks in Sydney where the Forex market would continue trading!

In contrast, there’s the market such as the…

The Stock Market

Why in contrast you may ask?

Since the Forex market is a decentralized global market, meaning, there’s only one Forex market in the world…

The stock market on the other hand is a centralized market where you get to own a portion of a company’s share.

That’s right.

It’s like getting a piece of the big pie as they say.

Basically…

The stock market allows you to put your money in “public” companies such as:

- Apple

- Microsoft

- Tesla

- Netflix

- And thousands of more stocks…

And you can be a part of those companies’ growth (and also their decline if it comes).

If their share price goes up?

You make a profit.

If their share price goes down?

You lose money.

Now, here’s a fun fact…

What if you have a huge piece of the pie like buying 50% of the shares available for one company?

In this case, you could be entitled to make decisions in the company, attend annual investor meetings, or possibly have perks.

Though you’d be tightly regulated by the Securities of Exchange Commission since you can (obviously) manipulate stock prices.

Of course…

It’s unlikely for retail traders like you and me to get a huge chunk of it, though.

But in simple terms, the stock market allows you and other millions of investors to bet on a company’s growth by acquiring a “share.”

Simple stuff, right?

Now here’s the thing:

I know that these markets are more complex than what I’ve explained.

So, if this section has got you hooked then you’re free to check out these courses here that explains these markets in-depth:

Forex Trading Course for Beginners (Free)

Stock Trading Course for Beginners (Free)

But if you think you’re ready to charge head-on into what this training guide is all about…

Then let’s tie these markets together and determine how they are different from each other.

Shall we?

So, what’s the difference between the two markets?

Well, it’s one thing to know the difference between the two markets.

But it’s another to determine the most CRUCIAL difference!

What do I mean?

It means that knowing these three differences almost means life and death to your trading portfolio.

“Are you serious?”

You bet!

So, what are these crucial differences?

They are:

- Timeframe flexibility

- Liquidity and volatility

- Risk management

Let me explain…

Forex market vs stock market: Which market offers timeframe flexibility?

Here’s the bottom line:

You have more flexibility in choosing the timeframes to trade on the Forex market than the Stock market.

Why?

Because the Stock market is only open for less than 8 hours.

The Forex market, however?

Is open 24 hours!

That gives the 8-hour and the 4-hour timeframe in Forex more information or data!

