Are you the type of trader that understands the direction of trends?

Even what side of the market you should be on?

But no matter what…

…you just can’t seem to time the entry correctly?!

Or perhaps you struggle to execute trades – uncertain about the reversal point at which the market may turn in your favour…

Sound familiar?

Luckily, I have something that’ll transform your doubt into solid confidence!

How?

The Tweezer Top Pattern!

Here’s what you will learn in this article:

- What the Tweezer Top Pattern is

- How to trade the Tweezer Top in an already trending market

- How to trade the Tweezer Top for trend reversal

- How you can transform small winners into impressive trend-capturing giants

- How to confidently navigate the market with precision

- Mistakes to avoid when adding this tool to the arsenal

Sound promising?

Well, let’s get started!

What is the tweezer Top Pattern?

The tweezer top pattern is a candlestick pattern that every trader should have in their toolbox.

It consists of two candlesticks, both with equal highs – one arriving after the other.

Now, these candles can come in all shapes and sizes…

The crucial thing is that the two highs of the candles are the same.

Let me show you…

Tweezer Top Pattern Examples:

Notice how every time the second candle attempts to surpass the previous candle’s price, it merely matches its high?

This is what I would call a Tweezer Top Pattern.

Now when I say match – do I mean exactly the same price?

Well, let’s be realistic.

Markets aren’t perfect systems.

With so many different participants across endless brokers and millions of different opinions, markets are rarely going to line up perfectly with the way the “textbook” shows it.

So when I talk about matching the high, I don’t mean picture-perfect – but close enough!

Allow me to demonstrate this on a chart…

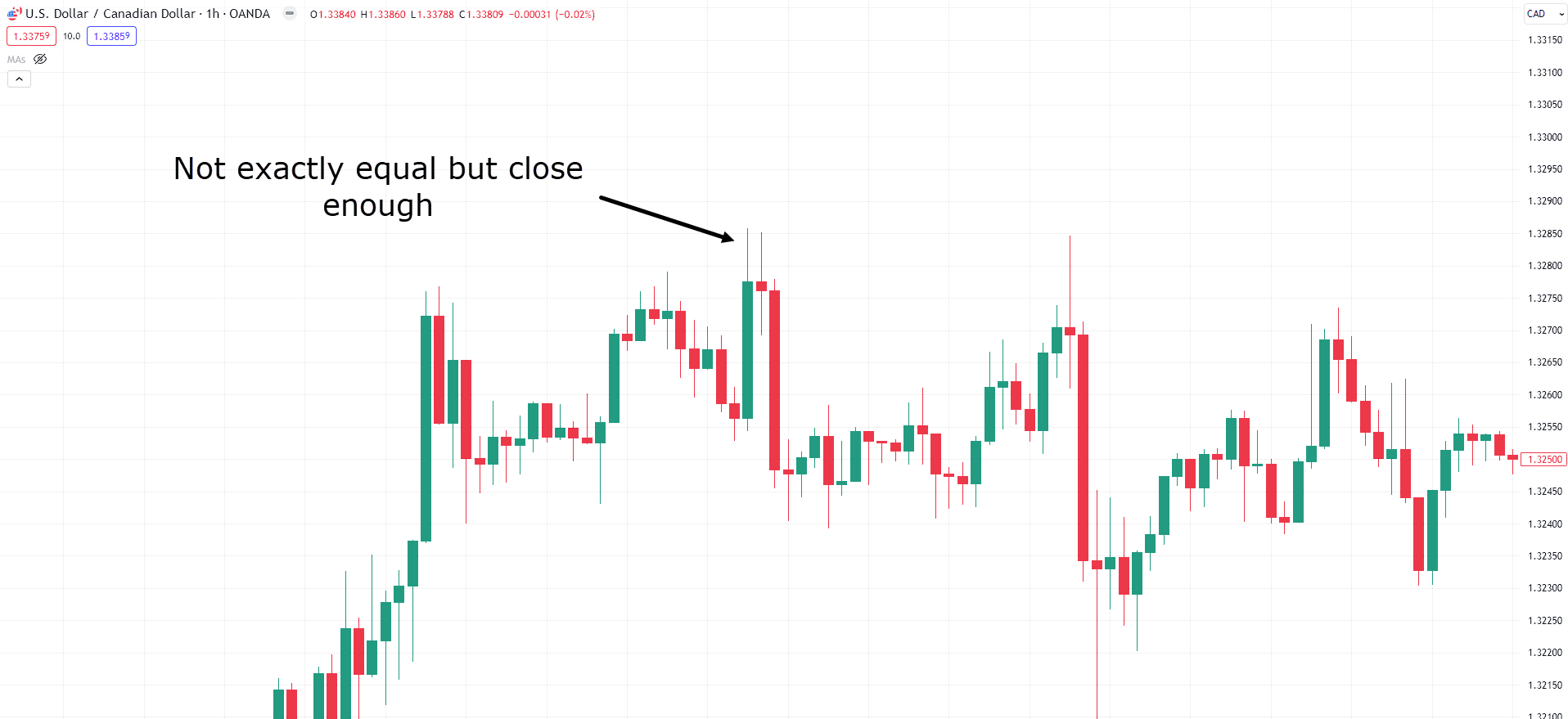

USD/CAD 1-Hour Chart:

While these highs aren’t precisely the same, they are very close.

In this example, I would still consider what you’re seeing as a Tweezer Top Pattern.

So why is the degree of perfection in these highs not so critical, anyway?

When you deconstruct a Tweezer Top Pattern, what are you truly observing?

If you think about it, you are basically seeing a short-term shift in momentum.

Price makes a new high… the bulls are in control and ready to push the next candle higher!

But the next attempt at making a higher high is met with selling pressure by bears!

Hence, in this sense, a Tweezer Top Pattern can identify shifts in momentum.

So let me ask you….

What do you think you would see if you looked at these exact same candles but on a lower timeframe?

Can you guess?…

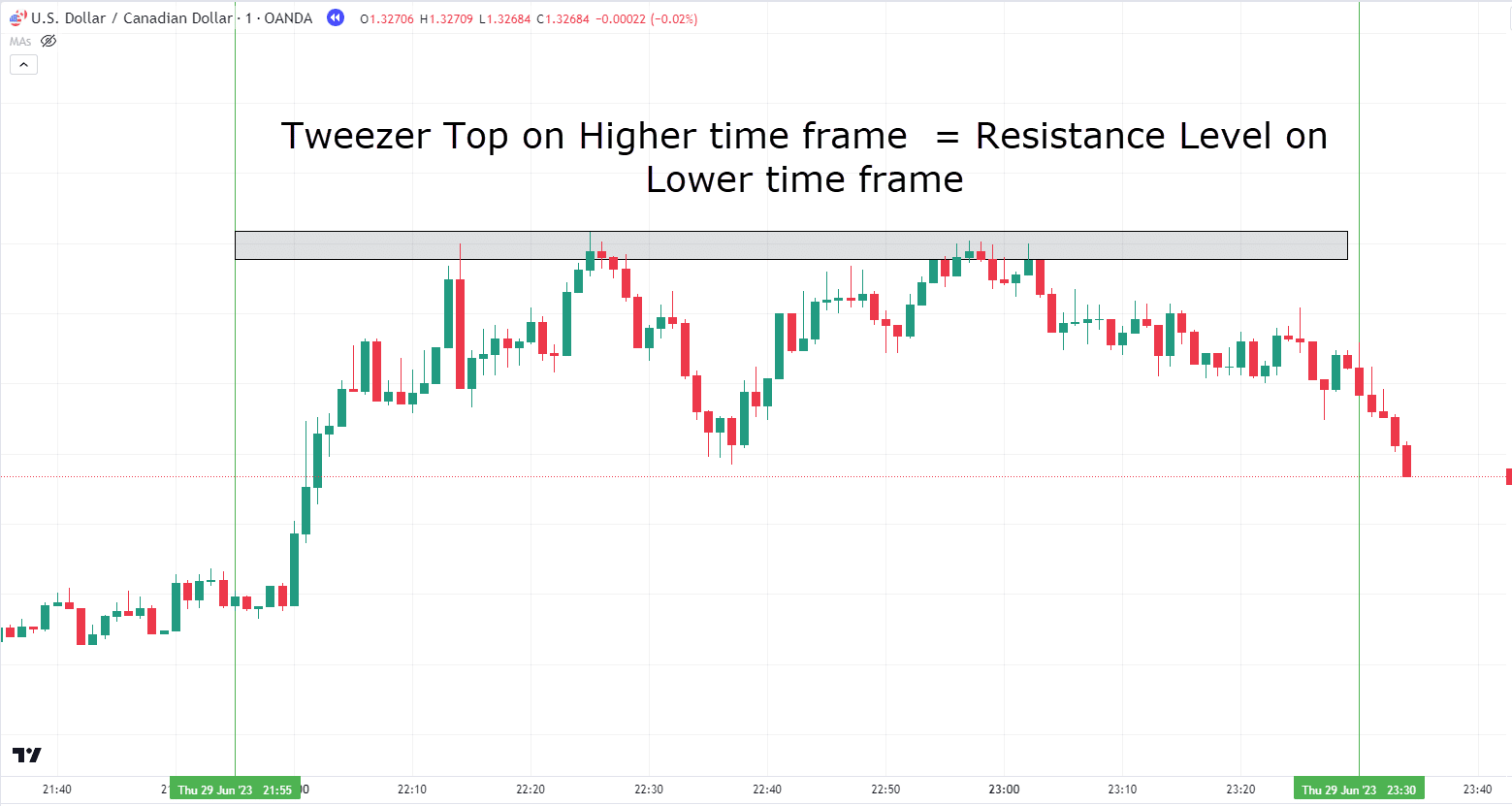

USD/CAD 1 Minute Chart:

See it?

A clear resistance level, right?

Price made repeated attempts to breach this level but failed after every attempt.

On the lower timeframe, this results in an easily recognizable resistance level…

…but on the higher timeframes – a Tweezer Top!

Now that you are familiar with the Tweezer Top Pattern, let’s get to the exciting part of how you can actually use it to generate profits!

Trading the Tweezer Top

There are two primary methods to trade the Tweezer Top Pattern.

One of these methods is when you are looking for a pullback trade in the larger trend.

The other is when you are looking for reversals from major key levels.

Let’s start with the pullback setup…

Tweezer Top Pullback Setup

You’ve probably seen that during a downtrend, price frequently experiences brief pullbacks – due to buyers entering the market at different levels.

These are actually opportunities that allow you to enter the market after the trend has either been confirmed or you missed your initial entry.

But how can you use the Tweezer Top Pattern to trade a pullback?

Well, first you must learn to identify an asset that is already in a downtrend.

