Free Once In a Lifetime TrainingDo You Want To Learn The Secrets of Gold Trading?

Our Gold Master Trader Will Reveal His Brand New Pattern, “The Golden Glitch”

What are realistic and acceptable Forex income goals?

Forex trading is a great way to generate additional income. However, even the best forex trading strategies will not make you a millionaire overnight. Developing a successful Forex trading strategy will require you to know the Forex market and set reasonable revenue expectations.

How to set realistic trading revenue goals is a tough question to answer because there are so many factors. Each trader is different, and the reality is that most traders lose some money because trading is tough, and it takes real effort and discipline to be successful.

Make sure to also check out our Forex Trading Beginner’s Guide.

In fact, some say trading discipline is the most important skill any forex trader can have. It is impossible to find out what the best independent traders make. Trading salaries and forex trading income are often not disclosed to the public.

Only a few people share that information. Those who do, may or may not be telling the truth.

Check out our guide on Forex trading for beginners as well!

We will start by looking at some independent forex trader salary public data available on the internet.

Salary.Com says: How much does a Foreign Exchange Trader III make? The median annual Foreign Exchange Trader III salary is $192,682, as of Jan 13, 2023. The range is usually between $142,667-$213,698. However, this can vary widely depending on a variety of factors.

This is what a professional Forex trader income makes, not the retail traders who work from home.

A foreign exchange trader job is hard to find. To become a forex trader, you will need knowledge of the industry and basic trading principles.

You may also be required to obtain certain forex trading certifications, depending on where and how you trade. You can do it if you work at it, however, I think it is better if we work on trading for ourselves. Here is everything you need to know about brokers.

How much can you make Trading the Forex Market?

Theoretically, there is no limit on how much a forex trader can make. In fact, due to leverage, forex traders can open incredibly large positions. The forex market accounts for roughly 6 trillion USD in daily trading activity. Inevitably, some forex traders end up making lots of money while others end up losing some money.

Make sure to check out our guide to Forex trading for beginners as well!

As a forex trader, you can theoretically make millions of dollars. Anything is possible, which is why so many people try to learn how to trade. However, success doesn’t just happen–you’ll need to develop a successful Forex trading strategy and be patient.

WAIT! Forex Income Is Challenging!

Before you start throwing loads of cash into a trading account, I need to tell you that only a few people get rich trading retail Forex. It is difficult to make money as a forex trader, and you must be a master of trading and discipline to achieve large-scale revenue goals.

We could describe the scenarios all day long. This is the reason a lot of people get into Forex trading in the first place. They see the possibilities of millions of dollars. The next thing you know, they will have lost several thousand dollars trading. This is because they trade without knowing what they are doing, and they lack discipline.

Realistic Trading Income Calculations:

So let’s calculate realistic numbers regarding profit potential. The first thing you have to realize is that the use of leverage in trading is an excellent way to maximize gains. And risk can be managed fairly well if you have the discipline. That is the problem though, most people do not have the discipline.

Traders often make irrational decisions caused by either fear or greed. But for the sake of this article, I am going to assume you have the trading discipline and the ability to follow a forex trading income; risk management plan.The great thing is you do not have to risk much to make a substantial profit.

Let me give you an example: You have an account of $10k, and you want to earn 2.5% per month, with a goal of 30% account growth per year. Now, you decide that you are only going to risk 1% of that account per trade.

A 1% risk of $10k is $100 USD, and therefore you are only risking 1% at any given time, and you could potentially earn 30% growth by never risking more than $100 at one time. There are more numbers that must be calculated, such as your win rate, your risk-to-reward ratio, etc.

So the scenarios could go on and on forever. You could, in fact, raise your risk to 2.5% or $250, hit your goal with a single trade, and meet your monthly goal by using a risk/reward ratio of 1:1.

Forex Income Compared to Real Estate Income

Compare that with real estate where someone might have to risk a great deal more to achieve the 2.5% gain. For example, you could spend $100k or more purchasing a house, and in trading, you can earn 2.5% with a much smaller investment by opening an account for as little as $1000. You can also read the information on gold investments.

You could potentially make 2.5% on one trade versus a lot more upfront money and time involved in real estate investment. That’s the only trade you would have to make that month in order to gain what you would be averaging what you could be earning in the real estate sector.

The conclusion is simple: Forex has such incredible potential, that it can easily surpass Real Estate even with minimal risk measures in place. I cannot think of many investments that yield anywhere near 100% ROI a year.

Let’s take a look and see how hard it would be to make this with minimal to moderate risk management. It comes out to 6% a month compounding.

Now that, my friend, is more than doable in this market. If you are confident in your profitability as a trader, and willing to risk, say 3% of your account on each trade, then with an RR of 1:2 you could easily achieve this percentage with one trade in a month. Forex is an excellent investment IF you take it slow and focus on the long term. Also, read a million USD Forex strategy.

What is the average forex trader’s salary?

I would like to compare Forex vs average and above average careers. Now, looking at the average income per capita (person) in the U.S., the average income per person in 2021 was $49,764 via The Balance Careers.

How to Increase Your Forex Income.

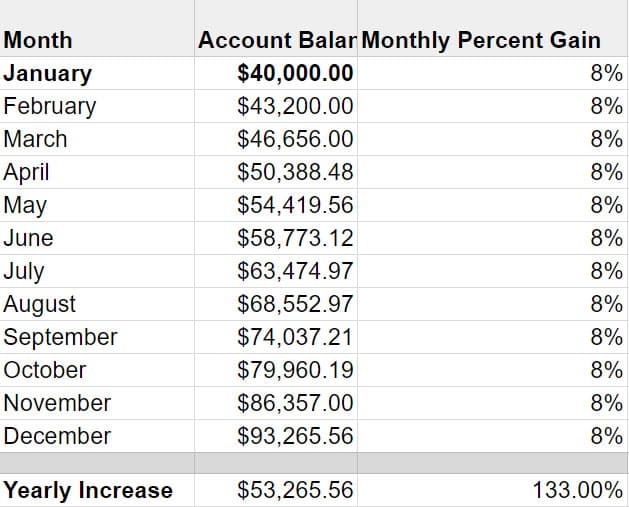

Let us imagine that you would like to make at least $50,000 a year trading. After all, you’re doing this for the money, so you want to make as much as possible. Once again using minimal-moderate risk, we said you could accumulate 8% a month. Assuming that you increase your lot sizes with your account each month, instead of weekly or daily for risk management purposes.

You would need to have a $40,000 account to make $53,265.56 a year, at 8% a month.

Now let’s say you minimize your expenses and work a job, so you were able to build your trading account.

How long would it take you to make $1 million off of a $10,000 account, at 10% ROI a month?

In 4 years you would have $970,000. Divide that by 4, and you get $242,500. Which means that you made $242,500 annually.

That is if you did not pull any money out, but instead let your account build at 10% ROI each month.

What if you wanted to wait until five years and then start pulling out all of your profits? In 5 years, you would have $3,044,816. Now you can feel free to pull out all of the profits each month. That would mean you would make $304,481 a month!

Just imagine that. If you build up your $10k account for five years, you could eventually be making $3,653,779 a year.

So, we see that it is much better to build up your account until you feel you NEED to take the money out. I mean, can you imagine making that kind of an income five years from now every month?

I am not even talking about something that is unachievable. 10% a month is possible in Forex by finding a great trading system, having the proper trading discipline, and finding a trading mentor.

It’s important to keep yourself in check, perfecting your craft each and every day by educating yourself.

In fact, 10% per month can be accomplished with only a few high-quality trades each month. Many traders get caught up in quantity instead of the quality of trades. We have a forex trading income calculator on this site to help you do your calculations.

I would challenge you to find another career in the world that will have you earning that kind of money in 5 years.

Remember though, don’t get caught up in the figures. Trading isn’t easy but can be done if you follow a forex trading plan. I say this simply to reinforce how profitable the Forex market can be if you work hard and have long-term goals in mind.

Do You Have to Pay Taxes on Forex Income?

Forex income tax is based on location, and the rules are different depending on where your residency is. Let’s cover some of the main countries here, to help you get started in your research.

Forex Income in the USA:

In the USA, you do have to pay Forex income tax and the rate can be as high as 37%, so you will want to be sure to include taxes in all net revenue calculations.

Forex Income in Malaysia:

Forex income in Malaysia is taxable, but the capital gains are not taxable. It might make sense for you to determine the difference between Forex income and Forex capital gains.

Forex Income in Canada:

Revenue from Forex trading in Canada is considered Capital Gains or Losses which means that if you make money you will have to count it as a capital gain. There is a tax on all capital gains in Canada. If your capital gains are less than $200, you do not have to pay tax on it.

Forex Income in the UK:

Trading Revenue generated from Forex trading in the UK is tax-free if it is done on a spread betting account. Do your research to find the right kind of account that will work for this.

Forex Income in Australia:

The rules for Forex trading tax in Australia are not specific just for the Forex market. They have adopted the exact same tax rules for the stock market.

Forex Income in South Africa:

The Forex trading tax in South Africa is a tiered tax system. That means that the more you make, the higher your tax will be. It starts at 18% of profit and goes up to a maximum of 40% tax on all trading profits.

Forex Income Tax in Singapore:

If you are trading on the side and still working a regular job, all revenue earned from trading is tax-free. However, if you are a full-time trader, then your trading revenue will be taxed.

Frequently Asked Questions About Forex Trading Income

How much money can I Make Trading Forex?

The amount you can make is unlimited! But that comes with a hard catch. Yes, it is unlimited, but you must be aware that most Forex traders lose money. So, the true answer is probably none.

How much money does the average Forex Trader Make?

There is no data for this because it is a global occupation, and we have to piece together data from all the brokers in the world, and they do not publicly release this data.

We do know that it is a sliding scale, the ones who are very successful make millions, and the rest either lose money or make very little.

The average Forex trader income is hard to calculate when you consider that most traders lose money. This makes the calculation much more difficult to find the average.

How to Report Income for Forex Trading?

The answer depends on where you live. Contact your local tax agency and find out from them.

Is there a specific Forex Trading Strategy that will increase my Forex trading income?

There are many to choose from. I would take a look at our compilation of some of the best trading strategies. These can help you increase your trading revenue.

Conclusion: Forex Trading Income

In conclusion, if we can maintain a realistic view of Forex, then we have a greater chance of setting reasonable goals. This helps us maintain a profitable trading strategy that brings us a steady Forex income over time.

If you don’t believe me, take a look at the Forex compounding calculator, which will tell you all you need to know about how much Forex income you can make.

“Nothing can stop the man with the right mental attitude from achieving his goal. Nothing on earth can help the man with the wrong mental attitude.”

Thomas Jefferson

Thank you for reading!

Please leave a comment below, if you have any questions about Realistic Forex Income!

Free Once In a Lifetime TrainingDo You Want To Learn The Secrets of Gold Trading?

Our Gold Master Trader Will Reveal His Brand New Pattern, “The Golden Glitch”