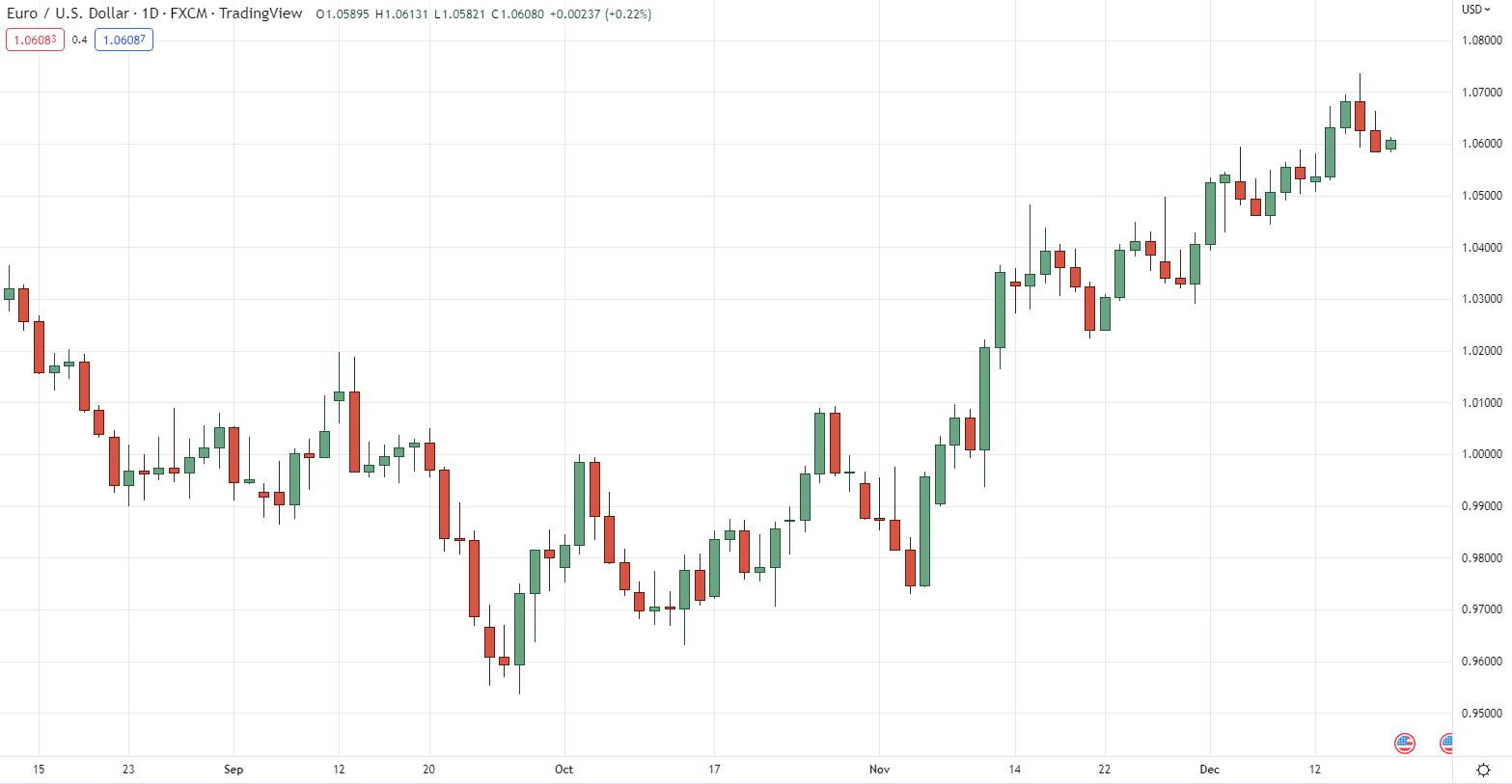

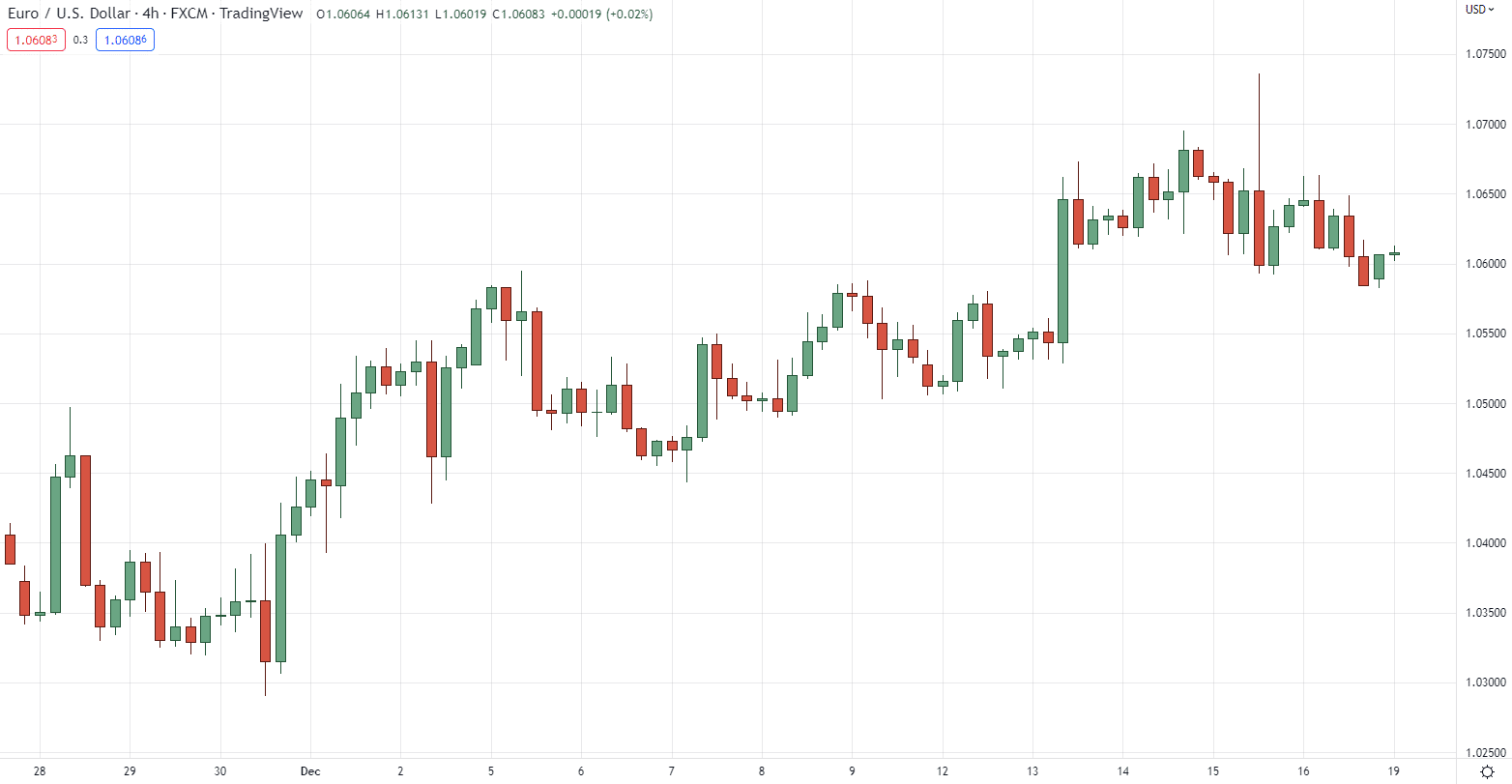

Here’s an example of EURUSD on the daily:

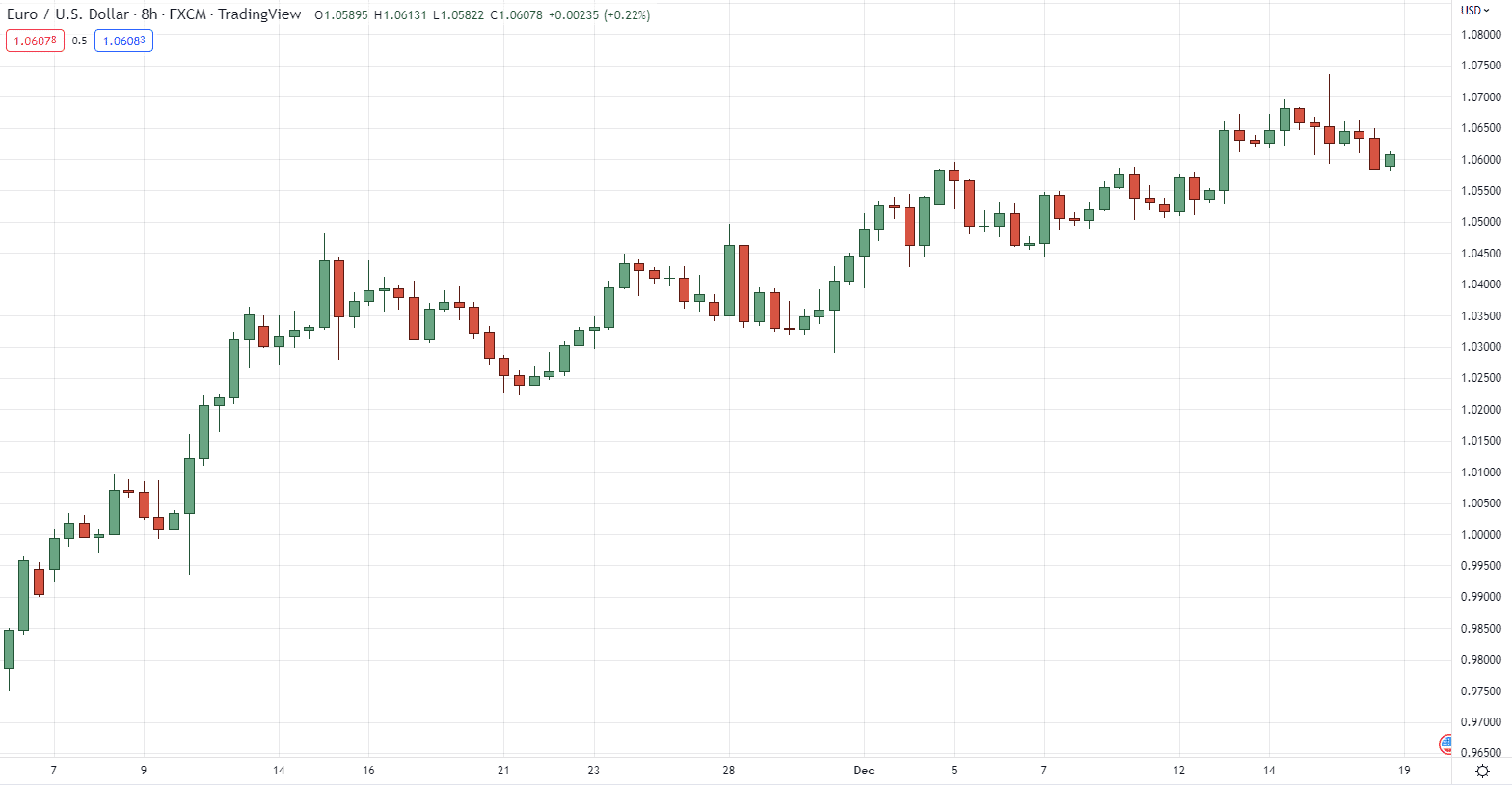

Then as we go down to the 8-hour timeframe, you can see that the candles are different from each other:

And in the 4-hour timeframe, you can precisely see what’s going on at this timeframe compared to the higher timeframe:

You see, it’s like looking into a whole new world!

How about the Stock market?

Recall…

It’s open less than 8 hours a day for a week.