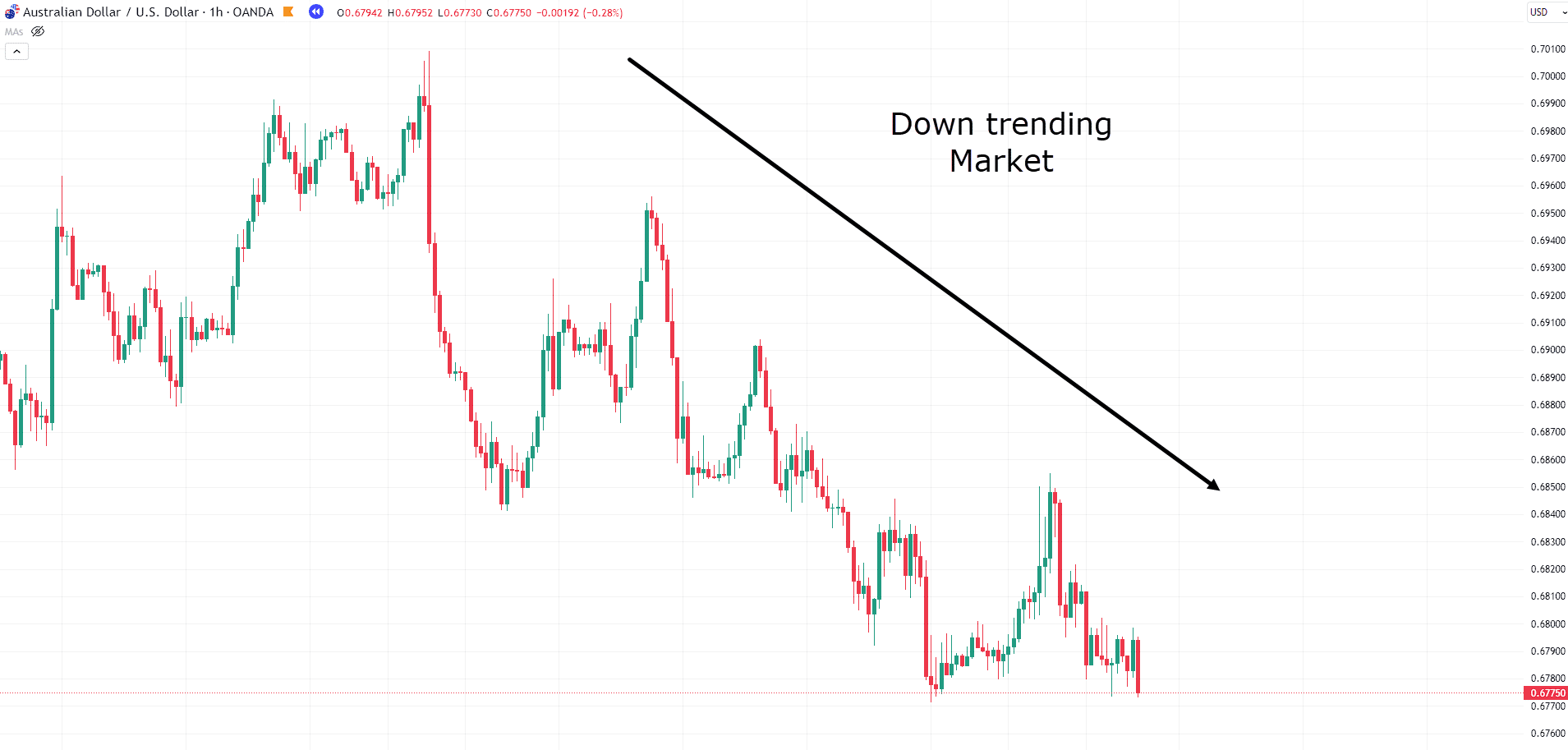

Take a look at this chart…

AUD/USD 1-Hour Chart:

See how the price is moving down but has brief pullbacks?

Well, these are great opportunities to enter the market.

And how do I know when the pullback is ready to continue in the direction of the major trend?

You guessed it… the Tweezer Top pattern!

So let’s wait for a Tweezer Top Pattern to form…

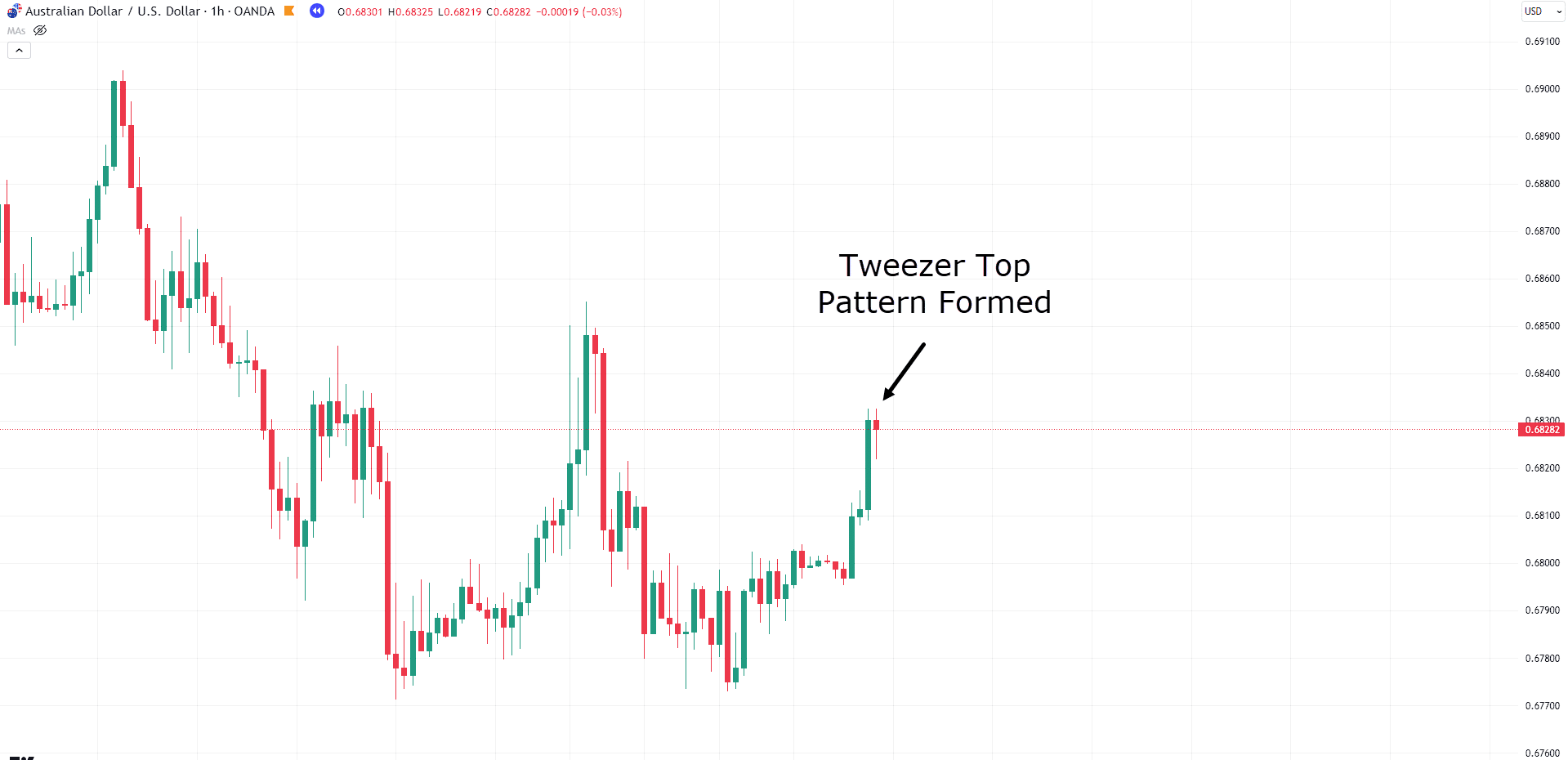

AUD/USD 1-Hour Chart:

As you can see here: overall trend down – CHECK!

Price has paused and is in a “Pullback” – CHECK!

The Tweezer Top Pattern has formed – CHECK!

I know what you are thinking!

“Rayner – Sell, you need to sell! Now!”

Hang on a minute! I know you are eager to profit from this but you are forgetting something!

Where are you going to set your stop loss and take profits?

As you know – I love to plan my trades carefully rather than take impulsive leaps of faith!

So let’s look at a logical way to set your stop losses and take profits…

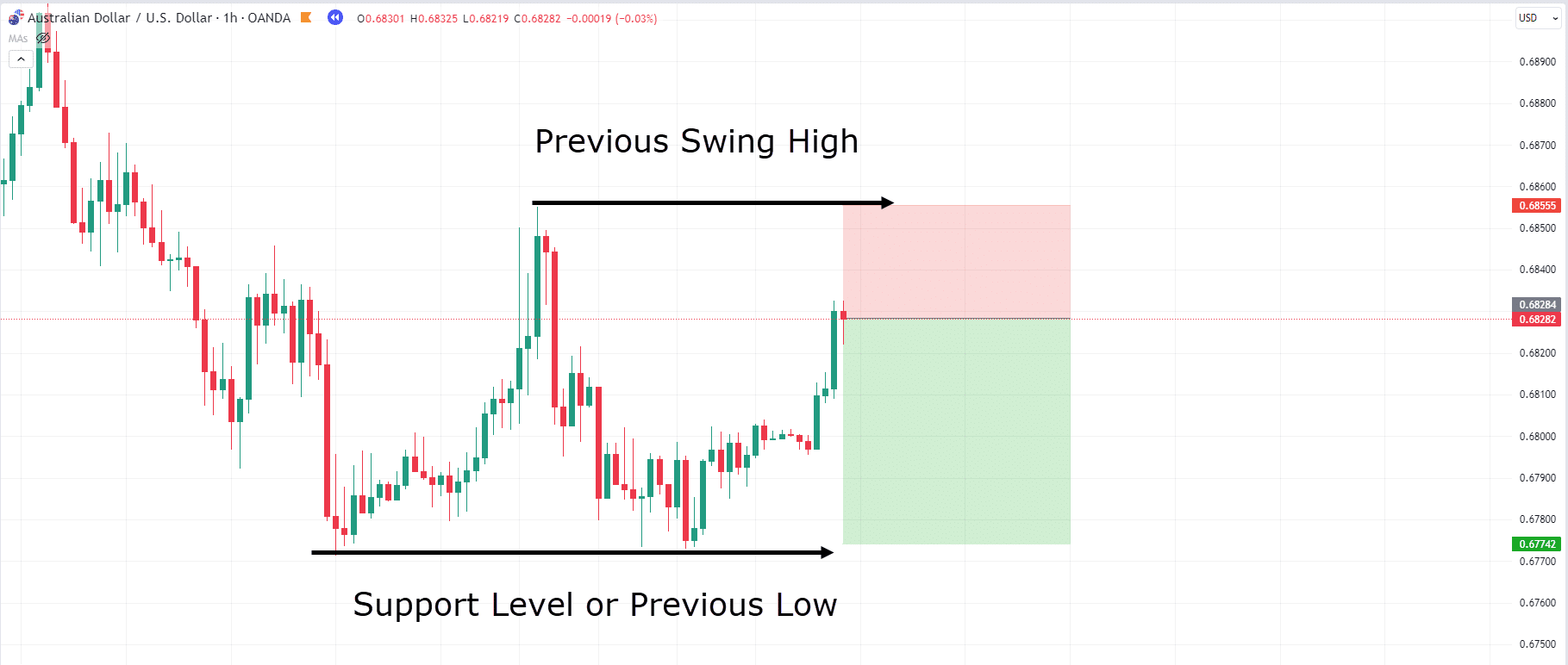

AUD/USD 1 Hour Chart Stop Loss Example #1:

Depending on how aggressive you want to be, a logical place for your stop loss would be above the previous high.

