Do you ever find yourself in a trade, worried about possible market volatility and unsure how external events might affect your carefully planned positions?

Who hasn’t, right??

Or perhaps you’ve mastered the art of entering trades at strategic levels but hesitate when faced with unpredictable upcoming news or uncertain market conditions?

Well, get ready for a game-changer!

Hedging in trading is the strategic shield you need to help protect your positions from unexpected market swings!

In this article, you’ll:

- Uncover the essence of hedging and why it’s a crucial risk management tool

- Explore how hedging can protect your longer-term trades from short-term market changes and unexpected news events.

- Learn how to use hedges effectively so that you can control risk and make the most of your potential profits.

- Gain insights from real-life examples, illustrating successful hedging strategies from entry to exit.

- Understand the risks and limitations of hedging, along with valuable tips to enhance your decision-making and success rate.

Are you ready to fortify your trading strategy and embrace the power of hedging?

Then let’s dive into the world of strategic risk management!

What is Hedging?

The majority of traders hedge to protect a longer-term position because they expect potentially volatile news is incoming…

The reasoning behind hedging is that a trader may still view a longer-term trade as viable but recognize a short-term pullback is possible if the news goes against their original strategy.

This helps to shield them from drawdowns in case the news is significantly worse than expected, leading to a market crash.

Let’s delve into an example…

USD/CAD Daily Chart Long-Term Trade Entry:

Let’s imagine you are looking at a buy at support on the USD/CAD pair.

Your trade targets are set much higher than the current price, based on previous levels or a specific trading strategy.

Throughout the duration of your longer-term trade, you are aware that high-impact news events may influence the market, causing potential drawdowns as your trade progresses…

In this kind of scenario, hedging your longer-term trade is worth thinking about.

Let’s take a look…

USD/CAD Daily Chart Long Term Trade News Event:

Now, in this example, let’s focus on a marked area on the chart that raises considerable concerns.

After recent unfavorable news for the USD and following a fundamental analysis, you believe it’s pretty likely there’s going to be some negative news for the USD…

USD/CAD 4-Hour Timeframe Chart Short Entry:

This is the point where thinking about a hedge trade becomes crucial.

Opening a new short position could be a strategic move to safeguard your longer-term trade from excessive drawdowns!

Let’s proceed to initiate that short position!…

USD/CAD 4-Hour Timeframe Trade Management:

Notice how the price continued its downward trajectory, coming very close to the original entry point of the initial long-term trade?

If you had hesitated from hedging during the high-impact news period, there’s a big chance that the profits from your long-term trade could have been entirely erased…

…perhaps even turning it into a losing trade!

But you’ll be happy to know that how you choose to manage the trade is entirely up to you!

Some traders might choose to secure early profits from the short position, focusing on a re-entry at the support zone…

Others might choose to await the breach of the support zone, close the long trade, and commit to the new downtrend with the short trade…

Basically, when it comes to hedging, there’s no definitive right or wrong approach!

It’s a risk management technique specifically aimed at protecting longer-term trades.

Traders may vary in their strategies, but mastering it requires practice and a deep understanding of your personal risk management.

You should note, too, that hedging isn’t solely used for situations like the one described.

It can still be a valuable option when uncertainty surrounds market direction in pivotal market areas…

When used together with effective risk management, it can really become a useful tool for finding profitability in trading.

Let’s look at another example!…

EUR/CAD Daily Timeframe Entry:

In this scenario, let’s assume you intended to initiate a long position at a robust daily support level where price has historically rebounded…

Targets are unspecified, as the goal of this trade is to be a longer-term position that depends on fundamental analysis and active trade management…

EUR/CAD 4-Hour Timeframe News Event:

To illustrate my point, let’s assume that throughout the trade, you’ve been carefully analyzing market news for the Euro and suspect there is significant bearish news on the horizon in the next few days…

The 4-hour candles begin to reject and fall short of reaching previous highs.