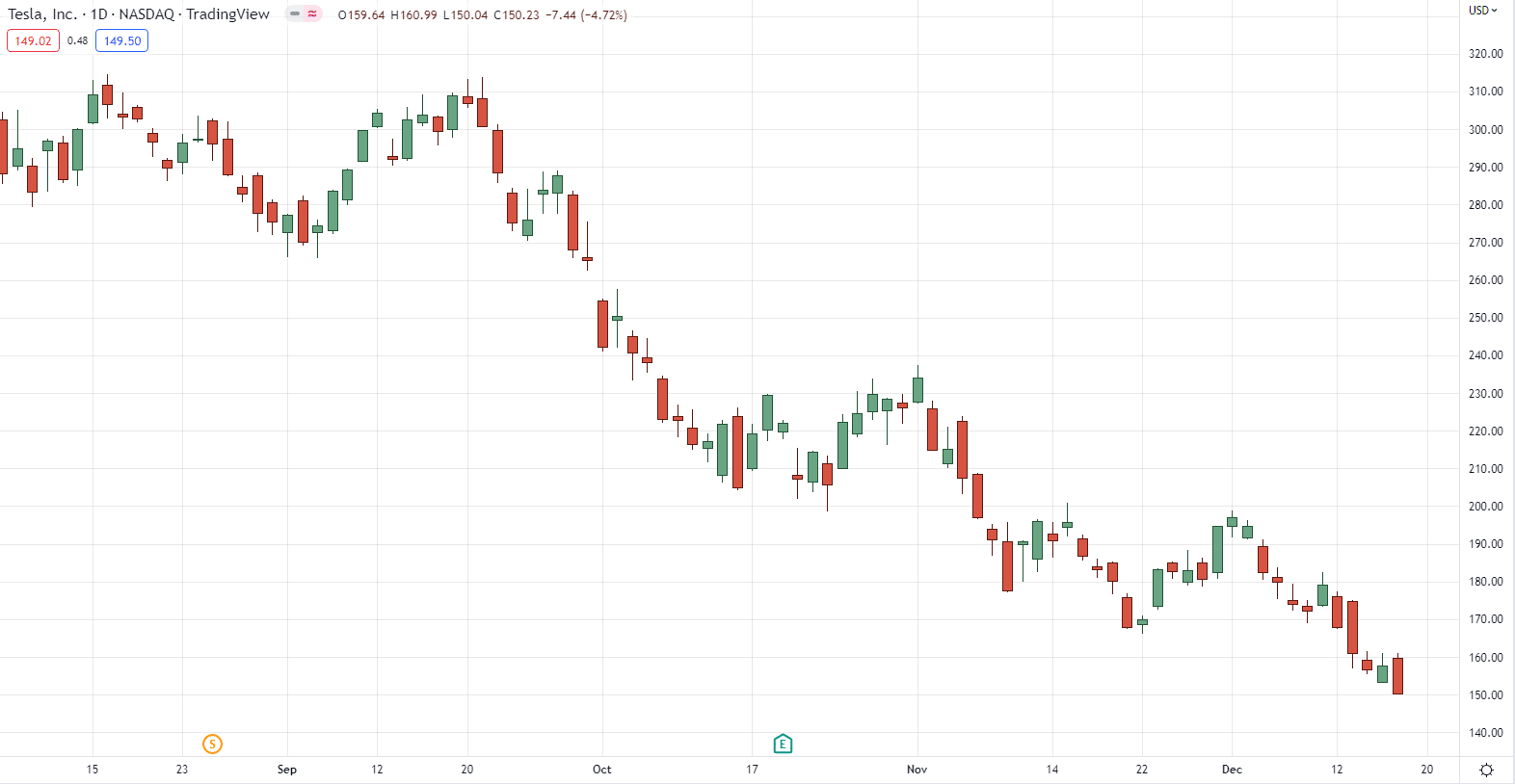

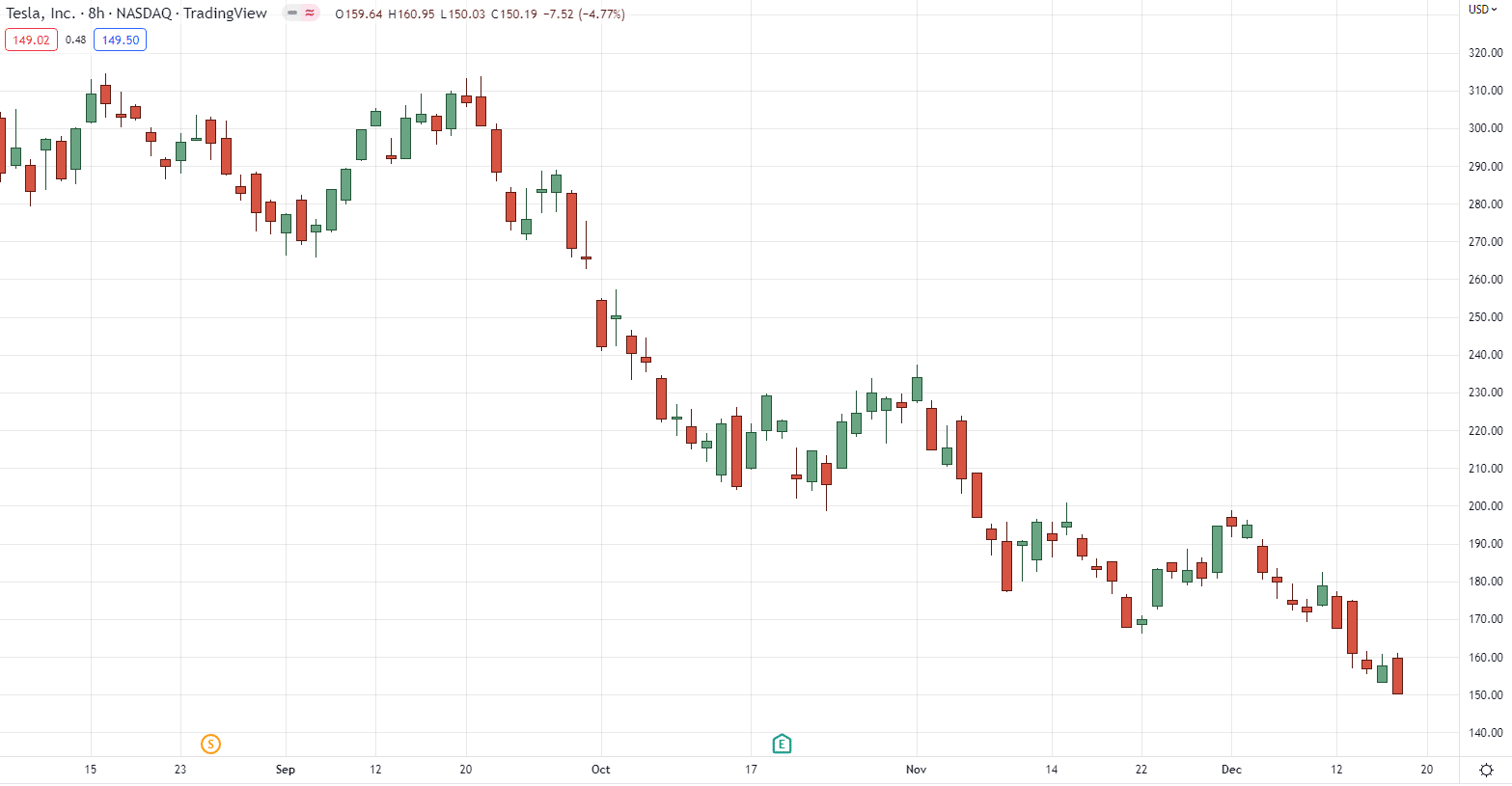

So, if the daily timeframe on a stock looks like this:

Here’s what it looks like on the 8-hour timeframe:

I know it nothing has changed, but it’s literally the 8-hour timeframe!