Why there?

Because if the price breaks above this high, your trade would be invalid.

Should the downtrend finish and the price begin a sequence of higher highs, you likely wouldn’t want to be holding a short position, would you?

And what about your take profit?

Depending on your individual trading strategy, a smart place to take either some or all of your profits is at the level price bounced previously.

This is because if the price does come back to this level, buyers may be attracted to buy into the market again and try to establish that level as support.

Make sense?

Good!

But what if you wanted to be extremely aggressive with your trades?…

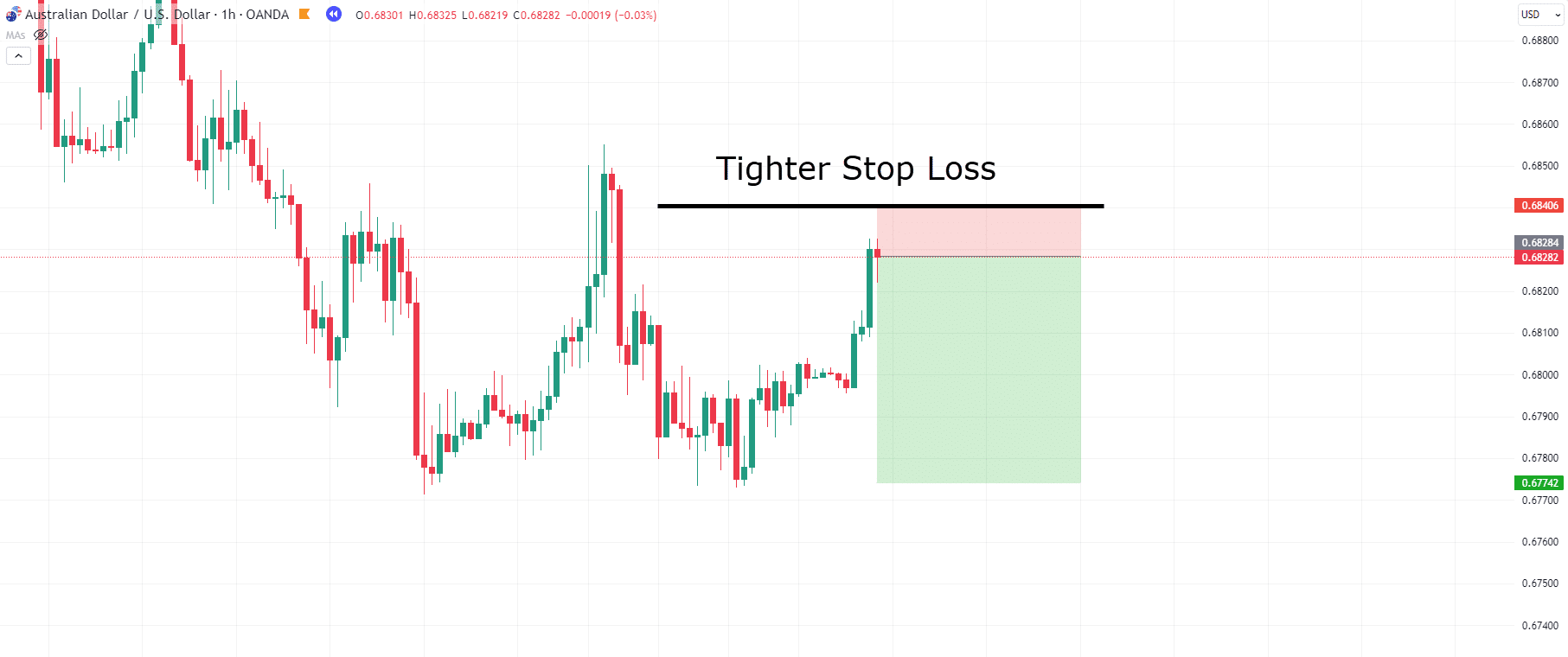

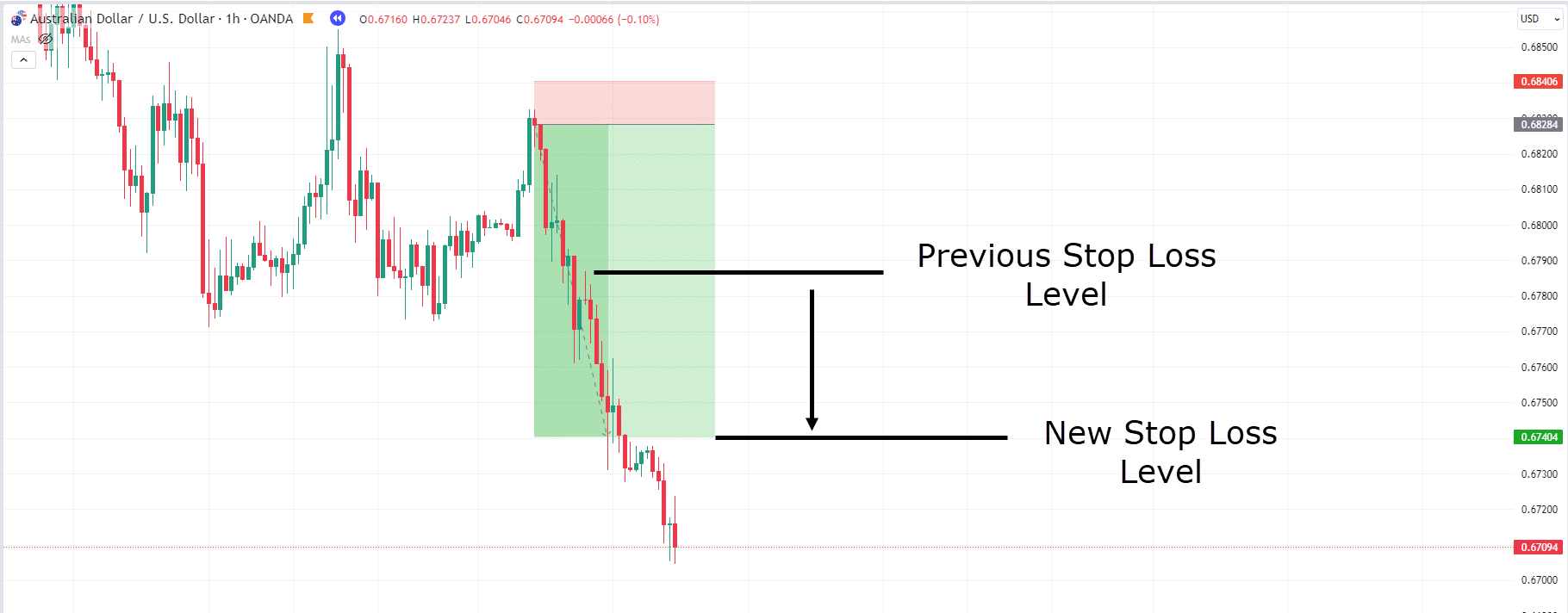

AUD/USD 1-Hour Chart Stop Loss Example #2:

Now the idea behind this stop loss is that you are relying on the tweezer top truly being the low timeframe resistance level, and a true reversal point.

The benefit of this approach is that, if you do time the Tweezer Top Pattern correctly, your Risk: Reward Ratio is significantly improved!

While this approach could potentially result in a greater number of overall losing trades…

…if you do emerge victorious, the gains could be that much more substantial!

So, how would these trades have played out?…

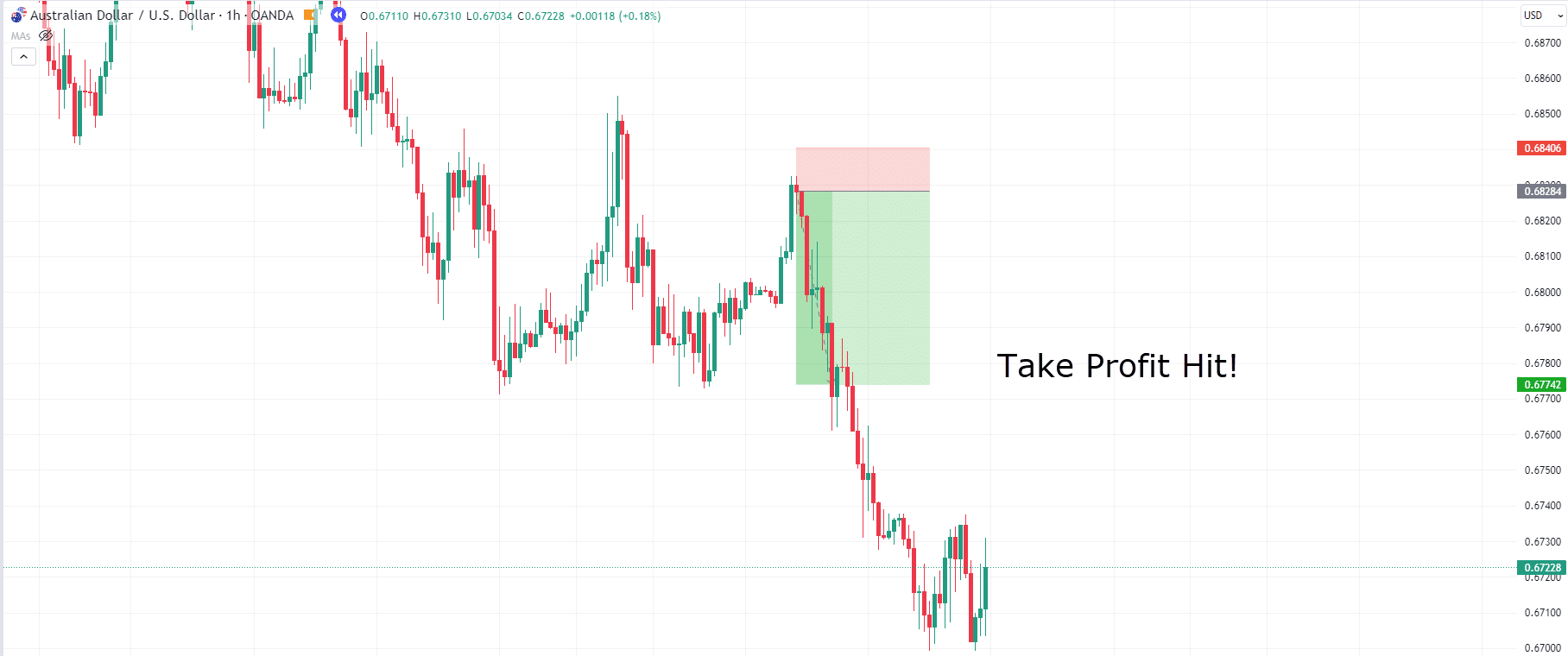

AUD/USD 1-Hour Chart Take Profit:

Wow! What a winner!