Through fundamental analysis, you’ve concluded that price might experience a pullback based on the impending news…

Therefore, you decide to initiate a short trade from this area…

EUR/CAD 4-Hour Timeframe News Event Entry:

In this scenario, assume that you strategically set the stop loss for the short position well above the previous resistances.

This precaution aims to give you plenty of room for potential volatility that might come with the unfolding news events in the upcoming days…

EUR/CAD 4-Hour Timeframe Long Position Close:

In the subsequent days, the Euro experienced worsening news, and as anticipated, the price chart began its descent!

While watching this downturn and considering the unfavorable news circulating about the Euro, you spot an opportunity to close out the original long trade…

The decision is driven by a change in your longer-term thinking on the bullish nature of the Euro.

It’s crucial to note that, even with the closure of the long position, you still maintain an open short position.

In this example, let’s assume you choose to keep the short position active.

Your reasoning is that the ongoing bearish momentum is probably going to prevent the original support level from holding its price…

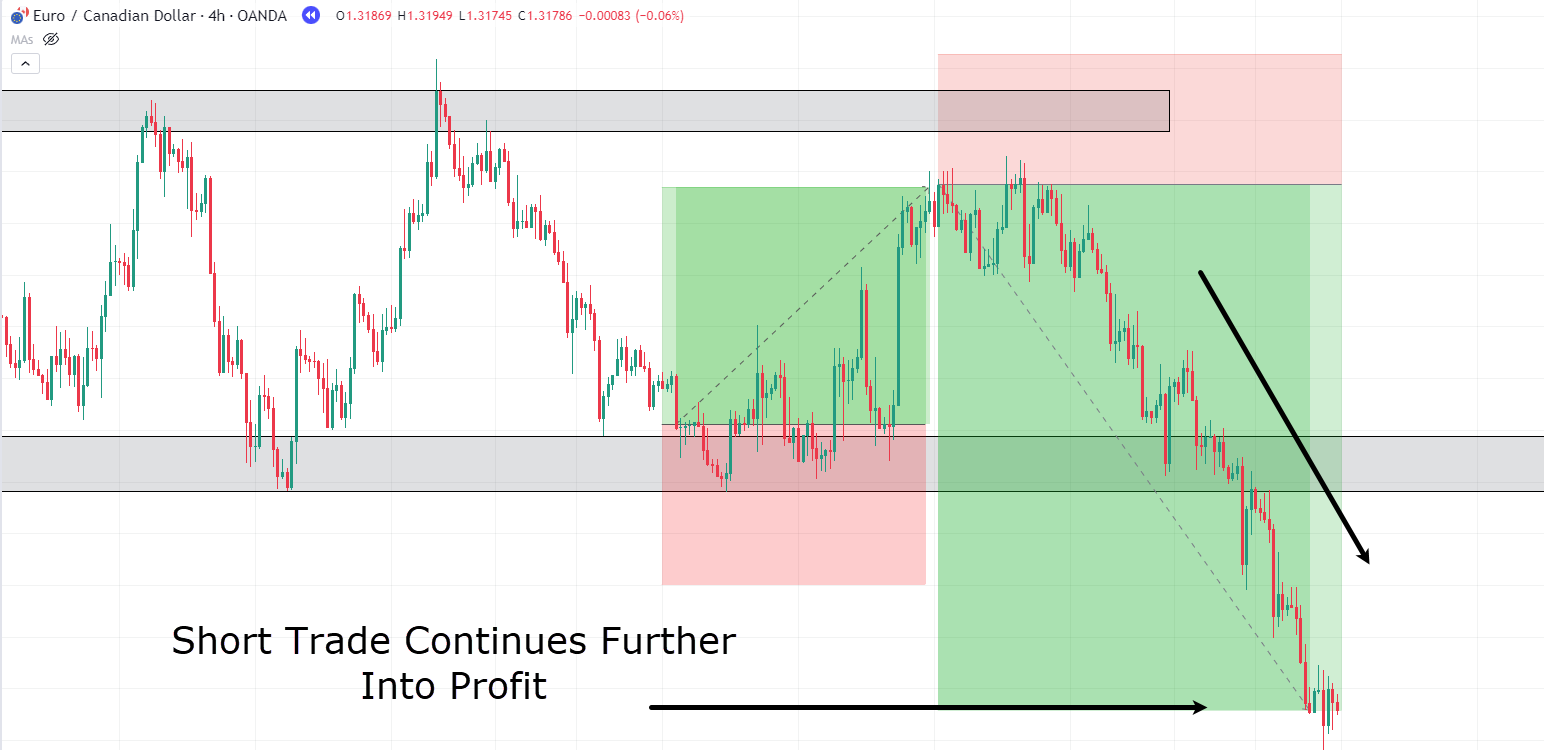

EUR/CAD 4-Hour Timeframe Short Position:

Your intuition proves accurate as the support level fails to hold, and the price continues its downward trajectory, yielding profits from the short position!

So, this scenario highlights the strategic use of hedging to protect a longer-term trade – especially when faced with unexpected news developments.

While your initial analysis may have been aligned with a bullish outlook, the ability to adapt and implement a short hedge gives you a better chance to deal with changing market conditions.

So this example really shows the importance of staying flexible in your trading approach!

Even though you can’t predict future news events weeks in advance, staying tuned to real-time shifts in market sentiment allows you to pivot your bias, creating hedging strategies that can work in favor of your chosen currency pair.

This adaptive mindset positions you to not only limit potential losses but also capitalize on new opportunities!

So keep your eyes and mind open!

How can you profit from Hedging?

While many traders look at hedging primarily as a shield against adverse moves in an existing position, the fundamental purpose of hedging is not profit generation…

…but risk limitation! (especially during volatile periods.)

However, this conventional use doesn’t tell the whole truth about hedging.

Hedging strategies can even extend to scenarios involving correlated pairs.

Consider two heavily correlated pairs—GBP/USD and EUR/USD.

Despite their correlation, setting up a hedge trade becomes a viable option if you hold contrasting views on both pairs.

But just how correlated are they?