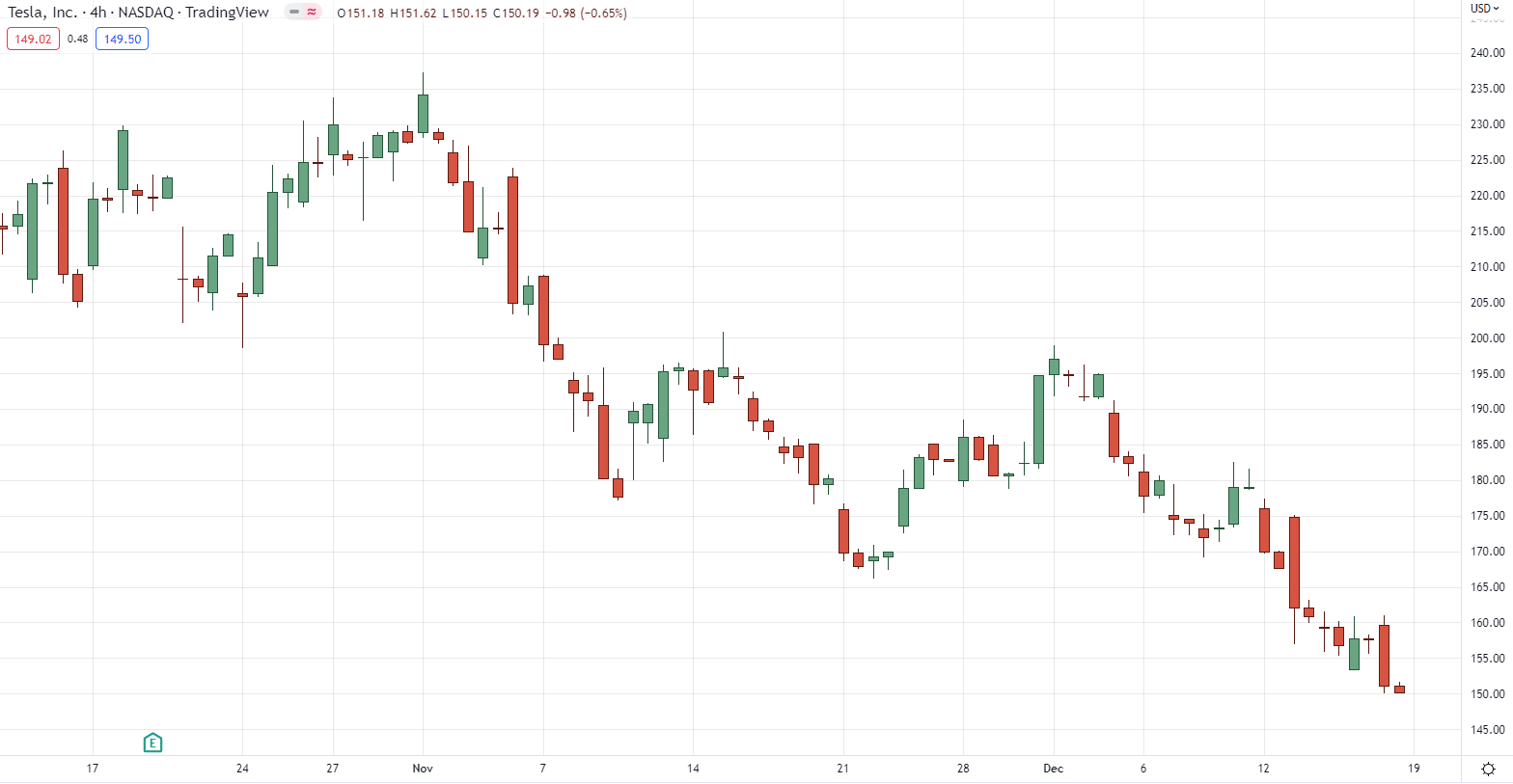

And now, the 4-hour timeframe:

They barely make any difference!

But of course, there’s a solution to this.

Solution #1

Focus on the higher timeframes only such as the daily.

Or…

Solution #2

Trade on the lower timeframes such as the 1-hour timeframe.

Avoid the middle like a plague!

Can you see how useful the information these timeframes are telling you?

Now you might be wondering:

“How is timeframe flexibility important?”

“Are these just useless stuff?”

“How can I use this in my trading?”

I understand how you feel.

But the reason why timeframe flexibility is that it allows you to do transition trading.

What does transition trading mean you might ask?

Let me give you an example…

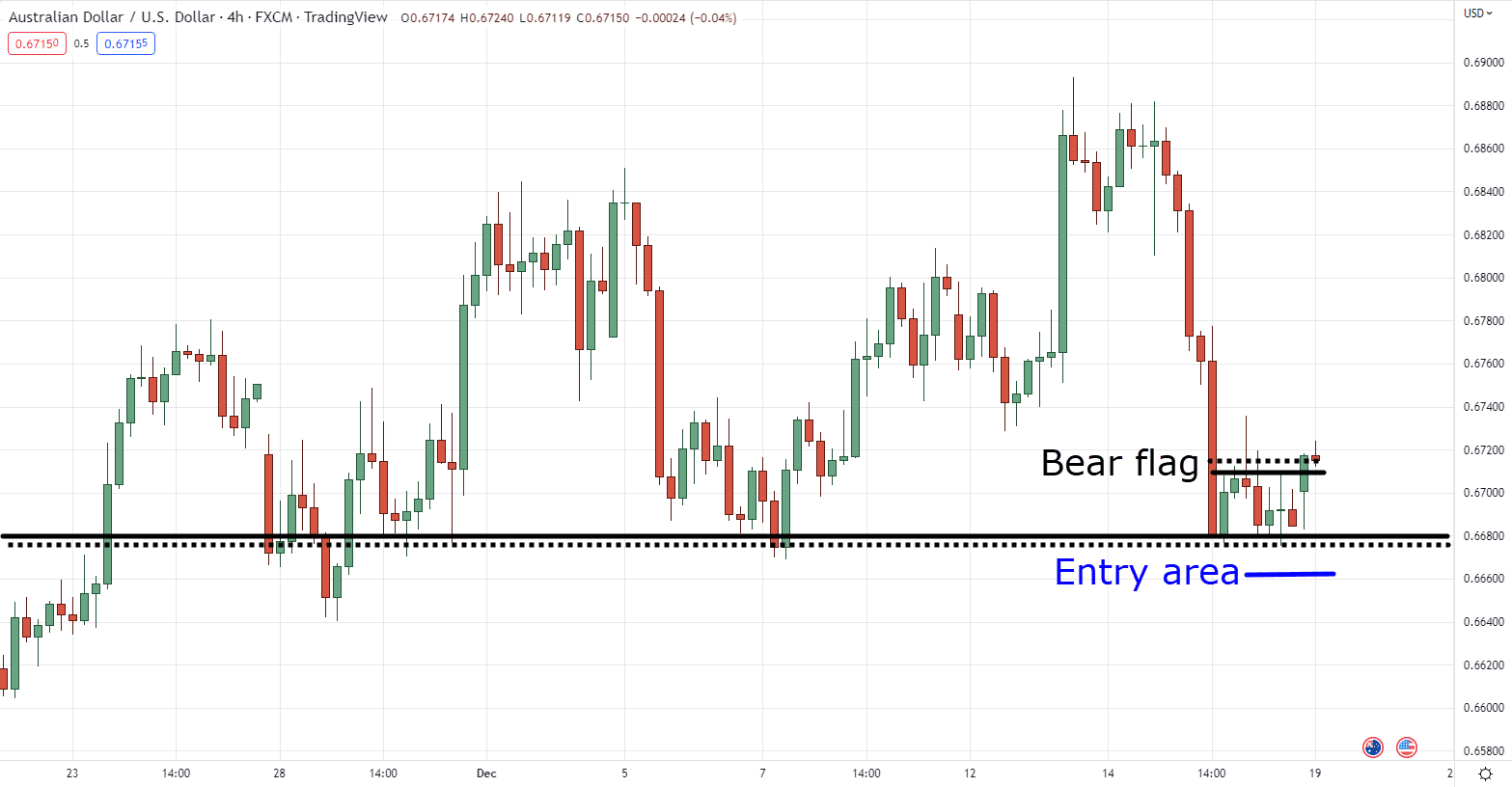

Let’s say that you’re a swing trader looking to enter this Forex pair in the 4-hour timeframe:

But as you can see…

There are no support levels to be seen!

Where would you take your profits!