But… hang on a minute…

Look at what could’ve been!!

While securing profits and achieving a winning outcome is always a good thing…

…you and I both know this trade might evoke a hint of regret due to its continuation after the exit…

But don’t worry!

There is still a way to capture more profits!

It takes a little bit more experience and steady hands but – it can be well worth the effort.

In this case, trailing stops can be a great way to capture trends and squeeze every last bit of money out of a trade.

Let’s continue looking at this AUD/USD example…

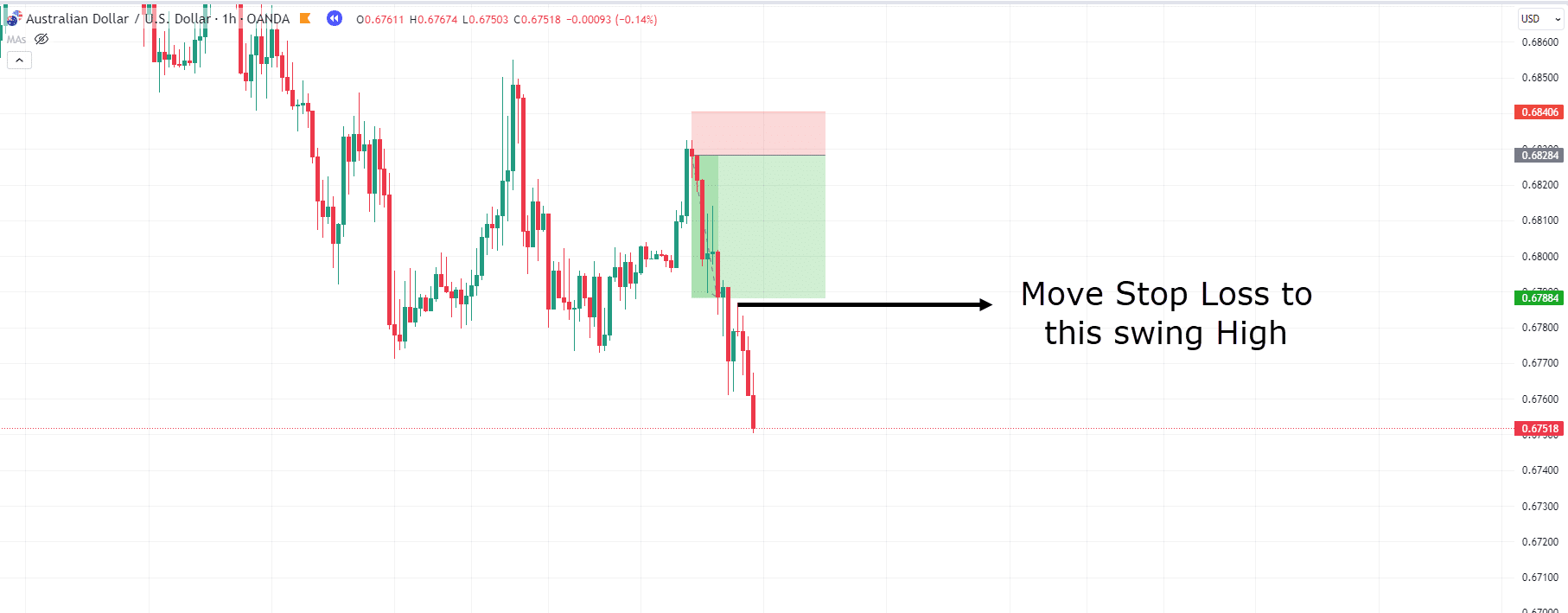

AUD/USD 1-Hour Chart Trailing Stop Loss:

As the price continues lower and smashes through the potential support area, you can assume that even lower prices are coming…

So the best way to take profits, while also allowing the market to move in your favour, is to follow the downtrend swings!

Although this level does not look like much of a swing high, you can see that price paused and tried to move higher from this point.

Accordingly, this is a logical level to temporarily move your stop loss to – taking any profits should the price return to this area.

Let’s continue with this trade…

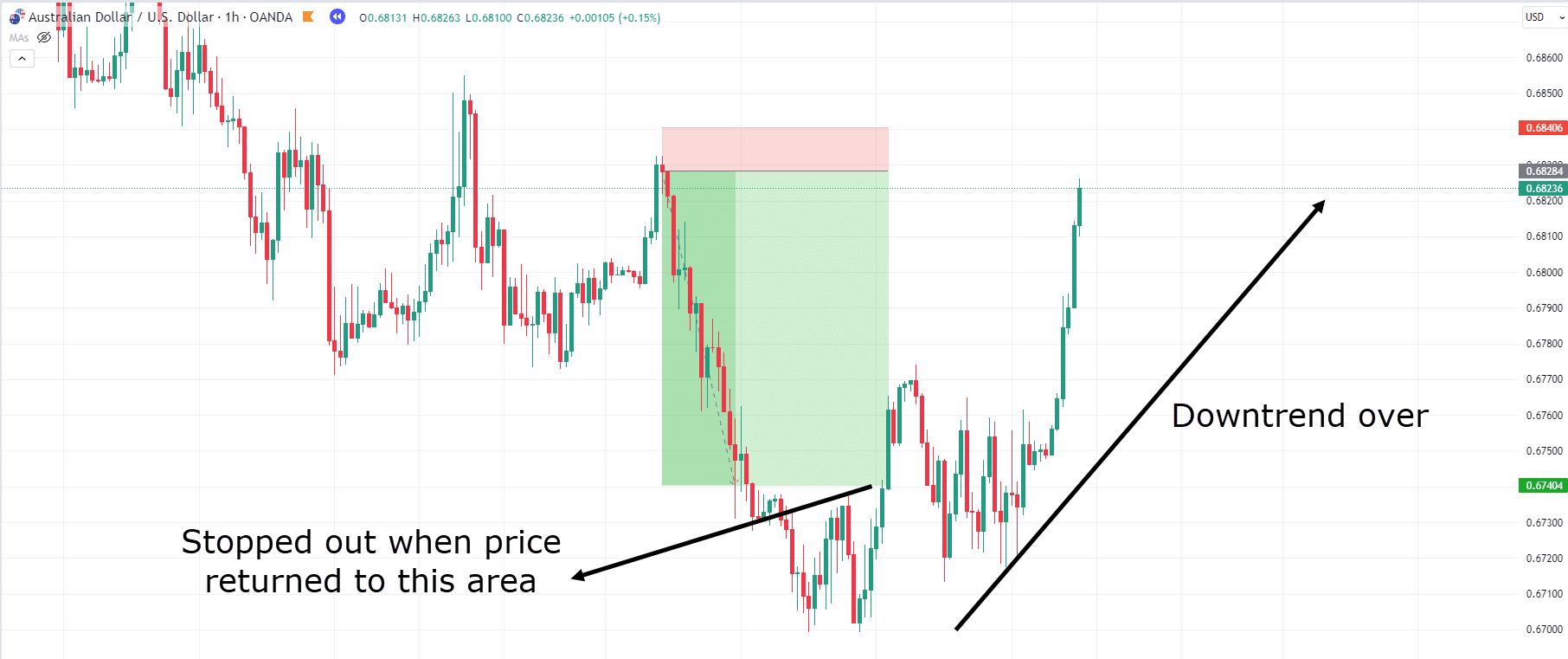

AUD/USD 1-Hour Chart Trailing Stop Loss #2:

Wow, this trade is really moving, hey!

Luckily, you didn’t just take profits because you were scared of losing a small portion of your winnings!

But, guess what! You are still in this trade!

How far can this go?!

Let’s find out…

AUD/USD 1-Hour Chart Taking Profits:

…and there it is!

Price tried one more time to go lower and failed to do so.

When the price came back up you would have been stopped out at a whopping 7RR for this trade!

Hopefully, you can clearly see why being stopped out with the trailing stop loss worked out well.

It captured the majority of what the trend had to offer before prices began forming higher highs and higher lows.

See how it can be beneficial to use all the tools you have learned over the years of trading to maximise profits with the Tweezer top pattern?