Let’s delve into the correlation between GBP/USD and EUR/USD…

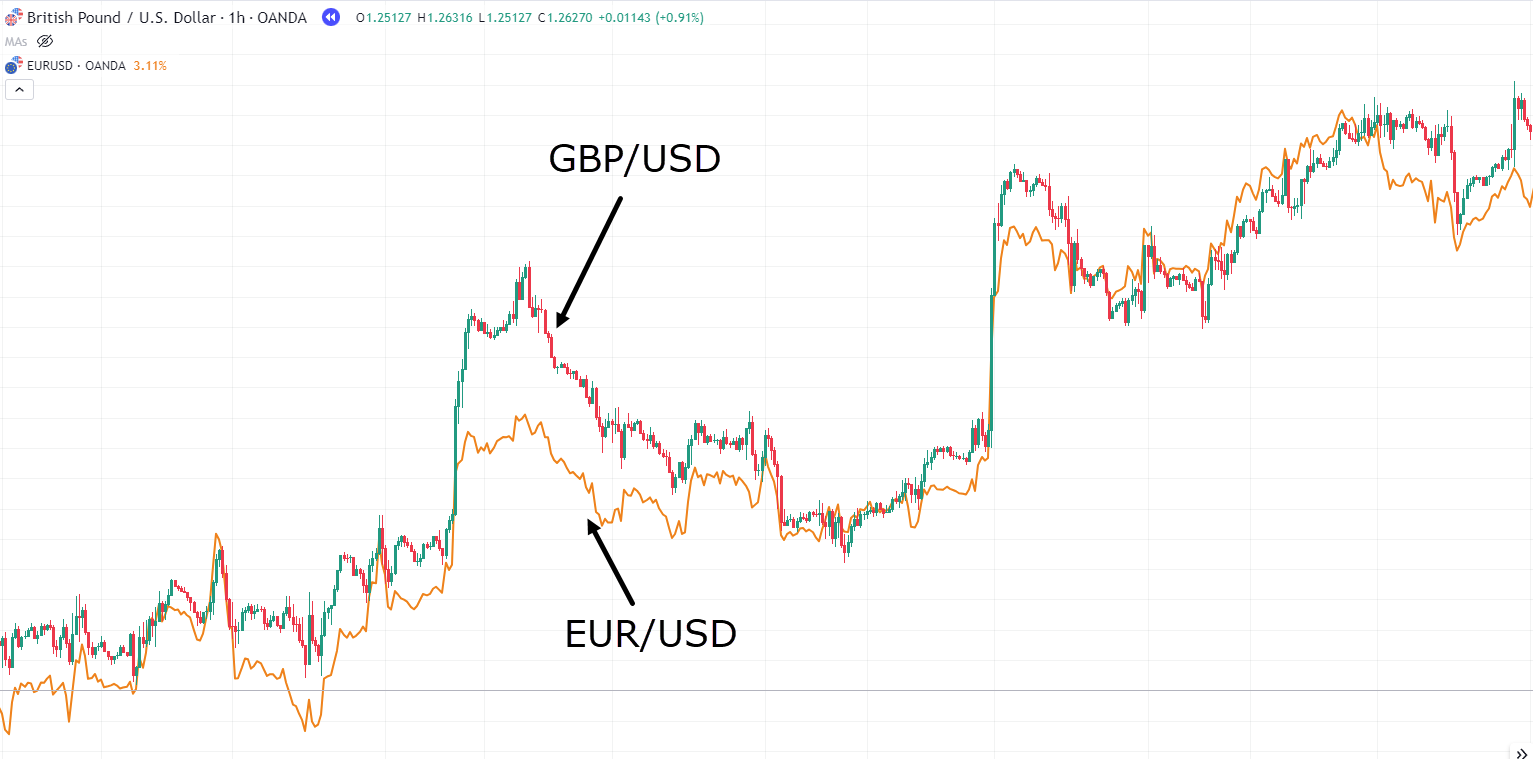

Correlation between GBP/USD and EUR/USD:

Look at how the charts move almost synchronously…

It happens this way because the USD influences both pairs.

Any event impacting the USD is likely to have a parallel effect on both of these pairs.

So you might wonder how it’s possible to hold opposing views on pairs that exhibit such close correlation…

And while it’s true, the pairs do act similarly…

…they don’t behave identically!

This difference becomes especially clear when looking at lower timeframe support and resistance levels.

Let’s explore an example illustrating how you could potentially initiate a hedge trade involving these two pairs—EUR/USD and GBP/USD…

EUR/USD 1 Hour Timeframe Chart Support:

Examining the EUR/USD pair, you notice a breakthrough of a minor resistance level, followed by a retest at a support level.

In response, you decide to go long on the EUR, basically taking a short stance on the USD…

Meanwhile, shifting your attention to the GBP/USD chart, a different picture unfolds…

Here, the price has breached a support level and has difficulty trying regain ground above it.

This divergence in the price action of the GBP/USD pair provides an opportunity for a hedging strategy!…

GBP/USD 1 Hour Timeframe Chart Resistance:

In this scenario, your analysis points to the USD strengthening against the GBP…

This creates an interesting hedging opportunity, as the two currency pairs show subtle differences in their price actions.

What makes this strategy particularly appealing is that you don’t necessarily need to predict the outcome of the upcoming news event!

By taking opposite sides on the USD, the long EUR/USD trade suggests a weakening USD, while the short GBP/USD trade indicates a strengthening USD.

Now, let’s introduce the element of a news event.

The beauty of this approach lies in its potential to maximize reward and limit risk, based on the news outcome…

Whether the news is positive or negative for the USD, these hedged trades are strategically positioned to manage the market dynamics.

Let’s delve into the potential outcomes!…

GBP/USD 1 Hour Timeframe Chart Stop Loss:

Oh no!

Unfortunately, it appears that the GBP/USD trade has experienced a full stopout!

This underscores the crucial importance of using effective stop-losses, especially when engaged in hedging strategies.

Now, considering that the hedged GBP/USD trade resulted in a loss, let’s assess the potential impact on the concurrently held EUR/USD trade…

EUR/USD 1 Hour Timeframe Take Profit:

Wow!

Look at that, a 6.6RR trade by simply exiting using the 50 Moving average break – all from trading the volatility of the news on both sides!

Now that’s impressive.

See how you didn’t need to know what side of the market was the right side?

OK so yes, you incurred a loss…

But in the process, you also gained a whopping 6.6RR…

…leaving you with 5.6 RR!!

When done properly, this is a great tool for trading news events!

Now, while celebrating successes is great, it’s crucial to understand the risks involved in trades affected by rapid market changes…

Let’s explore situations where the intricacies of hedging call for a cautious and practical approach.

First, a a scenario involving the closely correlated EUR/USD and AUD/USD pairs…

EUR/USD 1-Hour Timeframe Support Entry:

Here, you can observe a seemingly clear support level on the EUR/USD chart, right?

For the sake of this discussion, let’s assume there’s an impending high-impact news event within the next day…

AUD/USD 1-Hour Timeframe Reistance Entry:

You take a short position on the AUD/USD, using it as a hedge trade against the long position on EUR/USD…

These trades present opposing views, with the EUR trade suggesting a weakening USD, while the AUD trade implies a strengthening USD.

Now, let’s see how these trades unfolded…

AUD/USD 1-Hour Timeframe Stop Loss:

It appears there was a fakeout in this instance…

However, one might think that the EUR/USD trade would have turned profitable, right?…

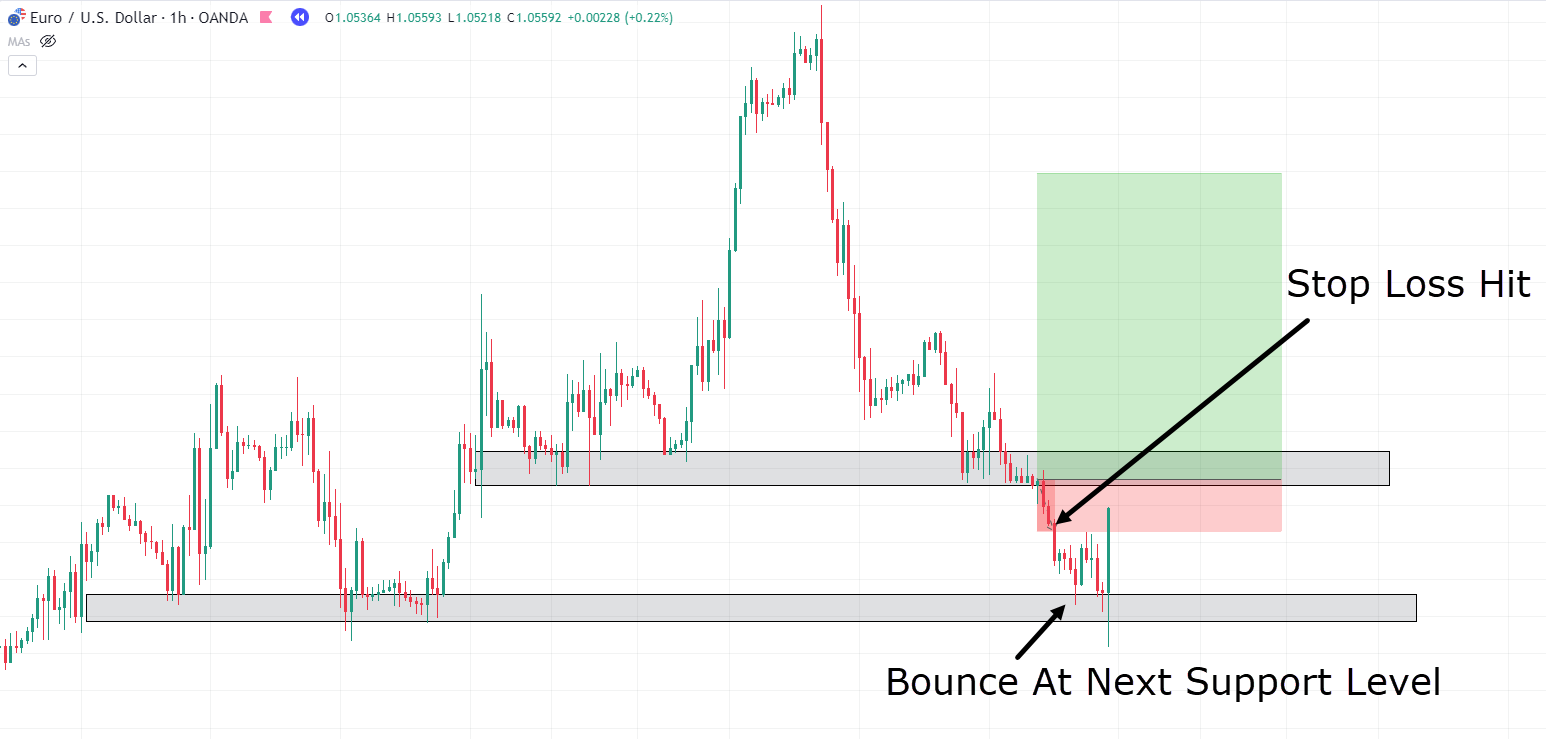

EUR/USD 1-Hour Timeframe Stop Loss:

Surprisingly, both trades hit their respective stop losses.

So, it’s fair to say – the market’s intricacies are not always straightforward!

Despite one reaching the stop loss, the other trade faced a similar fate…

As you can see, for whatever reason, the price was attracted to the next lower support level – where it got the bounce you were looking for!

This may be influenced by factors like news timing, and the potency of support and resistance levels, which can all impact the outcome of hedged trades.

You should remember that the unpredictable nature of markets means that news events may coincide with periods of low volatility, delaying reactions until a later time.

Alternatively, news may not even sway the market at all!

Thinking about it this way really highlights the importance of a nuanced approach to hedging.

While this strategy doesn’t hinge on news events exclusively, especially on shorter timeframes, it proves valuable for securing profits during uncertainty surrounding potential high-impact news.

It’s also crucial to acknowledge that this method may not always yield success.

A robust understanding of where price is likely to find support or resistance, along with an awareness of significant news events, is essential.

So, while hedging can provide opportunities to capture profits when uncertainty looms, it carries the risk of facing losses on both ends if market conditions don’t align with your expectations.

Now, let’s review the benefits of hedging as a quick recap.

Benefits of Hedging

You don’t have to know the outcome

The biggest advantage of hedging is its ability to free traders from the need to predict market directions.

With orders placed in both directions, traders can confidently allow profitable trades to mature while swiftly cutting losses with effective stop-loss management.

This approach minimizes risk, reducing the pressure to always be correct in trade predictions!

By prioritizing proper risk management, traders can focus on maximizing gains, understanding that being right all the time is not always necessary to be successful!

Profiting Across Timeframes

Hedging can serve as a useful tool, capable of generating profits across various timeframes.

Traders can capture gains in shorter timeframes while maintaining positions in longer-term trades.

This dual-pronged approach minimizes downsides and optimizes potential returns!

Riding the Market Flow

An often-overlooked benefit of hedging is its capacity to align traders more harmoniously with market dynamics.

By reducing the need to be infallible in your predictions, you can adapt swiftly to changing market conditions.

If anticipated price bounces fail to materialize? Well, you can seamlessly switch sides, enabling the capture of significant market movements.

In essence, when executed well, hedging enables traders to operate with confidence in the face of market uncertainties, creating a much more interesting and profitable trading experience!

Risks and Limitations

Vulnerability to Volatility

One of the significant risks you’ll find with hedging is susceptibility to volatility…

When there’s market turbulence, swift and unpredictable price movements can trigger stop losses on both sides of a hedged trade…

This scenario is amplified when market reactions are different from expected outcomes, especially during high-impact news events.

Risk increased

This is a crucial risk to think about when employing hedging techniques.

As shown in the last example, especially when a trade is not yet in profit, initiating a hedging trade could result in a stop-out on both trades.

Basically, this action doubles the amount of risk with a hedge bet on a correlated trade.

When both trades don’t go your way, it can lead to quick stop-outs that could have been restricted to just one trade…

Therefore, it’s essential to use hedging as a technique in suitable environments and situations!

Spreads Widen During News Events

During high-impact news events, spreads in the market can widen – a lot!

This widening of spreads increases the risk of triggering stop losses on both sides before the market stabilizes and absorbs the news impact…

Traders must be mindful of this and consider its implications for effective risk management.

Prerequisite: Accurate Support and Resistance Levels

Successful hedging relies heavily on the careful identification of support and resistance levels.

If you draw levels incorrectly or do not understand how the market works, you might enter trades too early on one pair while experiencing fakeouts on the other.

To avoid this mistake, traders must be careful to make sure that their technical analysis is correct!

Lower Timeframe Suitability

The hedging approach, particularly involving correlated pairs, is most effective on lower timeframes.

The dynamics of contrarian views on similar pairs are more obvious over shorter periods, providing windows of opportunity for successful hedging.

This phenomenon is less common on higher timeframes, where market imbalances tend to be corrected more swiftly.

Frequency and Quality of Setups

Quality setups for hedging, especially when approached from a support and resistance perspective for correlated pairs, may not happen all that often!

Uneven prices can happen in the market because of the way people trade and interact with it, even if there are not any major news events happening.

Traders must recognize the random nature of these setups and be careful in their market analysis to identify the very best moments for successful hedging.

In summary, while hedging offers valuable risk mitigation benefits, traders must navigate these inherent risks and limitations through careful analysis, accurate technical interpretation, and a strong awareness of market dynamics!

Conclusion

In conclusion, hedging stands out as a versatile risk management strategy, offering traders a useful shield against market uncertainties!

With careful management of both long and short positions, hedging is a unique way to deal with unstable situations.

By exploring the fine details of hedging in this guide, you’ve gained insights into its benefits and limitations.

It’s a risk management tool that, when wielded with precision, allows you to trade confidently in the face of unpredictable market events.

To sum up, you’ve:

- Unearthed how hedging can be a significant risk management tool.

- Explored how hedging can be employed in longer-term trades to minimize drawdowns caused by high-impact market news.

- Acquired new practical techniques that enable you to minimize risk while maximizing profits in high-volatility scenarios.

- Obtained insights from real practical examples illustrating what hedging looks like on lower timeframes and the potential outcomes when price deviates from expectations.

- Assessed the risks and limitations of hedging, along with valuable tips to enhance decision-making and success rates.

As you prepare to incorporate hedging into your trading, remember that, like any strategy, it has its nuances!

Careful consideration of market conditions, proper timing, and adherence to risk management principles are essential.

So, armed with a deeper understanding of hedging, it’s time to put this knowledge into practice!

I invite you to experiment with different scenarios, refine your approach, and adapt the concepts to your unique trading style.

What are your thoughts on hedging?

Have you explored its potential in your trading?

Feel free to share your experiences and insights in the comments below!