But wait…

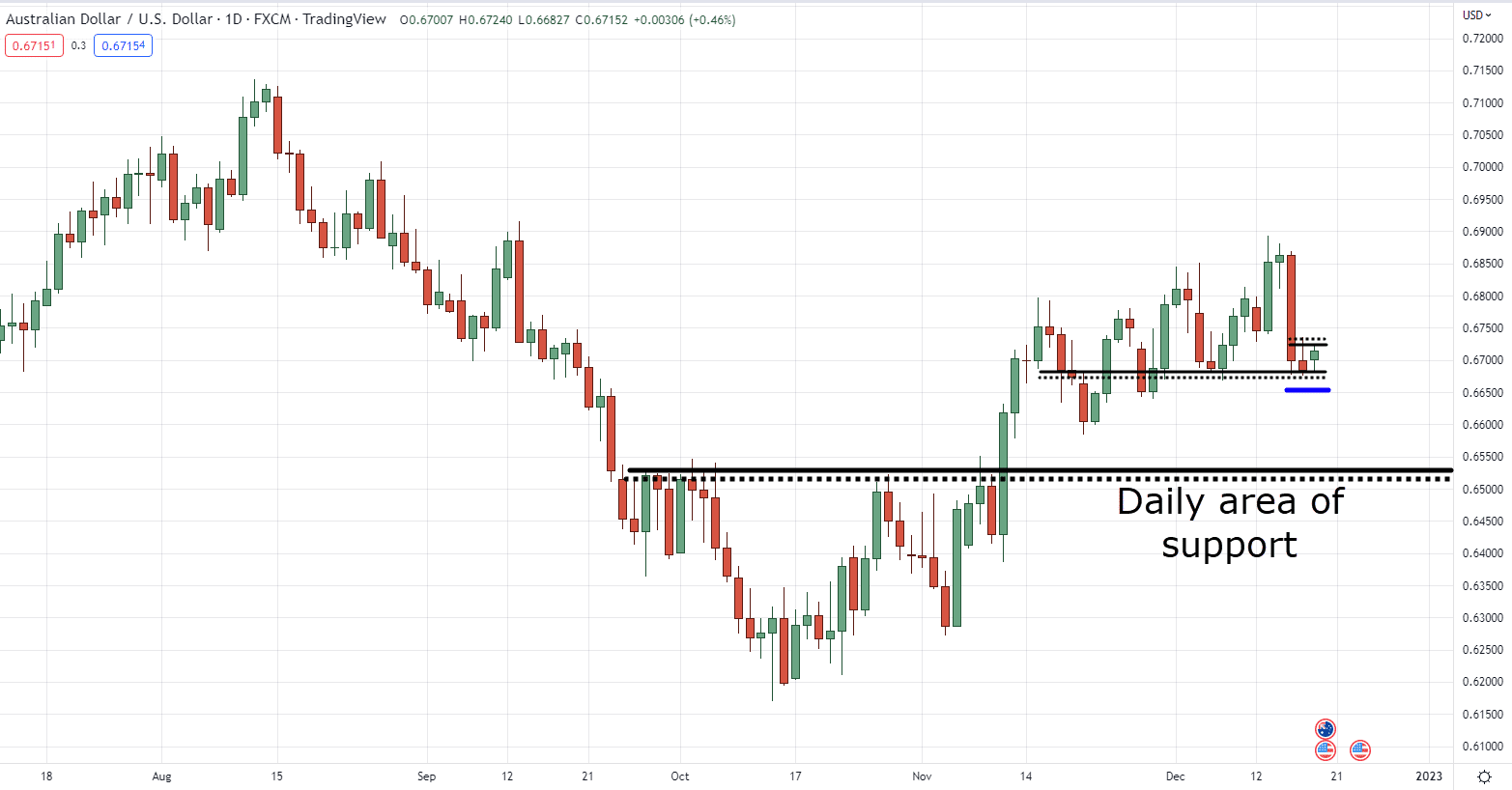

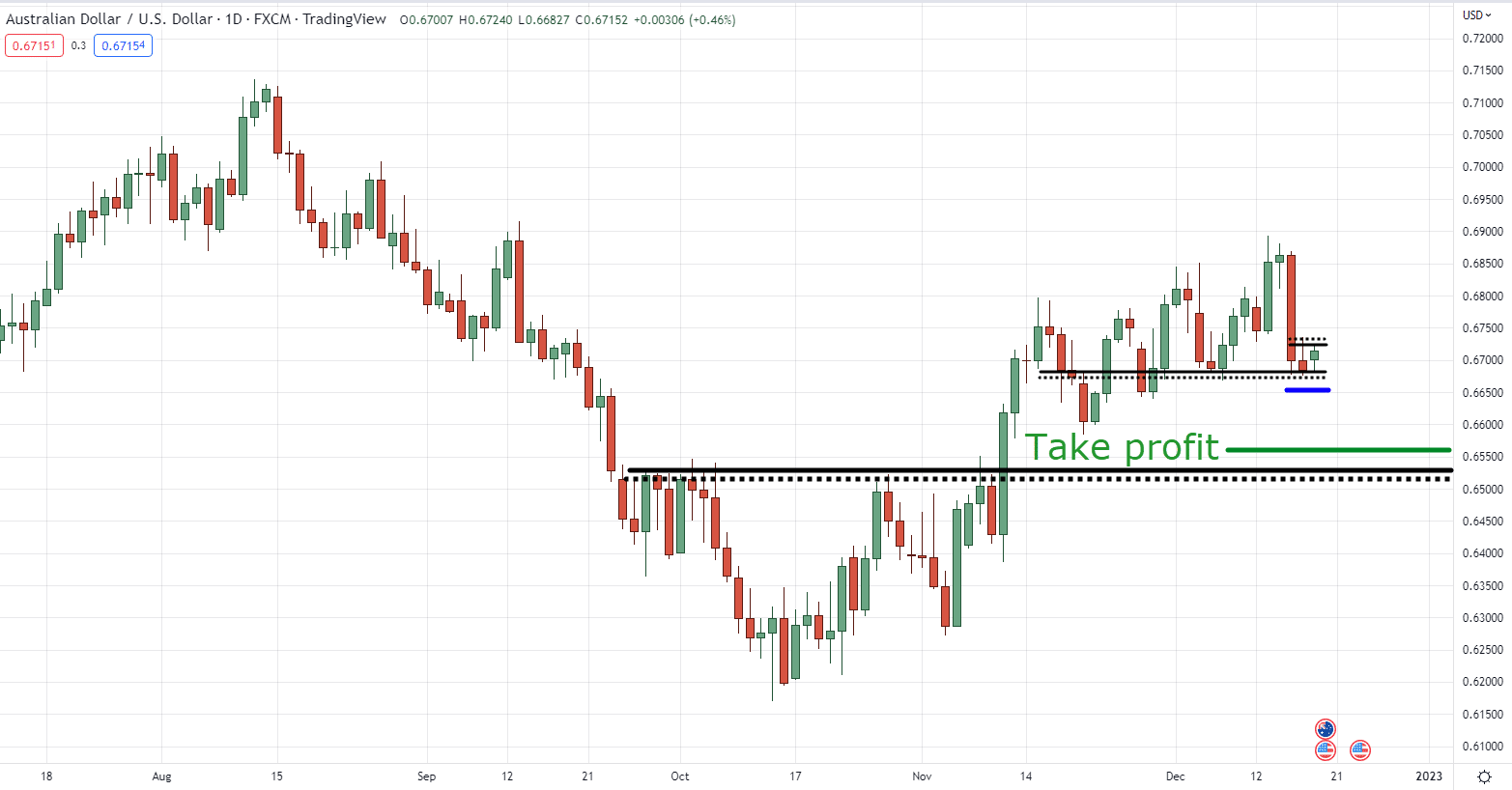

What if you look at the daily timeframe, would this change anything?

Boom!

Now that major levels can be seen, you now can base these resistance levels as your reference to take your profits!

Not only that, but this greatly improves your risk-to-reward ratio!

Sure, transition trading is still possible to do on the Stock markets.

However, you’d rather be comparing two timeframes on a smaller scale such as the 1-hour and the 4-hour timeframe.

Because it wouldn’t make sense for you to enter on the 1-hour timeframe and then look for take profit levels on the daily timeframe!

Makes sense?

Learning something new?

Now, since I mentioned the lower timeframes…

You’d be surprised how the lower timeframes can be very different in both the Stock and the Forex markets.

Let me tell you why in the next section…

Forex market vs stock market: How liquidity and volatility work

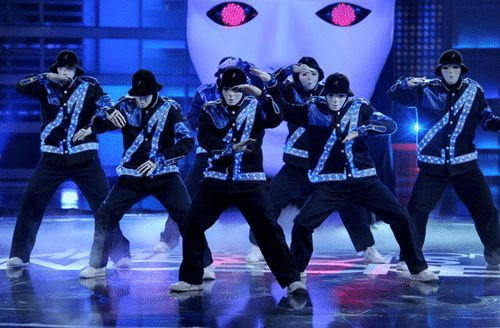

The Forex market is just like being a judge of America’s best dance crew!

Let me give you an example…

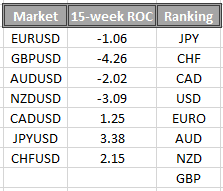

As you know, the US Dollar’s strength has been increasing for almost all of 2022.

So, what do you do?

You focus on USD pairs of course!

As you can see, Instead of trying to pick a single stock or a single singer…

You must focus on choosing a certain currency, a whole dance crew!

Because just like the previous example, a time will come when a certain dance crew will no longer be famous or be in the spotlight.

The same thing with a certain currency.

So, if the USD starts to weaken but the British Pound (GBP) starts to strengthen…

Then we focus on GBP pairs to trade.

(Thankfully, the Jabbawockeez are still famous, but you get the point)

So, how do we look for the best dance crew–

I mean…

How do we look for the best currencies to trade?

Well, a currency strength meter, of course!

Now, we already have a super-duper comprehensive guide on how you can create and use your currency strength meter.

So as much as I want to discuss it in today’s guide, you should check it out here:

The Essential Guide to Currency Strength Meter

So now…

How about the Stock market?

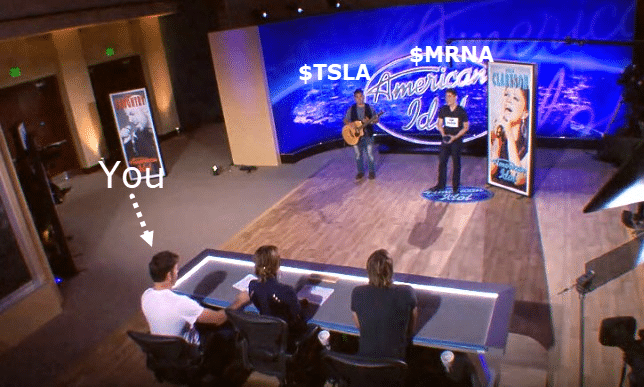

The Stock market is just like an American Idol audition.

Where there are thousands of singers to choose from!

Some singers get rejected.

While some are good enough to get them into the show.

What happens eventually?

They get the spotlight!

Even though there could be one winner on the show, a lot of them get famous!

Now…

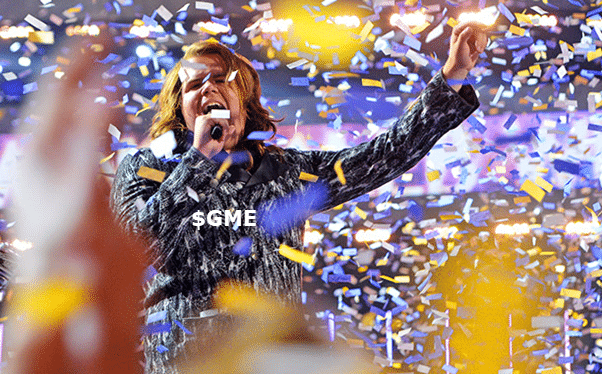

What happens when someone wins the show?

That’s right, the show starts a new season, and probably most of the singers from the previous season would be forgotten.

And it’s the same with the stock market.

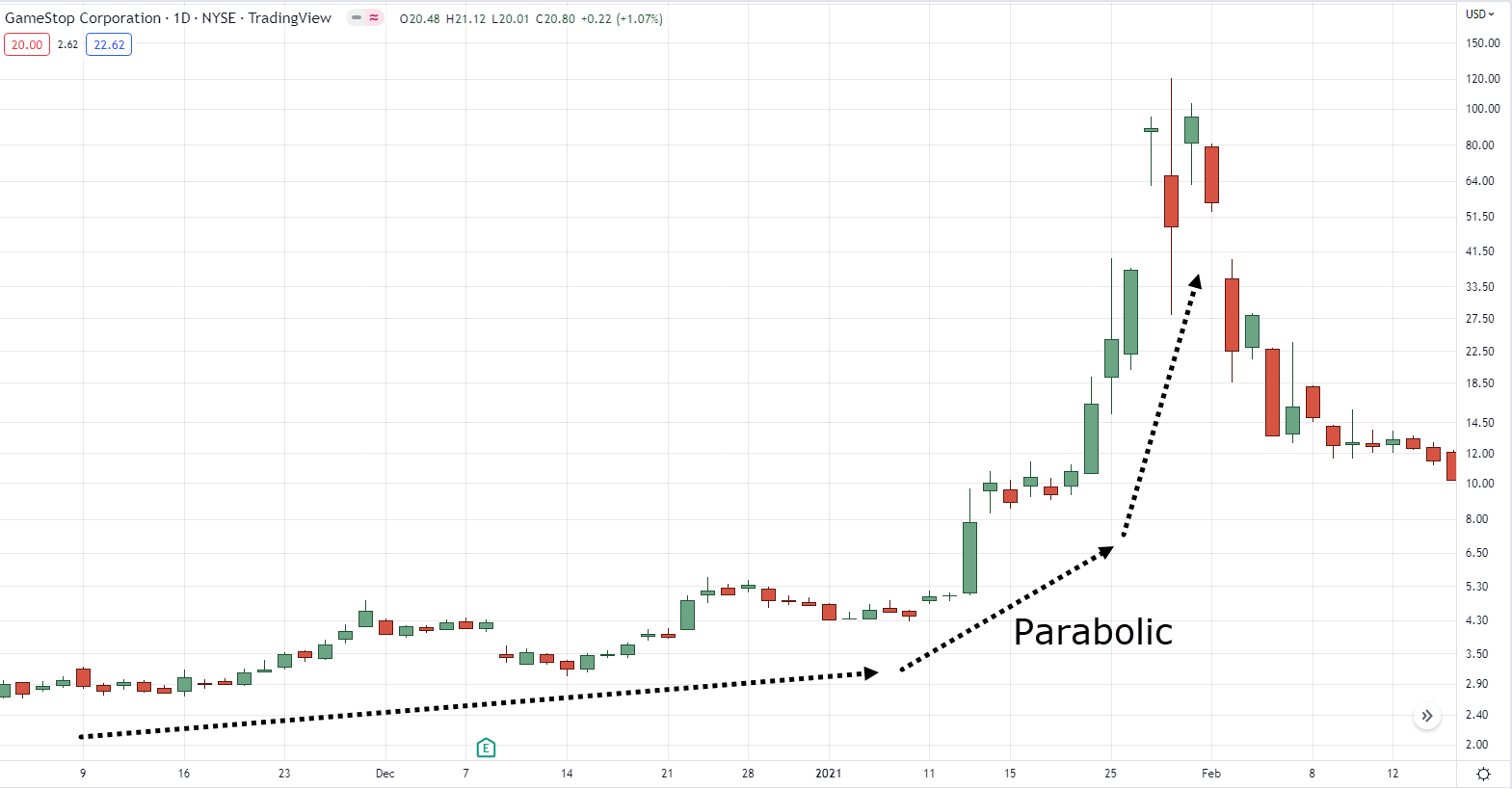

The stock market is just like a show where out of the thousands of stocks out there…

Some stocks get famous!

And what happens when a stock is famous?

They shoot up in price!

They gain liquidity and volatility just like GME when it was all over the news!

And what happens if a stock isn’t in the spotlight?

You guessed it.

Their chart looks like Morse code…

Who the heck would even trade this?

There’s no liquidity or volatility!

So…

How do judges differentiate good singers from bad ones out of the thousands of singers out there?

Just like the currency strength meter for the Forex market…

How do YOU differentiate good stocks from bad stocks out of the thousands of stocks out there?

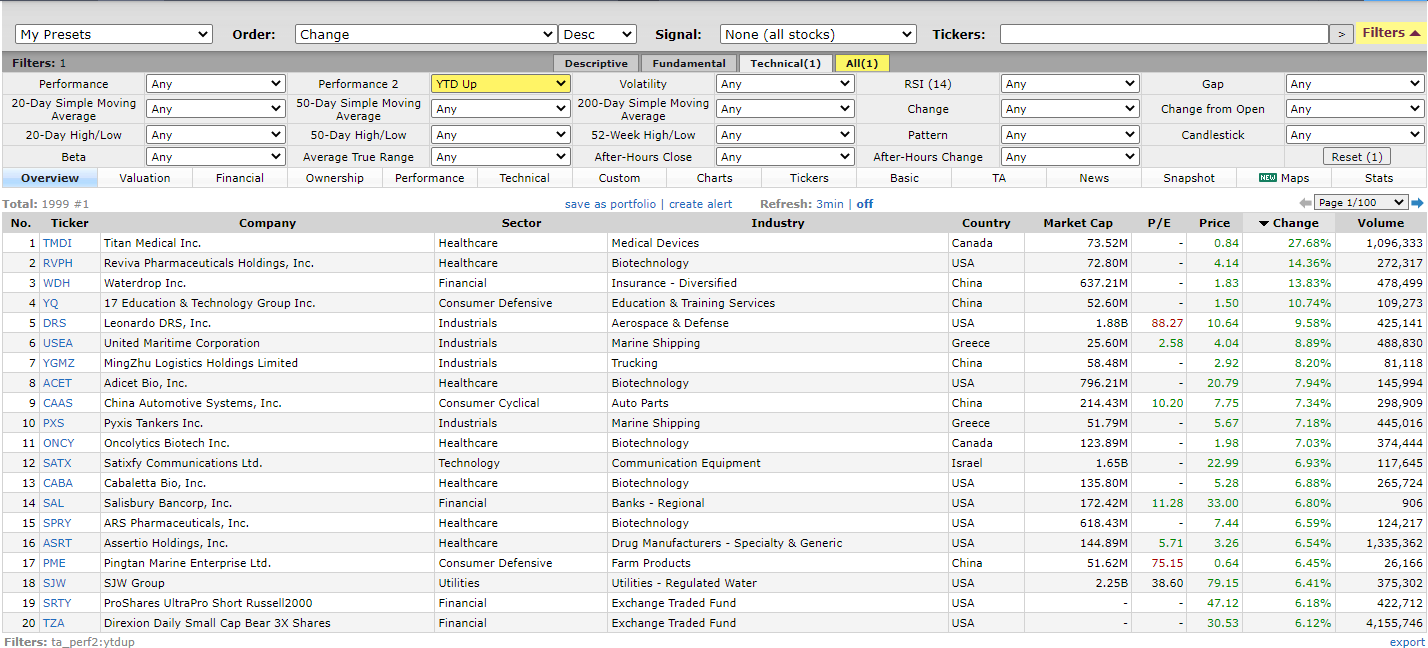

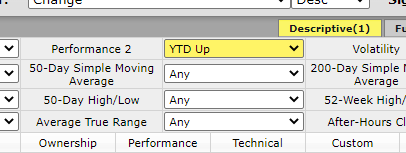

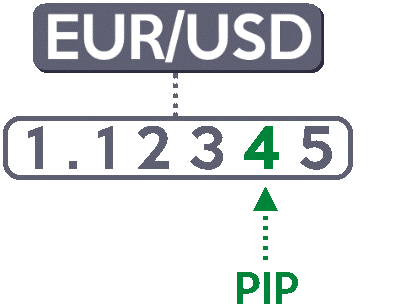

Simple, stock screeners.

Just like a judge, you insert what your standards are to your stock screener, and with just a push of a button…

The screener would filter out thousands of stocks out there based on the settings you’ve placed there.

One example would be the free stock screener called Finviz.

If you wish to determine the best-performing stock so far this year:

Then the screener would instantly give results out of the thousands of stocks out there.

Can you see how important a stock screener is?

So, remember!

Being a trader (judge) in the stock market is like choosing the best singer or stock out there!

On the other hand, the stock market is choosing the best dance crew or group of currencies out there!

With that said…

The next part is the most important one.

So, make sure you listen very, very closely.

Got it?

Forex market vs stock market: How risk management works

The purpose of risk management is one thing:

Well…

To manage your risk, of course!

But what specifically is the purpose of it?

That’s right.

Having risk management means that you never just buy any random shares and go all-in.

Everything is calculated.

You know exactly how many units or shares to buy and you exactly know what’s at stake before you even enter the trade!

But here’s the thing…

Managing your risk between the Forex market vs stock market can be different.

So, let’s break it down, shall we?

1. Forex market

Well, I hate to tell to you.

But managing your risk in the Forex market can be complex.

Why?

Because in stocks, percentages are almost all you need!

But in the Forex market, percentages in price movement are almost meaningless.

How so?

Two things…

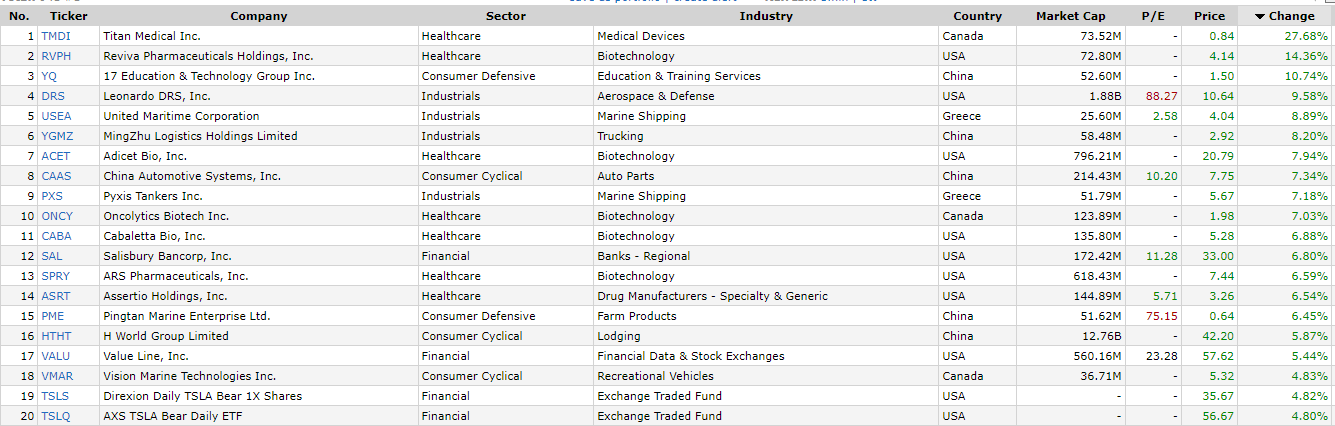

First, this is because we measure the Forex markets using pips, which is often the 4th decimal of the Forex pair price:

That’s why to manage your risk in the Forex market, you need to determine the pip value.

It means that if Forex moves 1 pip with or against you…

How much money will you gain or lose?

That’s what pip value means!

Second, we don’t buy shares when trading the Forex market.

We trade using Lot sizes.

Here’s what I mean:

- 100,000 Units = 1.00 Lot

- 10,000 Units = 0.10 Lot

- 1,000 Units = 0.01 Lot

- Below 1,000 Units = 0.001 Lot

So just because you can regularly buy 10 shares of a stock, do not.

I repeat.

Do not buy 10 lots no matter how big your account is!

You’re trying to buy 1,000,000 units and immediately blow up your account!

That’s insane!

Instead, identify these three things…

First, know the maximum amount you’re risking per trade.

Second, the distance of your stop loss to your entry price in pips (that’s right, in pips, not in percentage).

Third, determine the pip value.

Here’s an example

- The amount you’re risking = 1% of your $5,000 = $30

- Distance of stop loss from entry = 60pips

- Pip value = $8USD/pip

So, if the formula is…

Units to enter = max risk in $ / (stop loss distance * pip value)

Then your values should be…

Units to enter = $30 / (60 * 8)

So how many units you should enter on a trade?

That’s right.

0.06 lots!

This means that if you enter the trade right now on a certain Forex pair with 0.06 lots and with a stop loss of 60 pips away from your entry…

You will not lose more than $30 on the trade.

Now, how about the Stock market?

2. Stock market

First of all, there are many ways to manage your risk which you can learn more about here.

However!

One very popular risk management used by beginners and professionals (which is also simple compared to the Forex market)…

Is what we call the portfolio allocation method.

How do you apply it?

First, determine the size of your account.

Let’s say in this example, you have a $5,000 account.

Second, determine how much you are willing to allocate per trade.

In this case, let’s say you want to allocate 10% per trade.

This means that if you want to buy a stock, you won’t buy shares worth more than $500.

Are you following?

Finally, identify the stock price, and divide it by the amount you’re willing to allocate per trade!

So, if SIRI’s current price is 6.16

Just divide it by $500, which is your max allocation per trade.

How many shares should you buy?

Correct.

81 shares.

Easy peasy, right?

Take note:

If traders are in aggressive mode, they often allocate 20% of their portfolio per stock.

This gives them a maximum of 5 trades.

It’s riskier as there’s less diversification and more concentration on a stock!

If you’re in the conservative mode, however…

You can allocate 10% of your portfolio per trade.

This gives you better diversification while maintaining risk.

Makes sense?

Again, this is very important.

Knowing how to manage your risk well is your major key to surviving in this trading business!

Now, I have only touched the tip of the iceberg when it comes to risk management.

So, if you want more examples and methods surrounding risk management, I suggest you learn more about it here.

Now that you’re equipped with all of this knowledge…

Let’s tackle the million-dollar question:

Forex market vs stock market: Which is the best market to trade?

If you’ve been reading my guides for a while now I’m sure you’re familiar with the saying:

“There’s no such thing as the best, only the best one for you!”

Sure, there’s some truth to it as finding the best is never really a shortcut.

But in reality?

“The best is subjective”

What do I mean you may ask?

Simple.

The best market to trade is subjective in two ways:

- Experience in trading

- Market condition

Hmm.

Interesting, am I right?

Let me prove it to you…

1. Experience in trading

If you’re starting in trading, and especially if you don’t know how to apply risk management…

You have to start trading on the stock market before you trade on the Forex market.

Sure.

You can stay trading the stock market if you wish!

Or, who knows, trade both markets!

But again…

If you’re new to trading, I suggest starting trading the stock market first.

I’m sure you’re now wondering:

“Why?”

“Why shouldn’t I start trading the Forex market immediately?”

One word:

Leverage.

Leverage is optional when trading the stock market, or not even an option at all in some Stock markets.

But in the Forex markets…

Leverage is automatically in the equation since you won’t be able to trade the Forex markets without it!

Can you see how important it is?

No?

Let me explain…

Imagine that leverage in the Forex markets is like a credit card:

And let’s say that your leverage in the Forex markets is 1:10 (this is a ratio you’ll encounter often).

It means that if your starting capital is $5,000 your credit limit (or buying power), is $50,000.

Holy moly!

Now let me ask you…

If you’re starting your career; get your paycheck for the very first time.

And you’re still not sure how to manage your finances…

Would it be smart to get a credit card with a limit that’s 10 times your salary?

If you’re starting in trading and you’re still not sure how to manage your risk…

Would it be smart to get on trading with leverage?

Not quite!

So, in this case…

If you’re a beginner, I suggest you stick with the Stock market without leverage.

If you’re already proficient at managing your risk with discipline, then I suggest you trade the Forex market!

2. Market condition

Have you ever heard of this saying?

“The Stock market is easy!”

“Go all-in, you’ll be rich blindly in no time!”

“The Forex market is hard, don’t even dare try it!”

I hate to break to you…

But that’s just a myth!

The Stock Market does have some similarities with the Forex market!

Let me prove it to you.

This is the S&P 500 index on a daily timeframe:

As you can see, it’s in an uptrend!

A bull market!

Everything you touch turns into gold!

It’s “easy!”

But what if the US Stock market index is in a downtrend?

What if the Indian Stock market is in a downtrend?

What if the Chinese Stock Market is in a downtrend?

Is the Stock market still easy?

Heck no!

A bear market is where everything you touch turns into crap!

That’s whenever the Stock market is in turmoil you hear sayings such as:

“Cash is also a position”

“Stay in cash during these bloody times”

So, how about the Forex market?

Maybe it’s the one that’s actually “easy?”

Well…

Let’s take a chart that represents the “index” in the Forex market which is the dollar; the world reserve currency:

Similar to the Stock market’s index, what do you see?

A bull market!

It creates “easy” trending market conditions on pairs like the USDJPY on the daily timeframe:

And creates bear trending market conditions on pairs like EURUSD on the daily timeframe:

Now, if the dollar index is in a ranging market what do we get?

That’s right!

A “hard” Forex market!

And boy, trading on a ranging market condition is almost suicide!

So…

Do you see what I mean?

It all boils down to certain market conditions!

At this point…

We’ve talked not only about the difference between the Forex market vs Stock market but also about the risk management aspect of it.

What if, eventually you’ll be the type of trader who already mastered what they are and how risk is managed in both markets?

Which would you trade?

What’s the solution?

Fortunately, there’s a compromise.

But only take this as a suggestion and not financial advice.

Promise?

Great.

So, one solution is to…

Add funds or concentrate your funds when the Stock market is in a bull market

Yes, if you’re trading in a market where everything you touch turns into gold, then why wouldn’t you double down on the mining of it?

However, if the Stock market is in a bear market such as closing below the 200-period Moving Average:

Instead of holding cash and letting it stay there, why not add the cash to the Forex market?

In this case…

Not only do you get to:

- Avoid potential losses

- Sidestep an entire bear market season

- Be open-minded as you explore other markets

But you also get to:

- Get the best of both worlds

- Keep an active trading account

Because in the end…

That’s what it truly means to be a trader!

To stay-open minded to new markets (whether it be the agriculture or crypto markets).

And to always learn and improve from your trades.

Makes sense?

With everything said and done…

Let’s have a quick recap of what you’ve learned today.

Conclusion

Wow…

What a pretty long-ass guide, am I right?

But I know that for most traders reading this…

Choosing between the Forex market vs Stock market can both be a major dilemma and a decision.

So, here’s what you’ve learned in today’s training guide:

- The Forex market allows you to buy and sell currencies while the Stock market allows you to buy a share of a certain company

- There is more flexibility in choosing timeframes on the Forex market on the higher and lower timeframes

- Liquidity in the Stock market is not static and moves across thousands of stocks, this makes stock screeners crucial

- Risk management in the Stock market can be simpler than managing risk in the Forex market

- Trading the Stock market as a beginner without leverage can be more favorable than trading the Forex market as a beginner

Congratulations!

You’ve made it to the end of this training guide!

So, this time, I want to know what you think…

What else do you think I’ve missed?

Did this training guide help you decide on which market you should trade first?

Let me know in the comments below!