Let’s take a look at another example!…

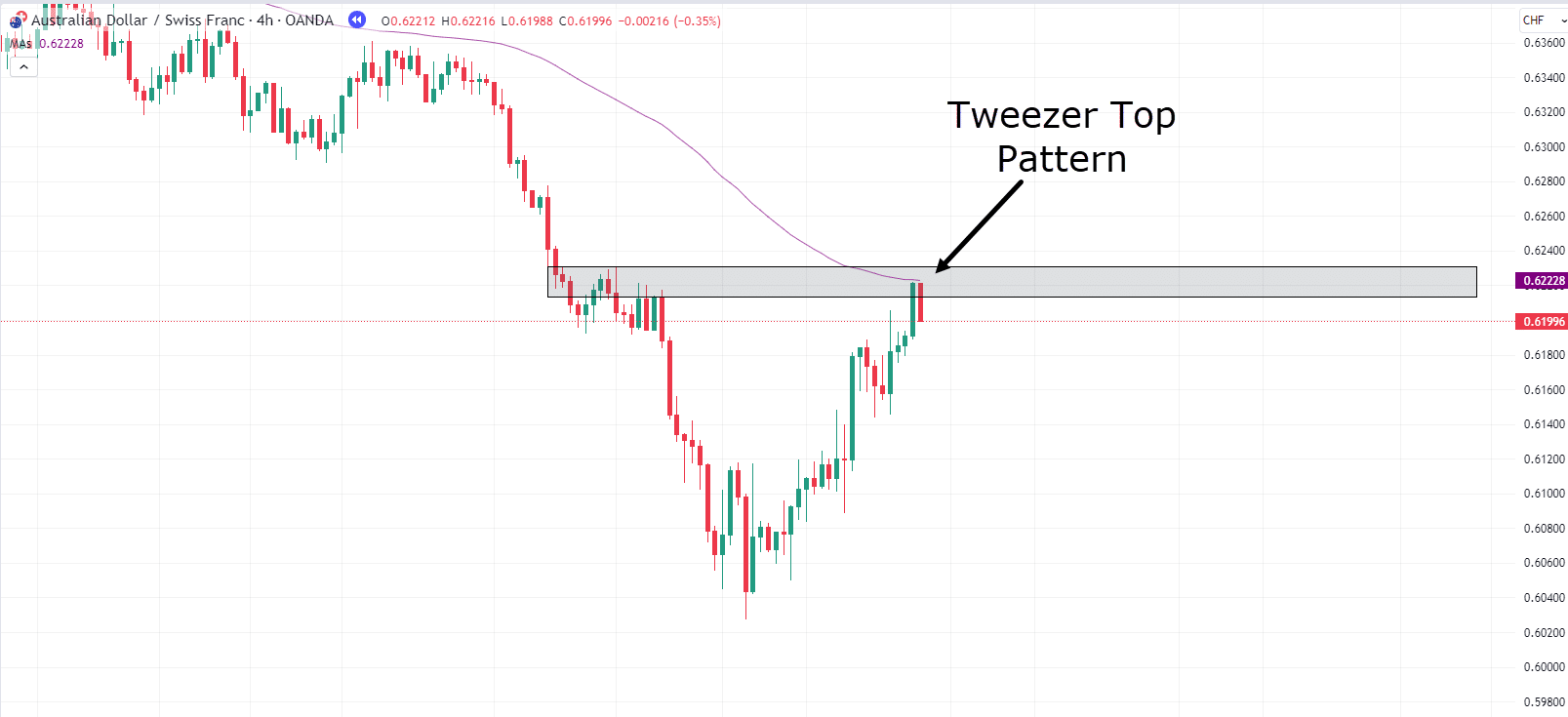

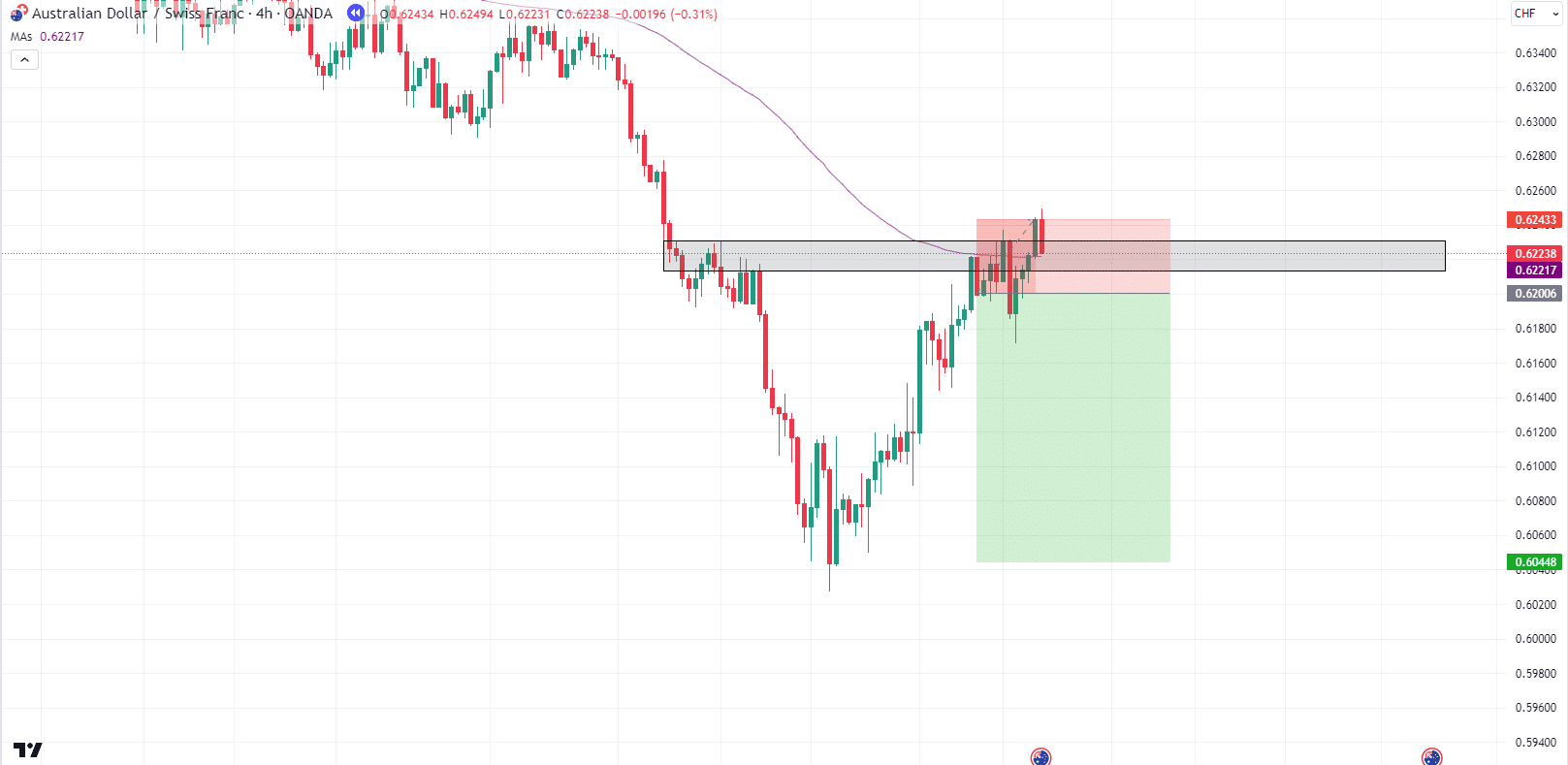

AUD/CHF 4-Hour Chart:

Now, the chart above clearly shows a downtrend.

You can observe a downward movement followed by a retracement that reaches the previous high…

What pattern has formed aligning with the Moving average and horizontal resistance level?

Correct! it’s the Tweezer Top Pattern!

Let’s take the trade!…

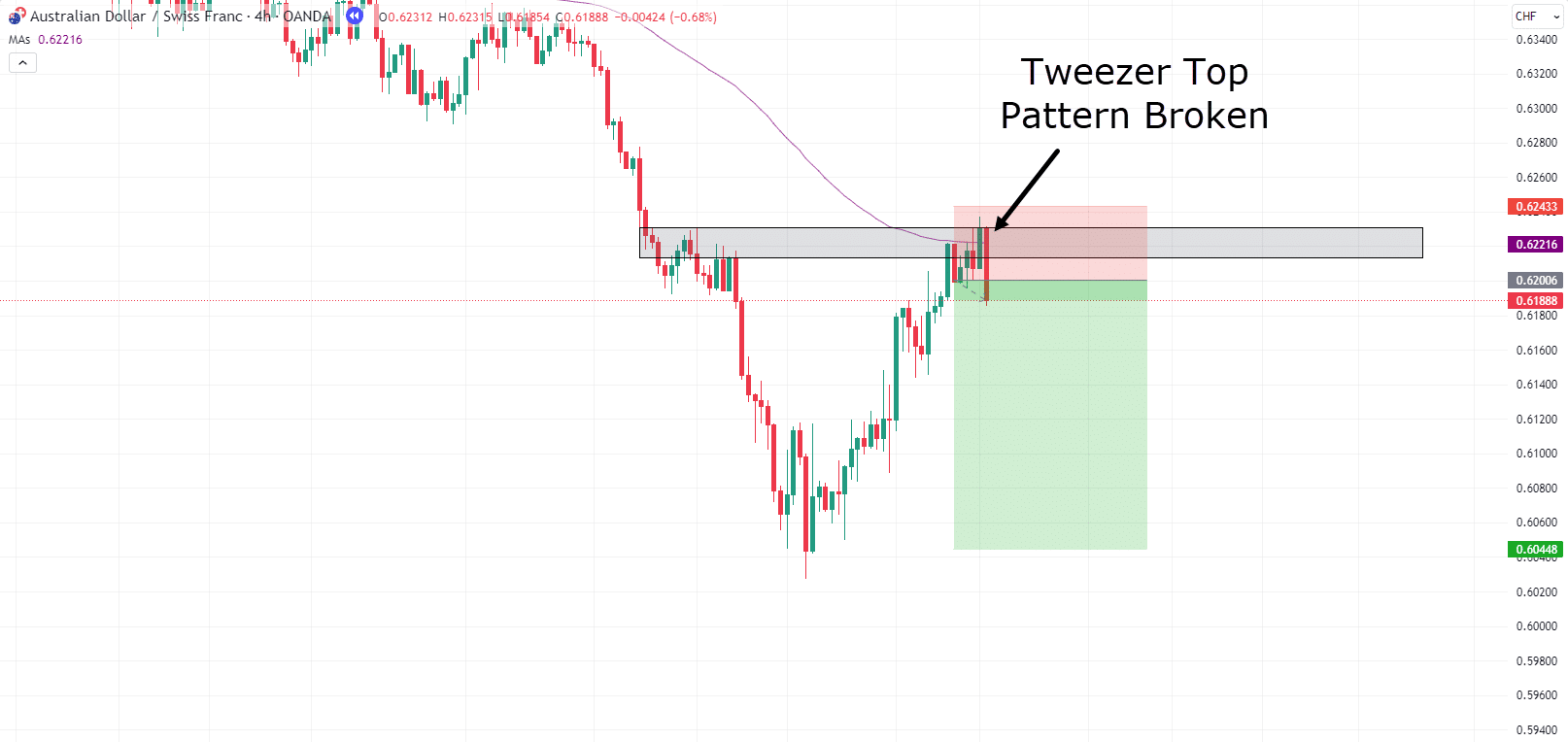

AUD/CHF 4-Hour Chart:

In this case, something interesting has happened!

Price has broken above the tweezer top pattern and seems to be closing above the MA100 as well.

This could indicate that this trade might not be ready for its next downward move.

However the price is still rejecting this zone so, let’s stick with it!…

AUD/CHF 4-Hour Chart:

Oh no!

It appears your intuition about the price not continuing downward was correct!

But… how could this happen?!

Well, like most systems out there – the Tweezer Top Pattern won’t always work perfectly.

It would be doing you a disservice if I made you believe that this trading method was foolproof!

The silver lining in this scenario is, though, that you sensed something was up as soon as the price broke above the tweezer top pattern, right?

It’s this awareness that would have allowed you to exit the trade early and only take a partial loss.

However, if you were confident in your position and committed to the Tweezer Top Pattern, accepting the full loss is also a valid course of action!

Just remember that even the most promising setup won’t work 100% of the time.

This doesn’t mean there is a flaw in the concept!

It just means that as traders, losing trades is part of the process.

As a trader, it is your responsibility to take the best setups you can – based on the information you have.

And I think it’s fair to say, with the information that was available… that trade was a good trade!

So, take a breath, learn from the experience, and get ready for the next opportunity!

Not to mention… Congratulations!

