Much of the focus on digital transformation in banking relates to digital delivery. During the pandemic the ability to provide banking transactions as well as to originate and process loan and new account applications in a “less-branch” environment clearly has been crucial.

But there is another aspect to digital transformation, and that is “digital growth.” In a narrow sense, digital growth for financial institutions is about embracing the modern buying journey for financial products, which 87% of consumers begin online. It also means uniting Marketing, Sales, Operations and IT around the goals of generating and nurturing digital leads and converting them into loans and deposits.

More broadly, digital growth embodies a cultural and organizational shift that is essential for traditional banks and credit unions to compete with institutions whose business models are built around a digital- and mobile-first growth strategy.

This is the message conveyed in a new book, “Banking on Digital Growth,” by James Robert Lay, Founder and CEO of the Digital Growth Institute. The book is a call to action, but more than that, in its 280 pages it lays out a detailed plan for financial marketers and other banking leaders, to bring their institutions up to competitive speed.

As CEO of the Digital Growth Institute for 18 years, Lay has advised more than 500 banks and credit unions. His firm also conducts extensive primary research relating to retail banking. Lay is a frequent speaker, including at The Financial Brand Forum.

( sponsored content )

An Existential Challenge for Four Out of Five

In the book’s introduction, Lay sets up three key factors impacting retail banking.

1. Money is stressful and it’s only getting worse. From soaring housing costs to the student loan crisis, financial anxiety is real — and it’s taking a significant toll on people’s health, relationships, and overall sense of well-being.

2. Consumers have changed. They simply don’t trust financial institutions like they used to. “Rather than welcoming the opportunity to fill a new need,” Lay writes, “with modern messaging and communication strategies that speak to those people (particularly Millennials and younger) desperately looking for a partner they can trust who can guide them, … most financial brands are still doing the same old marketing they always have.”

3. People have more options than ever before. They do their own research online before making any decisions. However, financial institutions “are still stuck in an outdated, branch-first growth model, where in-person branch visits are seen as primary selling opportunities,” Lay says in the book. “The truth of the matter is, even when folks do come into branches nowadays (if they come into a branch at all), most of the time their buying decisions have already been made long before.”

In an interview with The Financial Brand, Lay states that COVID has been the accelerant for digital transformation. Technology was a driving force before the pandemic, he says, but many financial brand leaders were either fighting it or just didn’t have a full awareness of the impact, according to Lay.

“They were saying, ‘Sure, digital is important, but our profitability is the best that it’s been in the last ten years. Why do we need to do anything?’ That has been upended with COVID,” says Lay. “The pandemic is transforming consumer behavior even more than technology ever could have.”

In the book Lay states that only 20% of traditional financial institutions have become what he calls “digital haves” — institutions that have truly embraced digital banking and digital growth. The other 80%, the digital “have-nots,” struggle to transform themselves. Of the larger group, the consultant states, “Either they will follow the lead of the 20% of ‘digital haves’ and pursue a bold digital growth strategy, or get left behind.”

What typically happens, however, is that banks and credit unions try this or that digital effort but then give up because it doesn’t yield results quickly enough, according to Lay. “This is one of the deadliest blind spots but also the most common,” he states. “When any industry is transformed by disruption, inevitably the digital growth potential appears limited at first, deceptively so.” As a result of this “digital denial” the leadership team reverts to basing their most important decisions on the past successes, which will not move the institution forward.

REGISTER FOR THIS FREE WEBINAR

Digital Growth – Is Your Institution Ready?

The COVID pandemic has triggered banks to move more quickly on digital transformation and is changing the way banks interact with customers.

TUESDAY, June 9th at 2pm (ET)

Marketing’s Role in the Revolution

“Marketing has the ability to be the primary digital ‘change agent’,” Lay tells The Financial Brand. First and foremost the department should provide the board and the executive team with clarity about what the digital growth opportunities are. In that way Marketing can move beyond being seen as a glorified in-house Kinko’s or “the adults that play with paint and crayons,” Lay maintains.

But too often Marketing gets cold feet due to four fears, described in the book:

- Fear of the unknown. “I know digital is important for us, but what should we do next?”

- Fear of change. “Why change now? We have had success up to this point.”

- Fear of failure. “What happens if we try this and fail? What will they think of me?”

- Fear of success. “What happens if this actually works? Can we even support this new type of growth?”

“As a result, they end up in a constant state of conflict, just trying to survive and not making any real progress or growth,” Lay states.

What marketing staffers should become, he states, are “experience engineers” — “thinking through and crafting the experiences of the buying journey for every product line.”