You’re now equipped with the knowledge to capture substantial winning trades…

…and also with how to manage your emotions when things don’t always go to plan!

Now, let me ask you something…

What would all this look like at the start of a trend?!

Read on to find out how Tweezer Top Reversal Patterns can capture even more profits!

Tweezer Top Reversal Pattern

Why does the Tweezer Top Reversal pattern make me just a tad more excited?

Consider this…

Unlike in the previous scenario, you’re not entering the trade midway through the trend…

Instead, you’re stepping in – right from the outset!

Now, you might be thinking, “So what, Rayner?”, “Is it actually different?”

Here’s the brilliance…

By entering at the trend’s peak, you’re positioning yourself for colossal potential gains if you manage to ride that trend to its fullest extent.

And why is this significant?

Because these opportunities come with minimal risk and the promise of MAXIMUM reward!

Brace yourself, as this section demands a significant degree of discipline to execute effectively…

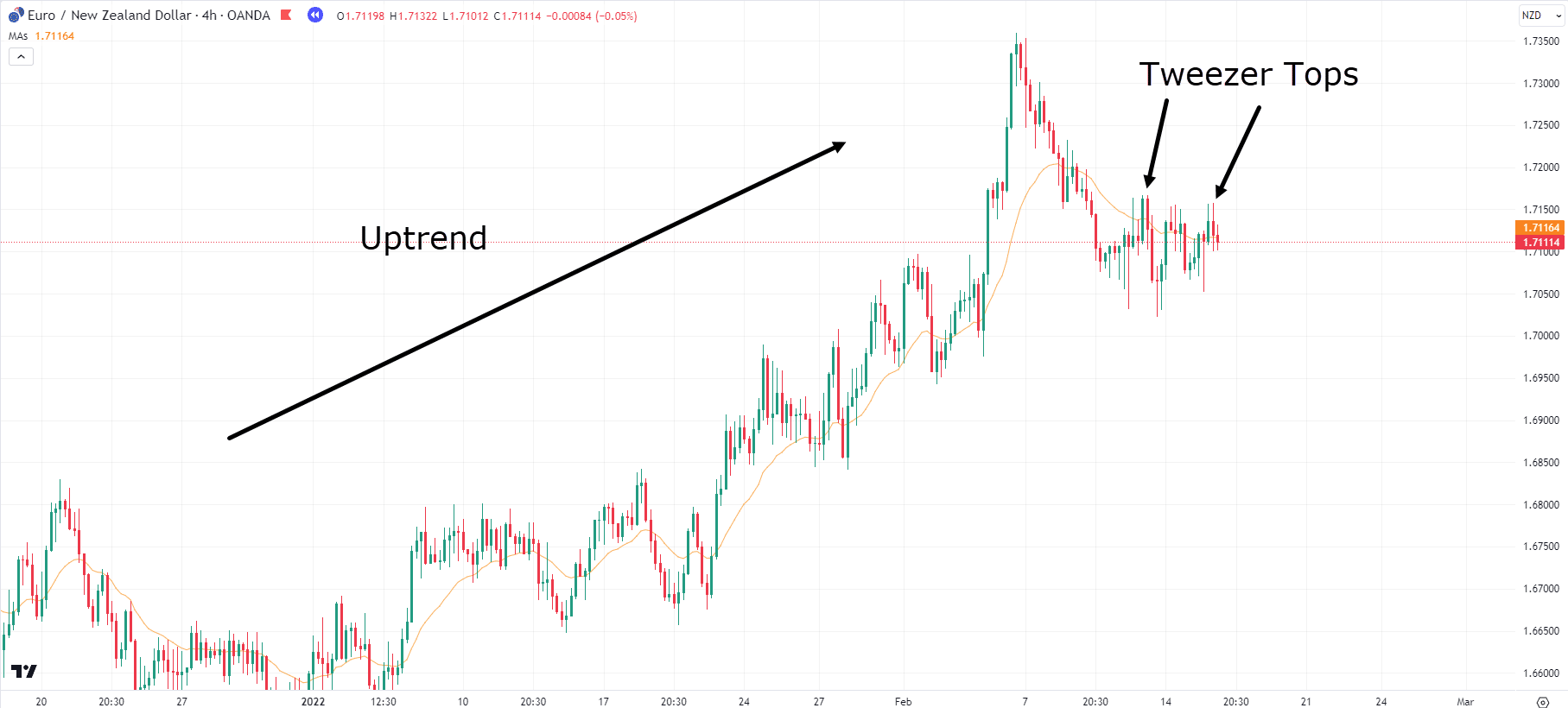

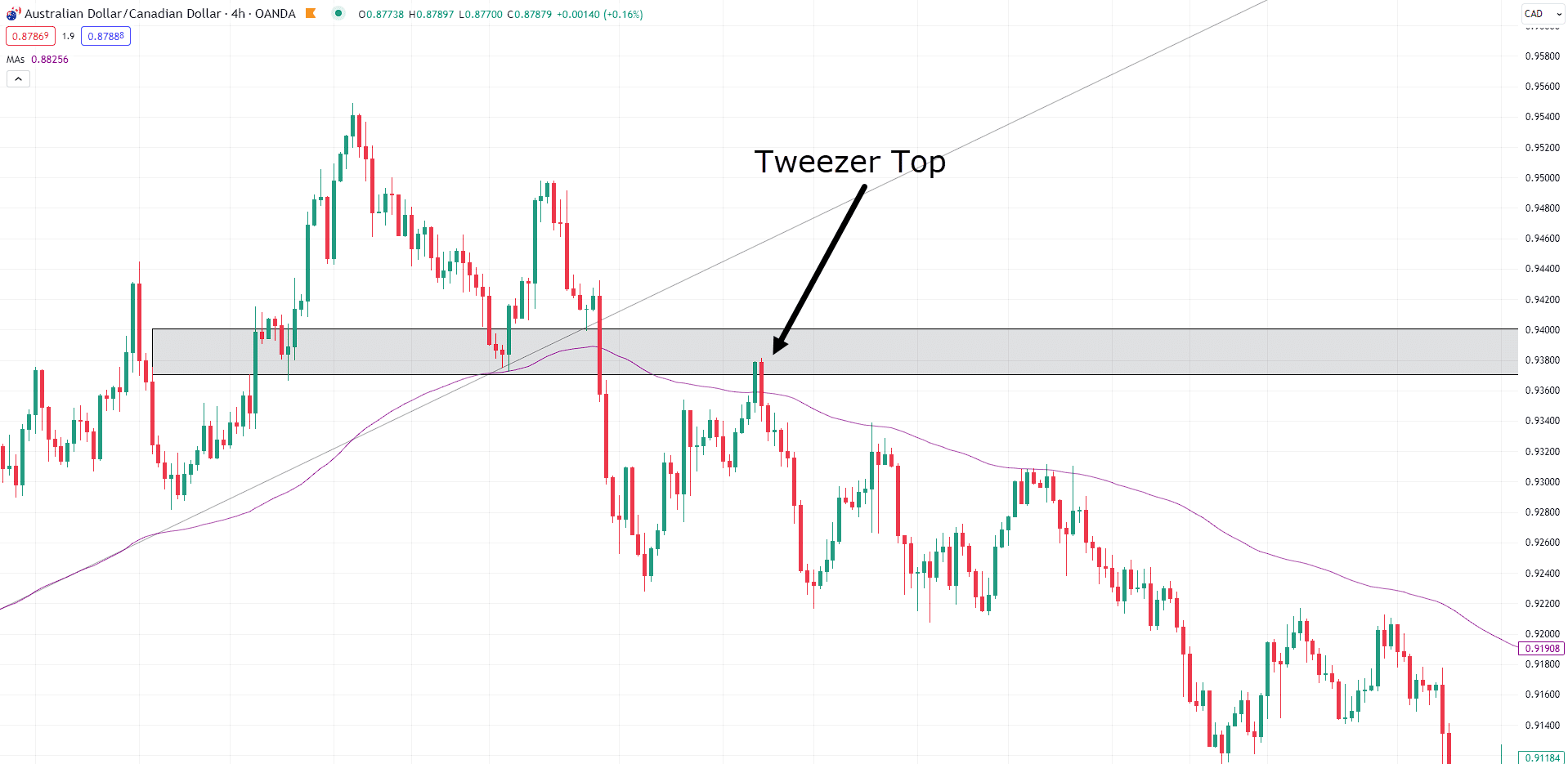

EUR/NZD 4-Hour Chart:

Looking at the chart, what do you see?

There is a clear uptrend that has one final large push before beginning to retrace a considerable distance, right?

The MA20 has started to shift from moving upwards to moving more sideways or even a little bit downward….

…there have also been multiple attempts to form higher highs that are met with failure….

Following that, you can see two Tweezer Top Patterns form.

As mentioned, this would indicate that there is a “possibility” that trends may be shifting.

Of course, you can’t be sure this is the reversal point…

But multiple indicators are suggesting a shift in momentum!

So let’s take a trade…

EUR/NZD 4-Hour Chart Entry:

The Stop Loss is safely above the tweezer top pattern, allowing for plenty of room for the price to wick up and come back below…

In fact, if you wanted to be more aggressive, you could place your Stop Loss even closer to the Tweezer Top Pattern.

Ultimate, it all comes down to playing around with what you feel comfortable with and what works best for your strategy.

Can you guess the result?…

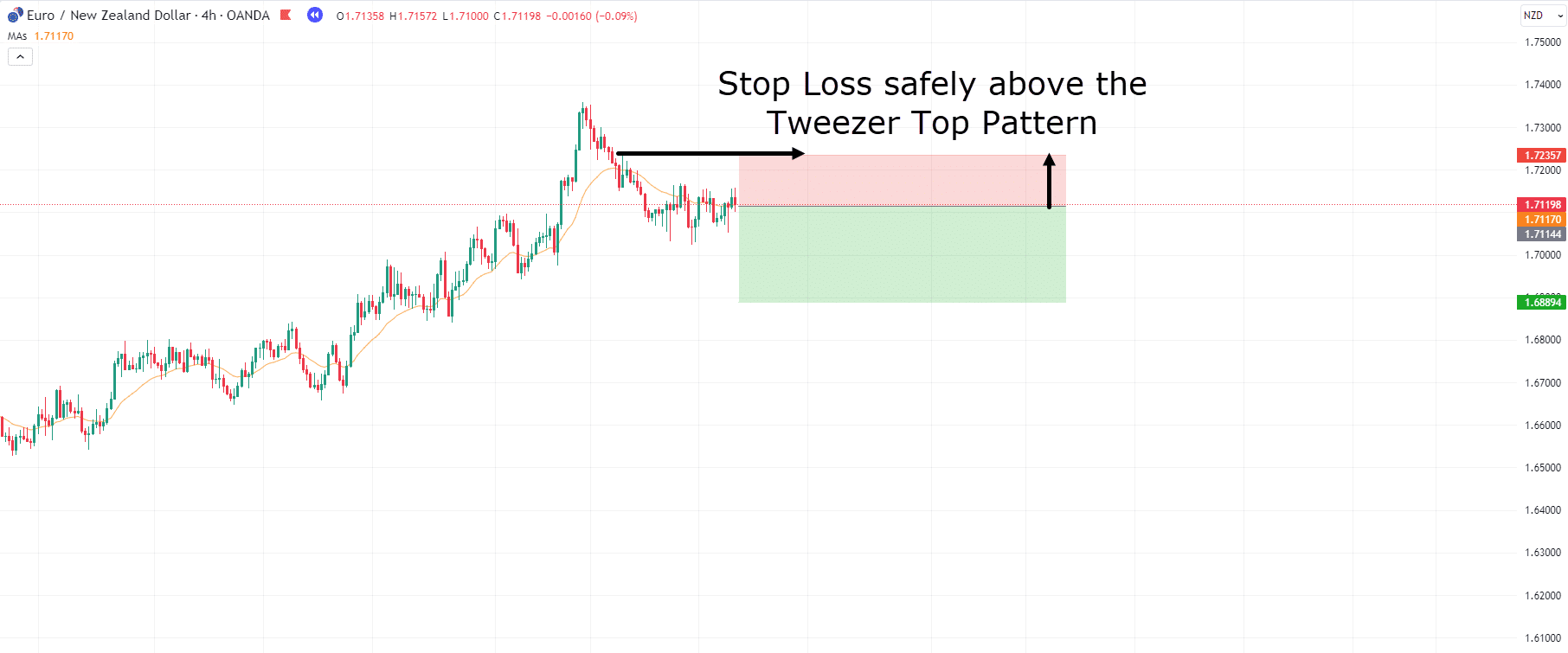

EUR/NZD 4-Hour Chart Exit:

Wow! Nice win!

There are a few different exit strategies in this situation.

Let’s quickly go through them…

Firstly, you could close the trade when a candle closes above the MA20.

This is a great way at capturing profits while reacting to the momentum of the market.

However, you will find, unless the situation is similar to this example where selling pressure is very strong, you might be stopped out more frequently instead of capturing the entire trend.

Option two is… waiting for a higher high to form.

As you can see on the chart, a possible take profit could occur when the price began breaking the highs of the previous highs…

The reason this is a good place to take profits is because it is identifying that momentum is shifting – from a downtrend ( Lower highs and Lower Lows ) to an uptrend (Higher highs and higher lows).

At that point, you should be removing your position and waiting for new opportunities.

The downside to this approach is you have to allow for price to eat into your profits slightly before confirming the trend is over and it’s time to exit.

Now the final option is simply to take profits along the way, pre-defining areas that make sense to you and committing to removing some of your position at those prices.

What prices, you say?

These could be key levels from previous support and resistances, daily targets, or they could even be set Risk Reward levels of 2RR, 4RR and so on.

But… this next bit is important…

I don’t want you to walk away from this article assuming you’ll catch the whole trend every time.

You need to keep your wits about you when using patterns.

Sometimes, if the market is screaming at you that it is time to exit the trade… it’s best to exit the trade!

However, if you are in profit and win your trade – pat yourself on the back, walk away and be happy with the paycheck!

At the end of the day, it’s simply not worth the stress and pain of not exiting at the right time and watching a massive winning position turn to dust!

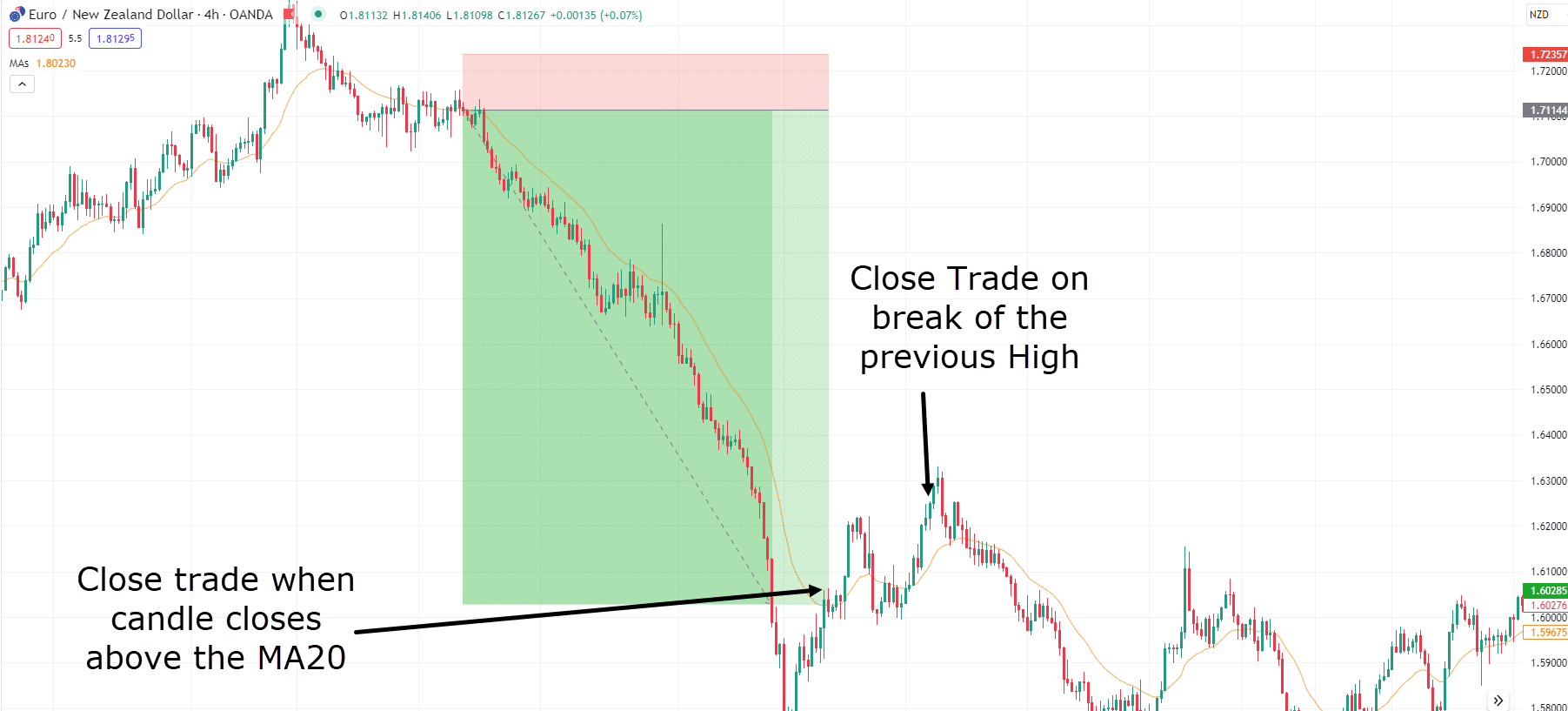

High-quality setups for trading Tweezer Tops

Look at this chart…

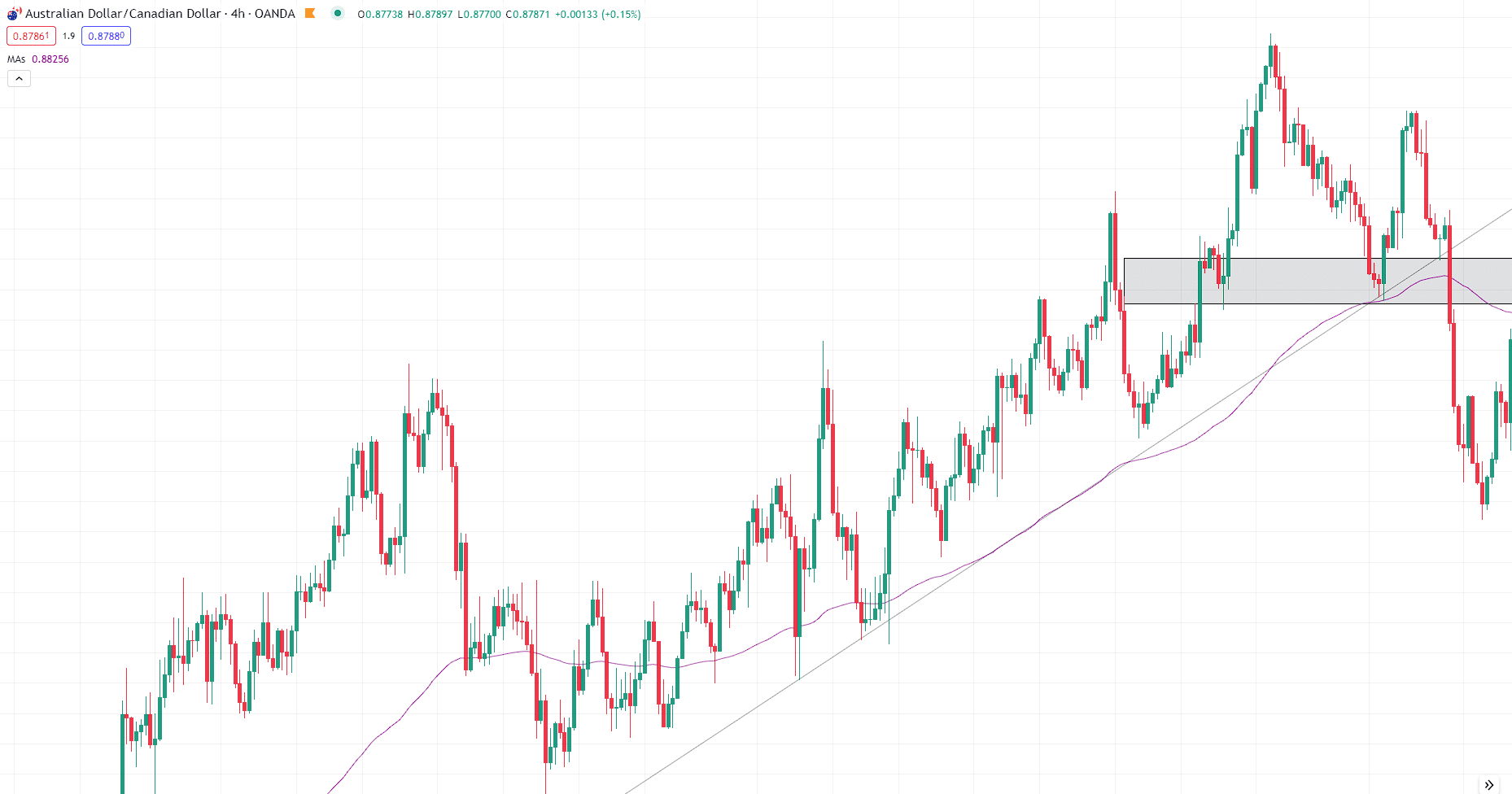

AUD/CAD 4-Hour Chart:

What do you see?

Price respects the trendline for 2 months before a strong bearish candle cuts through the trendline.

This is the first indication that the trend may be shifting.

At the same time as the trend breaks, the 100 Moving Average is also broken.

Moving averages can be used as support and resistance levels, and thus, the breach of this level further bolsters the idea that momentum is shifting…

Remember when support is lost, it becomes resistance…

Let’s take a closer look at what happened next…

AUD/CAD 4-Hour Chart:

Can you guess what pattern formed at the resistance level?

Yep, you guessed it…

Tweezer Top!

So for this high-quality setup, what arguments for a short sell are there?

Trendline break – CHECK!

100MA Break – CHECK!

Support And Resistance Flip – CHECK!

Tweezer Top Pattern – CHECK!

If you asked me, it’s hard to come by a more convincing set of indicators for initiating a trade in this context!

This is what I would call a high-quality setup.

Mistakes to avoid when trading Tweezer Top

By now you probably realize that not all indicators, candlestick patterns, or strategies are foolproof.

Let’s look at some mistakes you should avoid when using the Tweezer top pattern.

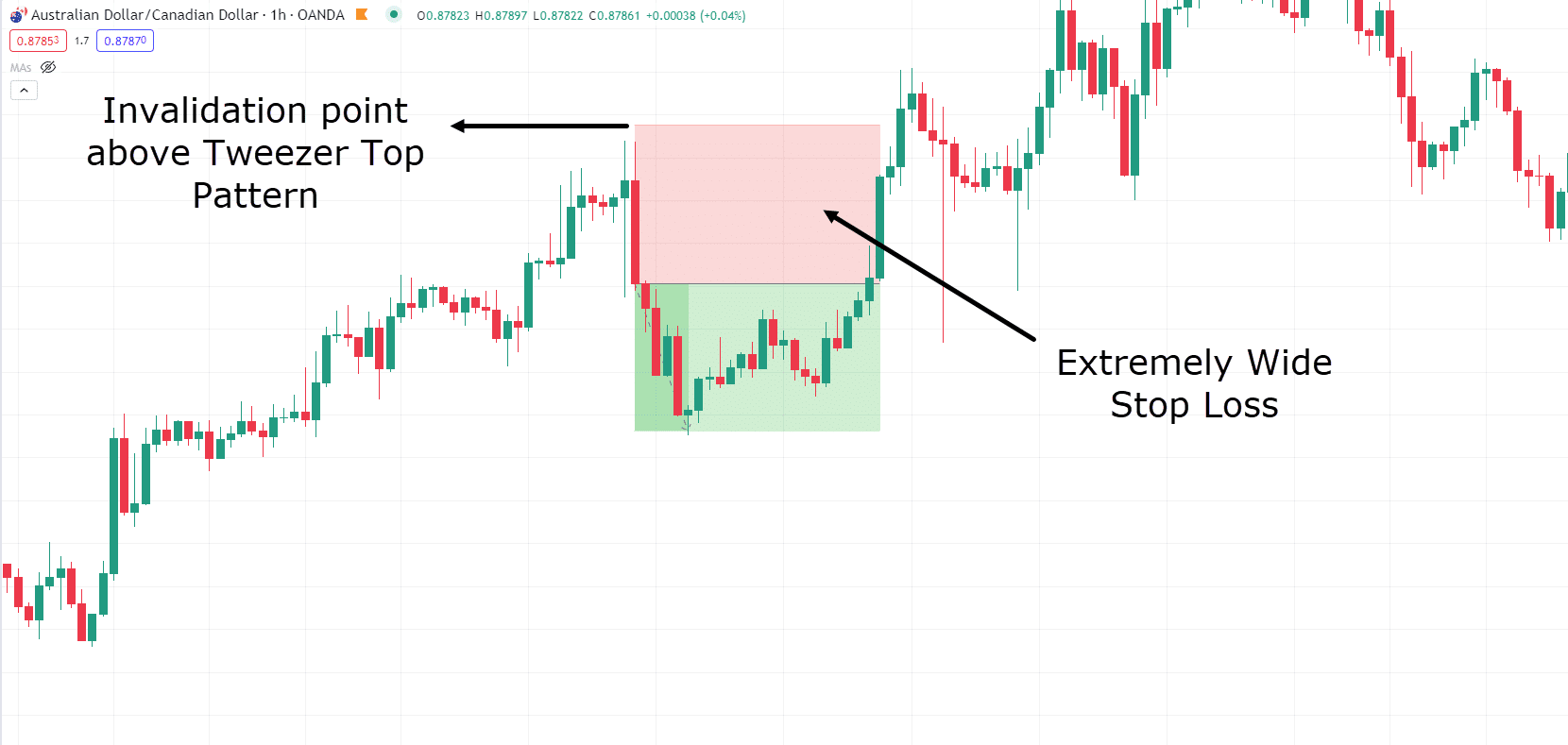

Entering too far from price movement

This may be up to your discretion as a trader, but try avoiding setups that require you to enter a long way away from your invalidation point.

So what do I mean by this?

Well, let’s look at the below example…

AUD/CAD 1-Hour Chart:

The tweezer top pattern formed with a large bearish candle that closed well down close to the low of the previous candle.

This does show great rejection…

However, if you are trying to take a profitable trade from it, the large distance between the entry and stop loss makes it difficult to have a favorable Risk to reward setup.

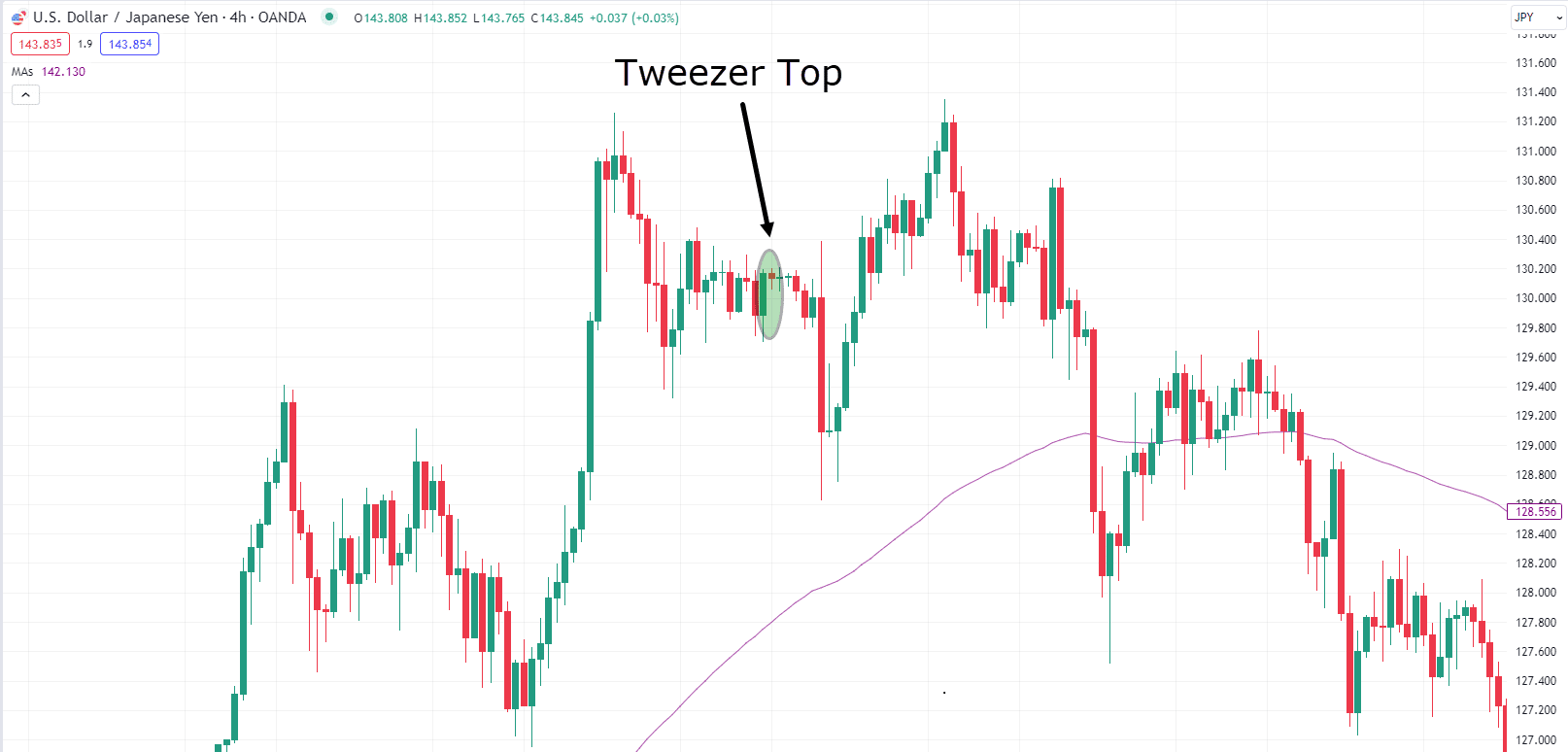

Random Tweezer Top Patterns

Now how about this chart…

What’s wrong with considering this tweezer top pattern?

There is a strong uptrend so it’s fine to be looking for Tweezer Top patterns, right?

However, when considering this setup, there are many other factors going against the trade….

The MA100 remains unbroken, and thus far, neither lower lows nor lower highs have manifested.

At this point, there is no shift in market structure and momentum.

So the crucial takeaway here is that not every Tweezer Top pattern warrants consideration as a trade.

You should use the pattern in the context of the whole market, among different levels and indicators that are added to your argument of why a trade makes sense.

Patterns aren’t perfect

Plainly speaking, due to the high frequency of Tweezer Top patterns in the market, there is a high chance that not all of them are selling signals.

The tweezer top pattern is an extremely helpful tool that gives an early warning signal that market momentum MIGHT be shifting.

This does NOT mean it’s guaranteed to every time.

Sometimes due to news or just the unpredictability of the market, tweezer top patterns can form without it signifying anything more than market indecision.

Head reeling from all that?

Let me wrap it up for you!

Conclusion

Tweezer Top Patterns are an extremely useful tool when used correctly.

They allow you to better time your entries, giving you added confluence and confidence to initiate the sell trade.

Tweezer Tops can be used in trending markets while also used as a reversal pattern to capture much larger trend setups.

When added with indicators such as moving averages, key levels and trendlines, arguments for high-quality setups can bolster your winning percentage.

Put together, Tweezer Top Patterns provide you with the opportunity to enter trades at points of potential Low risk, high-reward scenarios!

However, it’s important to remember that, like any pattern, effectiveness is influenced by the overall market context, and you should be aware of its limitations.

So, do you use the Tweezer Top Pattern?

Or are you excited to try this new tool out?

Let me know in the comments below!