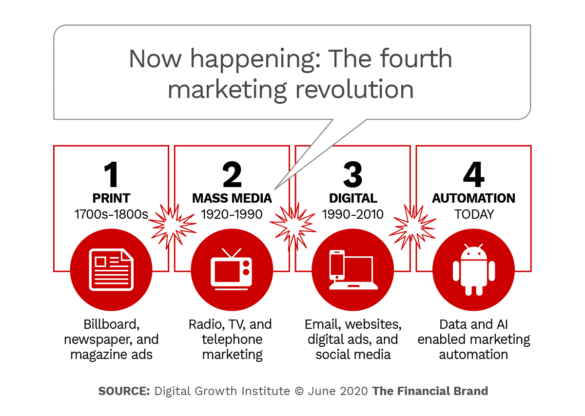

In the book, Lay explains that along with four Industrial Revolutions, there have been four Marketing Revolutions.

Now that the fourth marketing revolution is underway — powered by data and artificial intelligence — financial institution marketers, says Lay, must quickly realize that one-way, broadcast marketing is simply no longer relevant. The name of the game now, he continues, is reaching people where they are, communicating and building connections through empathy using digital relationships that put consumers first.

Read More:

The Empathy Advantage

Lay’s book talks a great deal about the importance of empathy, the ability to understand and share the feelings of another.

“Empathy is thrown around as a touchy-feely buzzword,” he states, “but at the executive level it has been somewhat ignored up to this point. I think that conversation is going to change because of the reality of a digital world.”

“Empathy might be the biggest competitive advantage of all in the new digital world.”

Empathy is paramount, he says, not just with consumers, but also internally. In fact the latter really should come first or else the rest won’t work. For example, there will be a lot of emotion tied to the changes brought by AI and digital transformation, Lay observes.

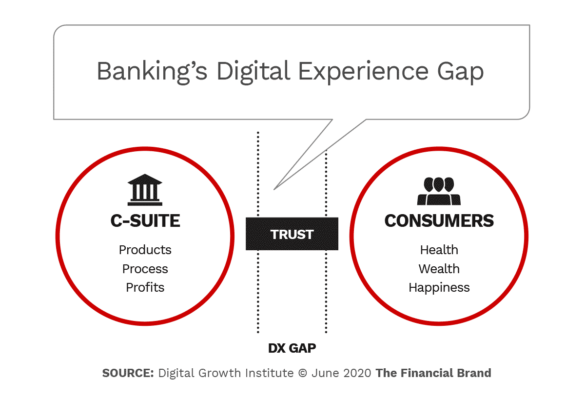

With consumers, money is one of the biggest pain points in people’s lives, Lay emphasizes. “In the future I see financial services being more than just a bank or just a credit union, but an institution that can really transform someone’s life for the positive.” Right now, however, that goal is hampered by what Lay describes as the “Digital Experience Gap.”

Clearly the financial brands’ drivers and the consumers’ are not fully aligned, so conflict is bound to arise, Lay states. He says that when he talks with banking leaders about empathy, they often want to know, “How does it all affect my bottom line?”

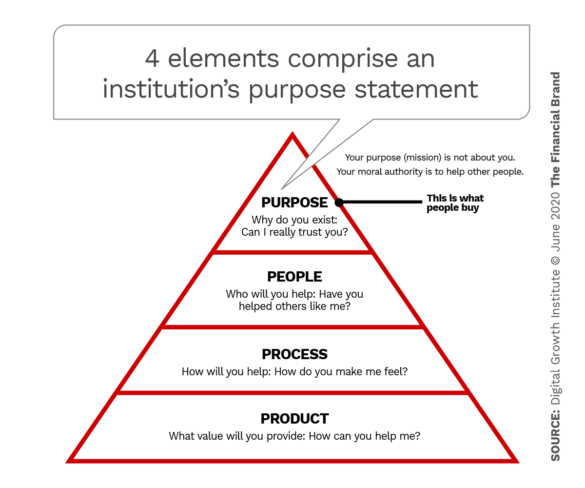

That’s an appropriate question, Lay acknowledges. But still, he firmly believes that “one of the greatest opportunities I see for financial brands … is clear: positioning around a purpose that transcends the promotion of commoditized products.” And right now, he adds, the neobanks and neolenders are the financial brands positioning around a purpose bigger than profits.

Unfortunately, says Lay, the vast majority of financial brands are not purpose-driven. Instead, they’re guided by their traditional mission or vision statements. Rather than trying to change those traditional documents, create a “purpose statement.” Outward-focused, a purpose statement “is intended to build trust and create value for people, resulting in a positive emotional response.”

Read More: